Macro

A Worsening War Scenario Is Playing Out Across Markets: Higher Commodities, Higher Breakevens, Flatter Yield Curve, Stronger Dollar, Lower Equities

As the US administration continues to escalate the situation in Ukraine, markets are caught in a perfect storm, having to manage enormous volatility and deteriorating liquidity, while inflation concerns and slower growth point more and more towards stagflation

Published ET

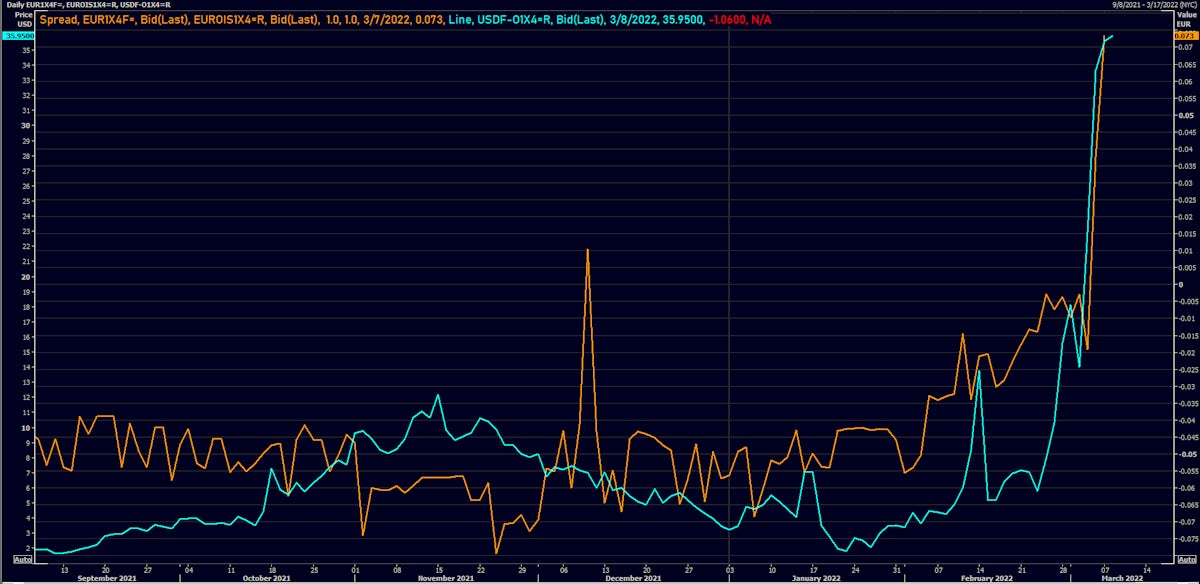

Funding in Euro and USD money markets has deteriorated markedly (1x4 FRA-OIS and FRA-EONIA spreads) | Source: Refinitiv

US RATES DAILY SUMMARY

- 3-Month USD LIBOR +6.3bp today, now at 0.6730%; 3-Month OIS +1.0bp at 0.4305%

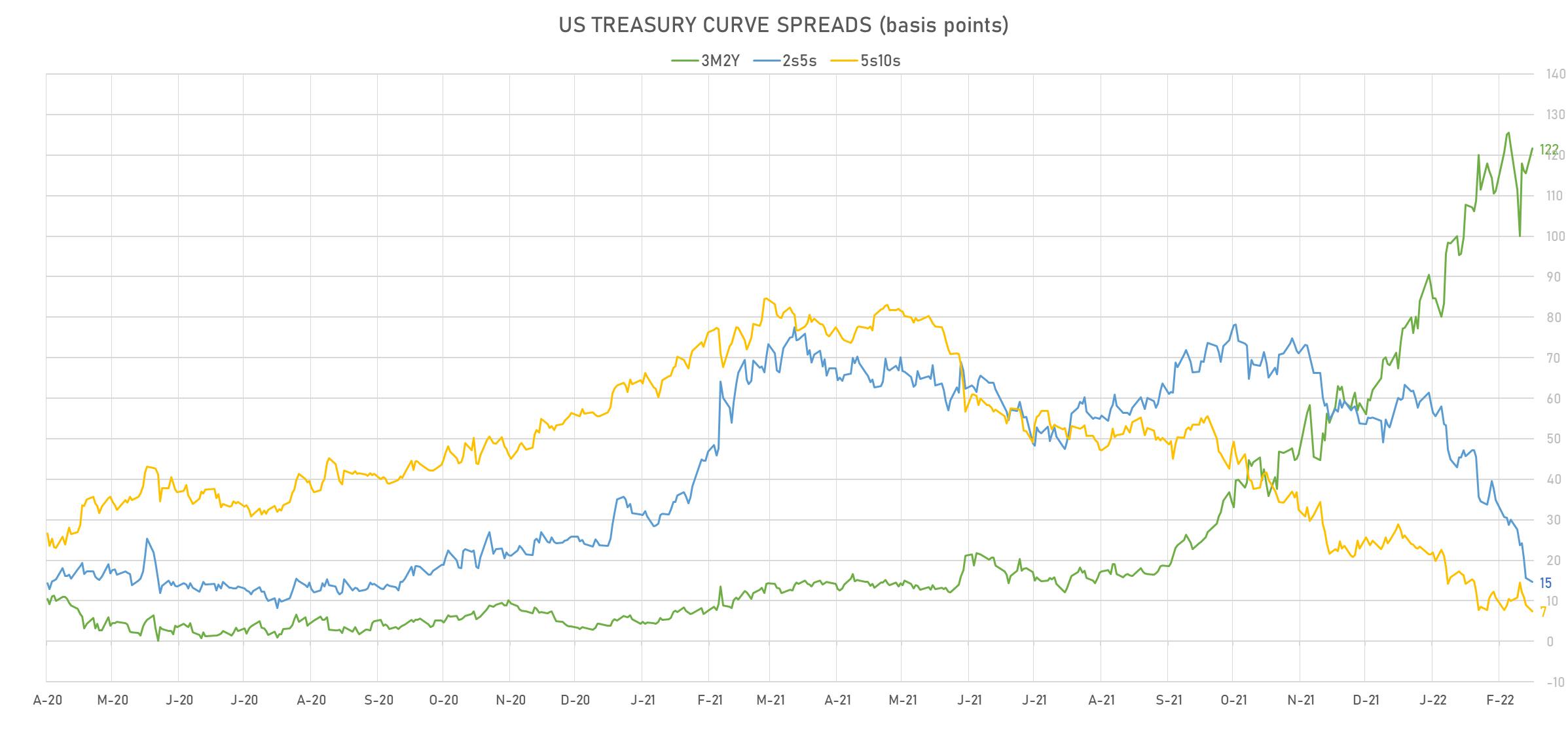

- US Treasuries 2s10s spread narrower at 24bp (down from 62bp a month ago)

- 1Y: 1.0368% (up 1.5 bp)

- 2Y: 1.5543% (up 6.6 bp)

- 5Y: 1.7000% (up 5.5 bp)

- 7Y: 1.7544% (up 4.9 bp)

- 10Y: 1.7751% (up 3.9 bp)

- 30Y: 2.1822% (up 2.2 bp)

- US treasury curve spreads: 3m2Y at 121.6bp (up 6.2bp today), 2s5s at 14.6bp (down -1.4bp), 5s10s at 7.5bp (down -1.8bp), 10s30s at 40.7bp (down -1.7bp)

- Treasuries butterfly spreads: 1s5s10s at -60.2bp (down -6.3bp), 5s10s30s at 33.7bp (up 1.2bp)

- TIPS 1Y breakeven inflation at 5.52% (up 25.0bp); 2Y at 4.33% (up 17.2bp); 5Y at 3.31% (up 16.3bp); 10Y at 2.85% (up 14.7bp); 30Y at 2.46% (up 12.4bp)

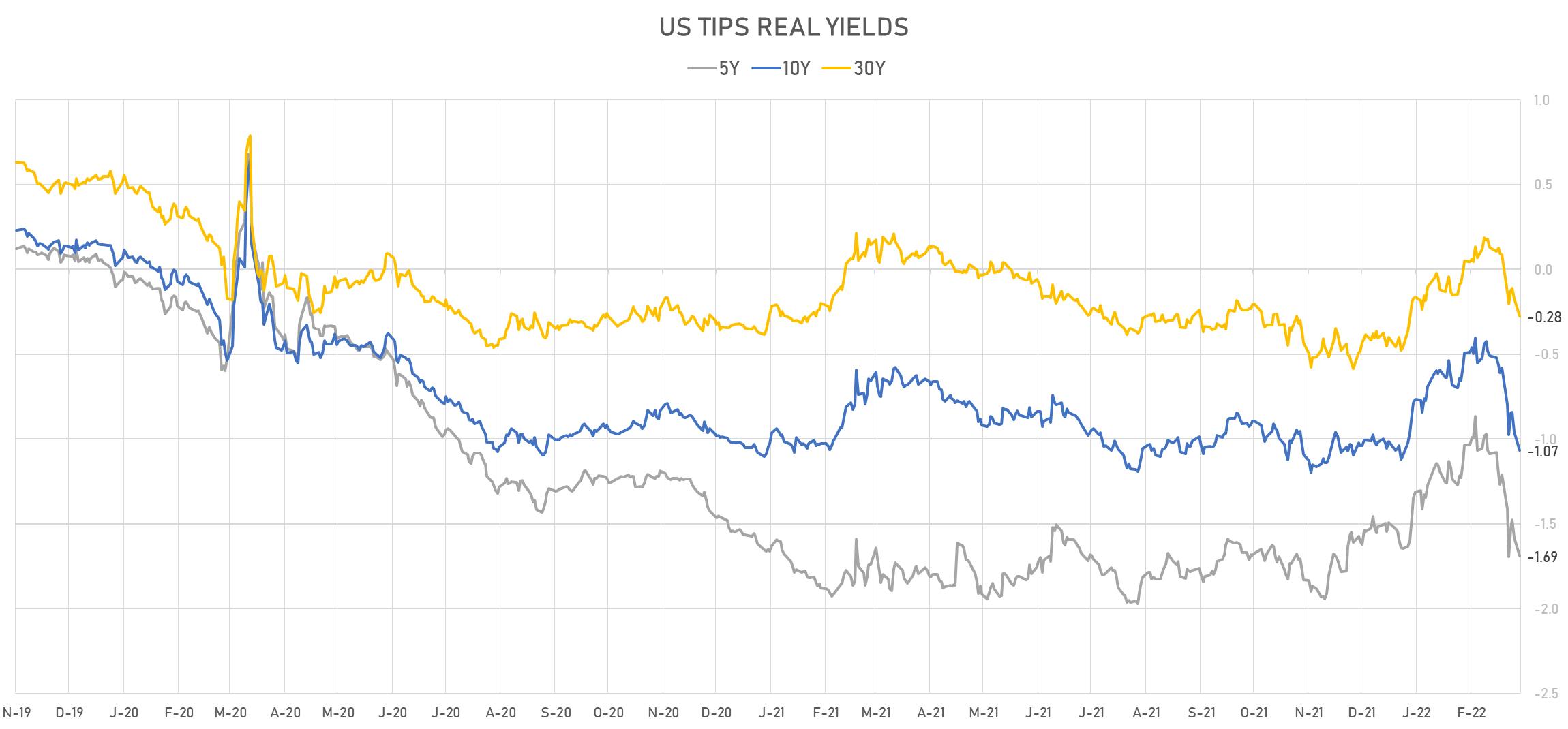

- US 5-Year TIPS Real Yield: -11.1 bp at -1.6910%; 10-Year TIPS Real Yield: -10.9 bp at -1.0660%; 30-Year TIPS Real Yield: -10.3 bp at -0.2760%

US MACRO RELEASES

- Consumer credit, total, Absolute change for Jan 2022 (FED, U.S.) at 6.84 Bln USD (vs 18.90 Bln USD prior), below consensus estimate of 23.80 Bln USD

- The Conference Board Employment Trends Index (ETI) for Feb 2022 (The Conference Board) at 119.18 (vs 117.62 prior)

US FORWARD RATES

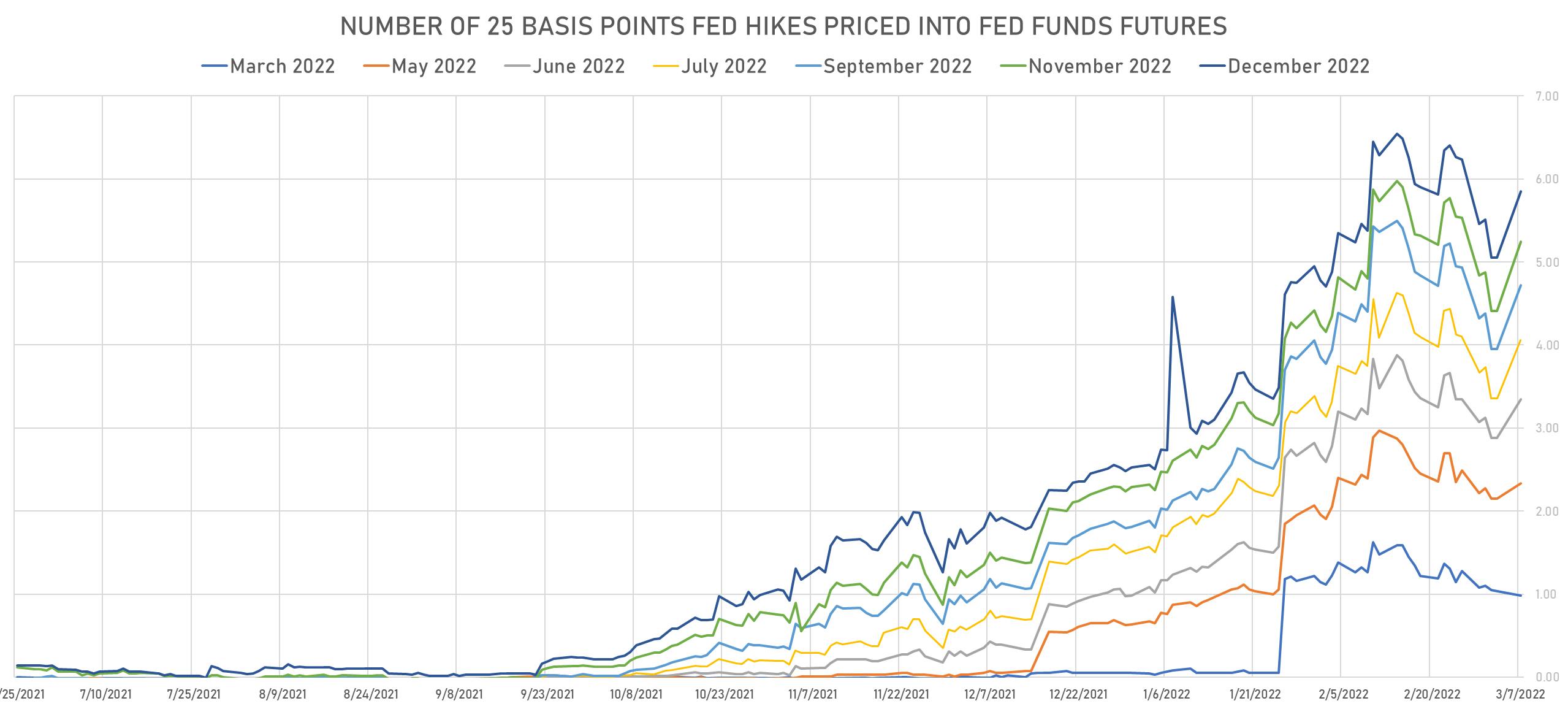

- Fed Funds futures now price in 24.5bp of Fed hikes by the end of March 2022, 58.4bp (2.33 x 25bp hikes) by the end of May 2022, and price in 5.85 hikes by the end of December 2022

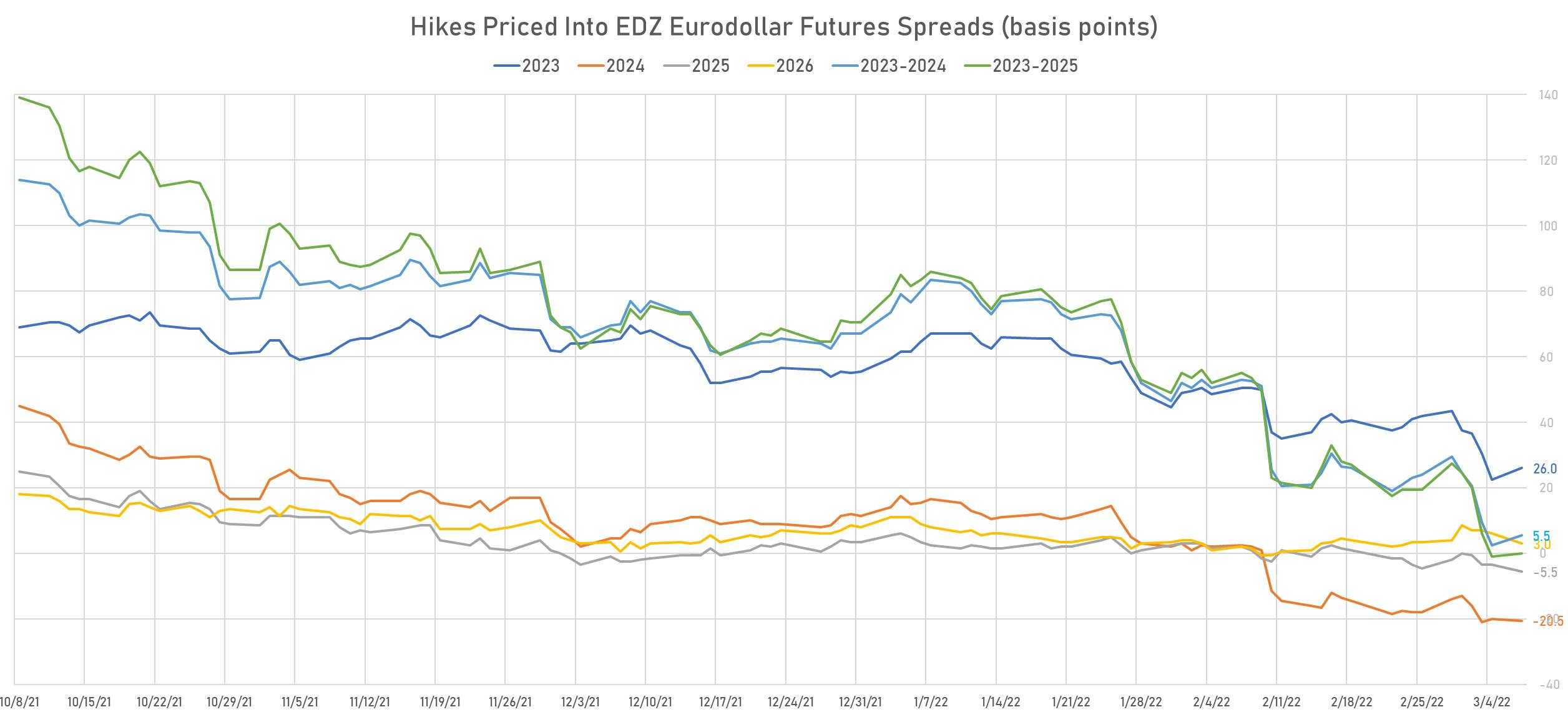

- 3-month Eurodollar futures (EDZ) spreads price in 26 bp of hikes in 2023 (equivalent to 1.0 x 25 bp hike), up 3.5 bp today, and -20.5 bp of hikes in 2024 (80% chance of a 25 bp rate cut)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.52% (up 25.0bp); 2Y at 4.33% (up 17.2bp); 5Y at 3.31% (up 16.3bp); 10Y at 2.85% (up 14.7bp); 30Y at 2.46% (up 12.4bp)

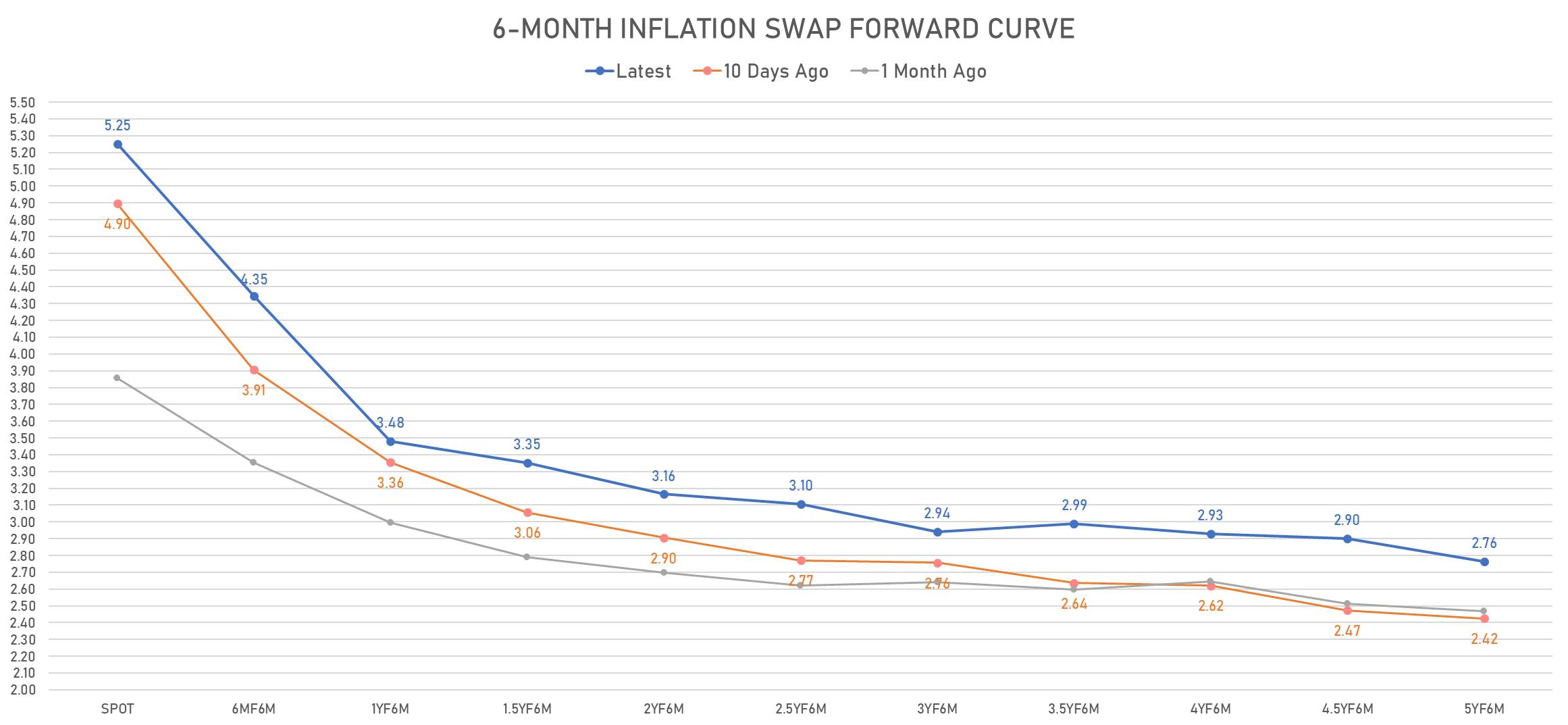

- 6-month spot US CPI swap up 39.7 bp to 5.252%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6910%, -11.1 bp today; 10Y at -1.0660%, -10.9 bp today; 30Y at -0.2760%, -10.3 bp today

RATES VOLATILITY & LIQUIDITY

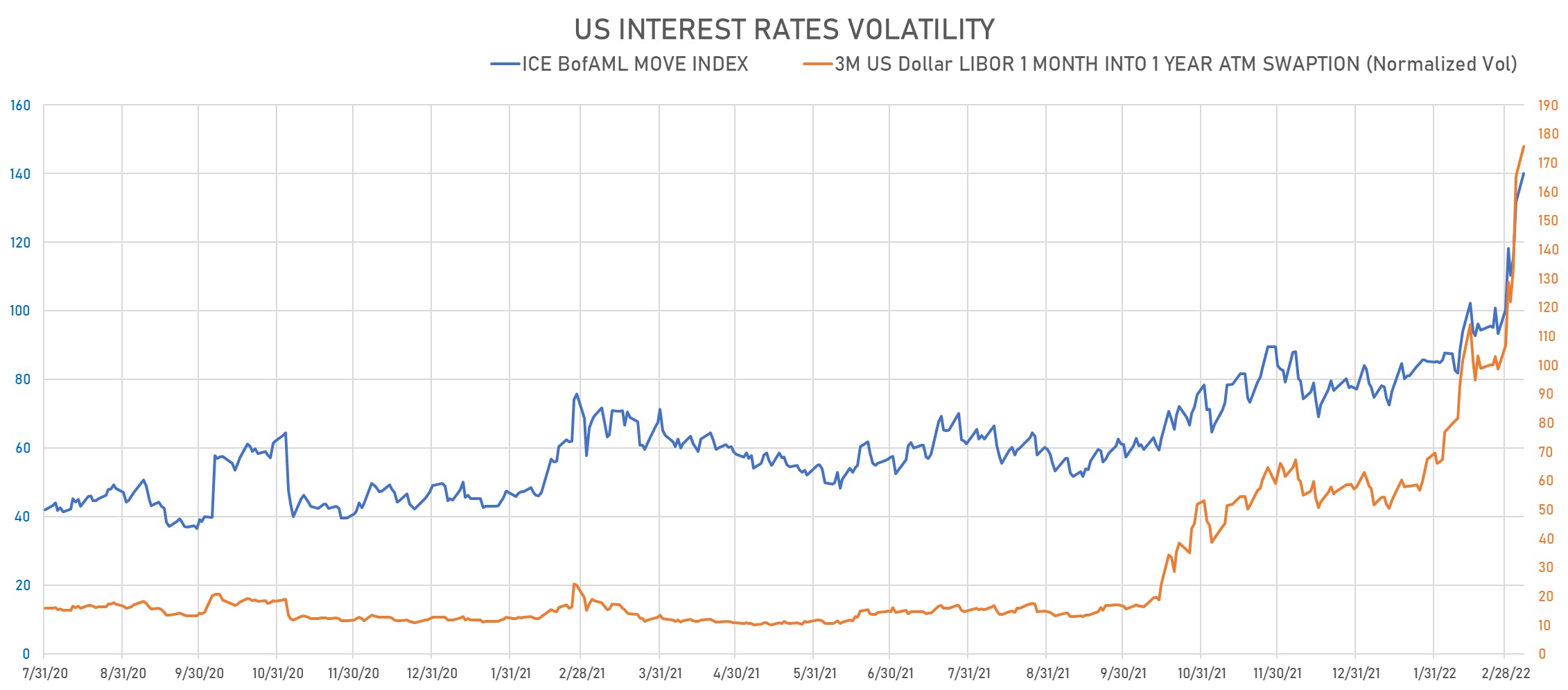

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 10.2 vols at 175.6 normals

- 3-Month LIBOR-OIS spot spread up 5.3 bp at 24.3 bp (12-months range: -5.5-24.3 bp)

KEY INTERNATIONAL RATES

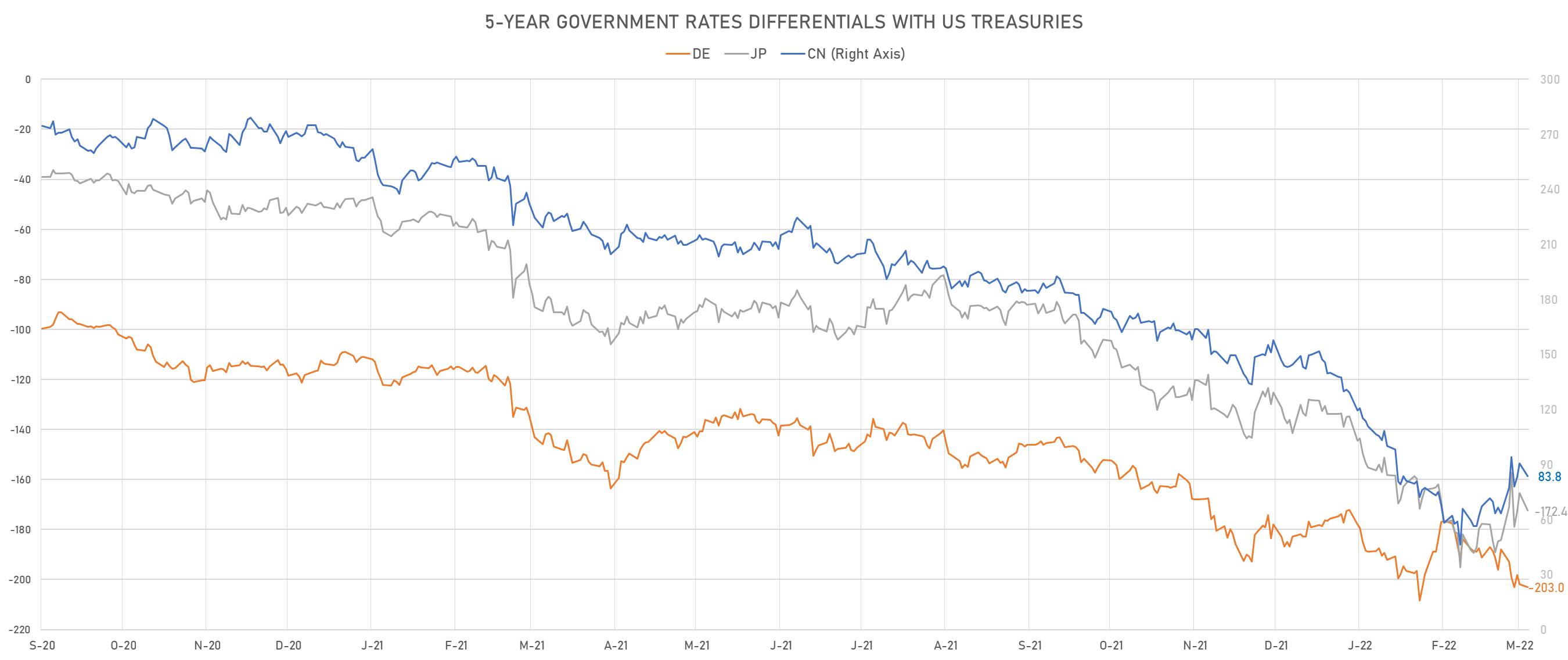

- Germany 5Y: -0.322% (up 9.4 bp); the German 1Y-10Y curve is 6.8 bp steeper at 65.5bp (YTD change: +23.6 bp)

- Japan 5Y: -0.007% (down -1.3 bp); the Japanese 1Y-10Y curve is 1.1 bp flatter at 23.6bp (YTD change: +5.9 bp)

- China 5Y: 2.561% (down -0.8 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 76.5bp (YTD change: +25.5 bp)

- Switzerland 5Y: -0.139% (unchanged); the Swiss 1Y-10Y curve is 8.6 bp flatter at 77.6bp (YTD change: +21.1 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +2.1 bp at 204.0 bp (YTD change: +31.9 bp)

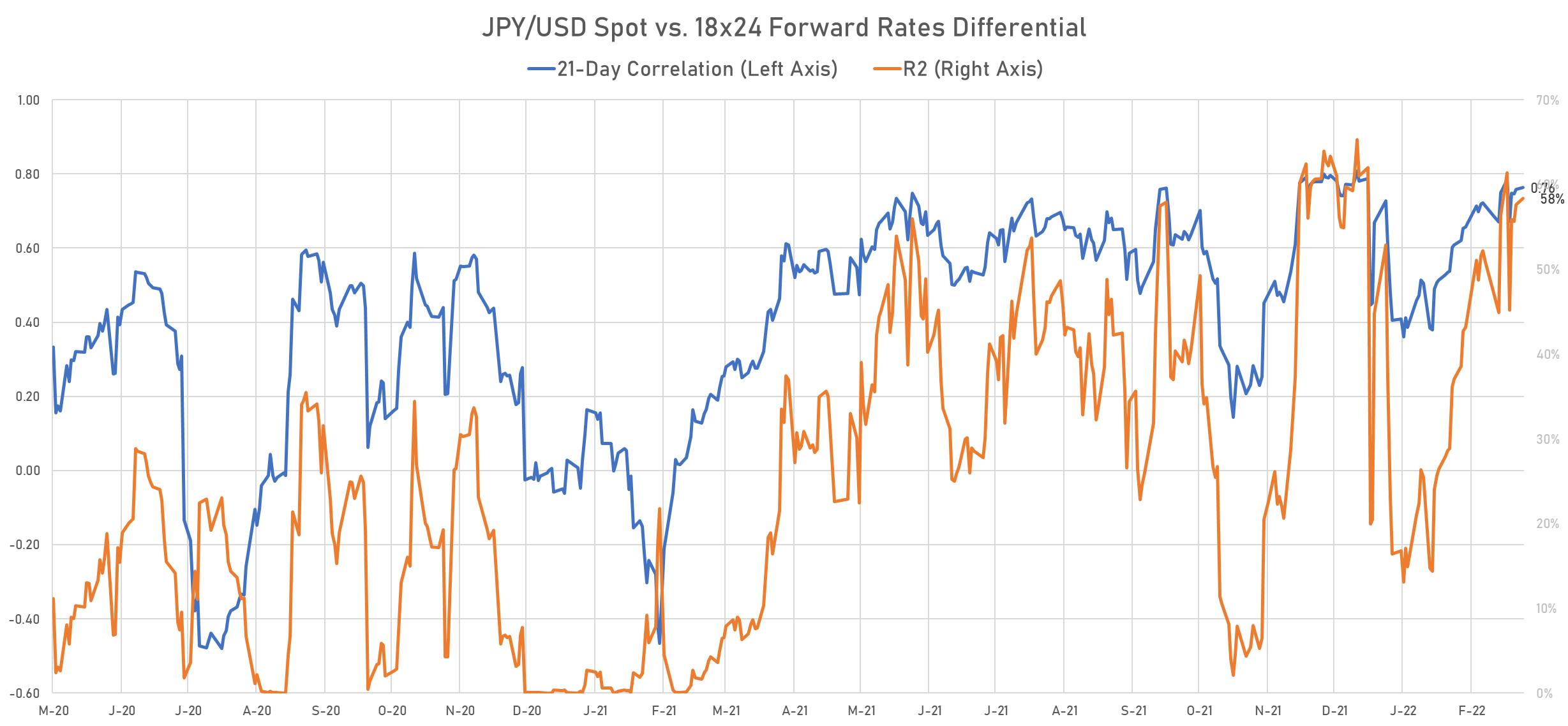

- US-JAPAN: +6.3 bp at 171.7 bp (YTD change: +37.0 bp)

- US-CHINA: +8.0 bp at -82.6 bp (YTD change: +46.6 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -1.1 bp at 135.8 bp (YTD change: +52.6bp)

- US-JAPAN: -6.9 bp at -43.8 bp (YTD change: +27.0bp)

- JAPAN-GERMANY: +5.8 bp at 179.6 bp (YTD change: +25.6bp)

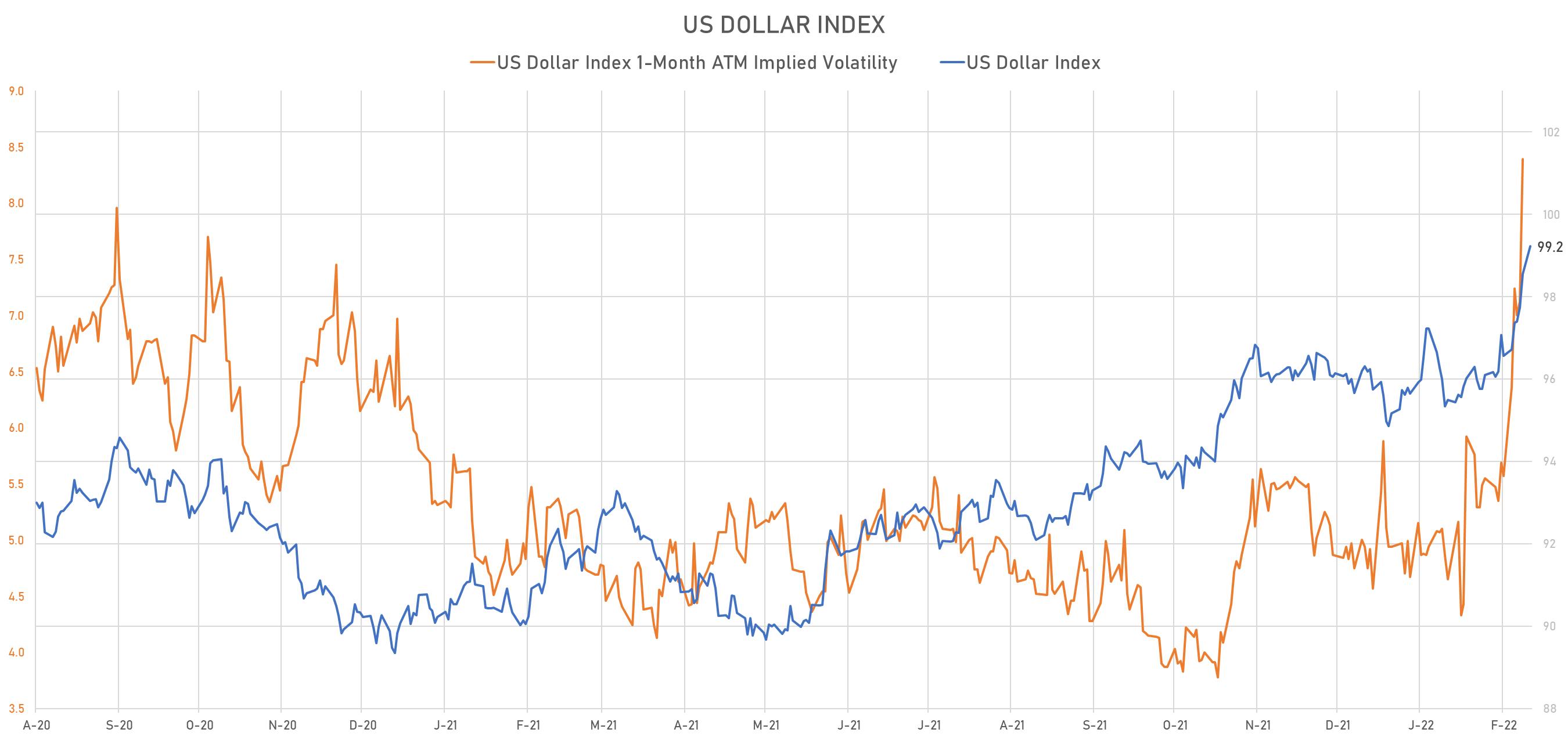

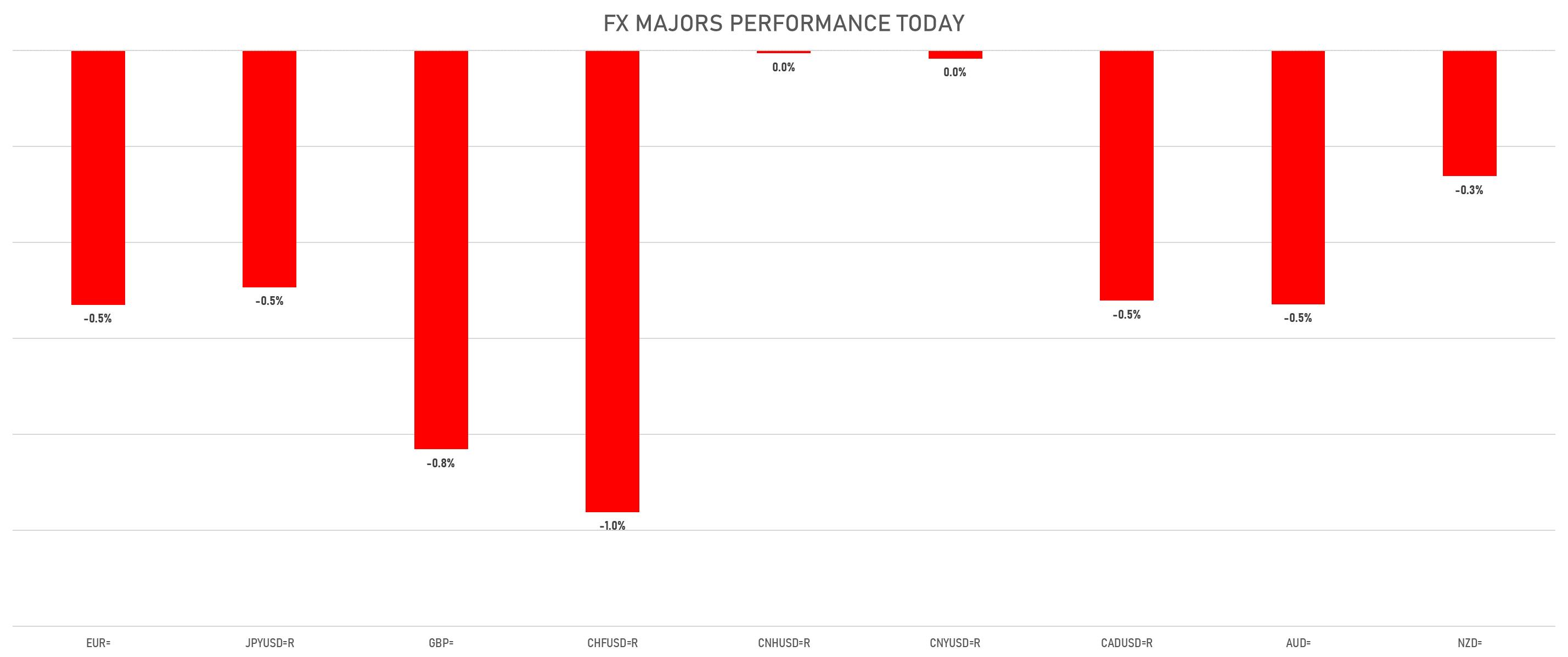

FX SUMMARY

- The US Dollar Index is up 0.68% at 99.23 (YTD: +3.73%)

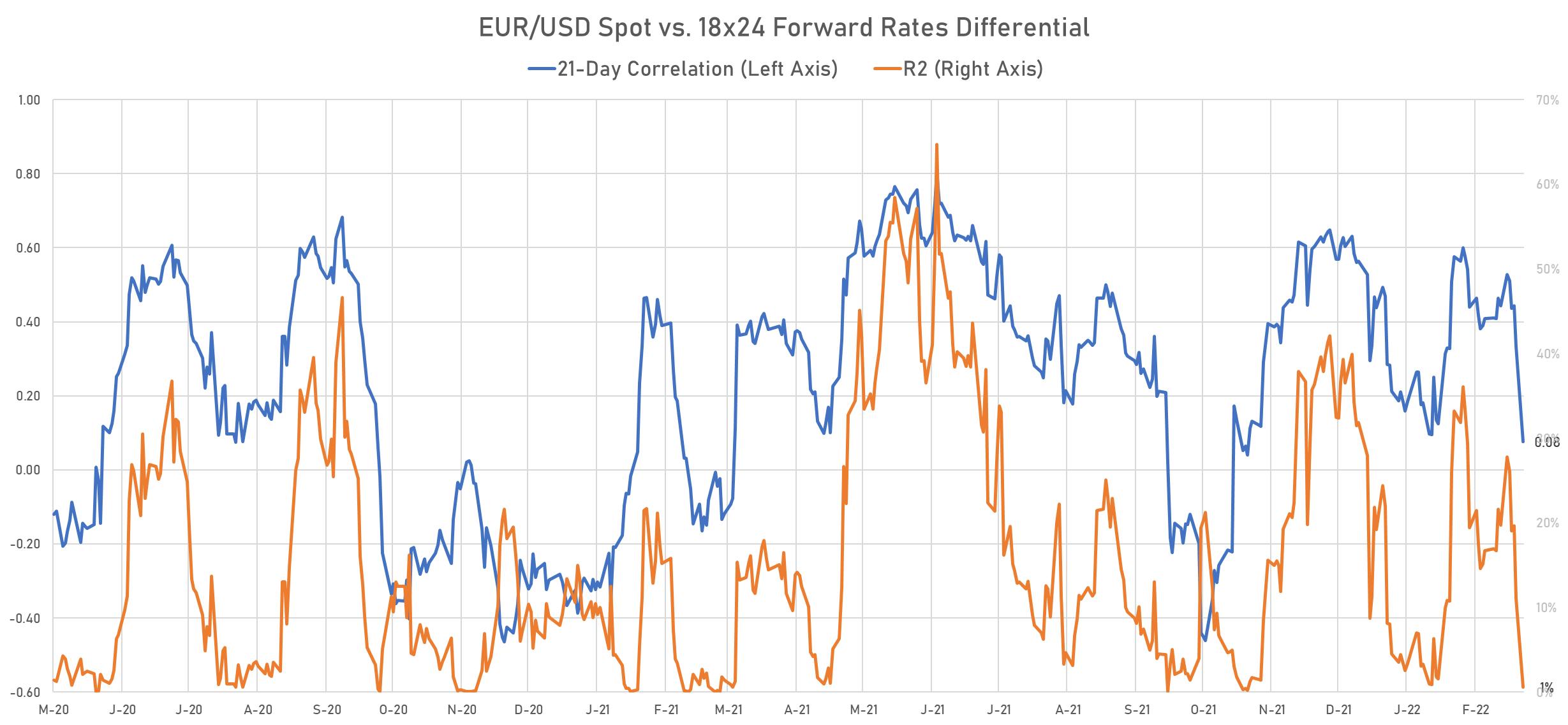

- Euro down 0.53% at 1.0868 (YTD: -4.4%), with the currency trading on risk aversion rather than fundamentals: recent moves have been largely untethered from rates differentials

- Yen down 0.49% at 115.35 (YTD: -0.2%), in line with moves in rates differentials

- Onshore Yuan down 0.02% at 6.3194 (YTD: +0.6%)

- Swiss franc down 0.96% at 0.9254 (YTD: -1.4%)

- Sterling down 0.83% at 1.3115 (YTD: -3.1%)

- Canadian dollar down 0.52% at 1.2800 (YTD: -1.3%)

- Australian dollar down 0.53% at 0.7331 (YTD: +1.0%)

- NZ dollar down 0.26% at 0.6842 (YTD: +0.3%)

GLOBAL MACRO DATA RELEASES

- Brazil, PMI, Composite, Output, Total for Feb 2022 (Markit Economics) at 53.50 (vs 50.90 prior)

- Brazil, PMI, Services Sector, Business Activity for Feb 2022 (Markit Economics) at 54.70 (vs 52.80 prior)

- Estonia, CPI, Change P/P, Price Index for Feb 2022 (Statistics Estonia) at 1.50 % (vs -0.10 % prior)

- Estonia, CPI, Change Y/Y, Price Index for Feb 2022 (Statistics Estonia) at 12.00 % (vs 11.30 % prior)

- Euro Zone, sentix, Investors sentiment for Mar 2022 (Sentix) at -7.00 (vs 16.60 prior), below consensus estimate of 5.30

- France, Reserve Assets, Current Prices for Feb 2022 (MINEFI, France) at 232,616.00 Mln EUR (vs 224,650.00 Mln EUR prior)

- Germany, New Orders, Manufacturing industry, Change P/P for Jan 2022 (Deutsche Bundesbank) at 1.80 % (vs 2.80 % prior), above consensus estimate of 1.00 %

- Germany, Retail Sales, Total excluding motor vehicles and automotive fuel, Change P/P for Jan 2022 (Destatis) at 2.00 % (vs -5.50 % prior), above consensus estimate of 1.80 %

- Germany, Retail Sales, Total excluding motor vehicles and automotive fuel, Change Y/Y for Jan 2022 (Destatis) at 10.30 % (vs 0.00 % prior), above consensus estimate of 9.80 %

- New Zealand, Reserve Assets, Current Prices for Feb 2022 (RBNZ) at 21,594.00 Mln NZD (vs 22,234.00 Mln NZD prior)

- Norway, Production, Manufacturing, Change P/P for Jan 2022 (Statistics Norway) at 3.30 % (vs -1.60 % prior)

- South Africa, Reserves, Gross gold and other foreign reserves, Current Prices for Feb 2022 (SA Reserve Bank) at 57.69 Bln USD (vs 57.20 Bln USD prior)

- South Africa, Reserves, Reserve Bank, international liquidity position, Current Prices for Feb 2022 (SA Reserve Bank) at 55.54 Bln USD (vs 55.01 Bln USD prior)

- Switzerland, Foreign reserves in convertible foreign currencies, Current Prices for Feb 2022 (Swiss National Bank) at 938,349.00 Mln CHF (vs 947,150.00 Mln CHF prior)

- Switzerland, Unemployment, Rate for Feb 2022 (SECO, Switzerland) at 2.20 % (vs 2.30 % prior), below consensus estimate of 2.30 %

- United Kingdom, House Prices, Halifax, UK, Change P/P for Feb 2022 at 0.50 % (vs 0.30 % prior)

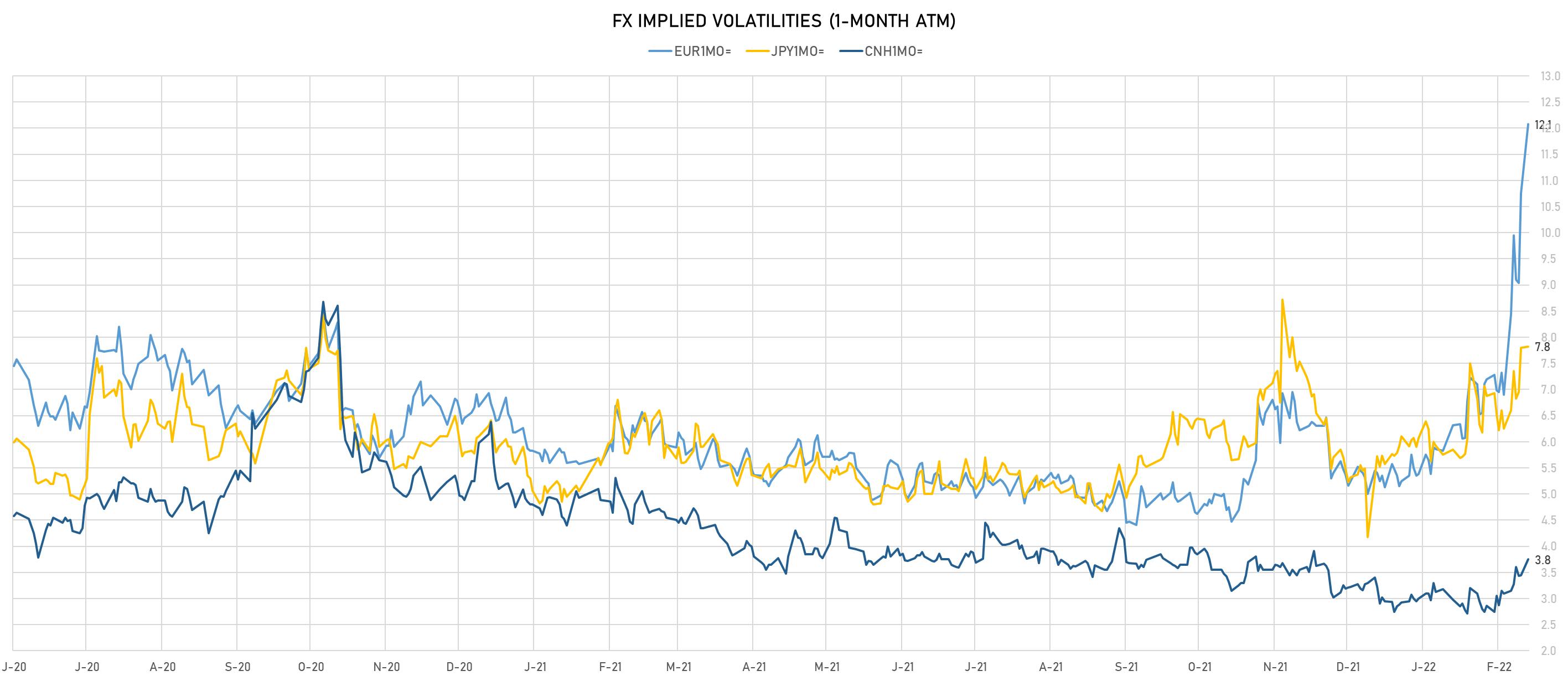

FX VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 9.71, up 0.86 (YTD: +3.60)

- Euro 1-Month At-The-Money Implied Volatility currently at 12.08, up 1.3 (YTD: +7.1)

- Japanese Yen 1M ATM IV unchanged at 7.83 (YTD: +3.7)

- Offshore Yuan 1M ATM IV currently at 3.75, up 0.3 (YTD: +0.5)

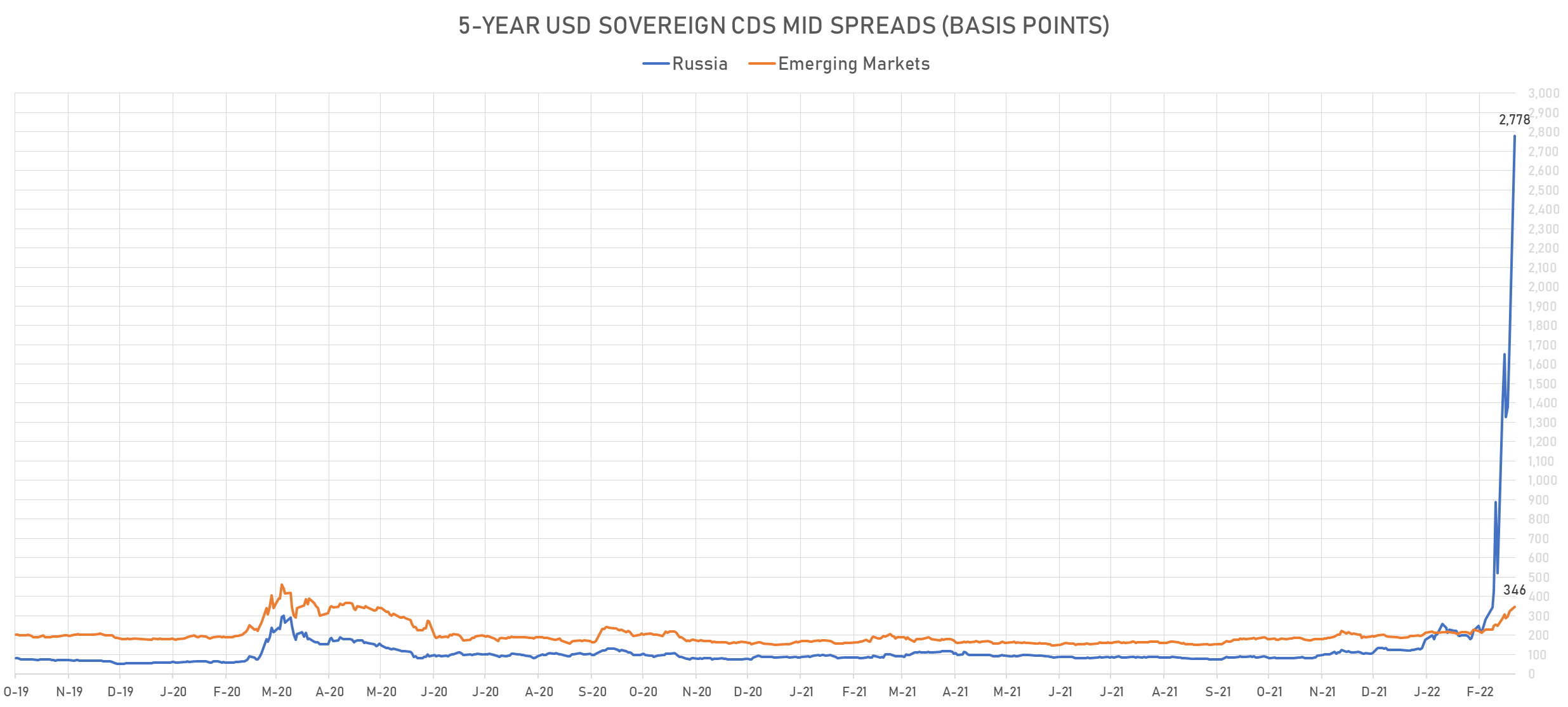

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- China (rated A+): up 7.1 basis points to 63 bp (1Y range: 29-66bp)

- Malaysia (rated BBB+): up 9.2 basis points to 82 bp (1Y range: 38-74bp)

- Philippines (rated BBB): up 12.0 basis points to 106 bp (1Y range: 39-97bp)

- Latvia (rated A-): up 12.0 basis points to 67 bp (1Y range: 43-68bp)

- Lithuania (rated A): up 12.5 basis points to 69 bp (1Y range: 44-70bp)

- Poland (rated A-): up 12.5 basis points to 69 bp (1Y range: 44-70bp)

- Israel (rated A+): up 14.0 basis points to 78 bp (1Y range: 50-80bp)

- Slovenia (rated A): up 14.5 basis points to 80 bp (1Y range: 51-82bp)

- Egypt (rated B+): up 402.1 basis points to 1,005 bp (1Y range: 283-837bp)

- Russia (rated B+): up 1,235.1 basis points to 2,516 bp (1Y range: 75-1,635bp)

LARGEST FX MOVES TODAY

- Mauritius Rupee up 2.2% (YTD: +0.4%)

- Vanuatu Vatu up 2.1% (YTD: 0.0%)

- Haiti Gourde down 1.9% (YTD: -6.8%)

- Iceland Krona down 2.0% (YTD: -3.4%)

- Samoa Tala down 2.3% (YTD: +0.2%)

- Hungarian Forint down 2.5% (YTD: -10.4%)

- Polish Zloty down 2.5% (YTD: -12.0%)

- Albanian Lek down 3.7% (YTD: -9.7%)

- Georgian Lari down 6.1% (YTD: -11.6%)

- Russian Rouble down 17.6% (YTD: -45.0%)

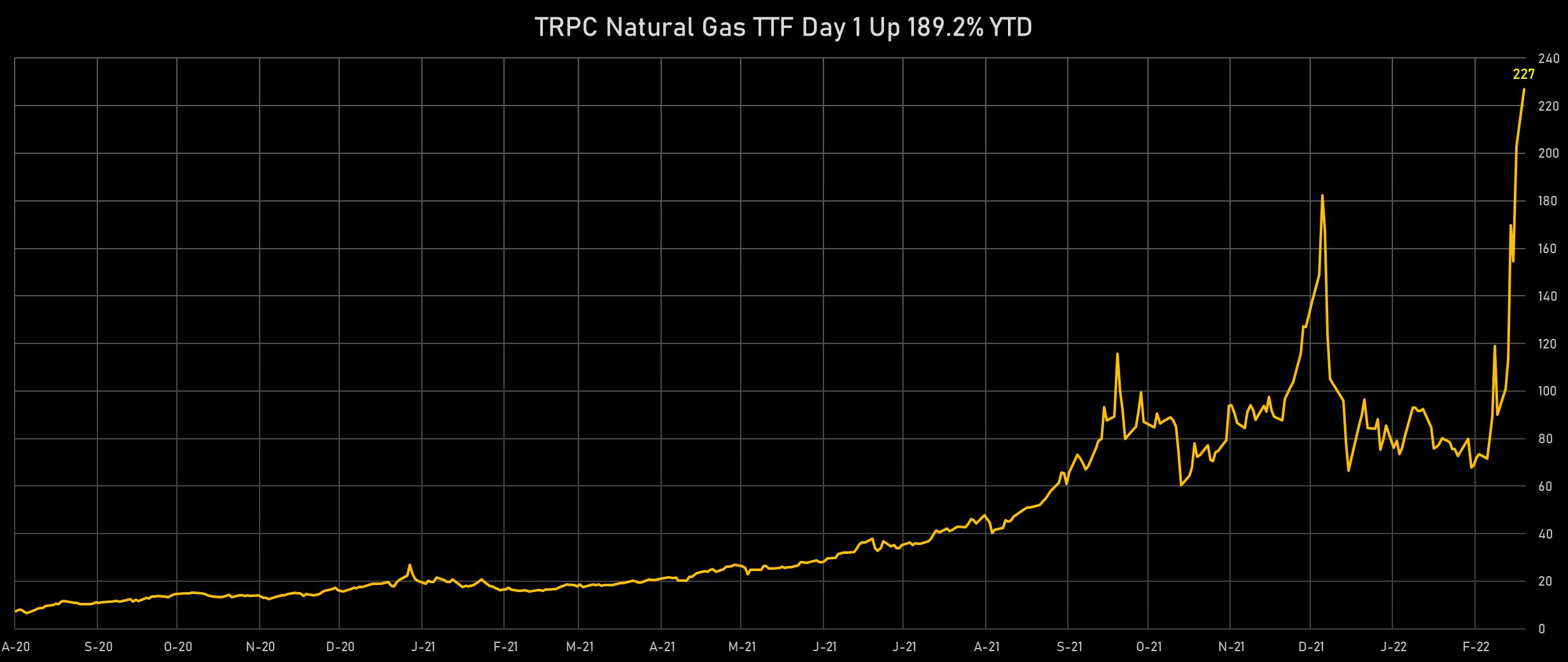

RISING COMMODITIES

- TRPC Natural Gas TTF Day 1 up 11.8% (YTD: 189.2%)

- ICE Europe Low Sulphur Gasoil up 9.6% (YTD: 91.5%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea up 8.7% (YTD: 70.5%)

- Baltic Exchange BALTIC CLEAN TNK up 8.3% (YTD: 35.1%)

- Baltic Exchange Capesize Index up 7.0% (YTD: -25.6%)

- Bursa Malaysia Crude Palm Oil up 6.6% (YTD: 40.3%)

- SHFE Nickel up 6.5% (YTD: 34.4%)

- Zhengzhou Exchange Thermal Coal up 6.5% (YTD: 32.1%)

- CBoT Wheat up 5.7% (YTD: 82.8%)

- Johnson Matthey Rhodium New York 0930 up 5.7% (YTD: 57.4%)

- SHFE Bitumen Continuation Month 1 up 5.6% (YTD: 20.8%)

- Brent Forties and Oseberg Dated FOB North Sea Crude up 5.4% (YTD: 65.2%)

- SGX Iron Ore 62% China CFR Swap Monthly up 5.4% (YTD: 42.9%)

- TRPC Natural Gas TTF Monthly up 5.1% (YTD: 148.9%)

- ICE Europe Brent Crude up 4.3% (YTD: 55.3%)

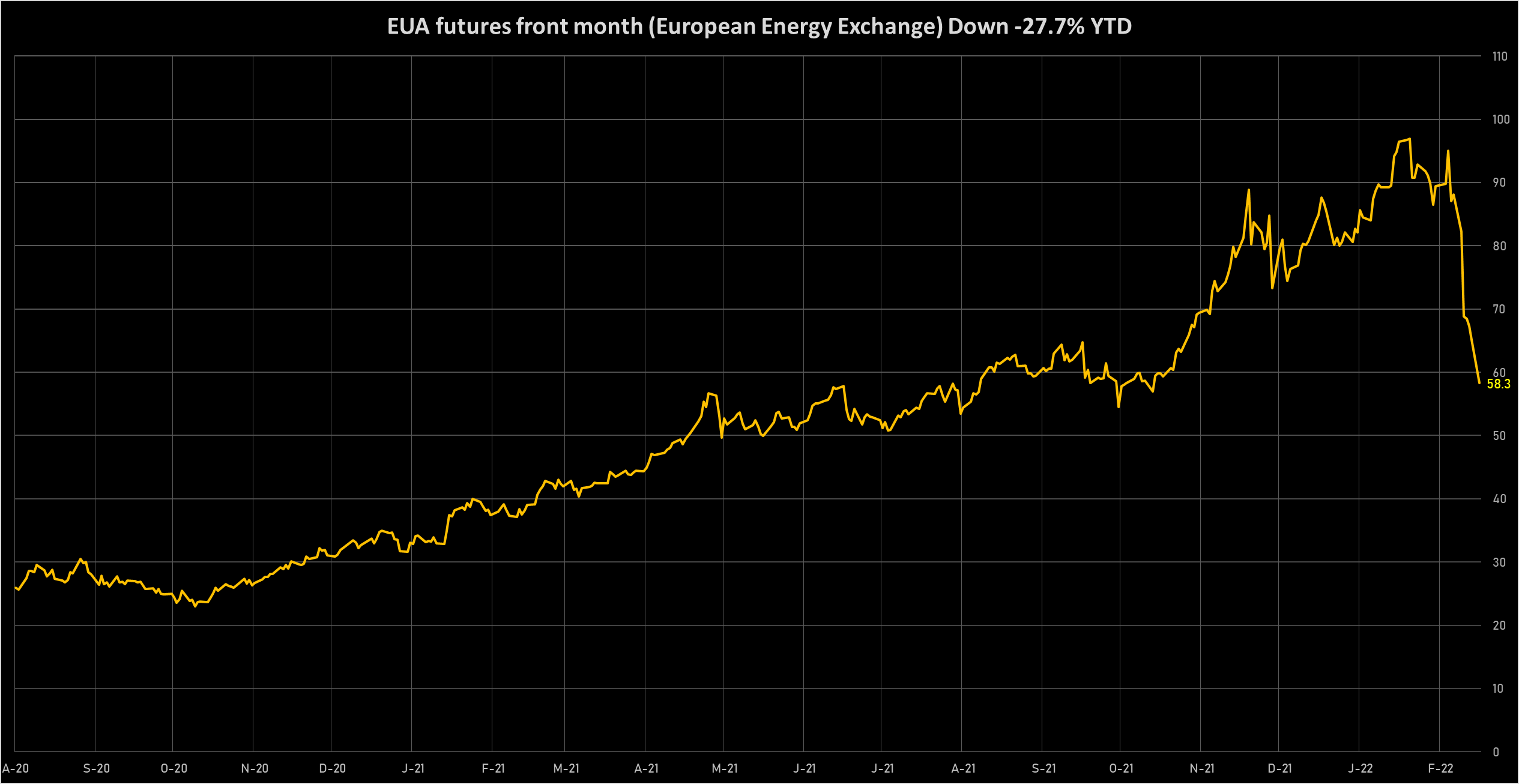

FALLING COMMODITIES

- EEX European-Carbon- Secondary Trading down -10.6% (YTD: -27.2%)

- EEX European Union Aviation Allowance Continuation Month 1 down -10.6% (YTD: -27.5%)

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -10.4% (YTD: -27.3%)

- COMEX Copper down -4.2% (YTD: 7.7%)

- NYMEX Henry Hub Natural Gas down -3.6% (YTD: 35.7%)

- DCE RBD Palm Oil down -2.9% (YTD: 42.2%)

- SMM Erbium Oxide Spot Price Daily down -1.3% (YTD: 13.1%)

- CBoT Rough Rice down -1.2% (YTD: 9.2%)

- CBoT Corn down -1.0% (YTD: 25.7%)

- Palladium spot down -0.5% (YTD: 52.5%)

- ICE-US Sugar No. 11 down -0.4% (YTD: 2.6%)

- CME Dry Whey down -0.3% (YTD: 24.4%)

- SHFE Rubber down -0.3% (YTD: -7.0%)

- CBoT Soybean Meal down -0.2% (YTD: 13.1%)

ENERGY COMMODITIES TODAY

- WTI crude front month currently at US$ 119.73 per barrel, up 3.2% (YTD: +55.1%); 6-month term structure in widening backwardation

- Brent crude front month currently at US$ 124.22 per barrel, up 4.3% (YTD: +55.3%)

- Brent 1-month at-the-money implied volatility at 82.5, down -6.8 vols (12-month range: 26.1-89.3)

- Newcastle Coal (ICE Europe) currently at US$ 422.65 per tonne, up 0.9% (YTD: +148.5%)

- Natural Gas (Henry Hub) currently at US$ 4.75 per MMBtu, down -3.6% (YTD: +35.7%)

- Gasoline (NYMEX) currently at US$ 3.59 per gallon, up 0.8% (YTD: +55.5%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 1,311.25 per tonne, up 9.6% (YTD: +91.5%)

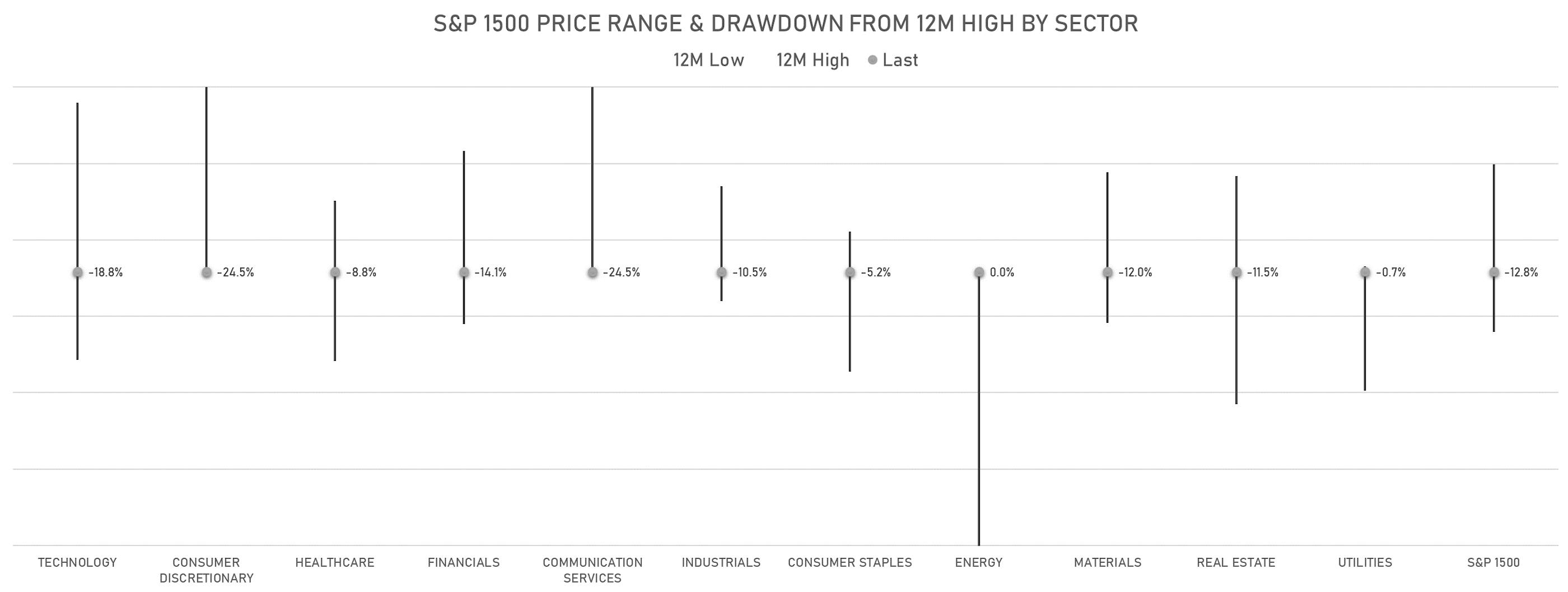

EQUITIES SUMMARY

- Daily performance of US indices: S&P 500 down -2.95%; Nasdaq Composite down -3.62%; Wilshire 5000 down -3.10%

- 13.5% of S&P 500 stocks were up today, with 34.7% of stocks above their 200-day moving average (DMA) and 28.7% above their 50-DMA

- Top performing sectors in the S&P 500: energy up 1.57% and utilities up 1.31%

- Bottom performing sectors in the S&P 500: consumer discretionary down -4.80% and communication services down -3.74%

- The number of shares in the S&P 500 traded today was 889m for a total turnover of US$ 98 bn

- The S&P 500 Value Index was down -2.2%, while the S&P 500 Growth Index was down -3.7%; the S&P small caps index was down -2.3% and mid-caps were down -3.8%

- The volume on CME's INX (S&P 500 Index) was 3.5m (3-month z-score: 1.6); the 3-month average volume is 2.6m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 down -1.10%; UK FTSE 100 down -0.40%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index down -1.45%, Japan's TOPIX 500 down -0.78%

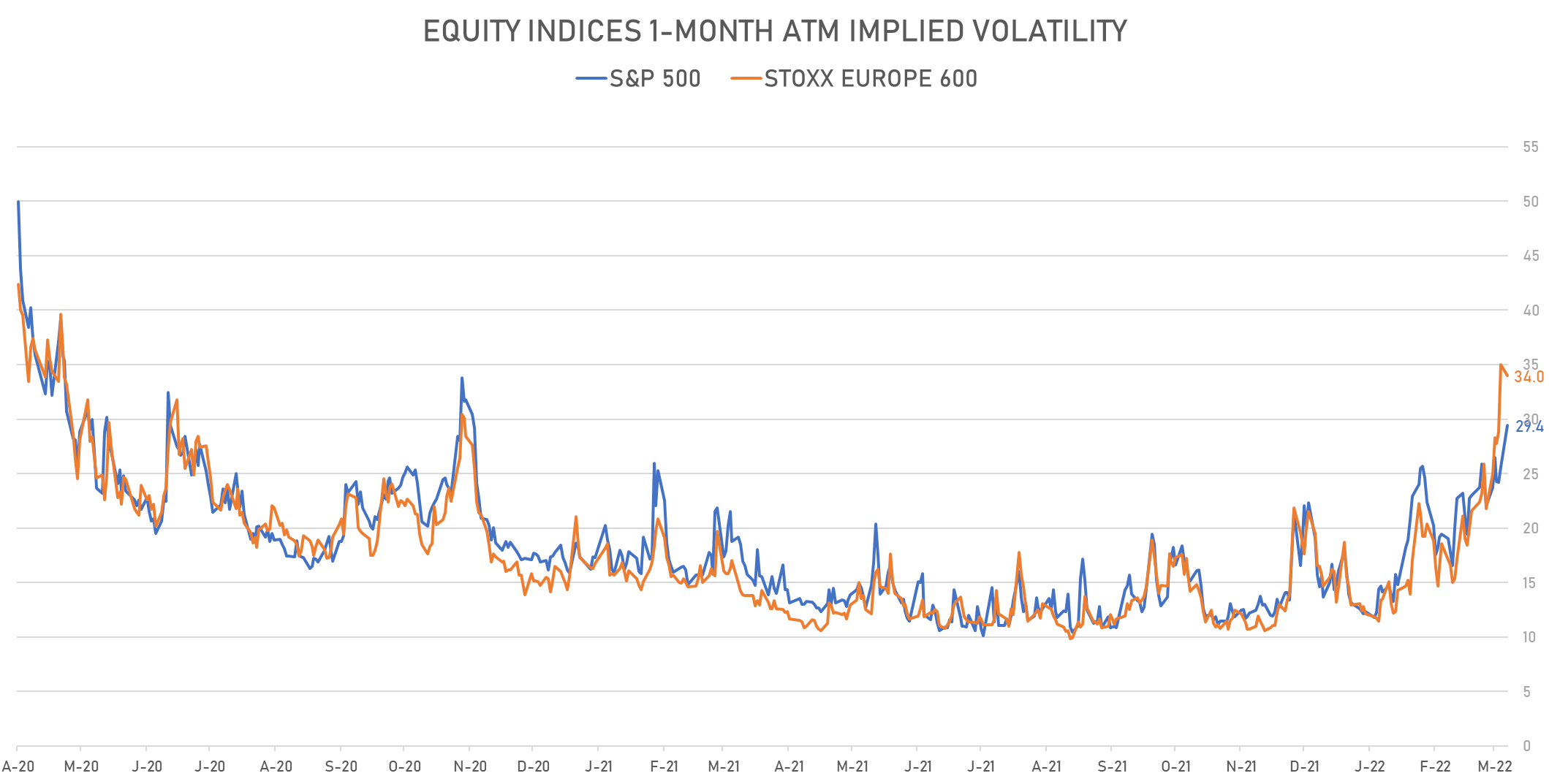

EQUITITY VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 29.4%, up from 25.6%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 34.0%, down from 35.0%

RISING STOCKS

- Sky Harbour Group Corp (SKYH), up 48.4% to $25.36 / 12-Month Price Range: $ 5.25-21.36 / Short interest (% of float): 0.5%; days to cover: 0.3

- Bed Bath & Beyond Inc (BBBY), up 34.2% to $21.71 / YTD price return: +48.9% / 12-Month Price Range: $ 12.39-44.51

- SES AI Corp (SES), up 29.1% to $5.68 / 12-Month Price Range: $ 4.30-11.47 / Short interest (% of float): 0.2%; days to cover: 0.8

- Faraday Future Intelligent Electric Inc (FFIE), up 18.9% to $5.66 / YTD price return: +6.4% / 12-Month Price Range: $ 3.71-17.48 / Short interest (% of float): 10.7%; days to cover: 14.7

- Uranium Energy Corp (UEC), up 18.7% to $4.58 / YTD price return: +35.8% / 12-Month Price Range: $ 1.89-5.79 / Short interest (% of float): 13.6%; days to cover: 3.6 (the stock is currently on the short sale restriction list)

- Clover Health Investments Corp (CLOV), up 18.2% to $2.60 / 12-Month Price Range: $ 1.95-28.85 / Short interest (% of float): 10.0%; days to cover: 2.5

- Transocean Ltd (RIG), up 16.7% to $4.95 / YTD price return: +79.3% / 12-Month Price Range: $ 2.63-5.13 / Short interest (% of float): 10.1%; days to cover: 3.7

- Mandiant Inc (MNDT), up 16.0% to $22.49 / YTD price return: +28.2% / 12-Month Price Range: $ 13.76-22.80 / Short interest (% of float): 6.5%; days to cover: 3.3

- Nov Inc (NOV), up 15.7% to $21.19 / YTD price return: +56.4% / 12-Month Price Range: $ 11.46-18.37 / Short interest (% of float): 3.5%; days to cover: 2.9

- Microvast Holdings Inc (MVST), up 15.1% to $7.49 / YTD price return: +32.3% / 12-Month Price Range: $ 4.77-15.99 / Short interest (% of float): 8.6%; days to cover: 16.2

FALLING STOCKS

- Inspirato Inc (ISPO), down 37.3% to $26.65 / YTD price return: +163.9% / 12-Month Price Range: $ 9.00-108.00 / Short interest (% of float): 0.2%; days to cover: 0.4 (the stock is currently on the short sale restriction list)

- Virgin Orbit Holdings Inc (VORB), down 20.4% to $5.23 / YTD price return: -35.0% / 12-Month Price Range: $ 5.71-11.28 / Short interest (% of float): 1.4%; days to cover: 0.6 (the stock is currently on the short sale restriction list)

- Melco Resorts & Entertainment Ltd (MLCO), down 19.9% to $7.54 / YTD price return: -25.9% / 12-Month Price Range: $ 8.87-22.19 / Short interest (% of float): 1.7%; days to cover: 1.8 (the stock is currently on the short sale restriction list)

- Azul SA (AZUL), down 19.0% to $10.51 / YTD price return: -20.4% / 12-Month Price Range: $ 11.31-29.45 / Short interest (% of float): 9.4%; days to cover: 3.5 (the stock is currently on the short sale restriction list)

- Bloomin' Brands Inc (BLMN), down 18.4% to $18.37 / YTD price return: -12.4% / 12-Month Price Range: $ 17.29-32.81 (the stock is currently on the short sale restriction list)

- Cue Health Inc (HLTH), down 17.3% to $8.29 / 12-Month Price Range: $ 7.12-22.55 (the stock is currently on the short sale restriction list)

- Vacasa Inc (VCSA), down 17.1% to $5.61 / YTD price return: -32.6% / 12-Month Price Range: $ 5.56-11.00 / Short interest (% of float): 0.8%; days to cover: 4.7 (the stock is currently on the short sale restriction list)

- Guess? Inc (GES), down 17.0% to $16.39 / YTD price return: -30.8% / 12-Month Price Range: $ 19.47-31.12 / Short interest (% of float): 19.4%; days to cover: 8.1 (the stock is currently on the short sale restriction list)

- Spirit Airlines Inc (SAVE), down 16.7% to $18.59 / YTD price return: -14.9% / 12-Month Price Range: $ 19.40-40.77 / Short interest (% of float): 11.6%; days to cover: 1.7 (the stock is currently on the short sale restriction list)

- Peabody Energy Corp (BTU), down 16.5% to $22.00 / YTD price return: +118.5% / 12-Month Price Range: $ 2.61-27.28 / Short interest (% of float): 6.7%; days to cover: 1.4 (the stock is currently on the short sale restriction list)