Macro

Risk Premia Drop Across Asset Classes: Treasuries, The US Dollar And Commodities Sell Off, While Equities Rise

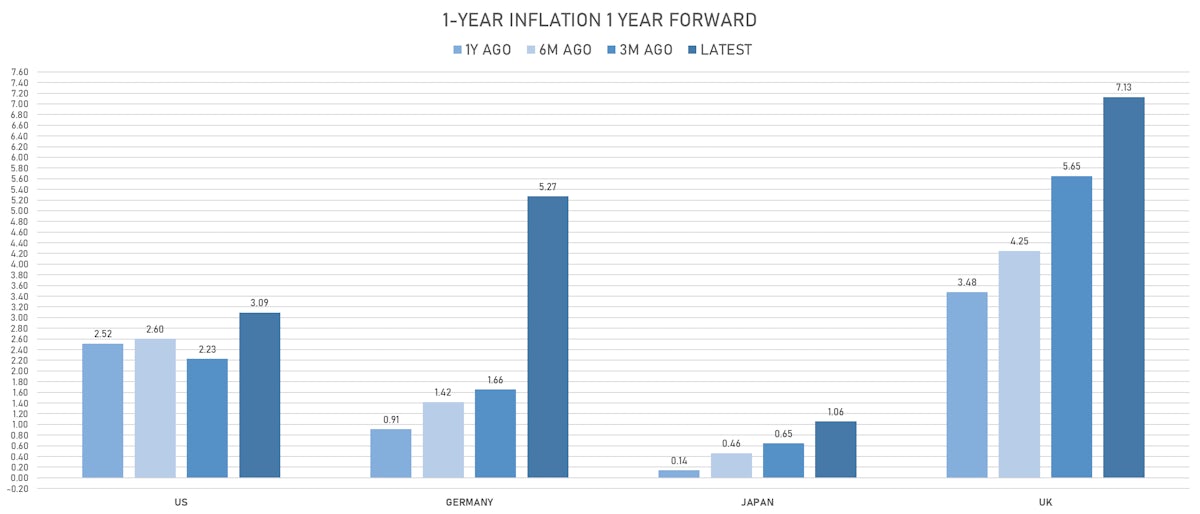

Important to watch the ECB decision on Thursday, as they're not expected to do anything, but the current inflation expectations (and the unlikelihood of them reversing anytime soon) would definitely justify a hike and could trigger a big move in the Euro after its recent weakness

Published ET

Changes in Global Inflation Expectations | Sources: ϕpost, Refinitiv data

US RATES SUMMARY

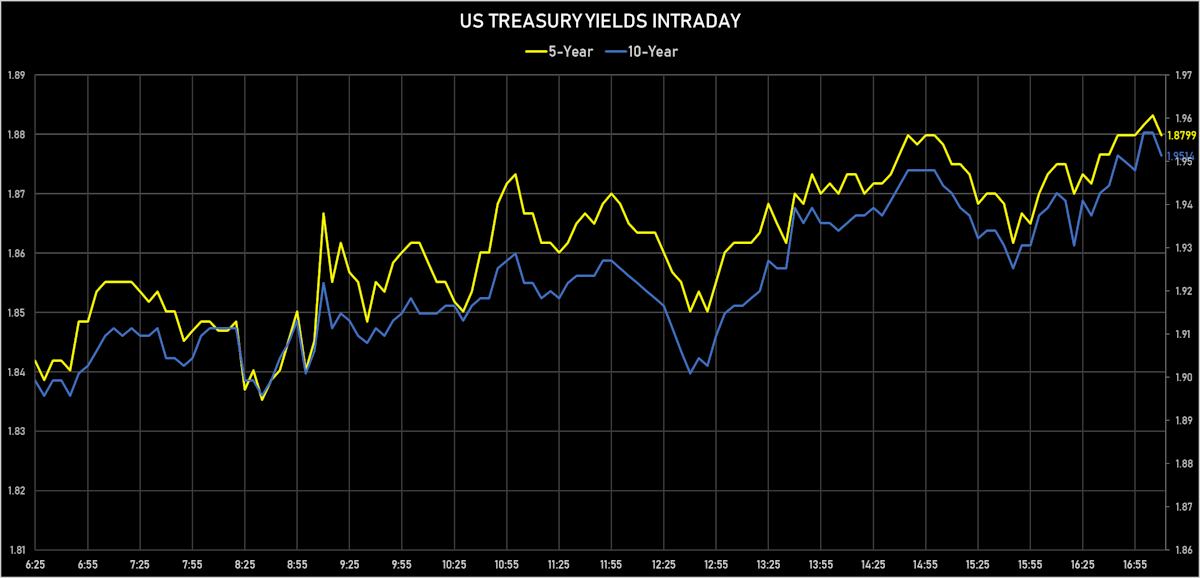

- 3-Month USD LIBOR +6.7bp today, now at 0.7700%; 3-Month OIS +3.4bp at 0.4785%

- The treasury yield curve steepened, with the 1s10s spread widening 7.8 bp, now at 84.2 bp (YTD change: -29.1bp)

- 1Y: 1.1089% (up 3.3 bp)

- 2Y: 1.6737% (up 7.5 bp)

- 5Y: 1.8791% (up 10.4 bp)

- 7Y: 1.9321% (up 10.6 bp)

- 10Y: 1.9506% (up 11.1 bp)

- 30Y: 2.3297% (up 11.2 bp)

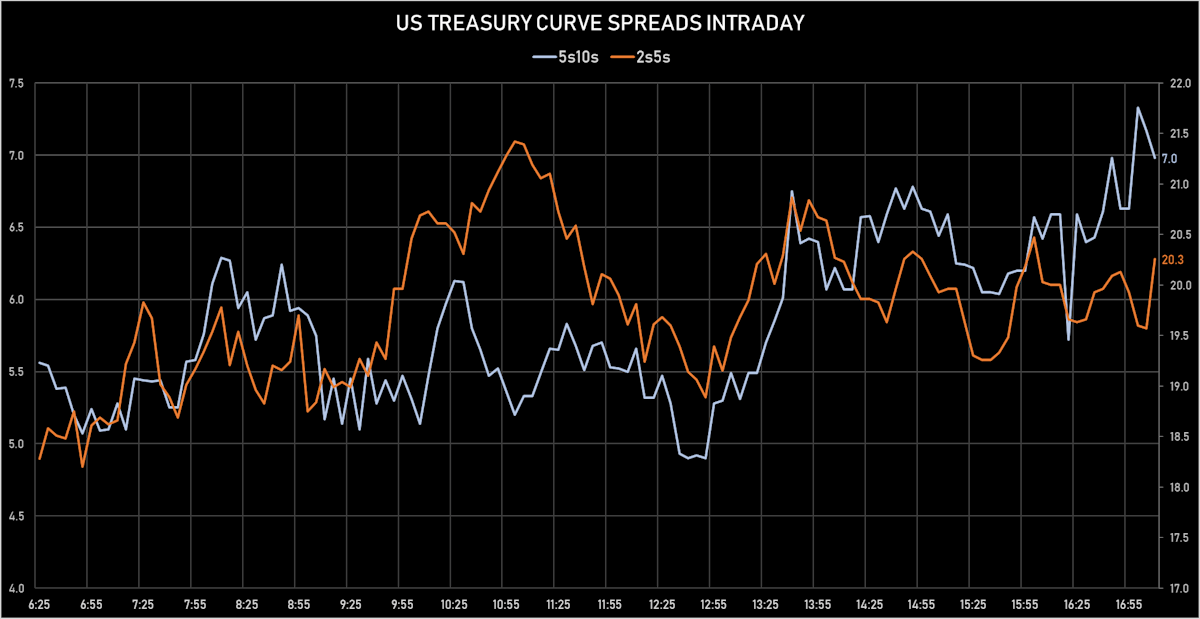

- US treasury curve spreads: 3m2Y at 129.5bp (up 6.9bp today), 2s5s at 20.5bp (up 2.9bp), 5s10s at 7.1bp (up 0.7bp), 10s30s at 37.9bp (up 0.1bp)

- Treasuries butterfly spreads: 1s5s10s at -70.6bp (down -5.3bp), 5s10s30s at 30.2bp (down -0.3bp)

- TIPS 1Y breakeven inflation at 5.45% (down -40.6bp); 2Y at 4.35% (down -12.7bp); 5Y at 3.33% (down -7.2bp); 10Y at 2.89% (down -3.8bp); 30Y at 2.53% (down -2.1bp)

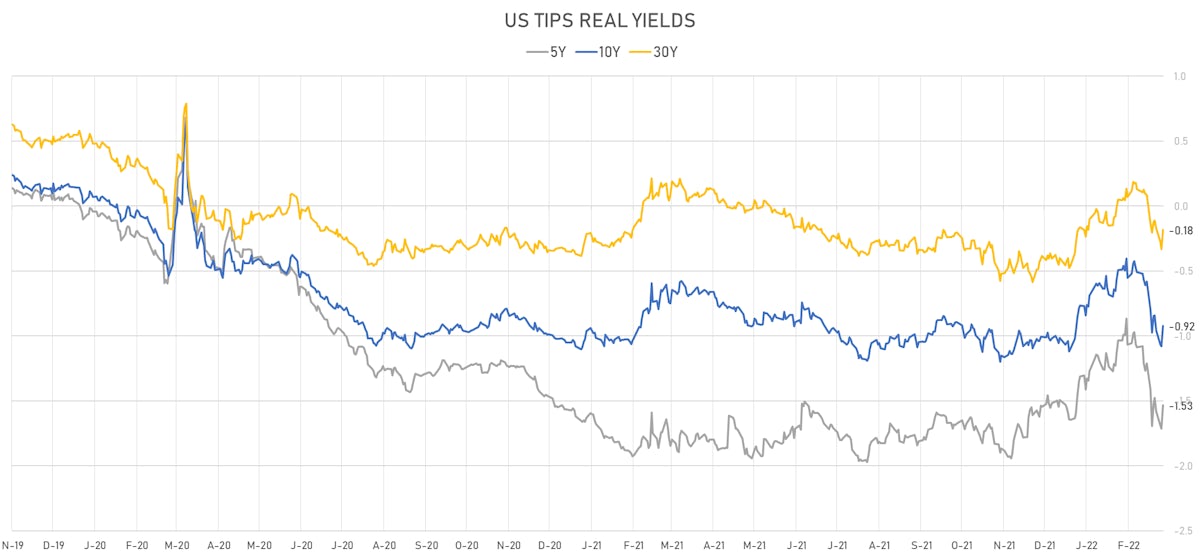

- US 5-Year TIPS Real Yield: +17.9 bp at -1.5330%; 10-Year TIPS Real Yield: +15.9 bp at -0.9220%; 30-Year TIPS Real Yield: +14.7 bp at -0.1840%

AUCTION RESULTS: $34BN 10-YEAR 1.875% COUPON TREASURY NOTE (91282CDY4)

- Mixed stats: pricing just off the when-issued, at a below-average cover but with reasonable end-user demand (at 86.2% vs 92.6% prior and 84.2% average)

- High yield: 1.920% (vs 1.904% prior), a 0.4bp tail vs when-issued at the bid deadline

- Bid/Cover: 2.47 (vs 2.68 prior and 2.51 average)

- dealer 13.7% (vs 14.7% average)

- Directs: 18.0% (vs 15.0% prior and 16.6% average)

- Indirects 68.2% (vs 77.6% prior and 67.5% average)

US MACRO RELEASES

- JOLTS Job Openings for Jan 2022 (BLS, U.S Dep. Of Lab) at 11.26 Mln (vs 10.93 Mln prior), above consensus estimate of 10.93 Mln

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 04 Mar (MBA, USA) at 8.50 % (vs -0.70 % prior)

- Mortgage applications, market composite index for W 04 Mar (MBA, USA) at 502.50 (vs 463.10 prior)

- Mortgage applications, market composite index, purchase for W 04 Mar (MBA, USA) at 267.60 (vs 246.30 prior)

- Mortgage applications, market composite index, refinancing for W 04 Mar (MBA, USA) at 1829.70 (vs 1685.70 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 04 Mar (MBA, USA) at 4.09 % (vs 4.15 % prior)

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for Mar 2022 (Refinitiv/Ipsos) at 54.72 (vs 53.62 prior)

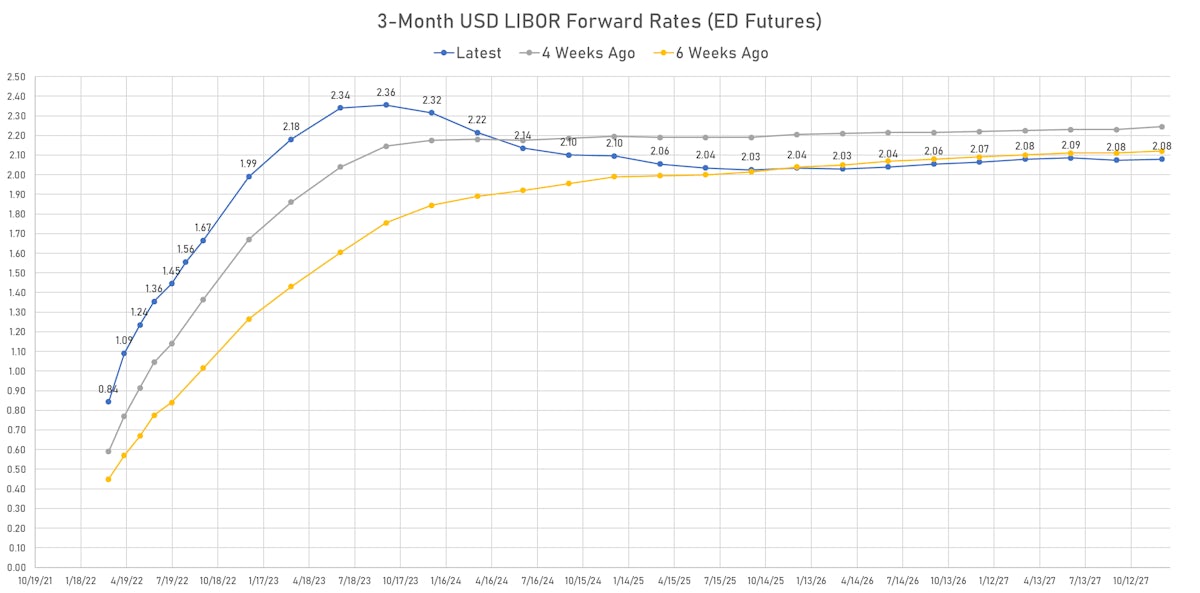

US FORWARD RATES

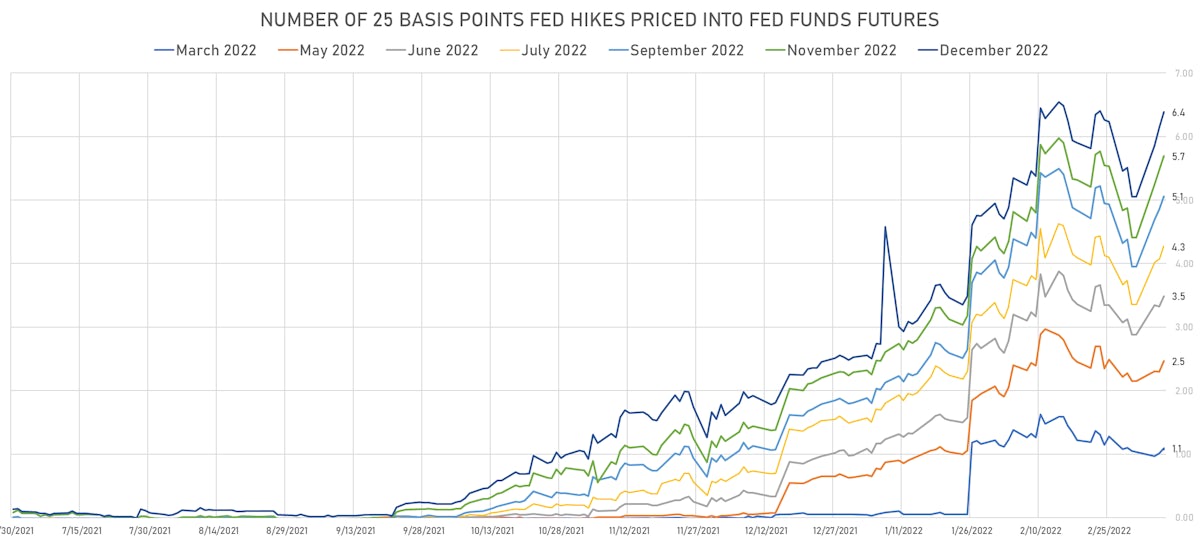

- Fed Funds futures now price in 27.3bp of Fed hikes by the end of March 2022, 61.7bp (2.47 x 25bp hikes) by the end of May 2022, and price in 6.39 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 32.5 bp of hikes in 2023 (equivalent to 1.3 x 25 bp hikes), up 5.5 bp today, and -22.0 bp of hikes in 2024 (equivalent to -0.9 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.45% (down -40.6bp); 2Y at 4.35% (down -12.7bp); 5Y at 3.33% (down -7.2bp); 10Y at 2.89% (down -3.8bp); 30Y at 2.53% (down -2.1bp)

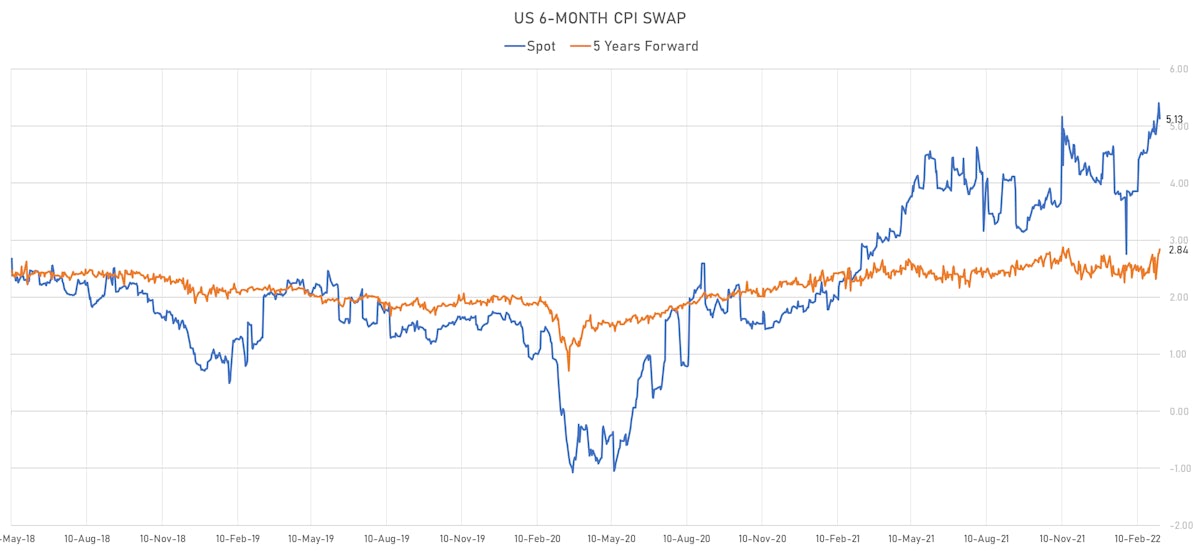

- 6-month spot US CPI swap down -27.4 bp to 5.130%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.5330%, +17.9 bp today; 10Y at -0.9220%, +15.9 bp today; 30Y at -0.1840%, +14.7 bp today

RATES VOLATILITY & LIQUIDITY

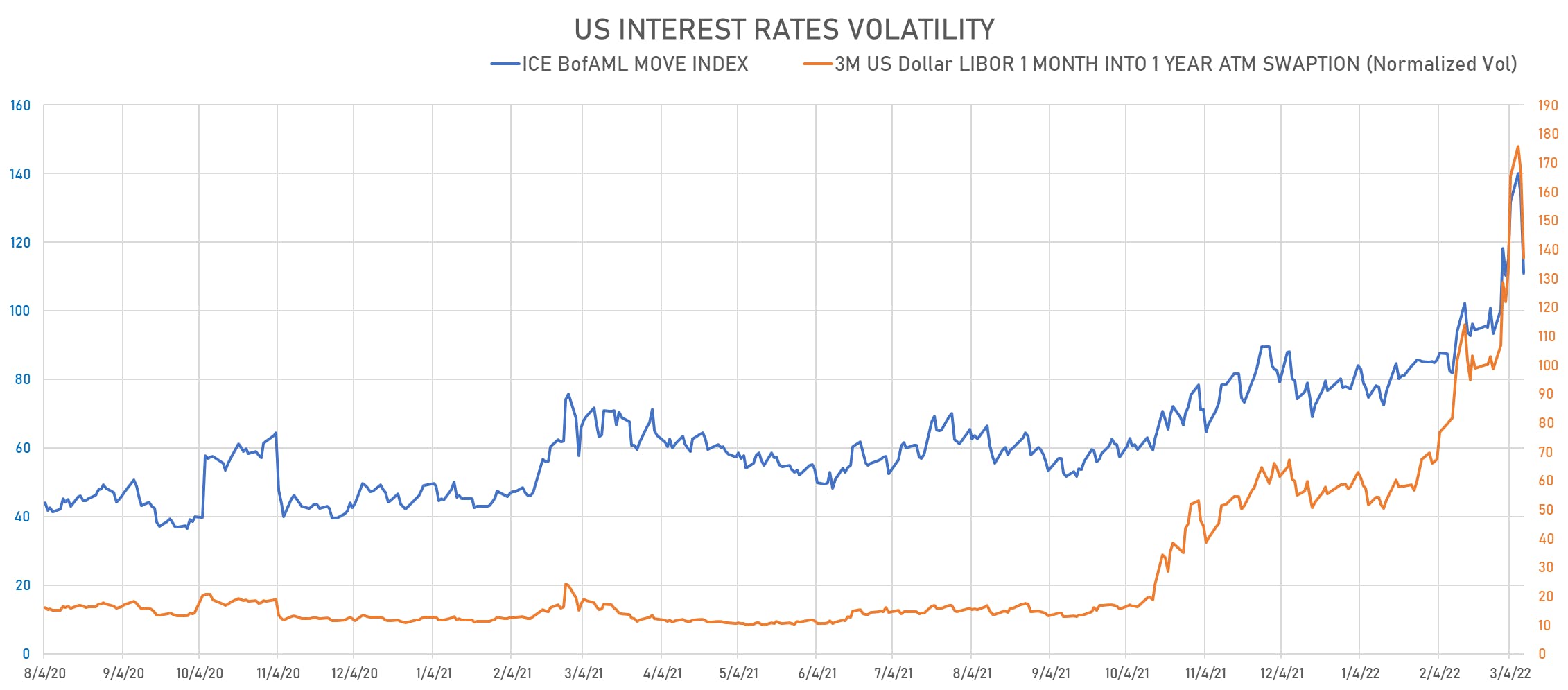

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -29.5% at 137.0%

- 3-Month LIBOR-OIS spread up 3.3 bp at 29.2 bp (12-months range: -5.5-29.2 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.116% (up 7.8 bp); the German 1Y-10Y curve is 8.4 bp steeper at 90.0bp (YTD change: +44.0 bp)

- Japan 5Y: 0.000% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp steeper at 23.1bp (YTD change: +7.2 bp)

- China 5Y: 2.566% (up 4.0 bp); the Chinese 1Y-10Y curve is 4.6 bp flatter at 73.8bp (YTD change: +22.8 bp)

- Switzerland 5Y: -0.057% (up 4.8 bp); the Swiss 1Y-10Y curve is 0.3 bp steeper at 90.4bp (YTD change: +26.9 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.0 bp at 199.3 bp (YTD change: +27.2 bp)

- US-JAPAN: +8.0 bp at 186.4 bp (YTD change: +51.7 bp)

- US-CHINA: +6.8 bp at -67.3 bp (YTD change: +61.9 bp)

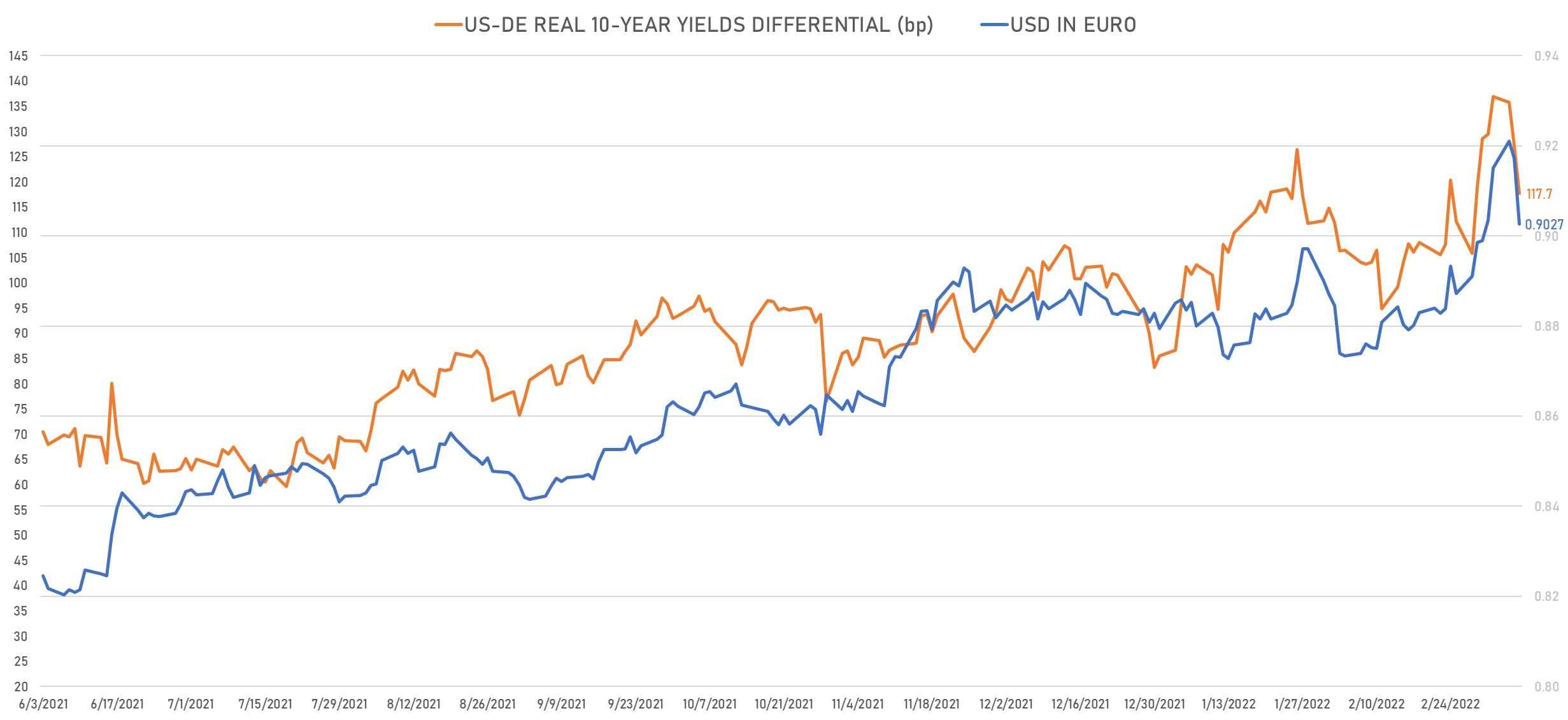

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: -9.5 bp at 117.7 bp (YTD change: +34.5bp)

- US-JAPAN: +19.9 bp at -21.9 bp (YTD change: +48.9bp)

- JAPAN-GERMANY: -29.4 bp at 139.6 bp (YTD change: -14.4bp)

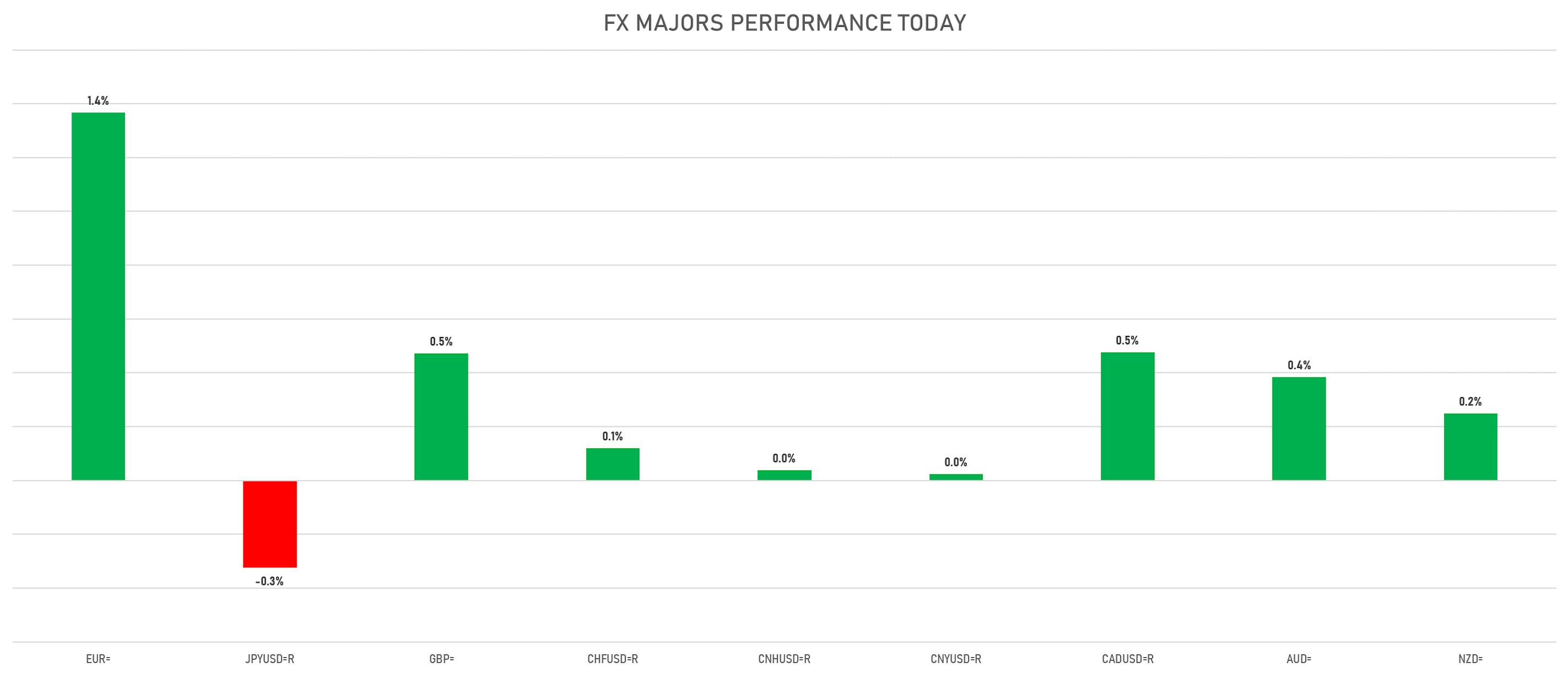

FX SUMMARY

- The US Dollar Index is down -1.17% at 98.01 (YTD: +2.45%)

- Euro up 1.37% at 1.1048 (YTD: -2.8%)

- Yen down 0.32% at 116.05 (YTD: -0.8%)

- Onshore Yuan up 0.02% at 6.3174 (YTD: +0.7%)

- Swiss franc up 0.12% at 0.9278 (YTD: -1.7%)

- Sterling up 0.47% at 1.3165 (YTD: -2.7%)

- Canadian dollar up 0.48% at 1.2818 (YTD: -1.4%)

- Australian dollar up 0.39% at 0.7294 (YTD: +0.5%)

- NZ dollar up 0.25% at 0.6821 (YTD: 0.0%)

MACRO DATA RELEASES

- Argentina, Production, Change Y/Y, Price Index for Jan 2022 (INDEC, Argentina) at -0.30 % (vs 10.10 % prior)

- Brazil, Production, General industry, Change P/P for Jan 2022 (IBGE, Brazil) at -2.40 % (vs 2.90 % prior), below consensus estimate of -1.90 %

- Brazil, Production, General industry, Change Y/Y for Jan 2022 (IBGE, Brazil) at -7.20 % (vs -5.00 % prior), below consensus estimate of -6.00 %

- China (Mainland), CPI, Average, Change Y/Y, Price Index for Feb 2022 (NBS, China) at 0.90 % (vs 0.90 % prior), in line with consensus

- China (Mainland), CPI, Change P/P for Feb 2022 (NBS, China) at 0.60 % (vs 0.40 % prior), above consensus estimate of 0.30 %

- China (Mainland), Producer Prices, Change Y/Y, Price Index for Feb 2022 (NBS, China) at 8.80 % (vs 9.10 % prior), above consensus estimate of 8.70 %

- Czech Republic, Trade Balance, CIF/FOB (National Concept), Current Prices for Jan 2022 (CSU, Czech Rep) at 6.20 Bln CZK (vs -15.00 Bln CZK prior), above consensus estimate of 0.00 Bln CZK

- Hungary, CPI, All Items, Change Y/Y, Price Index for Feb 2022 (HCSO, Hungary) at 8.30 % (vs 7.90 % prior), above consensus estimate of 8.10 %

- Italy, Production, Total industry excluding construction, Change P/P for Jan 2022 (ISTAT, Italy) at -3.40 % (vs -1.00 % prior), below consensus estimate of 0.00 %

- Italy, Production, Total industry excluding construction, Change Y/Y for Jan 2022 (ISTAT, Italy) at -2.60 % (vs 4.40 % prior), below consensus estimate of 3.20 %

- Mauritius, Policy Rates, Key Repo Rate for Q1 2022 (Bank of Mauritius) at 2.00 % (vs 1.85 % prior)

- Mexico, CPI, Change P/P, Price Index for Feb 2022 (INEGI, Mexico) at 0.83 % (vs 0.59 % prior), above consensus estimate of 0.80 %

- Mexico, CPI, Change Y/Y, Price Index for Feb 2022 (INEGI, Mexico) at 7.28 % (vs 7.07 % prior), above consensus estimate of 7.23 %

- Mexico, CPI, Core CPI, Change P/P, Price Index for Feb 2022 (INEGI, Mexico) at 0.76 % (vs 0.62 % prior), above consensus estimate of 0.74 %

- New Zealand, Electronic card transactions, Retail industry, Change P/P for Feb 2022 (Statistics, NZ) at -7.80 % (vs 3.00 % prior)

- New Zealand, Electronic card transactions, Retail industry, Change Y/Y for Feb 2022 (Statistics, NZ) at 1.10 % (vs 5.70 % prior)

- Russia, CPI, Change P/P for Feb 2022 (RosStat, Russia) at 1.20 % (vs 1.00 % prior)

- Russia, CPI, Change Y/Y for Feb 2022 (RosStat, Russia) at 9.20 % (vs 8.70 % prior)

- Sweden, Industrial Production, Change Y/Y for Jan 2022 (SCB, Sweden) at 3.90 % (vs 0.10 % prior)

- Sweden, Industrial Production, Change M/M, Volume Index for Jan 2022 (SCB, Sweden) at 1.10 % (vs -1.20 % prior)

- Sweden, Private Sector Production, Change M/M, Volume Index for Jan 2022 (SCB, Sweden) at 0.20 % (vs 0.60 % prior)

- Sweden, Private Sector Production, Change Y/Y for Jan 2022 (SCB, Sweden) at 7.60 % (vs 7.70 % prior)

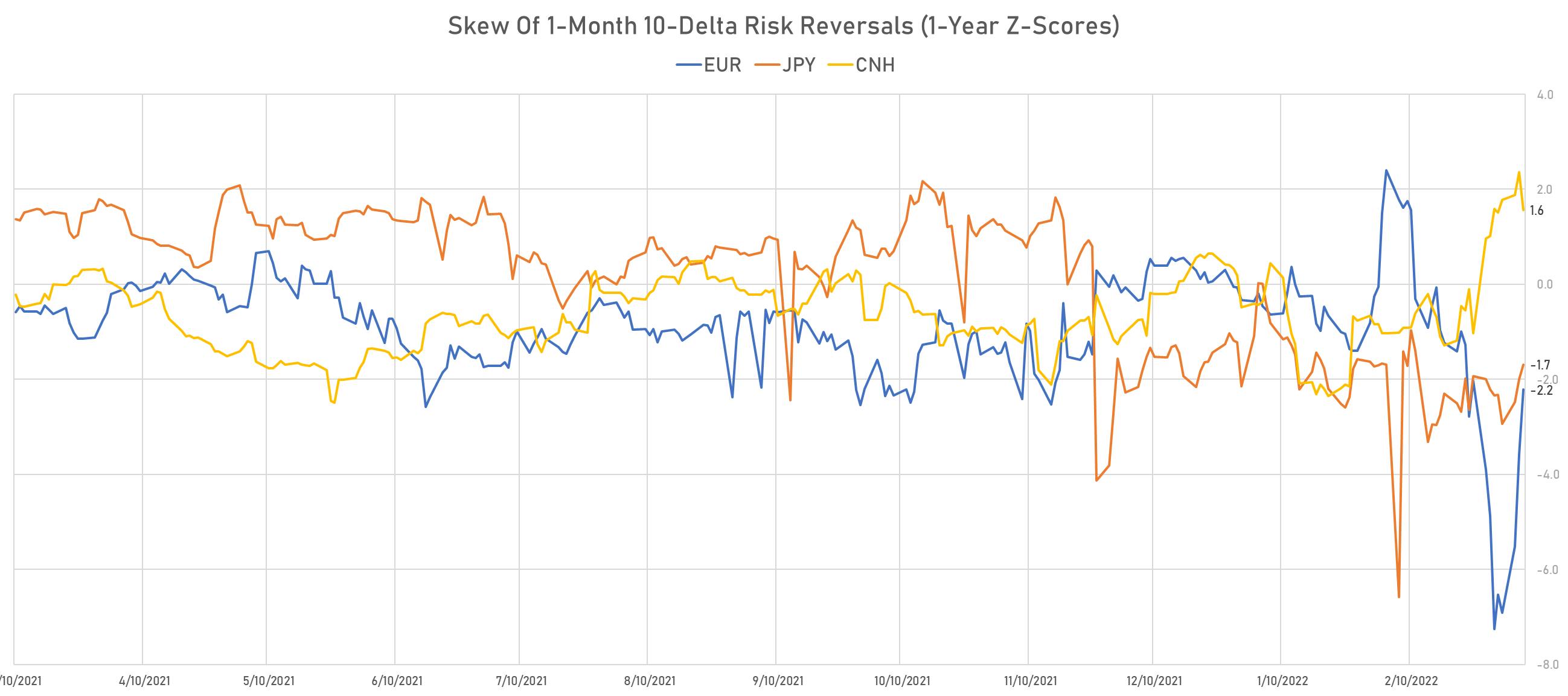

VOLATILITIES TODAY

- Deutsche Bank USD Currency Volatility Index currently at 8.99, down -0.96 (YTD: +2.88)

- Euro 1-Month At-The-Money Implied Volatility currently at 10.23, down -0.3 (YTD: +5.2)

- Japanese Yen 1M ATM IV currently at 6.75, down -0.8 (YTD: +2.6)

- Offshore Yuan 1M ATM IV currently at 3.08, down -0.5 (YTD: -0.2)

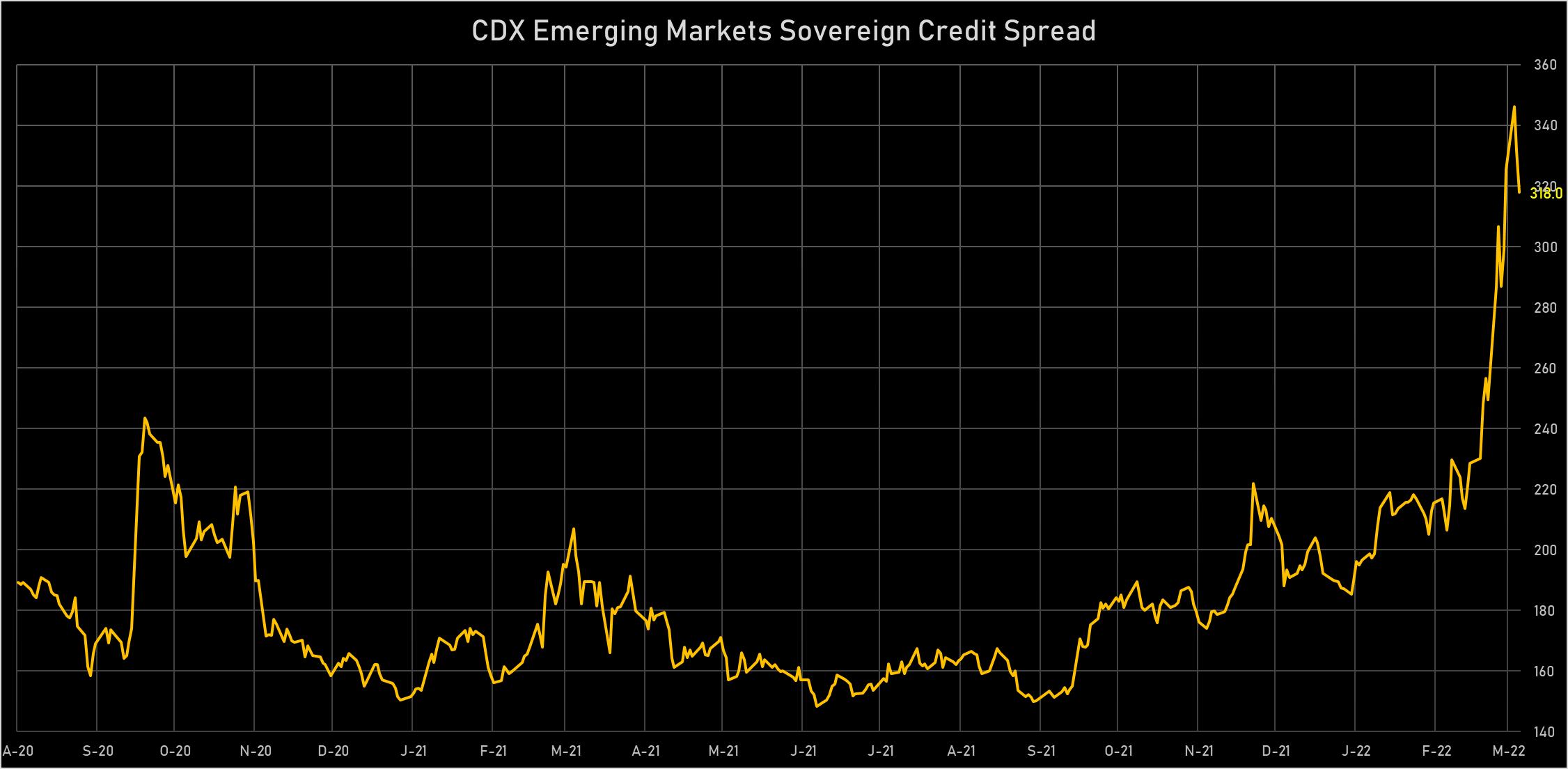

NOTABLE MOVES IN SOVEREIGN CDS BID SPREADS TODAY

- South Africa (rated BB-): down 21.8 basis points to 211 bp (1Y range: 178-246bp)

- Indonesia (rated BBB): down 12.5 basis points to 108 bp (1Y range: 66-124bp)

- Colombia (rated BB+): down 12.1 basis points to 207 bp (1Y range: 105-228bp)

- Mexico (rated BBB-): down 9.4 basis points to 107 bp (1Y range: 81-124bp)

- Philippines (rated BBB): down 7.6 basis points to 94 bp (1Y range: 39-106bp)

- Malaysia (rated BBB+): down 7.3 basis points to 70 bp (1Y range: 38-82bp)

- China (rated A+): down 6.4 basis points to 53 bp (1Y range: 29-66bp)

- Panama (rated WD): down 5.9 basis points to 89 bp (1Y range: 64-103bp)

- Chile (rated A-): down 5.7 basis points to 78 bp (1Y range: 48-95bp)

- Peru (rated BBB): down 5.2 basis points to 87 bp (1Y range: 68-105bp)

LARGEST FX MOVES TODAY

- Hungarian Forint up 4.4% (YTD: -4.8%)

- Polish Zloty up 3.7% (YTD: -6.6%)

- Albanian Lek up 2.9% (YTD: -6.7%)

- Swedish Krona up 2.7% (YTD: -6.9%)

- Czech Koruna up 2.6% (YTD: -4.2%)

- Solomon Is Dollar up 2.5% (YTD: +0.4%)

- Mexican Peso up 2.2% (YTD: -2.1%)

- Burundi Franc down 4.8% (YTD: -4.8%)

- Belarusian Rouble down 5.6% (YTD: -21.9%)

- Russian Rouble down 6.9% (YTD: -48.3%)

COMMODITIES: TOP GAINERS TODAY

- SHFE Nickel up 12.0% (YTD: 68.6%)

- SHFE Bitumen Continuation Month 1 up 10.3% (YTD: 37.0%)

- Bursa Malaysia Crude Palm Oil up 8.8% (YTD: 48.0%)

- EEX European Union Aviation Allowance Continuation Month 1 up 6.9% (YTD: -8.8%)

- SHFE Stannum up 4.9% (YTD: 23.4%)

- SMM Lithium Metal Spot Price Daily up 3.6% (YTD: 116.0%)

- SHFE Rubber up 2.7% (YTD: -5.8%)

- Shanghai International Exchange TSR 20 up 2.3% (YTD: -0.4%)

- Johnson Matthey Iridium New York 0930 up 2.1% (YTD: 22.5%)

- ICE Europe Low Sulphur Gasoil up 2.0% (YTD: 124.6%)

- Coffee Arabica Colombia Excelso EP spot up 1.5% (YTD: 6.8%)

- CBoT Soybean Meal up 1.0% (YTD: 19.7%)

- ICE-US Cocoa up 1.0% (YTD: 2.5%)

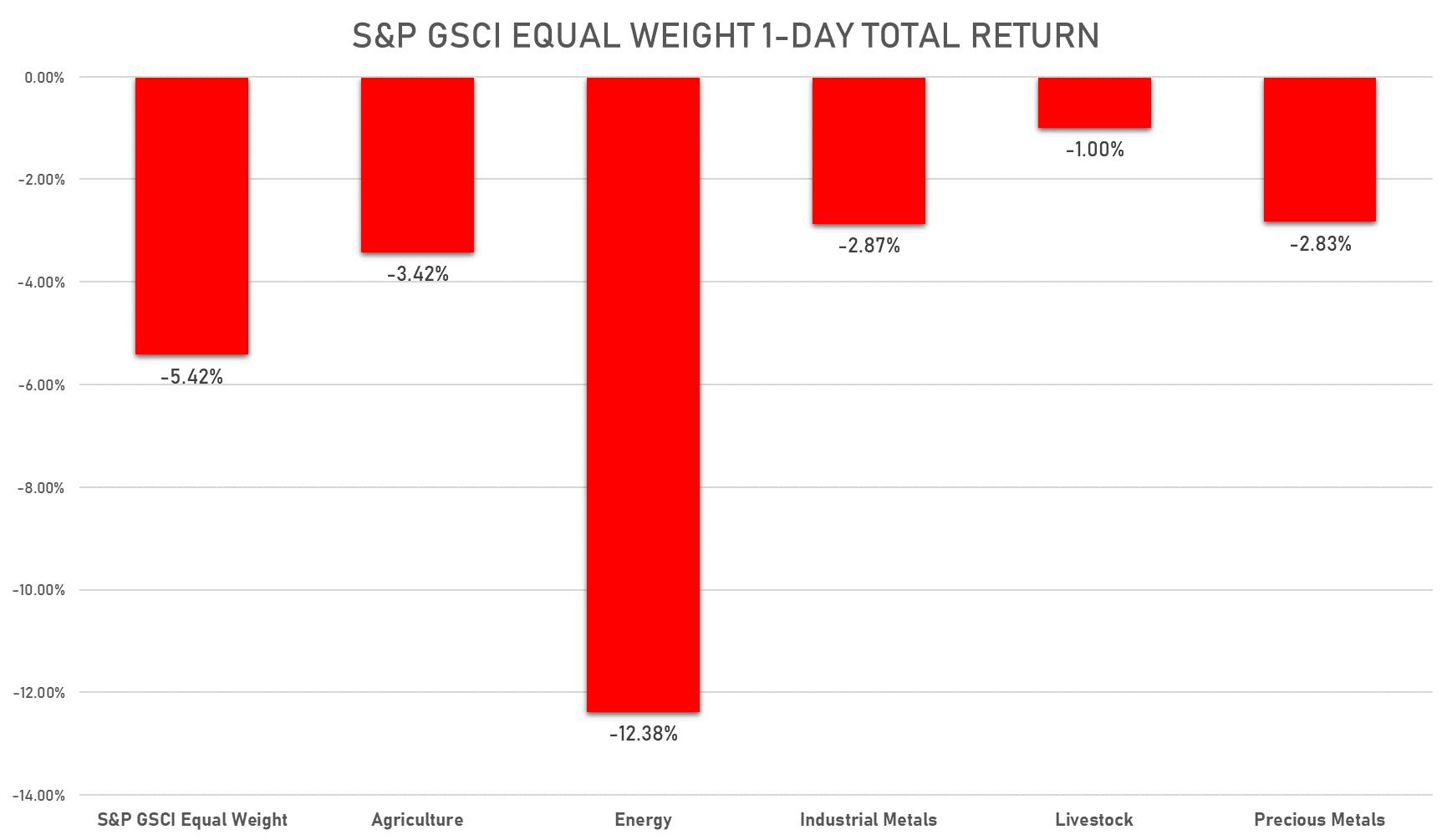

COMMODITIES: LOSERS TODAY

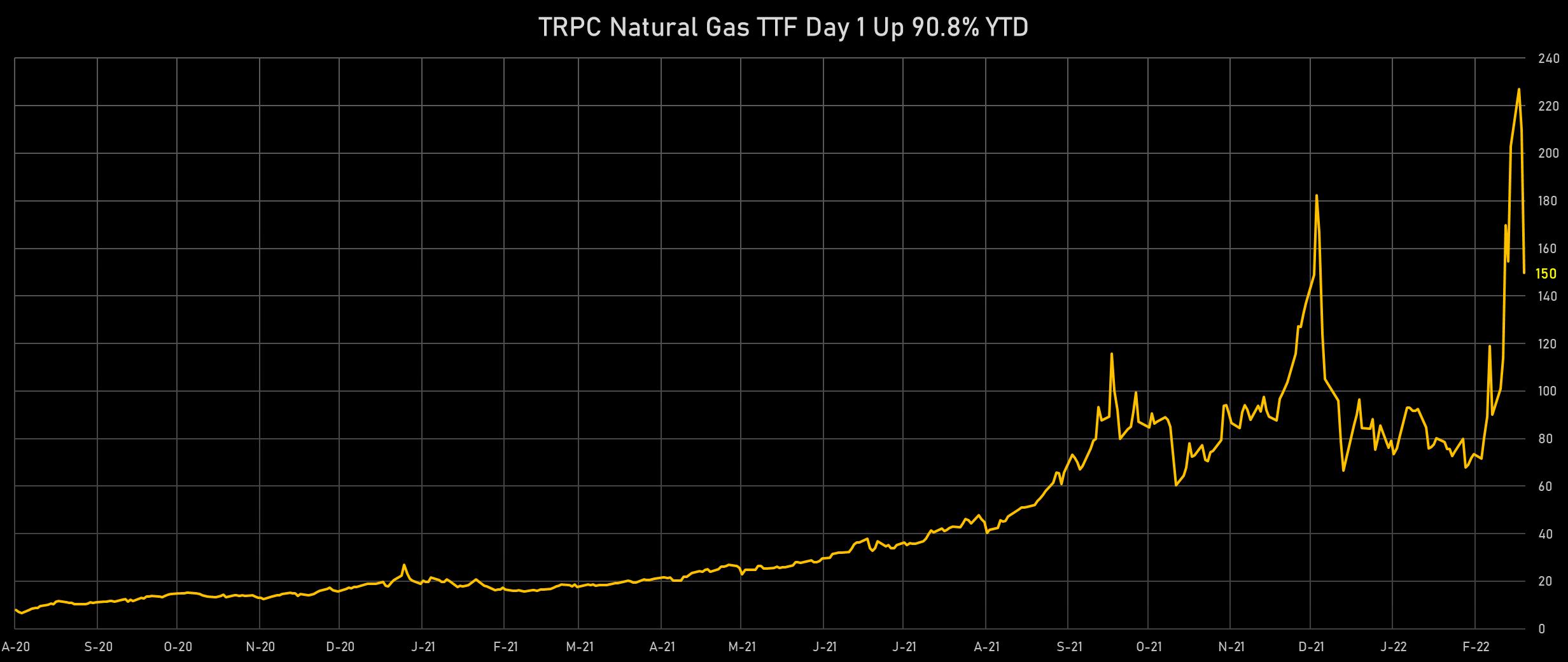

- TRPC Natural Gas TTF Monthly down -29.7% (YTD: 70.9%)

- TRPC Natural Gas TTF Day 1 down -28.7% (YTD: 90.8%)

- NYMEX NY Harbor ULSD down -21.9% (YTD: 44.6%)

- ICE Europe Brent Crude down -13.2% (YTD: 40.1%)

- NYMEX Light Sweet Crude Oil (WTI) down -12.1% (YTD: 41.2%)

- Crude Oil WTI Cushing US FOB down -12.0% (YTD: 41.6%)

- Brent Forties and Oseberg Dated FOB North Sea Crude down -12.0% (YTD: 50.2%)

- NYMEX RBOB Gasoline down -10.6% (YTD: 43.4%)

- Brent 1-month at-the-money implied volatility at 72.9, down -8.2 vols (12-month range: 26.1-89.3)

- Palladium spot down -7.3% (YTD: 49.7%)

- Platinum spot down -6.9% (YTD: 11.8%)

- Brent Crude Spot Free On Board (FOB) Sullom Voe North Sea down -6.5% (YTD: 66.2%)

- CBoT Wheat down -5.8% (YTD: 53.8%)

- Johnson Matthey Rhodium New York 0930 down -4.7% (YTD: 45.4%)

- SHFE Aluminum down -4.5% (YTD: 8.6%)

EQUITIES SUMMARY

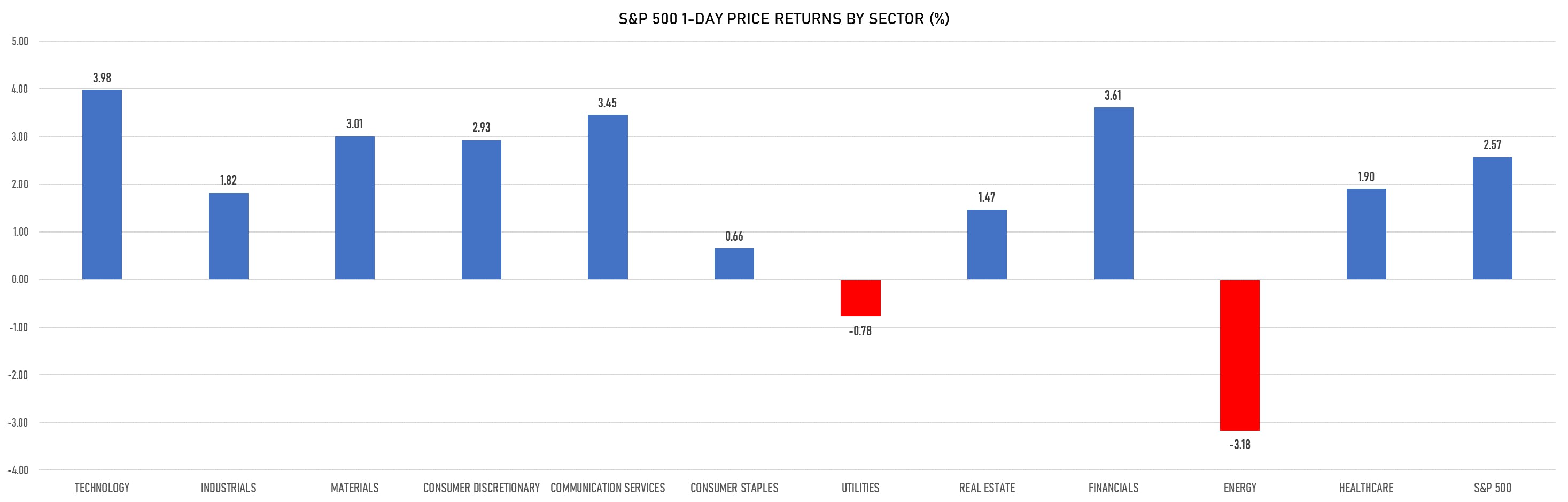

- Daily performance of US indices: S&P 500 up 2.57%; Nasdaq Composite up 3.59%; Wilshire 5000 up 2.71%

- 83.6% of S&P 500 stocks were up today, with 37.6% of stocks above their 200-day moving average (DMA) and 27.1% above their 50-DMA

- Top performing sectors in the S&P 500: technology up 3.98% and financials up 3.61%

- Bottom performing sectors in the S&P 500: energy down -3.18% and utilities down -0.78%

- The number of shares in the S&P 500 traded today was 791m for a total turnover of US$ 86 bn

- The S&P 500 Value Index was up 1.5%, while the S&P 500 Growth Index was up 3.7%; the S&P small caps index was up 2.1% and mid-caps were up 2.8%

- The volume on CME's INX (S&P 500 Index) was 3.0m (3-month z-score: 0.7); the 3-month average volume is 2.6m and the 12-month range is 1.3 - 4.6m

- Daily performance of international indices: Europe Stoxx 600 up 4.68%; UK FTSE 100 up 3.25%; tonight in Asia, the Hang Seng SH-SZ-HK 300 Index up 1.97%, Japan's TOPIX 500 up 3.95%

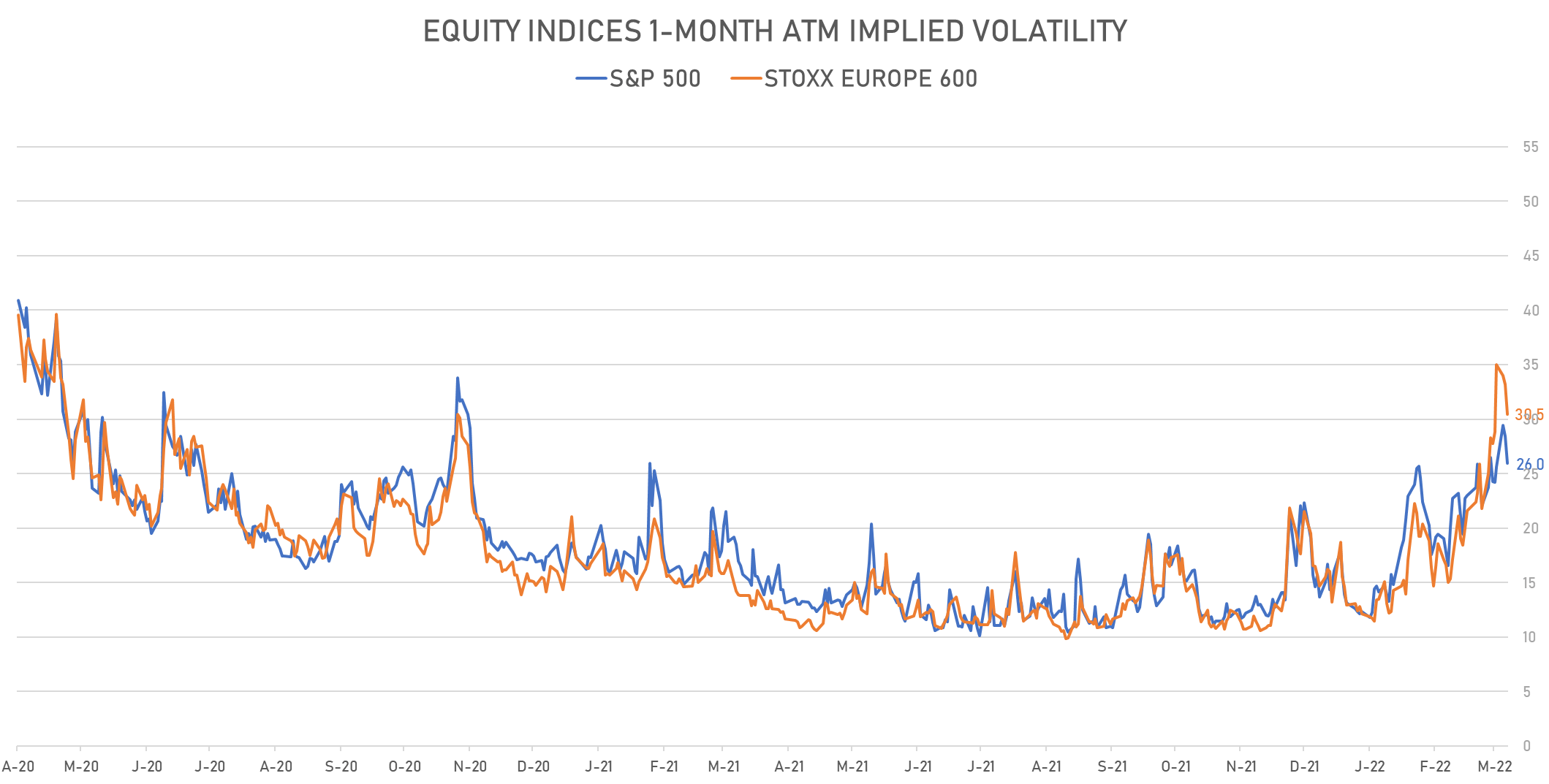

IMPLIED VOLATILITY

- 1-month at-the-money implied volatility on the S&P 500 at 26.0%, down from 28.4%

- 1-month at-the-money implied volatility on the Europe Stoxx 600 at 30.5%, down from 33.2%

TOP WINNERS

- AST SpaceMobile Inc (ASTS), up 44.9% to $9.78 / YTD price return: +23.2% / 12-Month Price Range: $ 4.84-15.48 / Short interest (% of float): 22.8%; days to cover: 9.1

- Cano Health Inc (CANO), up 43.2% to $6.53 / YTD price return: -26.9% / 12-Month Price Range: $ 4.17-16.17

- Bumble Inc (BMBL), up 41.9% to $23.64 / YTD price return: -30.2% / 12-Month Price Range: $ 15.41-76.49 / Short interest (% of float): 4.3%; days to cover: 3.1

- Dada Nexus Ltd (DADA), up 25.8% to $8.10 / YTD price return: -38.4% / 12-Month Price Range: $ 6.31-34.43

- Figs Inc (FIGS), up 23.1% to $17.29 / YTD price return: -37.3% / 12-Month Price Range: $ 13.04-50.40

- Bright Health Group Inc (BHG), up 20.9% to $2.20 / YTD price return: -36.0% / 12-Month Price Range: $ 1.73-17.93 / Short interest (% of float): 2.9%; days to cover: 3.8

- Bakkt Holdings Inc (BKKT), up 20.1% to $5.62 / YTD price return: -34.0% / 12-Month Price Range: $ 3.31-50.80 / Short interest (% of float): 34.7%; days to cover: 1.0

- Exscientia PLC (EXAI), up 19.1% to $15.79 / YTD price return: -20.1% / 12-Month Price Range: $ 11.10-30.38 / Short interest (% of float): 1.5%; days to cover: 5.5

- Silvergate Capital Corp (SI), up 18.7% to $126.66 / YTD price return: -14.5% / 12-Month Price Range: $ 80.78-239.26 / Short interest (% of float): 7.6%; days to cover: 1.9

- MongoDB Inc (MDB), up 18.6% to $334.09 / YTD price return: -36.9% / 12-Month Price Range: $ 238.01-590.00

BIGGEST LOSERS

- Natera Inc (NTRA), down 32.8% to $36.80 / YTD price return: -60.6% / 12-Month Price Range: $ 52.20-129.09 (the stock is currently on the short sale restriction list)

- ProShares Ultra Bloomberg Crude Oil (UCO), down 21.0% to $153.21 / YTD price return: +76.1% / 12-Month Price Range: $ 50.22-205.50 / Short interest (% of float): 3.2%; days to cover: 0.5 (the stock is currently on the short sale restriction list)

- Sky Harbour Group Corp (SKYH), down 18.0% to $24.50 / YTD price return: +140.9% / 12-Month Price Range: $ 5.25-32.81 / Short interest (% of float): 0.5%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Cricut Inc (CRCT), down 16.7% to $11.61 / YTD price return: -47.6% / 12-Month Price Range: $ 13.62-47.36 / Short interest (% of float): 12.4%; days to cover: 13.0 (the stock is currently on the short sale restriction list)

- Kinetik Holdings Inc (KNTK), down 12.2% to $61.36 / YTD price return: +.1% / 12-Month Price Range: $ 51.70-91.00 / Short interest (% of float): 1.2%; days to cover: 8.3 (the stock is currently on the short sale restriction list)

- United States Oil Fund LP (USO), down 11.7% to $75.47 / YTD price return: +38.8% / 12-Month Price Range: $ 39.27-87.84 / Short interest (% of float): 16.0%; days to cover: 1.2 (the stock is currently on the short sale restriction list)

- iShares S&P GSCI Commodity-Indexed Trust (GSG), down 10.7% to $23.08 / YTD price return: +35.2% / 12-Month Price Range: $ 13.65-26.08 / Short interest (% of float): 7.9%; days to cover: 2.7 (the stock is currently on the short sale restriction list)

- ProShares UltraPro Short QQQ (SQQQ), down 10.7% to $44.36 / YTD price return: +49.4% / 12-Month Price Range: $ 28.15-75.90 / Short interest (% of float): 8.5%; days to cover: 0.1 (the stock is currently on the short sale restriction list)

- iShares GSCI Commodity Dynamic Roll Strategy ETF (COMT), down 10.5% to $40.35 / YTD price return: +30.7% / 12-Month Price Range: $ 28.86-45.51 / Short interest (% of float): 0.3%; days to cover: 0.3 (the stock is currently on the short sale restriction list)

- Avidxchange Holdings Inc (AVDX), down 10.0% to $7.43 / YTD price return: -50.7% / 12-Month Price Range: $ 7.80-27.44 / Short interest (% of float): 2.8%; days to cover: 6.4 (the stock is currently on the short sale restriction list)