Macro

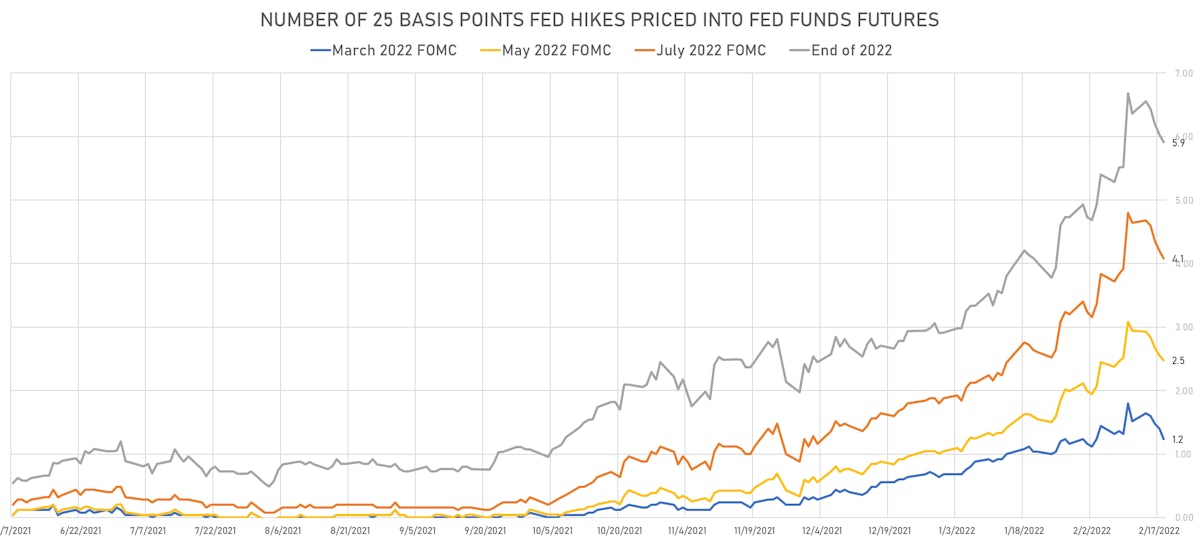

US Rates End The Week Higher, With A Flatter Curve; Market Still Prices In About 6 Hikes This Year

We're still 4 weeks away from the March FOMC, with ample time for Fed speakers to adjust current sentiment, but it looks increasingly unlikely that the Fed will kick off the tightening cycle with a 50bp hike

Published ET

Rate Hikes In 2022, Implied From Fed Funds Futures | Sources: ϕpost, Refinitiv data

OVERALL SUMMARY

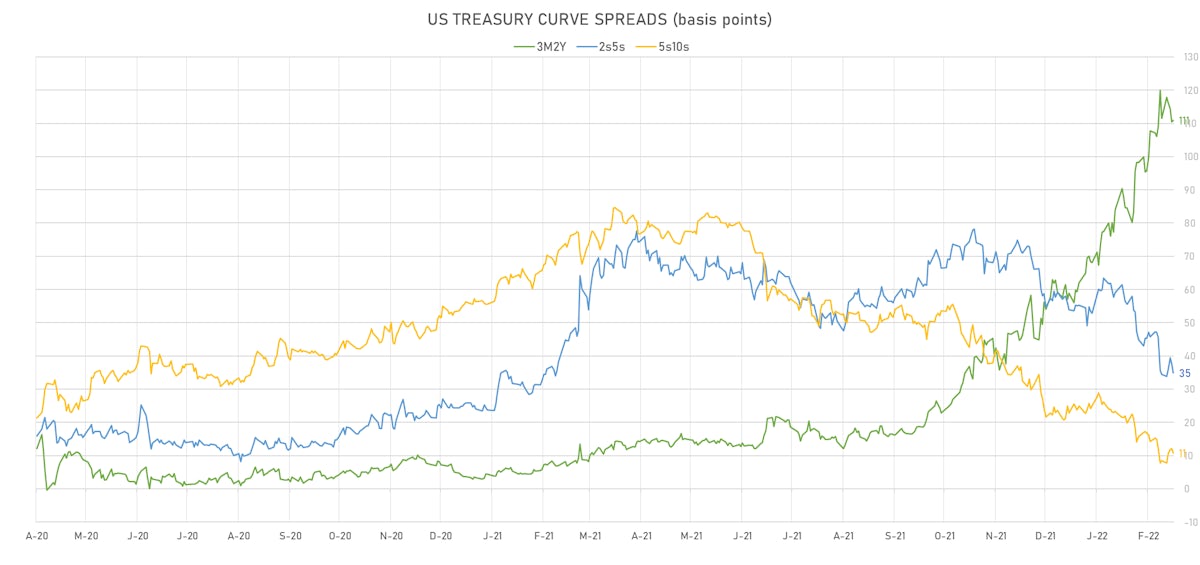

- In rates, this week brought a bull steepening of the US yield curve, with the front end continuing to lead

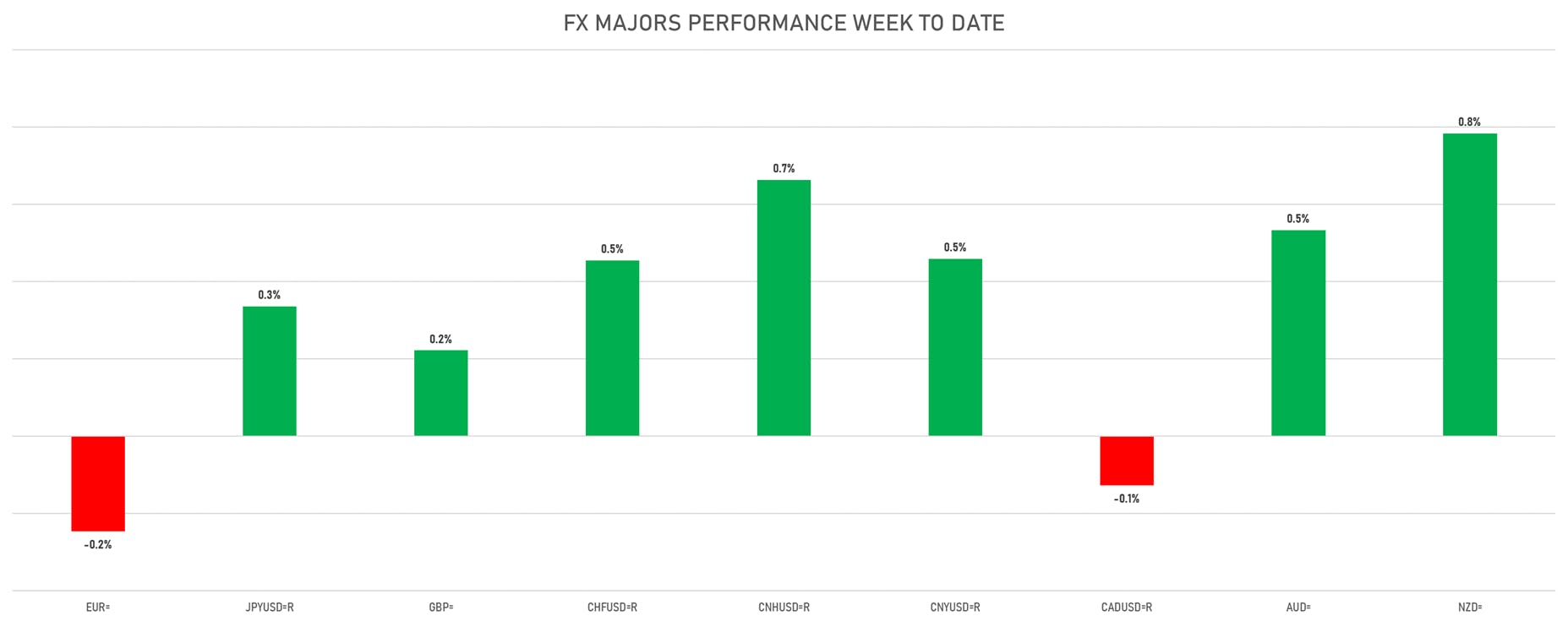

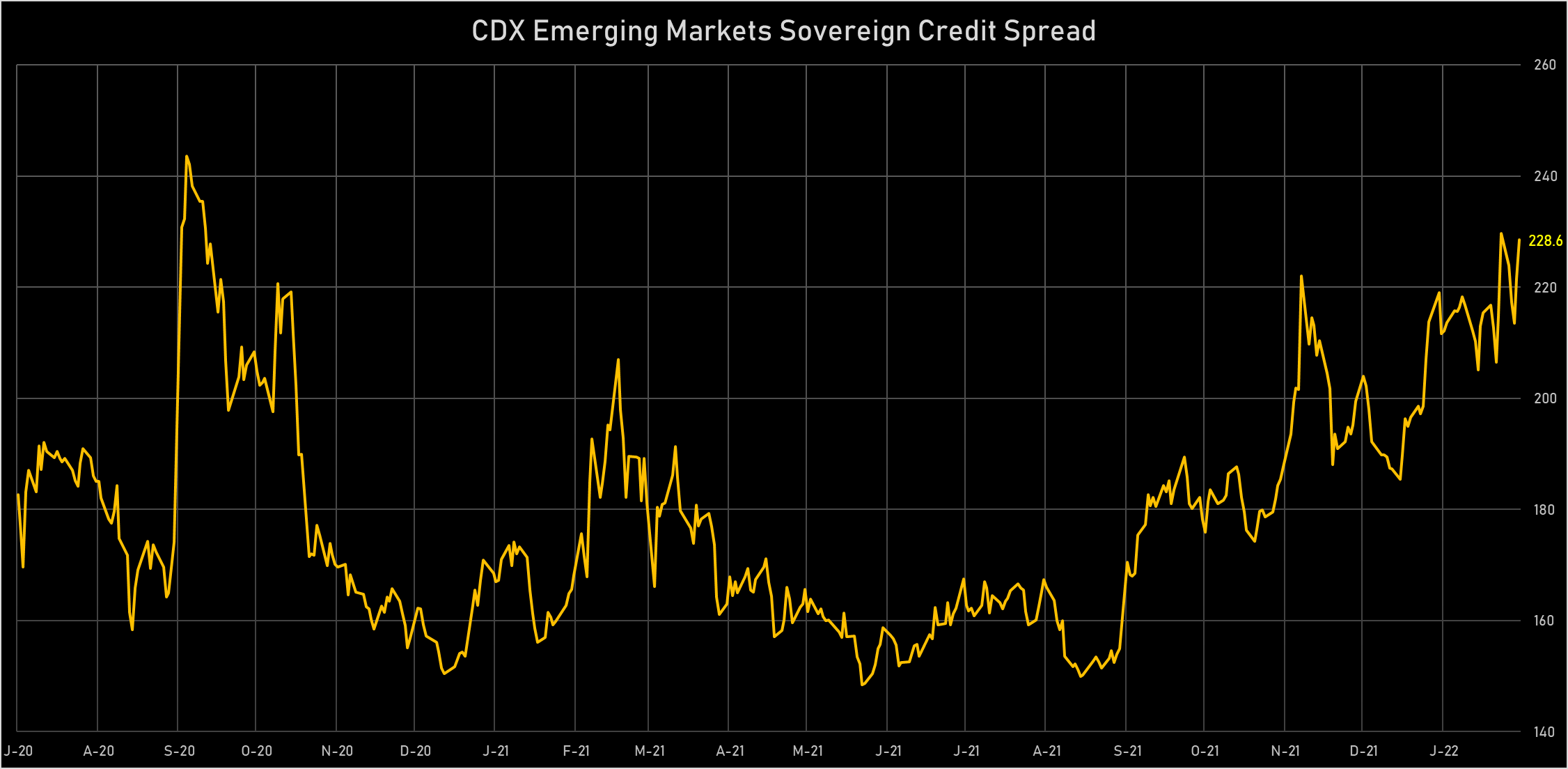

- In currencies, the US Dollar did well against majors, with EM FX holding up surprisingly well considering the level of geopolitical noise

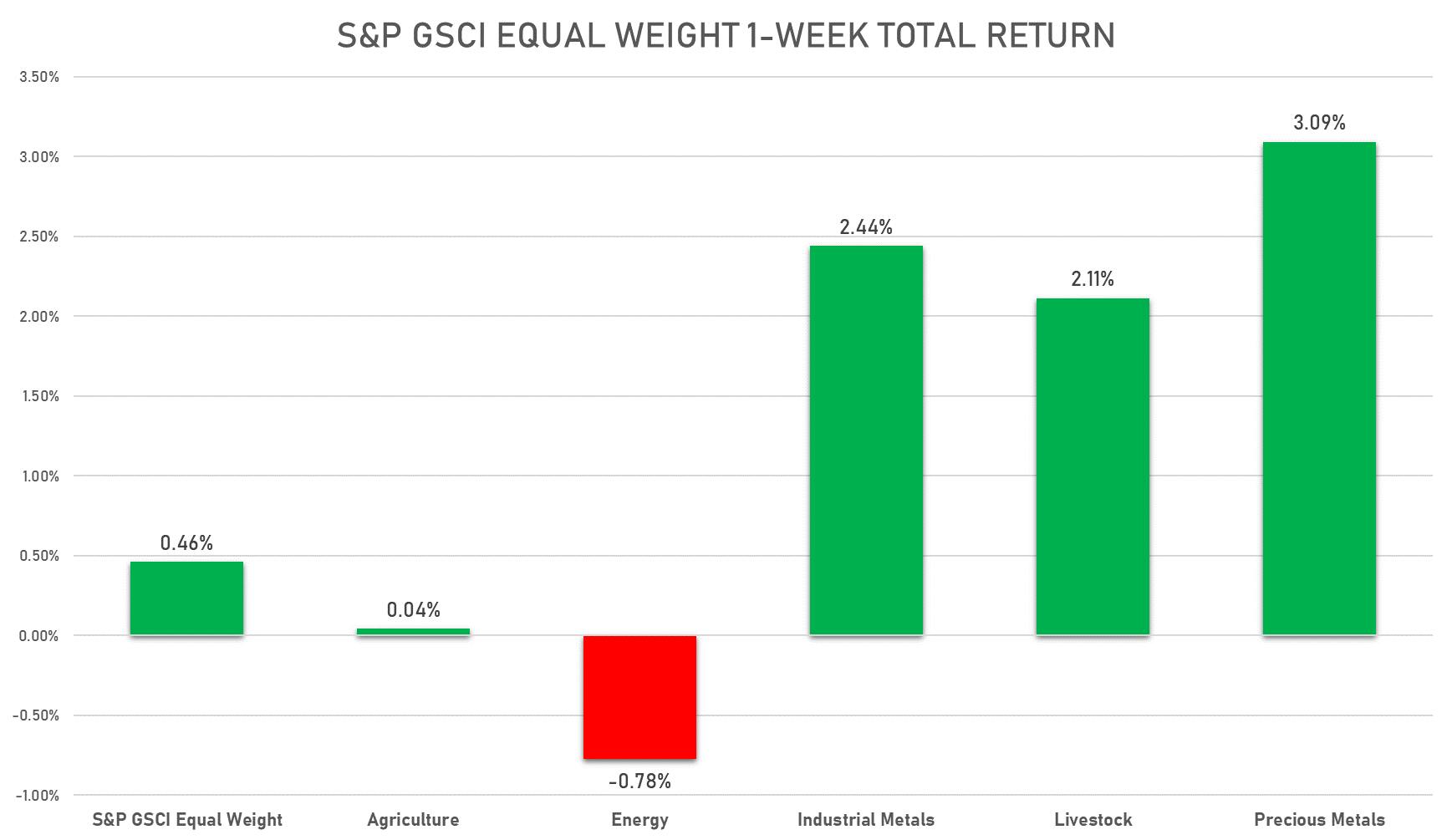

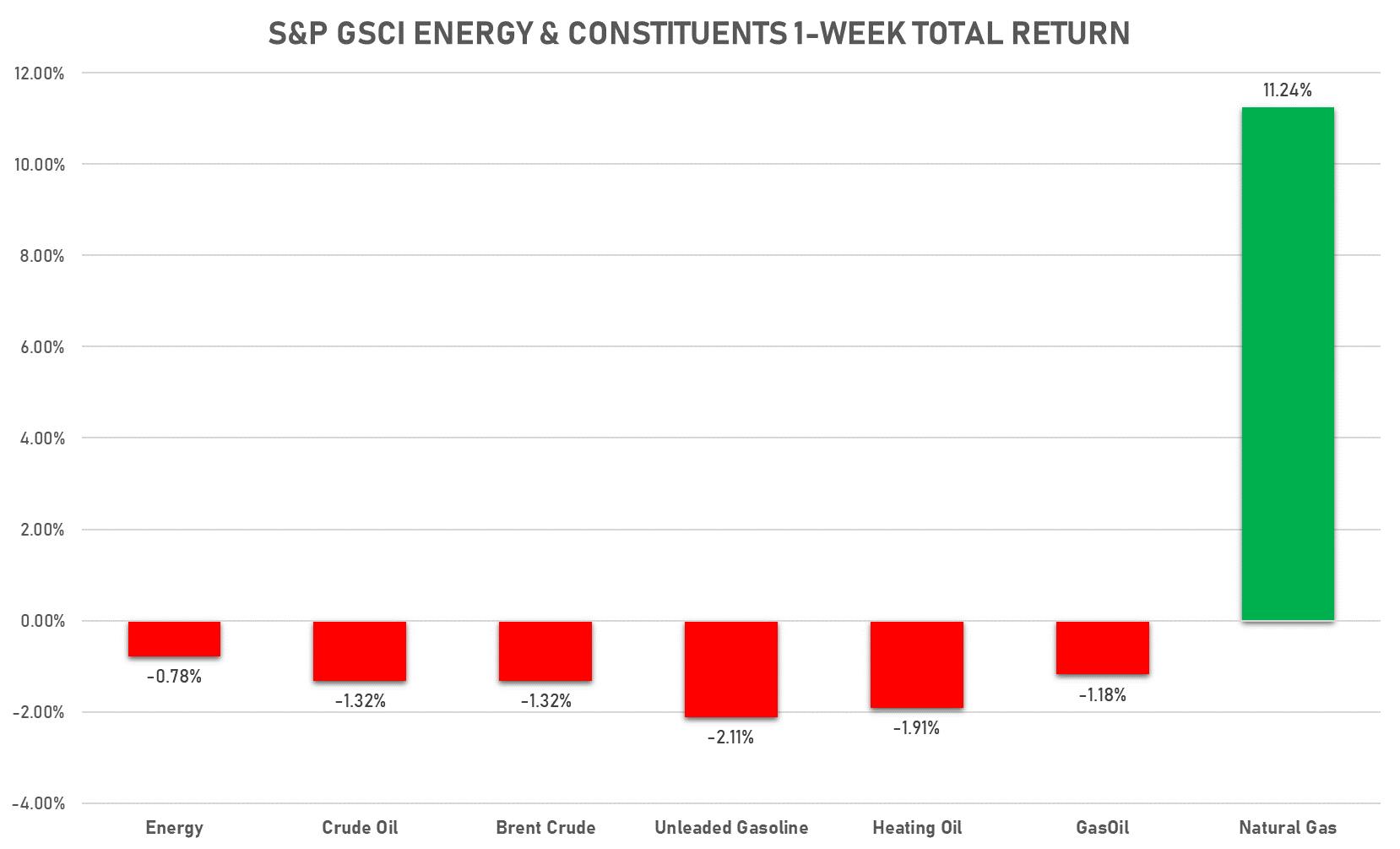

- In commodities, crude oil dipped, while nat gas prices jumped on the volatile situation along the Ukrainian border

US RATES ON FRIDAY

- 3-Month USD LIBOR +0.4bp today, now at 0.4850%; 3-Month OIS -2.1bp at 0.3750%

- The treasury yield curve flattened, with the 1s10s spread tightening -2.9 bp, now at 90.6 bp (YTD change: -22.2bp)

- 1Y: 1.0210% (down 1.3 bp)

- 2Y: 1.4696% (down 0.1 bp)

- 5Y: 1.8188% (down 2.8 bp)

- 7Y: 1.9117% (down 3.1 bp)

- 10Y: 1.9268% (down 4.2 bp)

- 30Y: 2.2421% (down 5.5 bp)

- US treasury curve spreads: 3m2Y at 110.9bp (up 0.4bp today), 2s5s at 35.1bp (down -2.7bp), 5s10s at 10.8bp (down -1.2bp), 10s30s at 31.6bp (down -1.3bp)

- Treasuries butterfly spreads: 1s5s10s at -74.8bp (up 0.5bp today), 5s10s30s at 19.6bp (down -0.9bp)

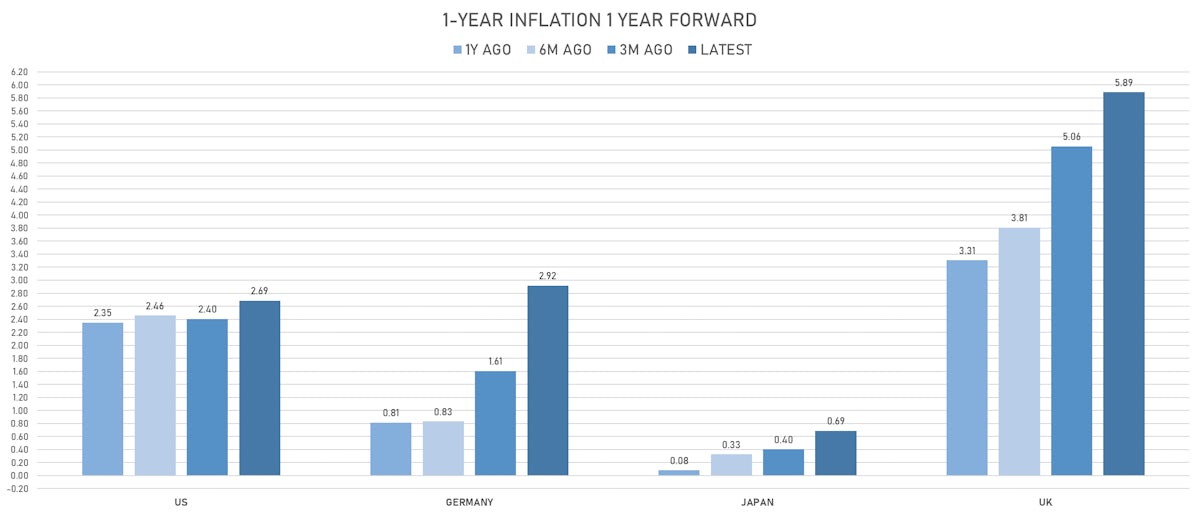

- TIPS 1Y breakeven inflation at 4.60% (up 1.5bp); 2Y at 3.66% (up 0.7bp); 5Y at 2.82% (down -0.9bp); 10Y at 2.45% (down -1.2bp); 30Y at 2.12% (down -3.8bp)

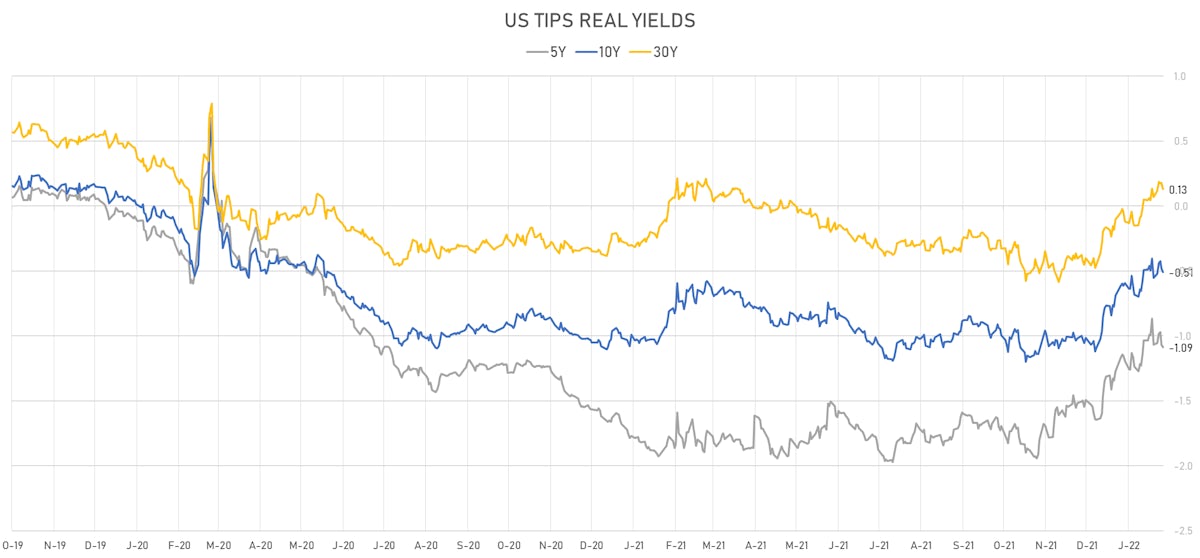

- US 5-Year TIPS Real Yield: -1.8 bp at -1.0870%; 10-Year TIPS Real Yield: -2.7 bp at -0.5080%; 30-Year TIPS Real Yield: -5.1 bp at 0.1280%

US FORWARD RATES

- Fed Funds futures now price in 30.4bp of Fed hikes by the end of March 2022, 61.4bp (2.46 x 25bp hikes) by the end of May 2022, and price in 5.91 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 40.5 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), up 0.5 bp today, and -14.5 bp of hikes in 2024 (equivalent to -0.6 x 25 bp hikes)

- 1-year US Treasury rate 5 years forward down 4.4 bp, now at 2.0720%, meaning that the 1-year Treasury rate is now expected to increase by 97.7 bp over the next 5 years

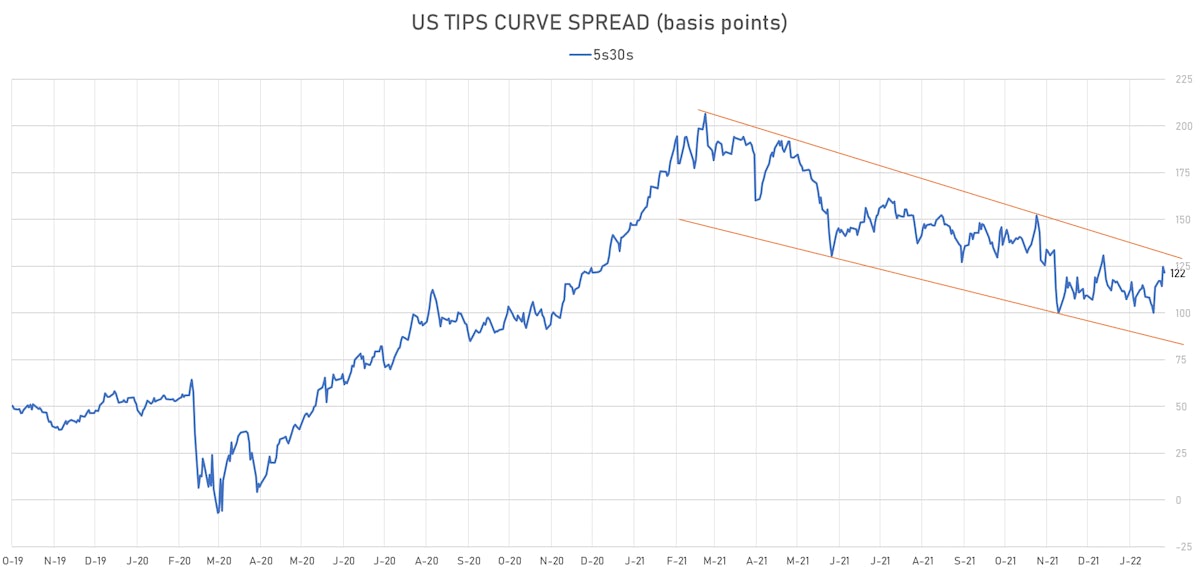

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.60% (up 1.5bp); 2Y at 3.66% (up 0.7bp); 5Y at 2.82% (down -0.9bp); 10Y at 2.45% (down -1.2bp); 30Y at 2.12% (down -3.8bp)

- 6-month spot US CPI swap down -5.6 bp to 4.524%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.0870%, -1.8 bp today; 10Y at -0.5080%, -2.7 bp today; 30Y at 0.1280%, -5.1 bp today

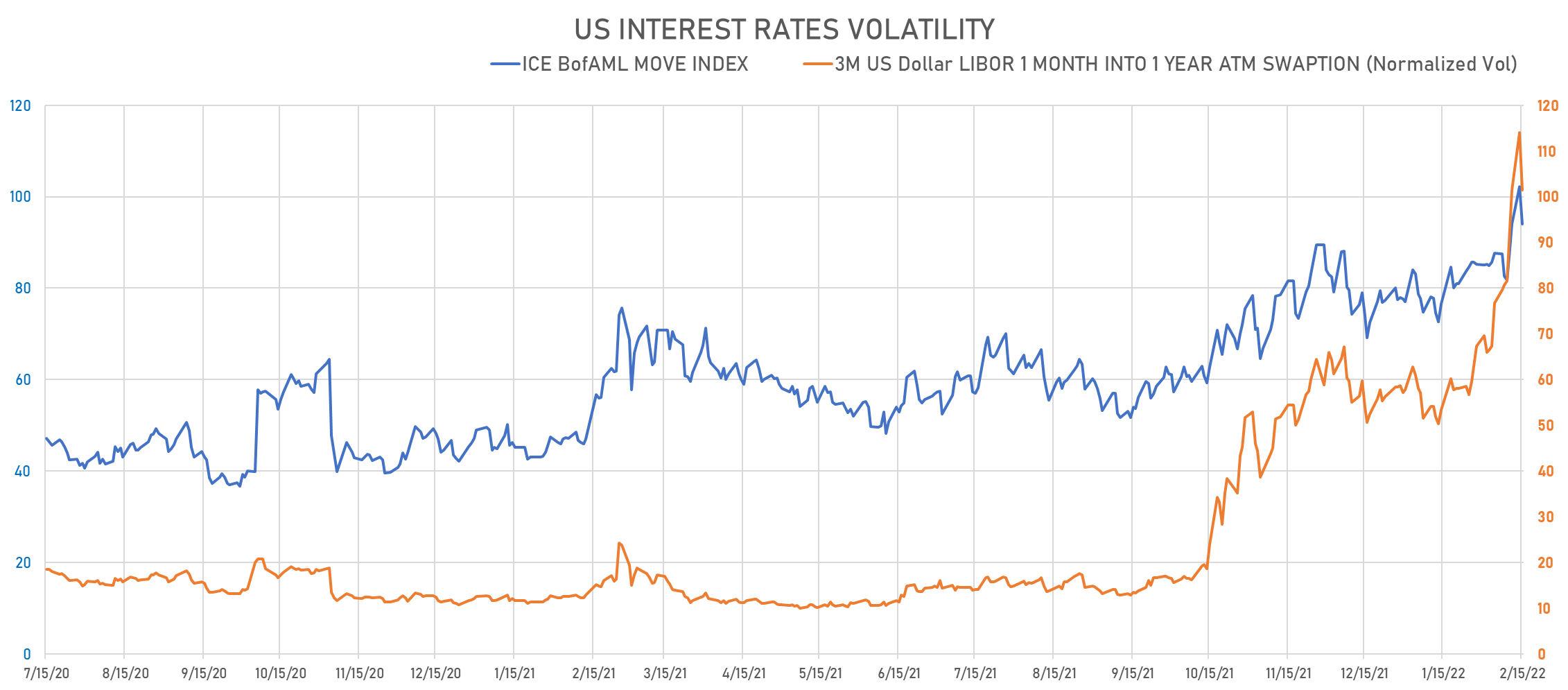

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.4 at 98.8 normals

- 3-Month LIBOR-OIS spread up 2.5 bp at 11.0 bp (12-months range: -5.5-13.4 bp)

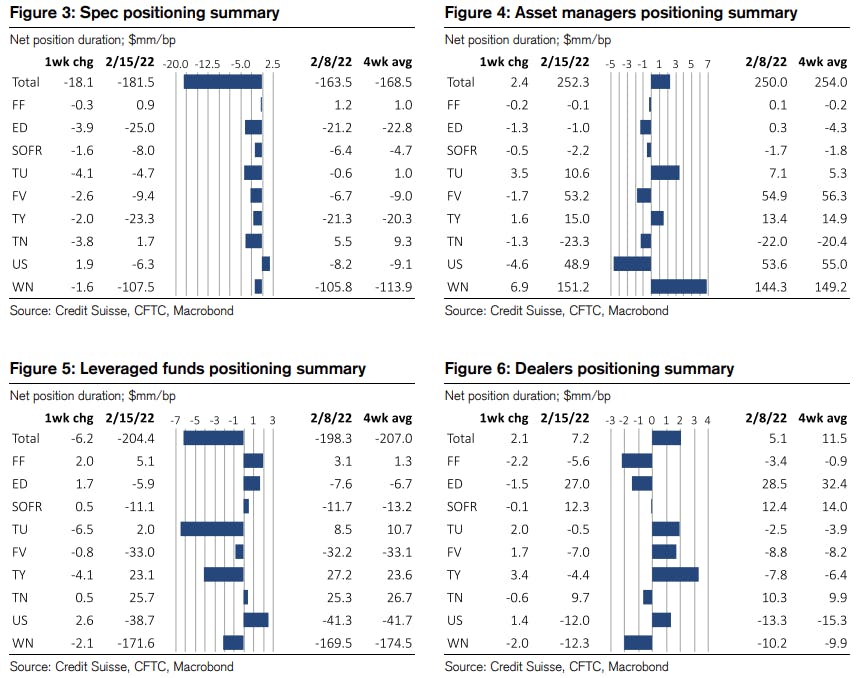

WEEKLY CFTC NET DURATION POSITIONING

- Both specs and leveraged funds increased their net short positioning this week

GLOBAL MACRO RELEASES ON FRIDAY

- Canada, Retail Sales, Change P/P for Dec 2021 (CANSIM, Canada) at -1.80 % (vs 0.70 % prior), above consensus estimate of -2.10 %

- Canada, Retail Sales, Retail Sales Ex-Autos MM, Change P/P for Dec 2021 (CANSIM, Canada) at -2.50 % (vs 1.10 % prior), below consensus estimate of -2.00 %

- Denmark, Consumer confidence indicator for Feb 2022 (statbank.dk) at -3.20 (vs -1.50 prior)

- Euro Zone, EC Consumer Survey, All Respondents, Consumer Confidence Indicator, Balance for Feb 2022 (DG ECFIN, France) at -8.80 (vs -8.50 prior), below consensus estimate of -8.00

- France, HICP, Change Y/Y, Price Index for Jan 2022 (INSEE, France) at 3.30 % (vs 3.30 % prior), below consensus estimate of 3.30 %

- France, HICP, Final, Change P/P, Price Index for Jan 2022 (INSEE, France) at 0.20 % (vs 0.10 % prior), above consensus estimate of 0.10 %

- Malaysia, Exports, Total, free on board, Change Y/Y for Jan 2022 (Statistics, Malaysia) at 23.50 % (vs 29.20 % prior)

- Malaysia, Imports, Total, cost insurance freight, Change Y/Y for Jan 2022 (Statistics, Malaysia) at 26.40 % (vs 23.60 % prior)

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for Jan 2022 (CSO, Poland) at 2.30 % (vs 0.50 % prior), above consensus estimate of 1.90 %

- Poland, Producer Prices, Total industry, Change Y/Y for Jan 2022 (CSO, Poland) at 14.80 % (vs 14.20 % prior), above consensus estimate of 14.40 %

- Poland, Production, Change Y/Y for Jan 2022 (CSO, Poland) at 19.20 % (vs 16.70 % prior), above consensus estimate of 14.80 %

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for Jan 2022 (CSO, Poland) at 9.50 % (vs 11.20 % prior), below consensus estimate of 10.10 %

- Slovakia, Unemployment, Rate, Total, registered for Jan 2022 (UPSVAR, Slovakia) at 7.00 % (vs 6.80 % prior), above consensus estimate of 6.90 %

- Sweden, CPI, All Items, Change P/P, Price Index for Jan 2022 (SCB, Sweden) at -0.50 % (vs 1.30 % prior), above consensus estimate of -0.70 %

- Sweden, CPI, All Items, Change Y/Y, Price Index for Jan 2022 (SCB, Sweden) at 3.70 % (vs 3.90 % prior), above consensus estimate of 3.60 %

- Sweden, CPI, Underlying inflation CPIF, Change P/P, Price Index for Jan 2022 (SCB, Sweden) at -0.50 % (vs 1.30 % prior), above consensus estimate of -0.70 %

- Sweden, CPI, Underlying inflation CPIF, Change Y/Y, Price Index for Jan 2022 (SCB, Sweden) at 3.90 % (vs 4.10 % prior), above consensus estimate of 3.80 %

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for Jan 2022 (ONS, United Kingdom) at 9.10 % (vs -0.90 % prior), above consensus estimate of 8.70 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for Jan 2022 (ONS, United Kingdom) at 1.70 % (vs -3.60 % prior), above consensus estimate of 1.20 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change Y/Y for Jan 2022 (ONS, United Kingdom) at 7.20 % (vs -3.00 % prior), below consensus estimate of 7.90 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for Jan 2022 (ONS, United Kingdom) at 1.90 % (vs -3.70 % prior), above consensus estimate of 1.00 %

- United States, Existing-Home Sales, Single-Family and Condos, total for Jan 2022 (NAR, United States) at 6.50 Mln (vs 6.18 Mln prior), above consensus estimate of 6.10 Mln

- United States, Existing-Home Sales, Single-Family and Condos, total, Change P/P for Jan 2022 (NAR, United States) at 6.70 % (vs -4.60 % prior), above consensus estimate of -1.00 %

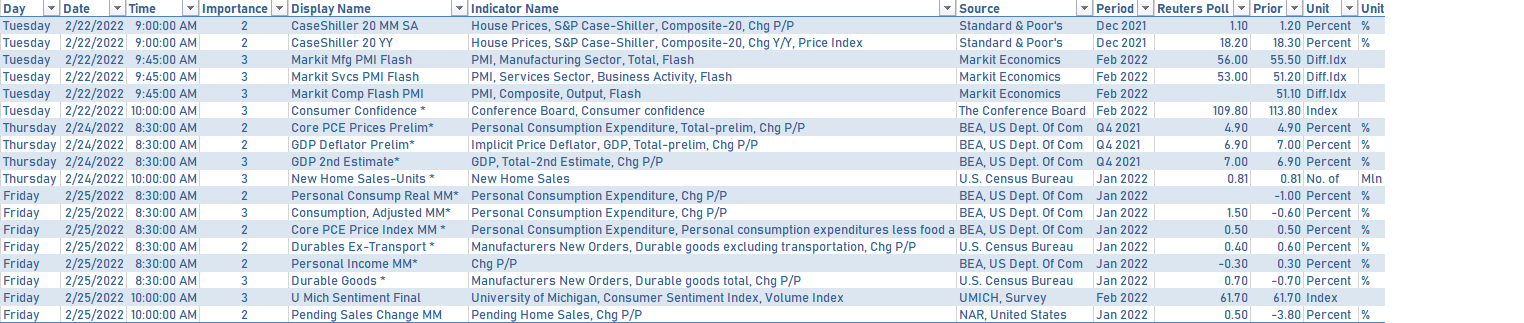

US MACRO WEEK AHEAD

- Monday is off, as it's President's Day

- The main releases next week will be January data for PCE, durable goods, and new home sales, as well as the Conference Board's consumer confidence for February

KEY INTERNATIONAL RATES

- Germany 5Y: -0.087% (down -4.5 bp); the German 1Y-10Y curve is 2.9 bp flatter at 83.3bp (YTD change: +42.1 bp)

- Japan 5Y: 0.055% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.8 bp flatter at 27.6bp (YTD change: +11.3 bp)

- China 5Y: 2.505% (up 2.3 bp); the Chinese 1Y-10Y curve is 4.9 bp flatter at 81.9bp (YTD change: +30.9 bp)

- Switzerland 5Y: 0.003% (down -2.0 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 92.8bp (YTD change: +34.3 bp)

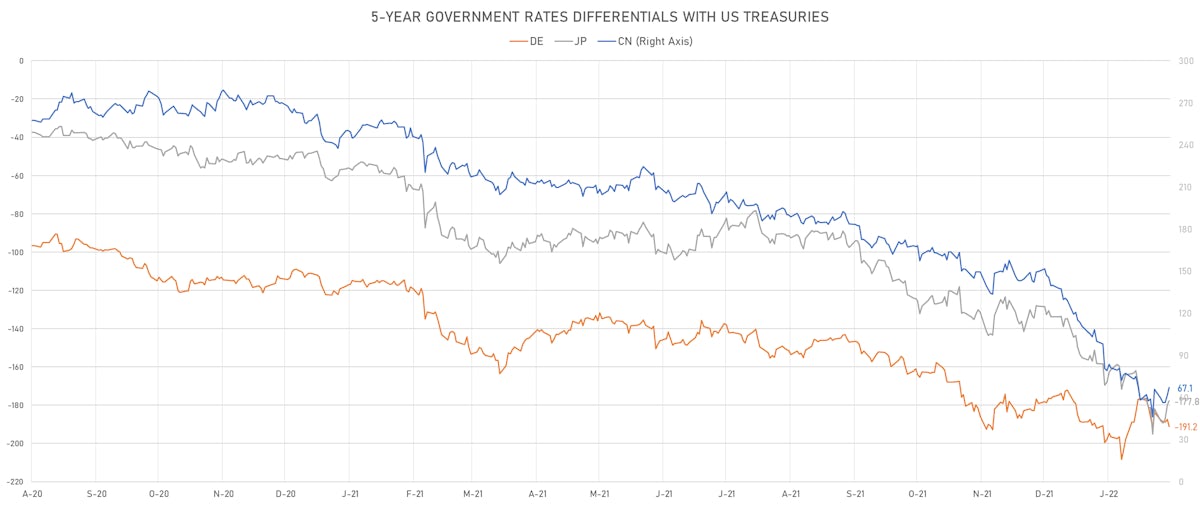

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +3.8 bp today at 191.2 bp (YTD change: +19.1 bp)

- US-JAPAN: -2.1 bp at 177.8 bp (YTD change: +43.1 bp)

- US-CHINA: -5.3 bp at -67.1 bp (YTD change: +62.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS

- US-GERMANY: +1.9 bp today at 108.0 bp (YTD change: +24.8bp)

- US-JAPAN: -1.6 bp at -12.9 bp (YTD change: +57.9bp)

- JAPAN-GERMANY: +3.5 bp at 120.9 bp (YTD change: -33.1bp)

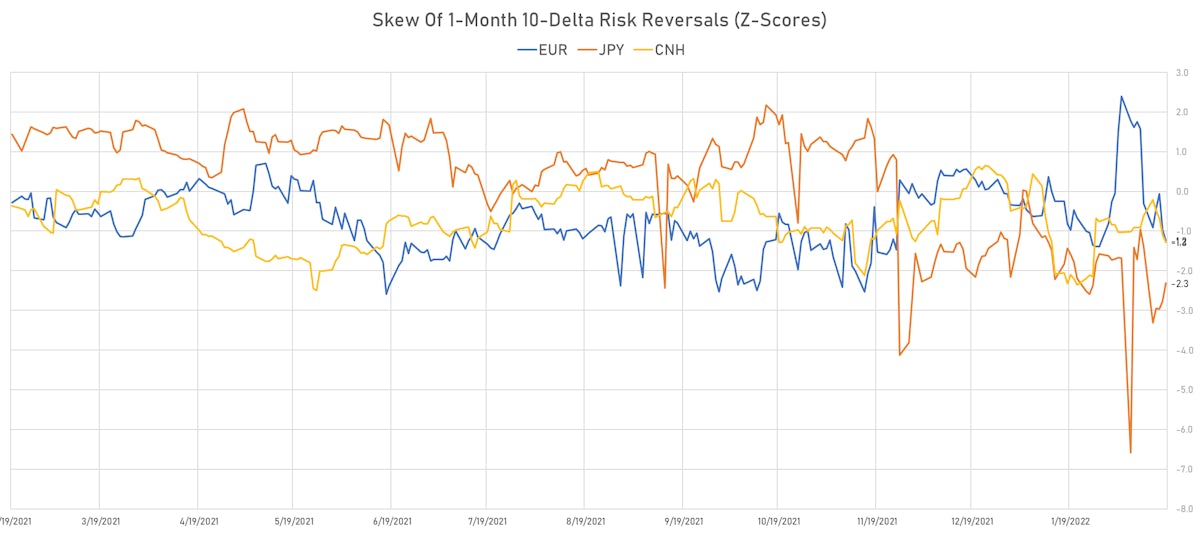

FX DAILY SUMMARY

- The US Dollar Index is up 0.35% at 96.10 (YTD: +0.46%)

- Euro down 0.34% at 1.1321 (YTD: -0.4%)

- Yen down 0.09% at 115.00 (YTD: +0.1%)

- Onshore Yuan up 0.20% at 6.3251 (YTD: +0.5%)

- Swiss franc down 0.15% at 0.9215 (YTD: -1.0%)

- Sterling down 0.18% at 1.3590 (YTD: +0.5%)

- Canadian dollar down 0.34% at 1.2749 (YTD: -0.9%)

- Australian dollar down 0.14% at 0.7173 (YTD: -1.2%)

- NZ dollar up 0.18% at 0.6699 (YTD: -1.8%)

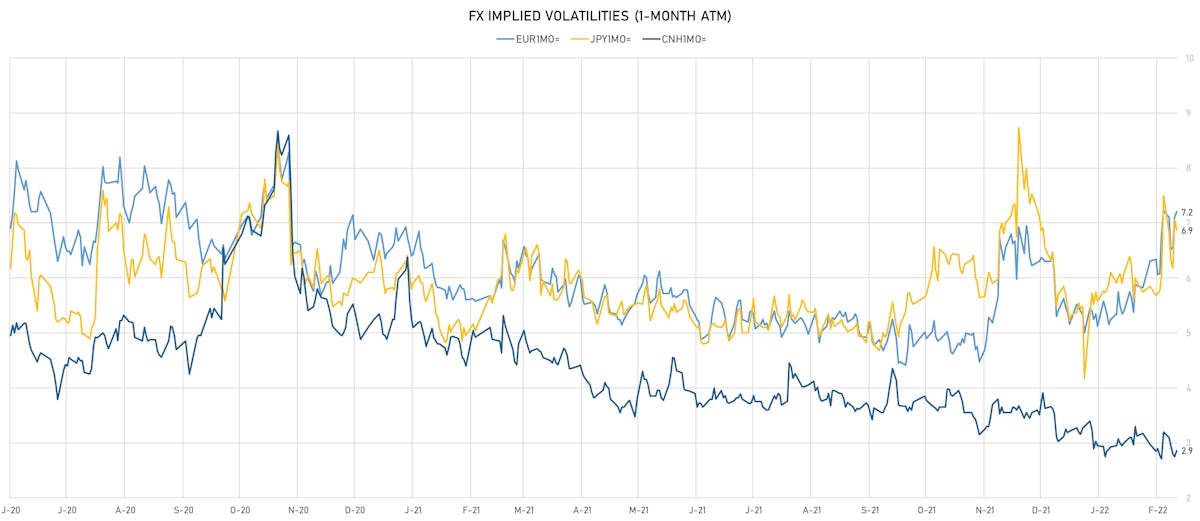

FX VOLATILITIES

- Deutsche Bank USD Currency Volatility Index currently at 7.27, up 0.16 (YTD: +1.16)

- Euro 1-Month At-The-Money Implied Volatility currently at 7.20, up 0.1 (YTD: +2.2)

- Japanese Yen 1M ATM IV currently at 6.88, down -0.2 (YTD: +2.7)

- Offshore Yuan 1M ATM IV currently at 2.86, up 0.1 (YTD: -0.4)

NOTABLE MOVES IN SOVEREIGN CDS THIS WEEK

- Russia (rated BBB): up 27.5 % to 275 bp (1Y range: 75-254bp)

- Turkey (rated B+): up 4.6 % to 532 bp (1Y range: 282-614bp)

- Brazil (rated BB-): down 2.7 % to 225 bp (1Y range: 156-266bp)

- Chile (rated A-): down 3.5 % to 79 bp (1Y range: 44-95bp)

- Indonesia (rated BBB): up 1.7 % to 96 bp (1Y range: 66-99bp)

- Philippines (rated BBB): up 1.4 % to 80 bp (1Y range: 36-83bp)

- Peru (rated BBB): down 2.1 % to 89 bp (1Y range: 56-105bp)

- Mexico (rated BBB-): down 3.3 % to 111 bp (1Y range: 81-124bp)

- China (rated A+): down 2.9 % to 52 bp (1Y range: 28-58bp)

- Argentina (rated CCC): down 6.4 % to 3,020 bp (1Y range: 1,355-3,883bp)

WEEKLY CFTC NET US DOLLAR POSITIONING DATA

- All currencies: reduction in net long US$ positioning

- G10: reduction in net long US$ positioning

- Emerging: increase in net short US$ positioning

- Euro: increase in net short US$ positioning

- Japanese Yen: increase in net long US$ positioning

- UK Pound Sterling: reduction in net long US$ positioning

- Australian Dollar: increase in net long US$ positioning

- Swiss Franc: increase in net long US$ positioning

- Canadian Dollar: reduced their net short US$ positioning

- New Zealand Dollar: reduction in net long US$ positioning

- Brazilian Real: increase in net short US$ positioning

- Russian Rouble: increase in net short US$ positioning

- Mexican Peso: increase in net short US$ positioning

LARGEST FX MOVES THIS WEEK

- New Zambian Kwacha down 7.3% (YTD: -4.7%)

- CFA Franc BEAC up 2.7% (YTD: +3.9%)

- Israeli Shekel up 1.8% (YTD: -2.9%)

- Peru Sol down 1.8% (YTD: +6.7%)

- Rwanda Franc down 1.6% (YTD: +1.6%)

- Brazilian Real up 1.5% (YTD: +8.4%)

- Chilean Peso down 1.5% (YTD: +6.4%)

- Indian Rupee up 1.3% (YTD: -0.3%)

- Angolan Kwanza down 1.3% (YTD: +7.3%)

- Seychelles Rupee down 9.6% (YTD: -7.1%)

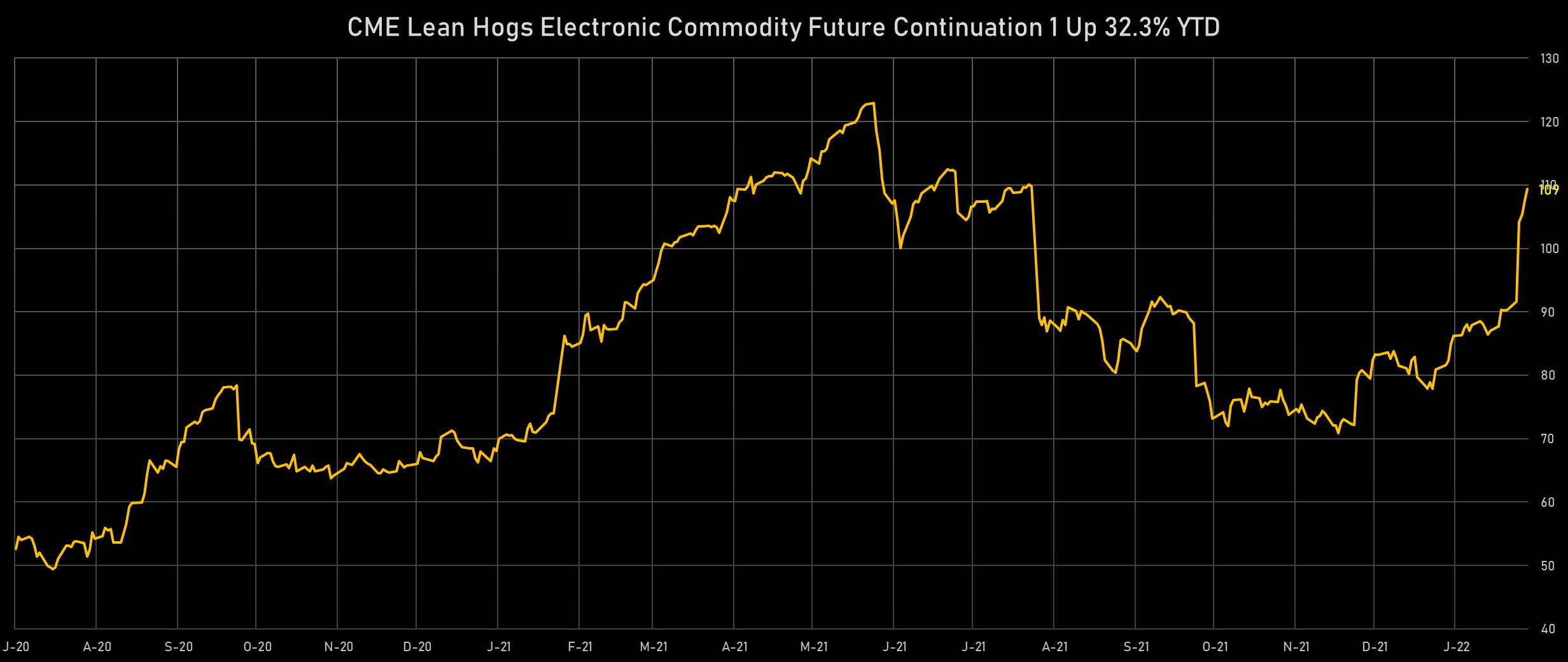

NOTABLE COMMODITIES GAINERS THIS WEEK

- CME Lean Hogs up 20.9% (YTD: 32.3%), now at 109.40

- NYMEX Henry Hub Natural Gas up 12.4% (YTD: 24.4%), now at 04.43

- Baltic Exchange Handysize Index up 10.0% (YTD: -13.1%), now at 1,285.00

- Zhengzhou Exchange Thermal Coal up 9.2% (YTD: 13.1%), now at 900.20

- Baltic Exchange Supramax Index up 7.7% (YTD: 1.0%), now at 2,325.00

- Baltic Exchange clean tank index up 6.5% (YTD: -13.4%), now at 687.00

- CME Random Length Lumber up 4.4% (YTD: 9.7%), now at 1,270.00

- Platinum spot up 3.8% (YTD: 10.8%), now at 1,066.02

- Bursa Malaysia Crude Palm Oil up 3.6% (YTD: 16.7%), now at 6,015.00

- WUXI Metal Cobalt Bi-Monthly up 3.4% (YTD: 9.5%), now at 529.50

- CBoT Soybean Oil up 2.8% (YTD: 21.0%), now at 67.57

- CME Cash settled Butter up 2.8% (YTD: 27.1%), now at 263.68

- Shanghai International Exchange TSR 20 Rubber up 2.6% (YTD: 3.1%), now at 11,830.00

- Gold spot up 2.1% (YTD: 4.6%), now at 1,898.06

- Baltic Exchange dirty tank index up 1.7% (YTD: -11.3%), now at 699.00

NOTABLE COMMODITIES LOSERS THIS WEEK

- Baltic Exchange Capesize Index down -9.8% (YTD: -28.8%), now at 1,675.00

- ICE-US Cocoa down -7.0% (YTD: 0.5%), now at 2,569.00

- Commodities Exchange Center Iron Ore 62% Fe CFR China (TSI) down -6.5% (YTD: 25.7%), now at 143.88

- SGX Iron Ore 62% China CFR Swap Monthly down -6.3% (YTD: 24.5%), now at 140.31

- ICE Europe Newcastle Coal Monthly down -5.2% (YTD: 36.6%), now at 232.35

- Shanghai International Exchange Bonded Copper down -4.9% (YTD: 2.4%), now at 63,520.00

- SHFE Bitumen Continuation Month 1 down -4.6% (YTD: 7.6%), now at 3,388.00

- NYMEX NY Harbor ULSD down -4.4% (YTD: 16.1%), now at 02.78

- SHFE Rebar down -4.2% (YTD: 4.8%), now at 4,836.00

- DCE Iron Ore Continuation Month 1 down -4.1% (YTD: 17.8%), now at 695.50

- EEX European-Carbon- Secondary Trading down -3.7% (YTD: 11.8%), now at 85.96

- EEX European Union Aviation Allowance Continuation Month 1 down -3.7% (YTD: 11.7%), now at 85.82

- Intercontinental Exchange European Union Allowance (EUA) Yearly down -3.7% (YTD: 11.6%), now at 89.47

- SHFE Hot Rolled Coil down -3.2% (YTD: 4.2%), now at 4,983.00

- SHFE Rubber down -2.9% (YTD: -3.1%), now at 14,030.00

ENERGY THIS WEEK

- WTI crude front month currently at US$ 91.07 per barrel, down -2.2% (YTD: +18.3%); 6-month term structure in tightening backwardation

- Newcastle Coal (ICE Europe) currently at US$ 232.35 per tonne, down -5.2% (YTD: +36.6%)

- Natural Gas (Henry Hub) currently at US$ 4.43 per MMBtu, up 12.4% (YTD: +24.4%)

- Gasoline (NYMEX) currently at US$ 2.67 per gallon, down -2.5% (YTD: +16.2%); 6-month term structure in widening backwardation

- Low Sulphur Gasoil (ICE Europe) currently at US$ 811.50 per tonne, down -1.9% (YTD: +19.7%)

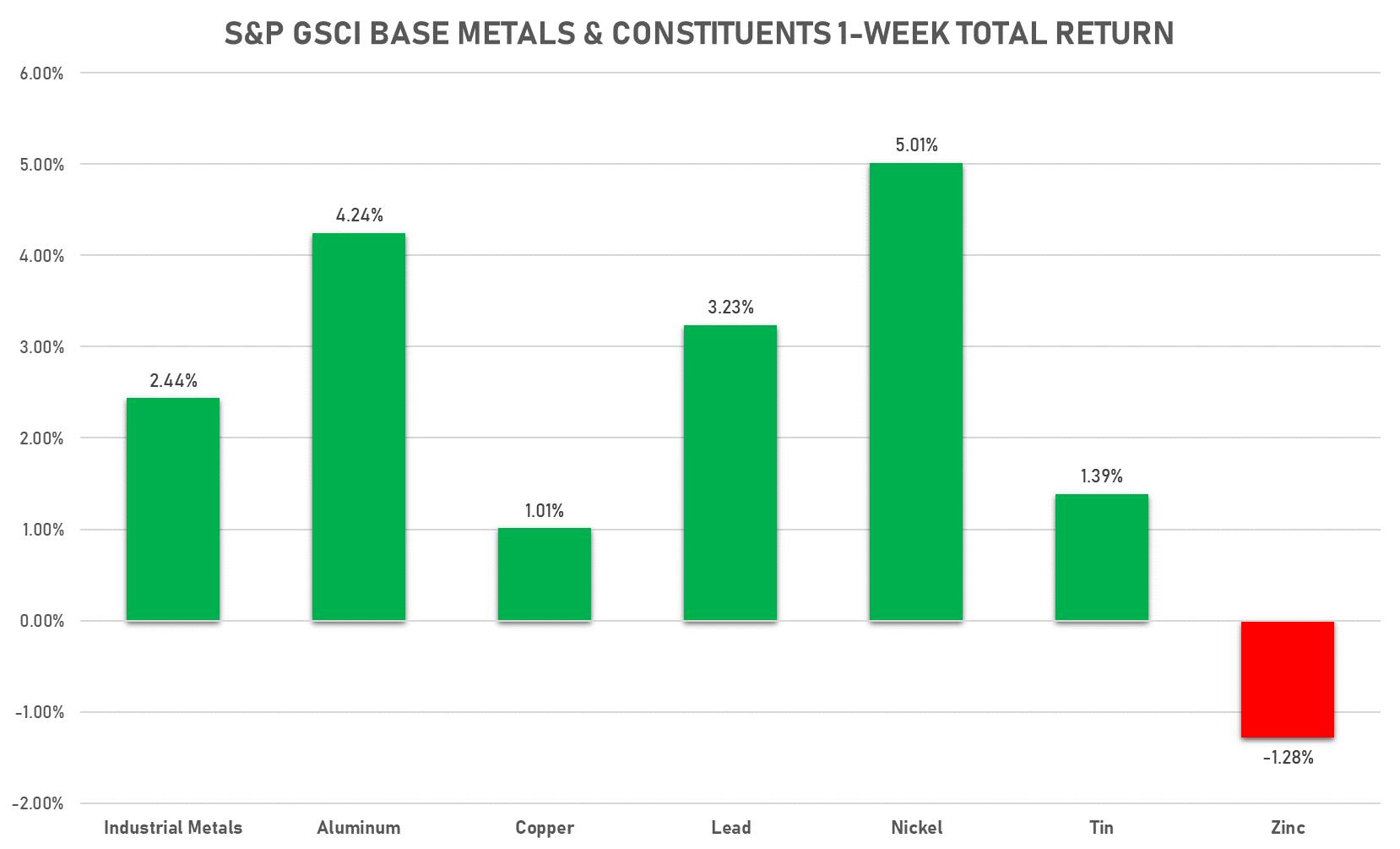

BASE METALS THIS WEEK

- Copper (COMEX) currently at US$ 4.53 per pound, up 0.3% (YTD: +3.1%)

- Iron Ore (Dalian Commodity Exchange) currently at CNY 695.50 per tonne, down -4.1% (YTD: +17.8%)

- Aluminum (Shanghai) currently at CNY 22,625 per tonne, down -0.6% (YTD: +12.4%)

- Nickel (Shanghai) currently at CNY 178,450 per tonne, up 0.3% (YTD: +17.1%)

- Lead (Shanghai) currently at CNY 15,400 per tonne, up 1.7% (YTD: +1.2%)

- Rebar (Shanghai) currently at CNY 4,836 per tonne, down -4.2% (YTD: +4.8%)

- Tin (Shanghai) currently at CNY 338,410 per tonne, down -1.2% (YTD: +12.5%)

- Zinc (Shanghai) currently at CNY 24,865 per tonne, down -2.1% (YTD: +4.8%)

- Refined Cobalt (Shanghai) spot price currently at CNY 534,000 per tonne, up 3.9% (YTD: +9.7%)

- Lithium (Shanghai) spot price currently at CNY 2,290,000 per tonne, up 12.8% (YTD: +71.5%)

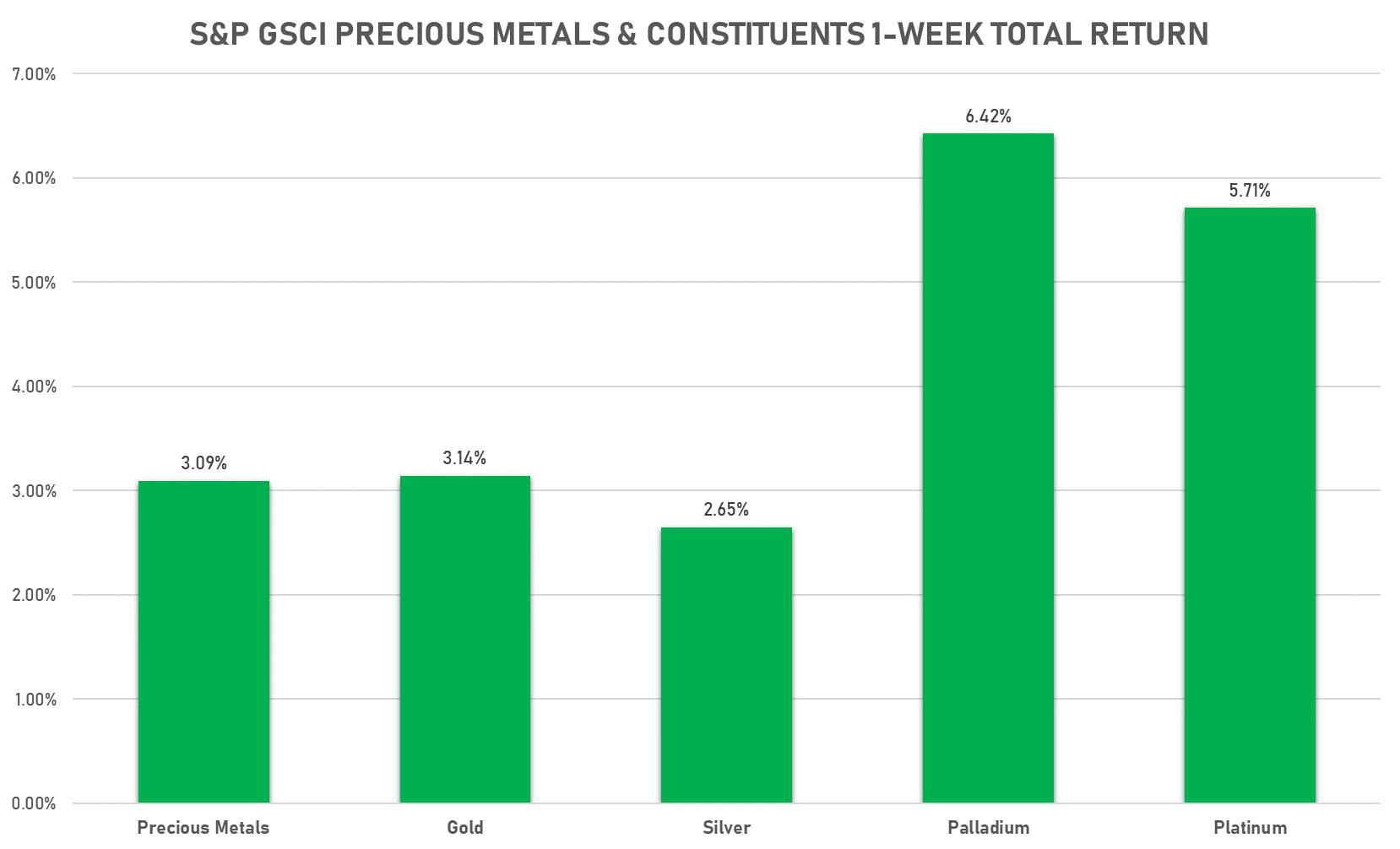

PRECIOUS METALS THIS WEEK

- Gold spot currently at US$ 1,898.06 per troy ounce, up 2.1% (YTD: +4.6%)

- Gold 1-Month ATM implied volatility currently at 14.98, up 23.6% (YTD: +17.7%)

- Silver spot currently at US$ 23.90 per troy ounce, up 1.5% (YTD: +3.8%)

- Silver 1-Month ATM implied volatility currently at 24.67, up 7.3% (YTD: +7.7%)

- Palladium spot currently at US$ 2,347.94 per troy ounce, up 1.6% (YTD: +19.5%)

- Platinum spot currently at US$ 1,066.02 per troy ounce, up 3.8% (YTD: +10.8%)

- Rhodium (Johnson Matthey, New York 09:30) currently at US$ 18,300 per troy ounce, down -0.3% (YTD: +29.8%)

- Iridium (Johnson Matthey, New York 09:30) currently at US$ 3,900 per troy ounce, unchanged (YTD: -2.5%)

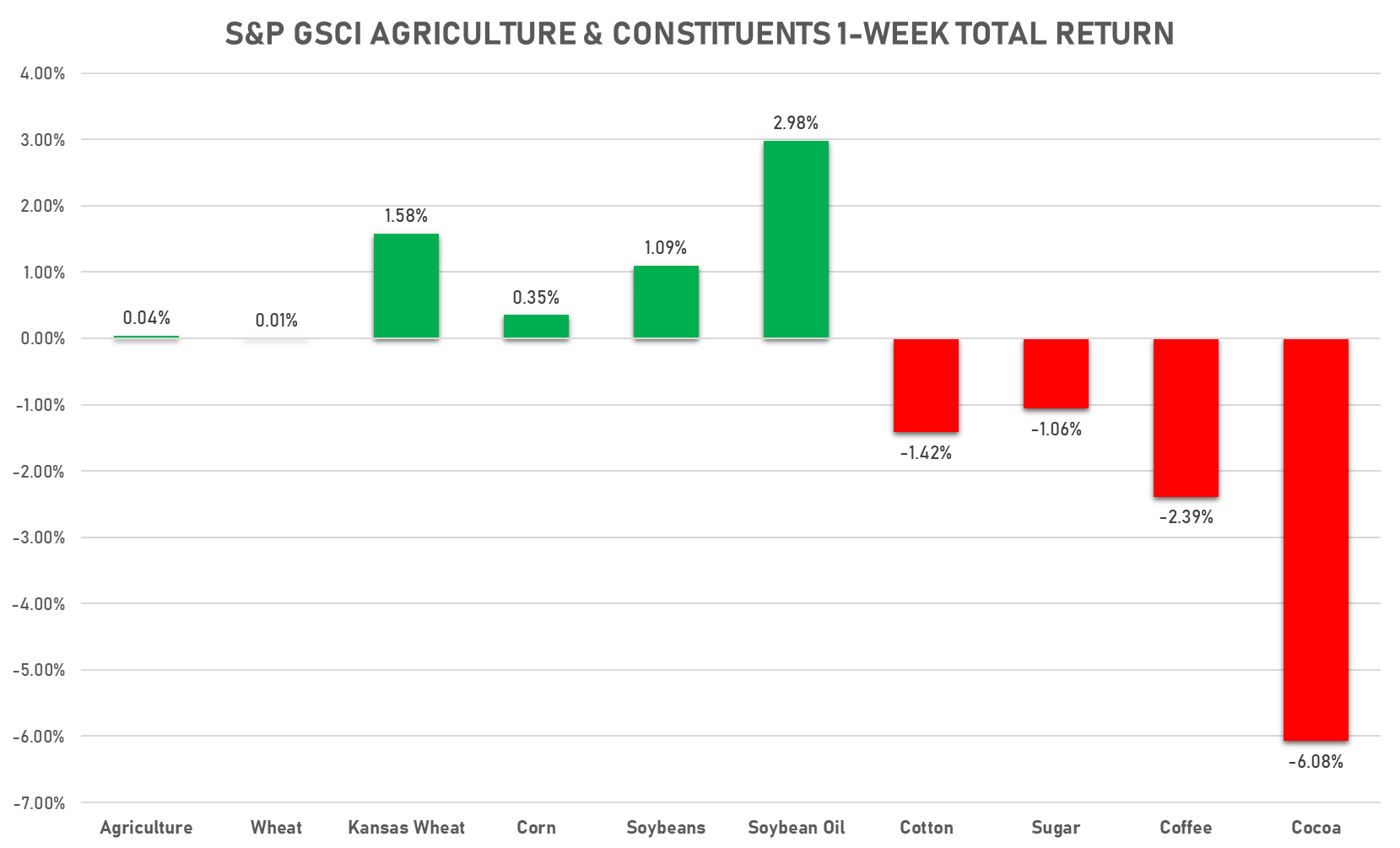

AGS THIS WEEK

- Live Cattle (CME) currently at US$ 143.25 cents per pound, up 1.0% (YTD: +3.0%)

- Lean Hogs (CME) currently at US$ 109.40 cents per pound, up 20.9% (YTD: +32.3%)

- Rough Rice (CBOT) currently at US$ 14.90 cents per hundredweight, down -2.0% (YTD: +2.2%)

- Soybeans Composite (CBOT) currently at US$ 1,601.50 cents per bushel, up 1.2% (YTD: +20.6%)

- Corn (CBOT) currently at US$ 654.25 cents per bushel, up 0.5% (YTD: +9.8%)

- Wheat Composite (CBOT) currently at US$ 797.00 cents per bushel, down -0.1% (YTD: +2.2%)

- Sugar No.11 (ICE US) currently at US$ 18.18 cents per pound, down -0.3% (YTD: -3.1%)

- Cotton No.2 (ICE US) currently at US$ 123.04 cents per pound, down -1.8% (YTD: +7.6%)

- Cocoa (ICE US) currently at US$ 2,569 per tonne, down -7.0% (YTD: +0.5%)

- Coffee Arabica (Colombia Excelso) currently at EUR 5,970 per tonne, down -2.0% (YTD: +8.4%)

- Random Length Lumber (CME) currently at US$ 1,270.00 per 1,000 board feet, up 4.4% (YTD: +9.7%)

- TSR 20 Rubber (Shanghai) currently at CNY 11,830 per tonne, up 2.6% (YTD: +3.1%)

- Soybean Oil Composite (CBOT) currently at US$ 67.57 cents per pound, up 2.8% (YTD: +21.0%)

- Crude Palm Oil (Bursa Malaysia) currently at MYR 6,015 per tonne, up 3.6% (YTD: +16.7%)

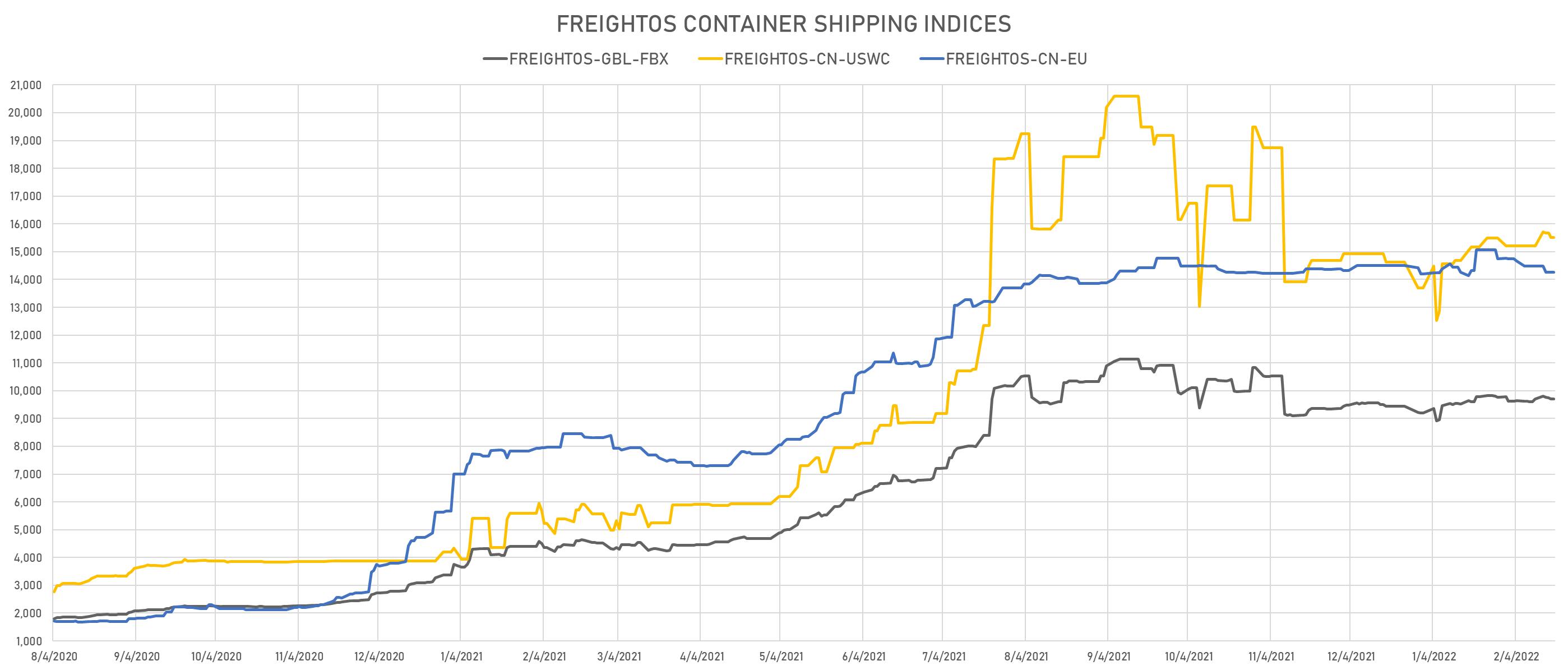

SHIPPING THIS WEEK

- Baltic Dry Index (Baltic Exchange) currently at 1,964, down -0.7% (YTD: -11.5%)

- Freightos China To North America West Coast Container Index currently at 15,511, up 1.9% (YTD: +13.2%)

- Freightos North America West Coast To China Container Index currently at 936, down -2.3% (YTD: +7.0%)

- Freightos North America East Coast To Europe Container Index currently at 563, down -1.4% (YTD: +4.3%)

- Freightos Europe To North America East Coast Container Index currently at 6,896, down -1.0% (YTD: -2.9%)

- Freightos China To North Europe Container Index currently at 14,269, down -1.5% (YTD: +0.5%)

- Freightos North Europe To China Container Index currently at 907, down -8.3% (YTD: -19.7%)

- Freightos Europe To South America West Coast Container Index currently at 8,070, down -3.9% (YTD: +3.3%)

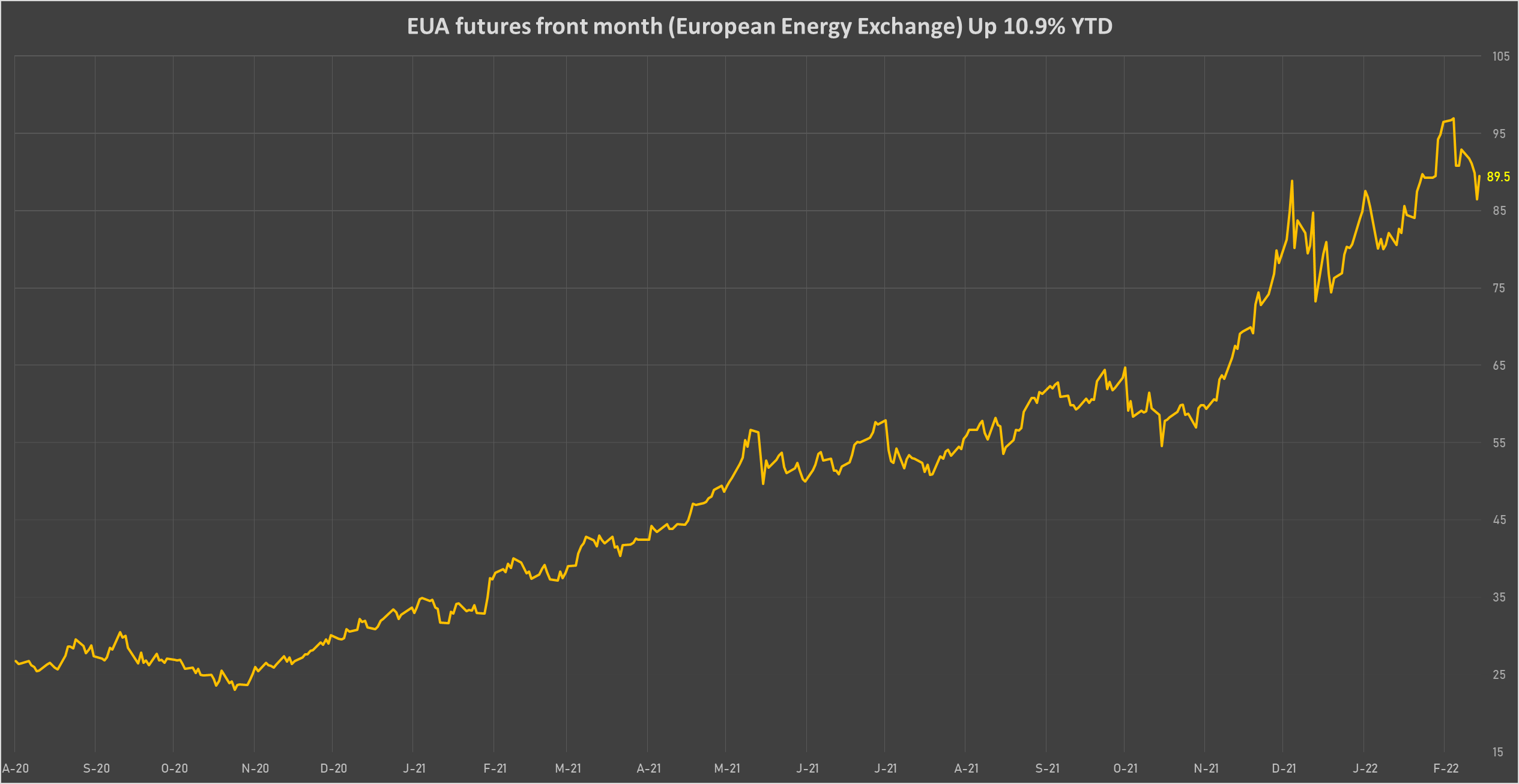

CARBON EMISSION ALLOWANCES (CO2)

- EUA front-month future (ICE) currently at EUR 89.47 per tonne, down -3.7% (YTD: +11.6%)

NET POSITIONS OF MANAGED MONEY (WEEKLY CFTC COTR REPORT)

ENERGY

- Light Sweet Crude reduced net long position

- Ice Brent increased net long position

- Gasoline RBOB increased net long position

- No.2 Heating Oil increased net long position

- Ice Gasoil reduced net long position

- Henry Hub Ice reduced net long position

METALS

- Gold increased net long position

- Silver increased net long position

- Platinum reduced net long position

- Palladium reduced net short position

- Copper-Grade#1 increased net long position

AGRICULTURE

- Wheat increased net short position

- Corn reduced net long position

- Rough Rice reduced net long position

- Oats reduced net long position

- Soybeans increased net long position

- Soybean Oil reduced net long position

- Soybean Meal increased net long position

- Lean Hogs increased net long position

- Live Cattle increased net long position

- Feeder Cattle increased net long position

- Cocoa increased net long position

- Coffee C increased net long position

- Robusta Coffee increased net long position

- Frozen Orange Juice reduced net long position

- Sugar No.11 reduced net long position

- White Sugar reduced net long position