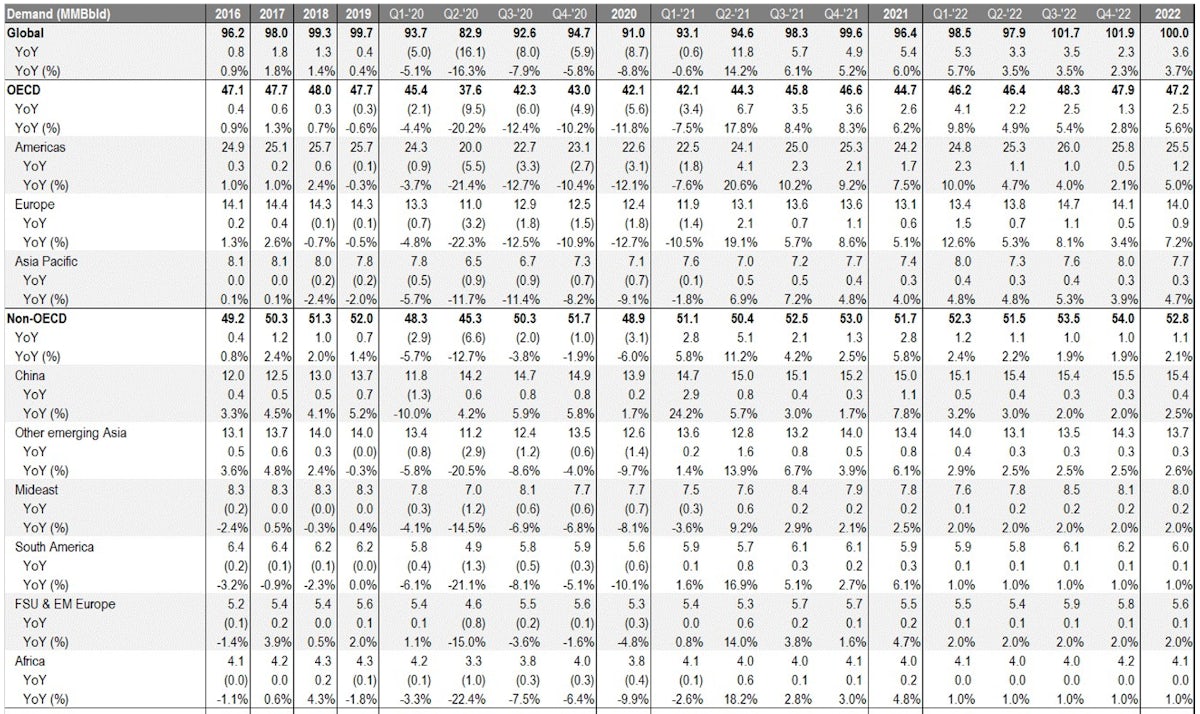

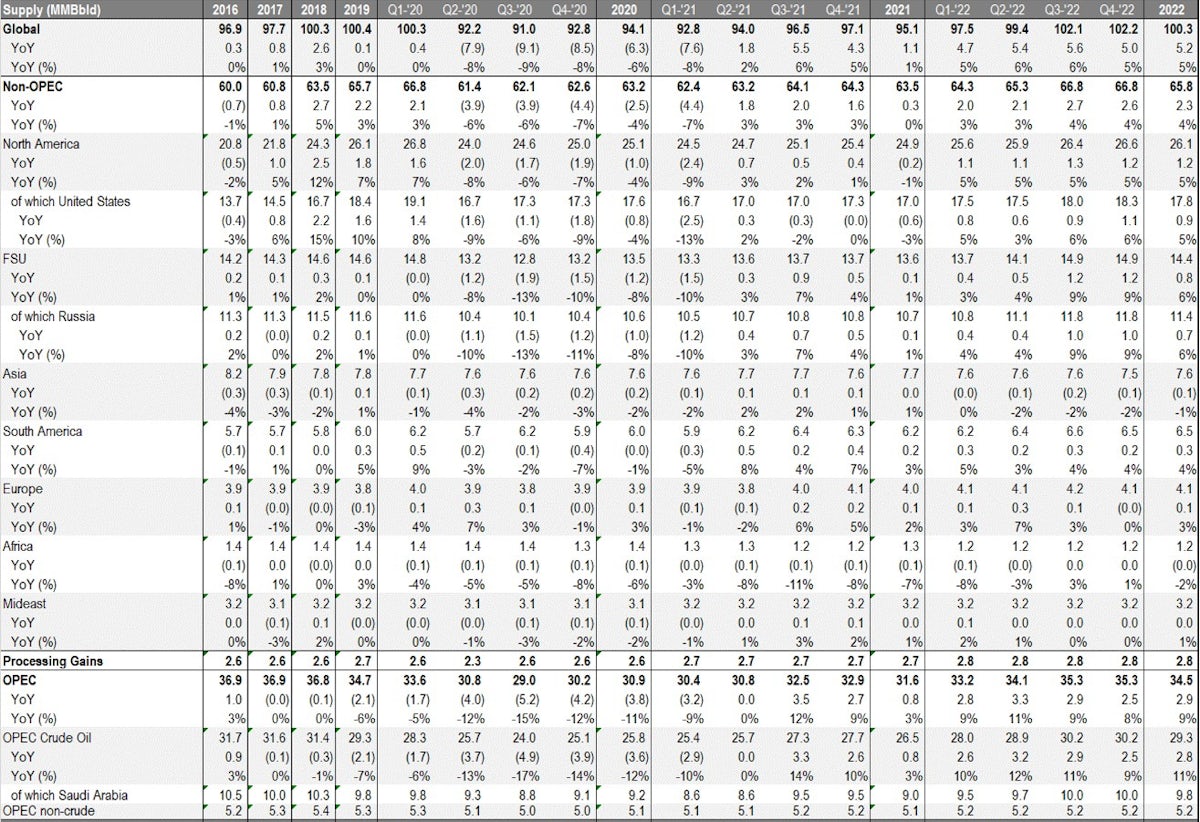

Macro

Likely OPEC+ Scenario Remains Increased Output To Balance The Market

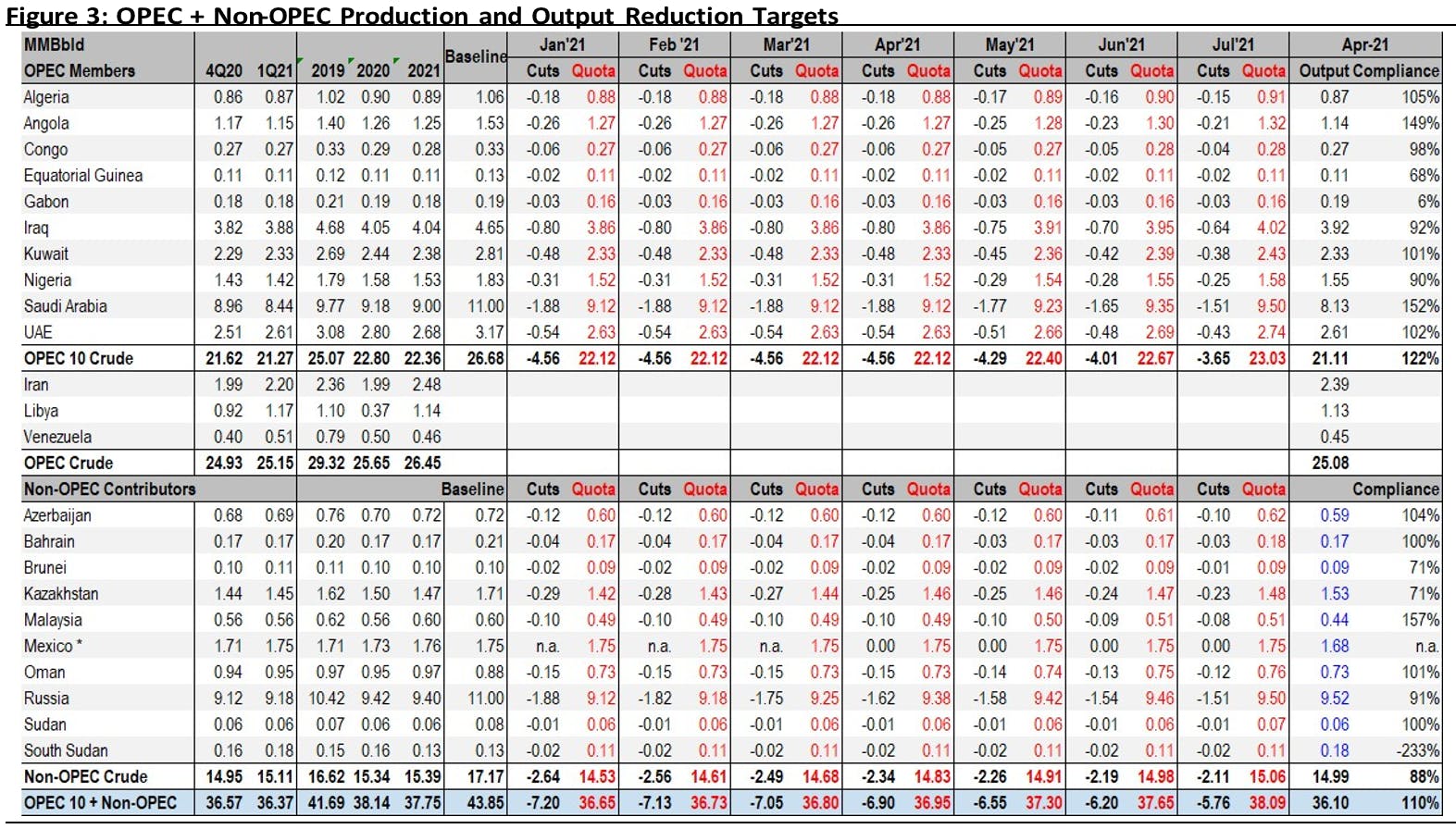

Note that there is no tightness in the market (as some observers have claimed), with OPEC+ currently sitting on about 6m bpd of extra supply

Published ET

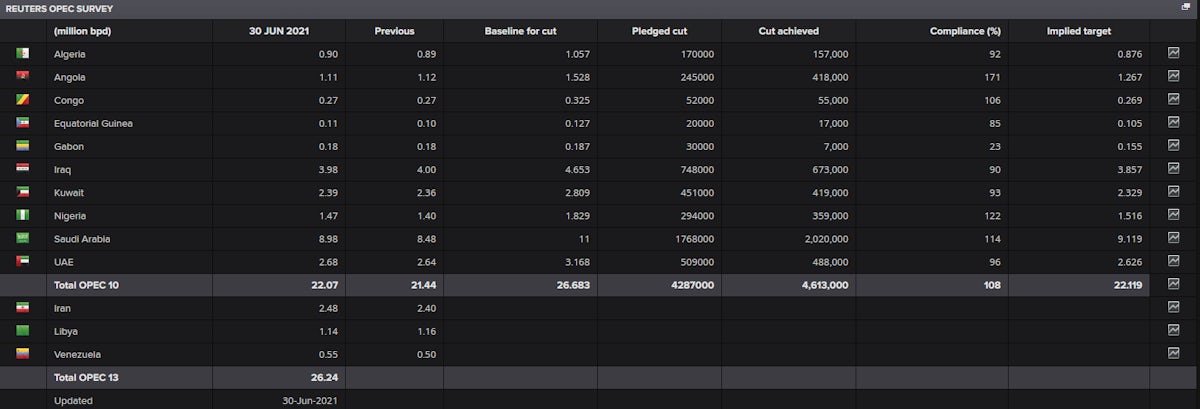

Reuters OPEC Baselines And Compliance Survey | Source: Refinitiv

WHAT'S HAPPENED THIS YEAR

- OPEC+ compliance has been surprisingly good, with oversupply coming mainly from Russia (who has overproduced its cap since March) and Iraq

- Russia wants to produce more (and a lower market price), as it wants to prevent a full revival of the US shale industry

- Inventories have been drawn in line with the increase in the spot price

- Iran nuclear talks open the possibility of the country providing more oil to the market. If a nuclear deal were to be agreed, analysts expect Iran to provide an additional 1.5m bpd in crude supply within 90 days

WHAT'S HAPPENING NOW

- The UAE, led by Abu Dhabi, consider their baseline production level should be 3.8m bpd (instead of the current 3.2m bpd), a level it achieved during the last price war in 2020

- Saudi Arabia and Russia are proposing to increase production by 400k bpd every month from August to December, thereby increasing supply by 2m bpd by the end of the year

- They do not propose to change baseline levels, something that would potentially jeopardize Russia's participation in the deal

POSSIBLE SCENARIOS

1. NO CHANGES TO CURRENT AGREEMENT

- Low Likelihood as OPEC+ doesn't want prices that are too high (hurtful to global growth)

- Bullish for spot prices which could keep rising towards $80-$90

2. MODIFIED AGREEMENT TO INCREASE SUPPLY

- Most likely outcome as current spot prices are fairly close to the estimated OPEC sweet spot of $65-70

- Prices would probably fall slightly and stabilize in the low '70s

3. OPEC+ AGREEMENT FALLS APART AND SUPPLIERS START A PRICE WAR

- Low likelihood as it benefits no one

- Very bearish for oil prices as flooding the market with the total OPEC+ baseline would lead to global supply significantly outpacing global demand