Is This Peak Inflation ?

The insistent chatter about rising prices and rising commodities makes us think we might be close to a top

Published ET

Stock Photo

There has been a lot of talk lately about "peak growth" and "peak earnings", suggesting somehow that things can never get better. That last statement seems plain wrong, as we are just getting started, slowly coming out of a very painful economic recession.

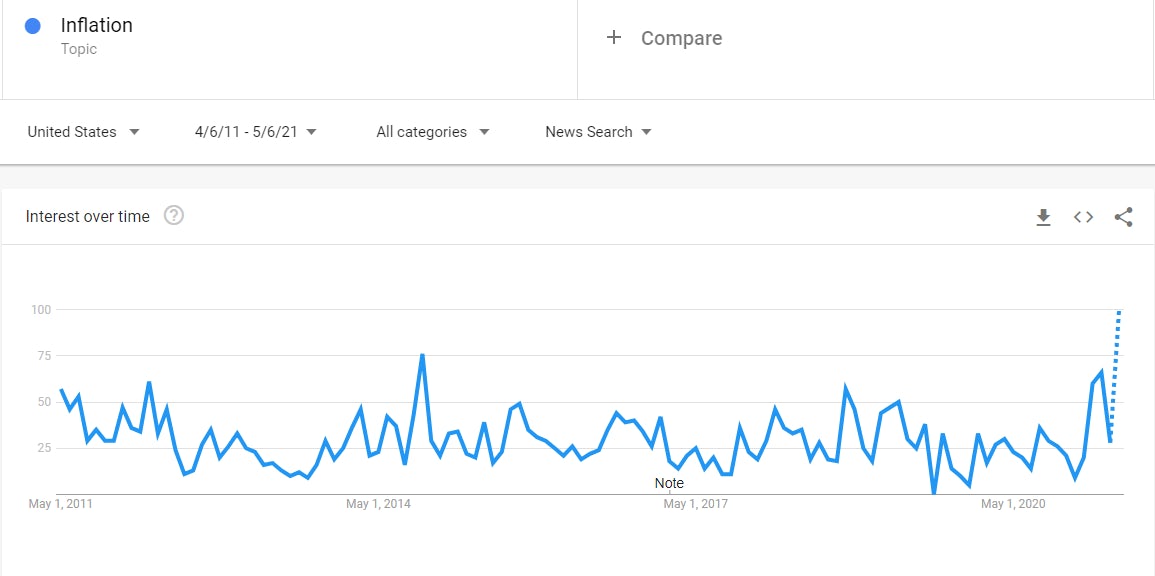

But something else seems peaking to us: in the last weeks, not a single corporate earnings call went by without multiple mentions of the word "inflation". And there has never been more interest in the topic according to Google Trends:

Now that probably explains why we and other news outlets choose to cover it. But there is a sinister undertone to many of the articles that we come across lately.

Let us quote a recent piece in the Wall Street Journal to understand what we mean:

"If we are at a turning point, the cost of being wrong is high. Investors who are buying 10-year Treasurys at 1.6% will lose horribly from higher inflation. Even hitting the Fed’s target of 2% over the period would mean a loss of spending power. If inflation picks up to the 1990s average of 3% it would be extremely painful, and if fears took hold that 3% could turn into the 1980s average above 5%, Treasurys would be massacred."

We should commend them for their daring use of vivid language.

Now, their thesis revolves around the following well-worn themes: monetary policy / central bank largesse, fiscal spending, deglobalization, demographics ("peak population"), and the comeback of labor unions.

We won't comment on their points, which are well known and can be discussed elsewhere.

We will just say that recent inflation experience (in the US, in Europe, in Japan) have shown the limits of monetary policy to inflate the economy (as opposed to investment assets). For some factual basis, here's a long-term chart of the US CPI, starting in 1914:

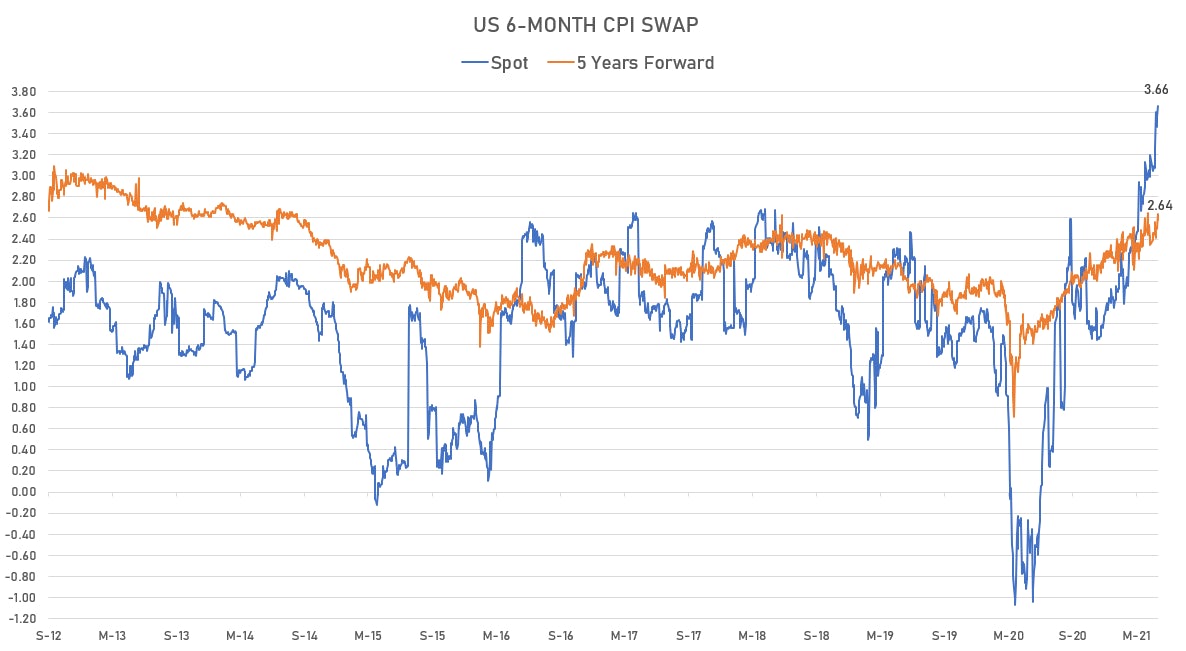

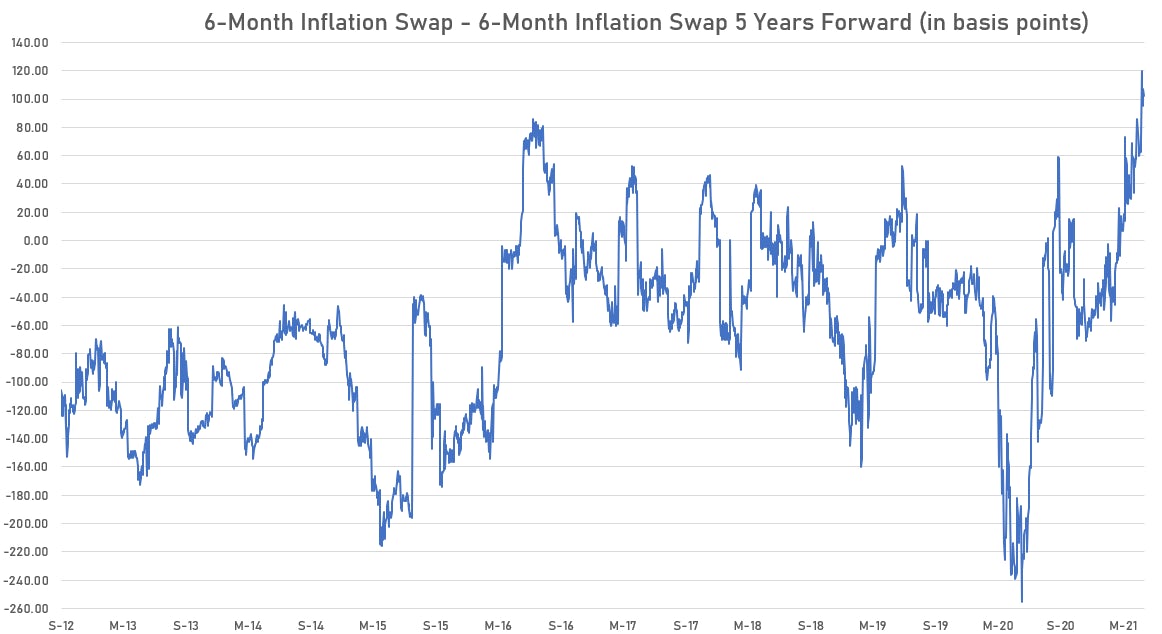

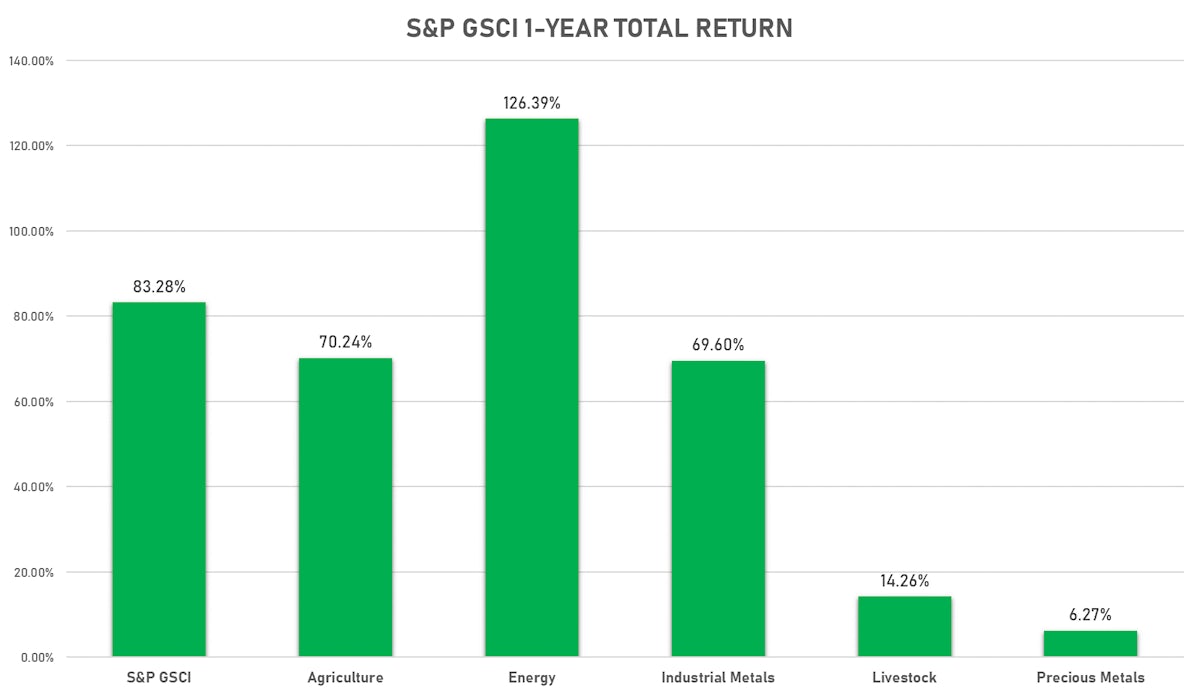

Our problem with alarmist reporting is that it seems to imply that somehow investors have completely forgotten about, or chosen to ignore, possible inflation. And looking at inflation-sensitive markets (see charts below for more details), we would say that a lot of inflation is already priced in:

- Treasury Inflation Protected Securities (TIPS) are extremely expensive

- US CPI swaps have an inverted curve, meaning that investors want protection now rather in the future. In fact, the spread between immediate and forward protection has never been greater

- Commodities have been on a furious tear in the past year

So what it means in simple terms is this: investors are alarmed about inflation, and have done as much as they can to protect themselves. If that is peak inflation, then perhaps time for a reversal?