Rates

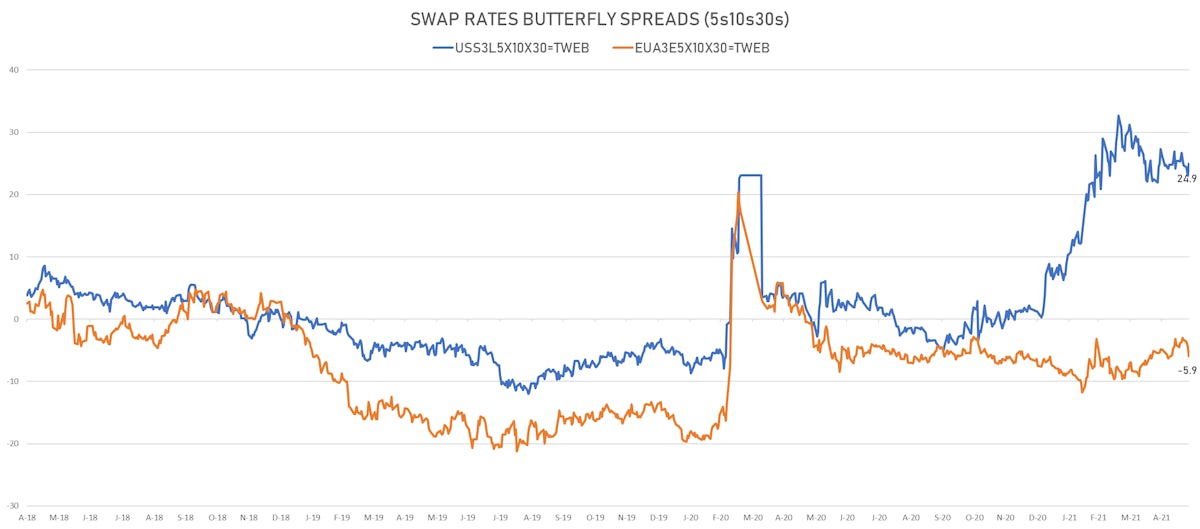

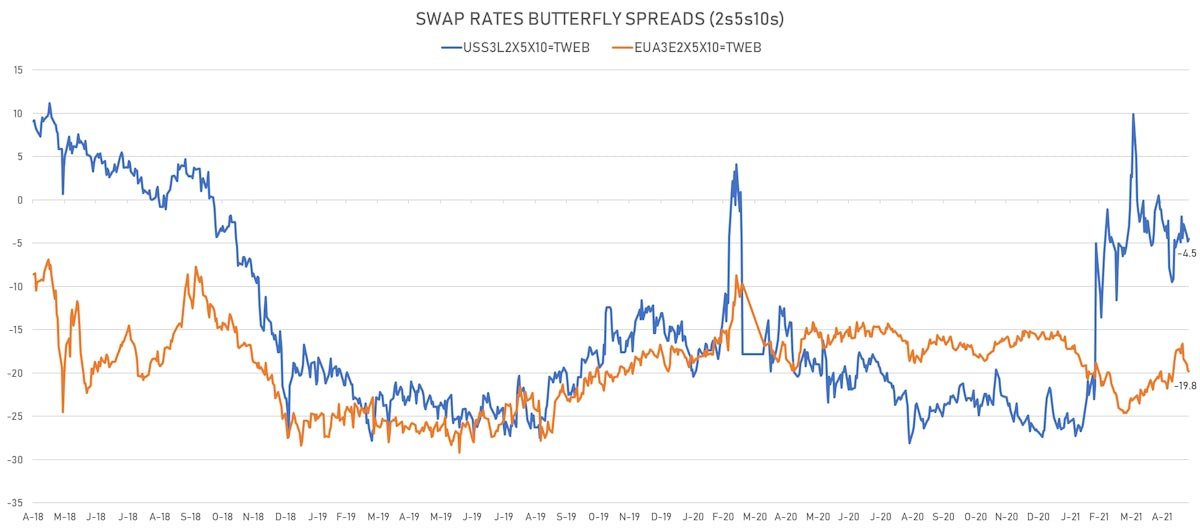

US Rates Rise, Curve Steepens Slightly As Fed Tapering Talk Gathers Momentum

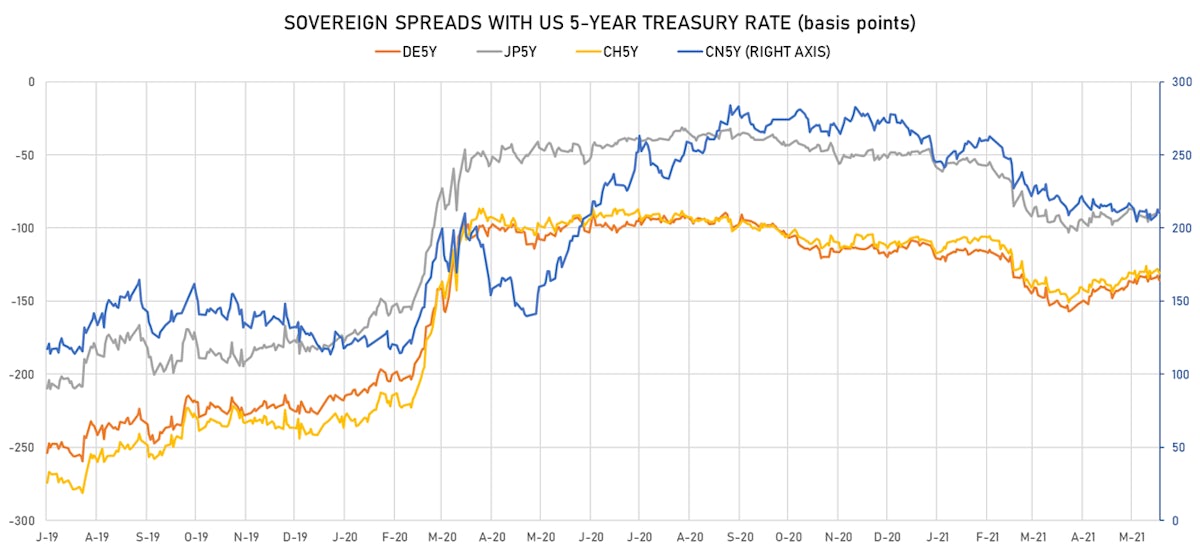

German rates move the other way and the curve flattens, with some market participants expecting the ECB to more explicitly signal that both policy rates and QE will remain on hold for a longer period (Goldman Sachs sees no ECB rate hikes until 2025 at the earliest)

Published ET

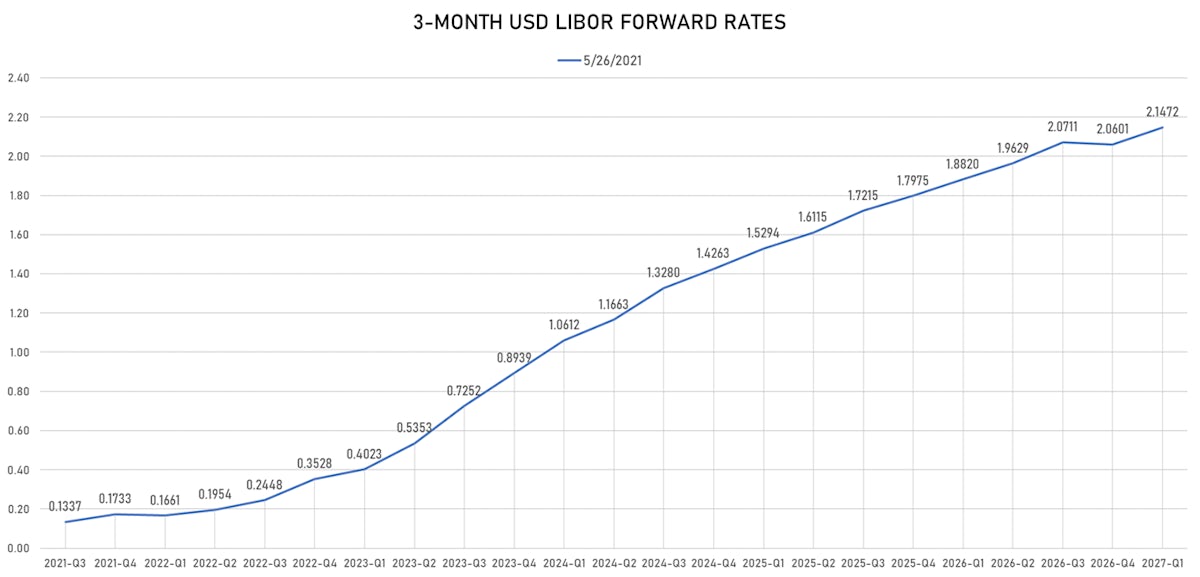

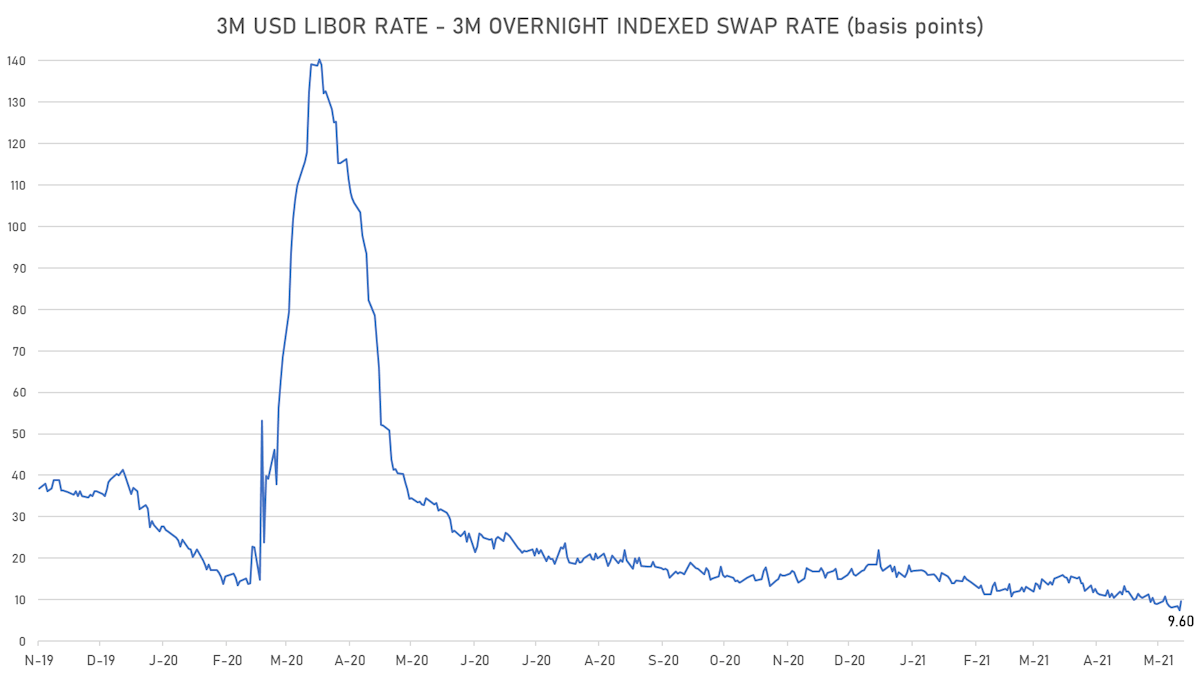

3-Month USD LIBOR AT LOWEST LEVEL EVER | Source: Refinitiv

QUICK US SUMMARY

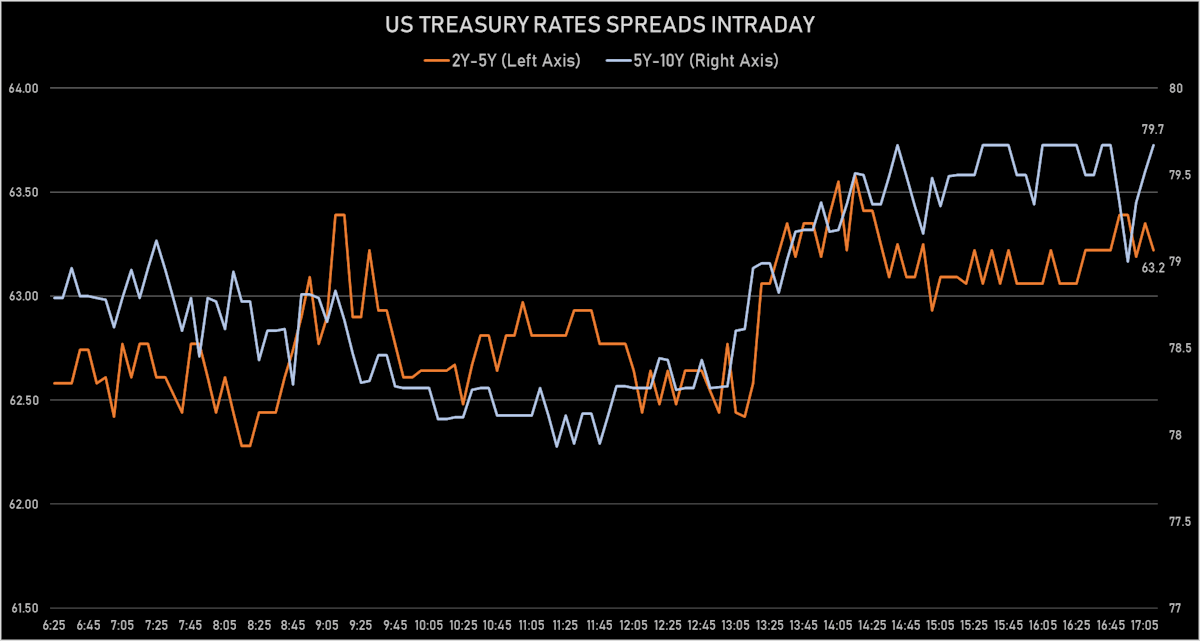

- Yield curve steepening, with the 1Y-10Y spread widening 2.0 bp on the day, now at 153.8 bp (YTD change: +73.3)

- 1Y: 0.0430% (unchanged 0.0 bp)

- 2Y: 0.1485% (up 0.3 bp)

- 5Y: 0.7824% (up 0.8 bp)

- 7Y: 1.2358% (up 1.4 bp)

- 10Y: 1.5808% (up 2.0 bp)

- 30Y: 2.2611% (up 0.8 bp)

- 3-month USD Libor rate down to new all-time low at 0.1385%

US MACRO RELEASES

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 21 May (MBA, USA) at -4.20

- Mortgage applications, market composite index for W 21 May (MBA, USA) at 693.70

- Mortgage applications, market composite index, purchase for W 21 May (MBA, USA) at 269.80

- Mortgage applications, market composite index, refinancing for W 21 May (MBA, USA) at 3,168.80

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 21 May (MBA, USA) at 3.18

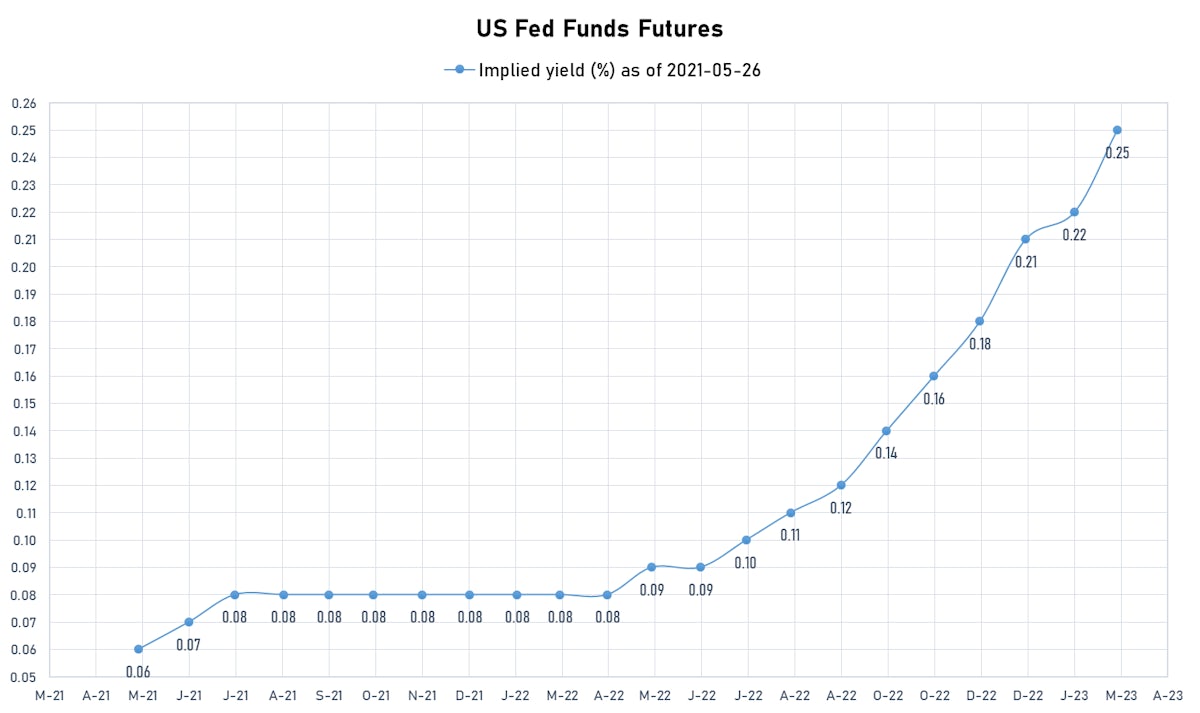

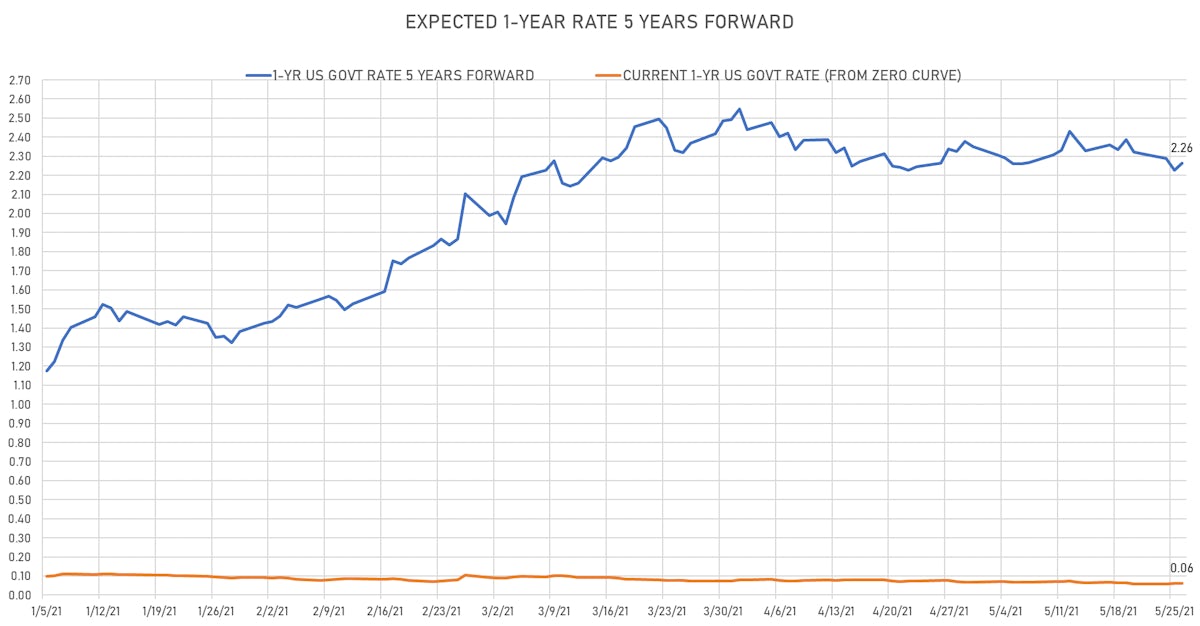

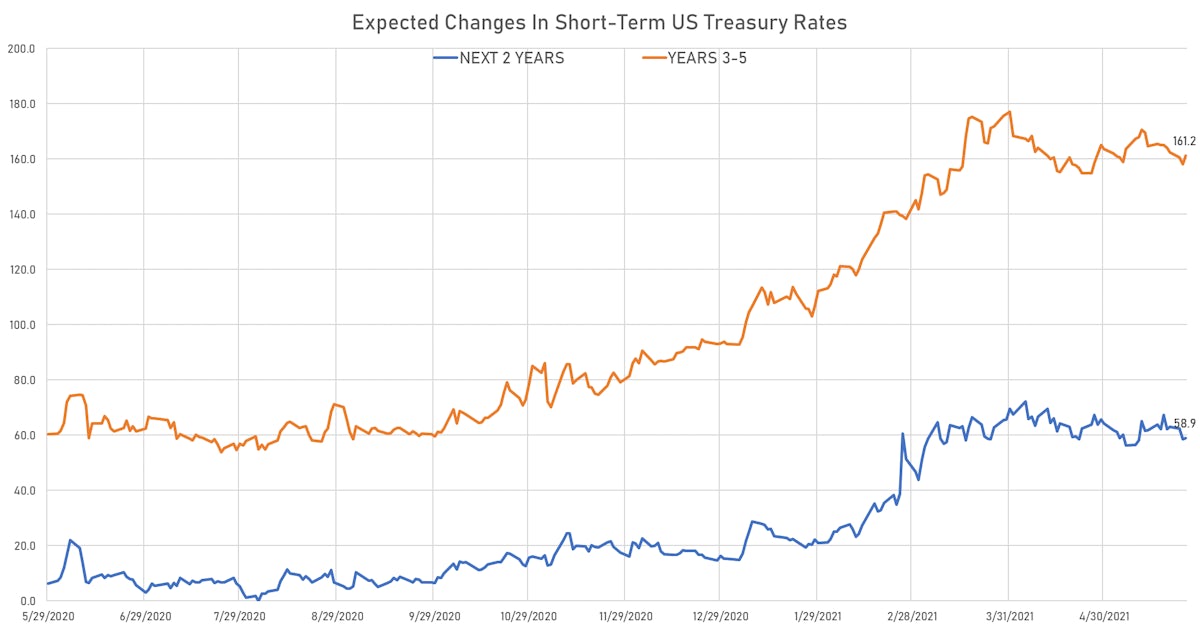

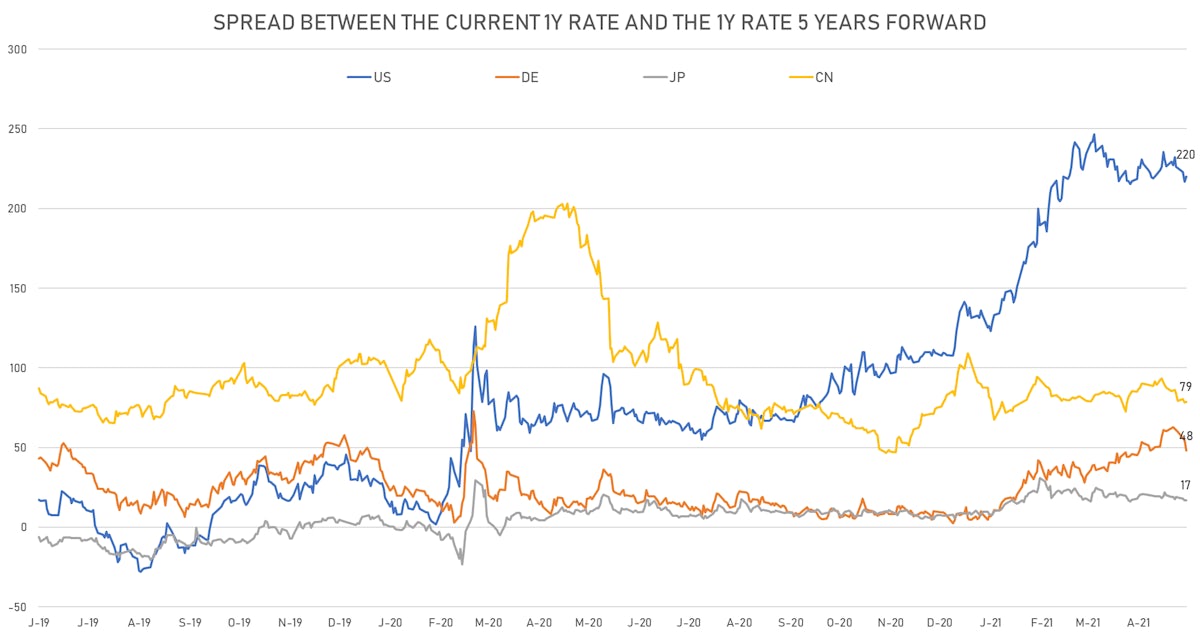

US FORWARD RATES

- 3-month USD Libor 5 years forward up 2.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 3.6 bp, now at 2.2631%

- Expectations of short-rates hikes over the next 5 years at 220.1 bp, up 3.4bp today

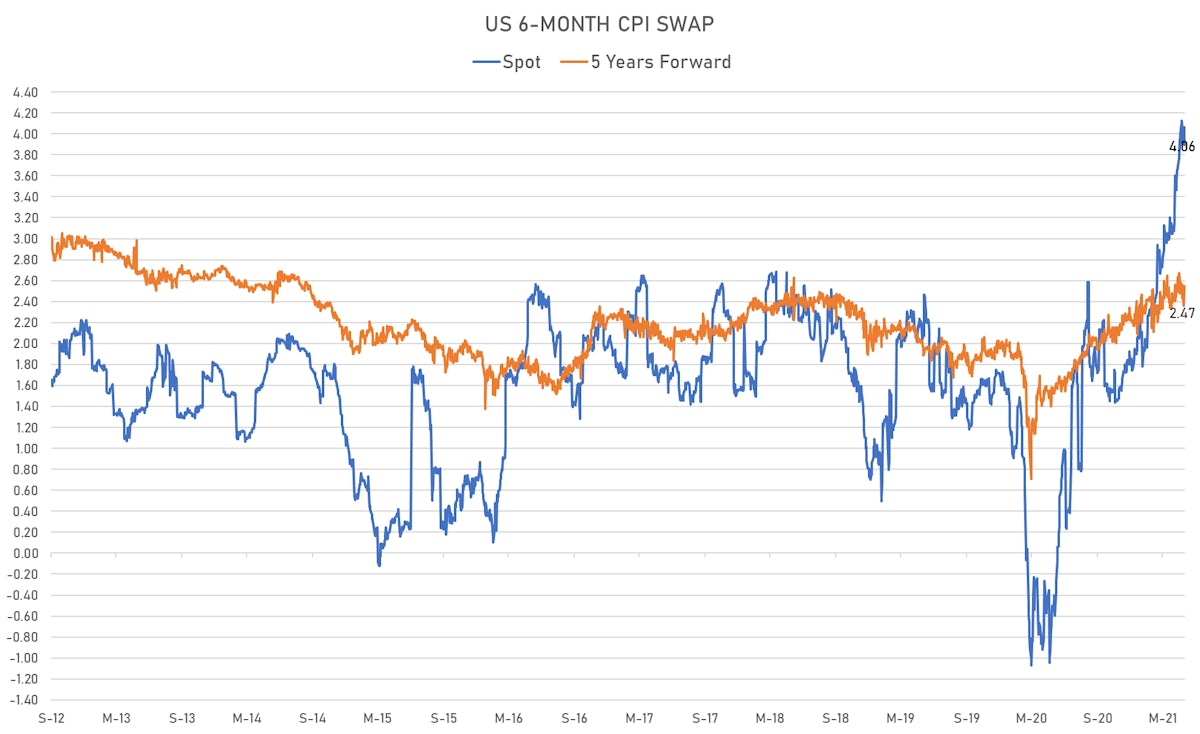

US INFLATION

- TIPS 1Y breakeven inflation at 3.31% (down -1.1bp); 2Y at 2.86% (down -4.5bp); 5Y at 2.63% (down -3.1bp); 10Y at 2.41% (down -2.1bp); 30Y at 2.31% (down -1.2bp)

- 6-month spot US CPI swap up 16.7 bp to 4.063%, with a steepening of the forward curve (longer-term inflation expectations stay anchored)

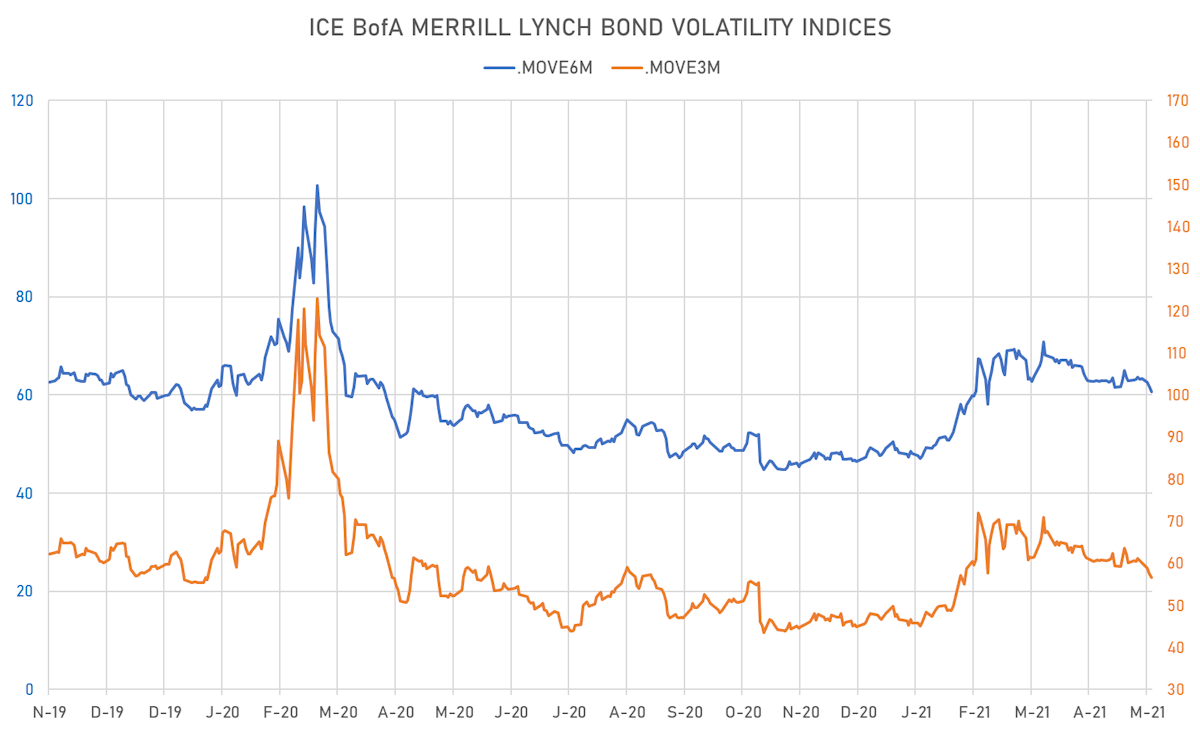

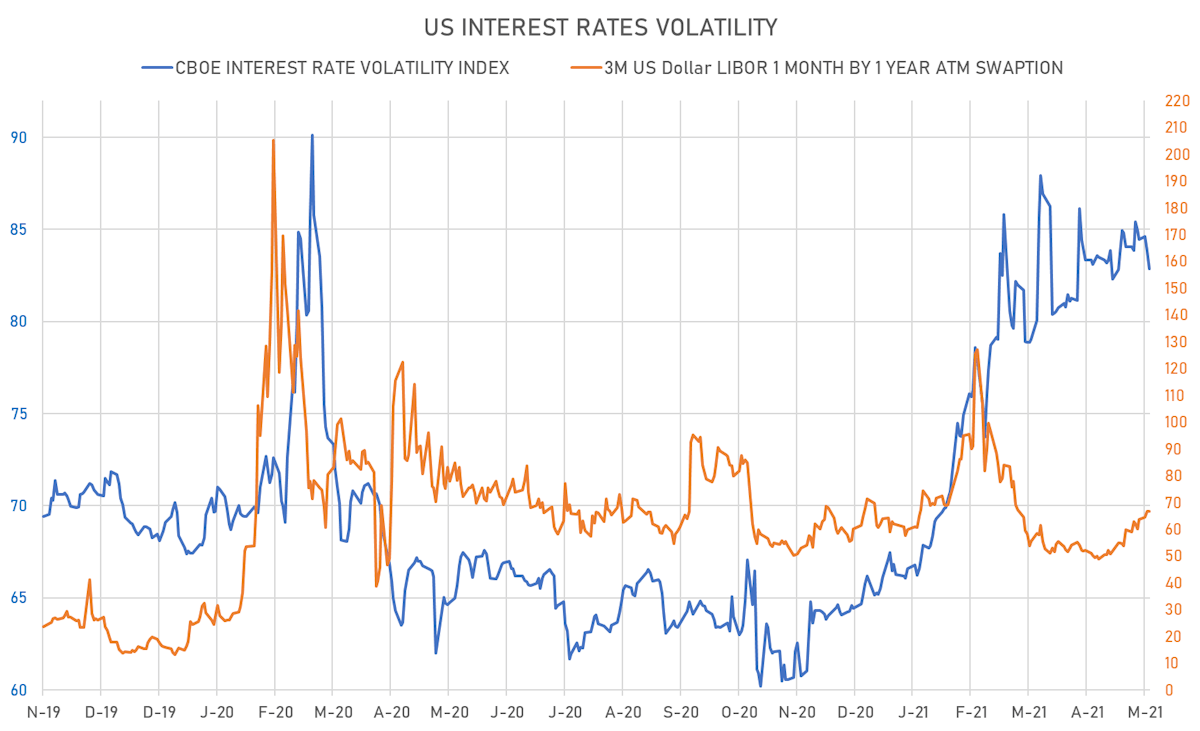

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.3% at 66.7%

- 3-Month LIBOR-OIS spread up 2.2 bp at 9.6 bp (12-months range: 7.5-33.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.577% (down -2.4 bp); the German 1Y-10Y curve is 5.4 bp flatter at 42.0bp (YTD change: +26.9 bp)

- Japan 5Y: -0.087% (down -0.2 bp); the Japanese 1Y-10Y curve is unchanged at 19.3bp (YTD change: +5.5 bp)

- China 5Y: 2.886% (down -1.2 bp); the Chinese 1Y-10Y curve is 0.3 bp steeper at 53.6bp (YTD change: +7.2 bp)

- Switzerland 5Y: -0.524% (down -2.0 bp); the Swiss 1Y-10Y curve is 2.7 bp flatter at 55.8bp (YTD change: +29.4 bp)