Rates

Underwhelming Housing Data Triggers Modest Reversal Of Recent Rates Moves

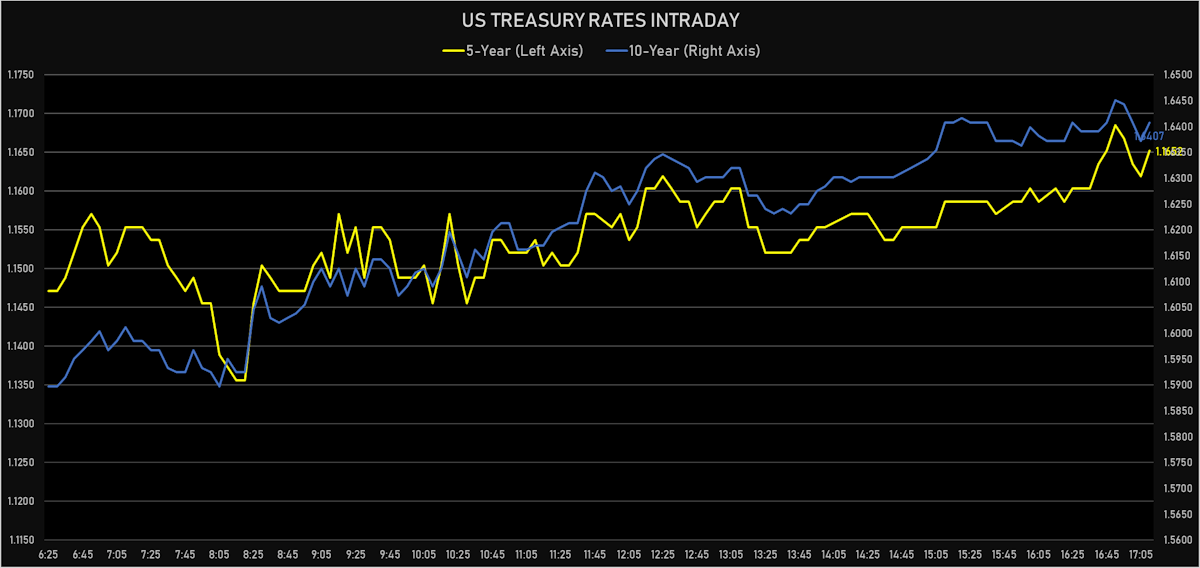

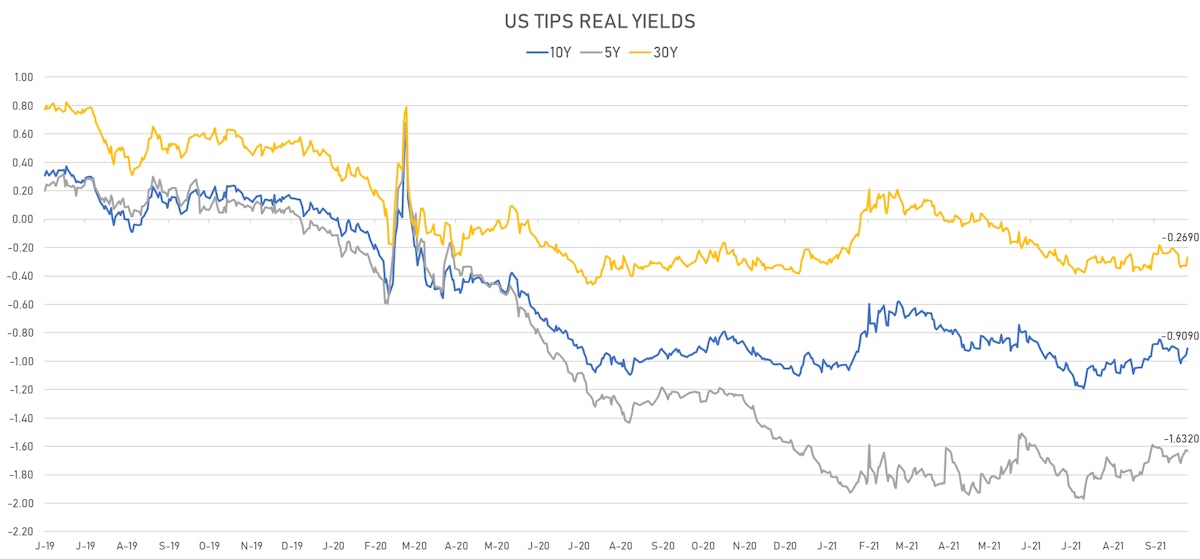

US rates dropped at the short end and rose at the long end, a move driven by real yields rather than inflation breakevens with the US TIPS 5s30s spread up 6.6bp today

Published ET

US Treasury Yield Curve Spreads Daily | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -0.20bp today, now at 0.1295%; 3-Month SOFR OIS 0.0bp today, now at 0.0490%

- The treasury yield curve steepened, with the 1s10s spread widening 5.7 bp, now at 153.7 bp (YTD change: +73.2bp)

- 1Y: 0.1040% (down 0.8 bp)

- 2Y: 0.3994% (down 2.2 bp)

- 5Y: 1.1652% (unchanged)

- 7Y: 1.4732% (up 2.9 bp)

- 10Y: 1.6407% (up 4.9 bp)

- 30Y: 2.0904% (up 6.5 bp)

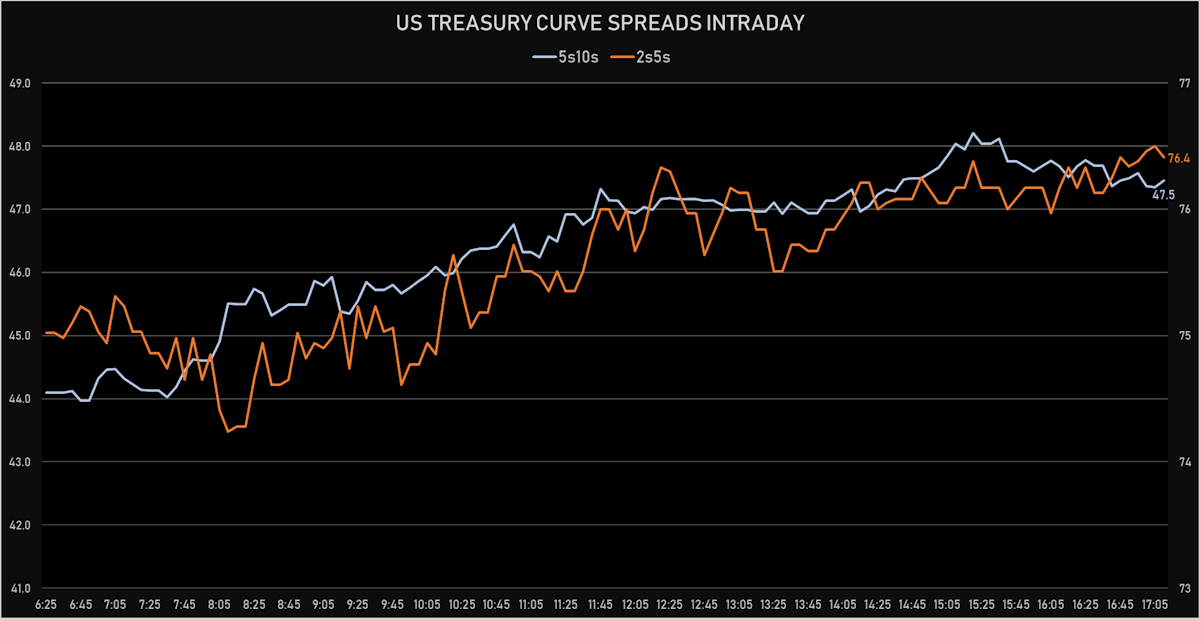

- US treasury curve spreads: 2s5s at 76.6bp (up 2.4bp today), 5s10s at 47.6bp (up 5.1bp today), 10s30s at 45.0bp (up 1.7bp today)

- Treasuries butterfly spreads: 1s5s10s at -59.7bp (up 4.8bp today), 5s10s30s at -3.5bp (down -3.1bp)

- US 5-Year TIPS Real Yield: -0.8 bp at -1.6320%; 10-Year TIPS Real Yield: +4.7 bp at -0.9090%; 30-Year TIPS Real Yield: +5.8 bp at -0.2690%

US MACRO RELEASES

- Atlanta Fed Q3 GDPNow at 0.5% (vs 1.2% Prior)

- Housing Starts for Sep 2021 (U.S. Census Bureau) at 1.56 Mln (vs 1.62 Mln prior), below consensus estimate of 1.62 Mln

- Housing Starts, Change P/P for Sep 2021 (U.S. Census Bureau) at -1.60 % (vs 3.90 % prior)

- Building Permits for Sep 2021 (U.S. Census Bureau) at 1.59 Mln (vs 1.72 Mln prior), below consensus estimate of 1.68 Mln

- Building Permits, Change P/P for Sep 2021 (U.S. Census Bureau) at -7.70 % (vs 5.60 % prior)

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 16 Oct (Redbook Research) at 15.40 % (vs 14.80 % prior)

US FORWARD RATES

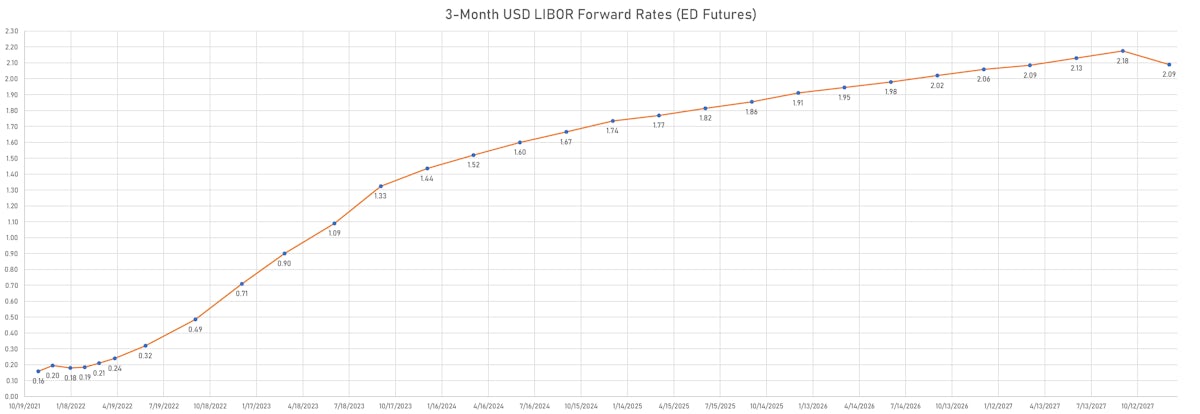

- 3-month Eurodollar future (EDU2) expected hike of 32.5 bp by the end of 2022 (meaning the market prices 130.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 126.0 bp over the next 3 years (equivalent to 5.04 rate hikes)

- The 3-month Eurodollar zero curve prices in 150.0 bp over the next 3 years (equivalent to 6.00 rate hikes)

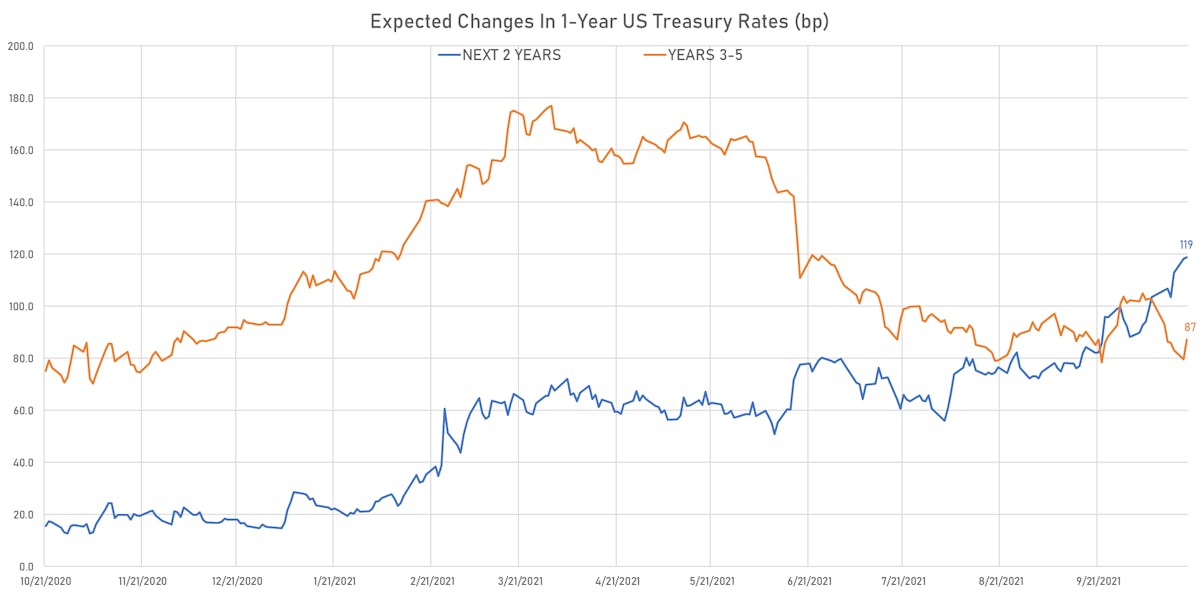

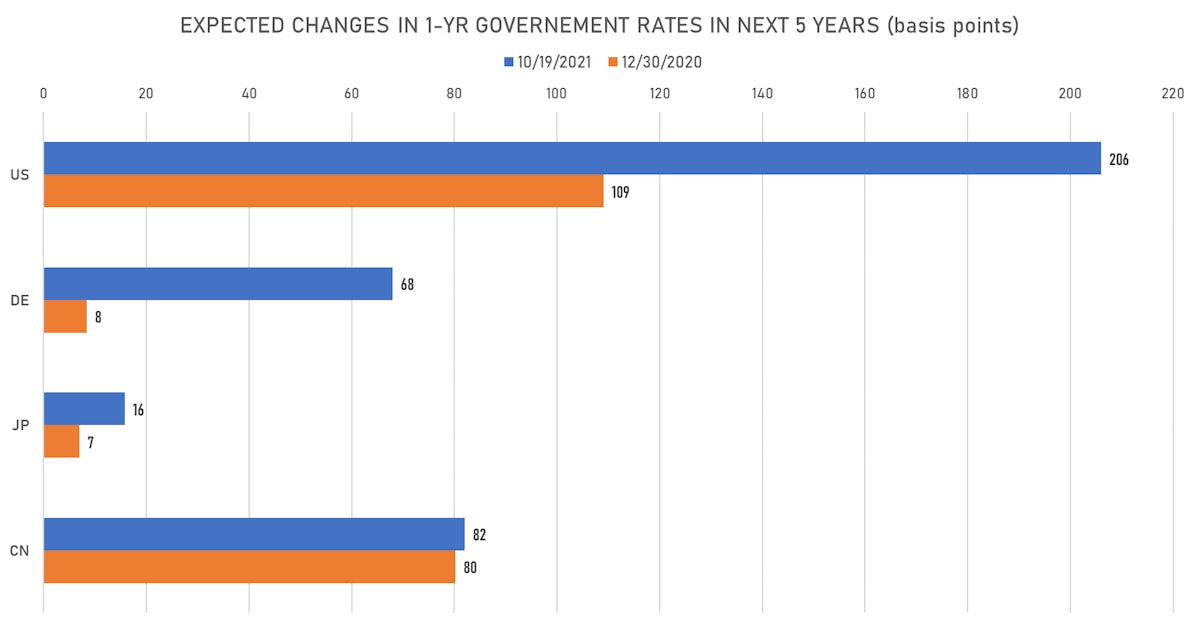

- 1-year US Treasury rate 5 years forward up 7.6 bp, now at 2.1874%, meaning that the 1-year Treasury rate is now expected to increase by 206.0 bp over the next 5 years (equivalent to 8.2 rate hikes)

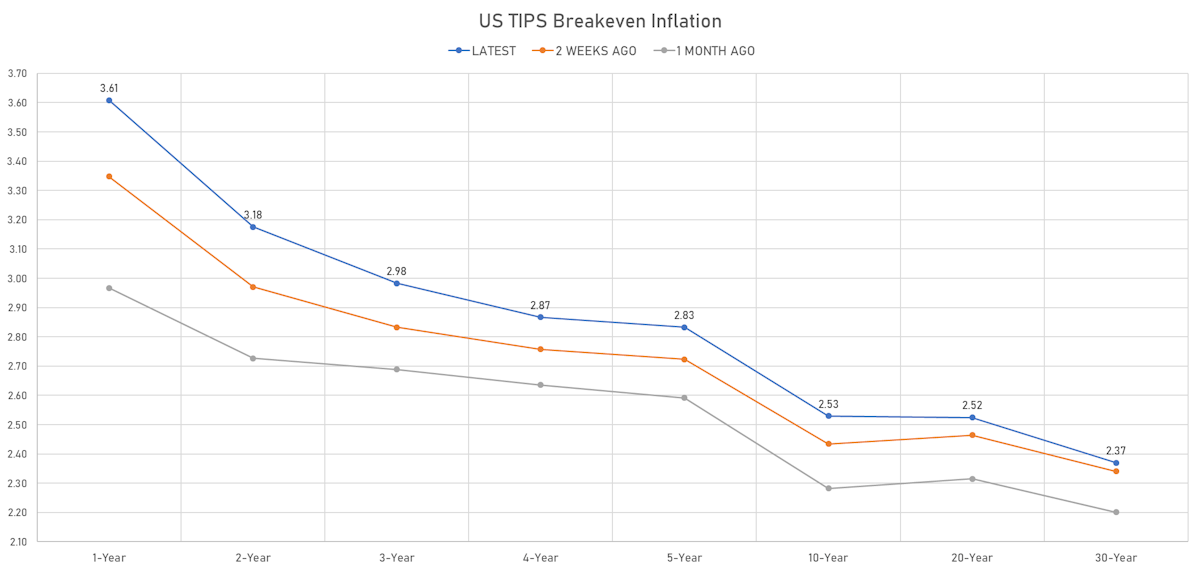

US INFLATION & REAL RATES

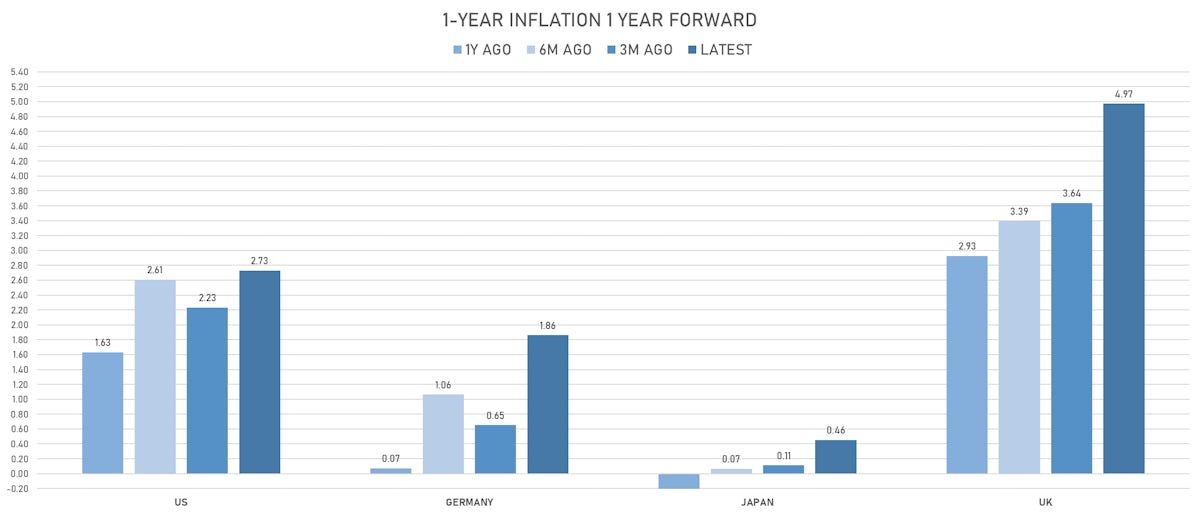

- TIPS 1Y breakeven inflation at 3.61% (up 7.6bp); 2Y at 3.18% (up 2.0bp); 5Y at 2.83% (up 0.9bp); 10Y at 2.53% (up 0.3bp); 30Y at 2.37% (up 0.7bp)

- 6-month spot US CPI swap down -6.0 bp to 3.564%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.6320%, -0.8 bp today; 10Y at -0.9090%, +4.7 bp today; 30Y at -0.2690%, +5.8 bp today

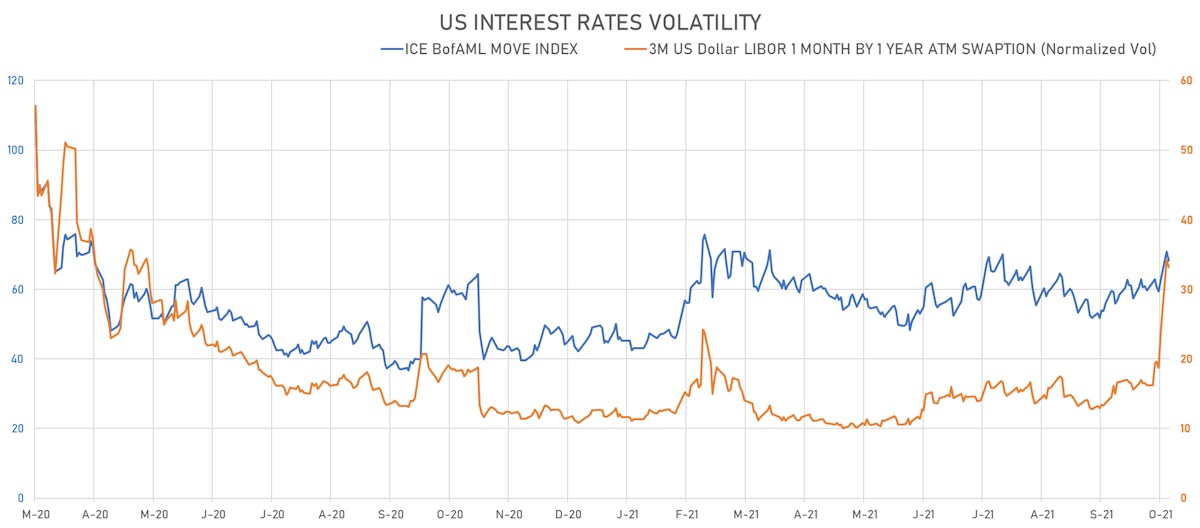

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.0% at 33.2%

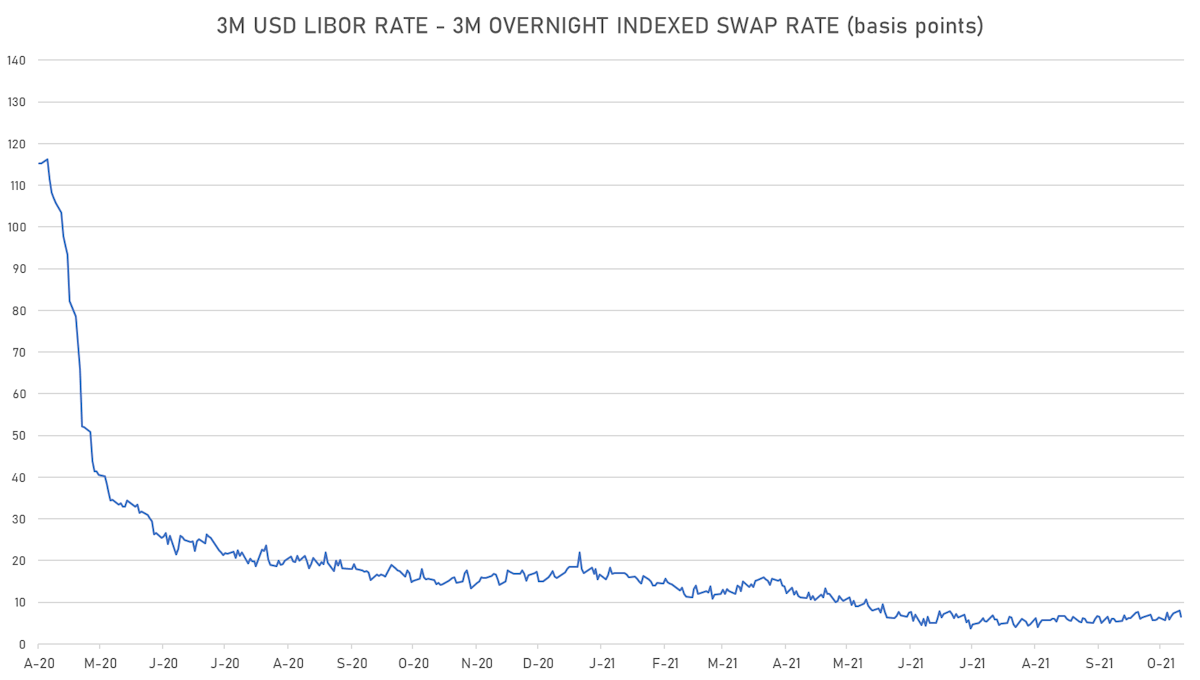

- 3-Month LIBOR-OIS spread down -1.5 bp at 6.6 bp (12-months range: 3.7-22.0 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.441% (up 2.0 bp); the German 1Y-10Y curve is 3.4 bp steeper at 56.4bp (YTD change: +40.4 bp)

- Japan 5Y: -0.072% (down -0.3 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 20.6bp (YTD change: +6.4 bp)

- China 5Y: 2.863% (down -2.2 bp); the Chinese 1Y-10Y curve is 1.3 bp flatter at 68.7bp (YTD change: +22.3 bp)

- Switzerland 5Y: -0.392% (up 0.9 bp); the Swiss 1Y-10Y curve is 0.7 bp steeper at 62.3bp (YTD change: +34.9 bp)