Rates

Rates Summary - 1 April 2021

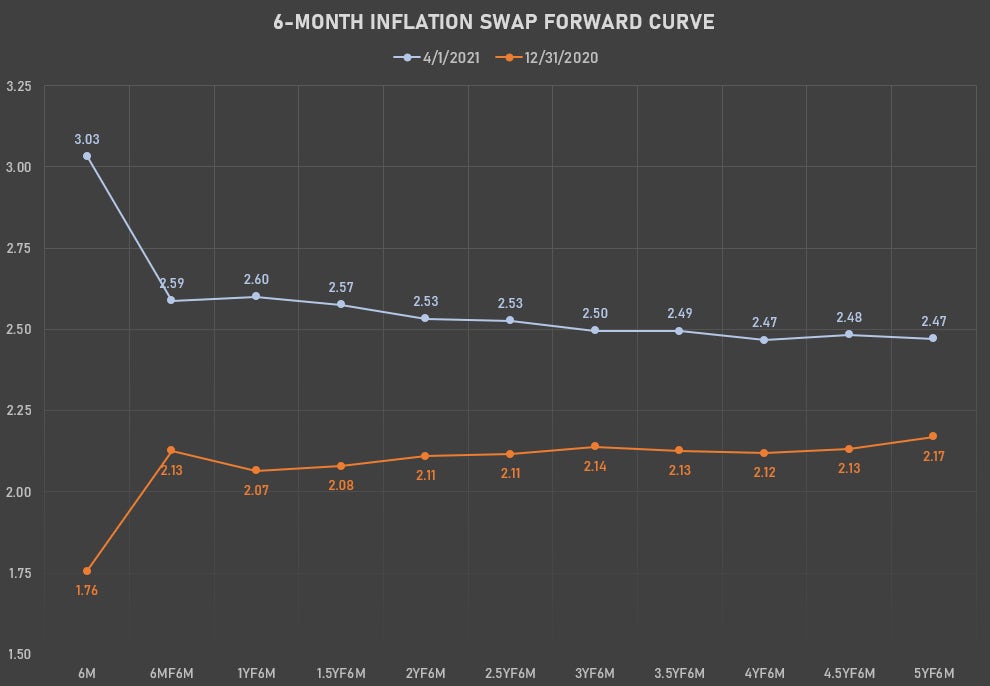

Medium- to long-term rates down, along with near-term forward inflation, after disappointing US jobless claims data

Published ET

Sources: ϕpost analysis, Refinitiv Eikon data

IN A NUTSHELL

- Mixed data but sentiment dominated by the jobless claims exceeding consensus estimates.

- Initial jobless claims at 719K, up 61K week on week, above consensus of 690K. Continuing claims at 3.79M also above consensus of 3.77M.

- The March ISM Manufacturing PMI was up 3.9 points m/m to 64.7, above 61.5 consensus (highest level since Dec-1983).

- Fed balance sheet total assets down US$ 31bn to US$ 7.69 trillion (holdings of treasuries up US$21bn, MBS down US$50bn)

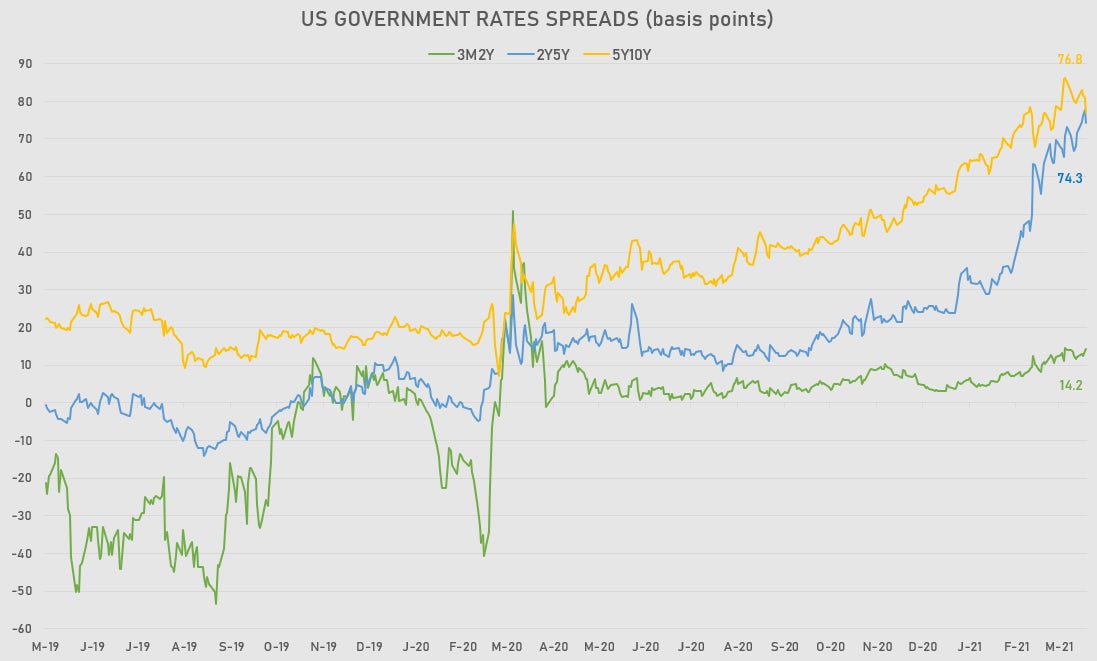

- US 2Y-treasury rate: 0.1624% (up 0.2 bp); 5Y: 0.9058% (down 3.2 bp); 10Y: 1.6735% (down 7.3 bp); 10Y-3M spread: 165.3 bp (down 7.0 bp)

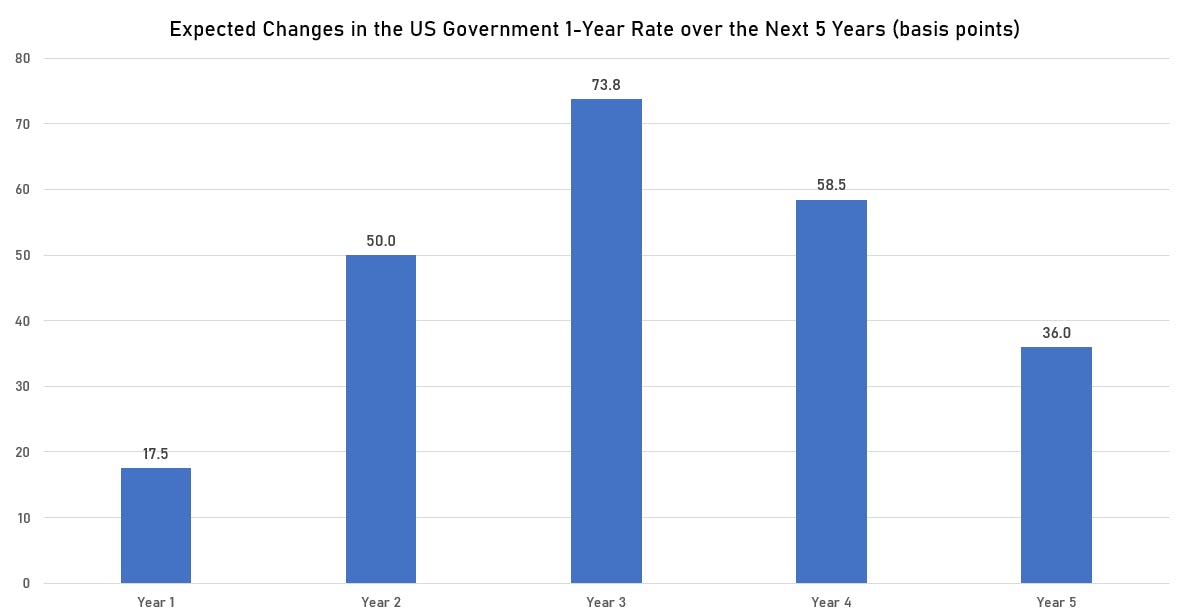

- 3-month USD Libor 5 years forward down 9.1 bp and the US Treasury 1-year rate 5 years forward down 11.0 bp

- 6-month forward inflation down -3.6 bp to 3.03%

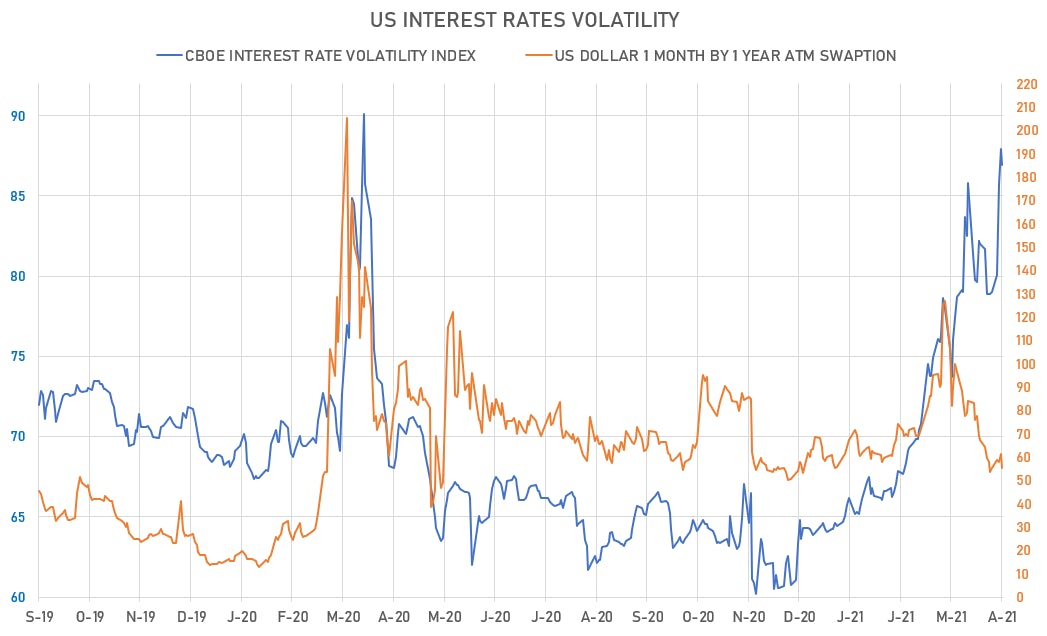

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.2% at 55.3%

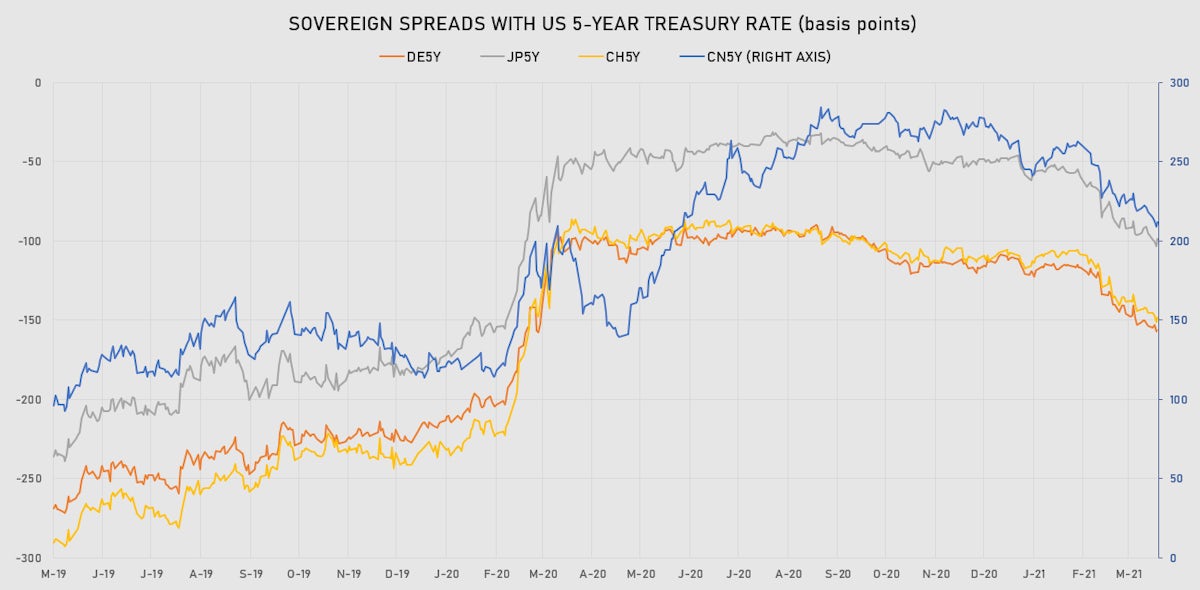

- Japanese 5Y: -0.079% (up 1.4 bp); German 5Y: -0.659% (down -2.6 bp); Chinese 5Y: 3.023% (down -0.2 bp); Swiss 5Y: -0.578% (down -0.6 bp)