Rates

Inflation Up, US Rates Inching Down After Lukewarm Economic Releases

Interesting to note how analysts have been perhaps too optimistic on macro data lately, and not optimistic enough on corporate earnings

Published ET

Sources: ϕpost, Refinitiv data

US ECONOMIC RELEASES

- Trade Balance, Total, Goods and services for Mar 2021 (U.S. Census Bureau) at -74.4, beat consensus estimate of -74.5

- Manufacturers New Orders, Total manufacturing, Chg P/P for Mar 2021 (U.S. Census Bureau) at 1.1, missed consensus estimate of 1.3

- Chain Store Sales, Johnson Redbook Index, yoy% index, Chg Y/Y for W 01 May (Redbook Research) at 14.2

- Manufacturers New Orders, Durable goods excluding defense, Chg P/P for Mar 2021 (U.S. Census Bureau) at 0.8

- Manufacturers New Orders, Durable goods excluding transportation, Chg P/P for Mar 2021 (U.S. Census Bureau) at 1.9

- Manufacturers New Orders, Durable goods total, Chg P/P for Mar 2021 (U.S. Census Bureau) at 0.8

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Chg P/P for Mar 2021 (U.S. Census Bureau) at 1.2

- Manufacturers New Orders, Total manufacturing excluding transportation, Chg P/P for Mar 2021 (U.S. Census Bureau) at 1.7

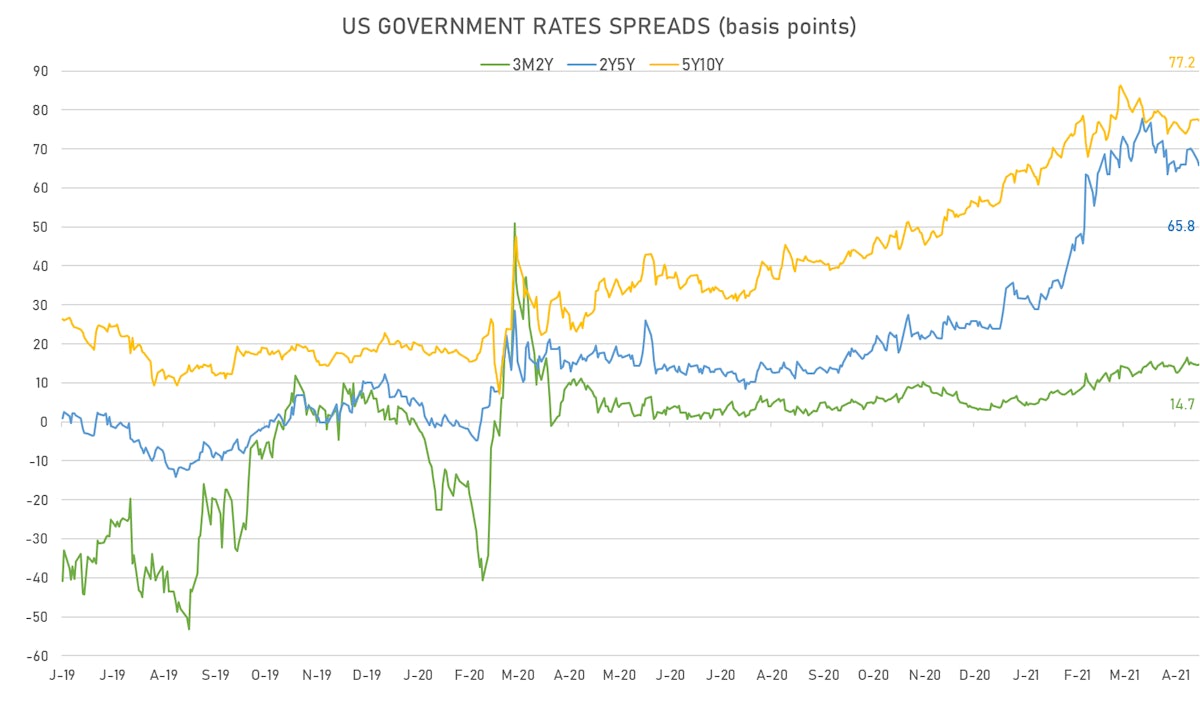

US TREASURY CURVE

- Yield curve flattening, with the 1Y-10Y spread tightening -0.6 bp on the day, now at 153.5 bp (YTD change: +73.0)

- 1Y: 0.0558% (down 0.3 bp)

- 2Y: 0.1624% (down 0.0 bp)

- 5Y: 0.8189% (down 0.6 bp)

- 7Y: 1.2711% (down 0.9 bp)

- 10Y: 1.5906% (down 0.9 bp)

- 30Y: 2.2622% (down 2.2 bp)

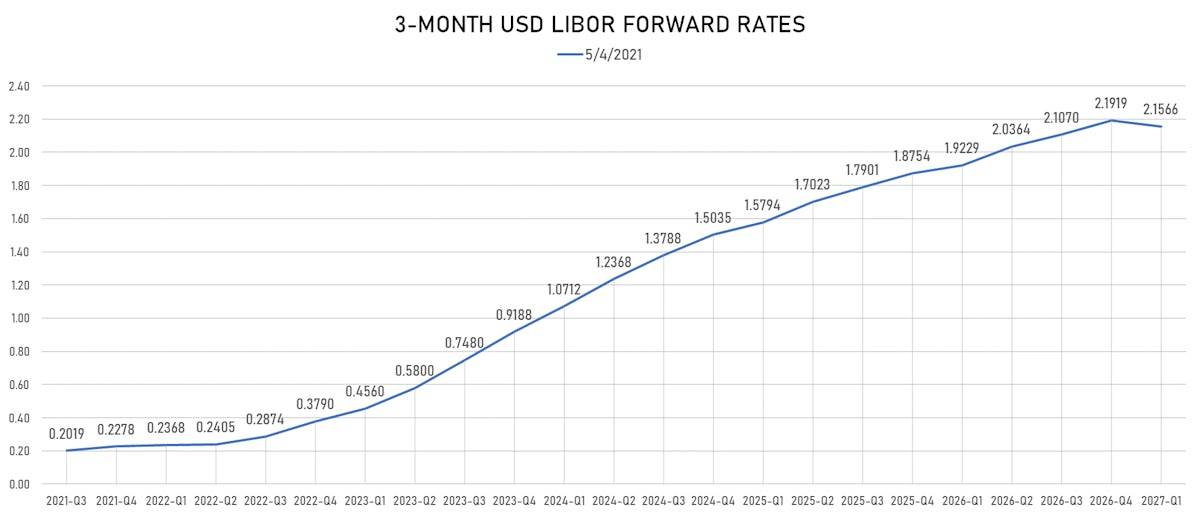

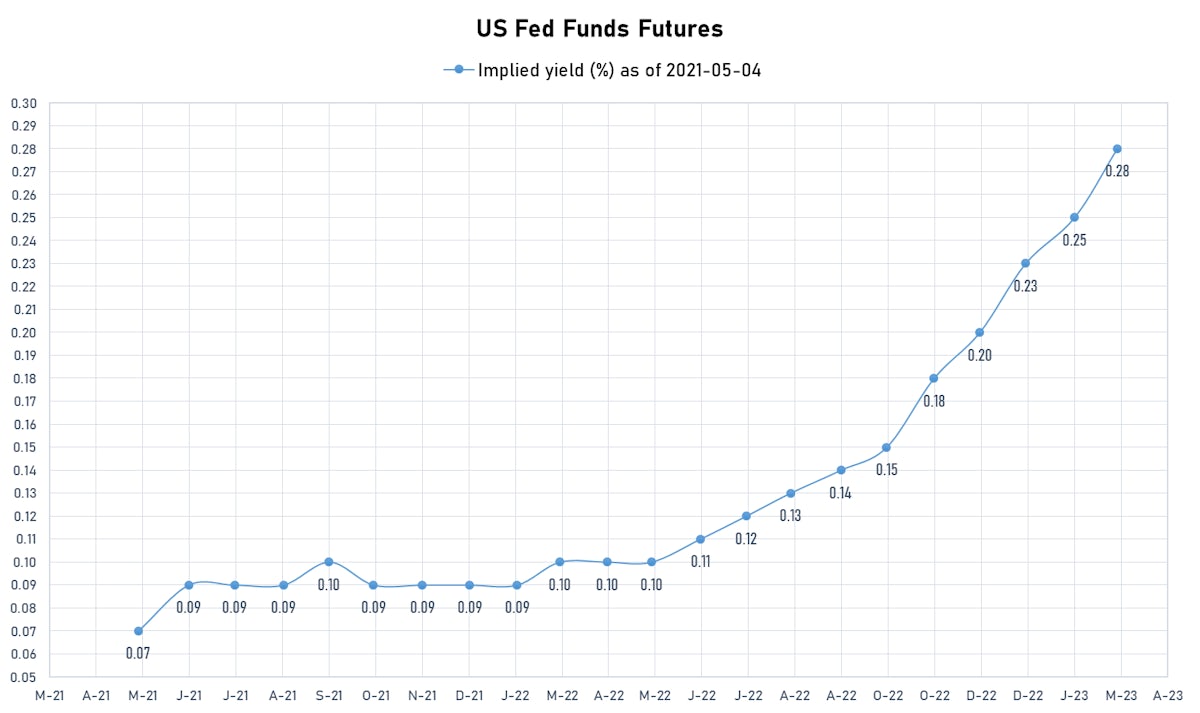

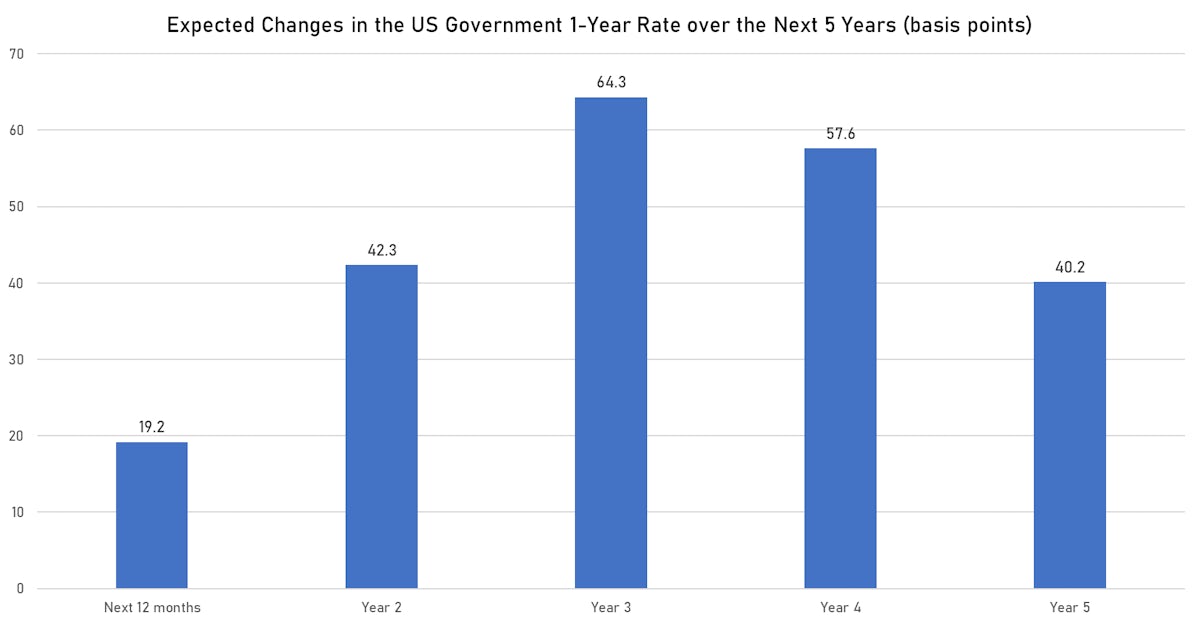

US FORWARD RATES

- 3-month USD Libor 5 years forward down 0.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 1.7 bp, now at 2.2913% (meaning that short-term rates are expected to increase by 223.6 bp over the next 5 years)

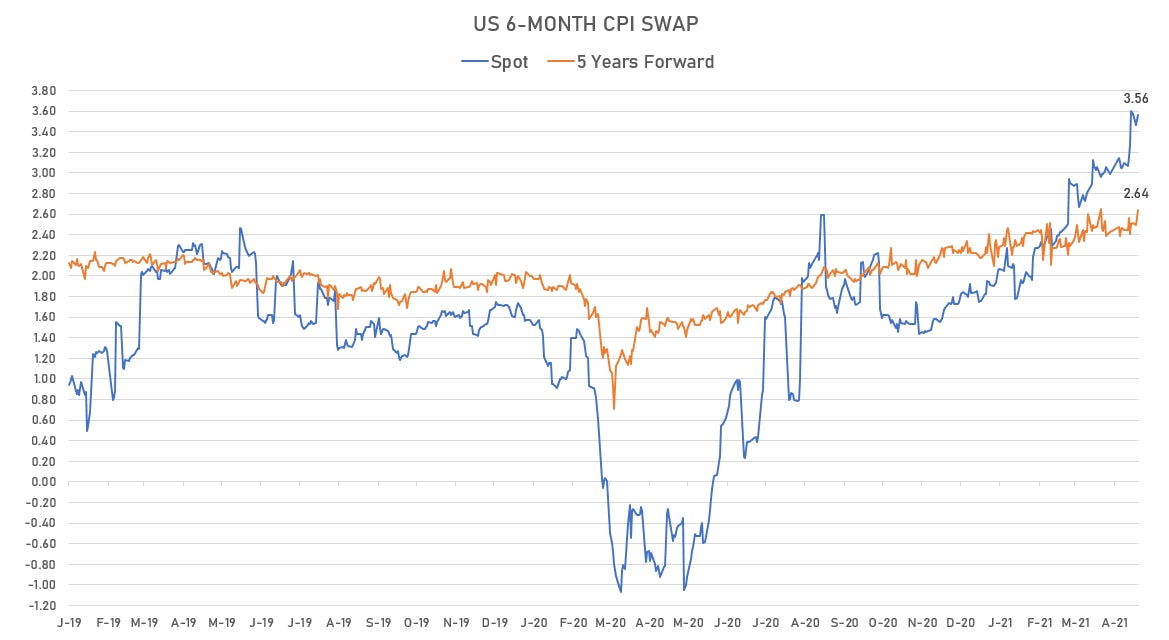

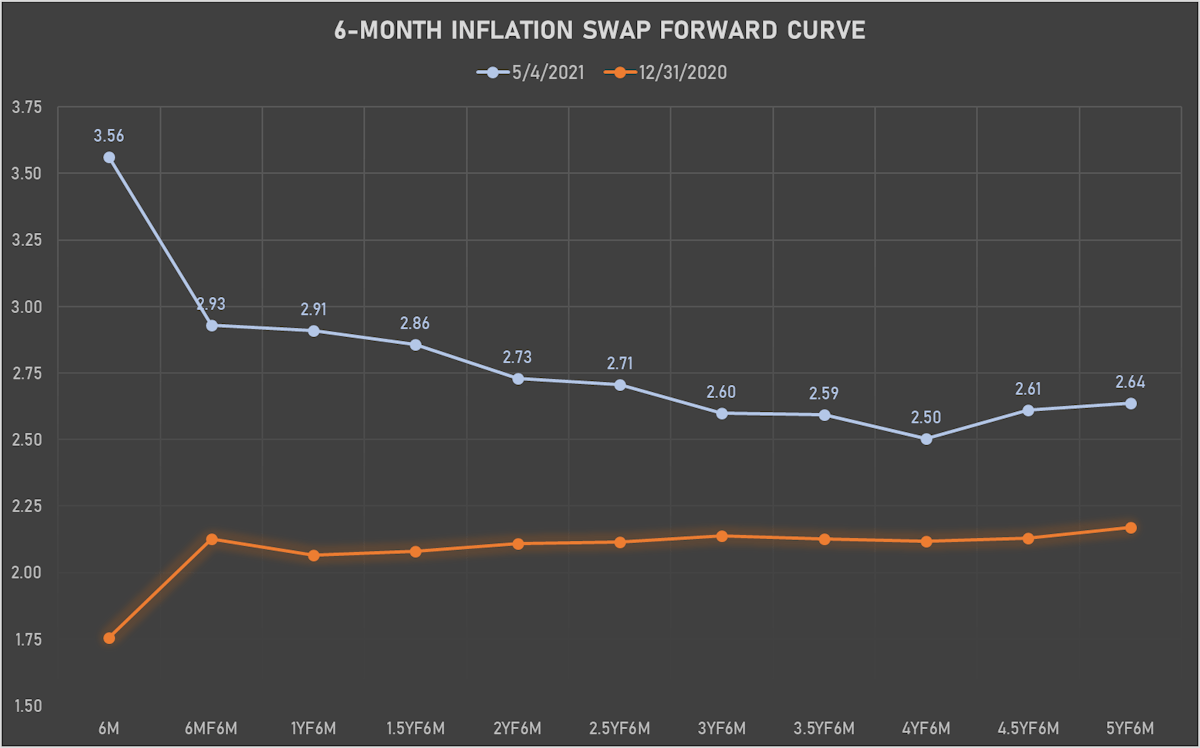

US INFLATION

- TIPS 1Y breakeven inflation at 2.83% (up 3.6bp); 2Y at 2.82% (up 3.0bp); 5Y at 2.73% (up 2.0bp); 10Y at 2.42% (up 0.5bp); 30Y at 2.27% (down -0.3bp)

- 6-month forward inflation swap up 9.6 bp to 3.561%

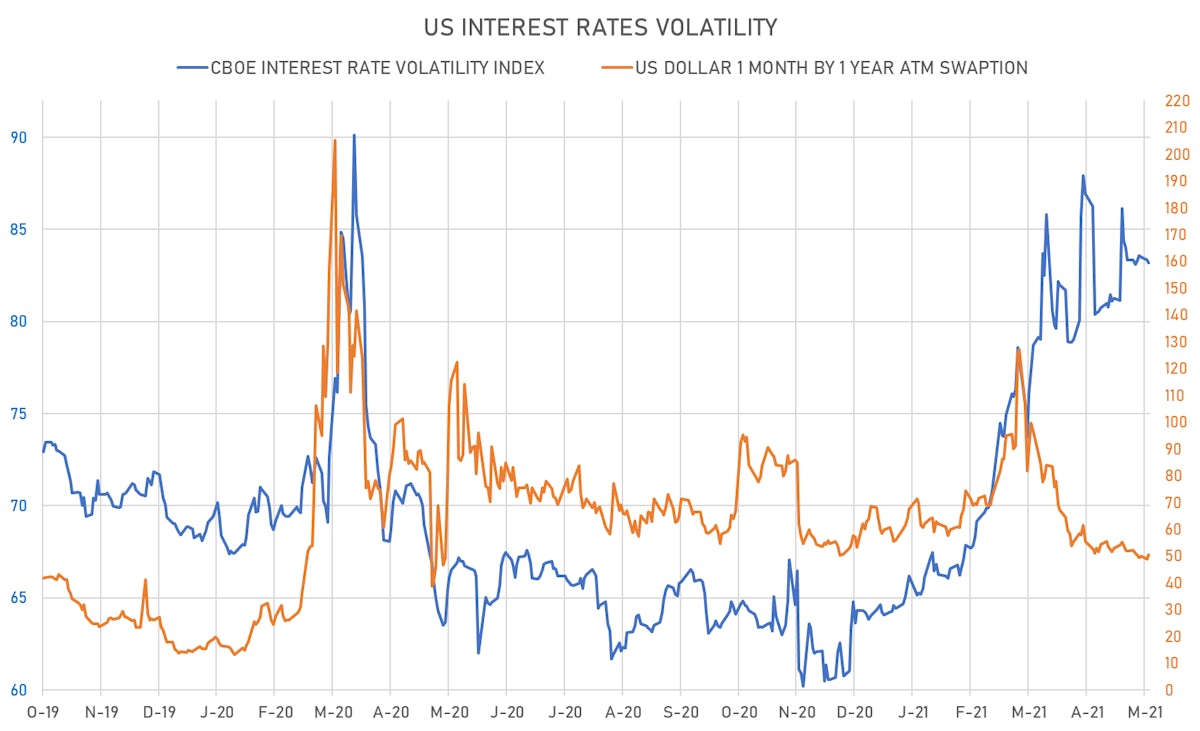

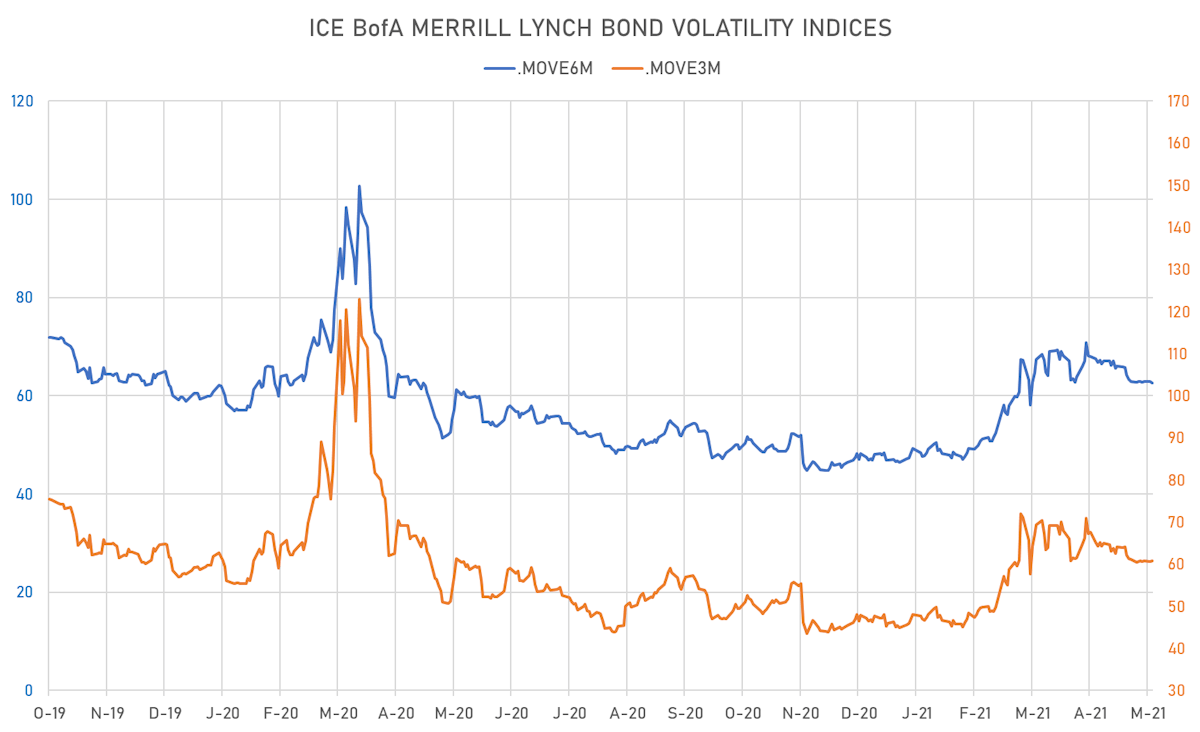

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.5% at 50.4%

- 3-Month LIBOR-OIS spread up 0.4 bp at 10.3 bp (12-months range: 9.9-50.8 bp)

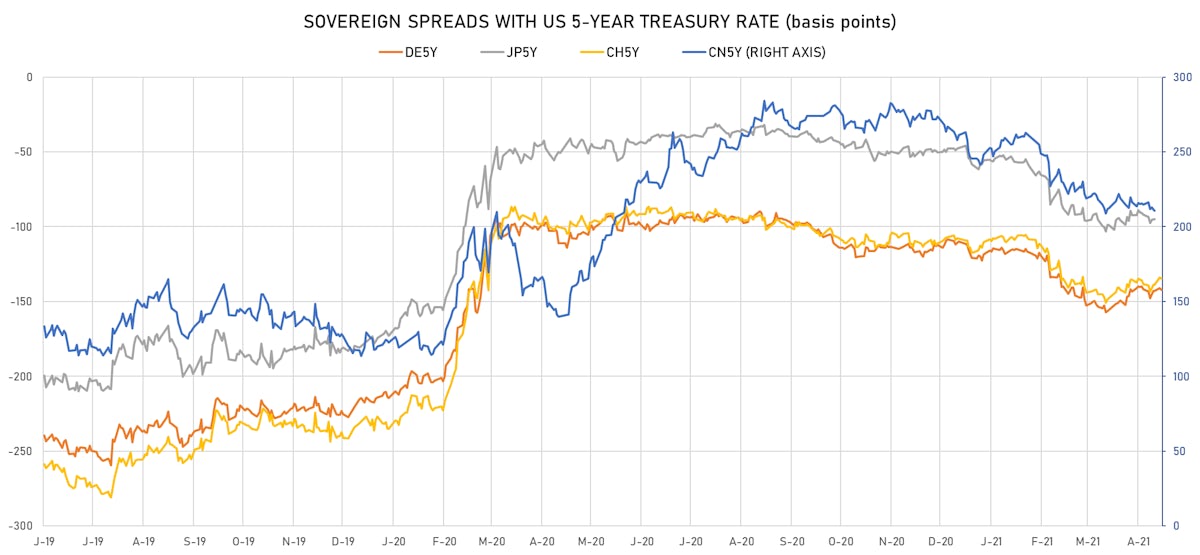

KEY INTERNATIONAL RATES

- Germany 5Y: -0.606% (down -2.3 bp); the German 1Y-10Y curve is 2.7 bp flatter at 40.2bp (YTD change: +24.7 bp)

- Switzerland 5Y: -0.529% (down -1.9 bp); the Swiss 1Y-10Y curve is 1.7 bp flatter at 53.8bp (YTD change: +27.4 bp)

- Chinese and Japanese markets are closed for holidays until May 5th