Rates

US Rates Stable With Very Little Macro Data Released On Monday

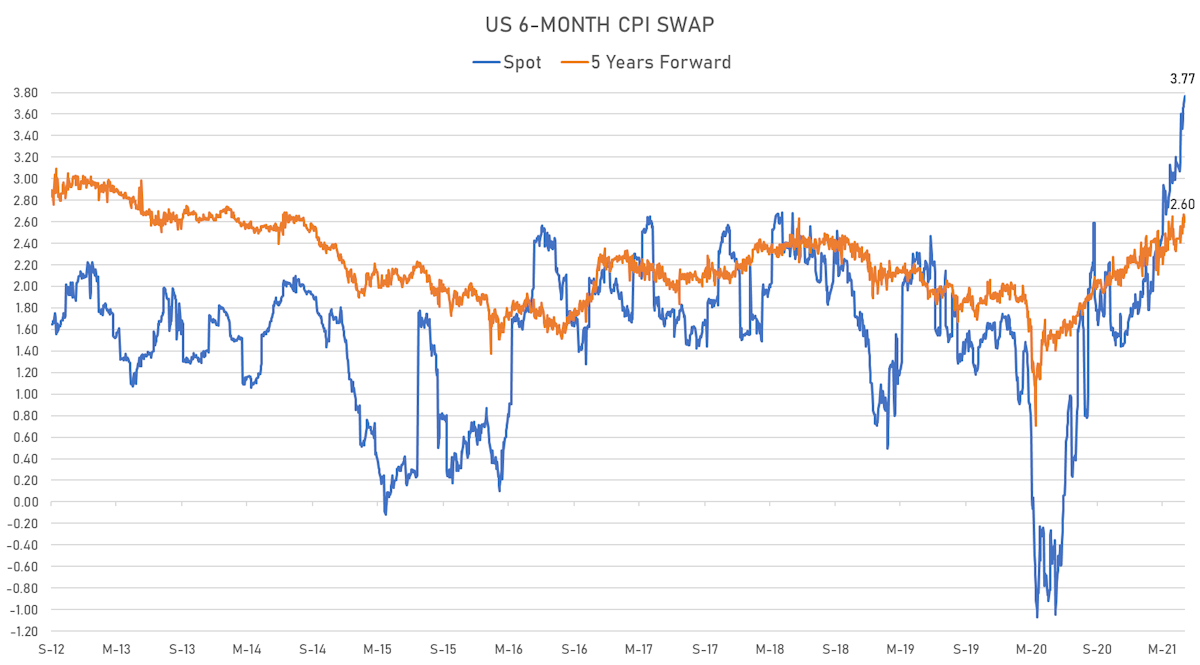

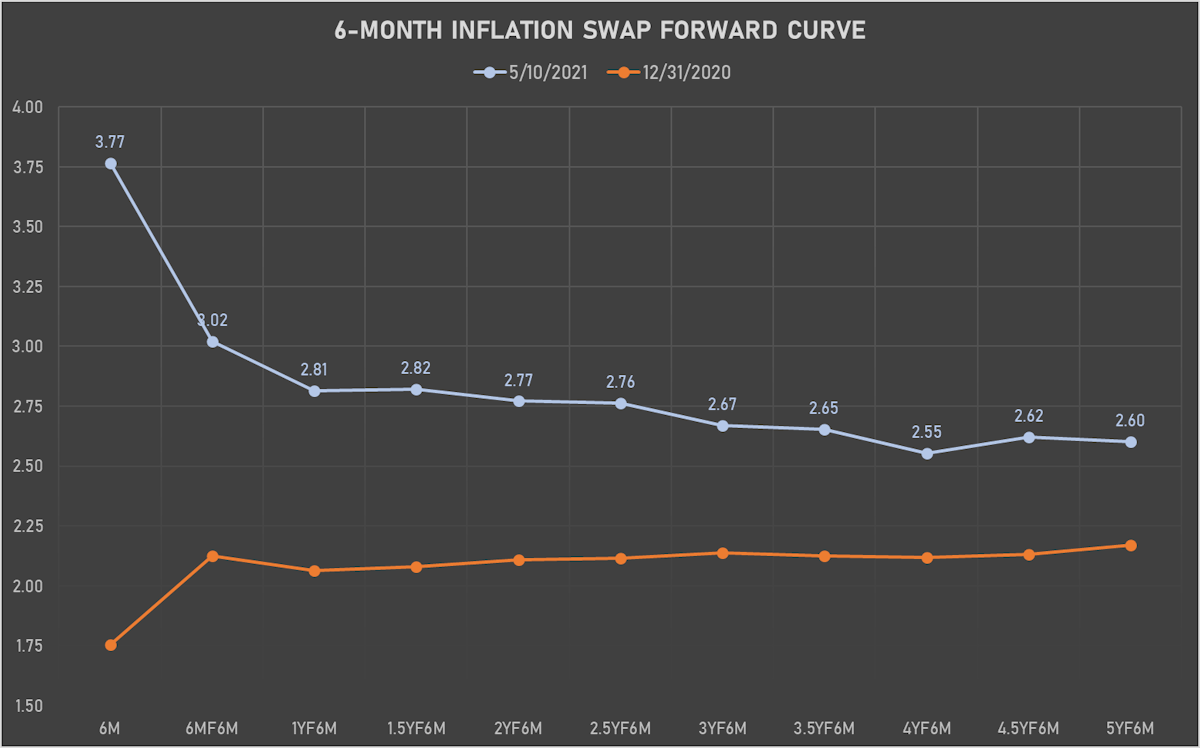

The inversion of the inflation curve is at deepest level ever, as short-term inflation swaps rise further to 3.77% (up 2% year-to-date)

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

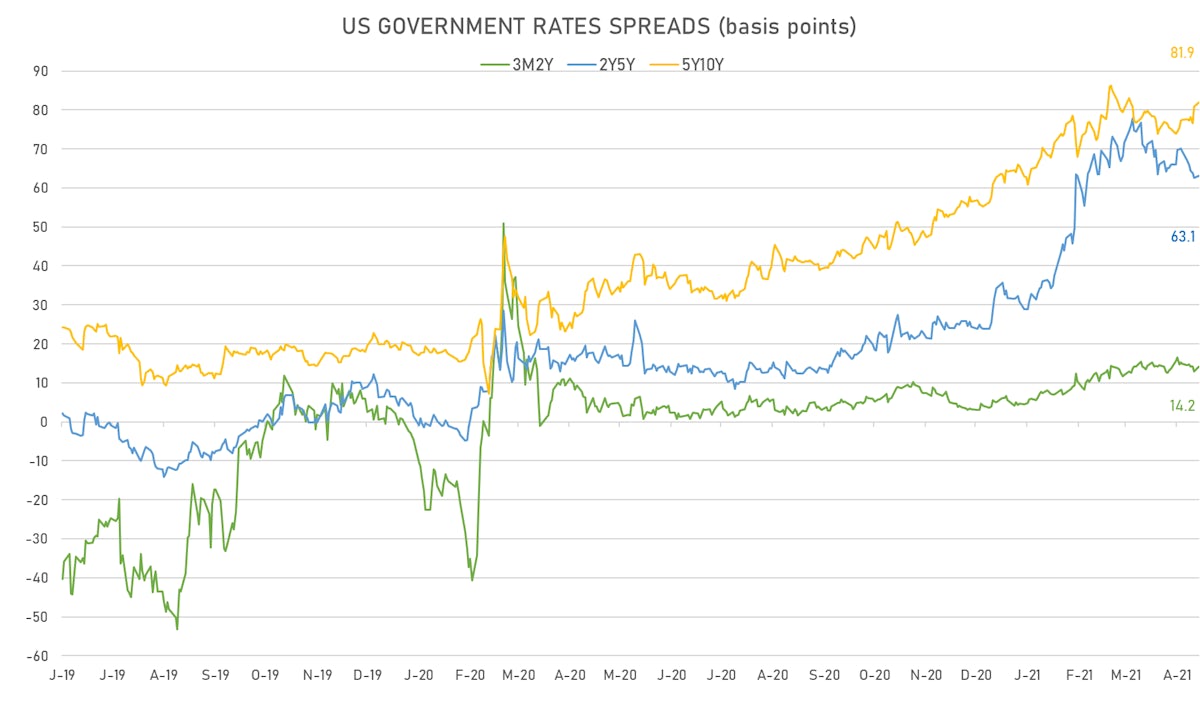

- Yield curve steepening, with the 1Y-10Y spread widening 2.7 bp on the day, now at 155.6 bp (YTD change: +75.1)

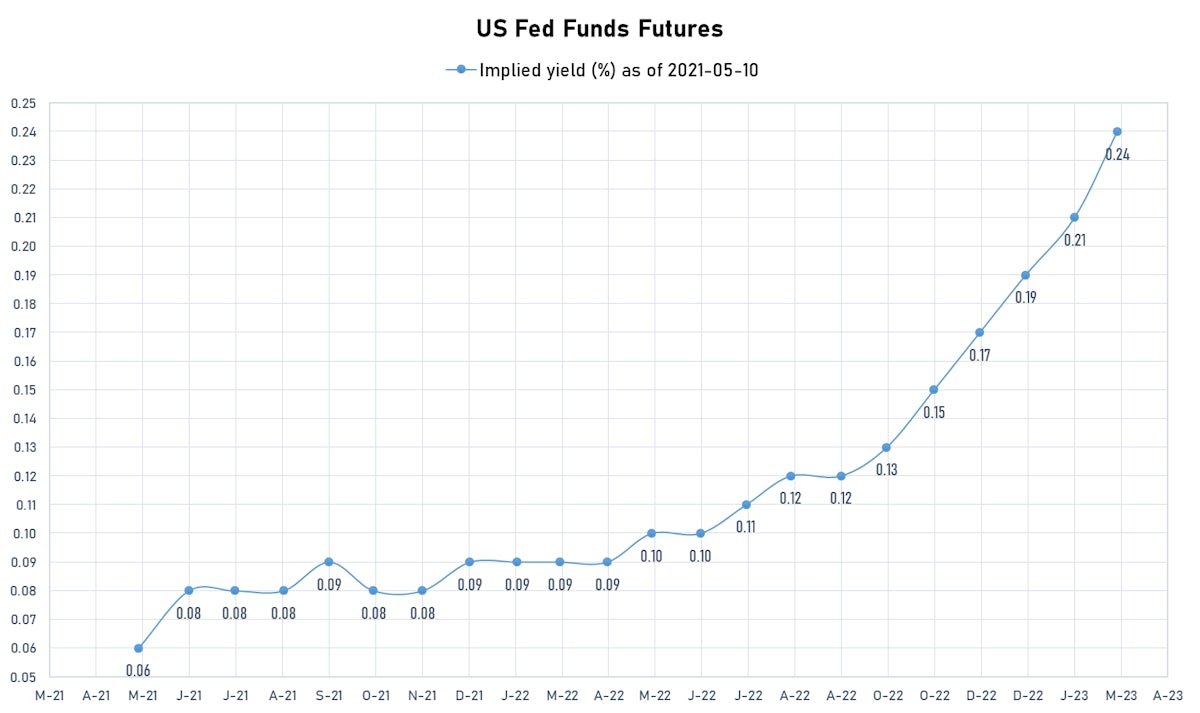

- Looking at Fed Funds Futures, liftoff for US rate hikes is still Q4 2022

- 1Y: 0.0482% (down 0.3 bp)

- 2Y: 0.1548% (up 0.8 bp)

- 5Y: 0.7853% (up 1.1 bp)

- 7Y: 1.2570% (up 1.9 bp)

- 10Y: 1.6038% (up 2.5 bp)

- 30Y: 2.3263% (up 4.5 bp)

US MACRO RELEASES

- The Conference Board Employment Trends Index (ETI) for Apr 2021 (The Conference Board) at 105.4

US INFLATION

- TIPS 1Y breakeven inflation at 2.92%; 2Y at 2.80% (down -0.8bp); 5Y at 2.78% (down -0.5bp); 10Y at 2.52% (down -0.3bp); 30Y at 2.35% (down -0.7bp)

- 6-month forward inflation swap up 7.5 bp to 3.77%

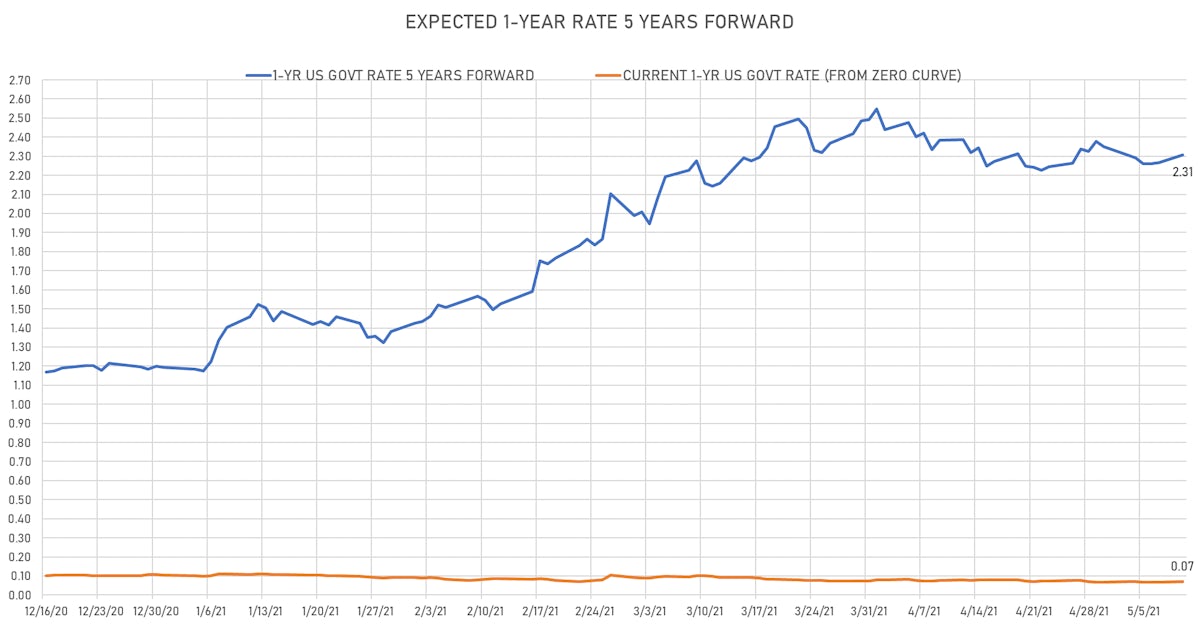

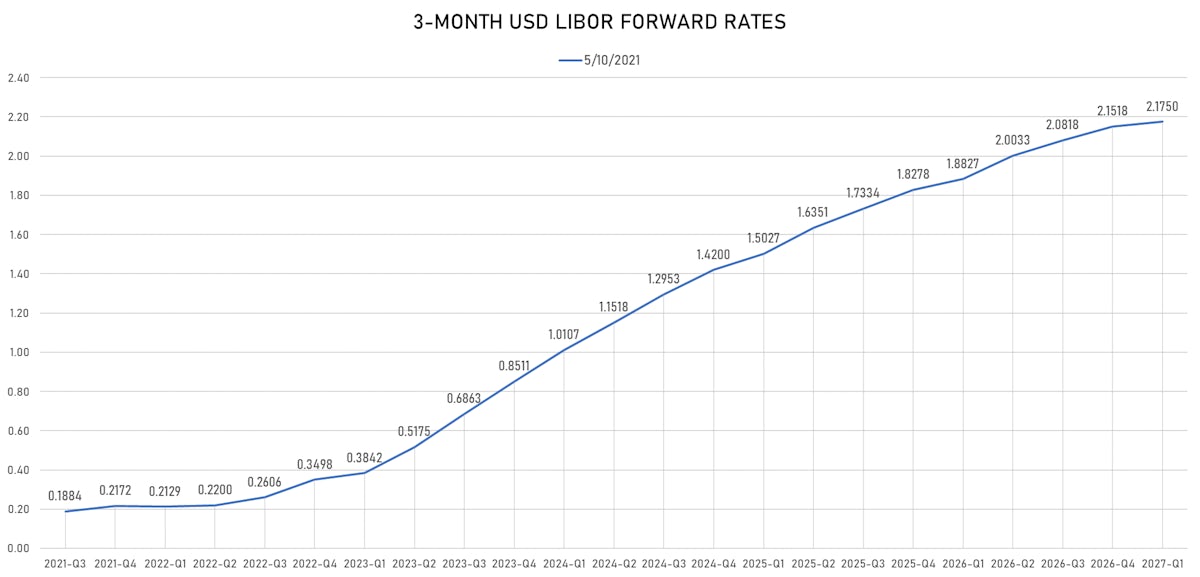

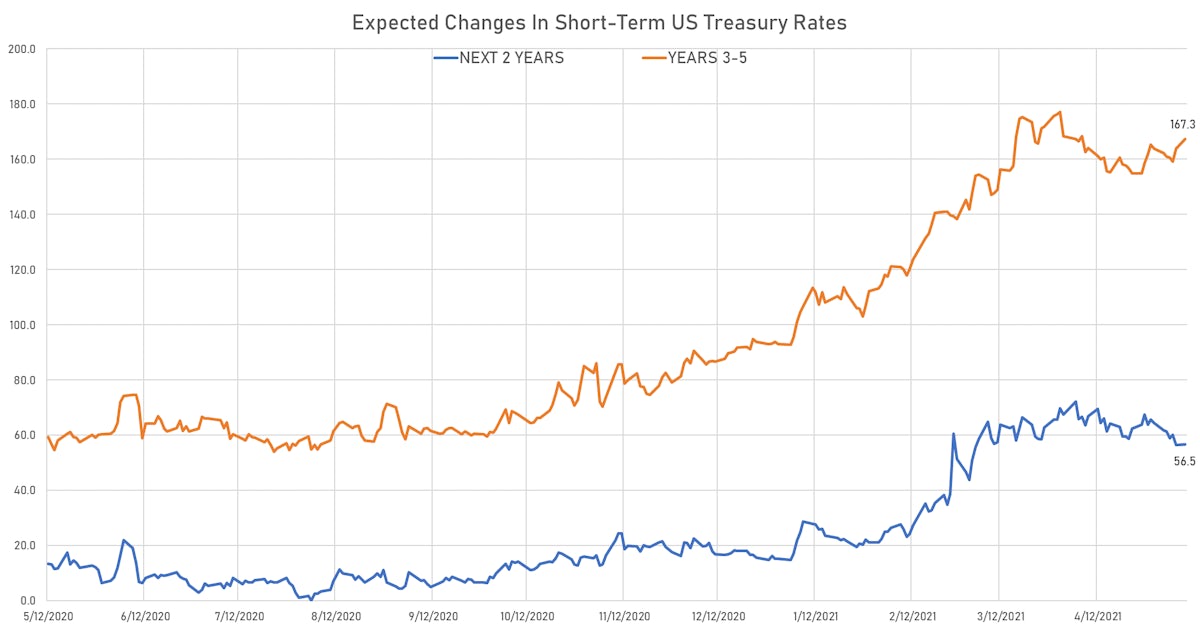

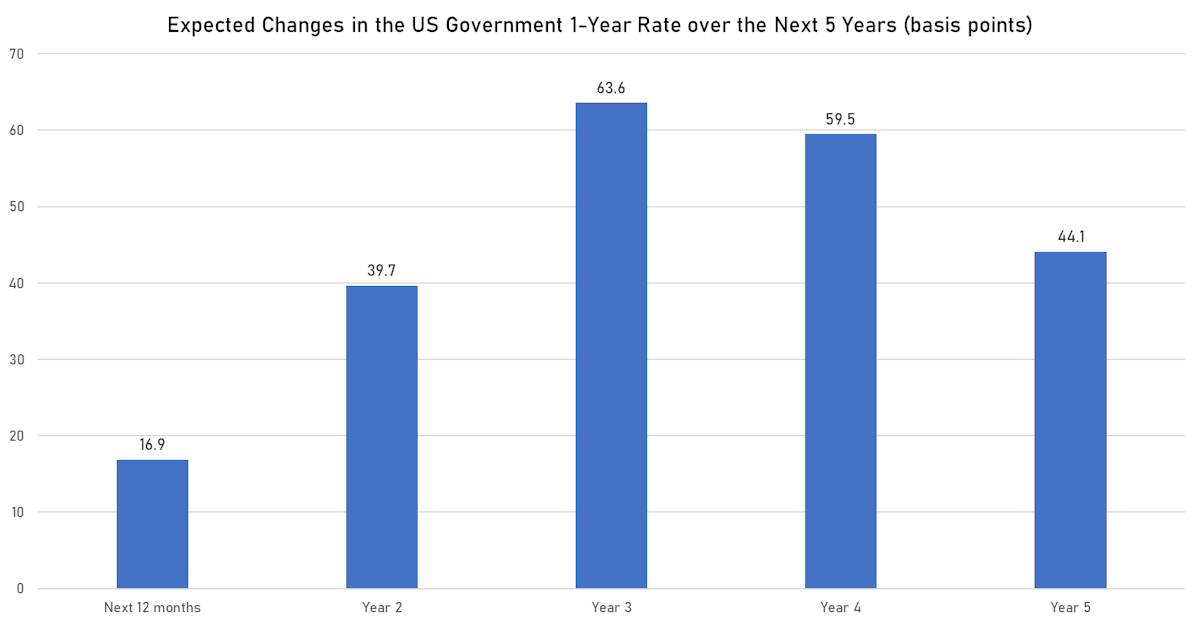

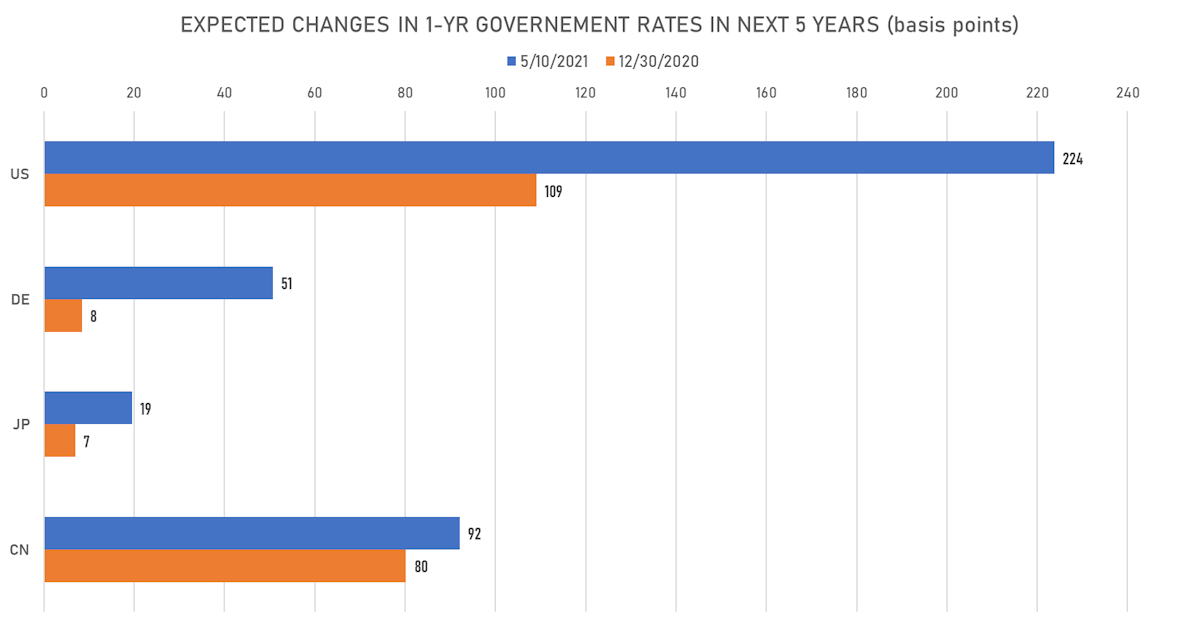

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.4 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 4.1 bp, now at 2.3080% (meaning that short-term rates are expected to increase by 223.8 bp over the next 5 years)

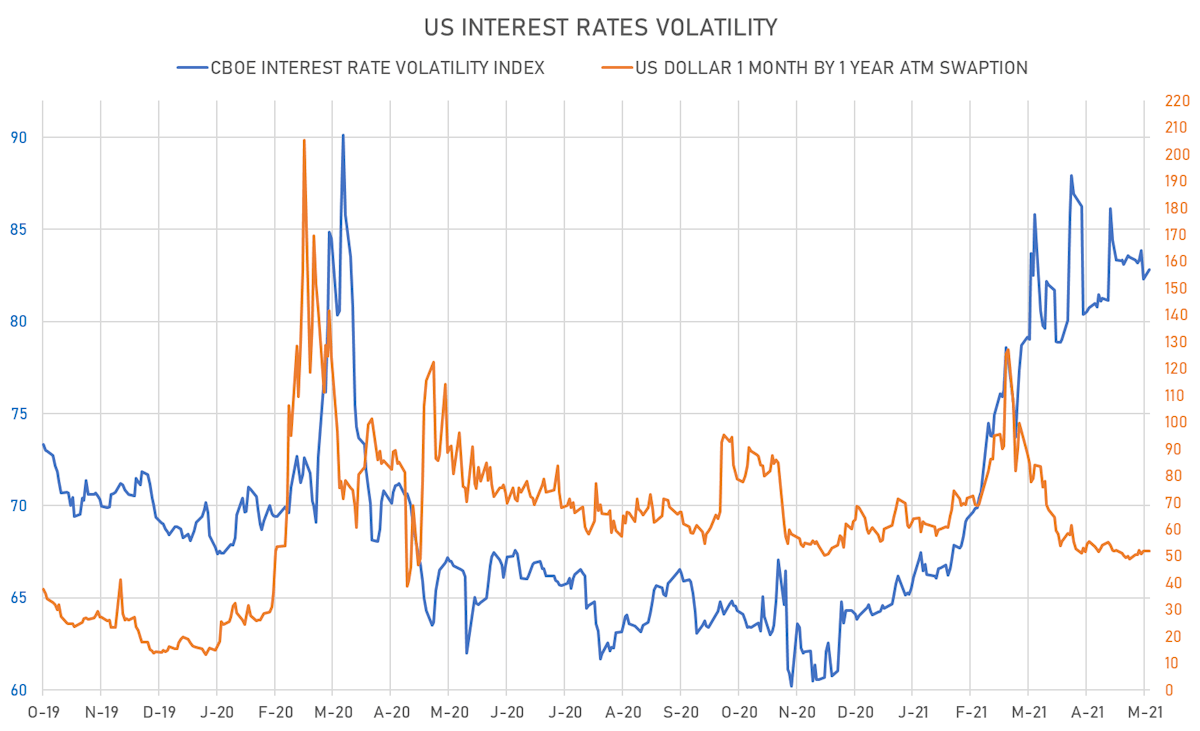

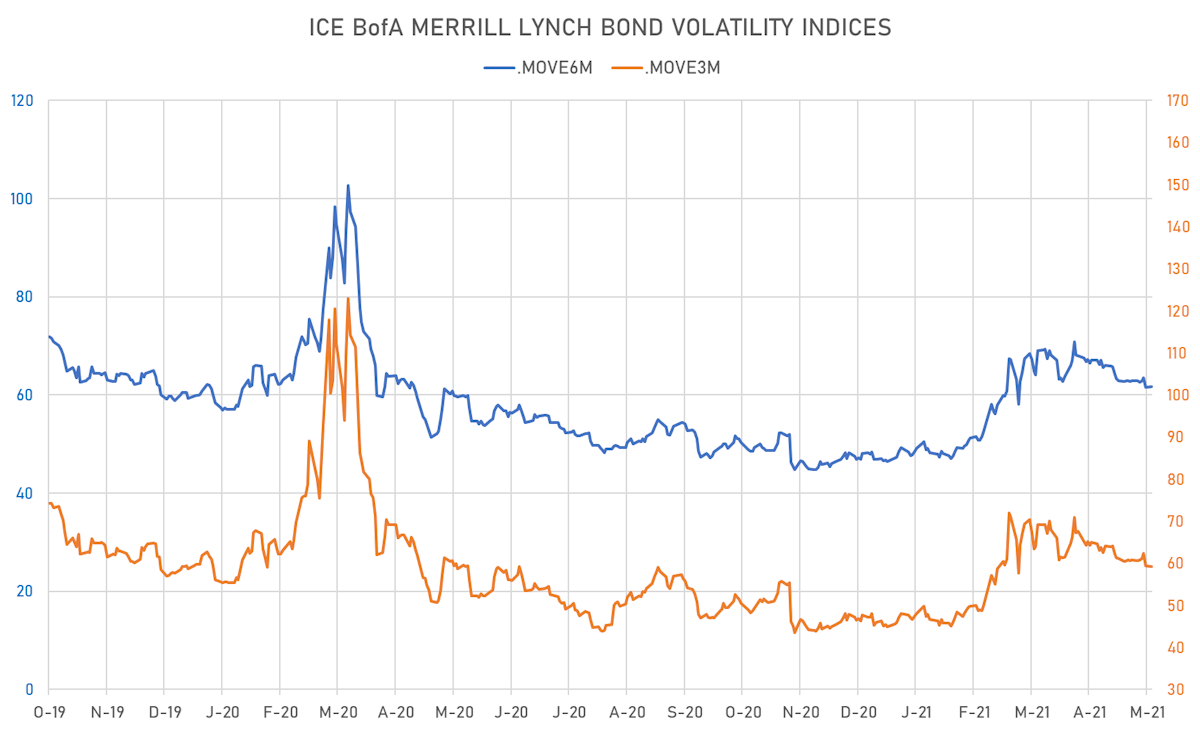

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 51.8%

- 3-Month LIBOR-OIS spread up 0.9 bp at 11.3 bp (12-months range: 9.9-40.3 bp)

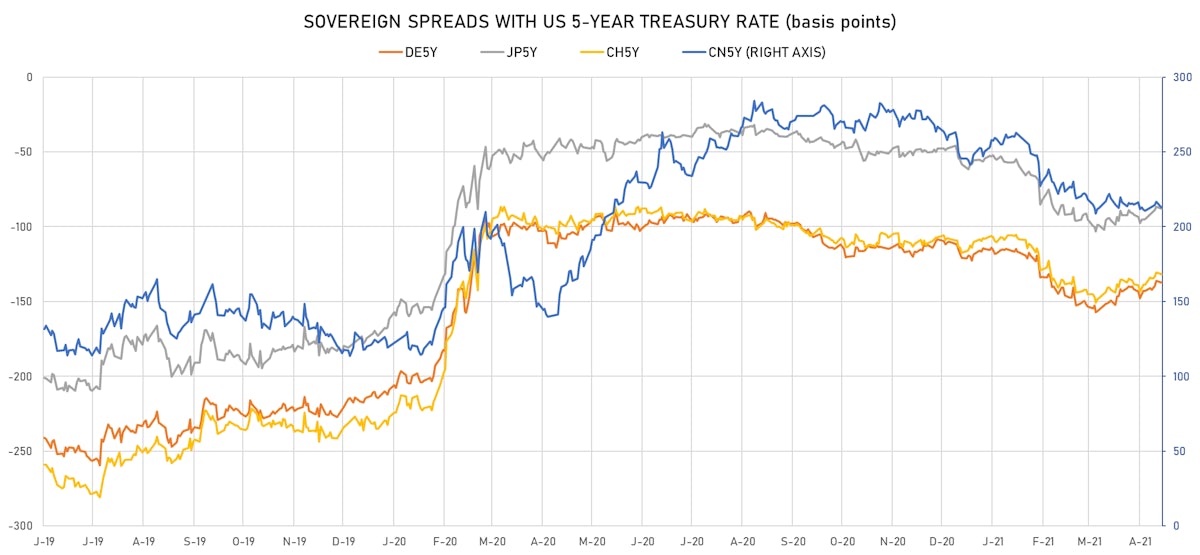

KEY INTERNATIONAL RATES

- Germany 5Y: -0.583% (up 0.1 bp); the German 1Y-10Y curve is 0.2 bp flatter at 43.0bp (YTD change: +26.1 bp)

- Japan 5Y: -0.095% (unchanged); the Japanese 1Y-10Y curve is 0.6 bp flatter at 20.3bp (YTD change: +5.8 bp)

- China 5Y: 2.913% (down -2.6 bp); the Chinese 1Y-10Y curve is 0.9 bp steeper at 60.2bp (YTD change: -43.3 bp)

- Switzerland 5Y: -0.531% (up 0.3 bp); the Swiss 1Y-10Y curve is 1.0 bp steeper at 56.0bp (YTD change: +9.8 bp)