Rates

BLS Core Inflation Data Lifts Rates And Short-Term Inflation Expectations

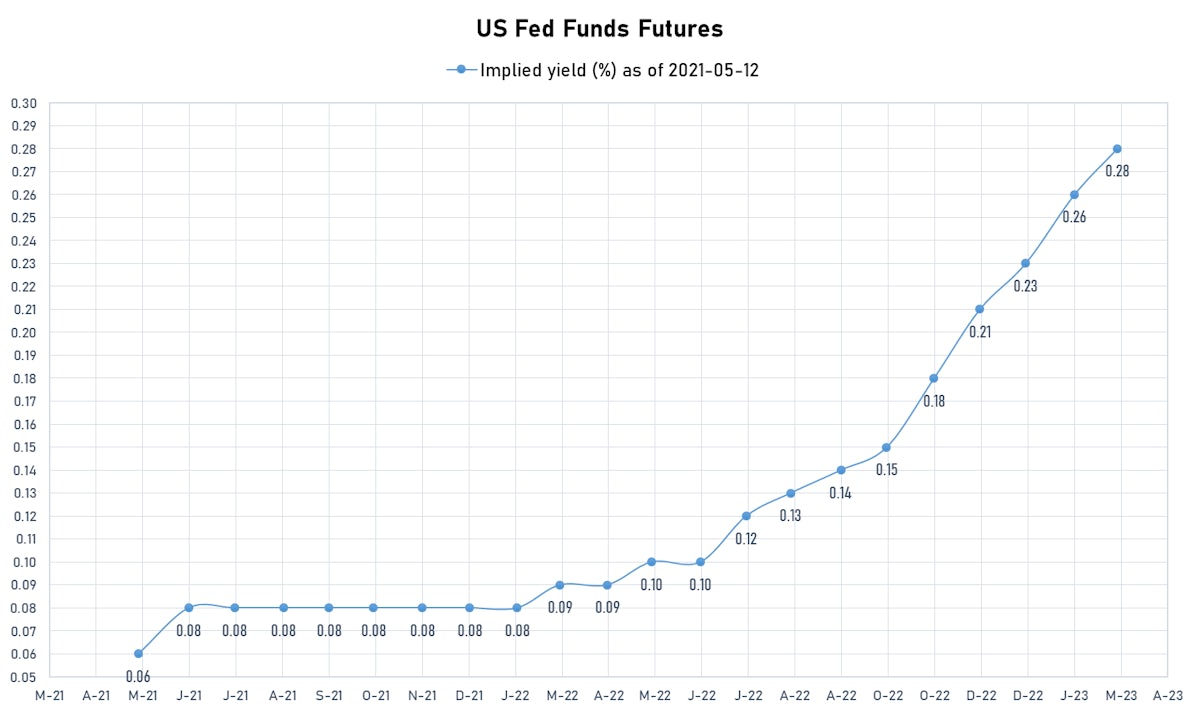

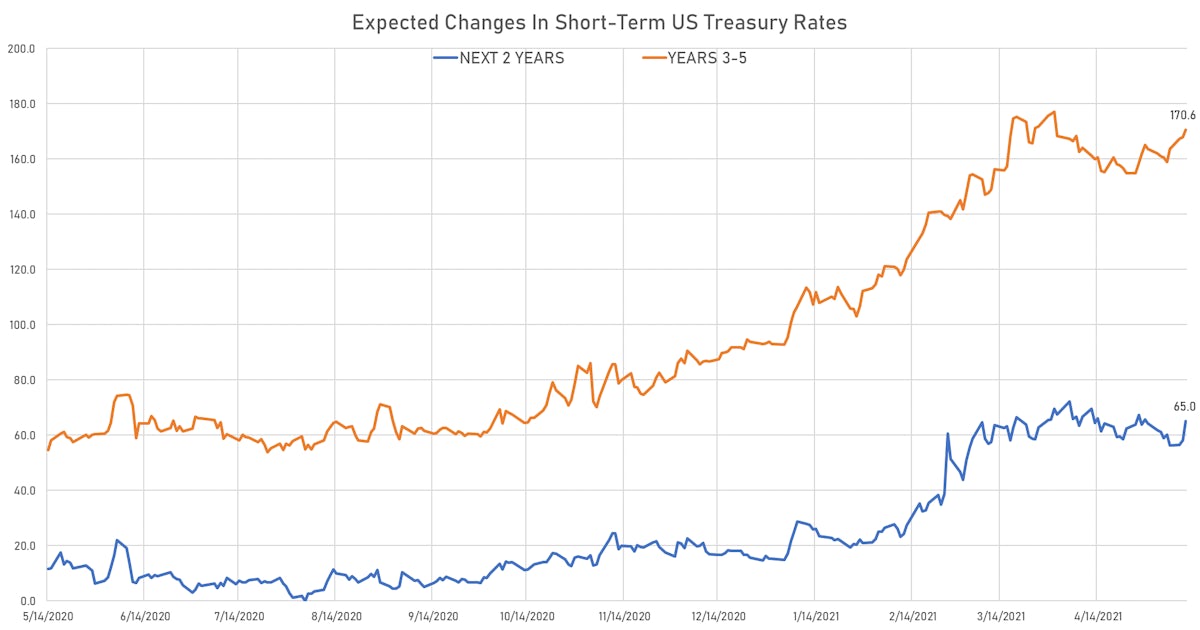

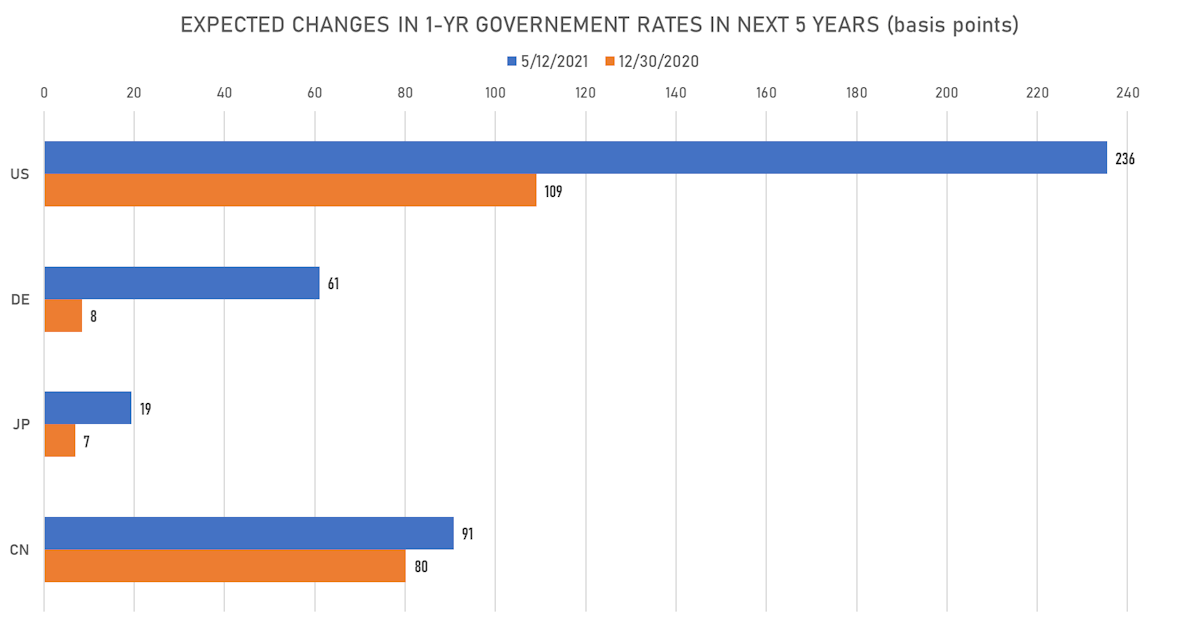

Market now sees rate hikes of 236 bp over the next 5 years, with liftoff still expected in Q4 2022

Published ET

1-Year US TIPS Breakeven Inflation | Source: Refinitiv

QUICK US SUMMARY

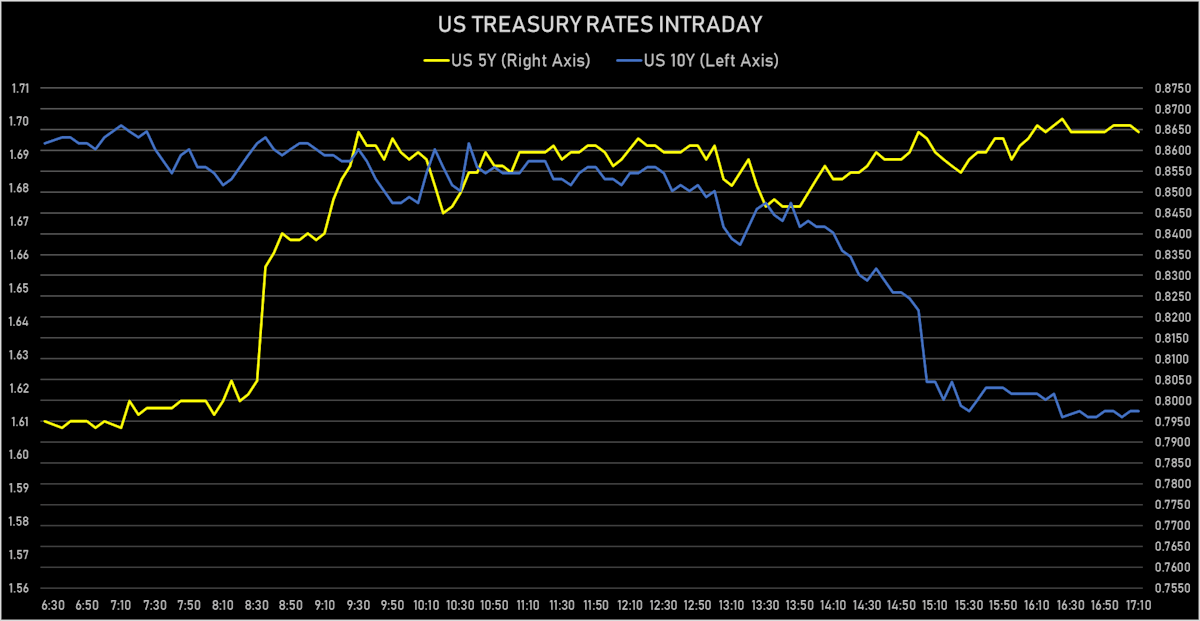

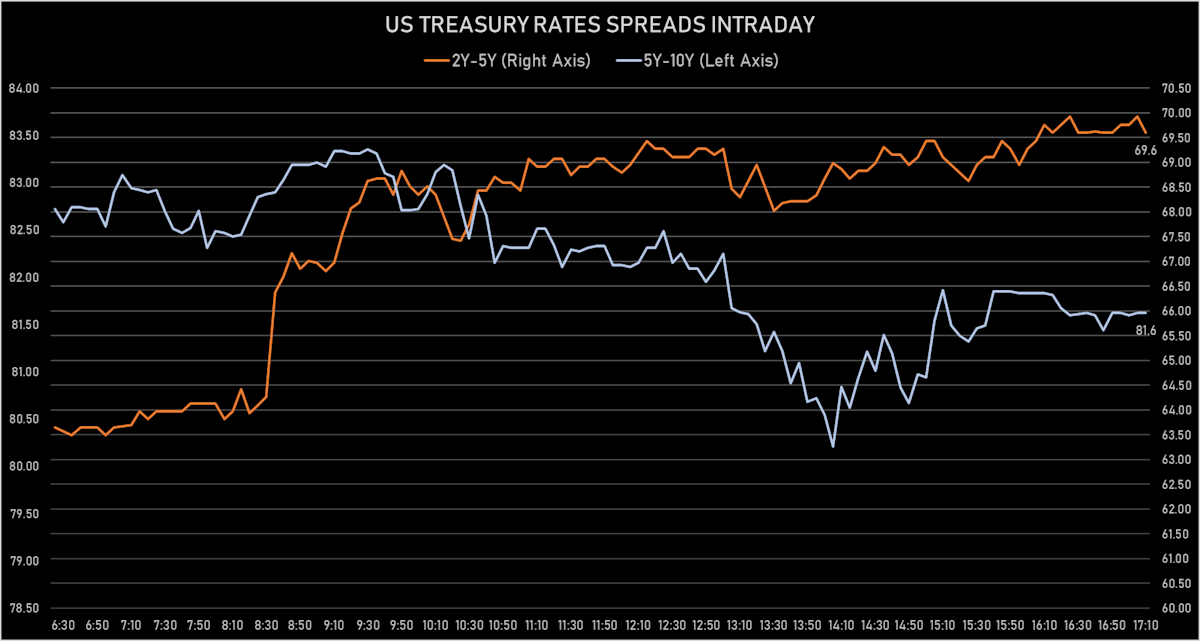

- Yield curve steepening, with the 1Y-10Y spread widening 7.2 bp on the day, now at 164.5 bp (YTD change: +84.1)

- 1Y: 0.0480% (down 0.0 bp)

- 2Y: 0.1668% (up 0.6 bp)

- 5Y: 0.8644% (up 6.3 bp)

- 7Y: 1.3419% (up 6.8 bp)

- 10Y: 1.6934% (up 7.2 bp)

- 30Y: 2.4145% (up 6.8 bp)

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for Apr 2021 (BLS, U.S Dep. Of Lab) at 4.2, above consensus estimate of 3.6

- CPI, All items less food and energy for Apr 2021 (BLS, U.S Dep. Of Lab) at 273.7

- CPI, All items less food and energy, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.9, above consensus estimate of 0.3

- CPI, All items less food and energy, Change Y/Y, Price Index for Apr 2021 (BLS, U.S Dep. Of Lab) at 3.0, above consensus estimate of 2.3

- CPI, All items, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.8, above consensus estimate of 0.2

- CPI, All items, Price Index for Apr 2021 (BLS, U.S Dep. Of Lab) at 267.1, above consensus estimate of 265.6

- CPI, FRB Cleveland Median, 1 month, Change M/M for Apr 2021 (Federal Reserve, Cleveland) at 0.2

- Earnings, Average Weekly, Total Private, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.2

- Federal Budget, Current Prices for Apr 2021 (Fiscal Service, USA) at -226.0, below consensus estimate of -220.0

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 07 May (MBA, USA) at 2.1

- Mortgage applications, market composite index for W 07 May (MBA, USA) at 715.3

- Mortgage applications, market composite index, purchase for W 07 May (MBA, USA) at 276.7

- Mortgage applications, market composite index, refinancing for W 07 May (MBA, USA) at 3,281.0

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 07 May (MBA, USA) at 3.1

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for May 2021 (Refinitiv/Ipsos) at 62.1

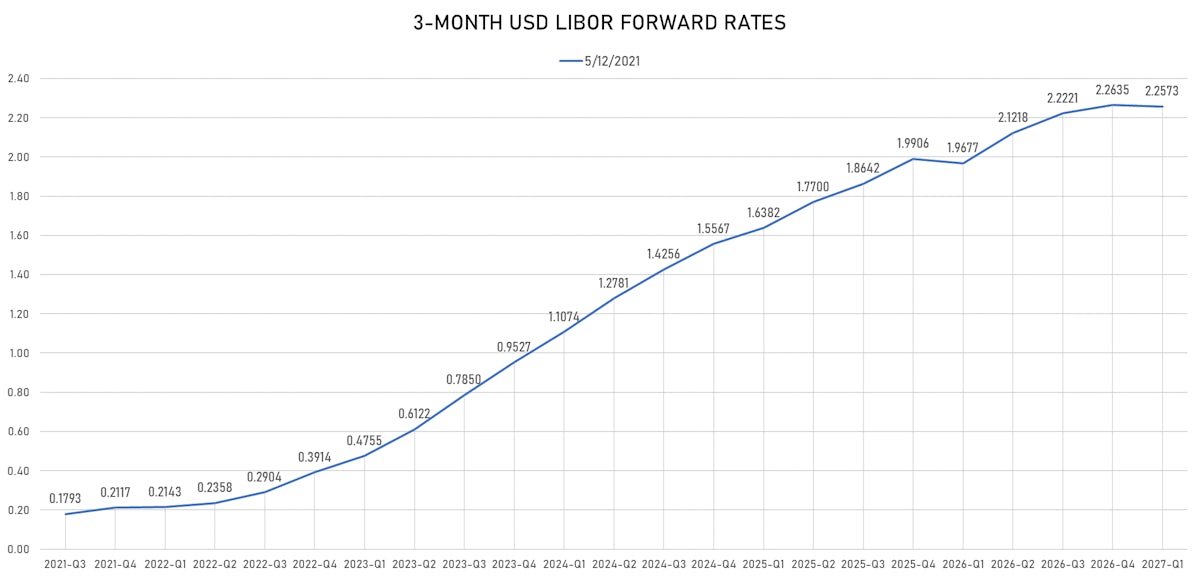

US FORWARD RATES

- 3-month USD Libor 5 years forward up 8.3 bp

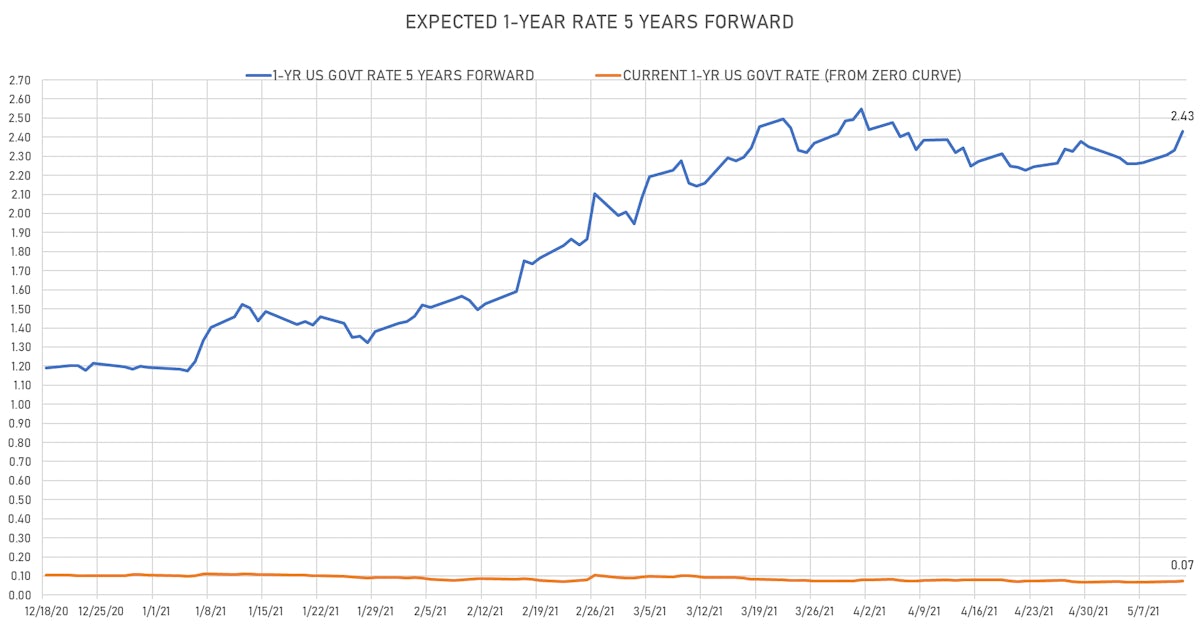

- US Treasury 1-year zero-coupon rate 5 years forward up 9.8 bp, now at 2.43% (meaning that short-term rates are expected to increase by 235.6 bp over the next 5 years)

- Fed Funds Futures curve still indicating rate hikes liftoff in Q4 2022

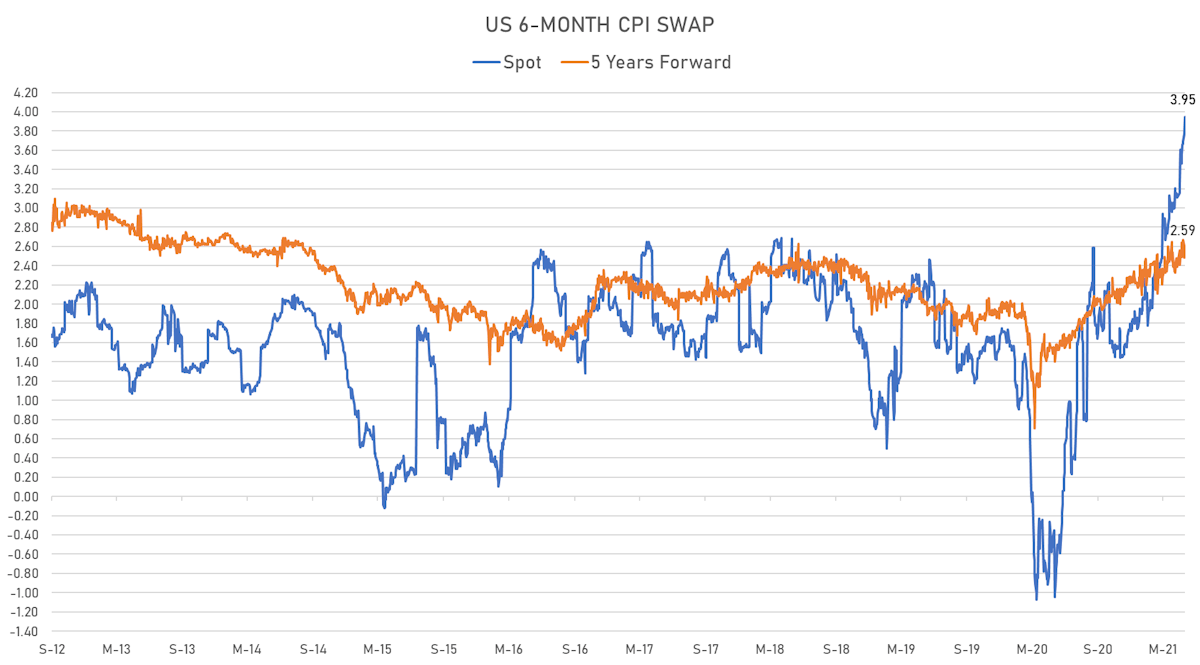

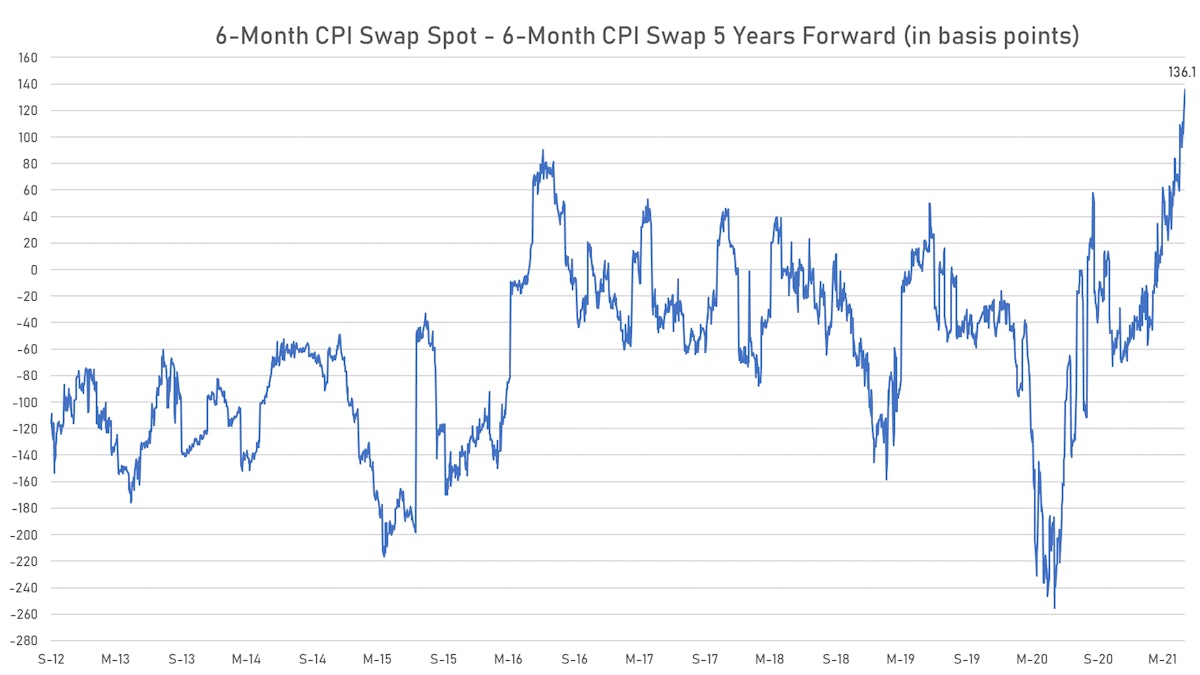

US INFLATION

- TIPS 1Y breakeven inflation at 3.16% (up 26bp); 2Y at 2.88% (up 12bp); 5Y at 2.79% (up 3.5bp); 10Y at 2.54% (up 2bp); 30Y at 2.38% (up 1bp)

- 6-month forward inflation swap up 18.2 bp to 3.948%

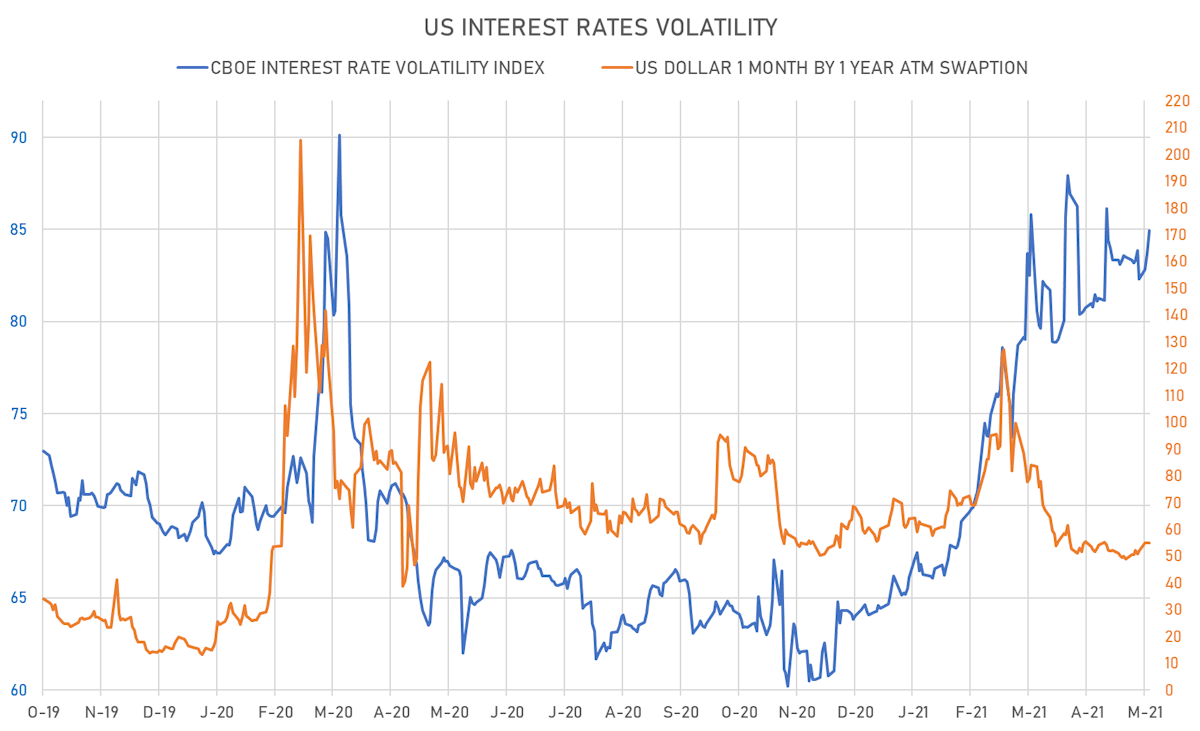

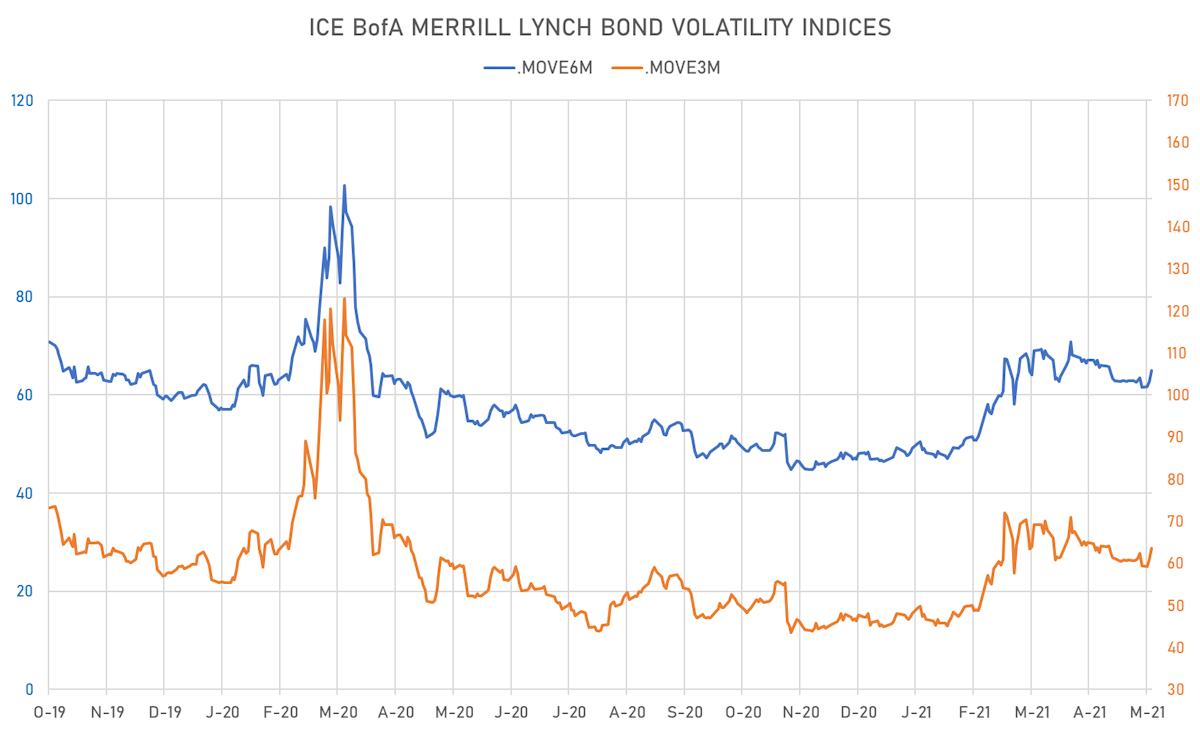

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) at 54.8%

- 3-Month LIBOR-OIS spread up 1.0 bp at 10.4 bp (12-months range: 9.4-36.6 bp)

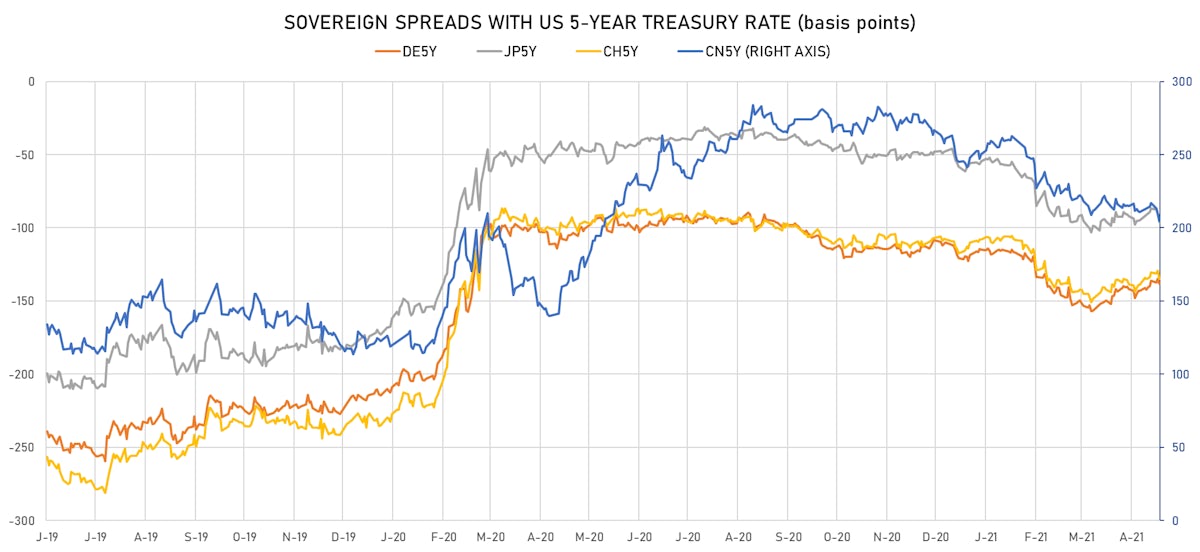

KEY INTERNATIONAL RATES

- Germany 5Y: -0.515% (up 2.9 bp); the German 1Y-10Y curve is 2.6 bp steeper at 50.8bp (YTD change: +34.7 bp)

- Japan 5Y: -0.082% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp steeper at 19.8bp (YTD change: +5.8 bp)

- China 5Y: 2.910% (up 0.8 bp); the Chinese 1Y-10Y curve is 1.7 bp flatter at 59.2bp (YTD change: +12.8 bp)

- Switzerland 5Y: -0.486% (up 0.4 bp); the Swiss 1Y-10Y curve is 0.7 bp steeper at 62.1bp (YTD change: +35.7 bp)