Rates

US Rates Pull Back As Markets Try To Balance Higher Inflation With Some Recent Macro Misses

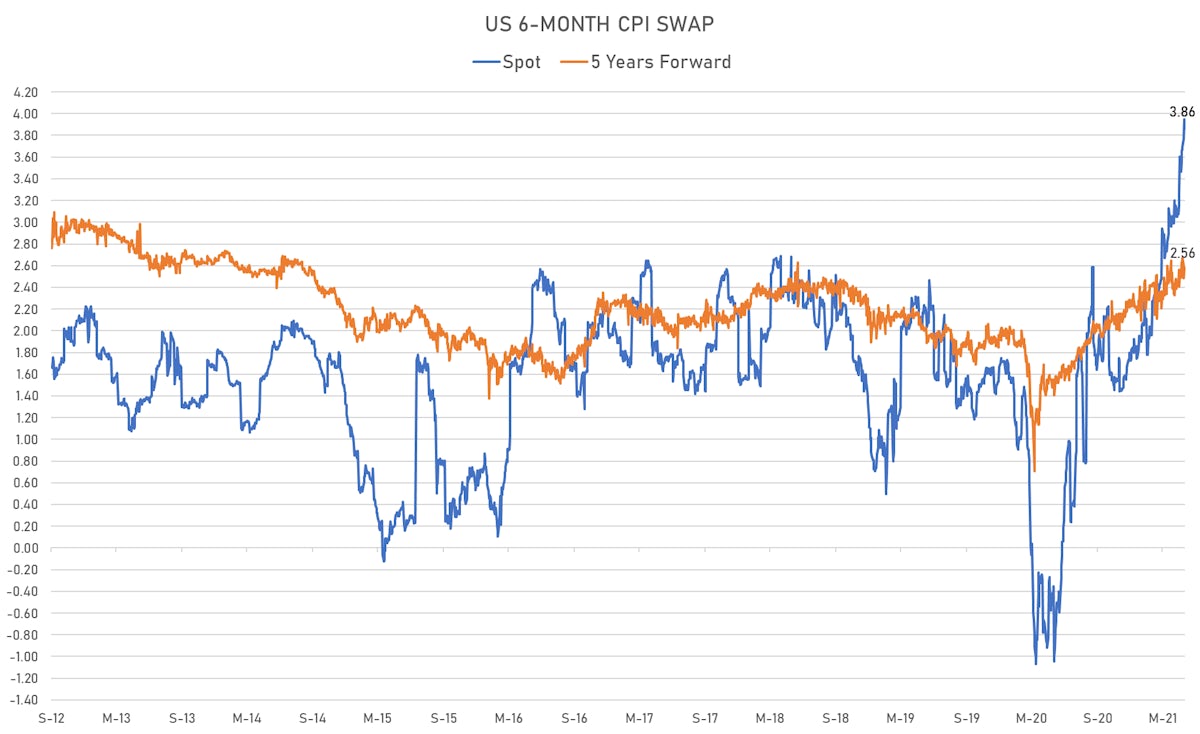

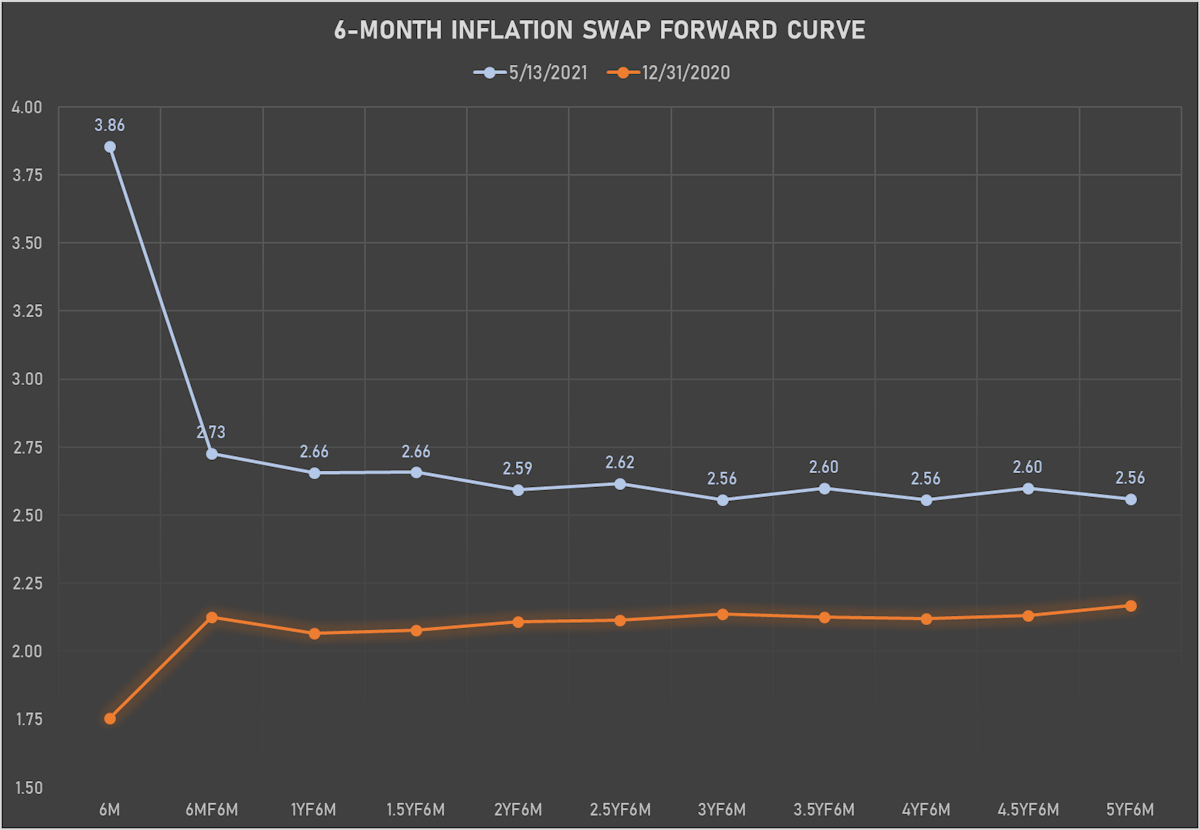

Short-term inflation stays at elevated levels, though the forward curve dropped back to where it was before the core CPI scare yesterday

Published ET

5-Year TIPS Breakeven Inflation | Source: Refinitiv

QUICK US SUMMARY

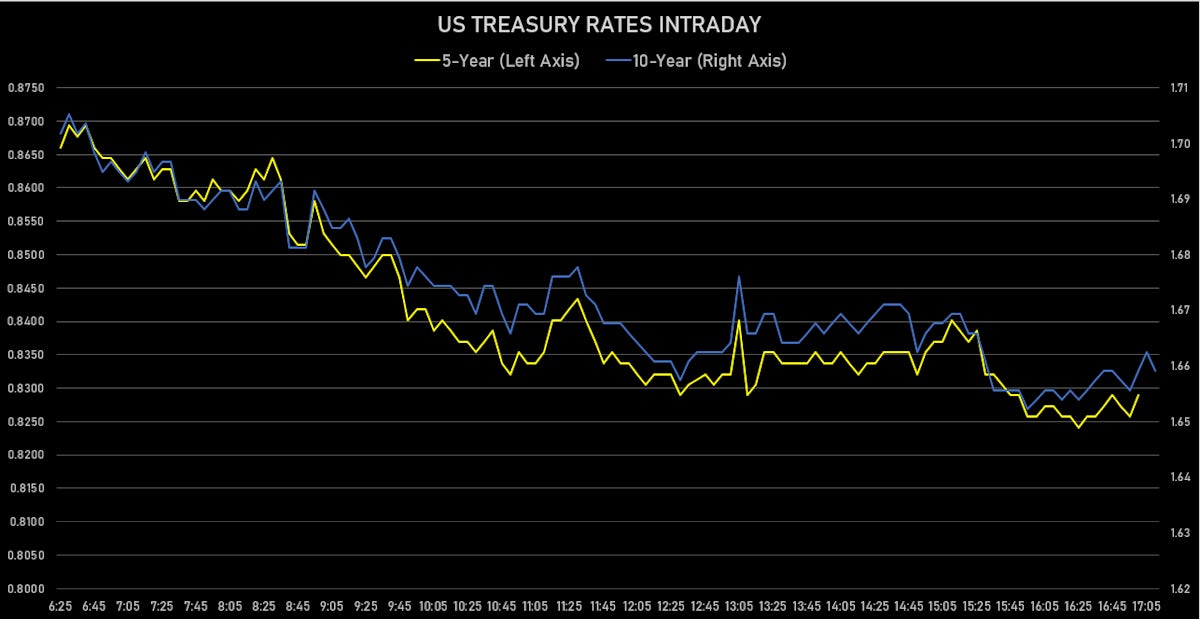

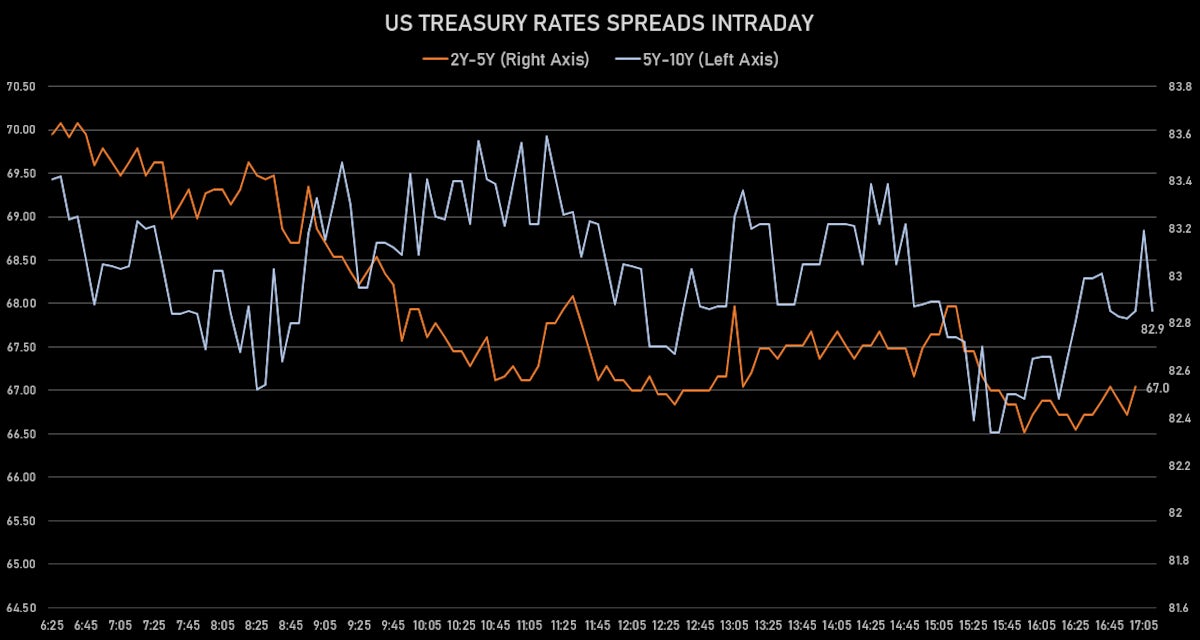

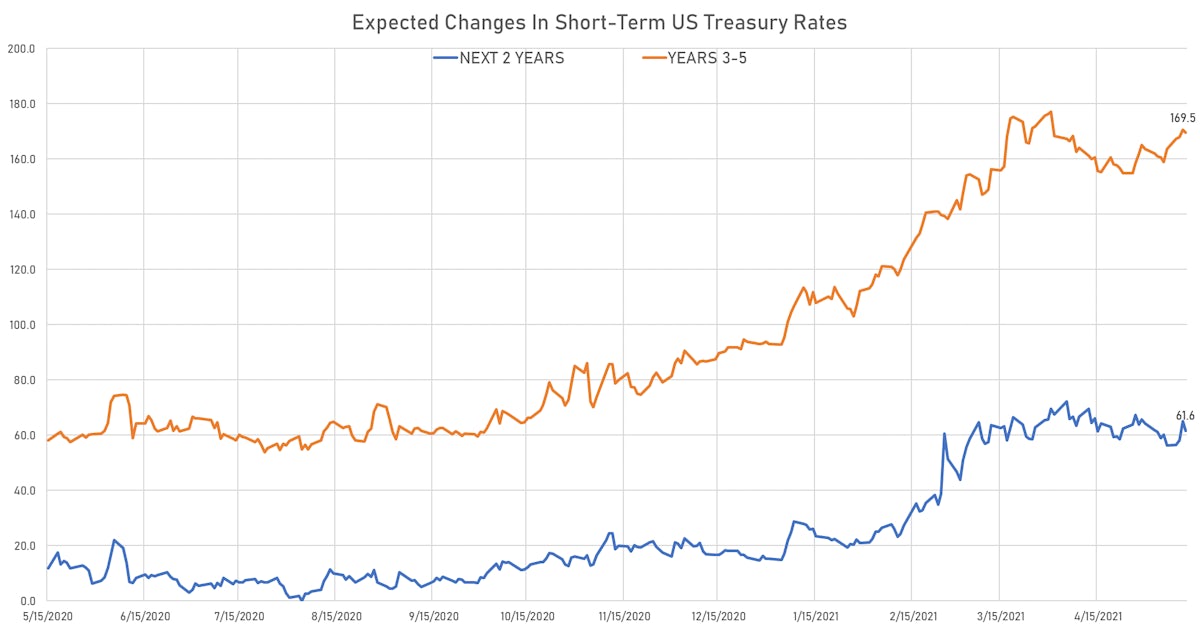

- Yield curve flattening, with the 1Y-10Y spread tightening -3.4 bp on the day, now at 161.1 bp (YTD change: +80.7)

- 1Y: 0.0480% (unchanged)

- 2Y: 0.1569% (down 1.0 bp)

- 5Y: 0.8289% (down 3.6 bp)

- 7Y: 1.3041% (down 3.8 bp)

- 10Y: 1.6591% (down 3.4 bp)

- 30Y: 2.4018% (down 1.3 bp)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 01 May (U.S. Dept. of Labor) at 3.7, in line with consensus

- Jobless Claims, National, Initial for W 08 May (U.S. Dept. of Labor) at 473.0, below consensus estimate of 490.0

- Jobless Claims, National, Initial, four week moving average for W 08 May (U.S. Dept. of Labor) at 534.0

- PPI ex Food/Energy/Trade MM, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.7

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Apr 2021 (BLS, U.S Dep. Of Lab) at 4.6

- Producer Prices, Final demand less foods and energy, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.7, above consensus estimate of 0.4

- Producer Prices, Final demand less foods and energy, Change Y/Y for Apr 2021 (BLS, U.S Dep. Of Lab) at 4.1, above consensus estimate of 3.7

- Producer Prices, Final demand, Change P/P for Apr 2021 (BLS, U.S Dep. Of Lab) at 0.6, above consensus estimate of 0.3

- Producer Prices, Final demand, Change Y/Y for Apr 2021 (BLS, U.S Dep. Of Lab) at 6.2, above consensus estimate of 5.9

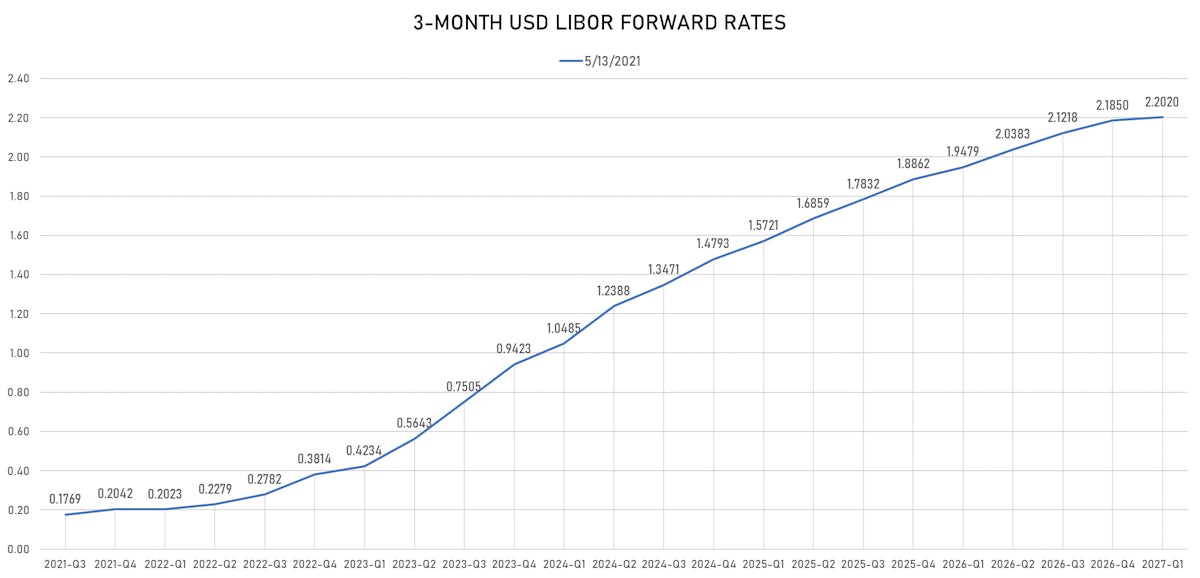

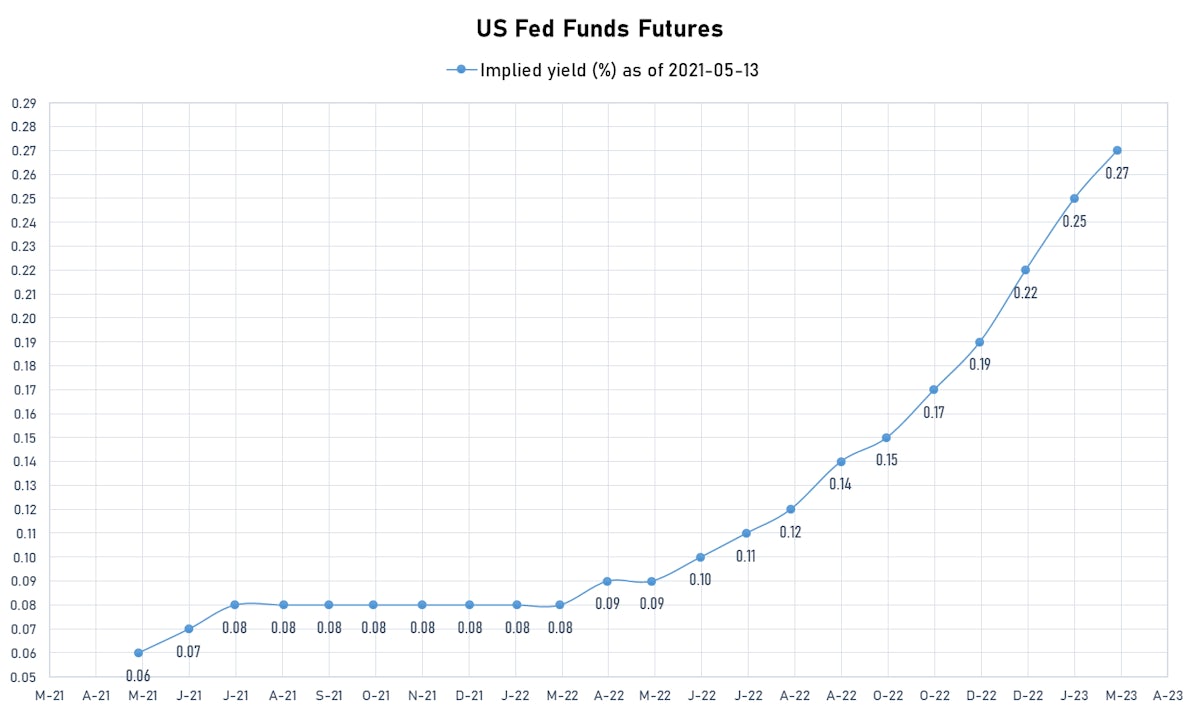

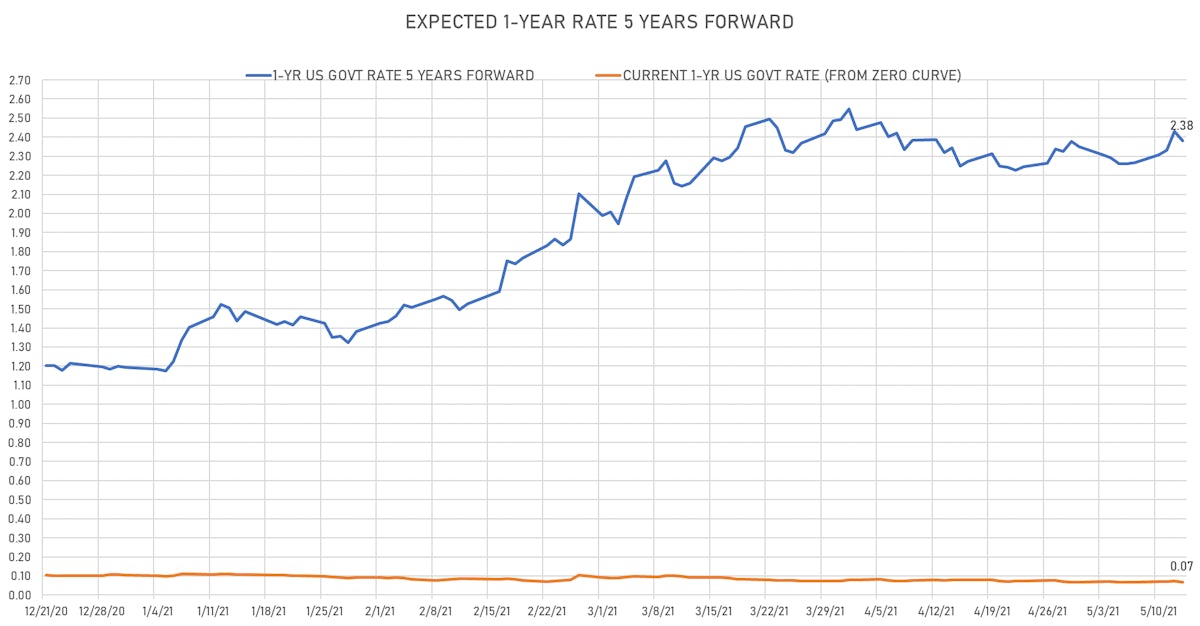

US FORWARD RATES

- 3-month USD Libor 5 years forward down 8.3 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 4.9 bp, now at 2.3808% (meaning that short-term rates are expected to increase by 231.2 bp over the next 5 years)

US INFLATION

- TIPS 1Y breakeven inflation at 3.11% (down -5.1bp); 2Y at 2.82% (down -5.7bp); 5Y at 2.73% (down -6.0bp); 10Y at 2.51% (down -3.0bp); 30Y at 2.38% (up 0.5bp)

- 6-month forward inflation swap down -9.1 bp to 3.856%

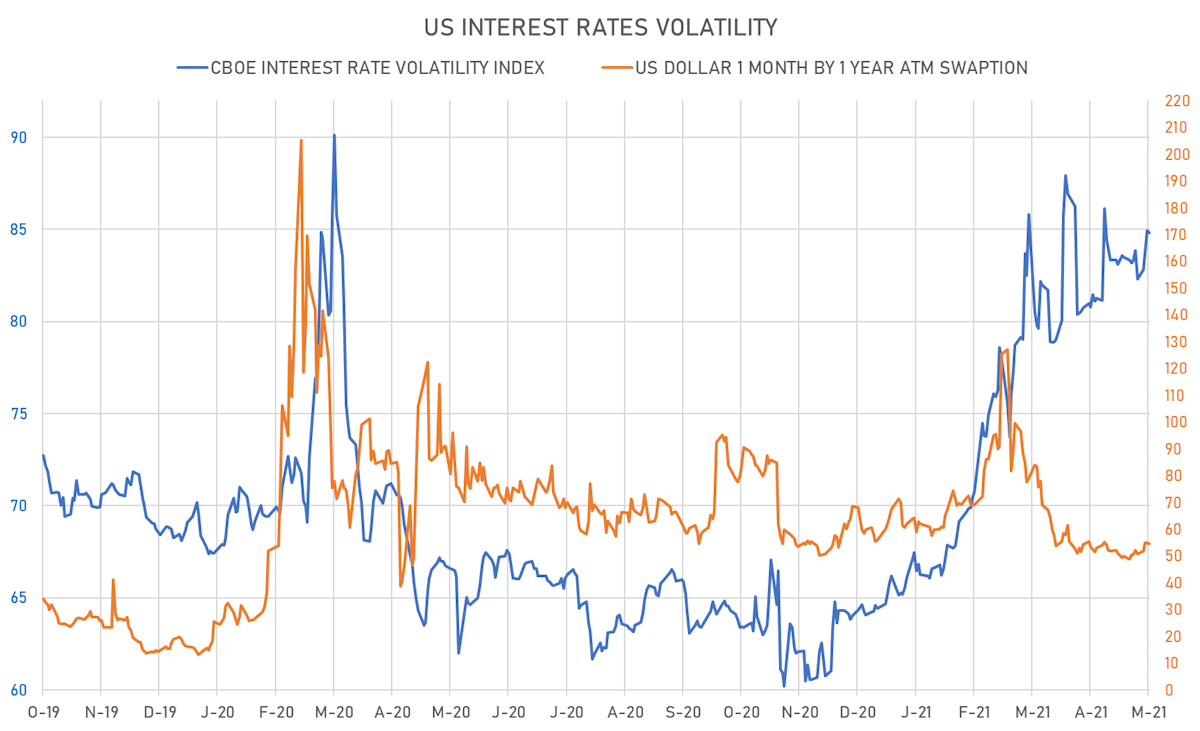

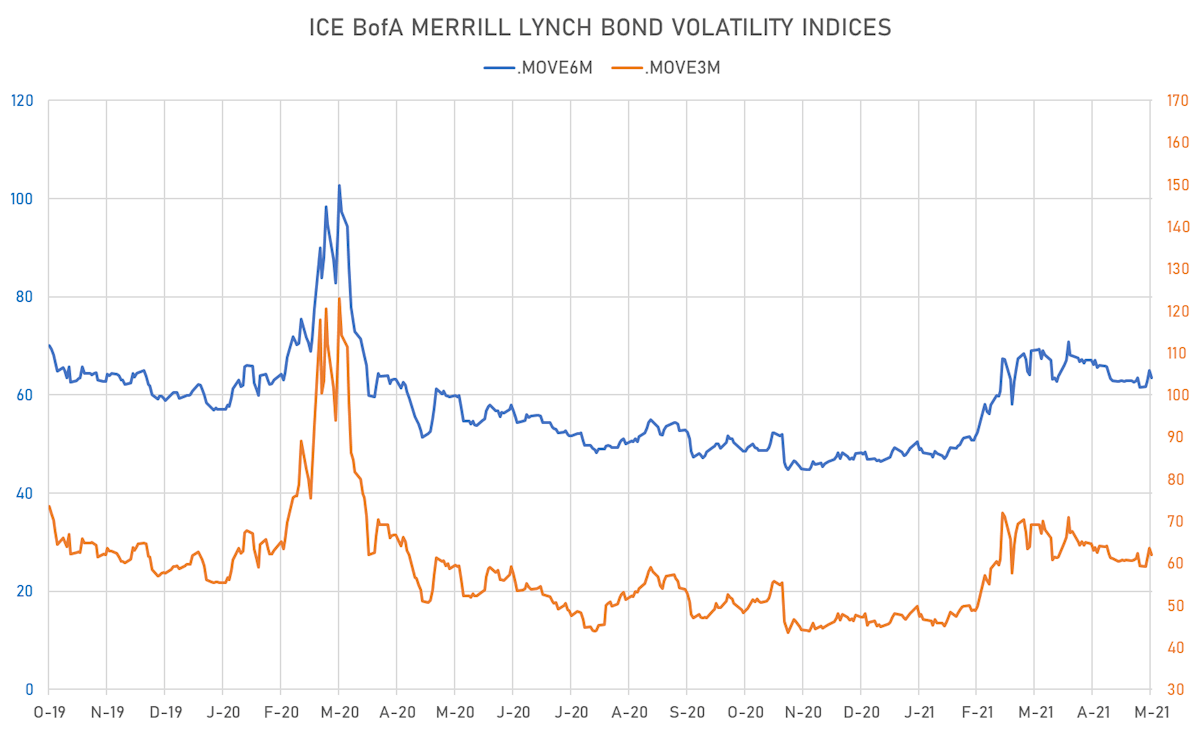

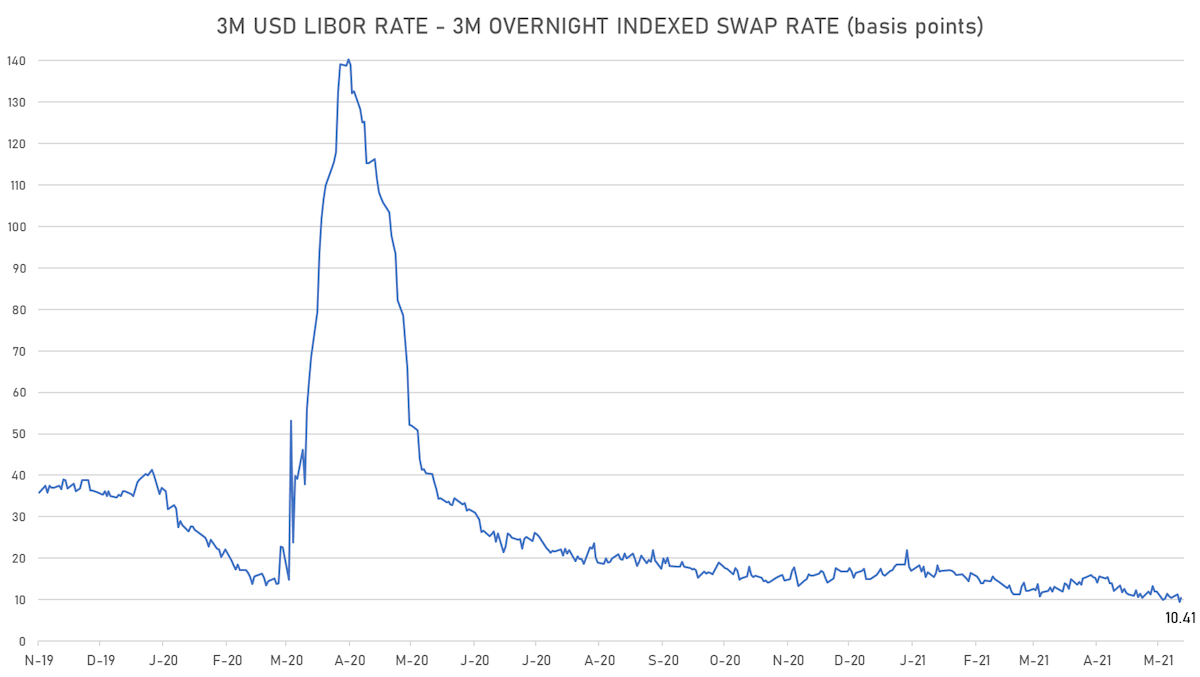

RATES VOLATILITY AND LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.3% at 54.5%

- 3-Month LIBOR-OIS spread up 1.0 bp at 10.4 bp (12-months range: 9.4-34.6 bp)

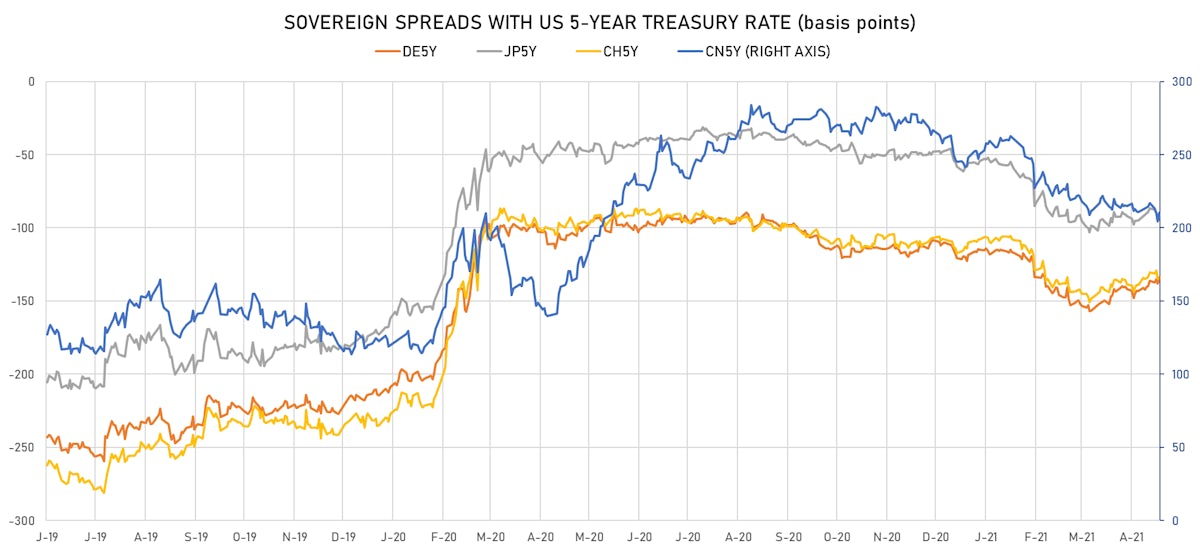

KEY INTERNATIONAL RATES

- Germany 5Y: -0.513% (up 1.2 bp); the German 1Y-10Y curve is 2.6 bp steeper at 51.5bp (YTD change: +37.3 bp)

- Japan 5Y: -0.085% (up 1.0 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 21.3bp (YTD change: +6.6 bp)

- China 5Y: 2.933% (up 2.3 bp); the Chinese 1Y-10Y curve is 1.5 bp flatter at 57.7bp (YTD change: +11.3 bp)

- Switzerland 5Y: -0.486% (up 0.4 bp); the Swiss 1Y-10Y curve is 2.3 bp flatter at 58.1bp (YTD change: +31.7 bp)