Rates

Rates Up Slightly, Short-Term Inflation Hedges Keep Climbing

Fed VC Clarida still views inflation as "likely to be transitory", sees the economy growing 6.5%-7% this year

Published ET

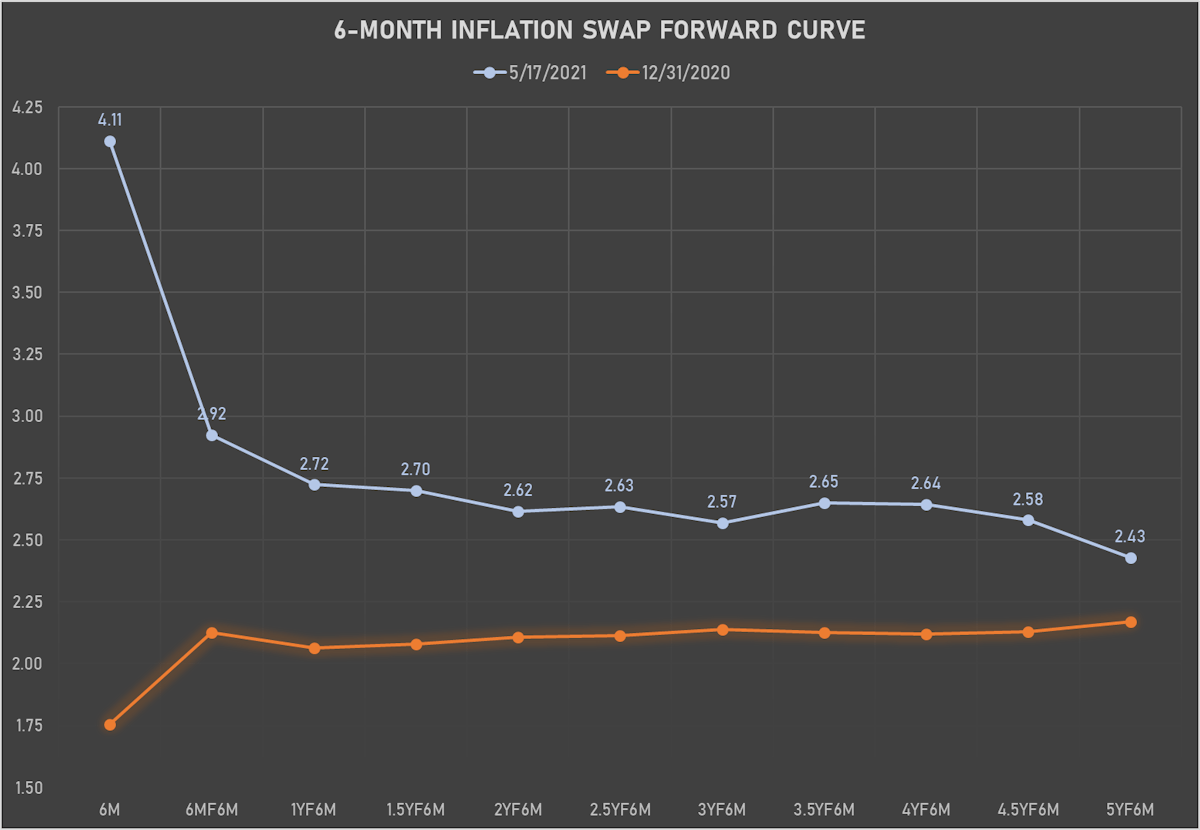

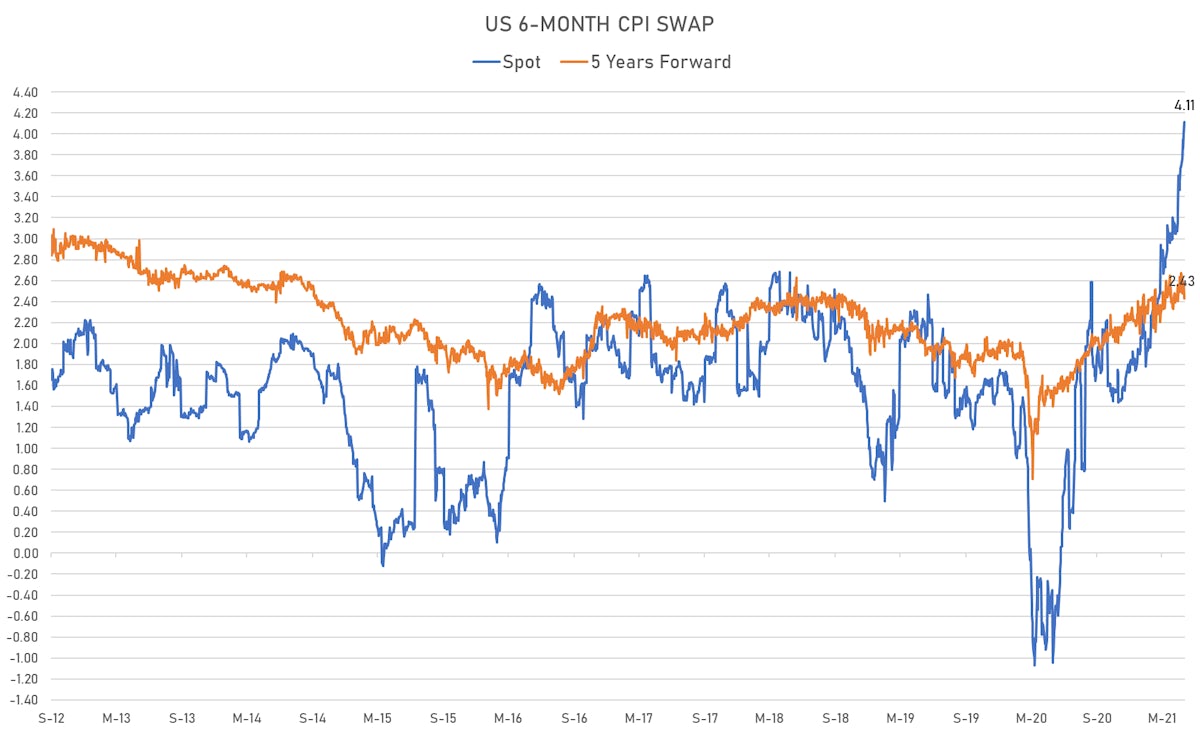

Inversion of the inflation curve rising to new record | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

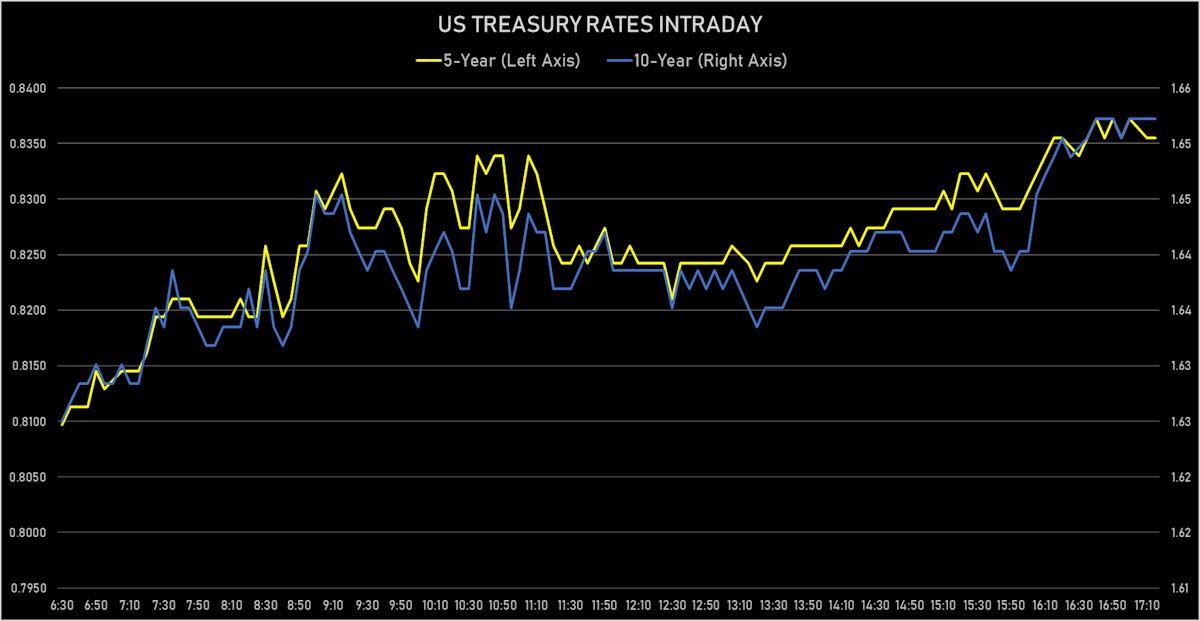

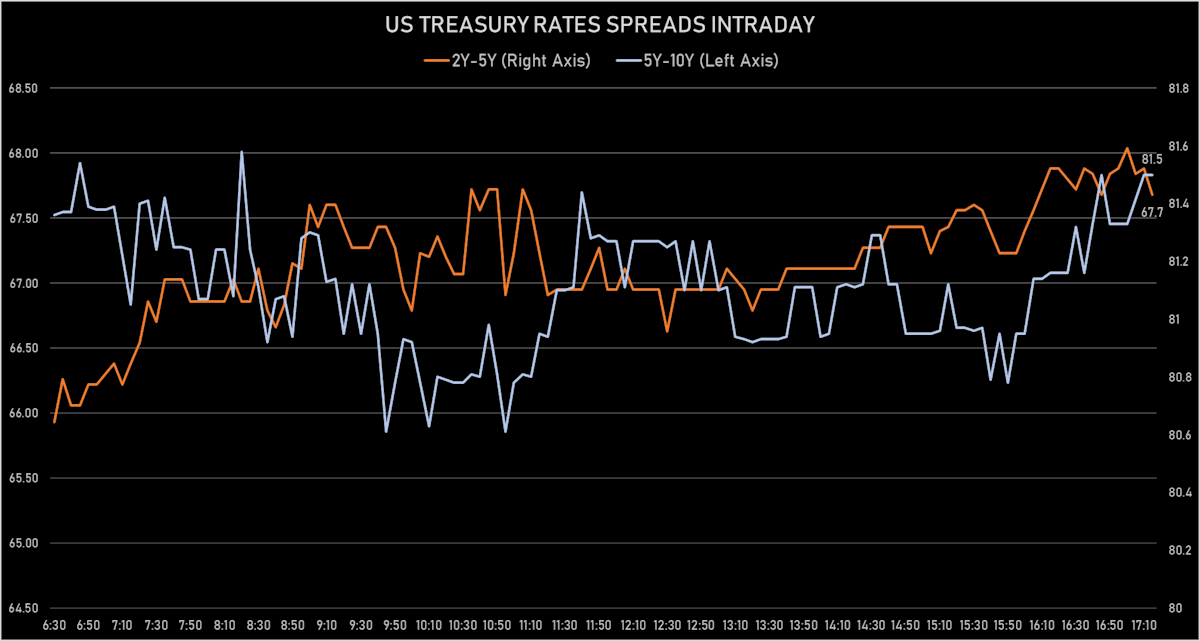

- Yield curve steepening, with the 1Y-10Y spread widening 1.7 bp on the day, now at 160.4 bp (YTD change: +80.0)

- 1Y: 0.0480% (unchanged)

- 2Y: 0.1551% (up 0.6 bp)

- 5Y: 0.8355% (up 1.8 bp)

- 7Y: 1.3019% (up 1.9 bp)

- 10Y: 1.6522% (up 1.7 bp)

- 30Y: 2.3648% (up 1.8 bp)

US MACRO RELEASES

- NAHB/Wells Fargo Housing Market Index for May 2021 (NAHB, United States) at 83.0, in line with estimates

- Net flows total, Current Prices for Mar 2021 (U.S. Dept. Treas.) at 146.4

- Net foreign acquisition of long-term securities, Current Prices for Mar 2021 (U.S. Dept. Treas.) at 224.7

- Net purchases (net long-term capital inflows), total, Current Prices for Mar 2021 (U.S. Dept. Treas.) at 262.2

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Mar 2021 (U.S. Dept. Treas.) at 118.9

- New York Fed, General Business Condition for May 2021 (FED, NY) at 24.3, above consensus estimate of 23.9

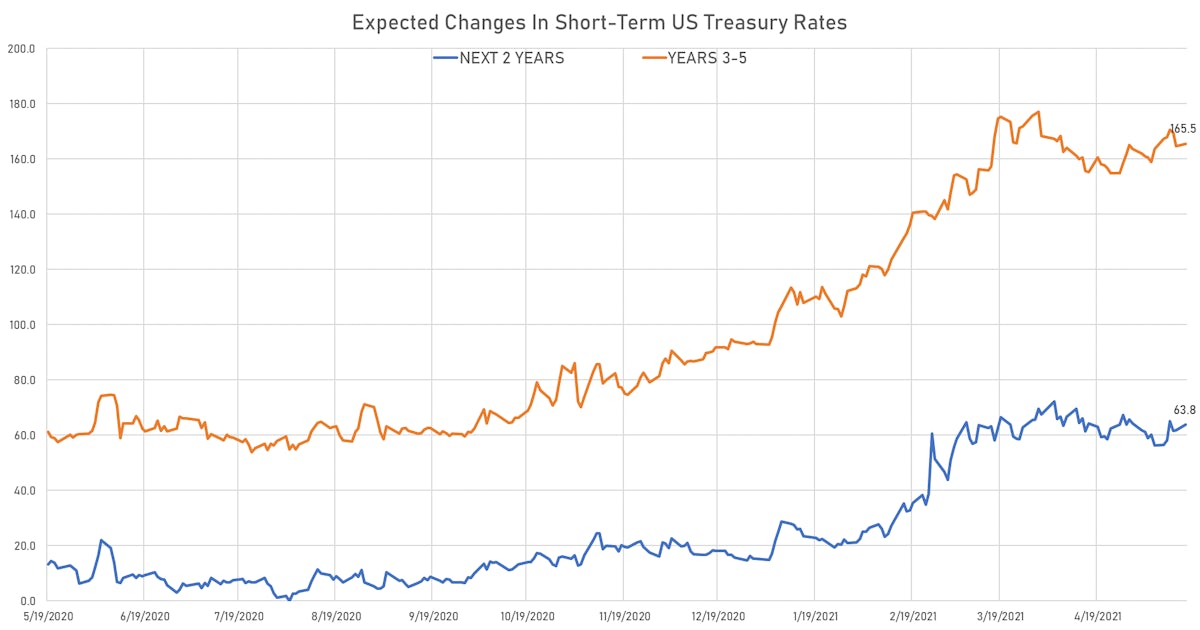

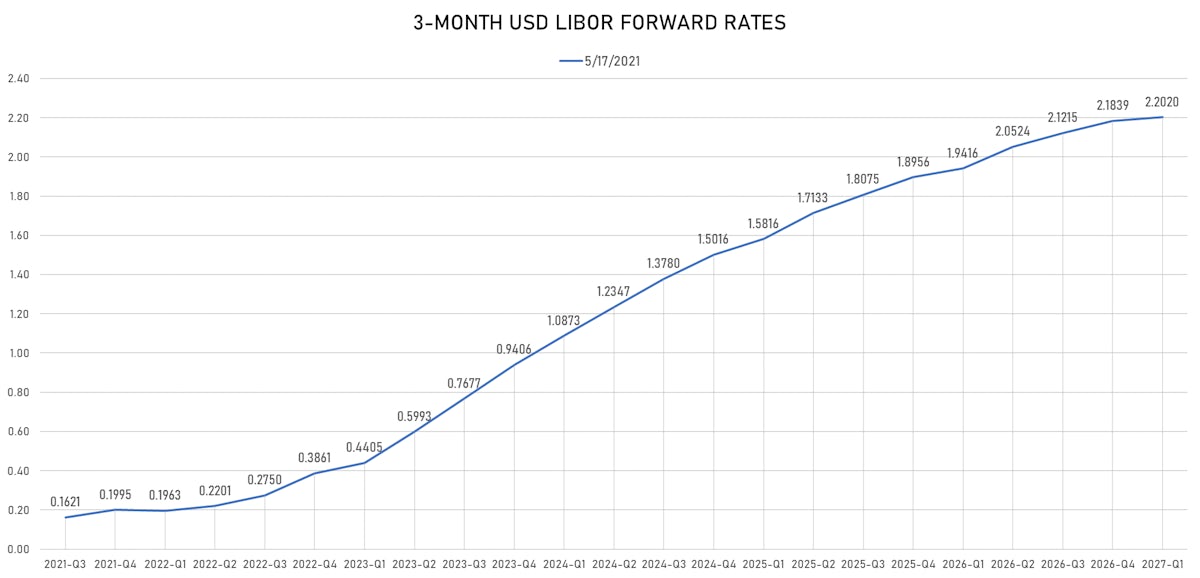

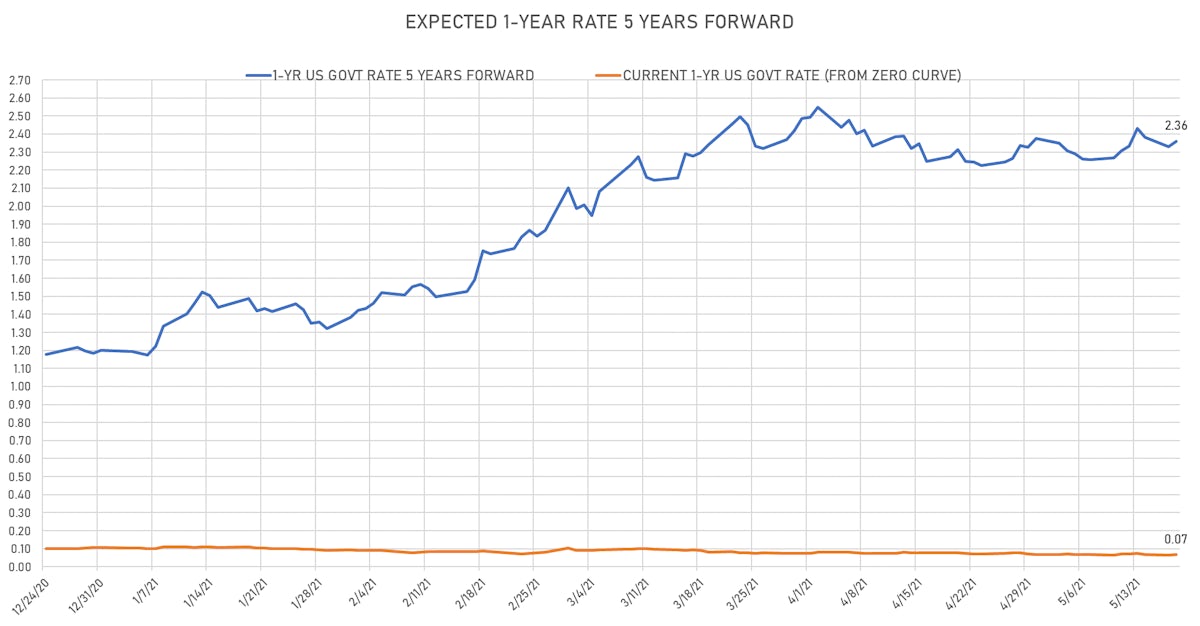

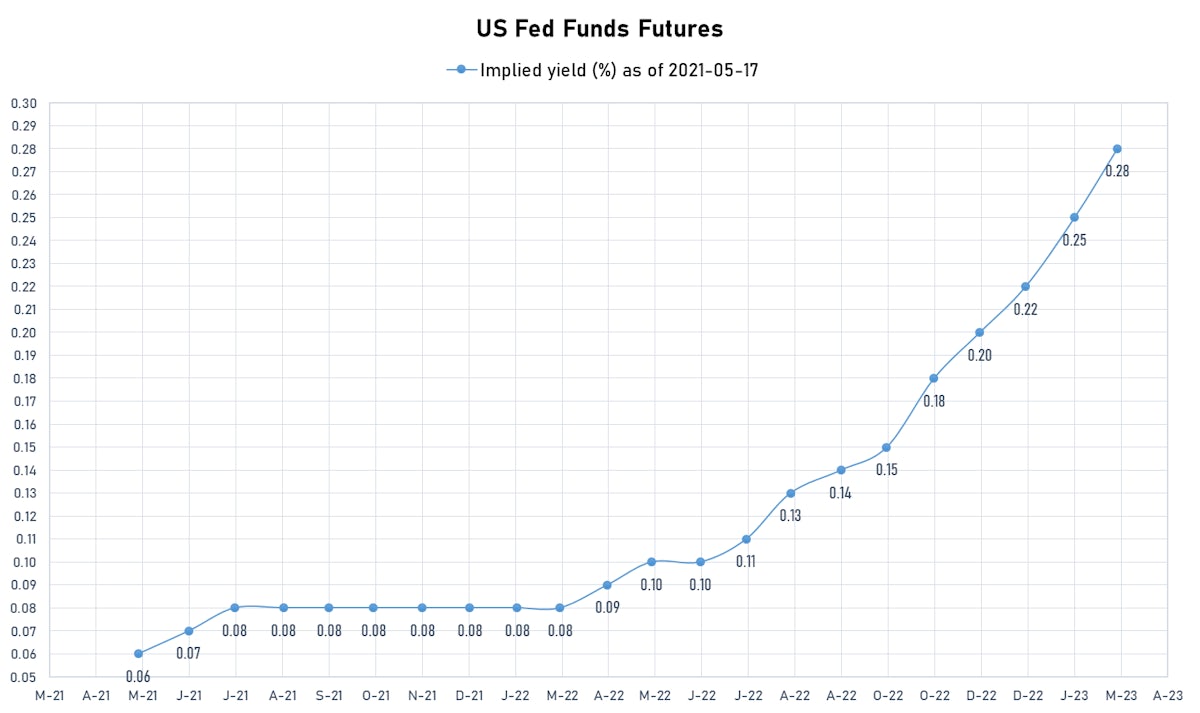

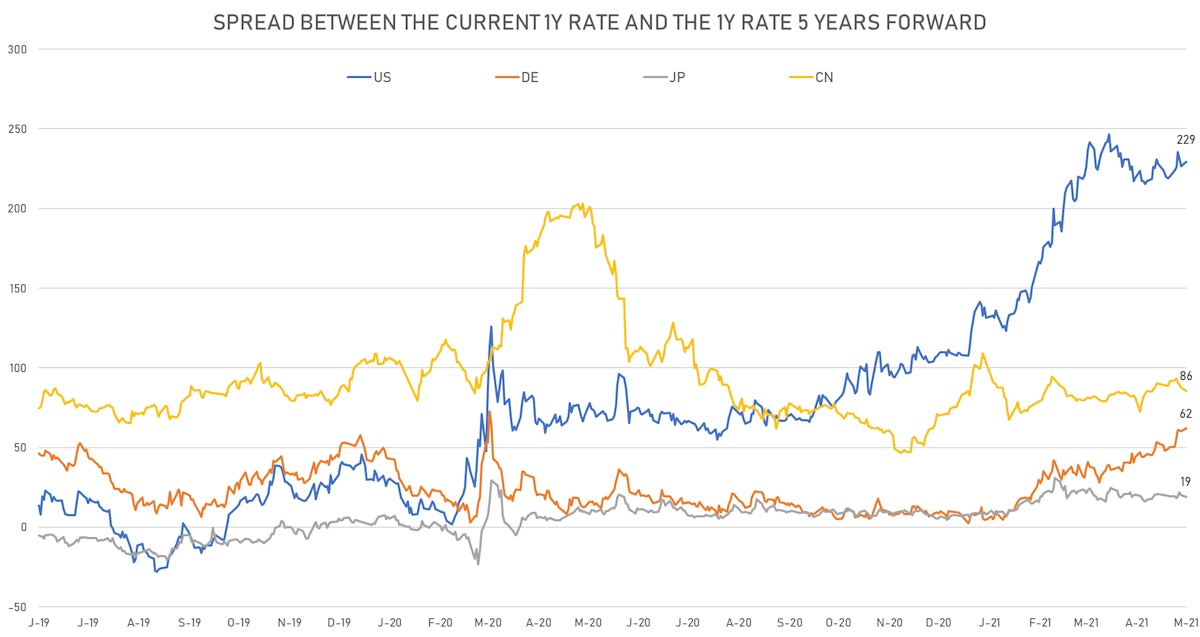

US FORWARD RATES

- 3-month USD Libor 5 years forward up 2.3 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 3.1 bp, now at 2.3603%

- US rate hikes expected to start in Q4 2022 and to increase by 229.4 bp over the next 5 years

US INFLATION

- TIPS 1Y breakeven inflation at 3.35% (up 8.5bp); 2Y at 2.96% (up 7.5bp); 5Y at 2.81% (up 5.5bp); 10Y at 2.54% (up 2.4bp); 30Y at 2.39% (up 0.5bp)

- 6-month forward inflation swap up 10.2 bp to 4.11%

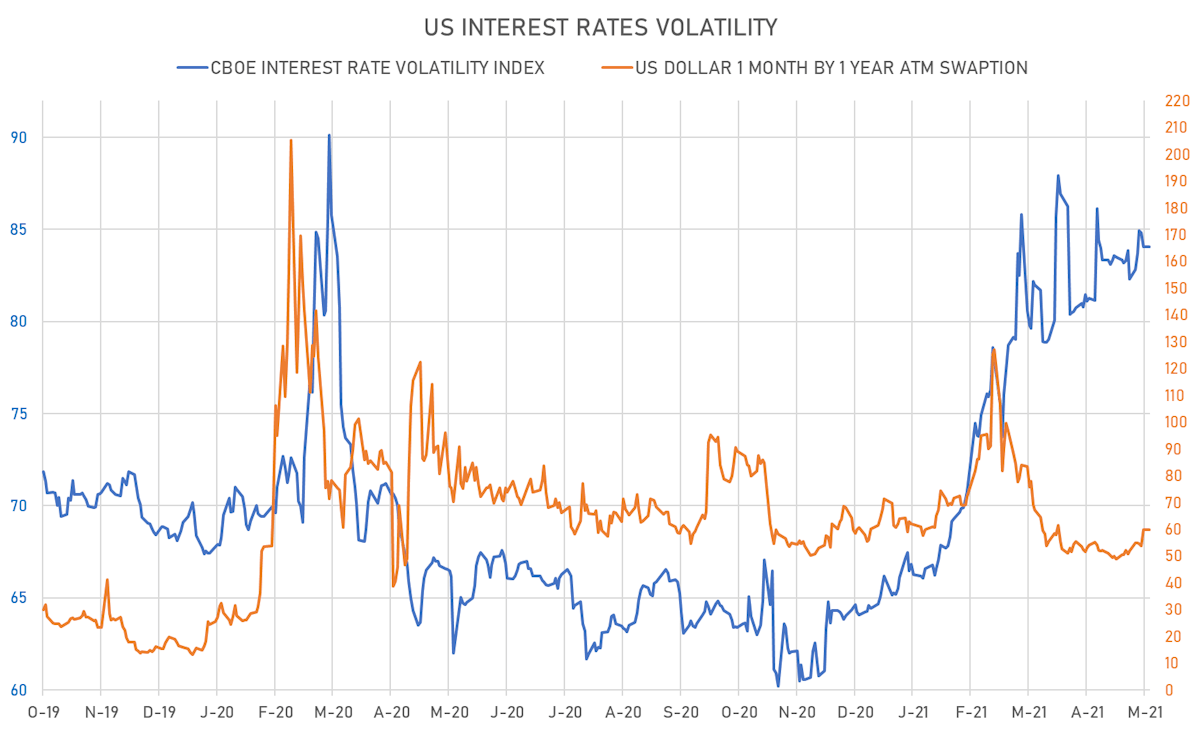

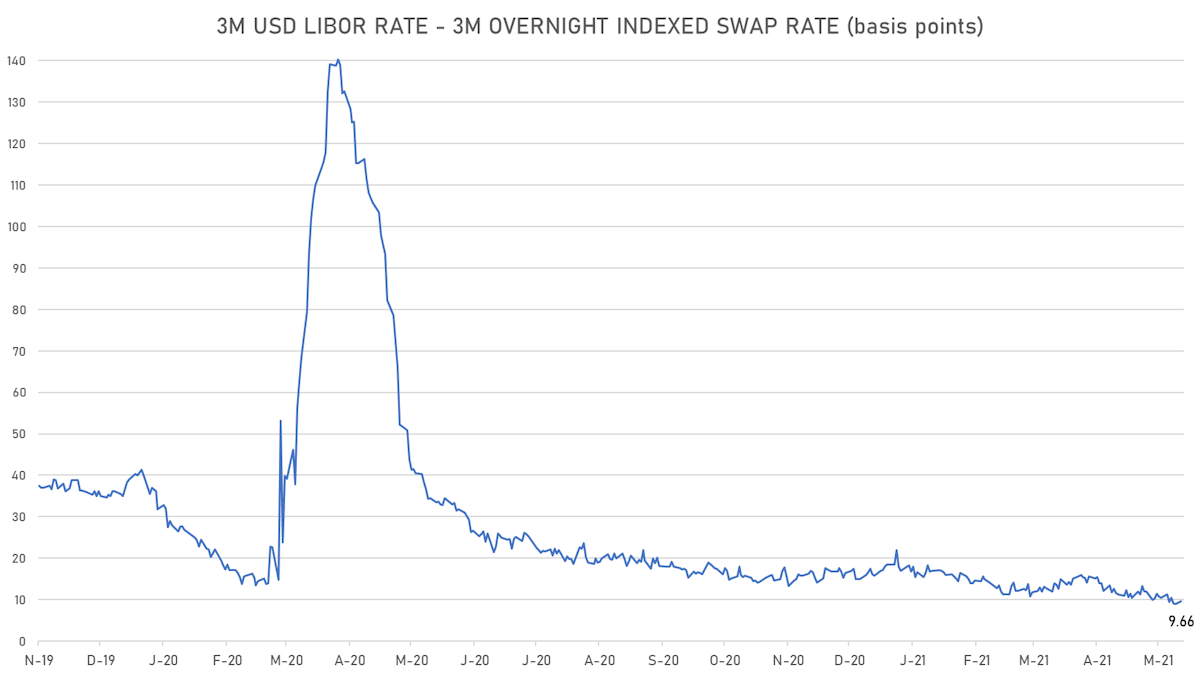

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 5.9% at 59.7%

- 3-Month LIBOR-OIS spread up 0.7 bp at 9.7 bp (12-months range: 9.0-34.4 bp)

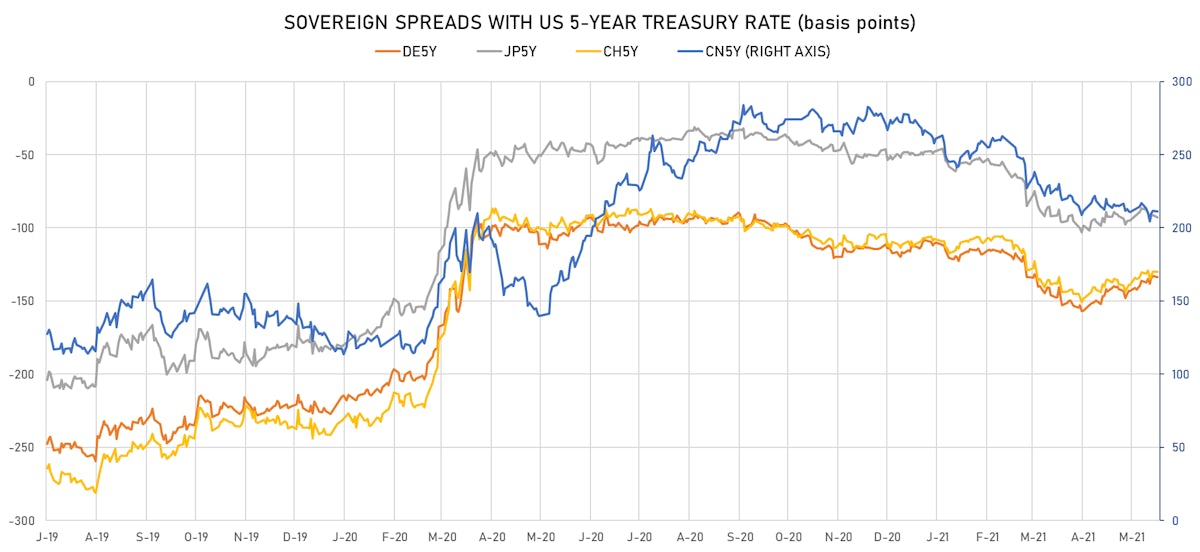

KEY INTERNATIONAL RATES

- Germany 5Y: -0.509% (up 0.5 bp); the German 1Y-10Y curve is 0.7 bp steeper at 51.4bp (YTD change: +35.6 bp)

- Japan 5Y: -0.099% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 20.5bp (YTD change: +5.9 bp)

- China 5Y: 2.943% (up 1.0 bp); the Chinese 1Y-10Y curve is 1.0 bp flatter at 57.8bp (YTD change: +11.4 bp)

- Switzerland 5Y: -0.472% (up 1.1 bp); the Swiss 1Y-10Y curve is 11.5 bp steeper at 67.5bp (YTD change: +41.1 bp)