Rates

US Rates Down After April Housing Starts Miss

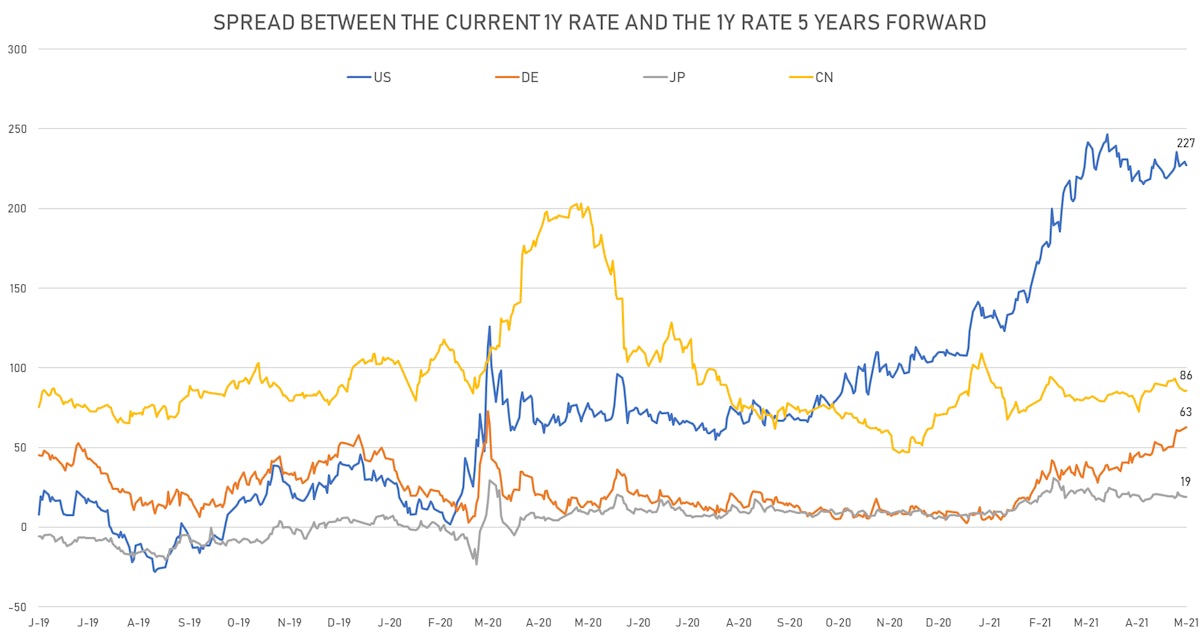

Forward rates have stalled in the US since March, but they're going up in Germany, a sign that rising Eurozone growth will lead to higher rates and (in the short-term) a steeper Bund curve

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

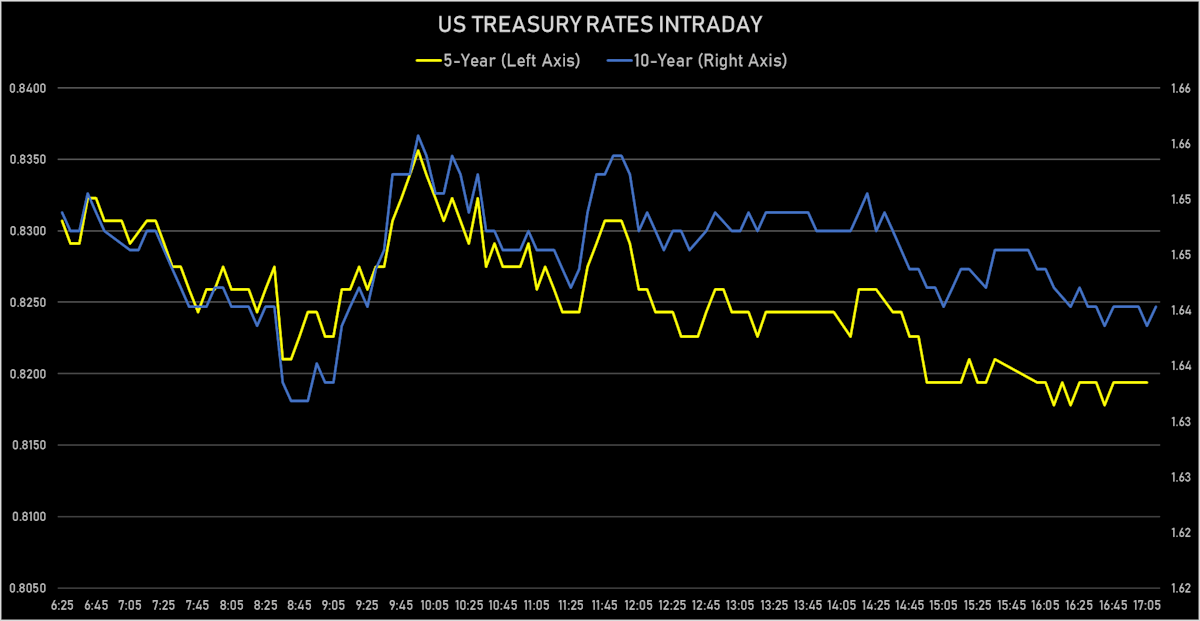

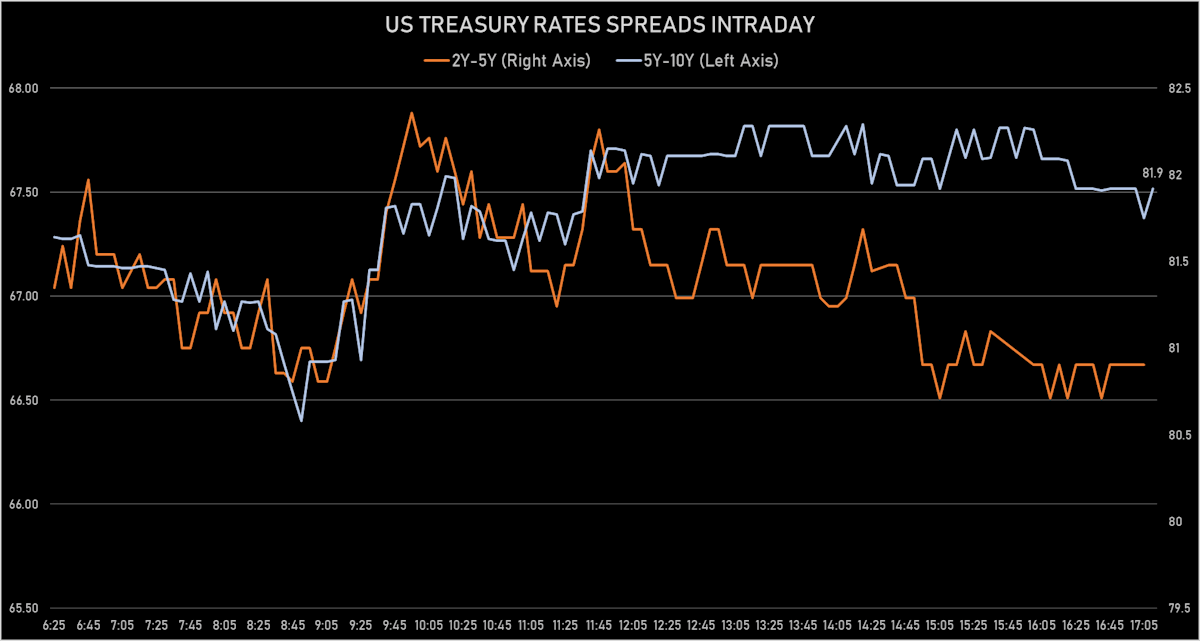

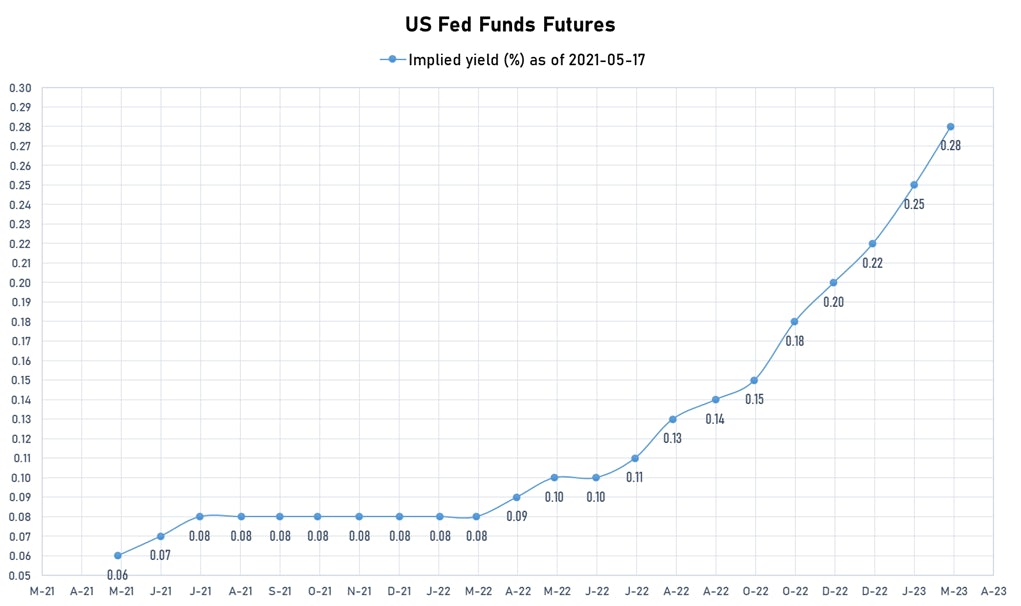

- Yield curve flattening, with the 1Y-10Y spread tightening -1.2 bp on the day, now at 159.2 bp (YTD change: +78.8)

- 1Y: 0.0480% (unchanged)

- 2Y: 0.1511% (down 0.4 bp)

- 5Y: 0.8194% (down 1.6 bp)

- 7Y: 1.2842% (down 1.8 bp)

- 10Y: 1.6403% (down 1.2 bp)

- 30Y: 2.3618% (down 0.3 bp)

US MACRO RELEASES

- Building Permits for Apr 2021 (U.S. Census Bureau) at 1.8, in line with consensus estimate

- Building Permits, Change P/P for Apr 2021 (U.S. Census Bureau) at 0.3

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 15 May (Redbook Research) at 12.6

- Housing Starts for Apr 2021 (U.S. Census Bureau) at 1.6, below consensus estimate of 1.7

- Housing Starts, Change P/P for Apr 2021 (U.S. Census Bureau) at -9.5

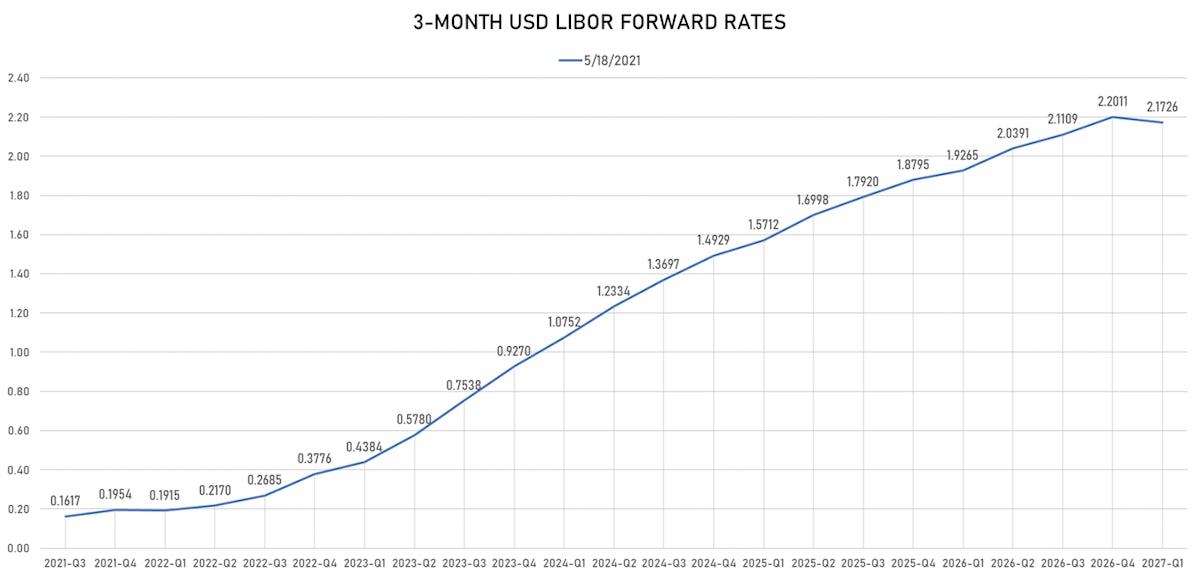

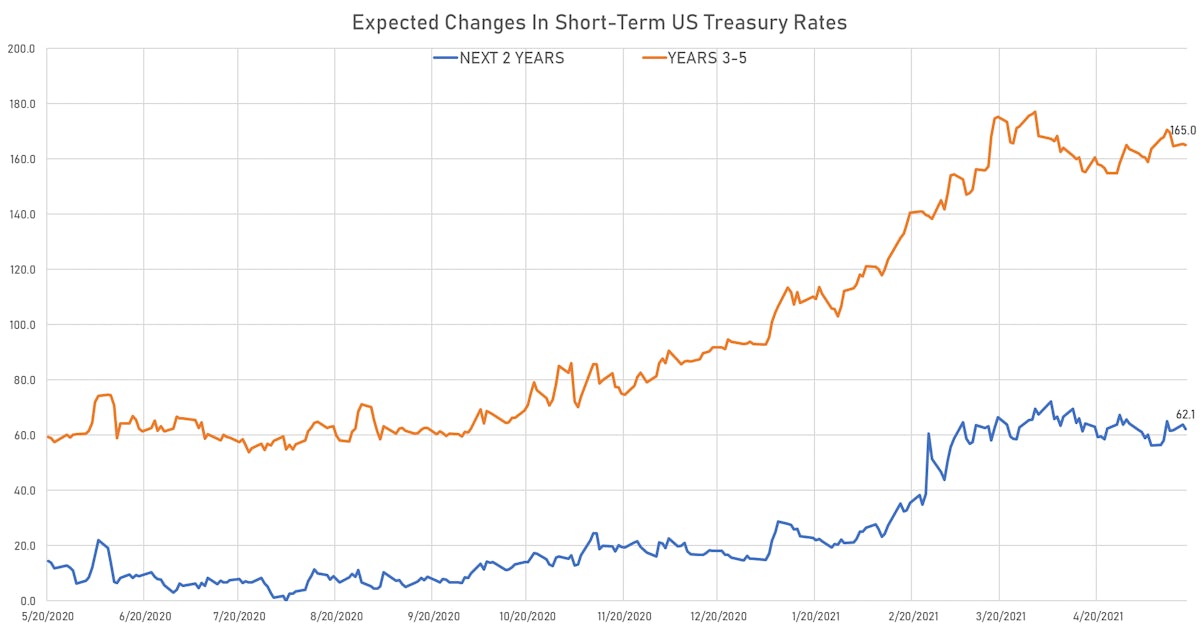

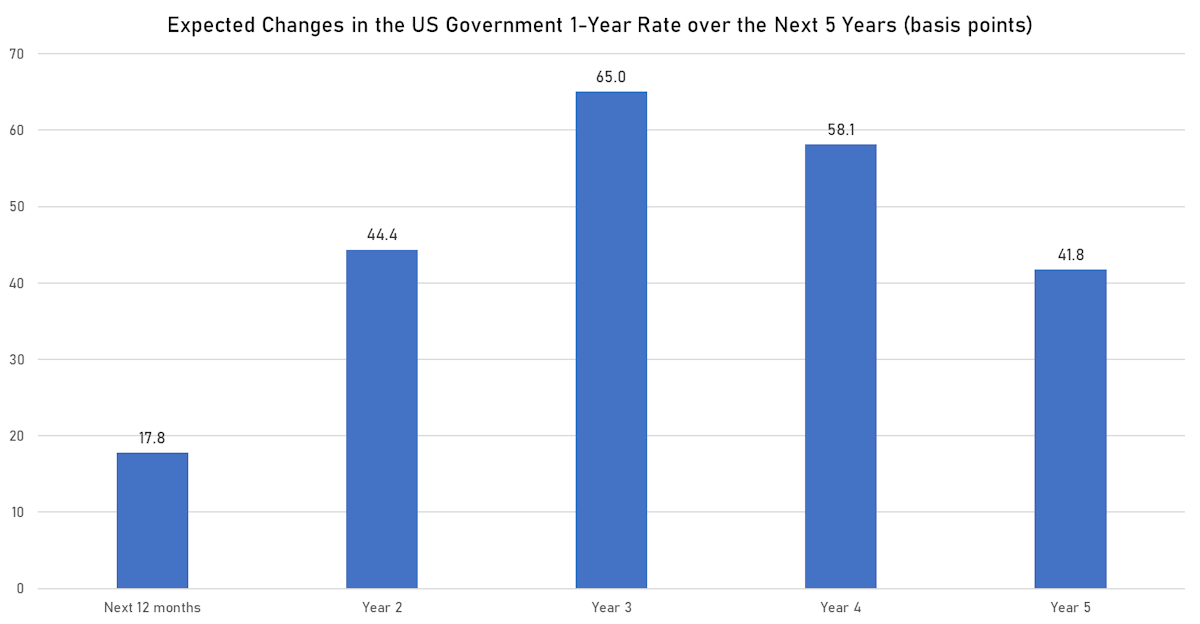

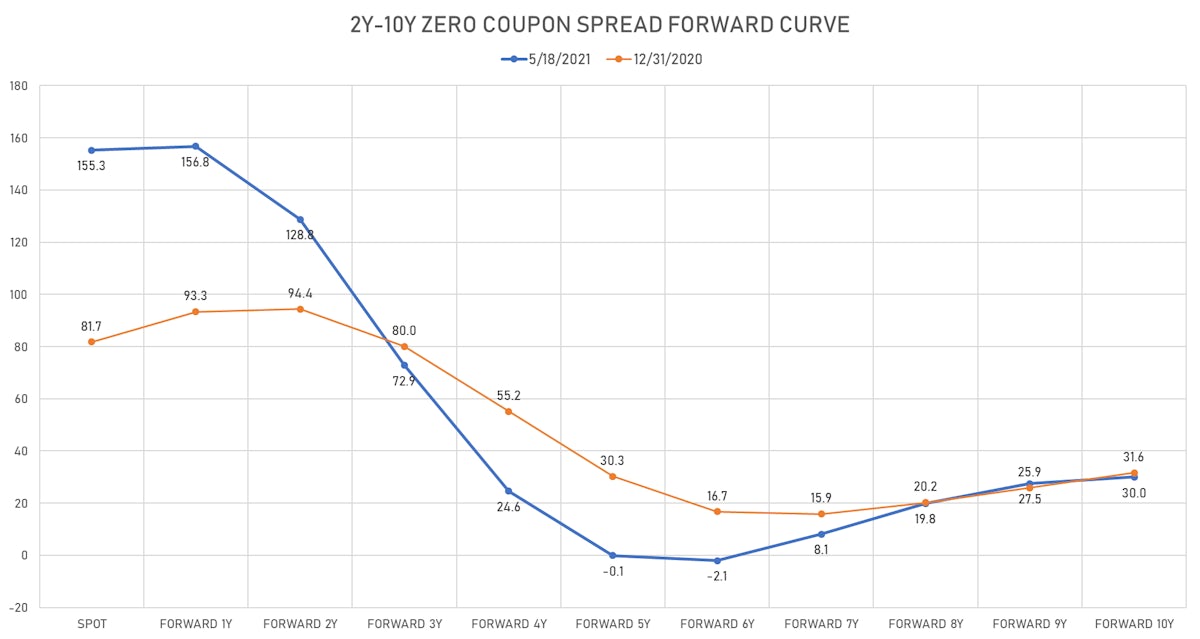

US FORWARD RATES

- 3-month USD Libor 5 years forward down 1.3 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 2.5 bp, now at 2.3358% (meaning that short-term rates are expected to increase by 227.1 bp over the next 5 years)

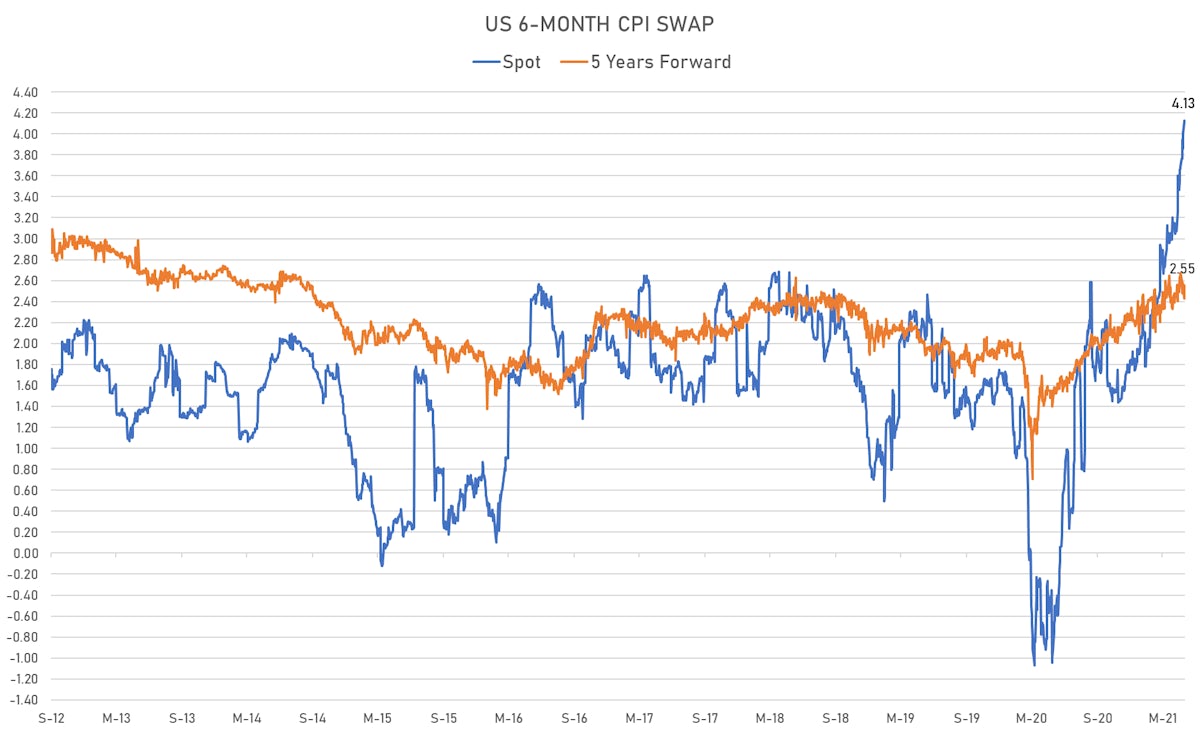

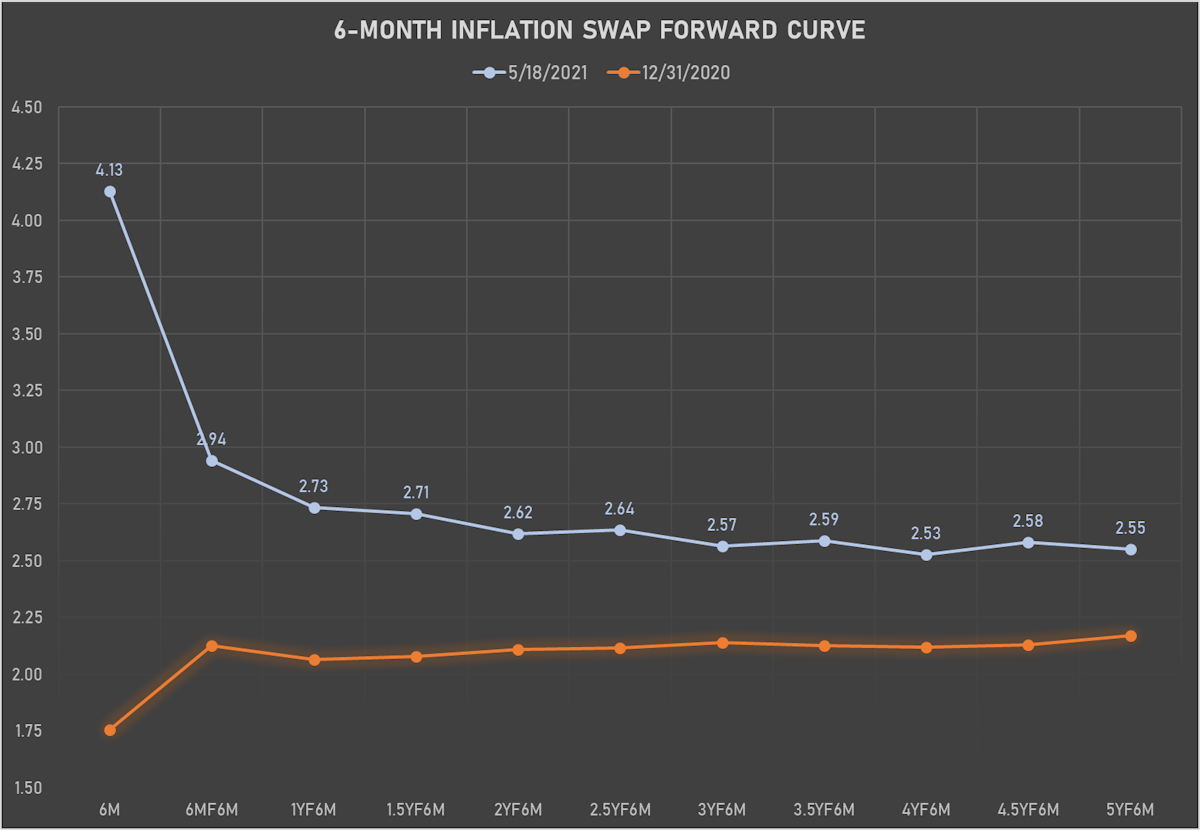

US INFLATION

- TIPS 1Y breakeven inflation at 3.36% (up 1.0bp); 2Y at 2.95% (down -0.5bp); 5Y at 2.78% (down -3.3bp); 10Y at 2.53% (down -1.3bp); 30Y at 2.39% (down -0.7bp)

- 6-month forward inflation swap up 1.8 bp to 4.129%, at a record premium over the 5-year forward

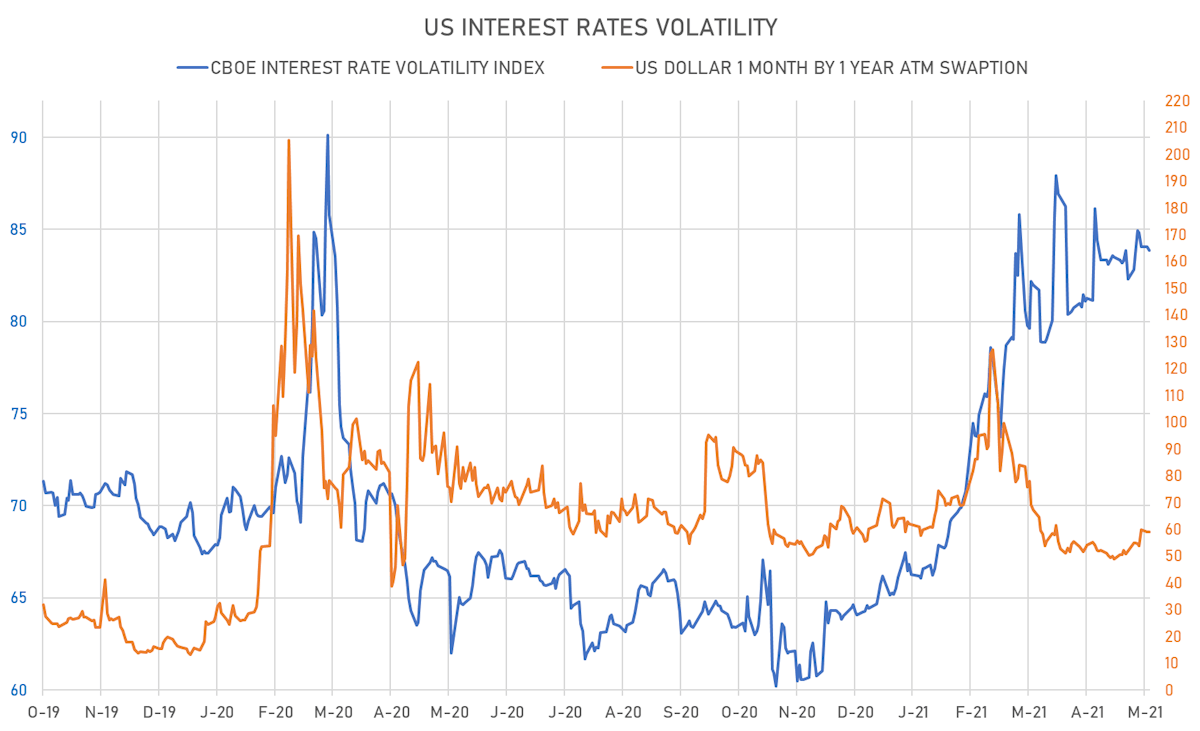

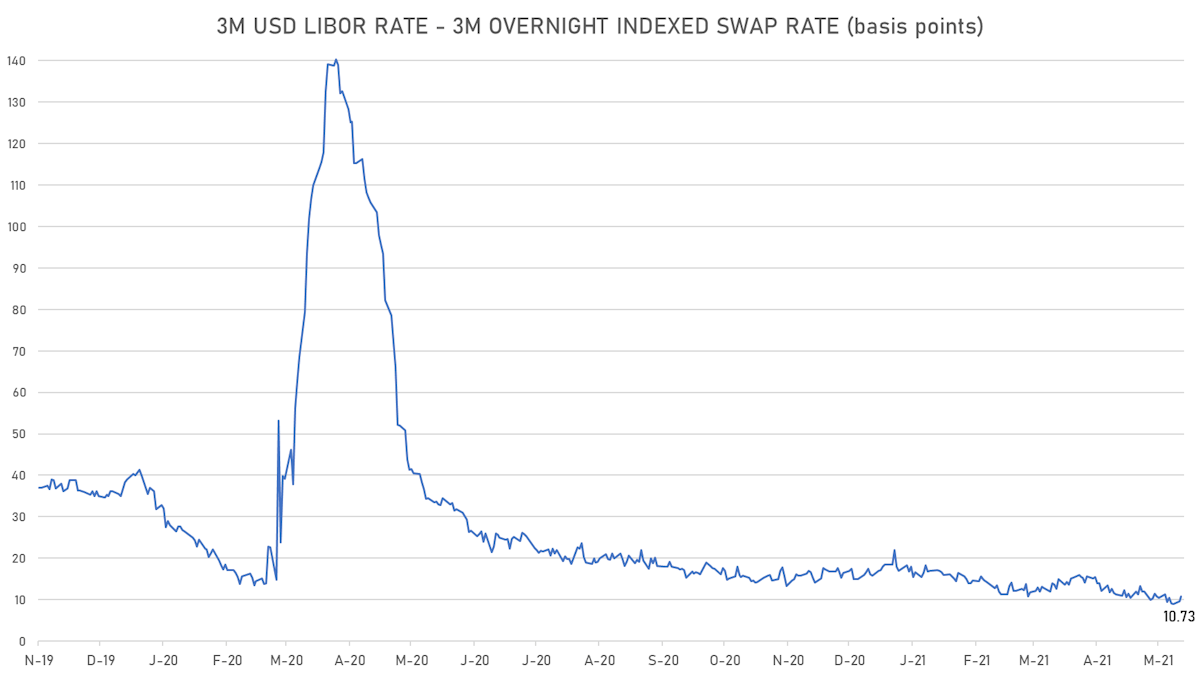

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.7% at 59.0%

- 3-Month LIBOR-OIS spread up 1.1 bp at 10.7 bp (12-months range: 9.0-34.4 bp)

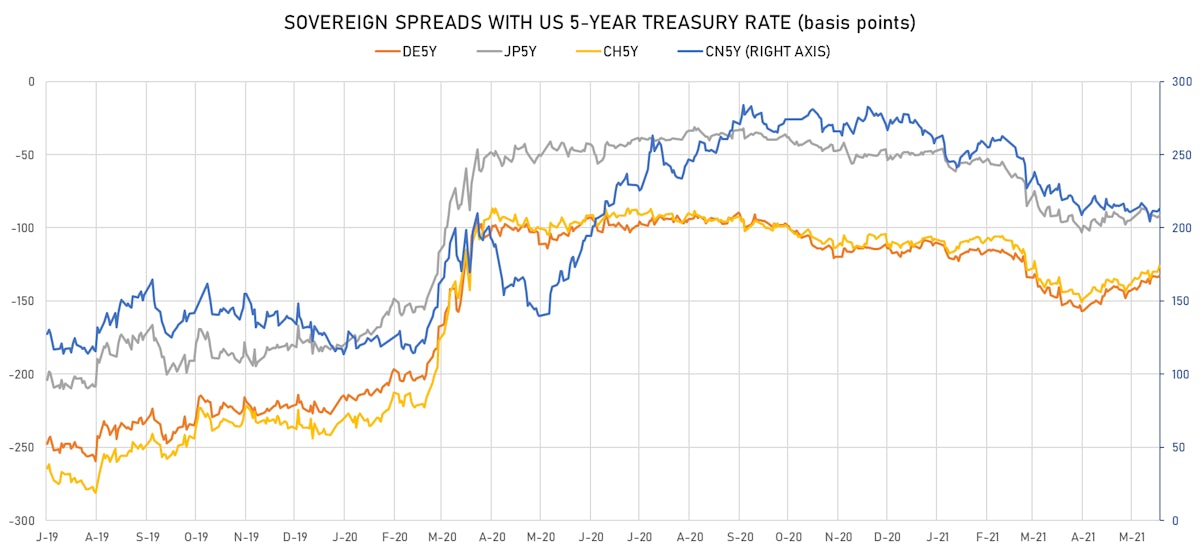

KEY INTERNATIONAL RATES

- Germany 5Y: -0.501% (unchanged); the German 1Y-10Y curve is 2.1 bp steeper at 53.5bp (YTD change: +37.7 bp)

- Japan 5Y: -0.087% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 19.8bp (YTD change: +5.8 bp)

- China 5Y: 2.946% (up 0.3 bp); the Chinese 1Y-10Y curve is 0.9 bp flatter at 56.9bp (YTD change: +10.5 bp)

- Switzerland 5Y: -0.438% (up 3.4 bp); the Swiss 1Y-10Y curve is 0.2 bp steeper at 67.7bp (YTD change: +41.3 bp)