Rates

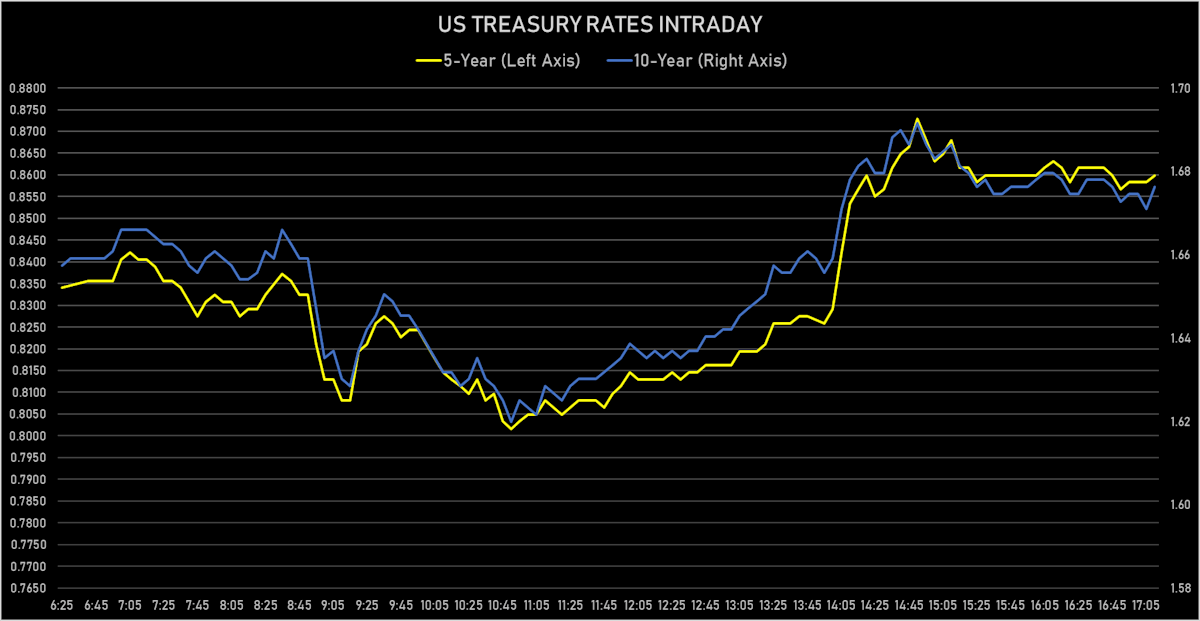

US Rates Rise Most In The Belly Of The Curve As FOMC Participants Suggest Taper Discussion Could Start Soon

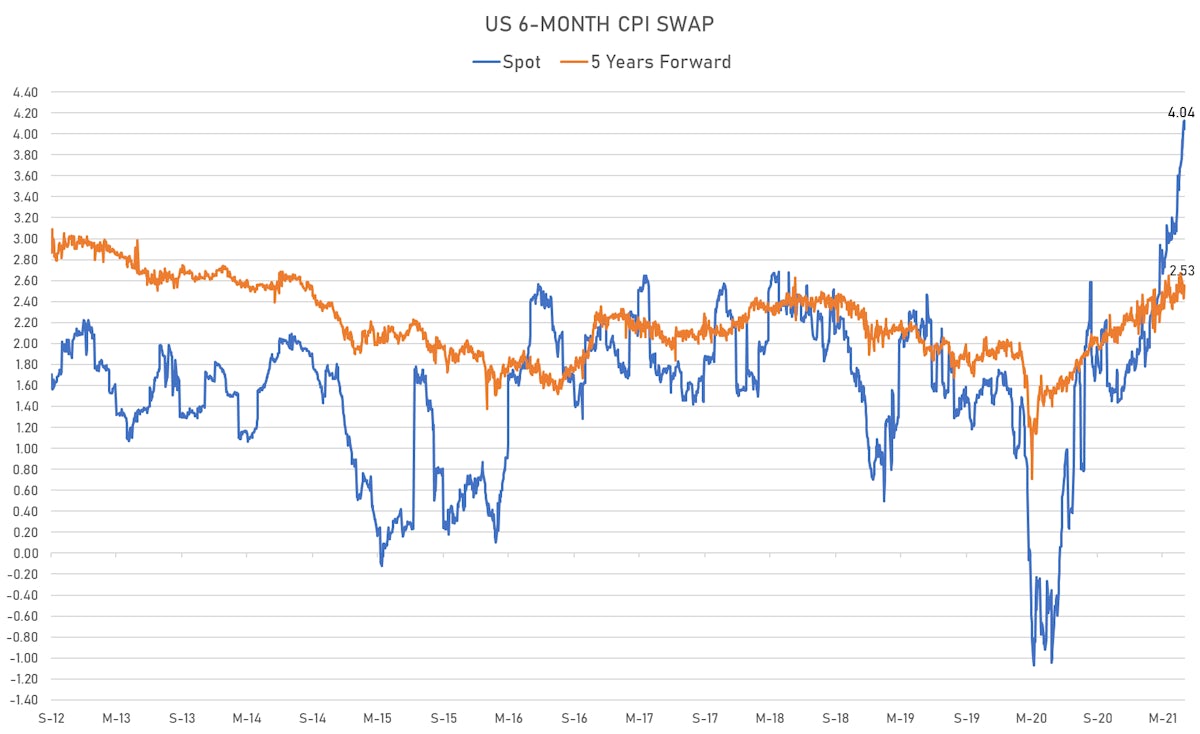

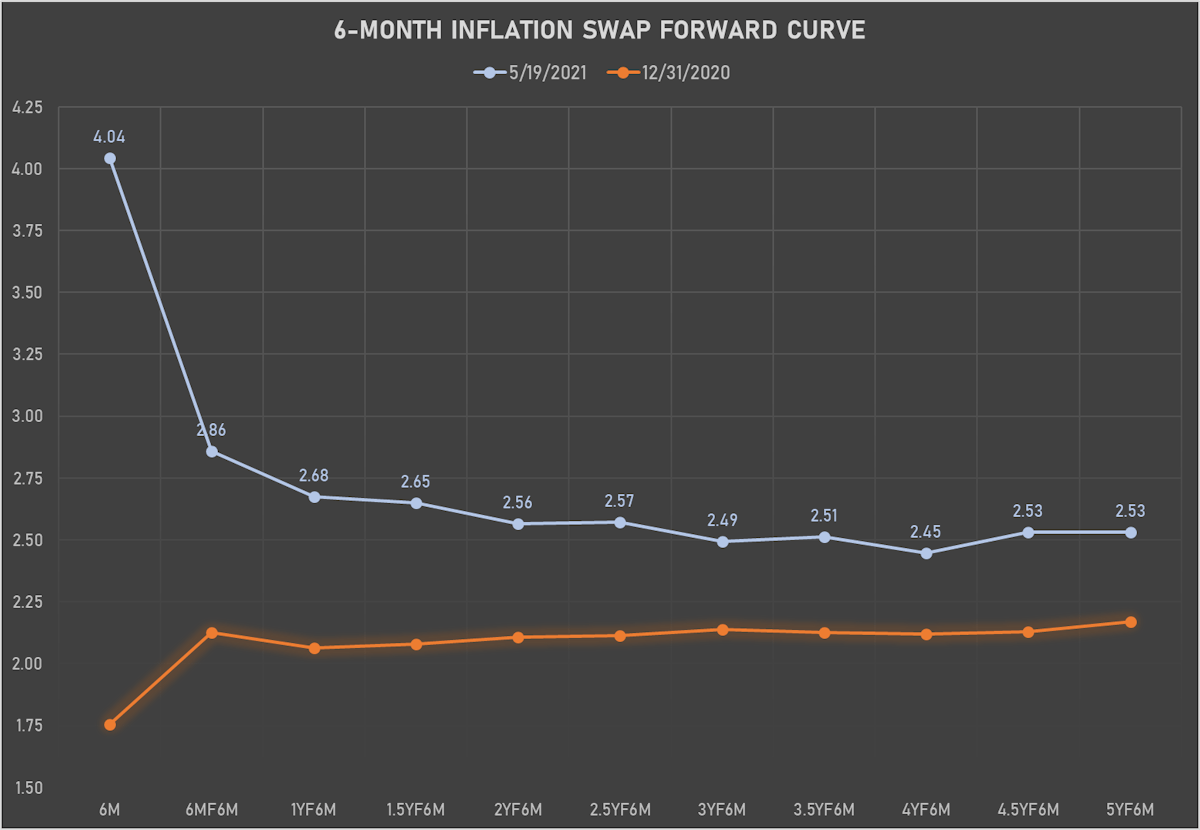

Short-term inflation expectations drop back slightly, but the 6-month CPI swap is still above 4%

Published ET

QUICK US SUMMARY

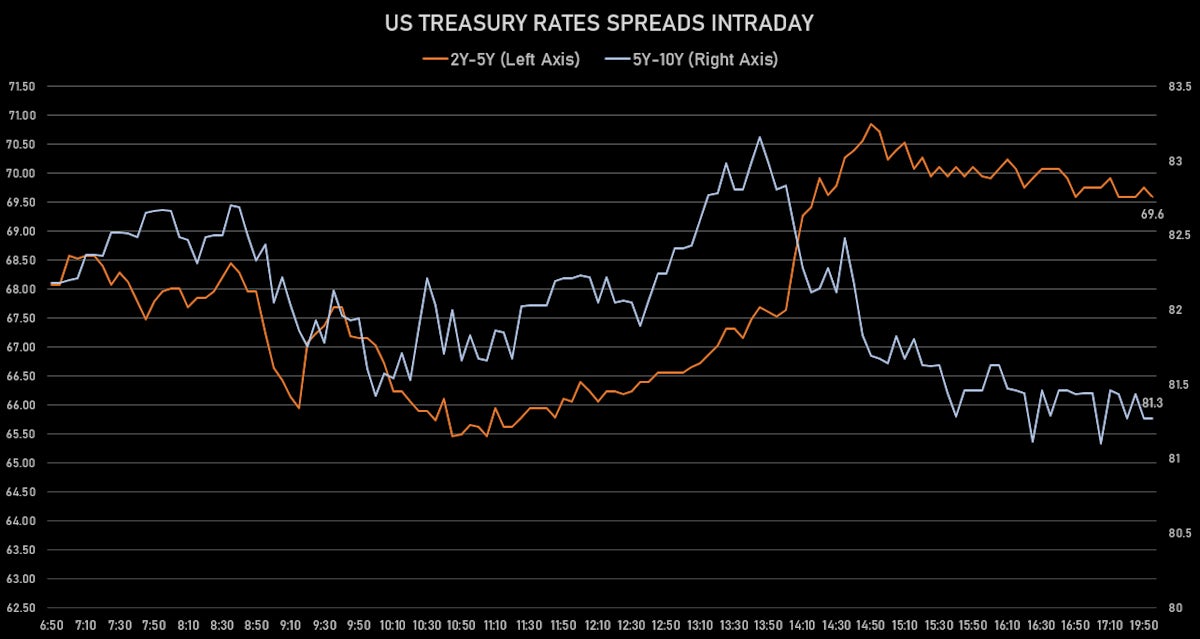

- Yield curve steepening, with the 1Y-10Y spread widening 3.6 bp on the day, now at 162.8 bp (YTD change: +82.4)

- 1Y: 0.0480% (unchanged)

- 2Y: 0.1592% (up 0.8 bp)

- 5Y: 0.8599% (up 4.1 bp)

- 7Y: 1.3267% (up 4.3 bp)

- 10Y: 1.6762% (up 3.6 bp)

- 30Y: 2.3750% (up 1.3 bp)

US MACRO RELEASES

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 14 May (MBA, USA) at 1.2

- Mortgage applications, market composite index for W 14 May (MBA, USA) at 724.2

- Mortgage applications, market composite index, purchase for W 14 May (MBA, USA) at 265.3

- Mortgage applications, market composite index, refinancing for W 14 May (MBA, USA) at 3,413.3

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 14 May (MBA, USA) at 3.2

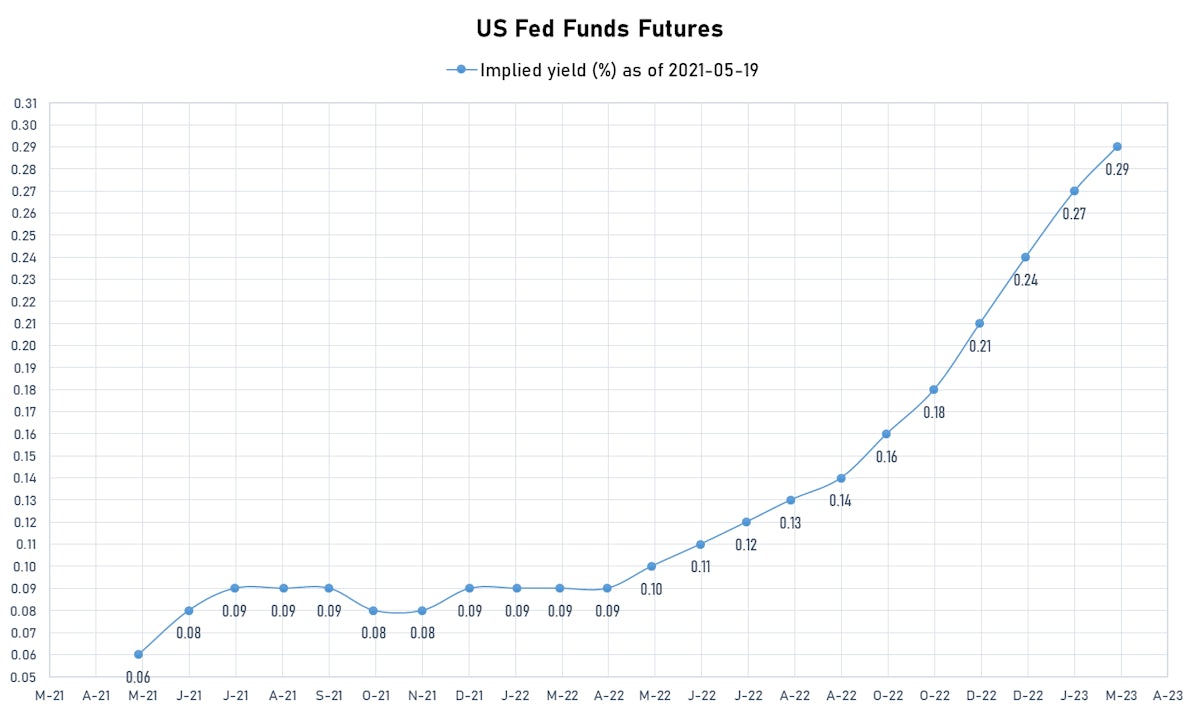

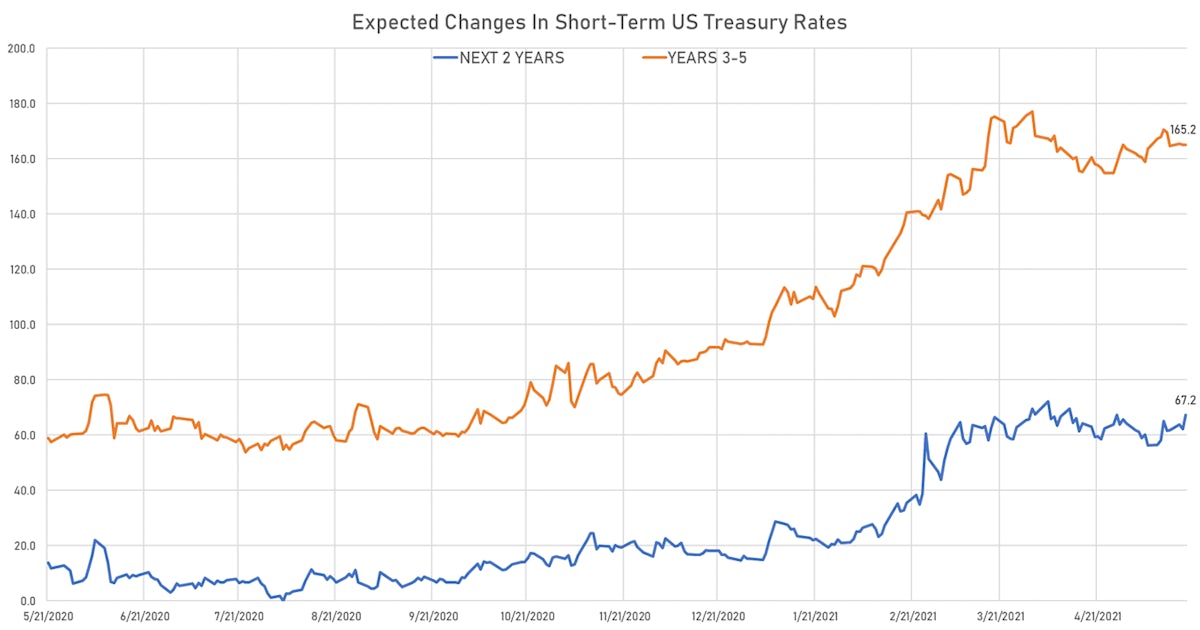

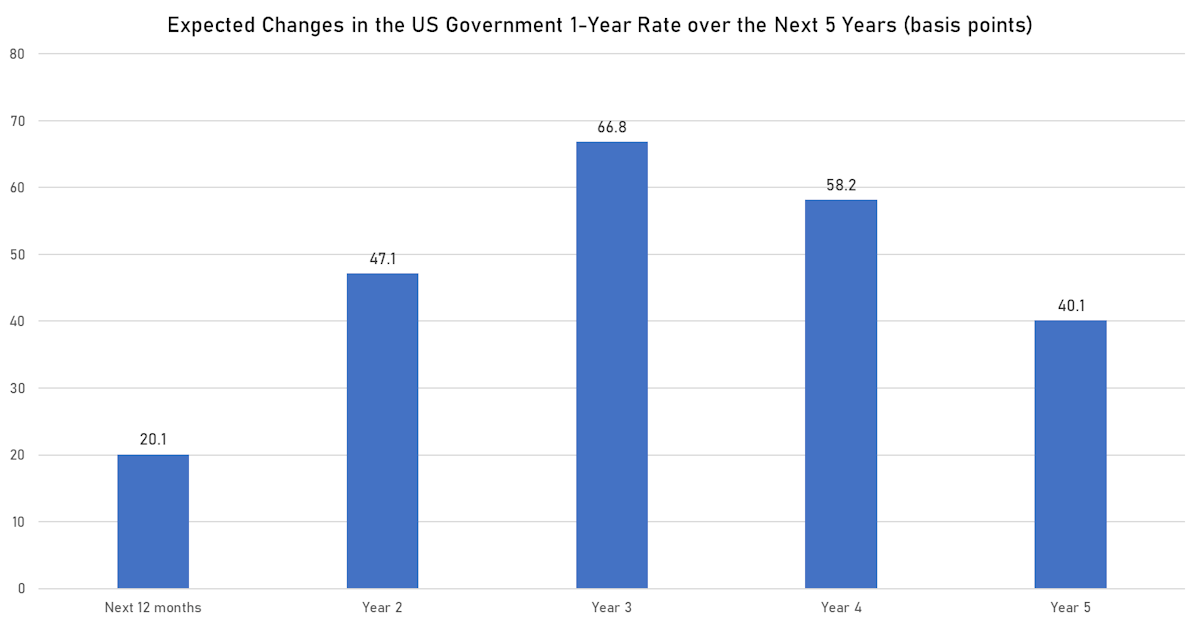

US FORWARD RATES

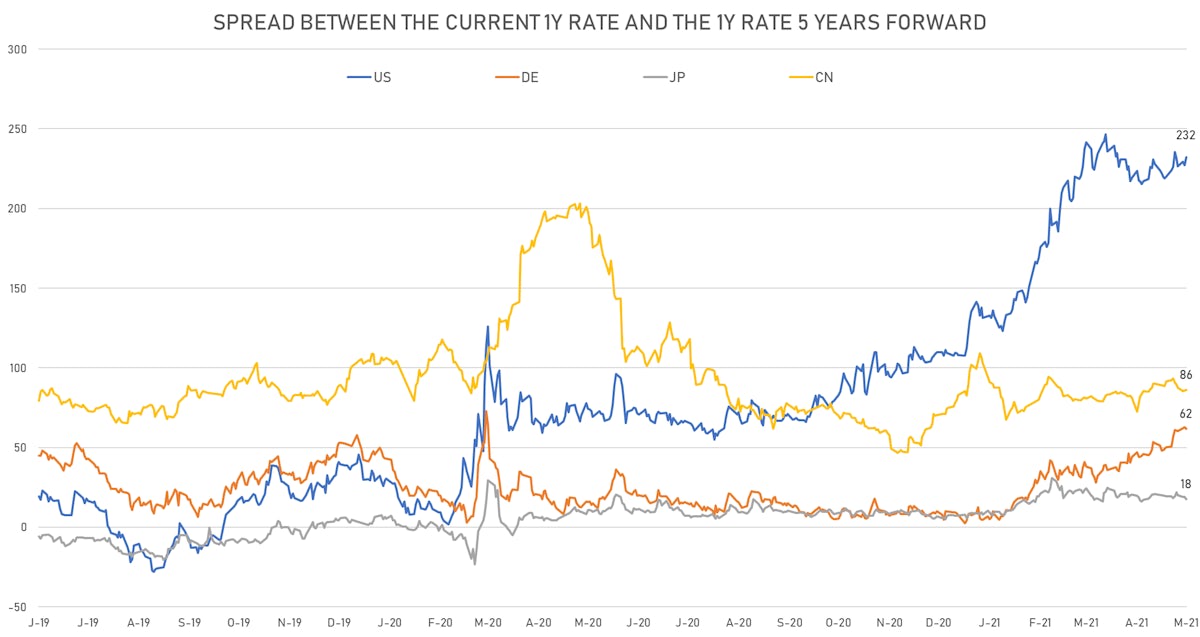

- 3-month USD Libor 5 years forward up 5.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 5.2 bp, now at 2.3877%

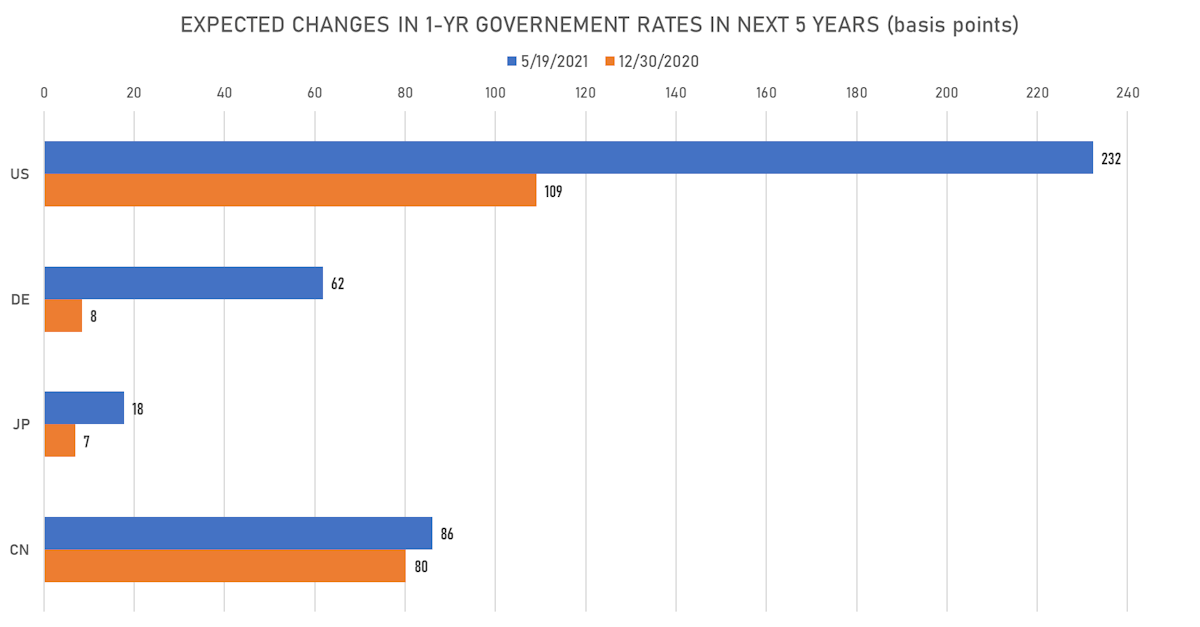

- Short-term rates are expected to increase by 232.4 bp over the next 5 years, starting in Q4 2022

US INFLATION

- TIPS 1Y breakeven inflation at 3.22% (down -14.6bp); 2Y at 2.83% (down -11.7bp); 5Y at 2.69% (down -8.8bp); 10Y at 2.47% (down -5.6bp); 30Y at 2.35% (down -3.1bp)

- 6-month forward inflation swap down -8.6 bp to 4.04%

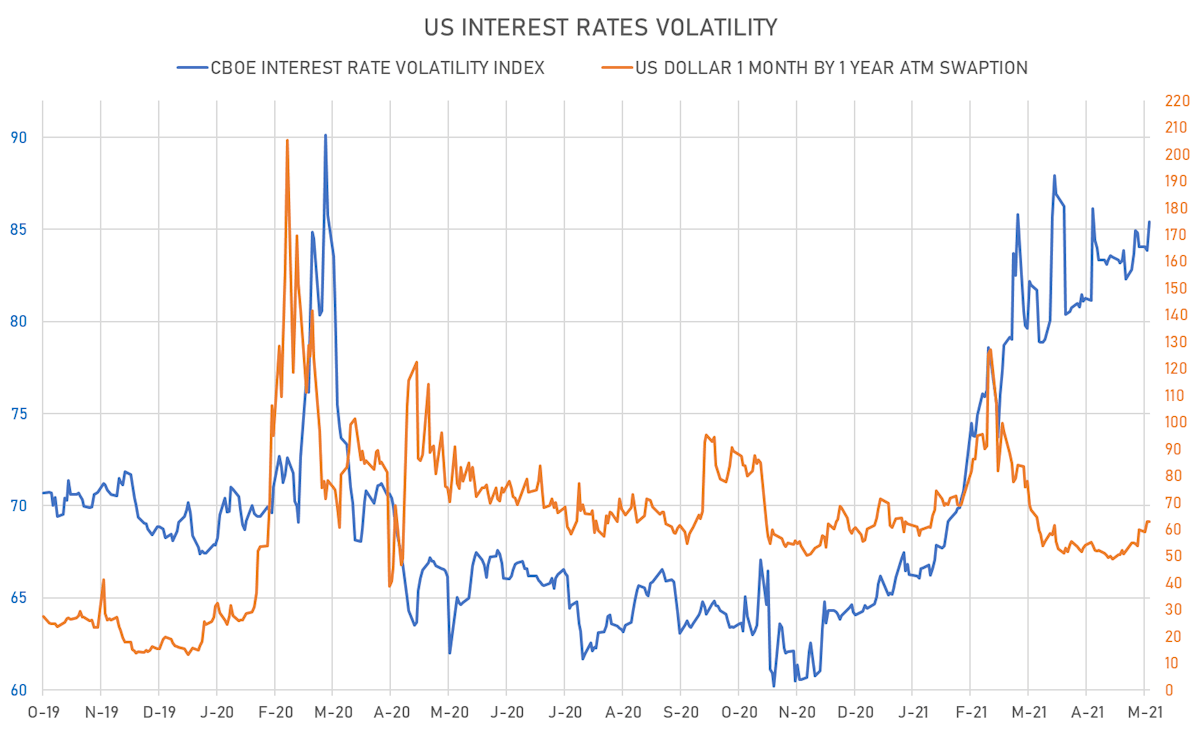

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.9% at 62.9%

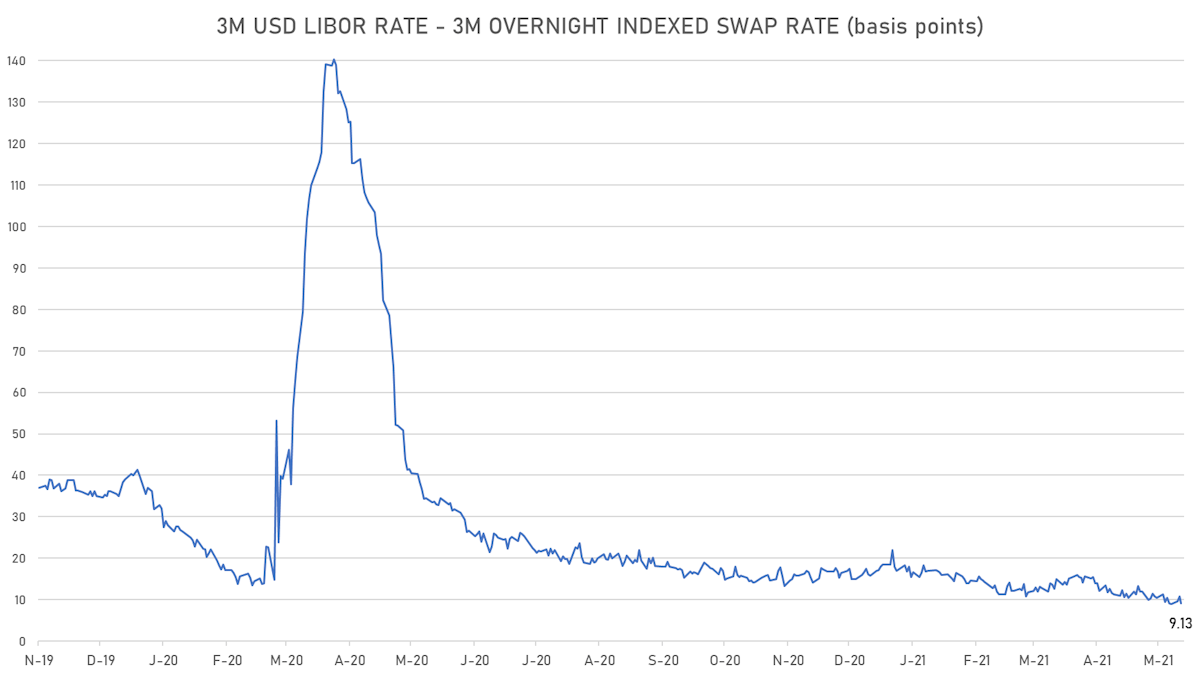

- 3-Month LIBOR-OIS spread down -1.6 bp at 9.1 bp (12-months range: 9.0-34.4 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.495% (up 0.5 bp); the German 1Y-10Y curve is 2.0 bp flatter at 51.4bp (YTD change: +35.7 bp)

- Japan 5Y: -0.091% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.4 bp flatter at 20.3bp (YTD change: +5.4 bp)

- China 5Y: 2.929% (down -1.7 bp); the Chinese 1Y-10Y curve is 0.1 bp flatter at 56.8bp (YTD change: +10.4 bp)

- Switzerland 5Y: -0.478% (down -4.0 bp); the Swiss 1Y-10Y curve is 2.5 bp flatter at 65.2bp (YTD change: +38.8 bp)