Rates

Another Batch Of Disappointing US Macro Data Brings Rates Down

US inflation expectations fell again today, with the short-term CPI swaps down 12bp, now under 4%, and TIPS breakevens falling across the curve

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

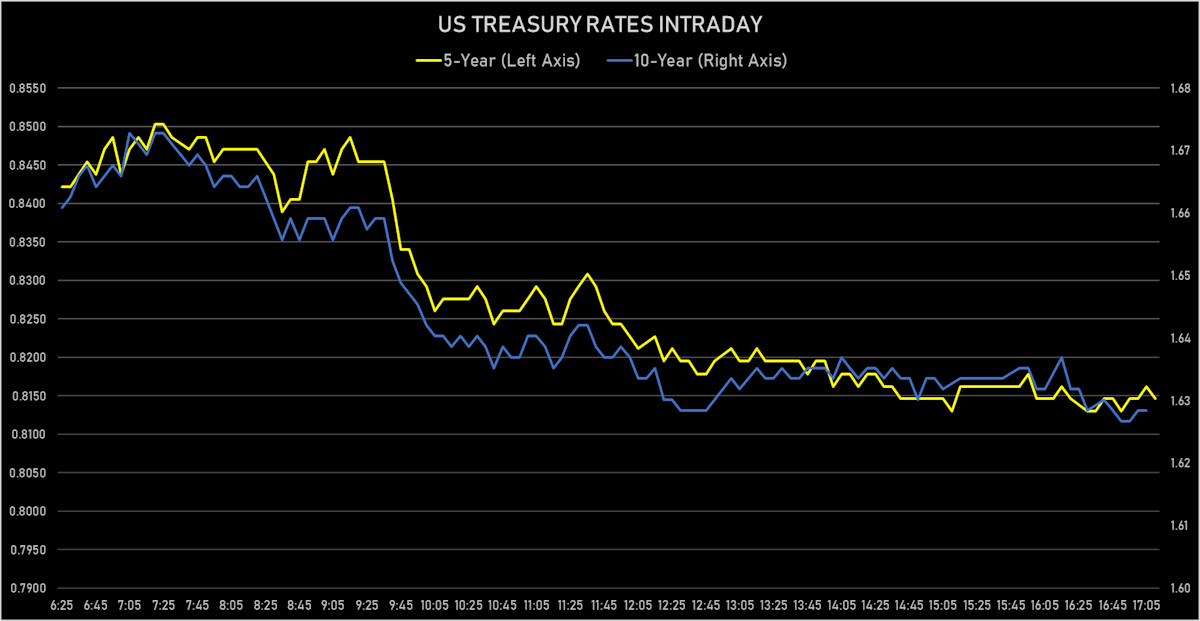

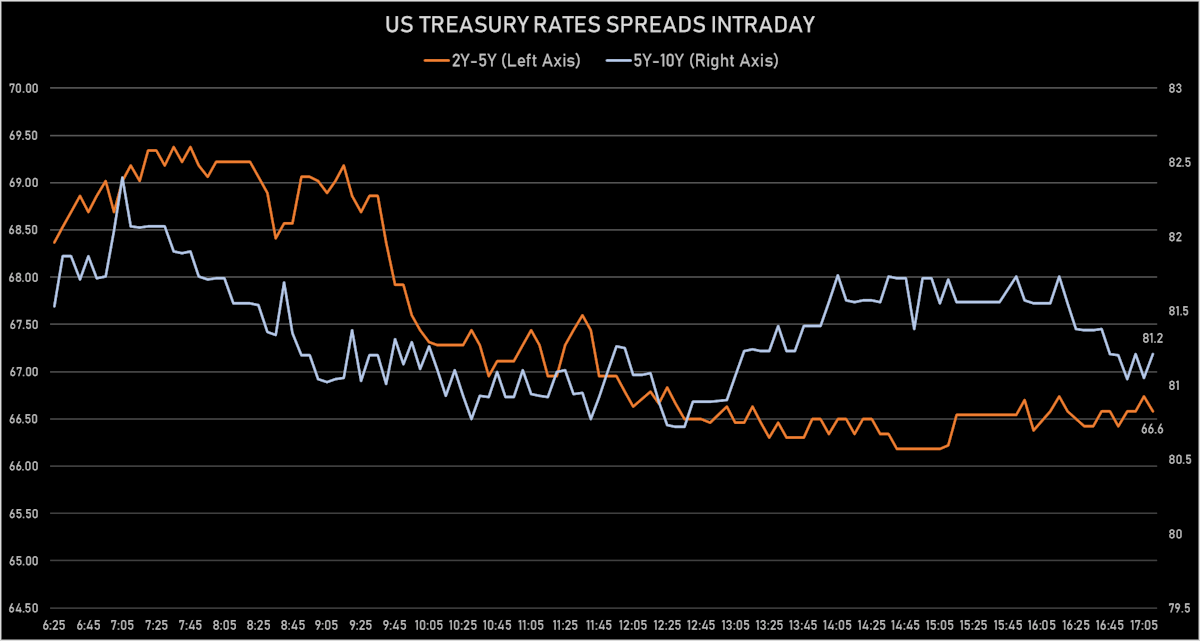

- Yield curve flattening, with the 1Y-10Y spread tightening -4.1 bp on the day, now at 158.7 bp (YTD change: +78.3)

- 1Y: 0.0410% (down 0.7 bp)

- 2Y: 0.1472% (down 1.2 bp)

- 5Y: 0.8146% (down 4.5 bp)

- 7Y: 1.2783% (down 4.8 bp)

- 10Y: 1.6284% (down 4.8 bp)

- 30Y: 2.3335% (down 4.2 bp)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 08 May (U.S. Dept. of Labor) at 3.8, above consensus estimate of 3.6

- Jobless Claims, National, Initial for W 15 May (U.S. Dept. of Labor) at 444.0, below consensus estimate of 450.0

- Jobless Claims, National, Initial, four week moving average for W 15 May (U.S. Dept. of Labor) at 504.8

- Leading Index, Change P/P for Apr 2021 (The Conference Board) at 1.6, above consensus estimate of 1.4

- Philadelphia Fed, Future capital expenditures for May 2021 (FED, Philadelphia) at 37.4

- Philadelphia Fed, Future general business activity for May 2021 (FED, Philadelphia) at 52.7

- Philadelphia Fed, General business activity for May 2021 (FED, Philadelphia) at 31.5, below consensus estimate of 43.0

- Philadelphia Fed, New orders for May 2021 (FED, Philadelphia) at 32.5

- Philadelphia Fed, Number of employees for May 2021 (FED, Philadelphia) at 19.3

- Philadelphia Fed, Prices paid for May 2021 (FED, Philadelphia) at 76.8

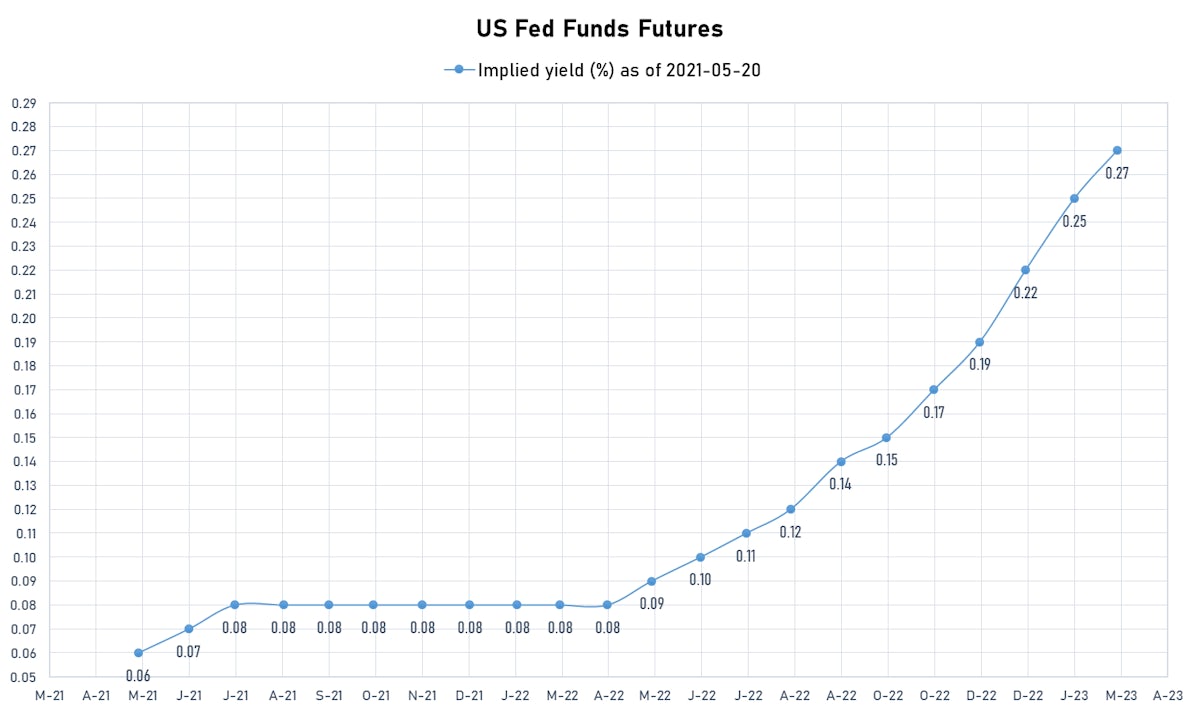

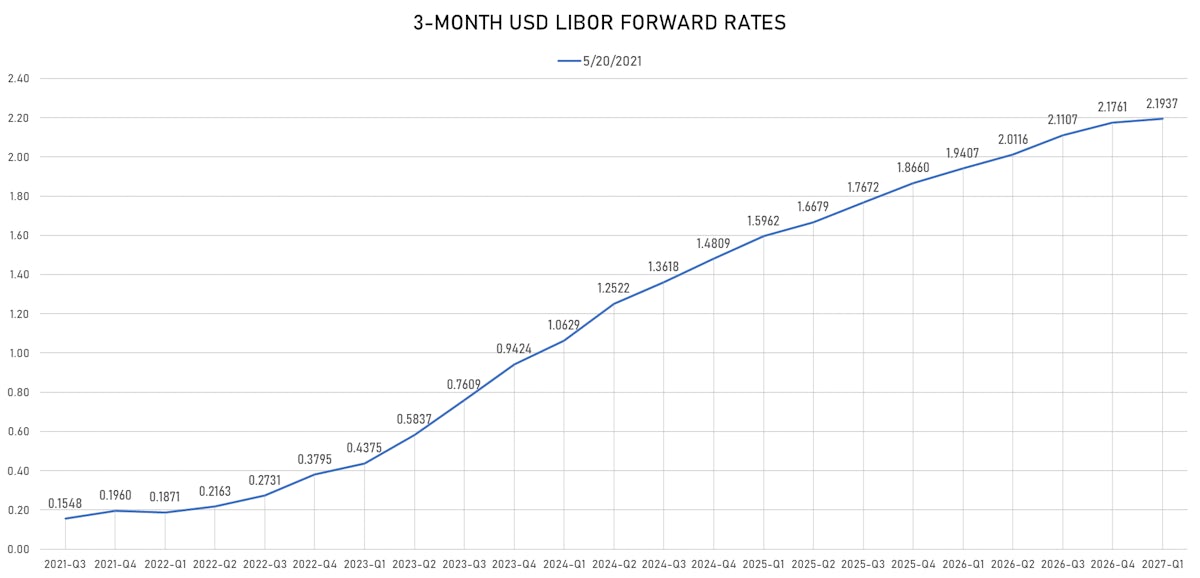

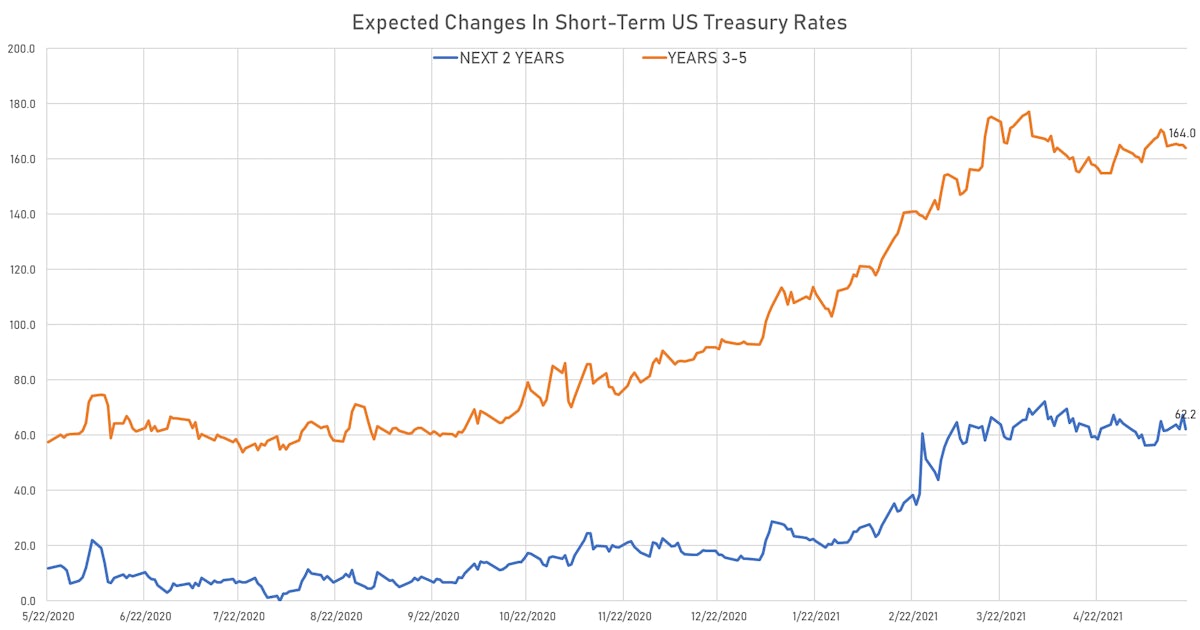

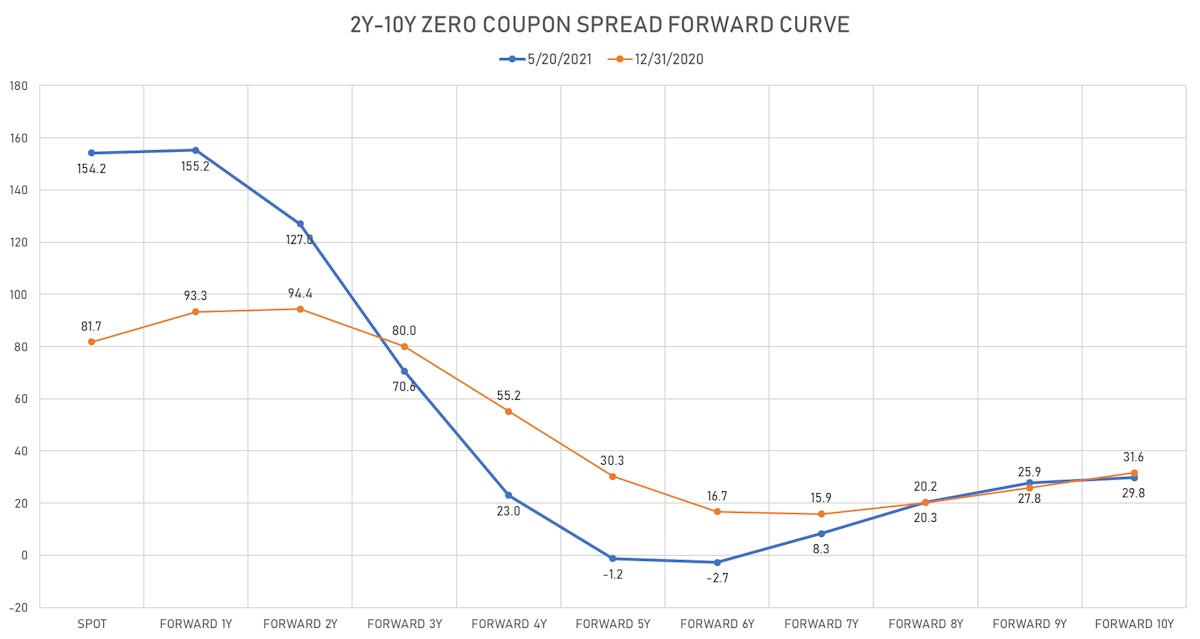

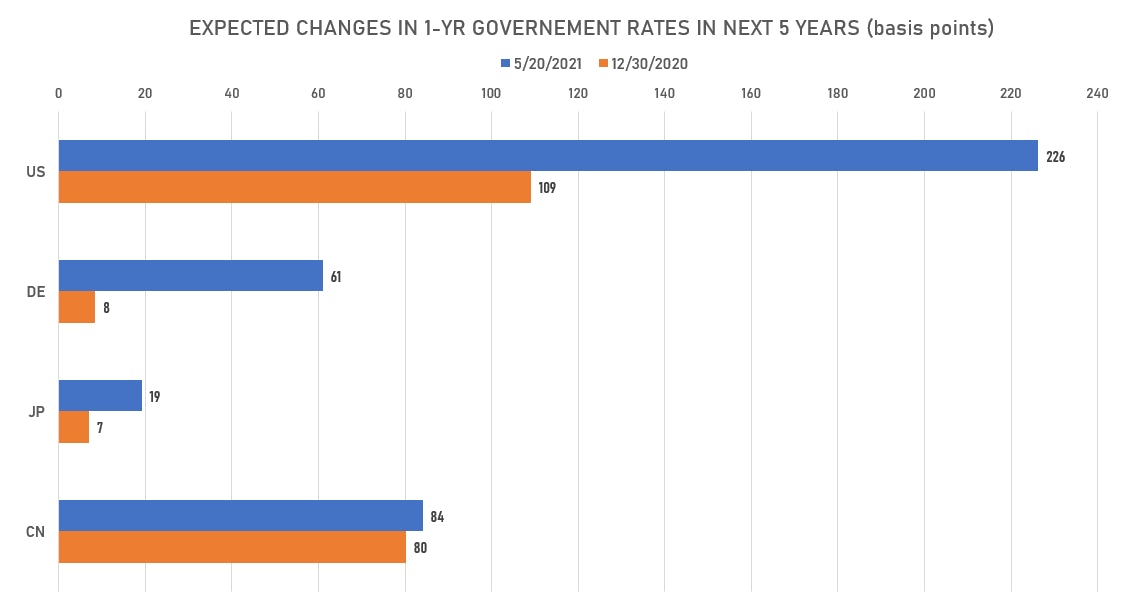

US FORWARD RATES

- 3-month USD Libor 5 years forward down 8.3 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 6.7 bp, now at 2.3210%

- Short-term rates are now expected to increase by 226.2 bp over the next 5 years

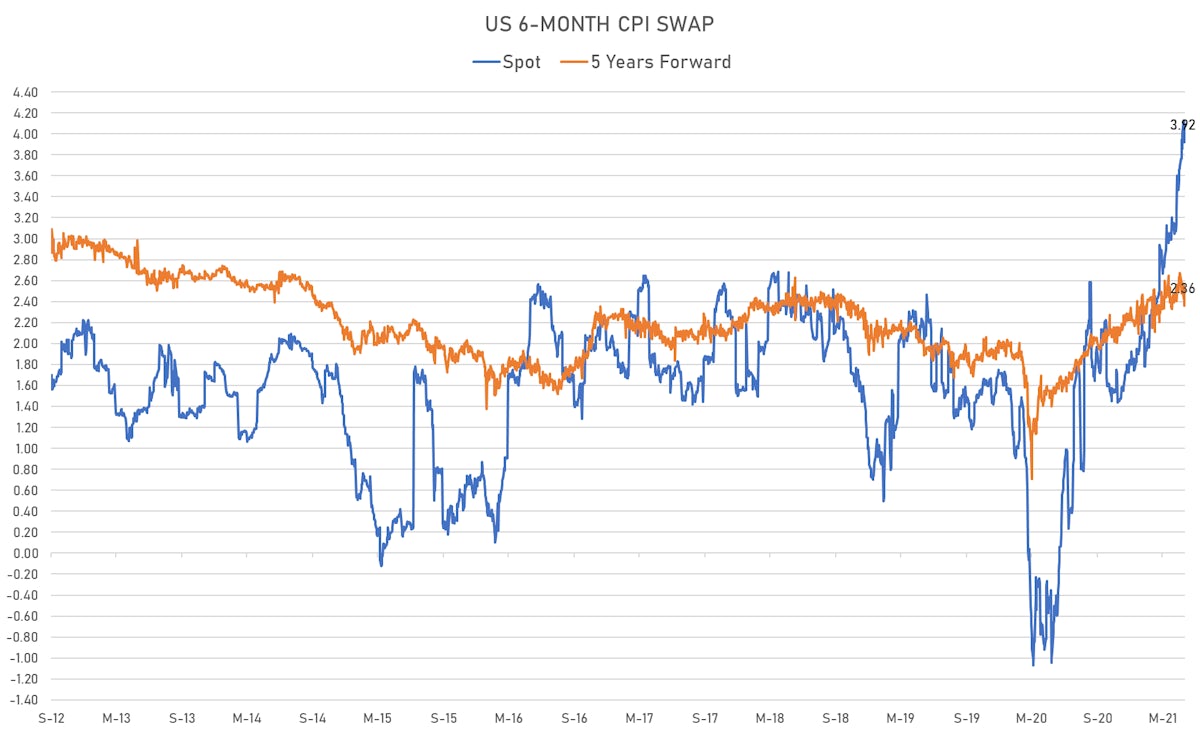

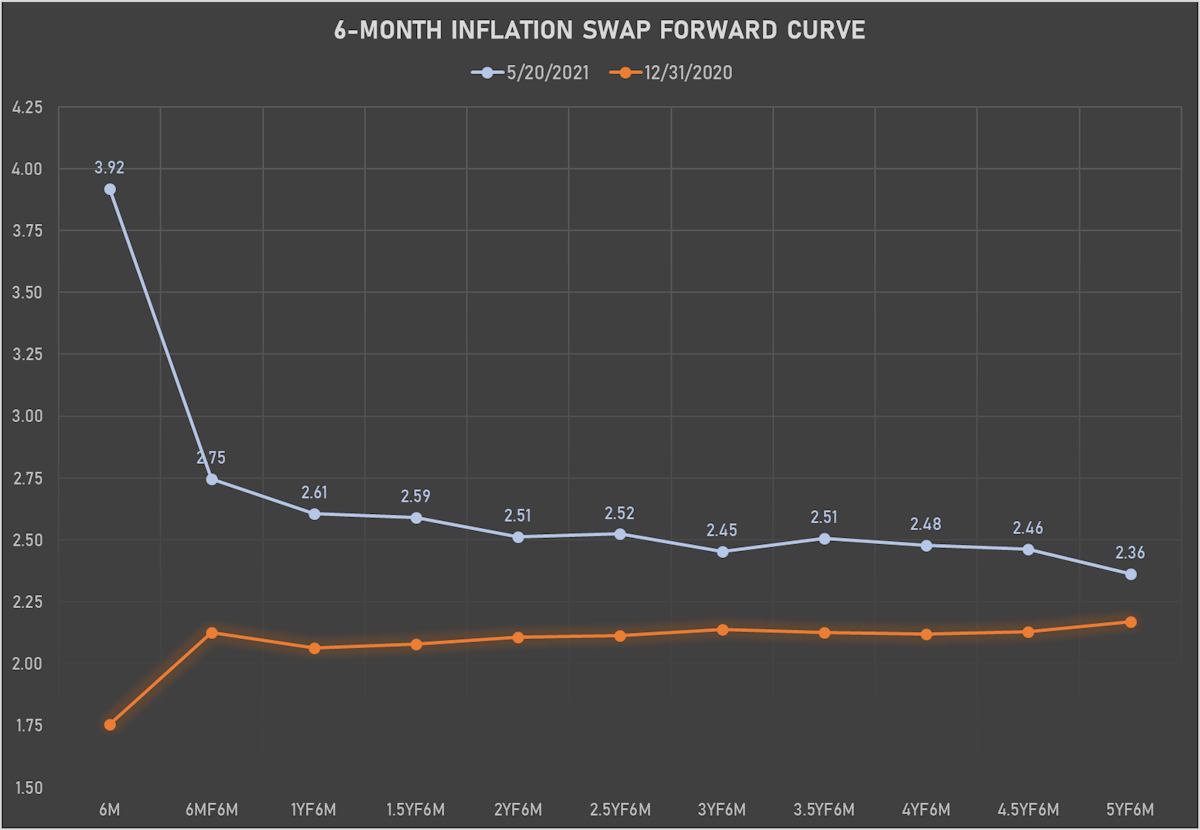

US INFLATION

- TIPS 1Y breakeven inflation at 3.14% (down -7.4bp); 2Y at 2.78% (down -5.3bp); 5Y at 2.63% (down -5.4bp); 10Y at 2.43% (down -4.3bp); 30Y at 2.32% (down -3.8bp)

- 6-month forward inflation swap down -12.4 bp to 3.92%

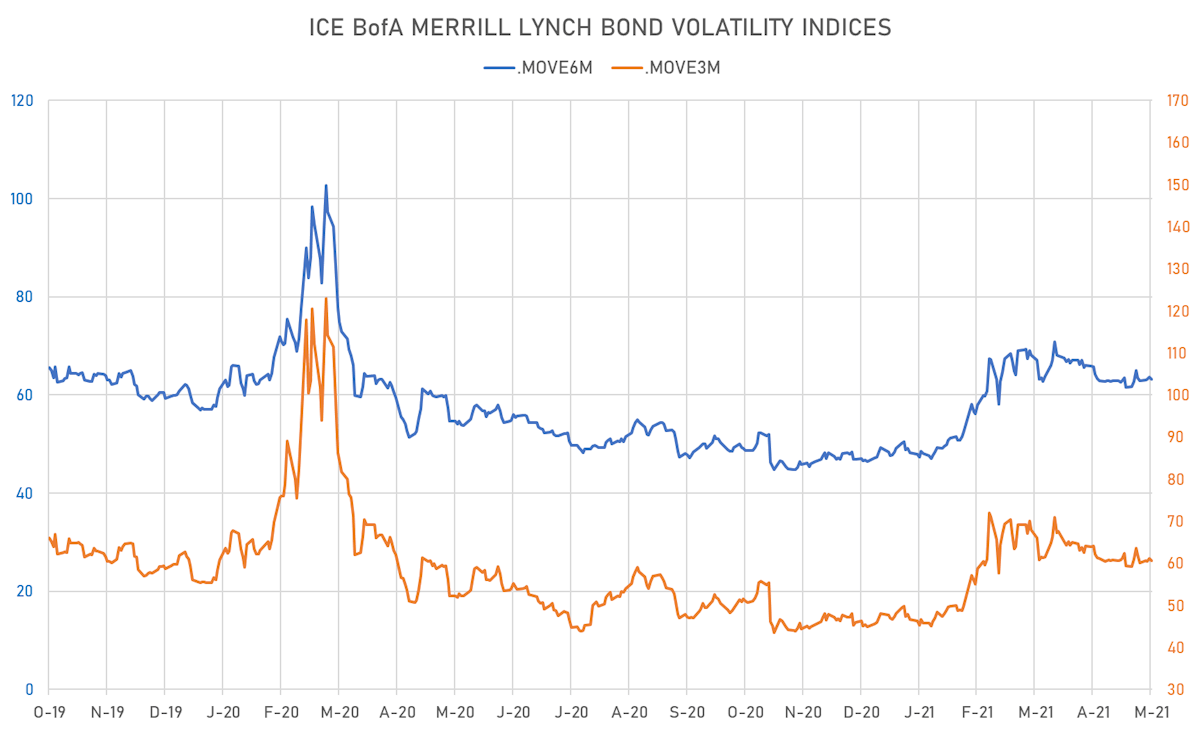

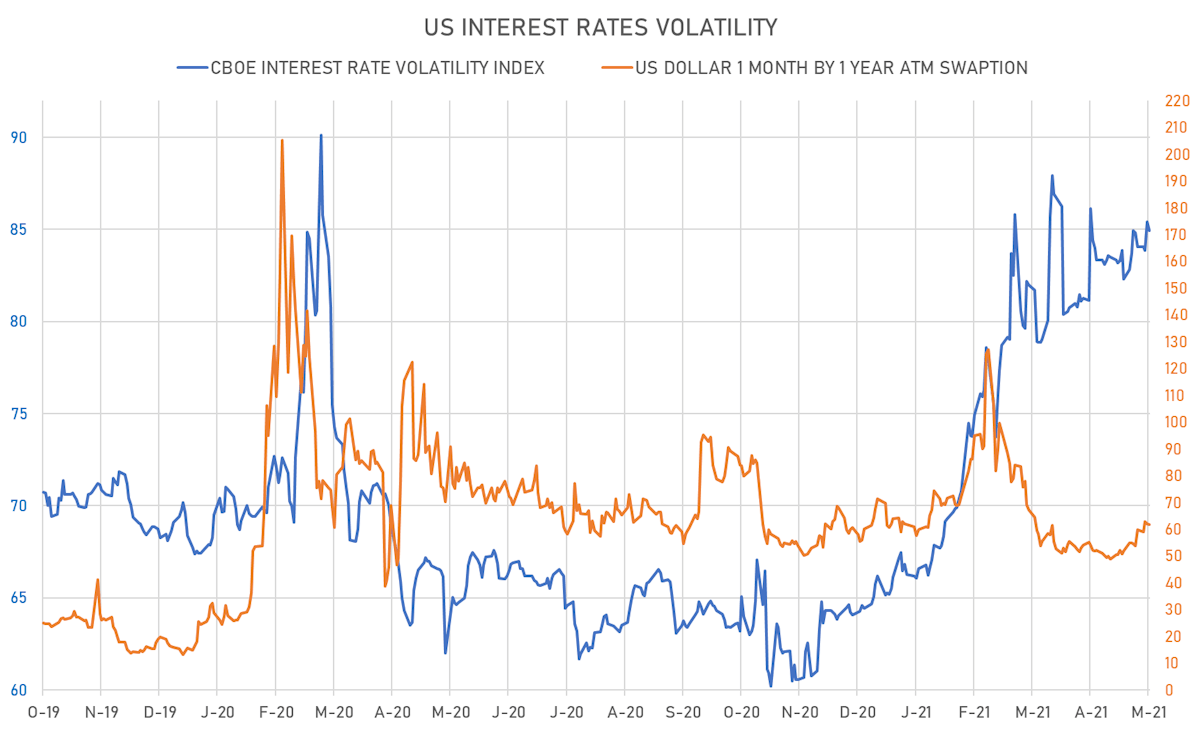

RATES VOLATILITY & LIQUIDITY

- Volatility falls slightly: USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.0% at 61.8%

- Ample liquidity: 3-Month LIBOR-OIS spread down -0.6 bp at 8.5 bp at lowest level of the past year (12-months range: 8.5-34.4 bp)

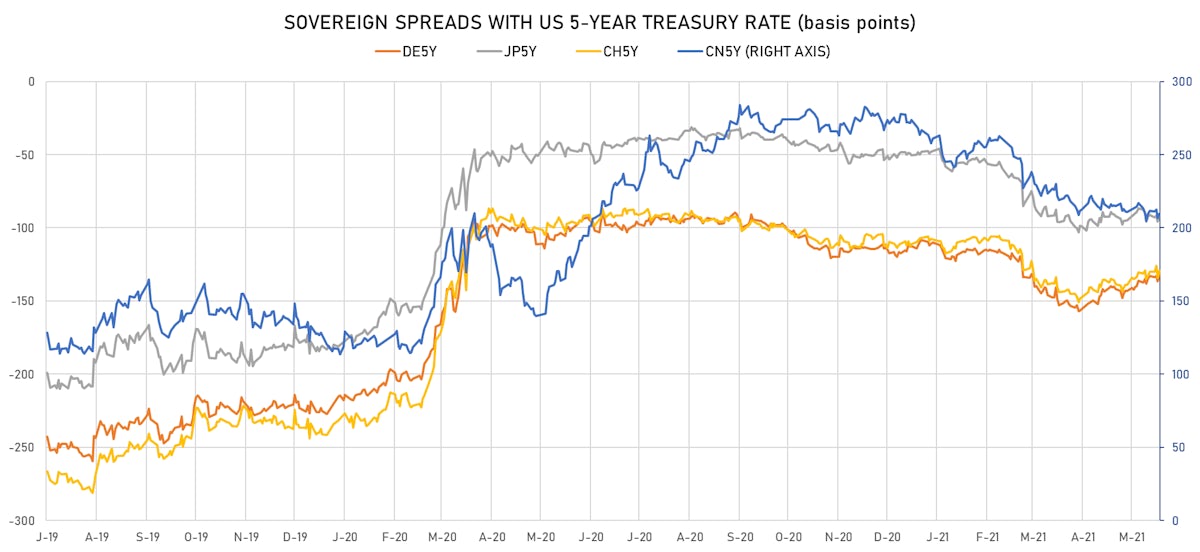

KEY INTERNATIONAL RATES

- International markets are still trailing the US by a wide margin in terms of forward rates expectations (and implied rate hikes), though recent macro data has allowed a tightening of the differential

- Germany 5Y: -0.498% (up 0.7 bp); the German 1Y-10Y curve is 0.8 bp steeper at 51.7bp (YTD change: +36.5 bp)

- Japan 5Y: -0.082% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp steeper at 20.3bp (YTD change: +5.7 bp)

- China 5Y: 2.912% (down -1.7 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 56.5bp (YTD change: +10.1 bp)

- Switzerland 5Y: -0.478% (down 0.0 bp); the Swiss 1Y-10Y curve is 2.3 bp flatter at 59.9bp (YTD change: +36.5 bp)