Rates

US Rates Curve And Inflation Forward Curve Flatter In Uneventful Friday Session

Home sales weak again, hurting the narrative of a booming housing market: sales peaked in October 2020 and applications for mortgages have now dropped 19% between January and April 2021

Published ET

US TIPS Breakeven Curve Steepened This Week | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

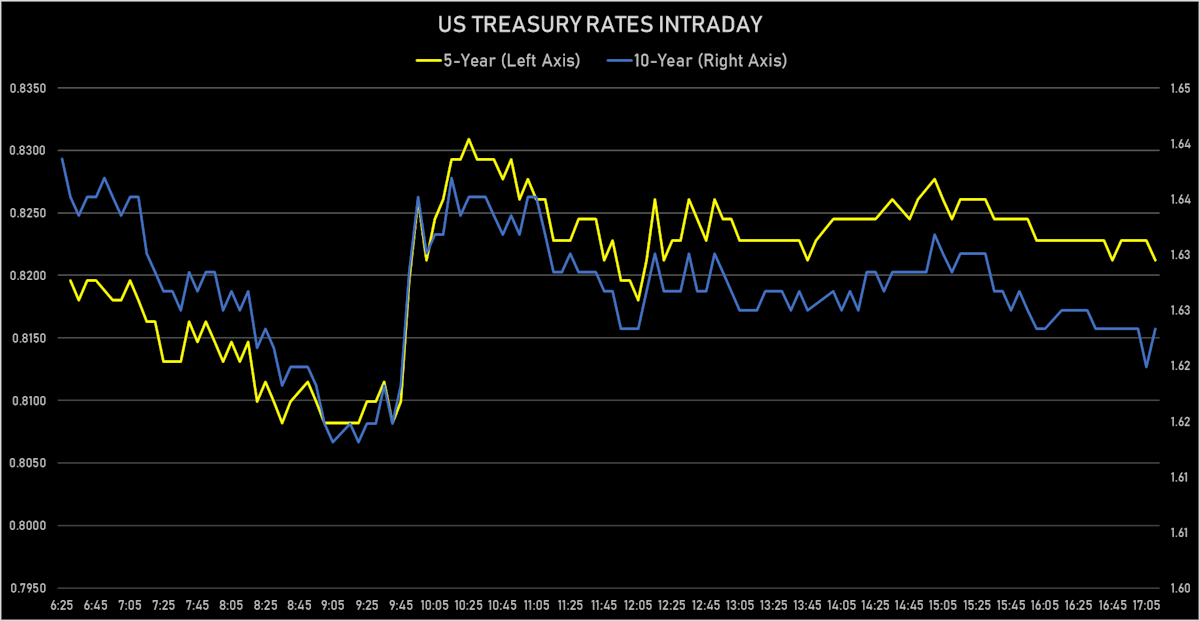

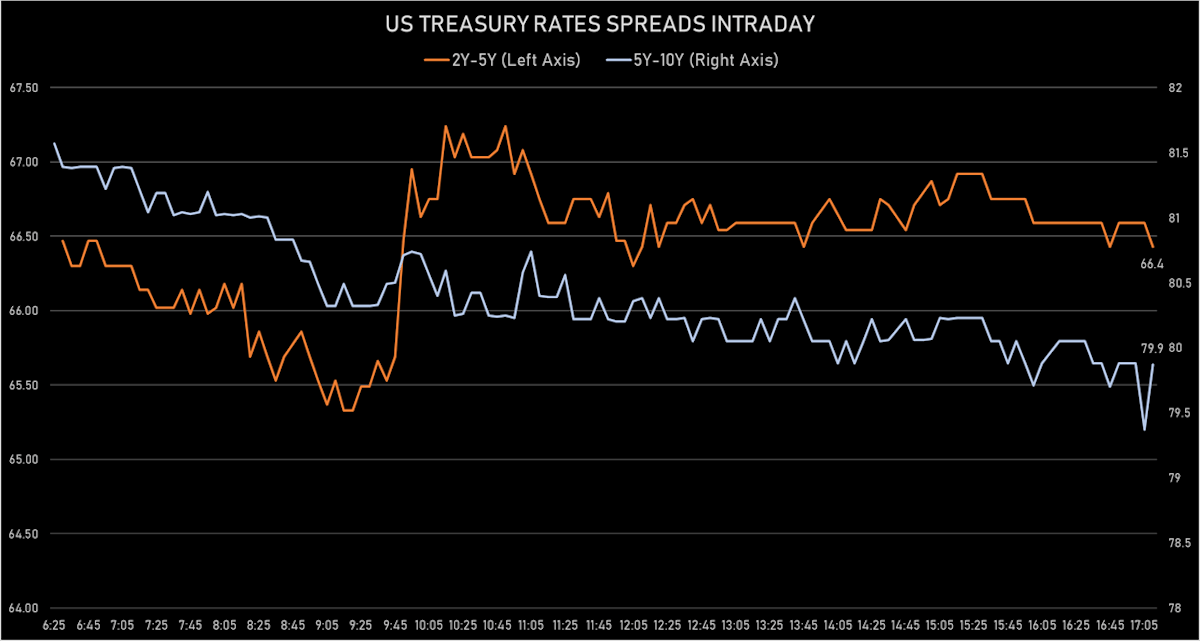

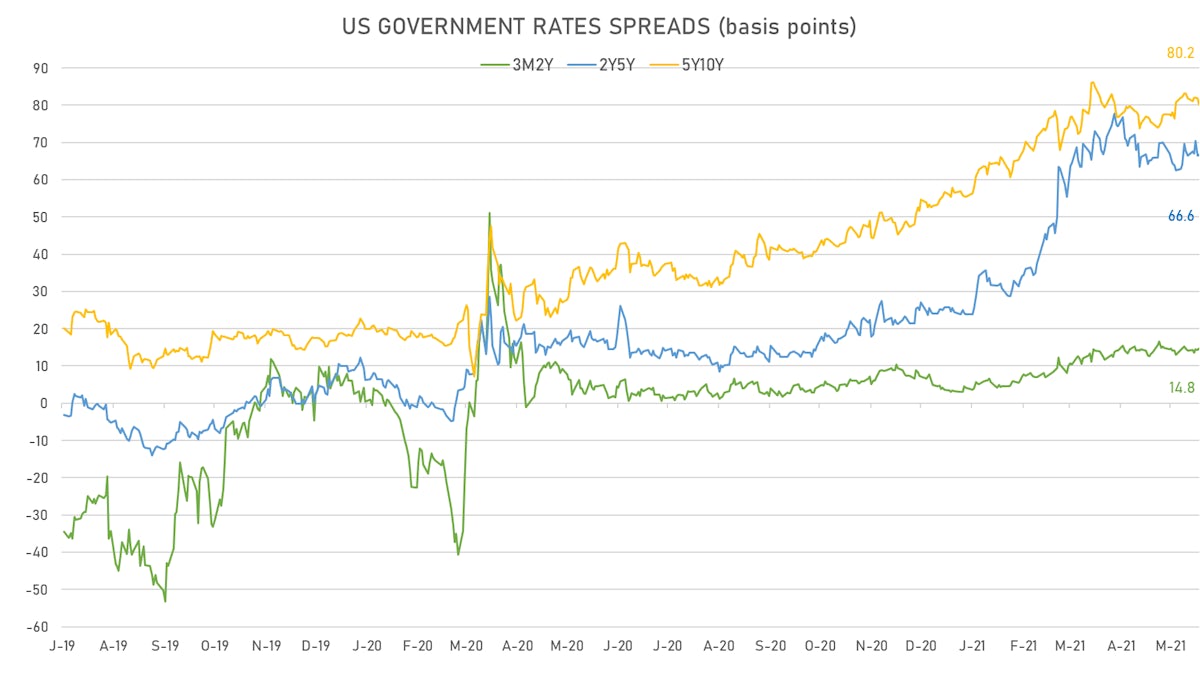

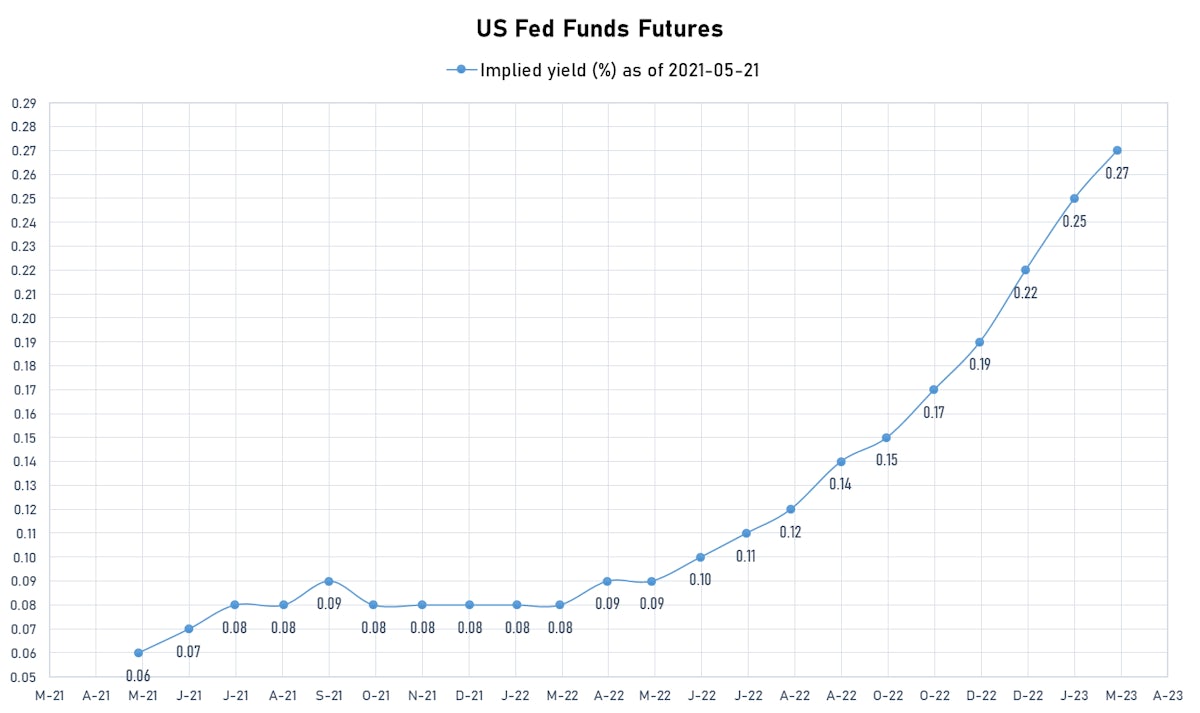

- Yield curve flattening, with the 1Y-10Y spread tightening -0.5 bp on the day, now at 158.2 bp (YTD change: +77.8)

- 1Y: 0.0410% (unchanged 0.0 bp)

- 2Y: 0.1553% (up 0.8 bp)

- 5Y: 0.8212% (up 0.7 bp)

- 7Y: 1.2795% (up 0.1 bp)

- 10Y: 1.6233% (down 0.5 bp)

- 30Y: 2.3176% (down 1.6 bp)

US MACRO RELEASES

- Existing-Home Sales, Single-Family and Condos, total for Apr 2021 (NAR, United States) at 5.9, below consensus estimate of 6.1

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Apr 2021 (NAR, United States) at -2.7, below consensus estimate of 2.0

- PMI, Composite, Output, Flash for May 2021 (Markit Economics) at 68.1

- PMI, Manufacturing Sector, Total, Flash for May 2021 (Markit Economics) at 61.5, above consensus estimate of 60.2

- PMI, Services Sector, Business Activity, Flash for May 2021 (Markit Economics) at 70.1, above consensus estimate of 64.5

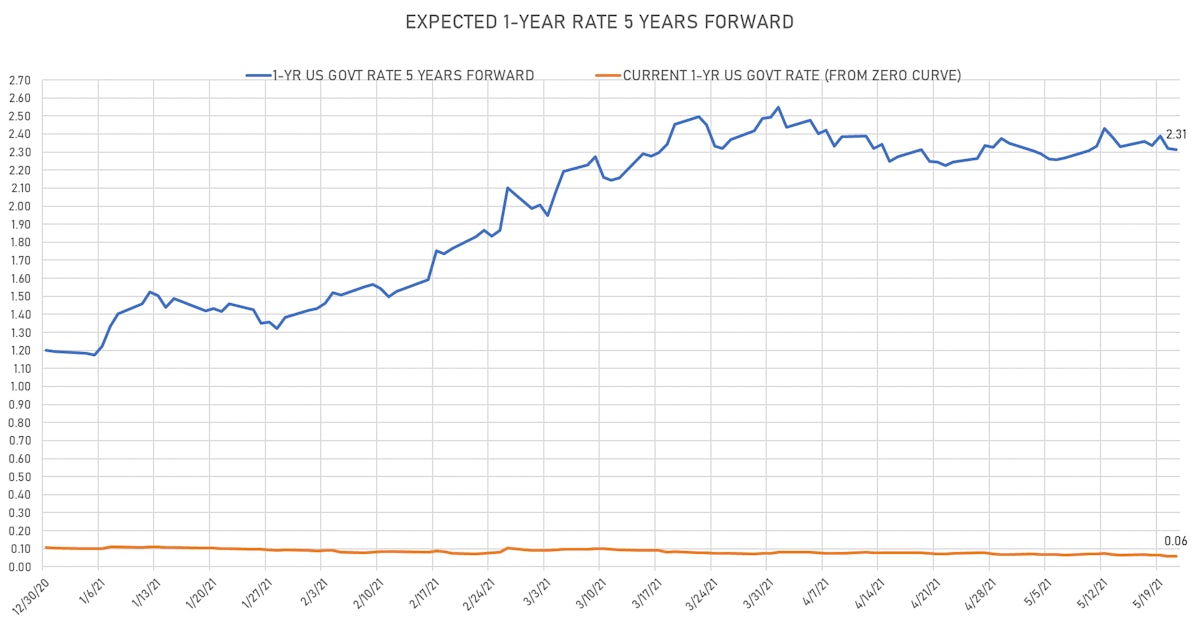

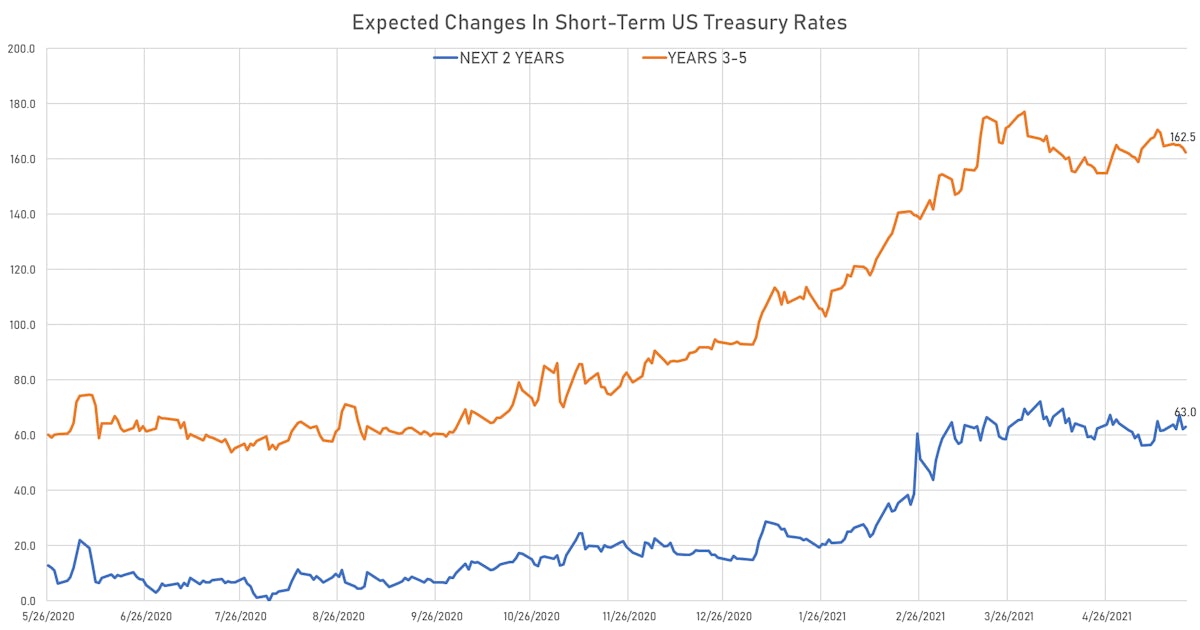

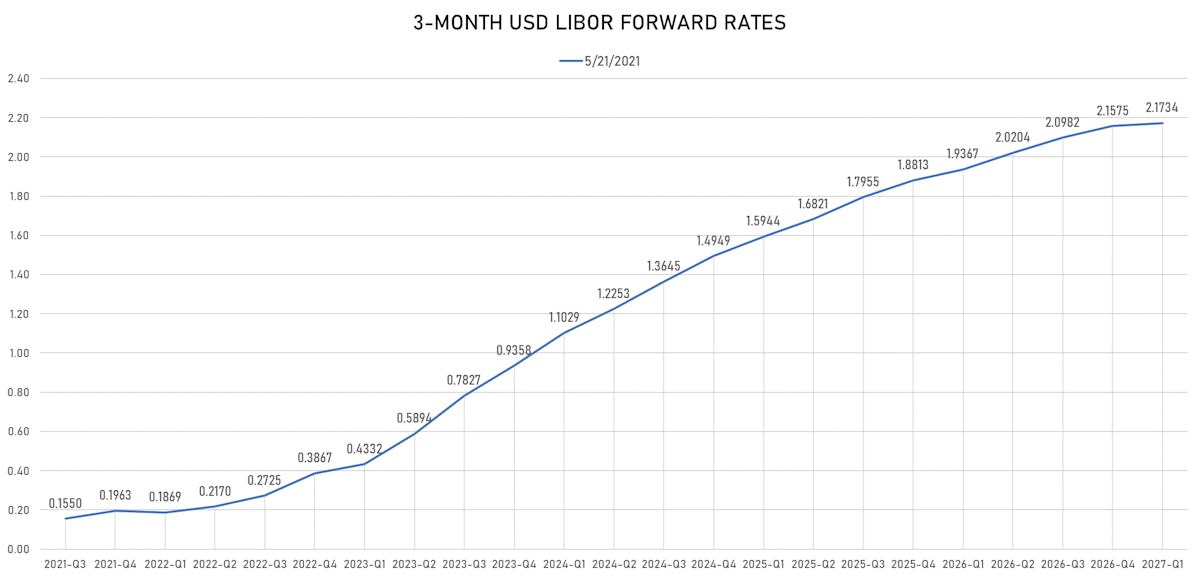

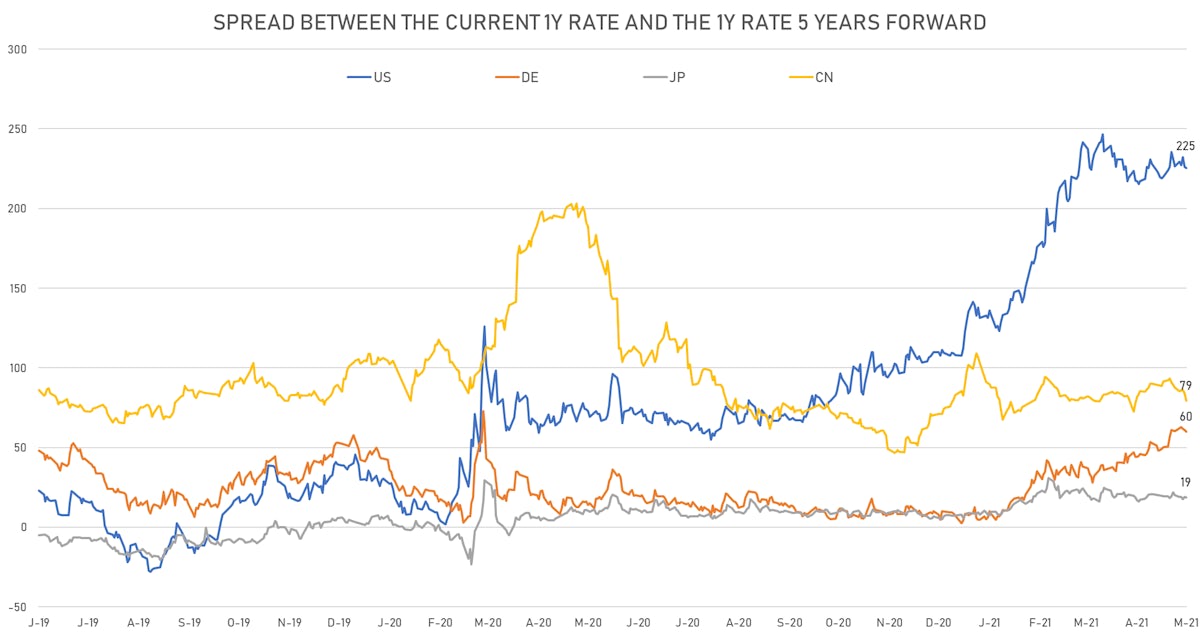

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.9 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 0.8 bp, now at 2.3128%

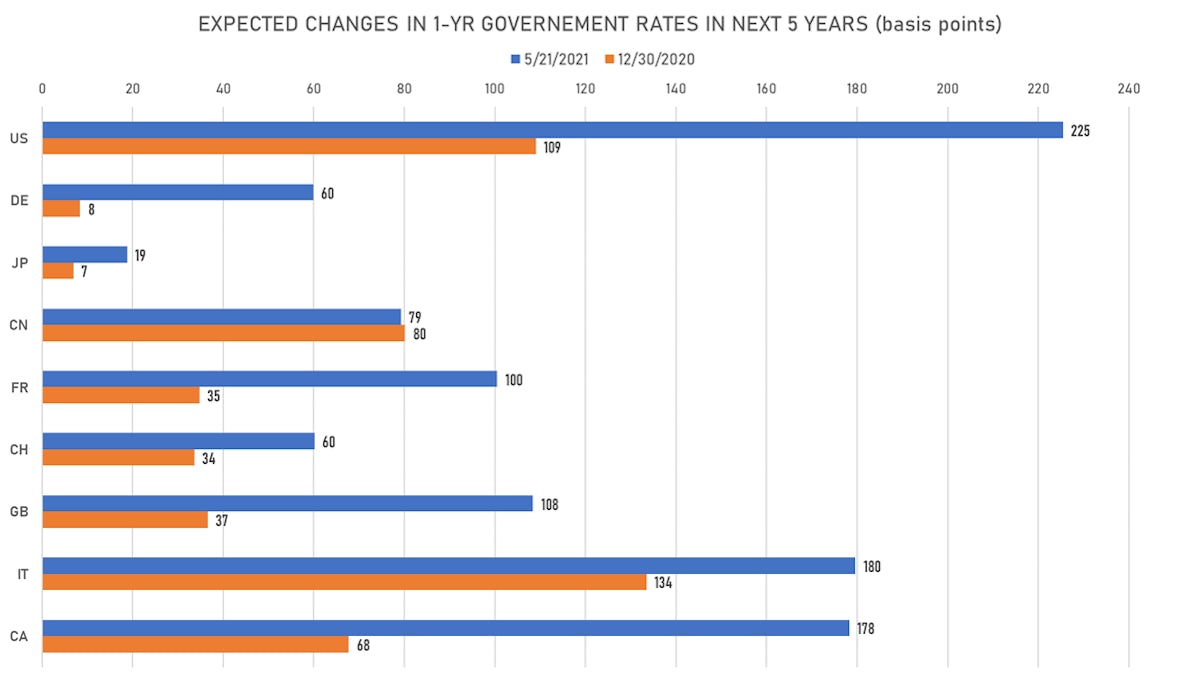

- Short-term rates are now expected to increase by 225.4 bp over the next 5 years, down from a week ago

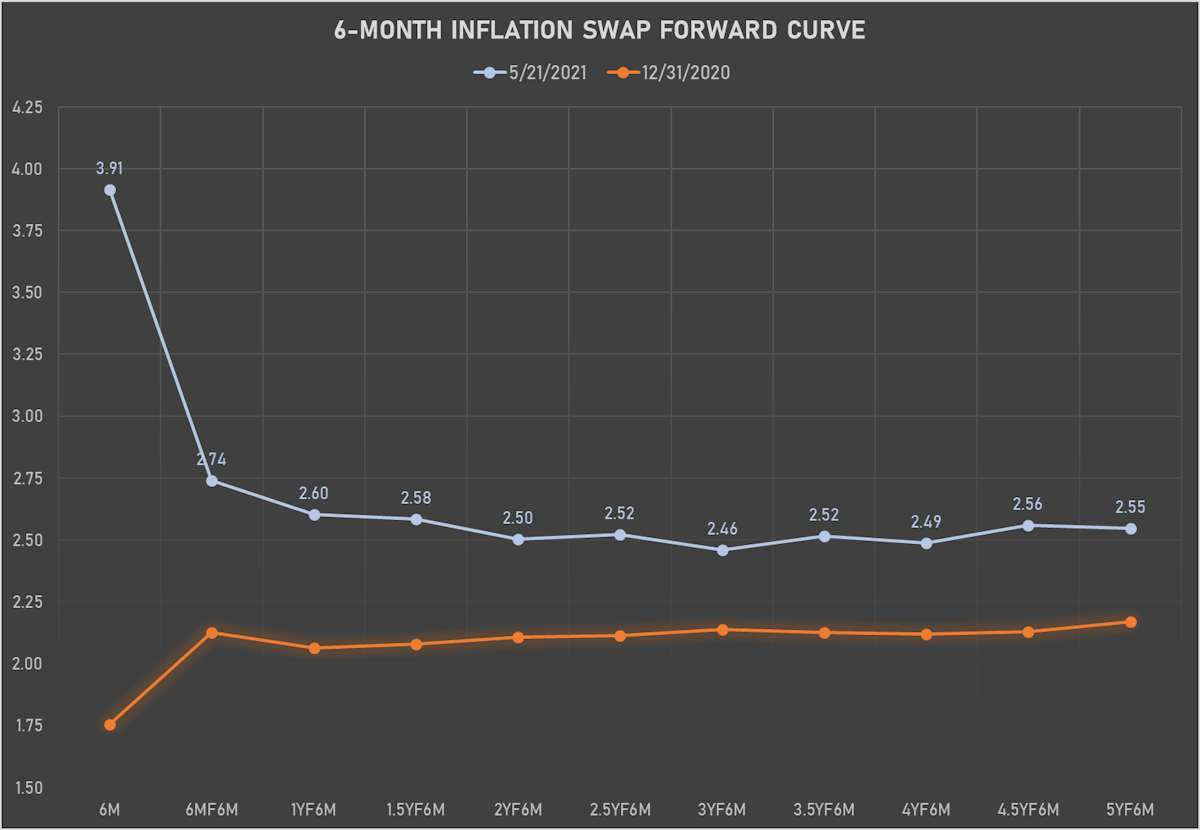

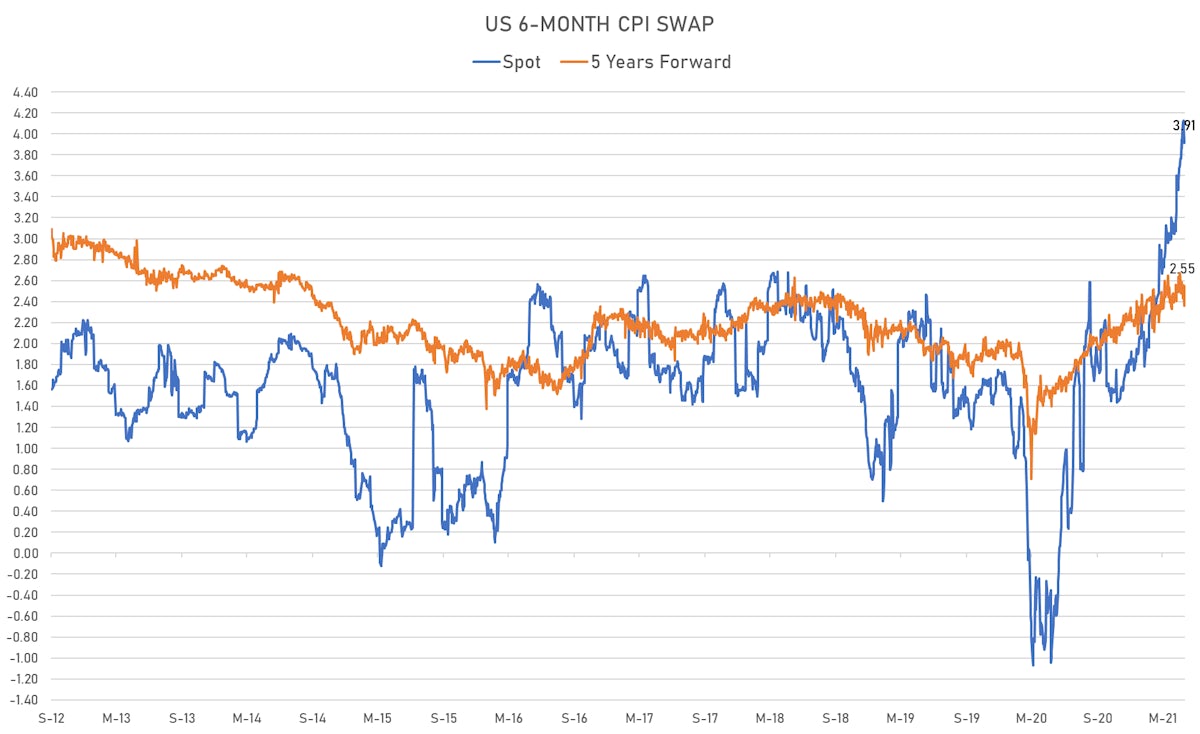

US INFLATION

- TIPS 1Y breakeven inflation at 3.22% (up 7.9bp); 2Y at 2.82% (up 4.4bp); 5Y at 2.66% (up 2.6bp); 10Y at 2.43% (down -0.4bp); 30Y at 2.31% (down -0.2bp)

- 6-month spot US CPI swap down -0.3 bp to 3.915%, with a flattening of the forward curve

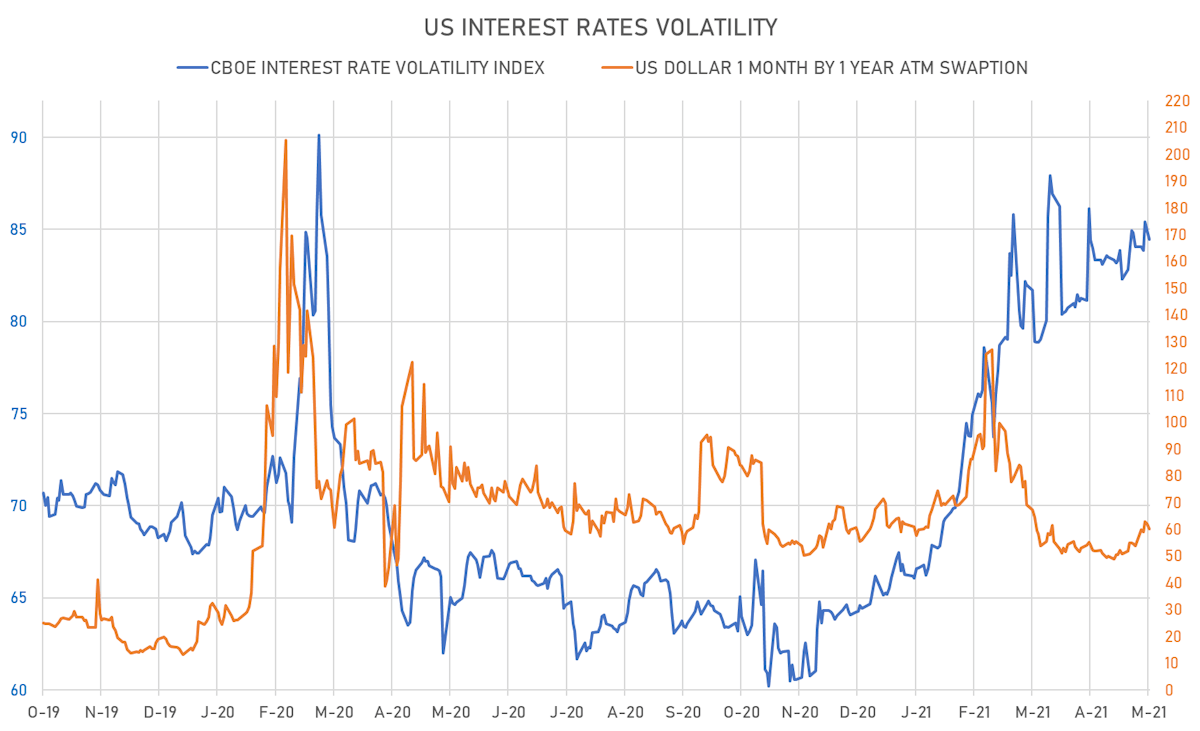

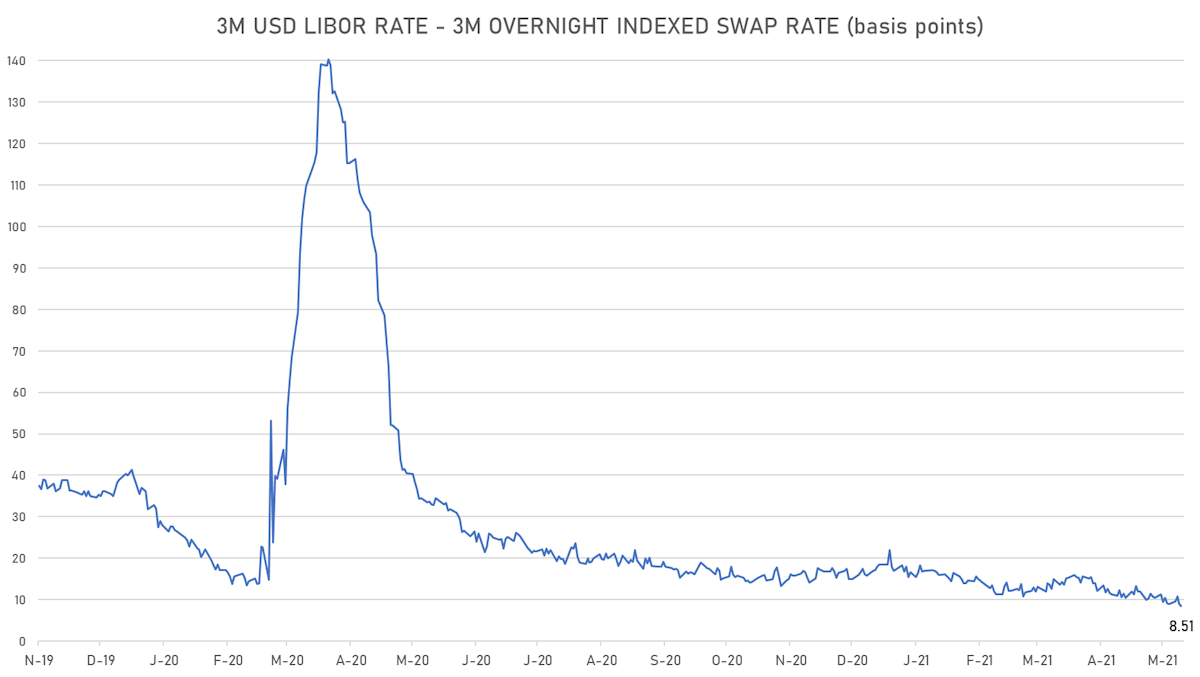

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.7% at 60.1%

- 3-Month LIBOR-OIS spread down -0.6 bp at 8.5 bp to the lowest level in a year (12-month range: 8.5-34.4 bp)

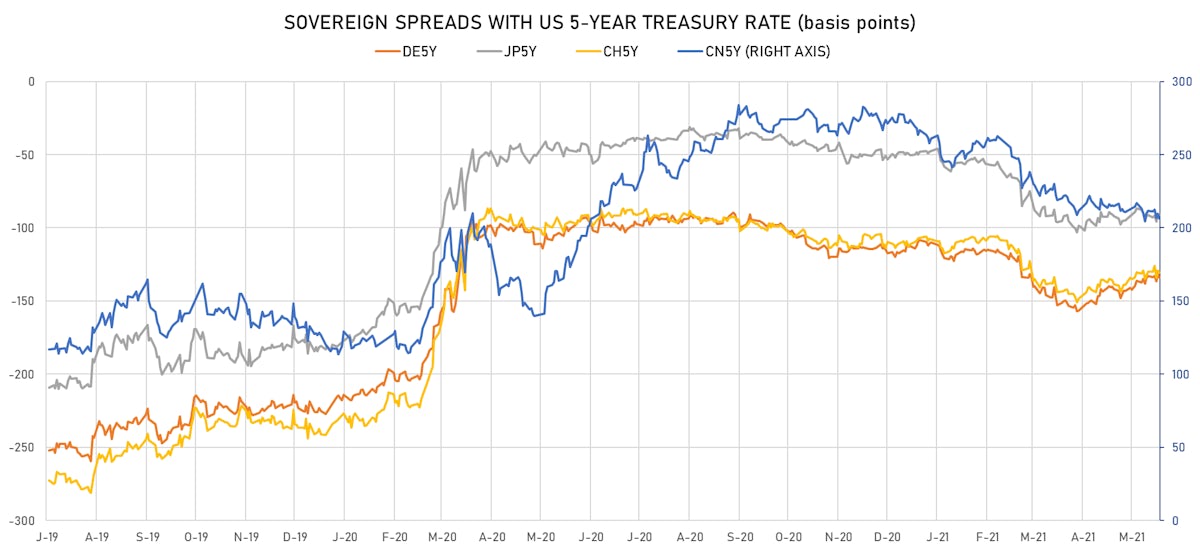

KEY INTERNATIONAL RATES

- Germany 5Y: -0.523% (down -2.4 bp); the German 1Y-10Y curve is 1.7 bp flatter at 49.7bp (YTD change: +34.8 bp)

- Japan 5Y: -0.082% (unchanged); the Japanese 1Y-10Y curve is 0.1 bp steeper at 21.3bp (YTD change: +5.8 bp)

- China 5Y: 2.885% (down -2.7 bp); the Chinese 1Y-10Y curve is 1.5 bp flatter at 55.0bp (YTD change: +8.6 bp)

- Switzerland 5Y: -0.484% (down -0.6 bp); the Swiss 1Y-10Y curve is 2.9 bp flatter at 60.0bp (YTD change: +33.6 bp)