Rates

US Rates Edged Down On Light Macro Schedule

The Chicago Fed National Activity Index came in below market consensus, adding another disappointing data point to recent US releases

Published ET

10-Year TIPS Real Yield | Source: S&P Capital IQ

QUICK US SUMMARY

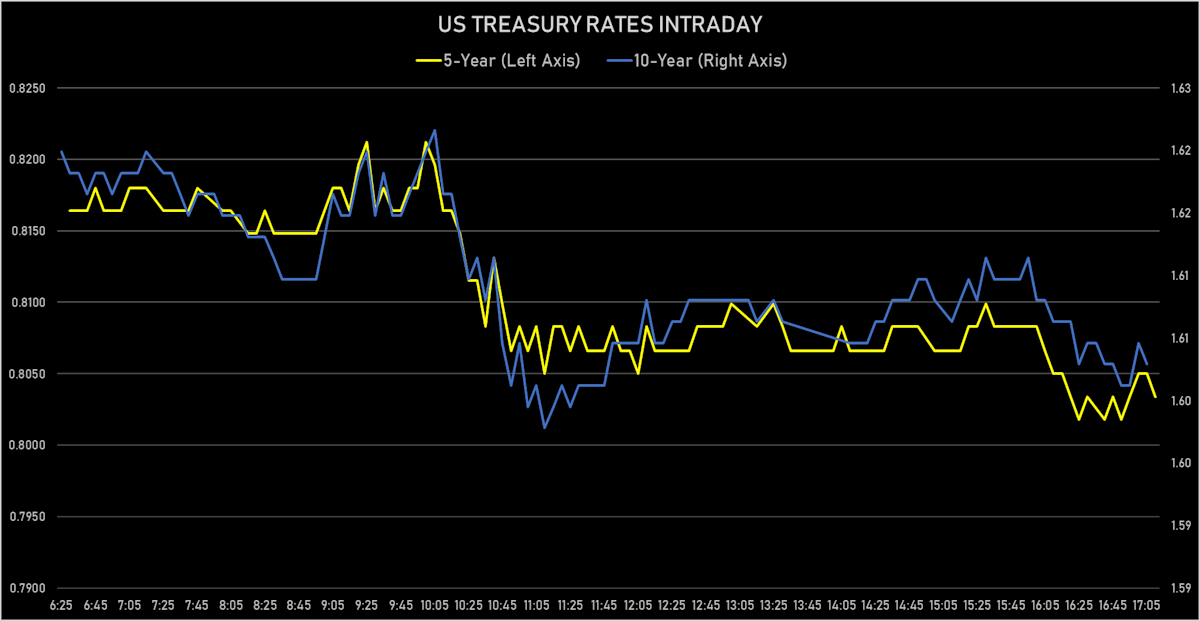

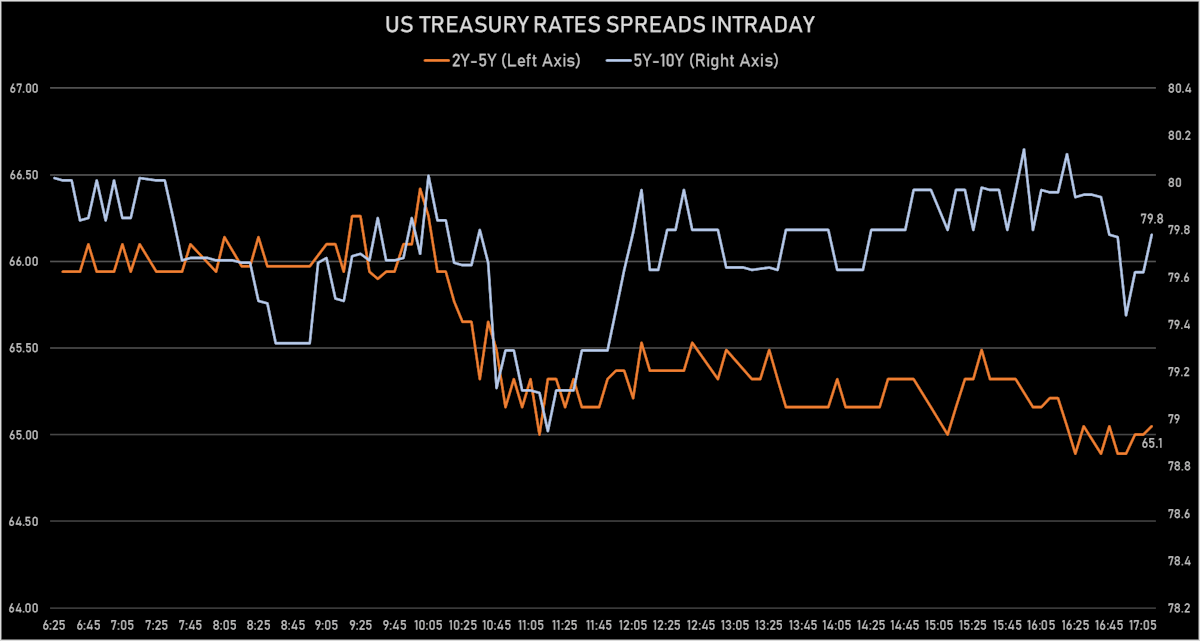

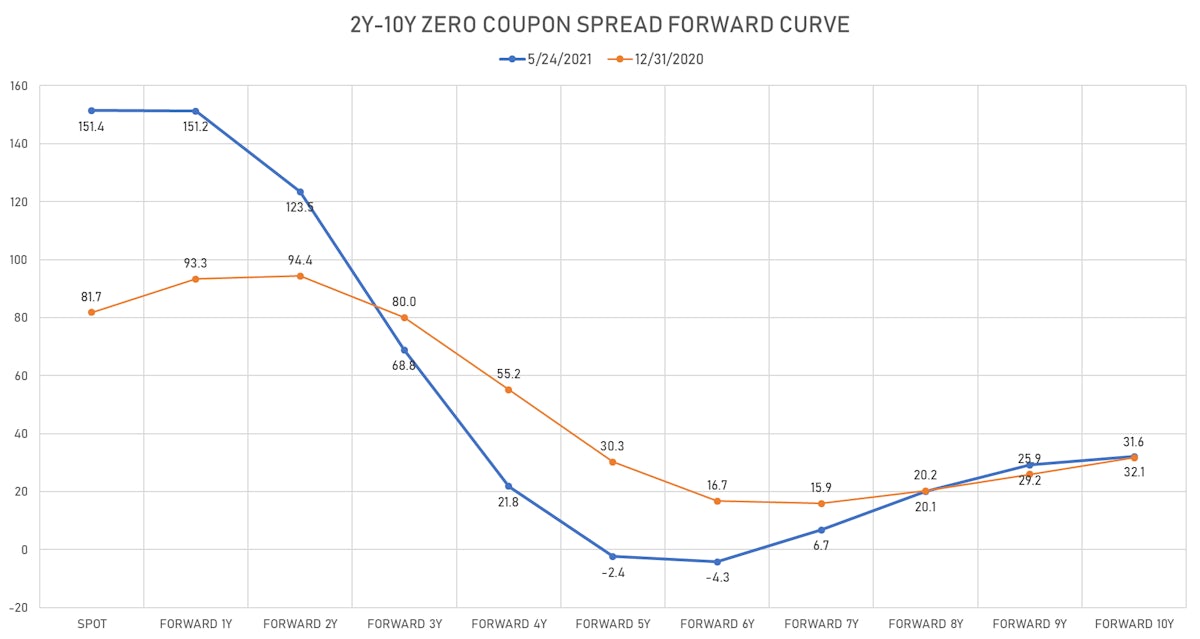

- Yield curve flattening, with the 1Y-10Y spread tightening -2.0 bp on the day, now at 156.0 bp (YTD change: +75.5)

- 1Y: 0.0430% (unchanged 0.0 bp)

- 2Y: 0.1513% (down 0.4 bp)

- 5Y: 0.8034% (down 1.8 bp)

- 7Y: 1.2618% (down 1.8 bp)

- 10Y: 1.6029% (down 2.0 bp)

- 30Y: 2.3004% (down 1.7 bp)

US MACRO RELEASES

- Chicago Fed National Activity Index for Apr 2021 (Fed Res, Chicago) at 0.2, below consensus of 1.2

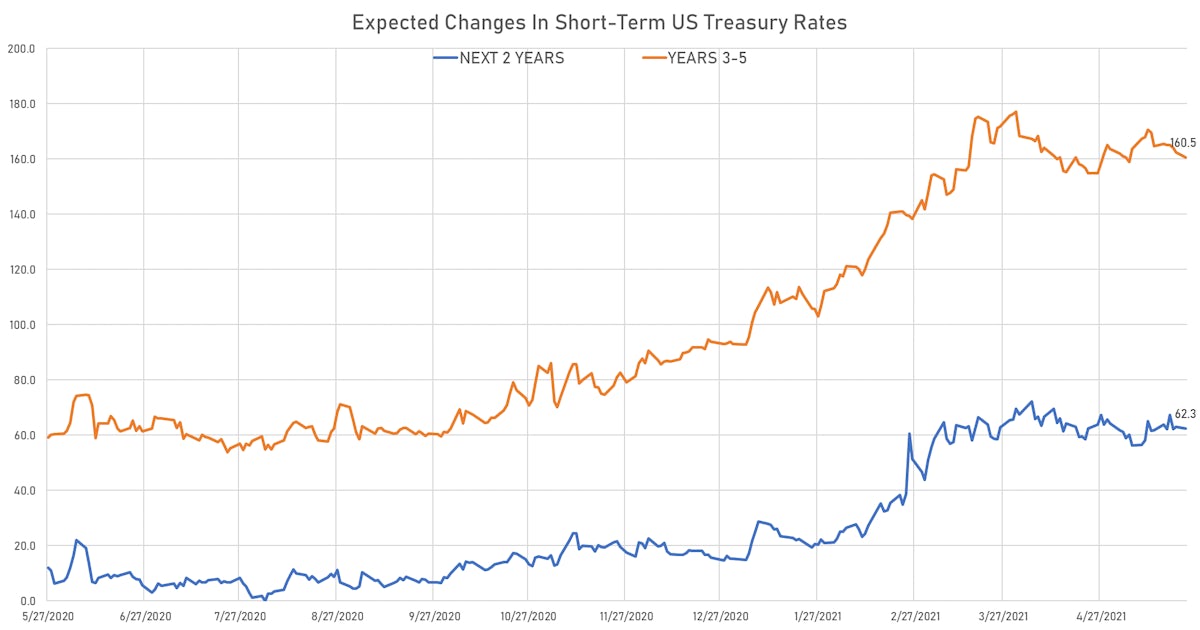

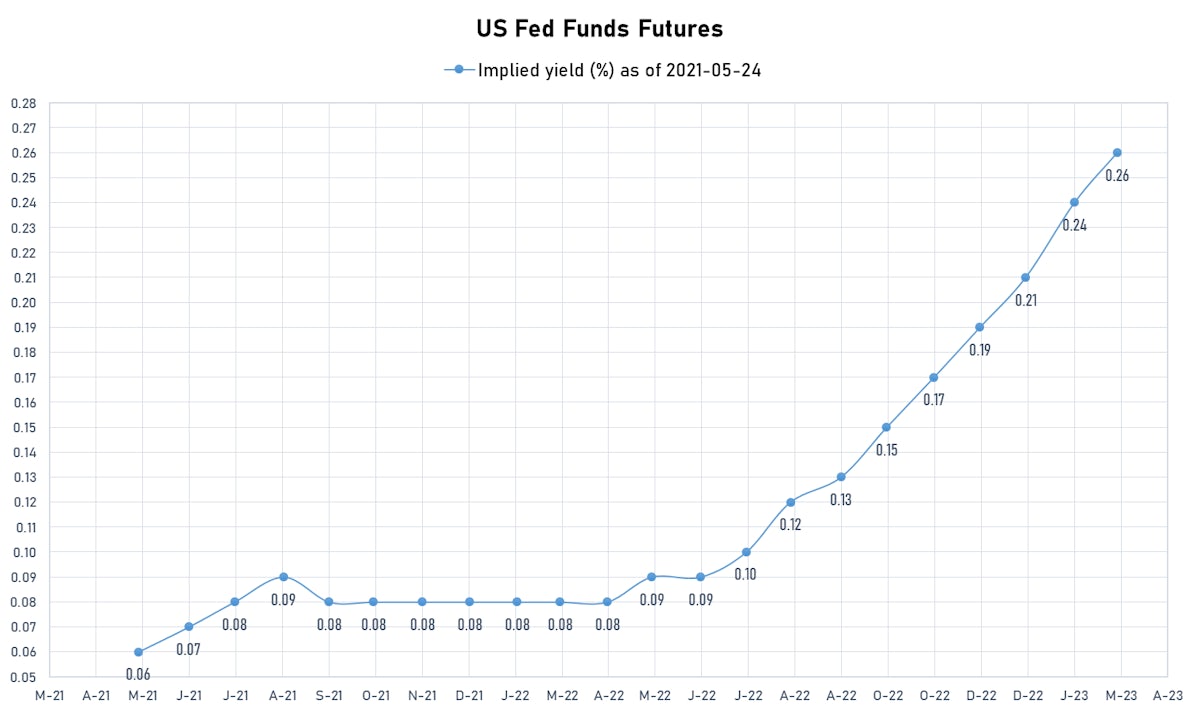

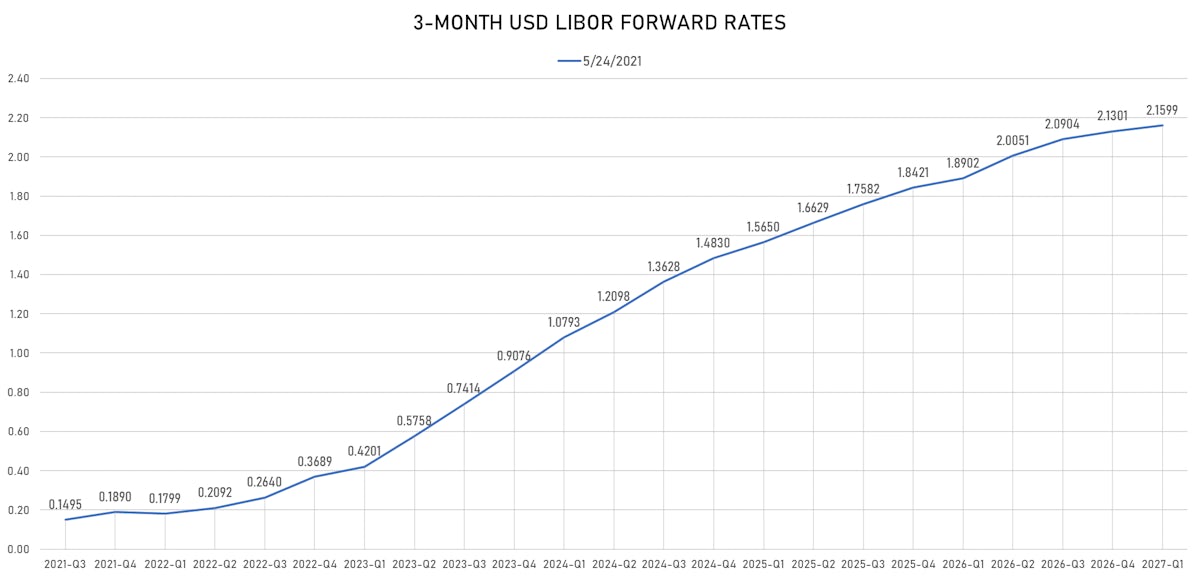

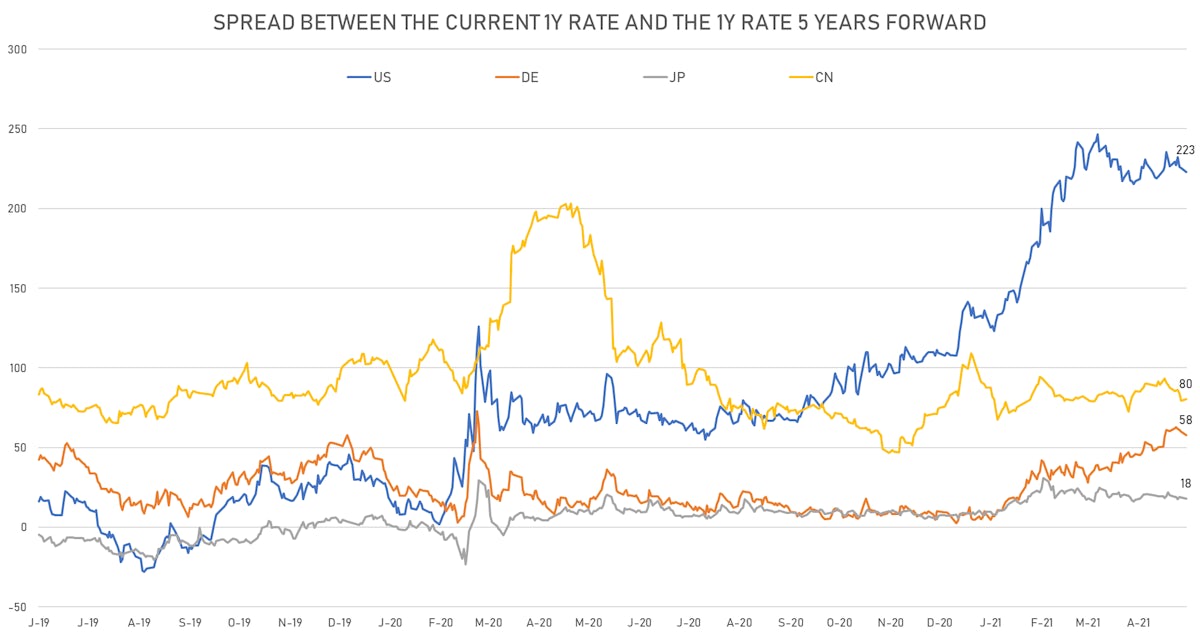

US FORWARD RATES

- 3-month USD Libor 5 years forward down 1.5 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 2.6 bp, now at 2.2872%

- Short-term rates are expected to increase by 222.8 bp over the next 5 years, well down from 236bp a couple of weeks ago

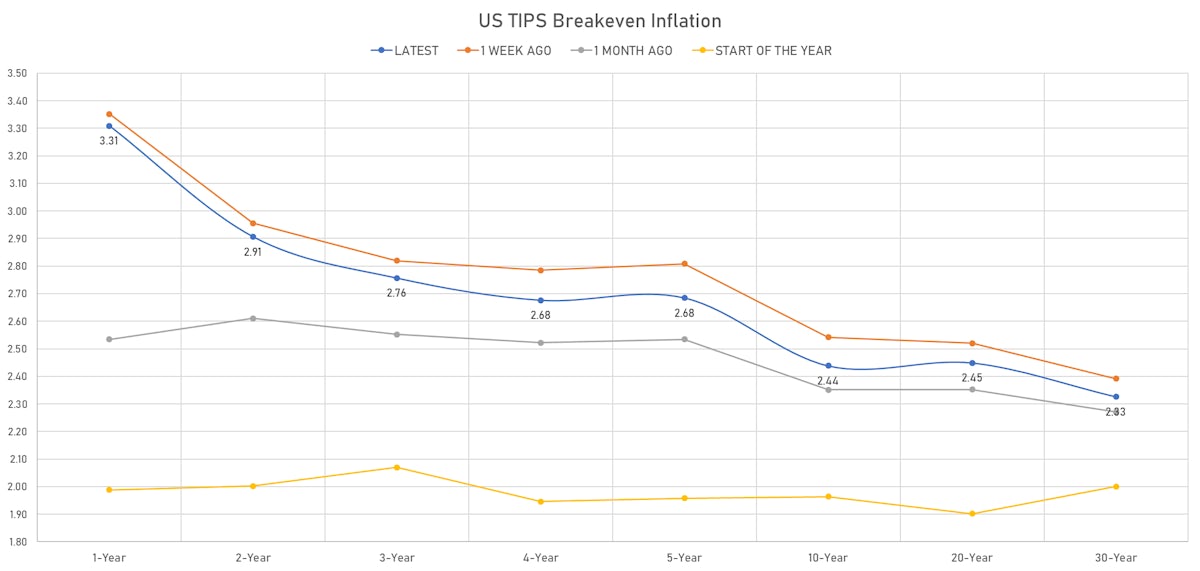

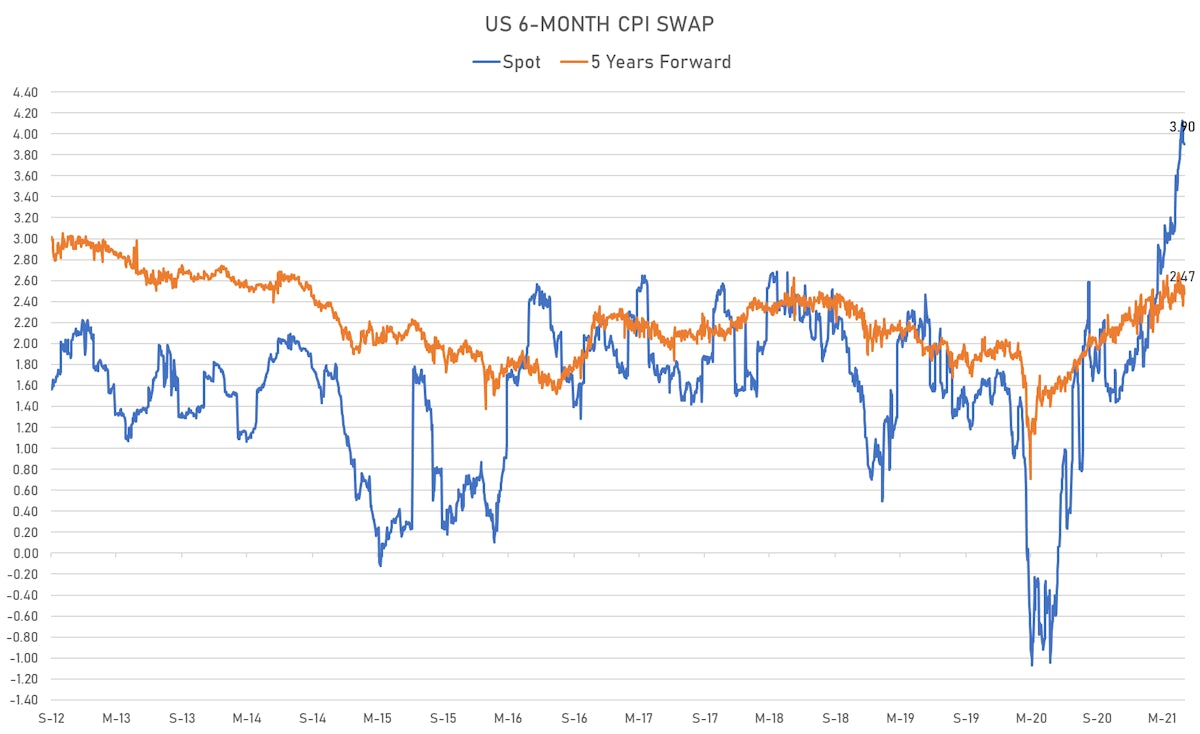

US INFLATION

- TIPS 1Y breakeven inflation at 3.31% (up 8.8bp); 2Y at 2.91% (up 8.2bp); 5Y at 2.68% (up 2.5bp); 10Y at 2.44% (up 1.3bp); 30Y at 2.33% (up 1.2bp)

- 6-month spot US CPI swap down -1.1 bp to 3.904%, with a steepening of the forward curve

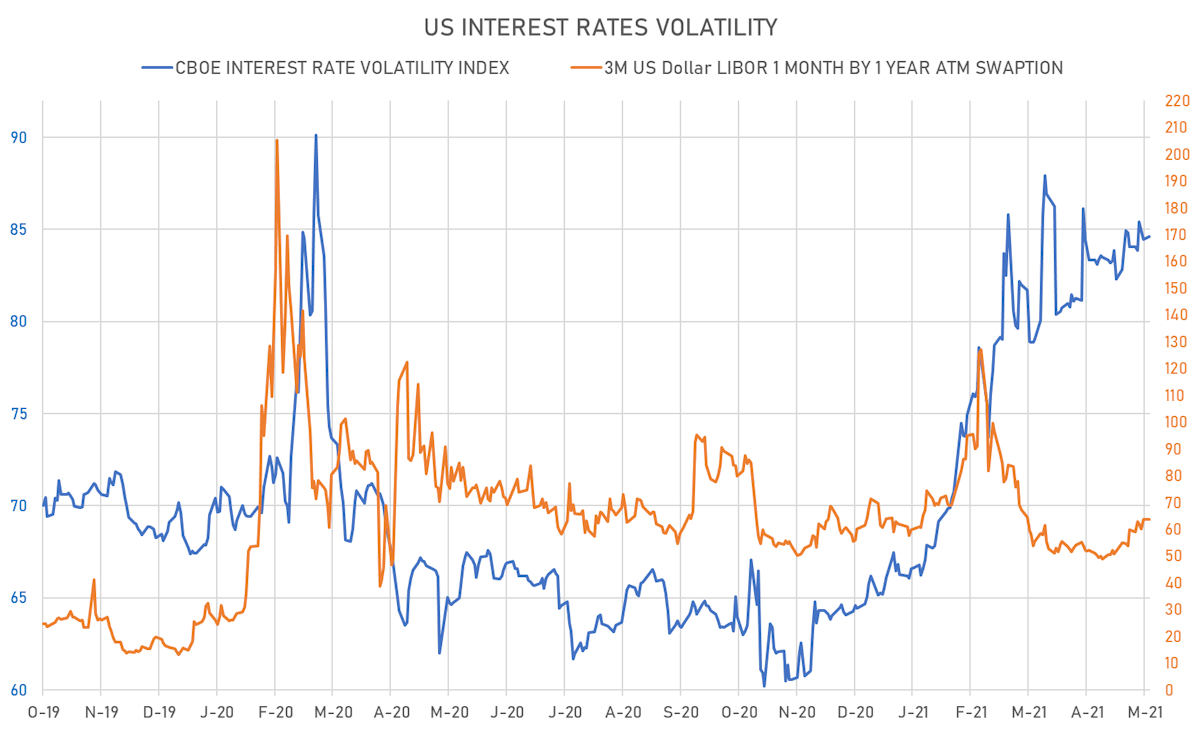

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.5% at 63.7%

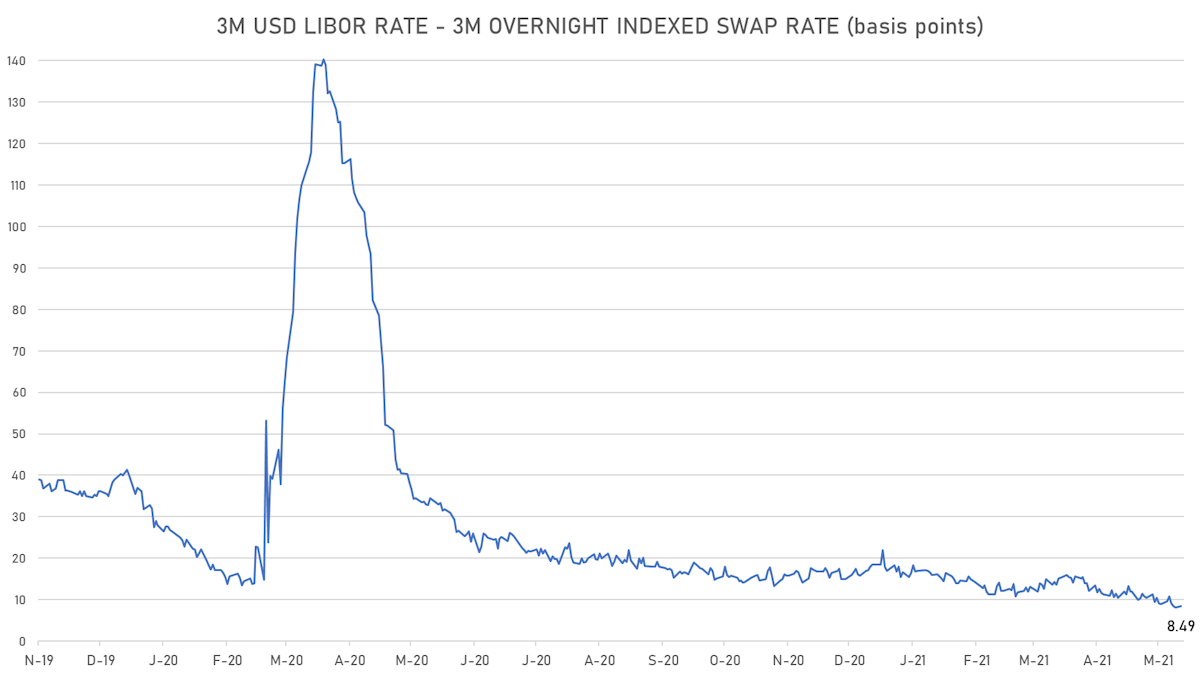

- 3-Month LIBOR-OIS spread up 0.4 bp at 8.5 bp (12-months range: 8.1-33.4 bp)

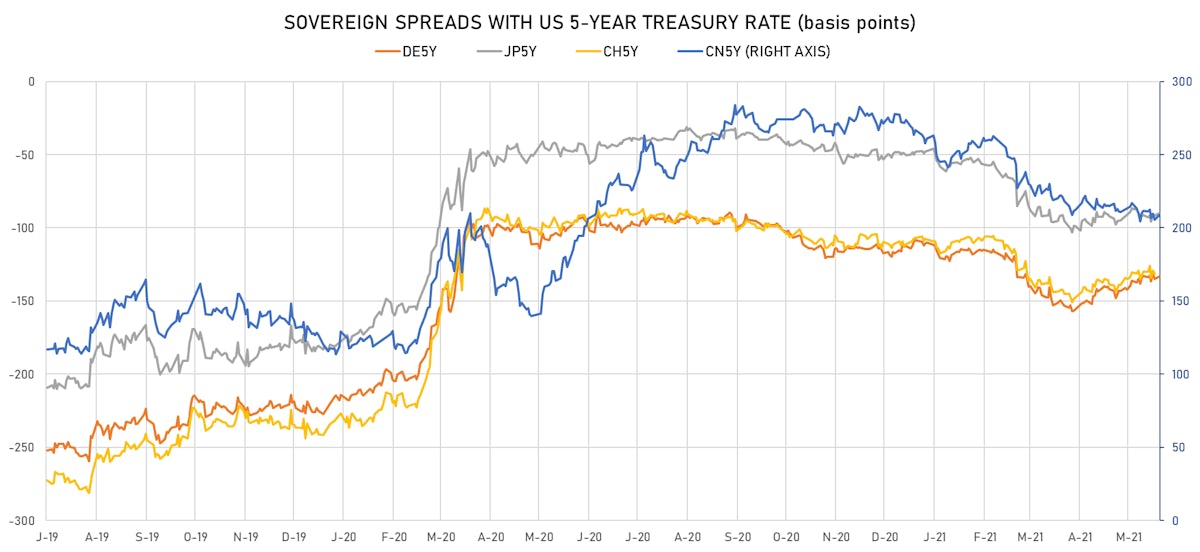

KEY INTERNATIONAL RATES

- Germany 5Y: -0.531% (down -0.9 bp); the German 1Y-10Y curve is 0.6 bp flatter at 49.6bp (YTD change: +34.2 bp)

- Japan 5Y: -0.087% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 19.9bp (YTD change: +5.7 bp)

- China 5Y: 2.893% (up 0.8 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 54.6bp (YTD change: +8.2 bp)

- Switzerland 5Y: -0.484% (down -0.6 bp); the Swiss 1Y-10Y curve is 2.1 bp steeper at 62.0bp (YTD change: +35.6 bp)

- The important change since March is that the expectation of rate hikes have come down in the US while they rose in Germany / EU countries. So the changes in macro expectations (from good to worse in the US and bad to better in the EU) are being at least partially priced in.