Rates

US Rates Curve Flattens Further With Mostly Disappointing Macro Releases

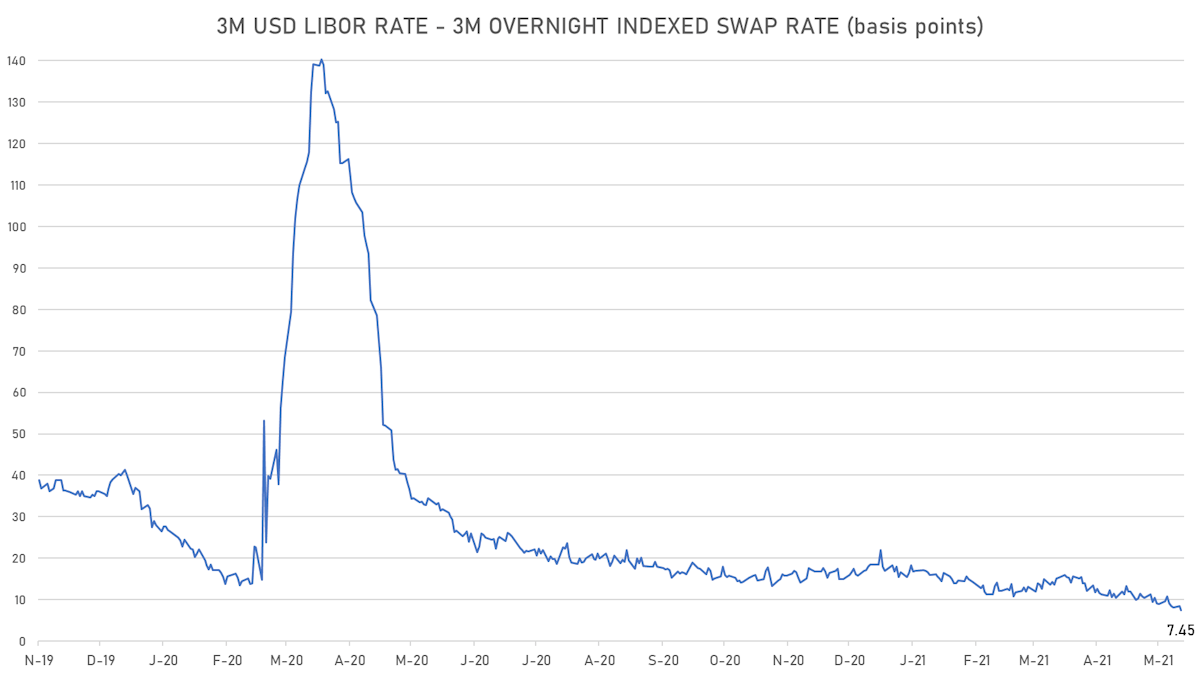

The interbank money markets and repo drop further to unprecedented levels, with an enduring imbalance of cash and collateral

Published ET

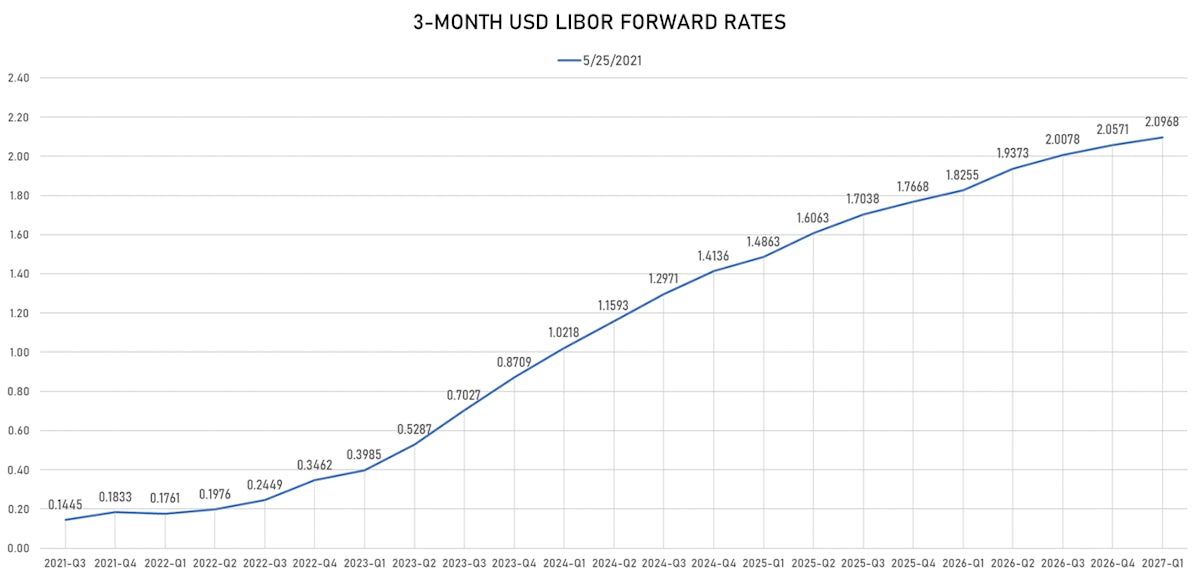

3-Month USD Libor At Lowest Level Ever | Source: Refinitiv

QUICK US SUMMARY

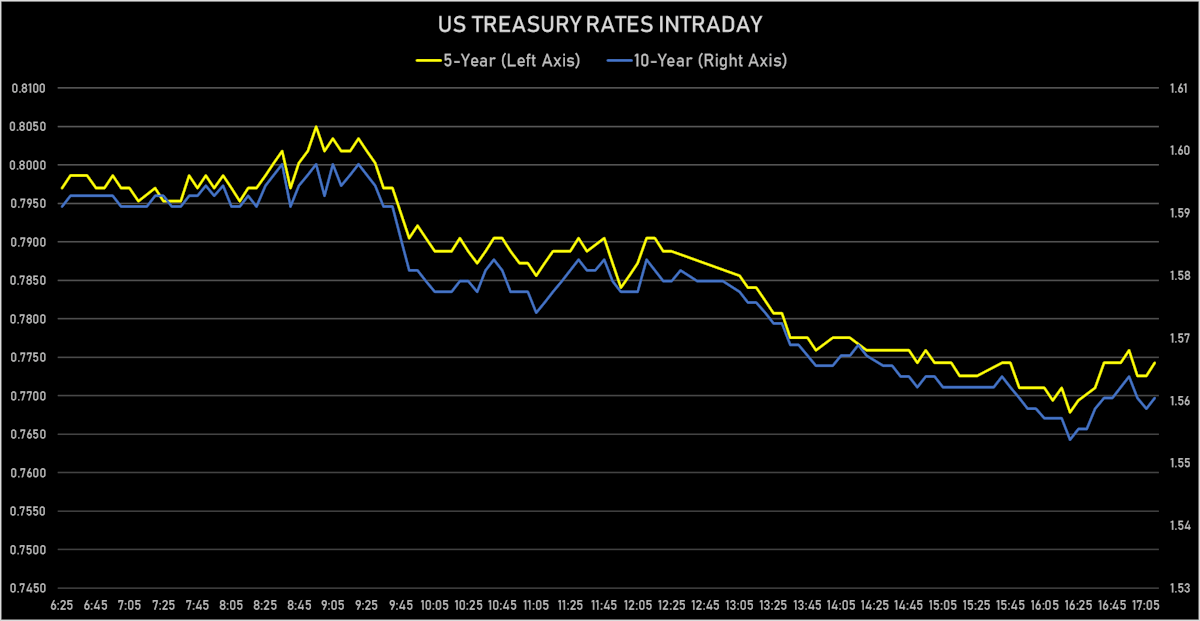

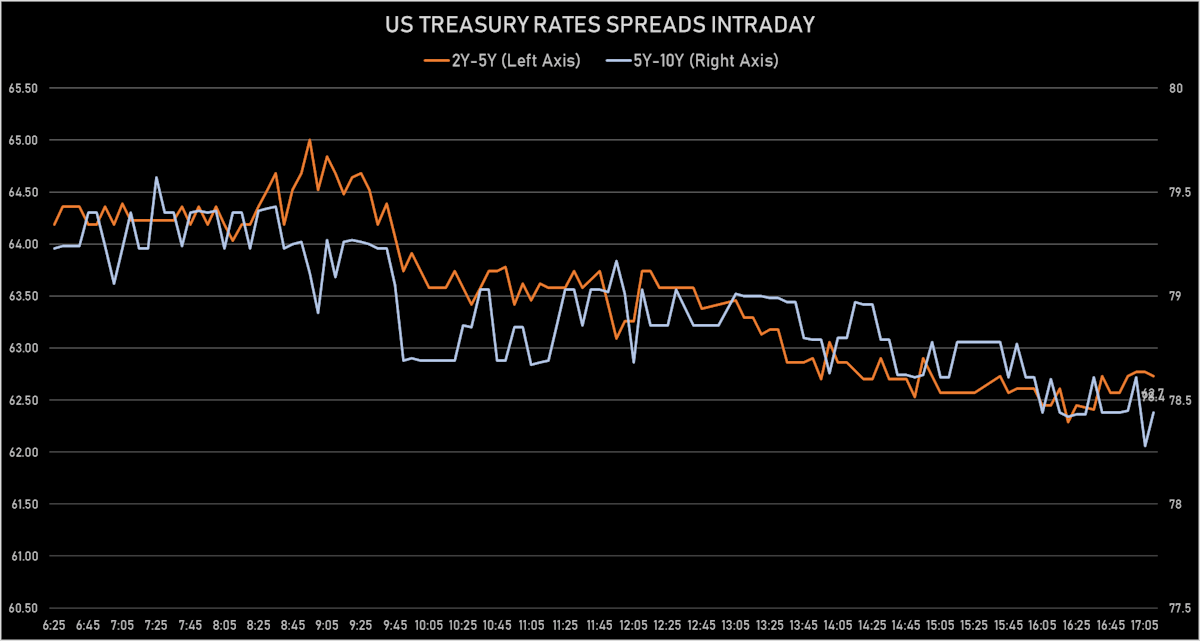

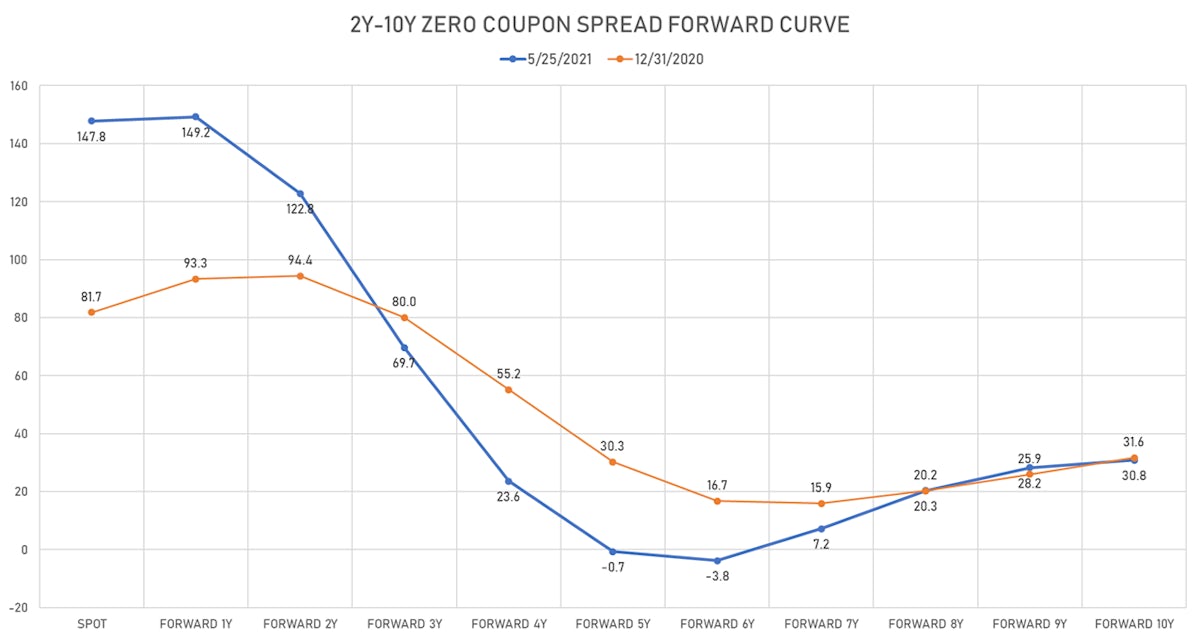

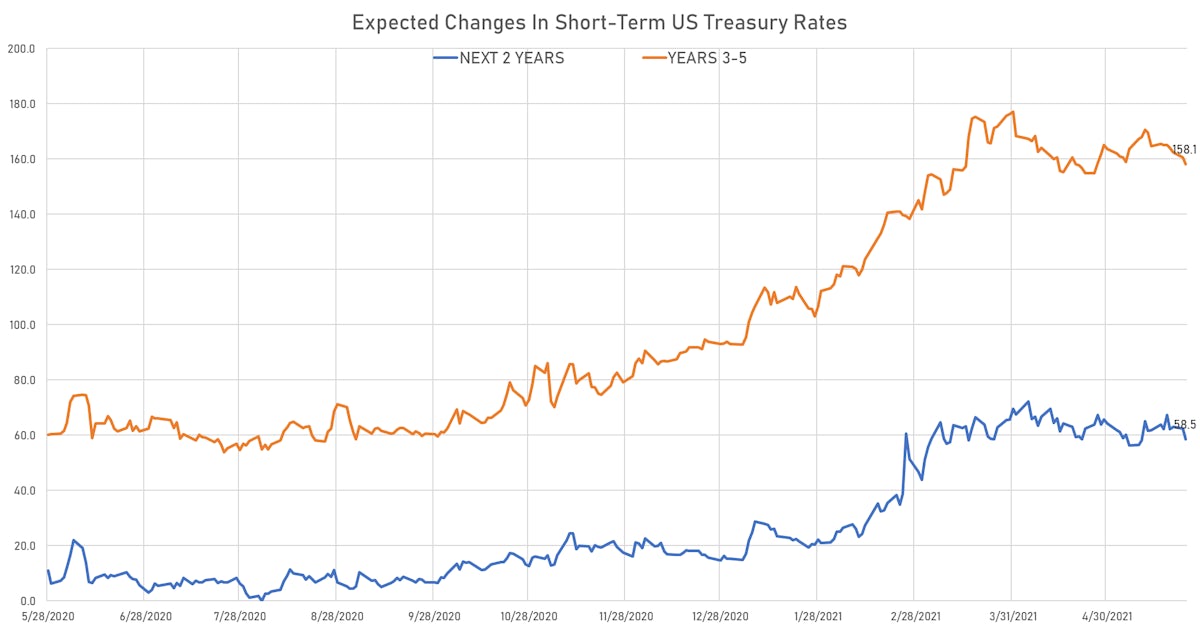

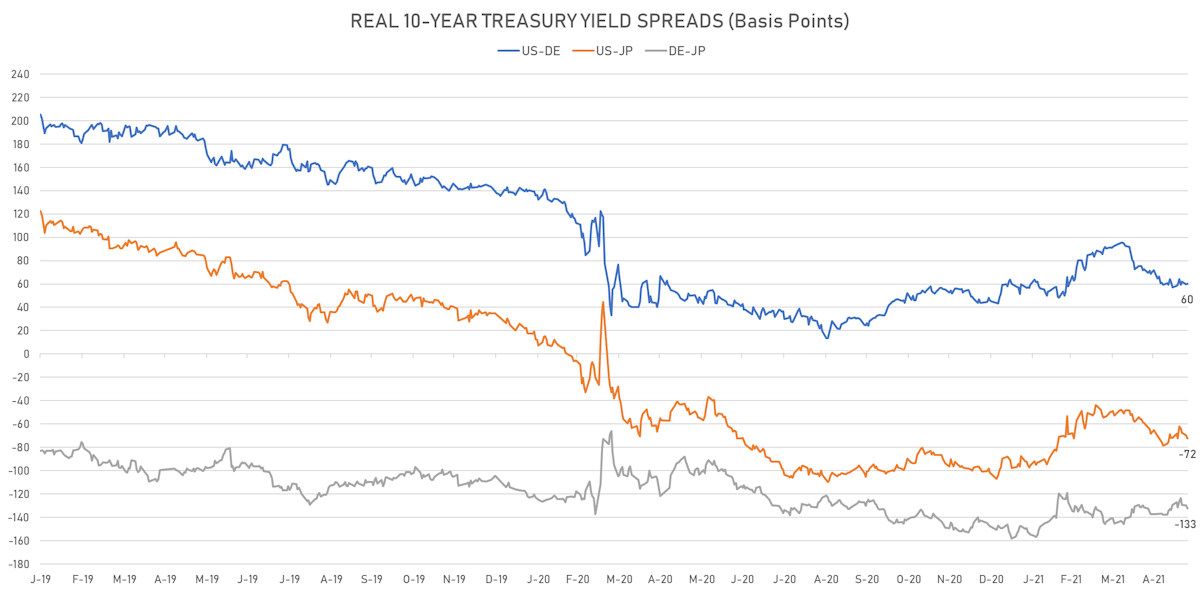

- Yield curve flattening, with the 1Y-10Y spread tightening -4.3 bp on the day, now at 151.9 bp (YTD change: +71.5)

- 1Y: 0.0410% (unchanged 0.0 bp)

- 2Y: 0.1453% (down 0.6 bp)

- 5Y: 0.7743% (down 2.9 bp)

- 7Y: 1.2217% (down 4.0 bp)

- 10Y: 1.5604% (down 4.3 bp)

- 30Y: 2.2526% (down 4.8 bp)

- Strong 2-year treasury notes auction: some market participants speculating that the excess cash (sitting in repo & bills) is spilling over into the front-end of the coupon curve

US MACRO RELEASES

- Building Permits for Apr 2021 (U.S. Census Bureau) at 1,760K, , below consensus estimate of 1,770K

- Building Permits, Change P/P for Apr 2021 (U.S. Census Bureau) at -1.3

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 22 May (Redbook Research) at 13.6

- Conference Board, Consumer confidence for May 2021 (The Conference Board) at 117.2, below consensus estimate of 119.2

- House Prices, FHFA, USA (Purchase-Only) for Mar 2021 (OFHEO, United States) at 324.9

- House Prices, FHFA, USA (Purchase-Only), Change P/P for Mar 2021 (OFHEO, United States) at 1.4

- House Prices, FHFA, USA (Purchase-Only), Change Y/Y for Mar 2021 (OFHEO, United States) at 13.9

- House Prices, S&P Case-Shiller, Composite-20, Change P/P for Mar 2021 (Standard & Poor's) at 1.6, above consensus estimate of 1.2

- House Prices, S&P Case-Shiller, Composite-20, Change P/P, Price Index for Mar 2021 (Standard & Poor's) at 2.2

- House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for Mar 2021 (Standard & Poor's) at 13.3, above consensus estimate of 12.3

- New Home Sales for Apr 2021 (U.S. Census Bureau) at 0.9, below consensus estimate of 1.0

- New Home Sales, Change P/P for Apr 2021 (U.S. Census Bureau) at -5.9

- Richmond Fed Manufacturing, Manufacturing Index for May 2021 (FED, Richmond) at 18.0, below consensus estimate of 19.0

- Richmond Fed Manufacturing, Shipments, current conditions for May 2021 (FED, Richmond) at 12.0

- Richmond Fed Services, Revenues for May 2021 (FED, Richmond) at 29.0

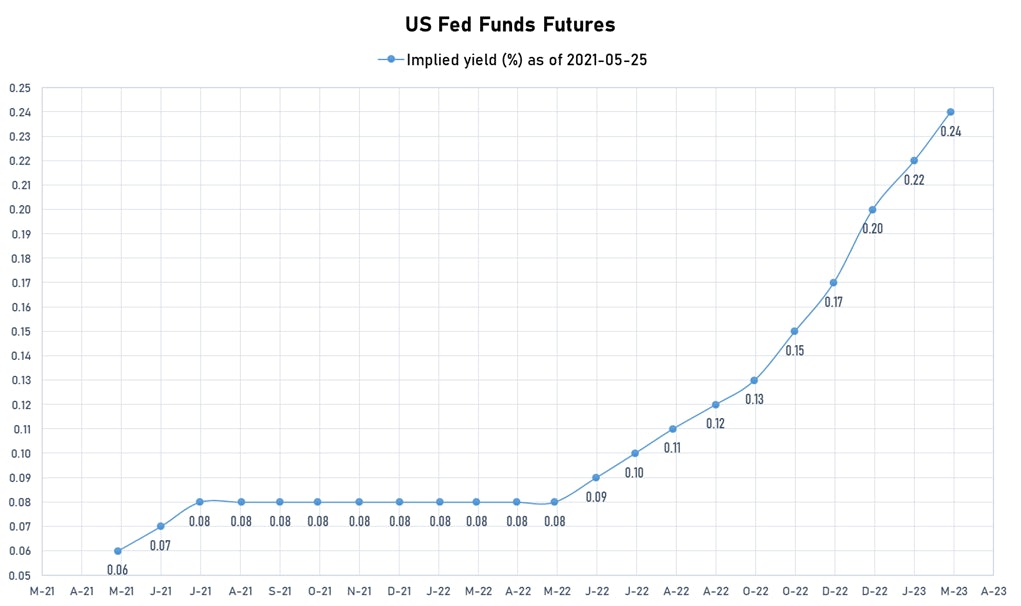

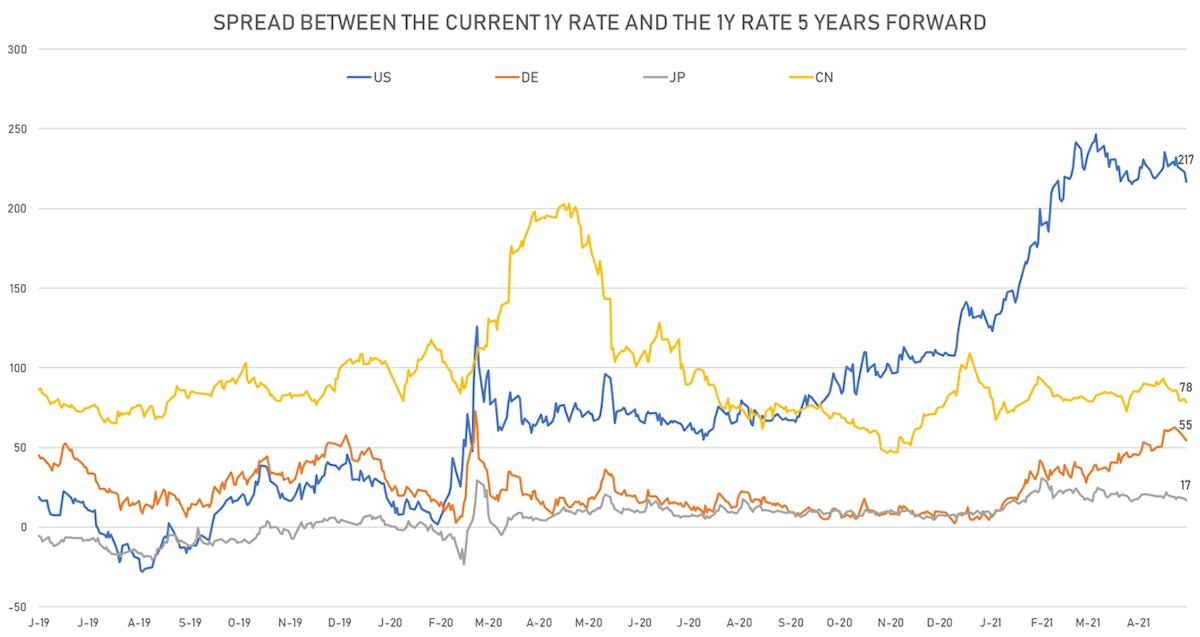

US FORWARD RATES

- 3-month USD Libor 5 years forward down 6.8 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 6.1 bp, now at 2.2267%, meaning that short-term rates are now expected to increase by 216.7 bp over the next 5 years (down from 236bp two weeks ago)

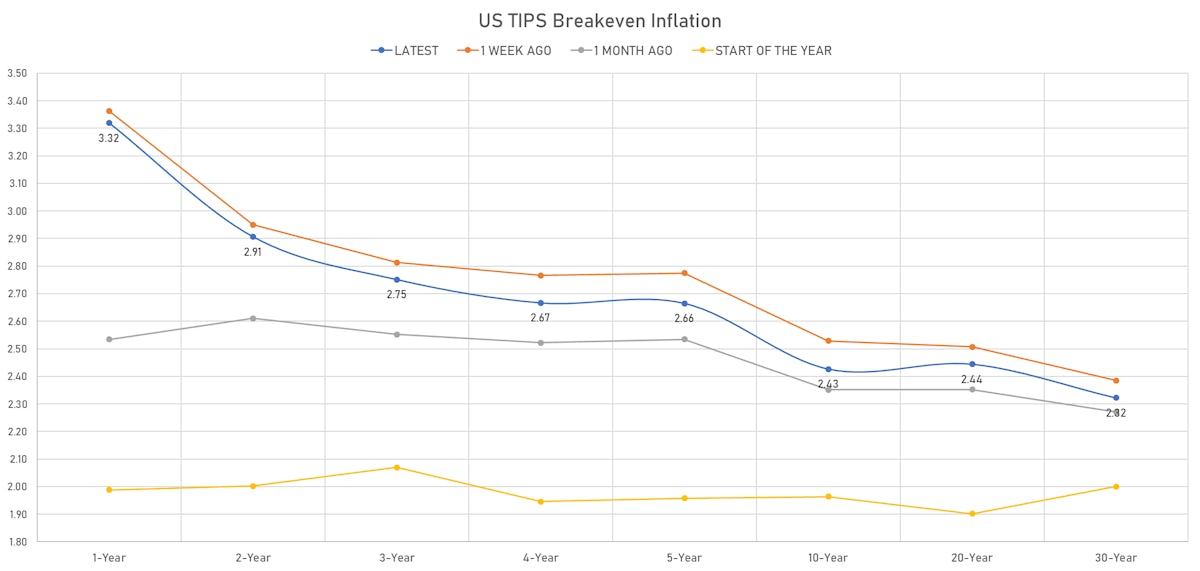

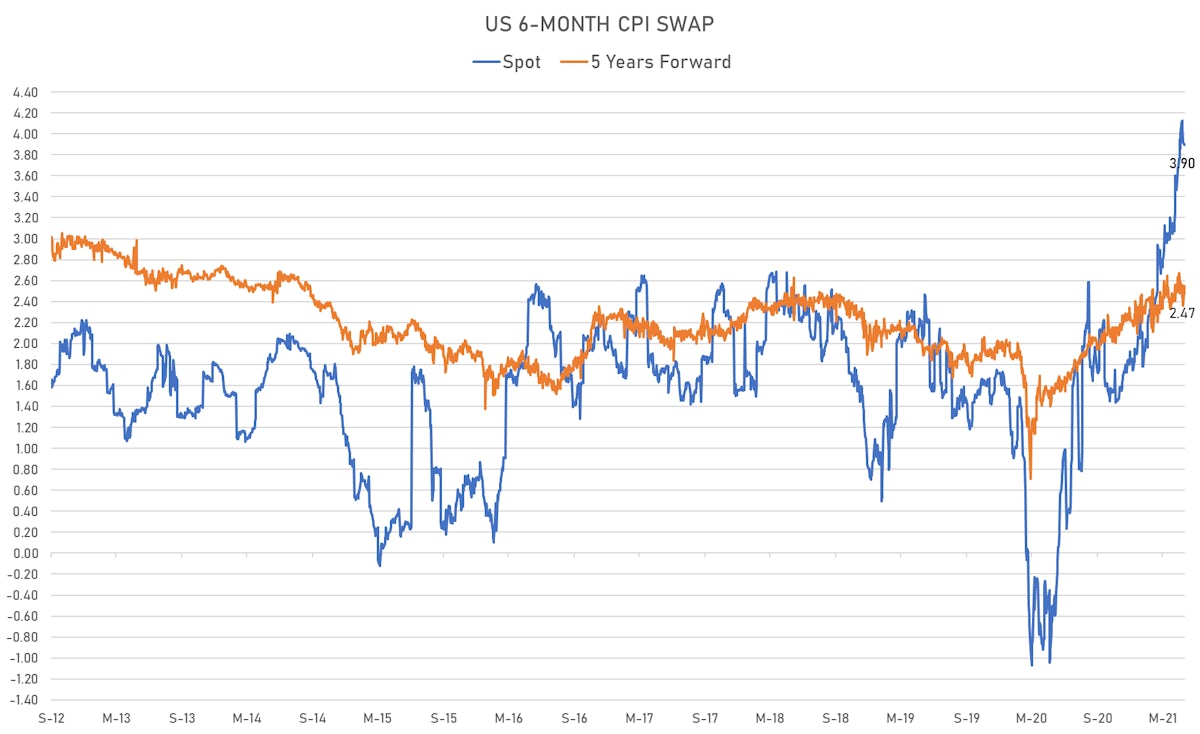

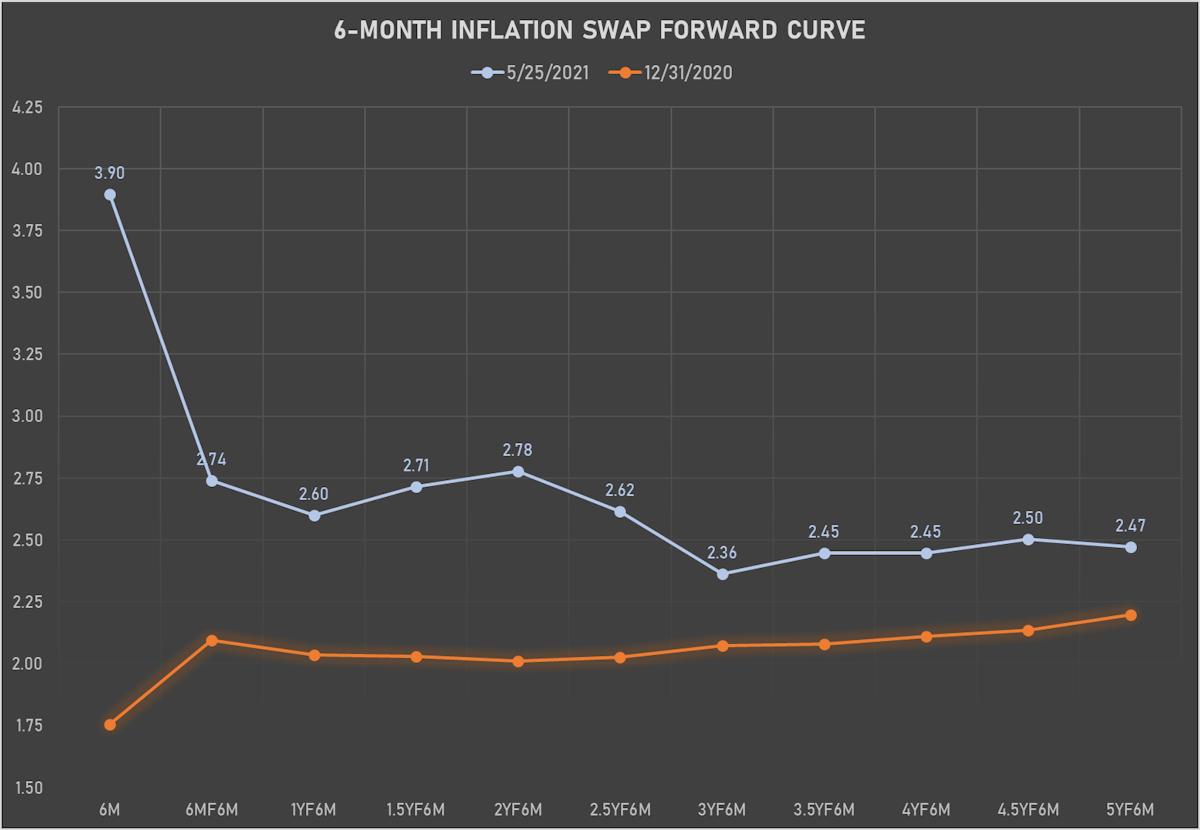

US INFLATION

- TIPS 1Y breakeven inflation at 3.32% (up 1.1bp); 2Y at 2.91% (up 0.0bp); 5Y at 2.66% (down -2.0bp); 10Y at 2.43% (down -1.2bp); 30Y at 2.32% (down -0.4bp)

- 6-month spot US CPI swap down -0.8 bp to 3.896%, with a steepening of the forward curve

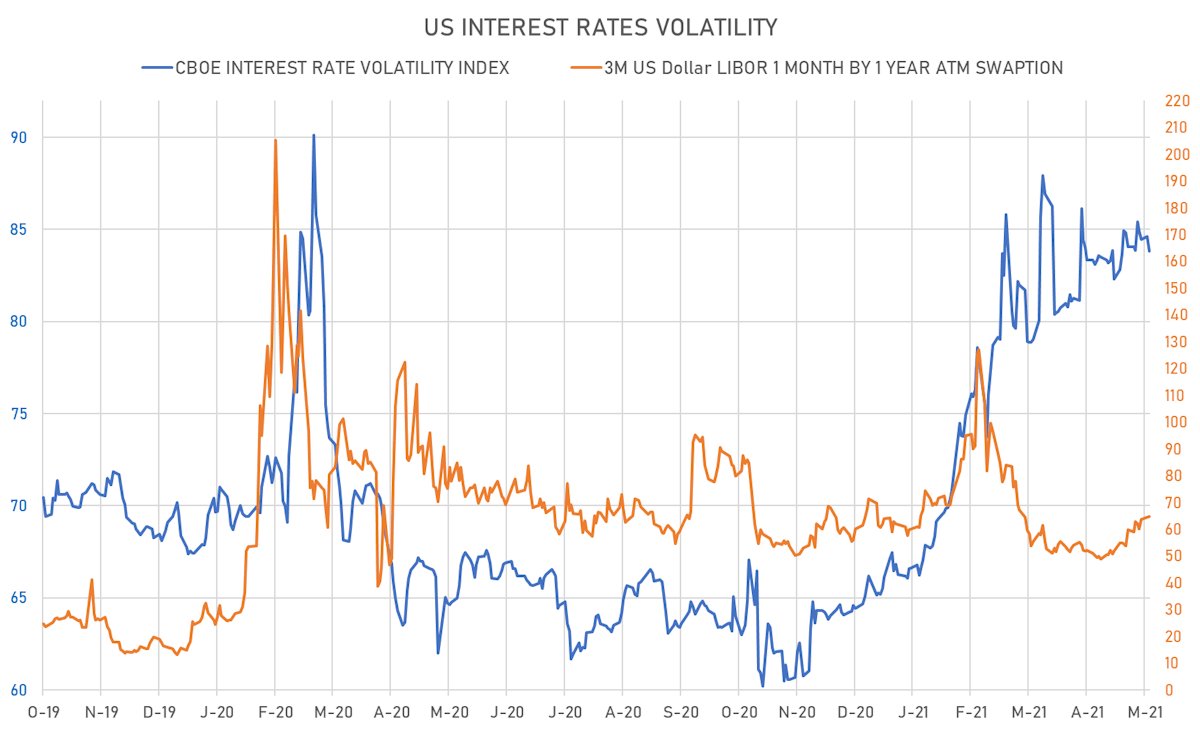

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 64.7%

- 3-Month LIBOR-OIS spread down -1.0 bp at 7.5 bp (12-months range: 7.5-33.4 bp)

KEY INTERNATIONAL RATES

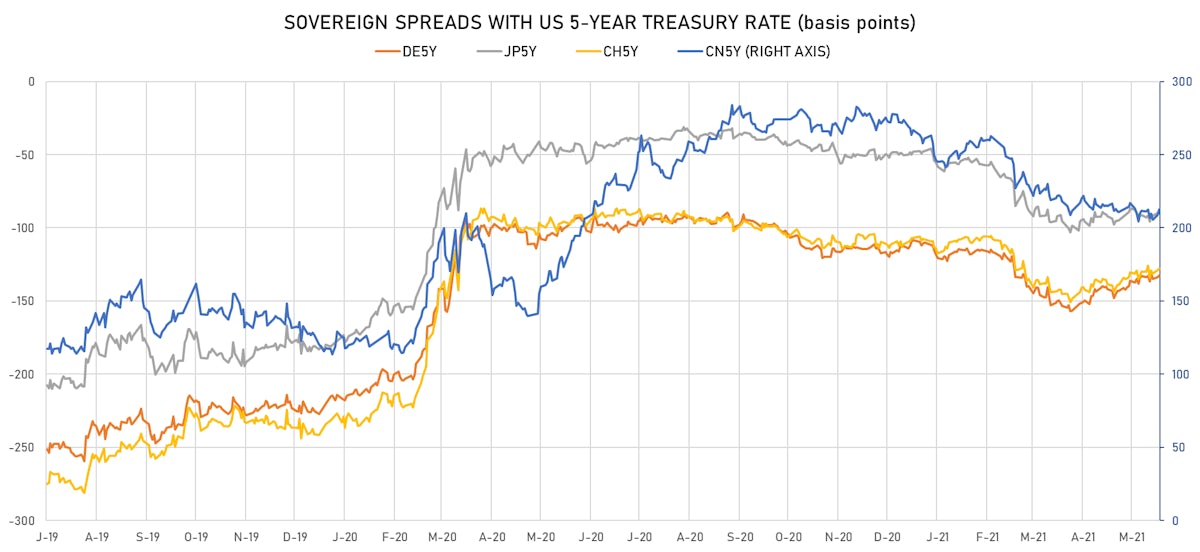

- Germany 5Y: -0.563% (down -2.2 bp); the German 1Y-10Y curve is 1.9 bp flatter at 46.6bp (YTD change: +32.3 bp)

- Japan 5Y: -0.087% (down -0.3 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 20.5bp (YTD change: +5.5 bp)

- China 5Y: 2.898% (up 0.5 bp); the Chinese 1Y-10Y curve is 1.3 bp flatter at 53.3bp (YTD change: +6.9 bp)

- Switzerland 5Y: -0.498% (down -2.0 bp); the Swiss 1Y-10Y curve is 1.5 bp flatter at 56.5bp (YTD change: +32.1 bp)