Rates

Rates Up On Strong Macro Data (Excluding Transportation)

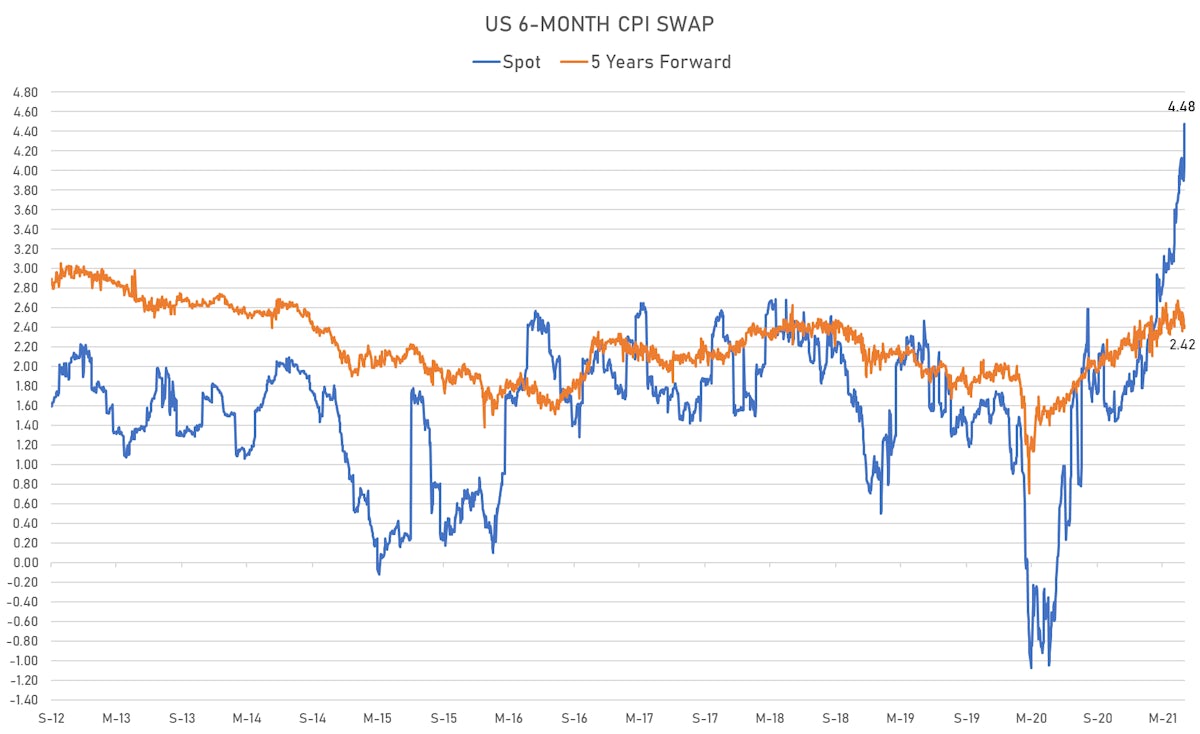

Short-term inflation swaps jump as GDP implicit price deflator for Q1 2021 comes in at 4.30%, higher than market consensus

Published ET

US GDP Implicit Price Deflator (Total, Prelim) | Source: Refinitiv

QUICK US SUMMARY

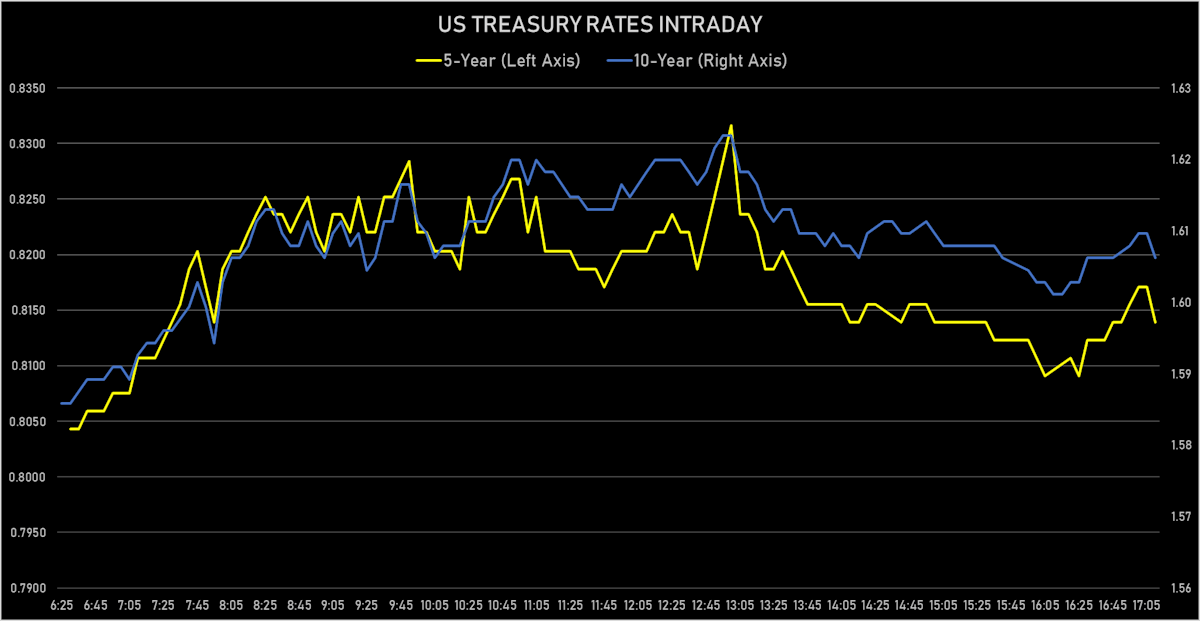

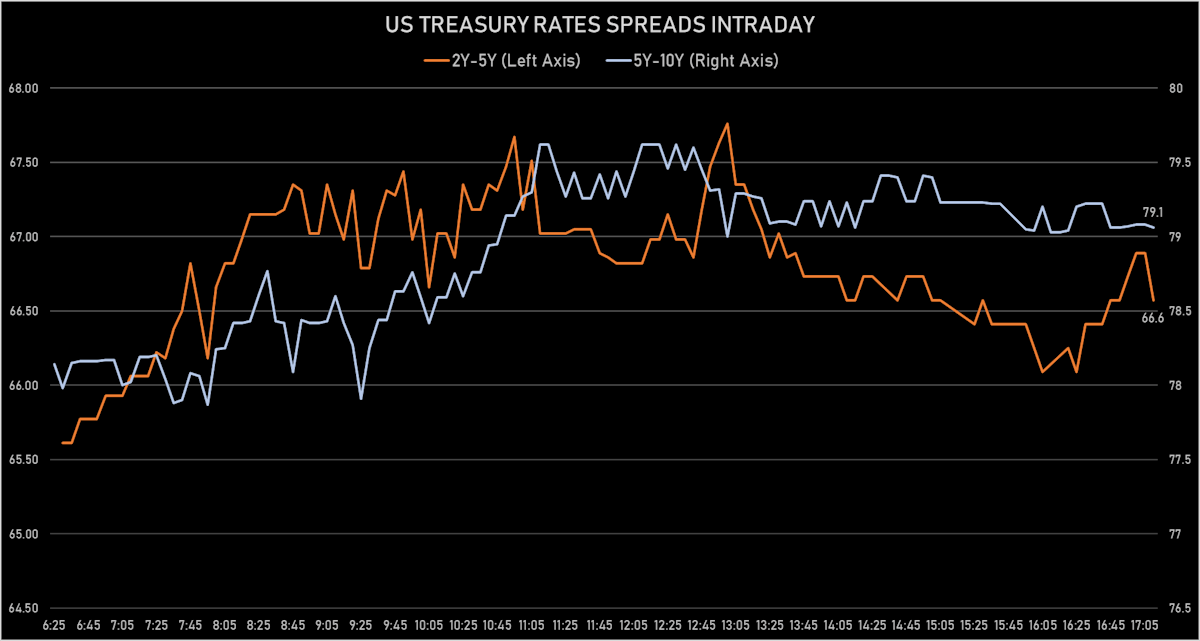

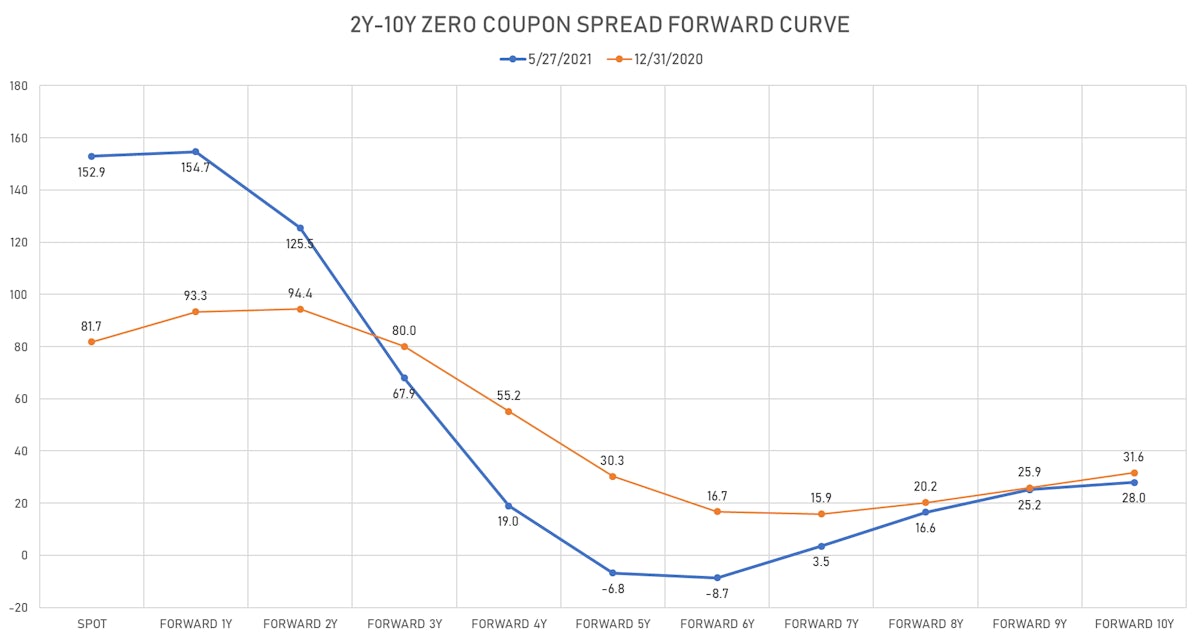

- Yield curve steepening, with the 1Y-10Y spread widening 2.5 bp on the day, now at 156.5 bp (YTD change: +76.1)

- 1Y: 0.0410% (unchanged)

- 2Y: 0.1466% (down 0.2 bp)

- 5Y: 0.8139% (up 3.2 bp)

- 7Y: 1.2571% (up 2.1 bp)

- 10Y: 1.6062% (up 2.5 bp)

- 30Y: 2.2803% (up 1.9 bp)

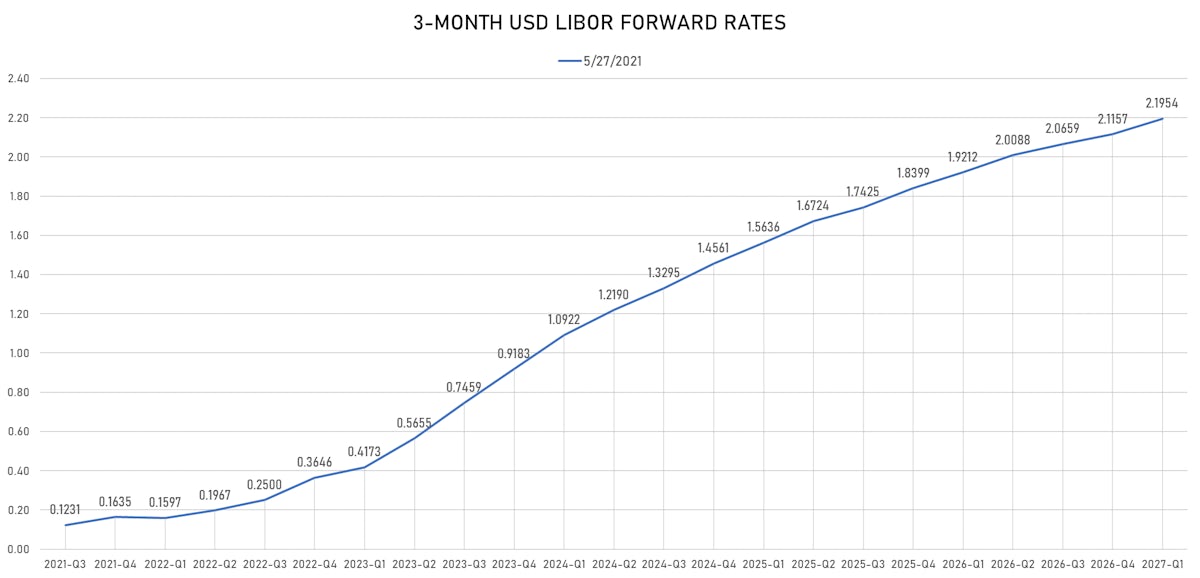

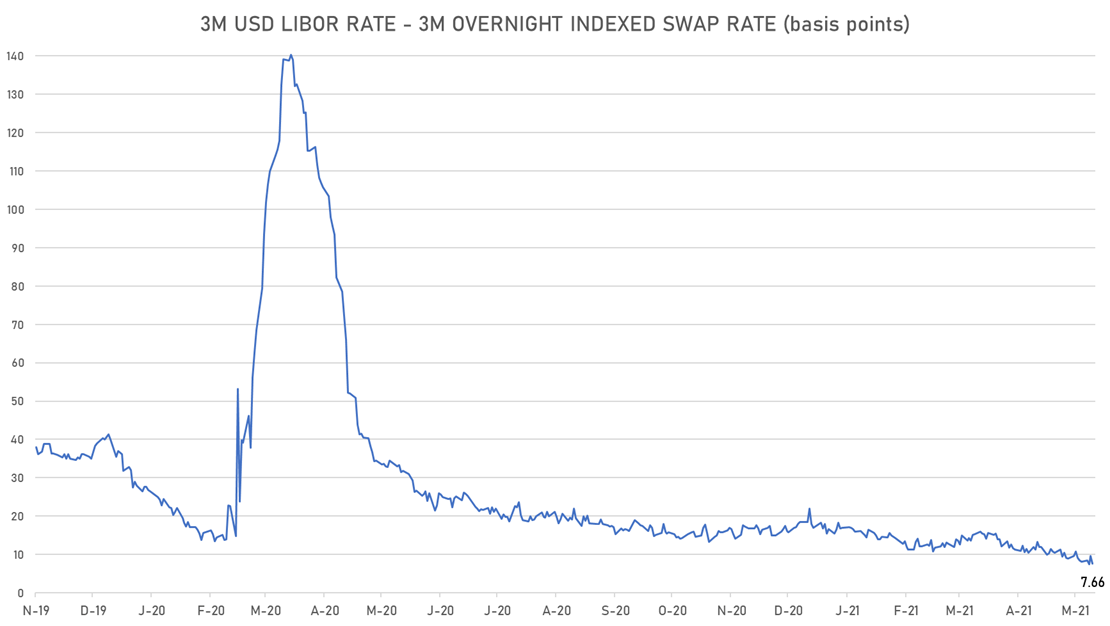

- 3-month USD Libor at new all-time low, as demand for the Fed's reverse repo facility hit a record $485.3B on Thursday, putting further pressure on short-term rates

- Treasury $62 bn 7-year auction was well received: high yield of 1.285% vs 1.306% prior; direct bids: 20.7% vs 20.6% prior; indirect bids: 59.6% vs 57.1% prior; bid-to-cover: 2.41 vs 2.31 prior

US MACRO RELEASES

- Corporate Profits, With IVA and CC Adj, Total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at -0.80

- GDP, Total-2nd Estimate, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 6.40, below consensus estimate of 6.50

- Implicit Price Deflator, GDP, Total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 4.30, above consensus estimate of 4.10

- Jobless Claims, National, Continued for W 15 May (U.S. Dept. of Labor) at 3.64, below consensus estimate of 3.68

- Jobless Claims, National, Initial for W 22 May (U.S. Dept. of Labor) at 406.00, below consensus estimate of 425.00

- Jobless Claims, National, Initial, four week moving average for W 22 May (U.S. Dept. of Labor) at 458.75

- Kansas Fed, Current composite index for May 2021 (FED, Kansas) at 26.00

- Kansas Fed, Current production index for May 2021 (FED, Kansas) at 32.00

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Apr 2021 (U.S. Census Bureau) at 0.00

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Apr 2021 (U.S. Census Bureau) at 1.00, above consensus estimate of 0.80

- Manufacturers New Orders, Durable goods total, Change P/P for Apr 2021 (U.S. Census Bureau) at -1.30, below consensus estimate of 0.70

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Apr 2021 (U.S. Census Bureau) at 2.30, above consensus estimate of 0.80

- Pending Home Sales, United States for Apr 2021 (NAR, United States) at 106.20

- Pending Home Sales, United States, Change P/P for Apr 2021 (NAR, United States) at -4.40, below consensus estimate of 0.80

- Personal Consumption Expenditure, Profits after tax total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 11.30

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 2.50, above consensus estimate of 2.30

- Personal Consumption Expenditure, Total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 3.70

- Total-prelim, Change P/P for Q1 2021 (BEA, US Dept. Of Com) at 9.40

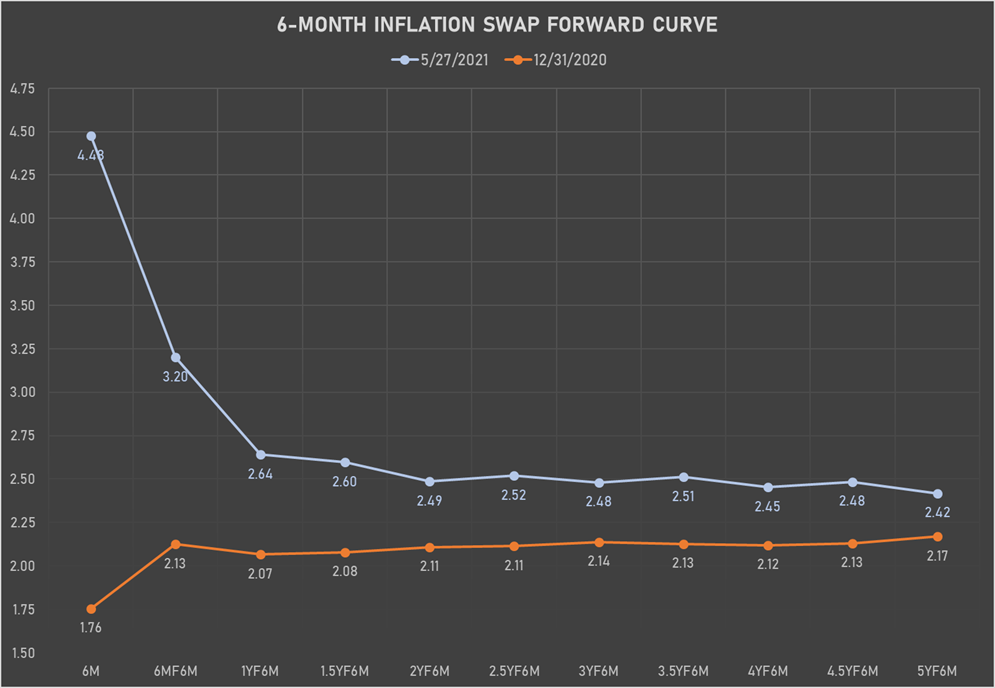

US FORWARD RATES

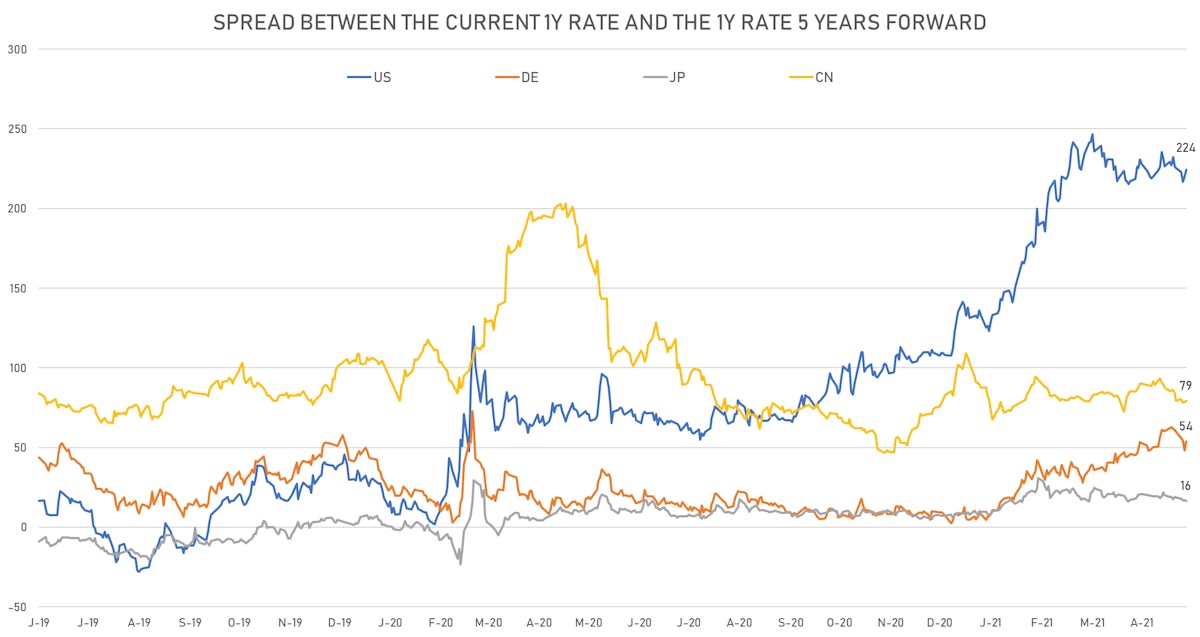

- 3-month USD Libor 5 years forward up 4.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 4.2 bp, now at 2.3051%

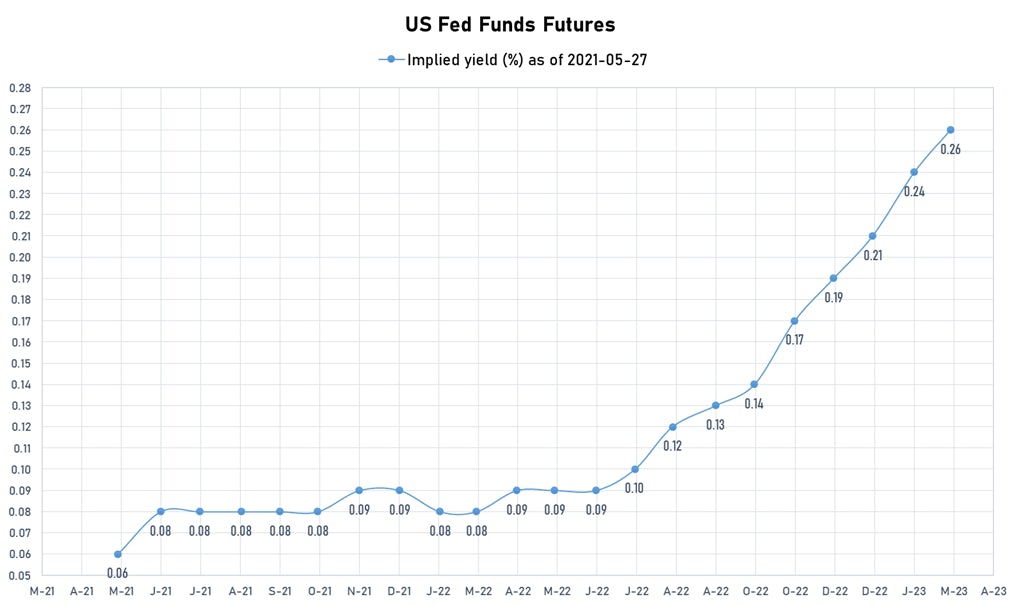

- Short-term rates are expected to increase by 224.2 bp over the next 5 years, up 4bp

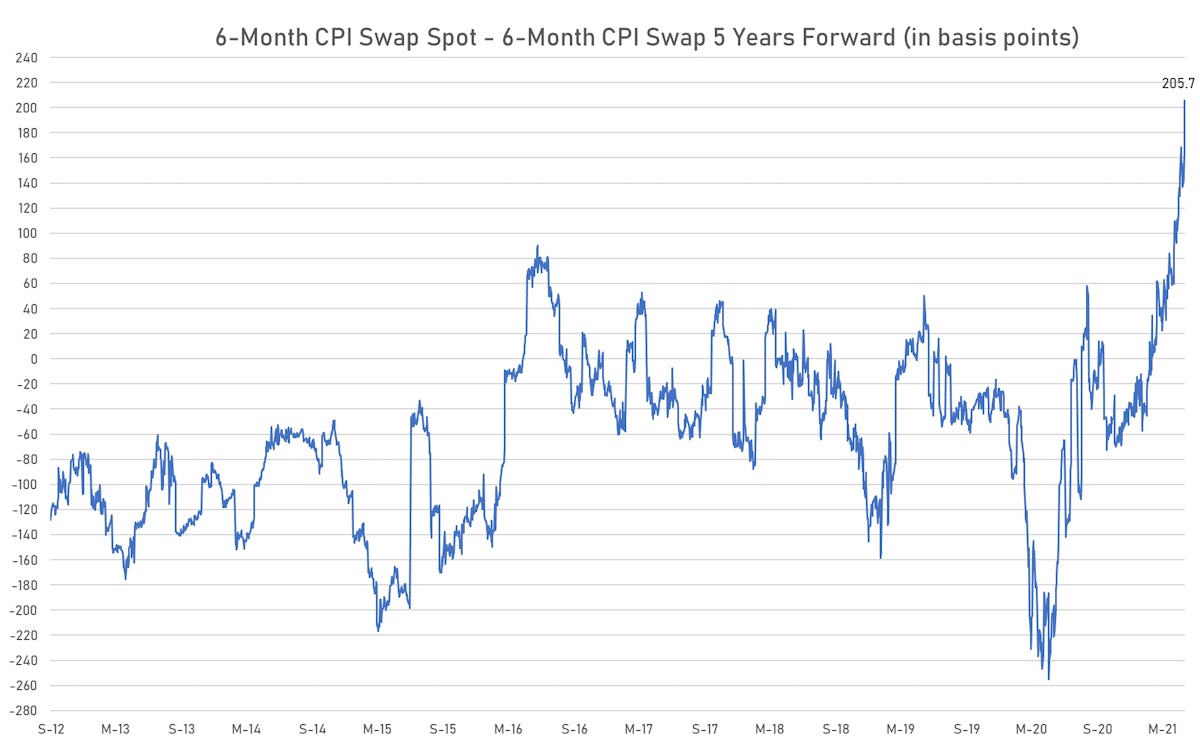

US INFLATION

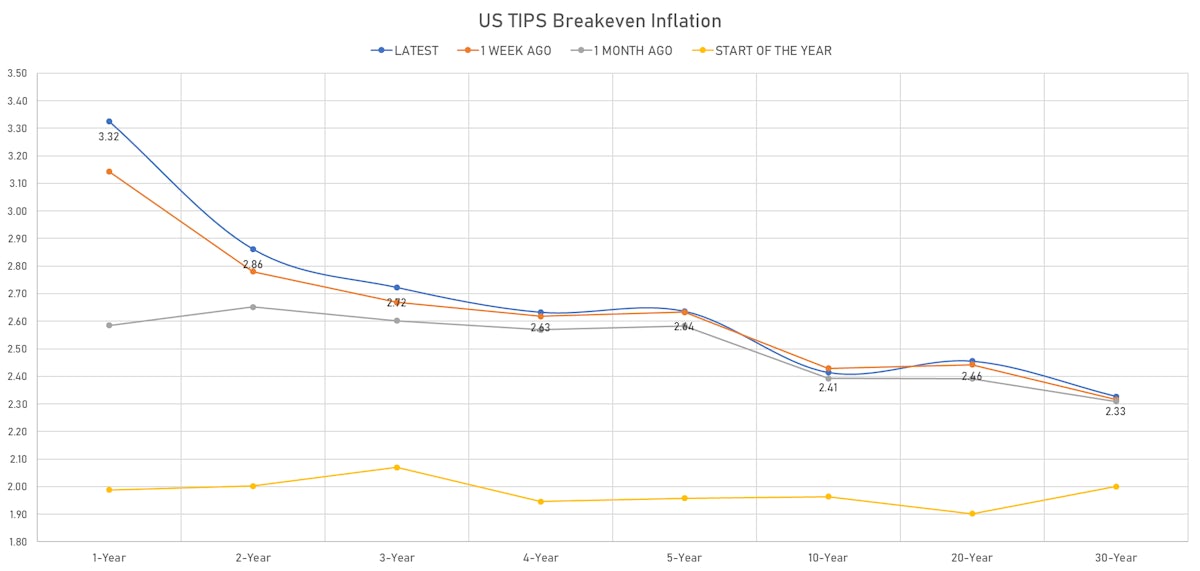

- TIPS 1Y breakeven inflation at 3.32% (up 1.7bp); 2Y at 2.86% (up 0.0bp); 5Y at 2.64% (up 0.2bp); 10Y at 2.41% (up 0.8bp); 30Y at 2.33% (up 1.7bp)

- 6-month spot US CPI swap up a whopping 41.2 bp to 4.475%, with a steepening of the forward curve

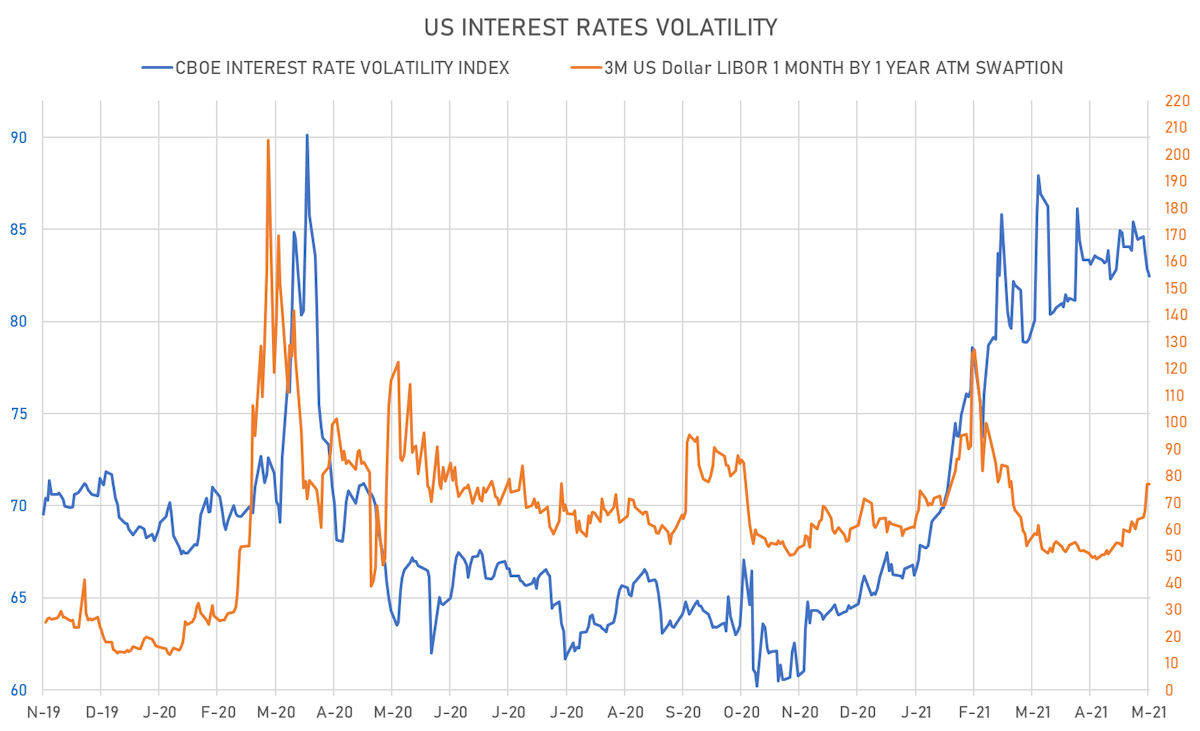

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 10.2% at 76.9%

- 3-Month LIBOR-OIS spread down -1.9 bp at 7.7 bp (12-months range: 7.5-31.8 bp), with 3M USD Libor at a fresh all-time low

KEY INTERNATIONAL RATES

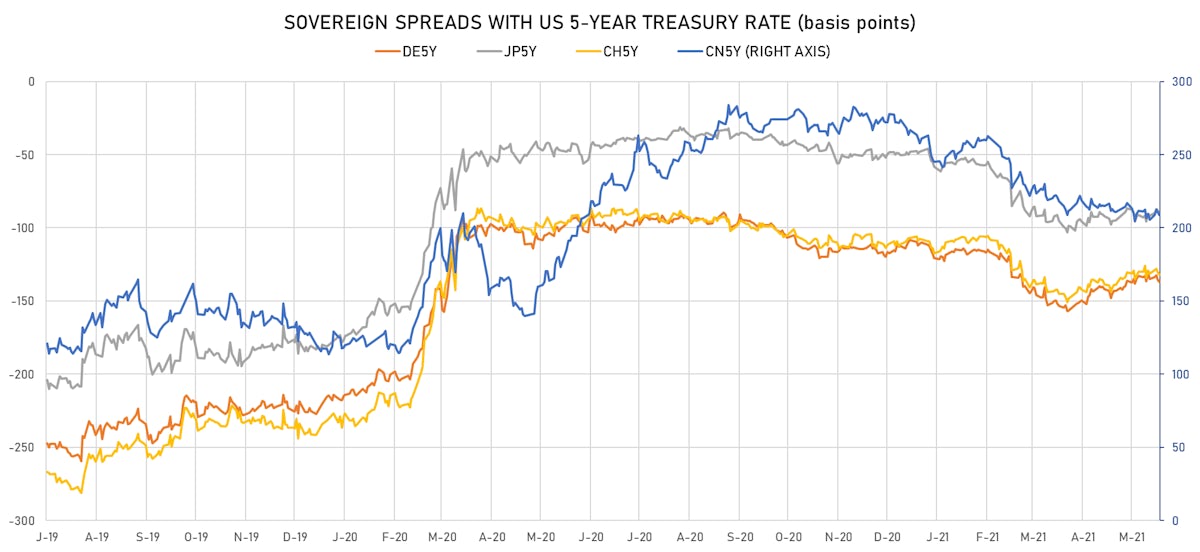

- Germany 5Y: -0.557% (up 2.2 bp); the German 1Y-10Y curve is 4.6 bp steeper at 46.4bp (YTD change: +31.5 bp)

- Japan 5Y: -0.092% (down 0.0 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 20.7bp (YTD change: +5.7 bp)

- China 5Y: 2.900% (up 1.4 bp); the Chinese 1Y-10Y curve is 0.5 bp steeper at 54.1bp (YTD change: +7.7 bp)

- Switzerland 5Y: -0.507% (up 1.7 bp); the Swiss 1Y-10Y curve is 4.8 bp steeper at 60.9bp (YTD change: +34.2 bp)