Rates

Good Headline ISM Manufacturing Numbers Lift US Rates; Short-Term Inflation Expectations Stay Elevated

Labor shortages, shortages of raw materials and transportation constraints still limit the ability of US manufacturers to keep up with the strong rebound in demand

Published ET

US 2-10 Spot curve steepens While the 5 Years Forward Stays Inverted | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

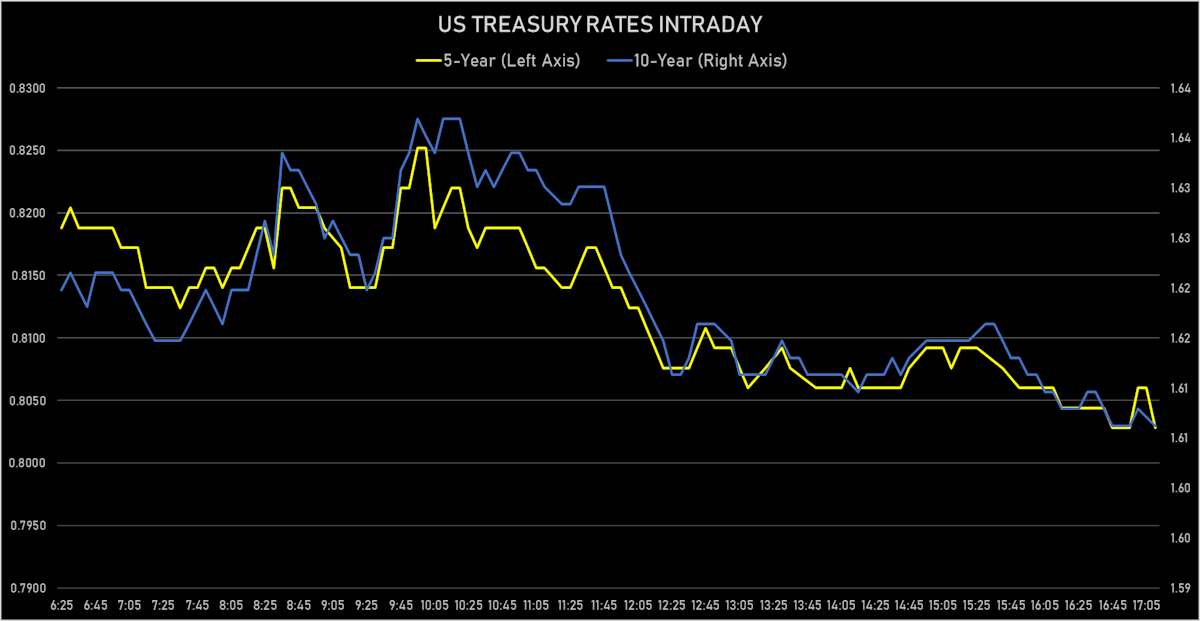

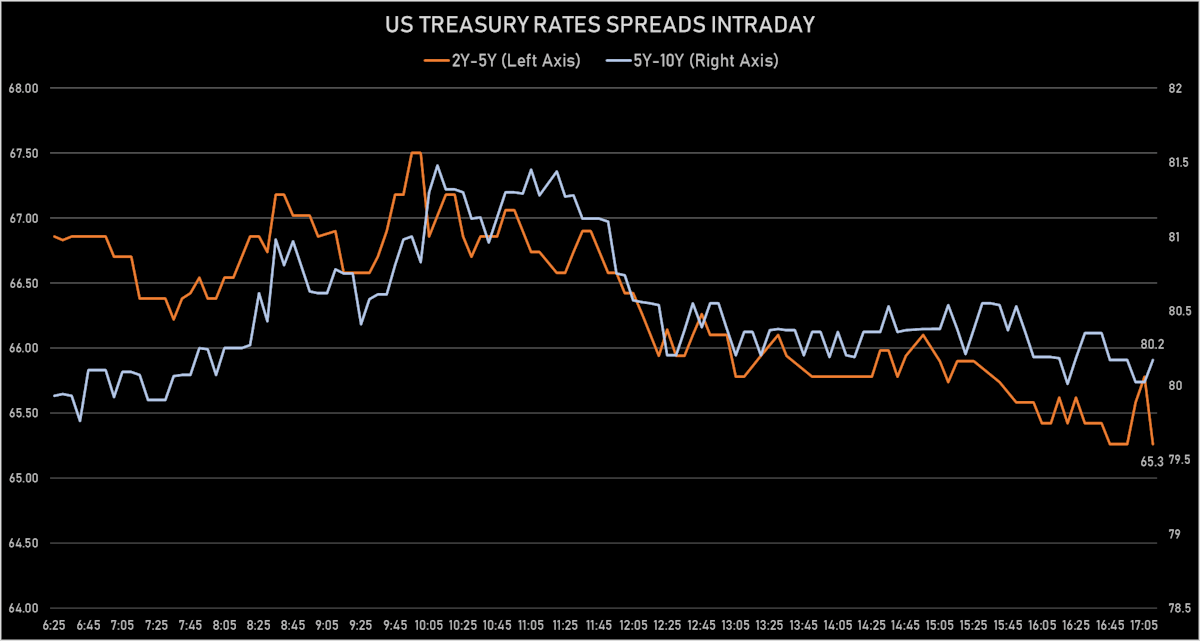

- Yield curve steepening, with the 1Y-10Y spread widening 2.0 bp on the day, now at 156.3 bp (YTD change: +75.9)

- 1Y: 0.0430% (up 0.5 bp)

- 2Y: 0.1486% (up 0.8 bp)

- 5Y: 0.8028% (up 1.5 bp)

- 7Y: 1.2687% (up 2.1 bp)

- 10Y: 1.6062% (up 2.6 bp)

- 30Y: 2.2867% (up 2.4 bp)

US MACRO RELEASES

- Construction Spending, Change P/P for Apr 2021 (U.S. Census Bureau) at 0.20, below consensus estimate of 0.50

- Dallas Fed, General Business Activity for May 2021 (Fed Reserve, Dallas) at 34.90

- ISM Manufacturing, Employment for May 2021 (ISM, United States) at 50.90

- ISM Manufacturing, New orders for May 2021 (ISM, United States) at 67.00

- ISM Manufacturing, PMI total for May 2021 (ISM, United States) at 61.20, above consensus estimate of 60.90

- ISM Manufacturing, Prices for May 2021 (ISM, United States) at 88.00, below consensus estimate of 89.80

- PMI, Manufacturing Sector, Total, Final for May 2021 (Markit Economics) at 62.10

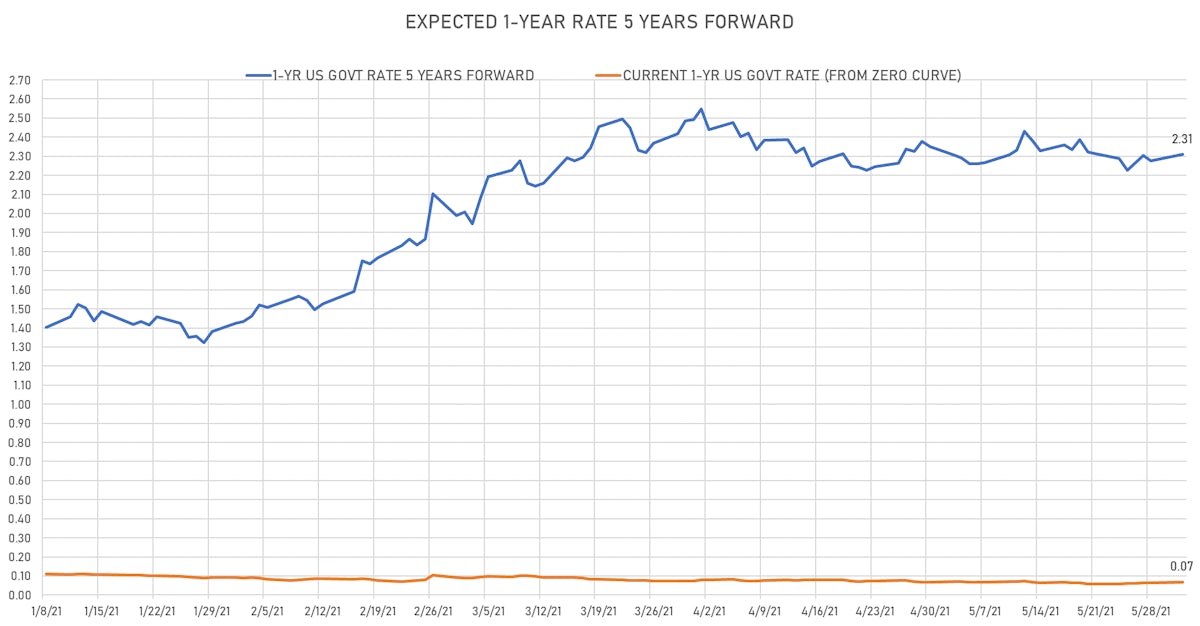

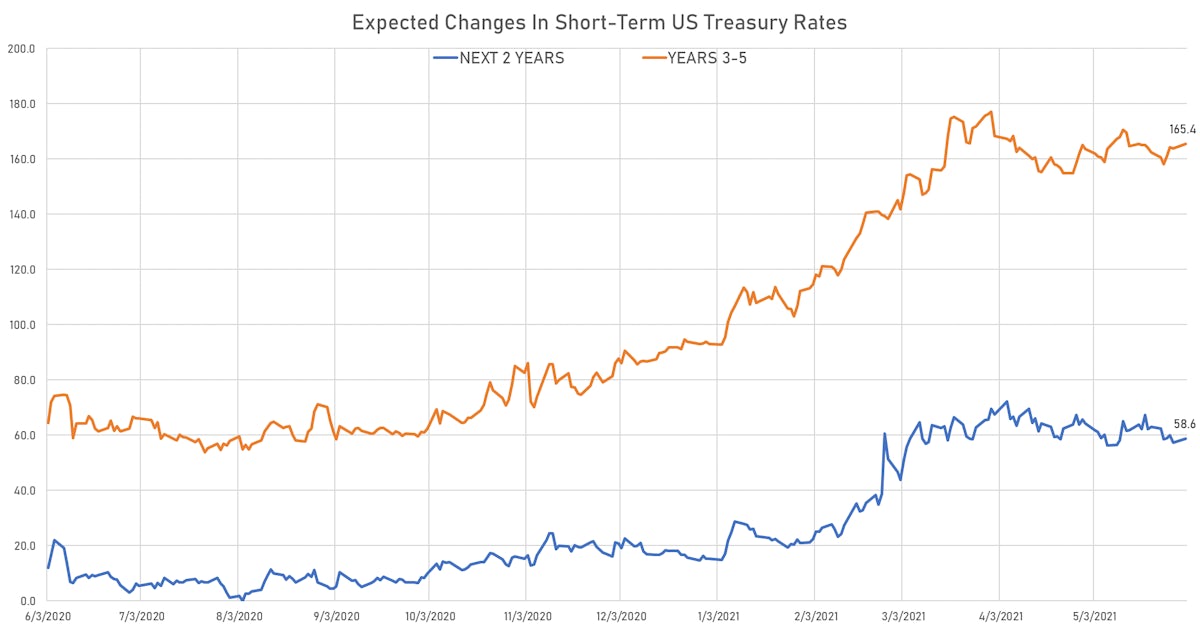

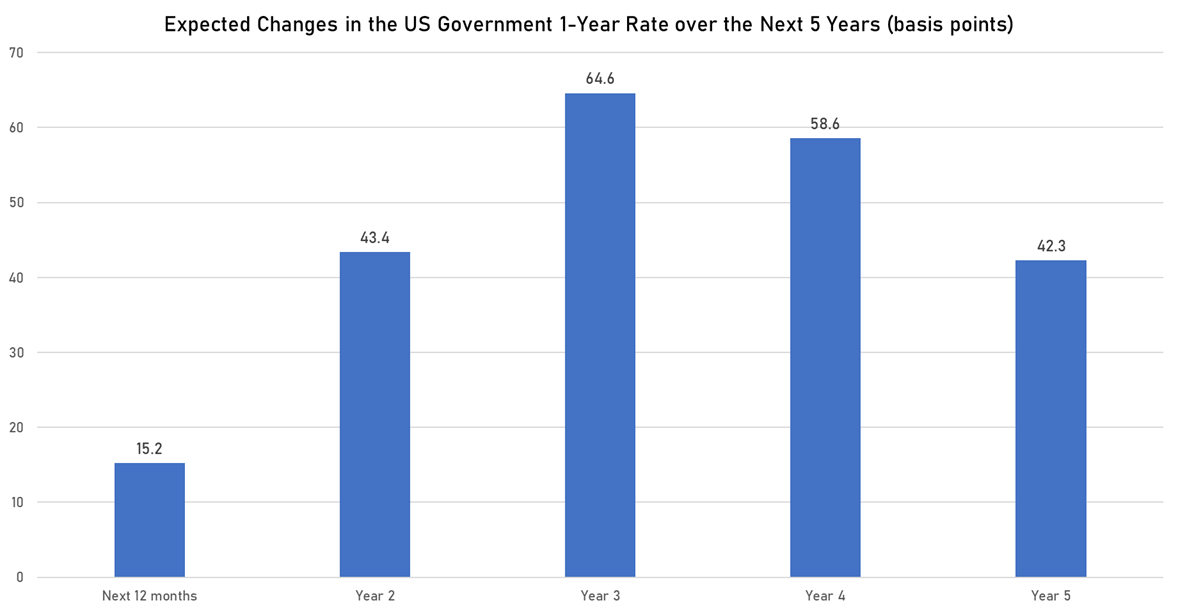

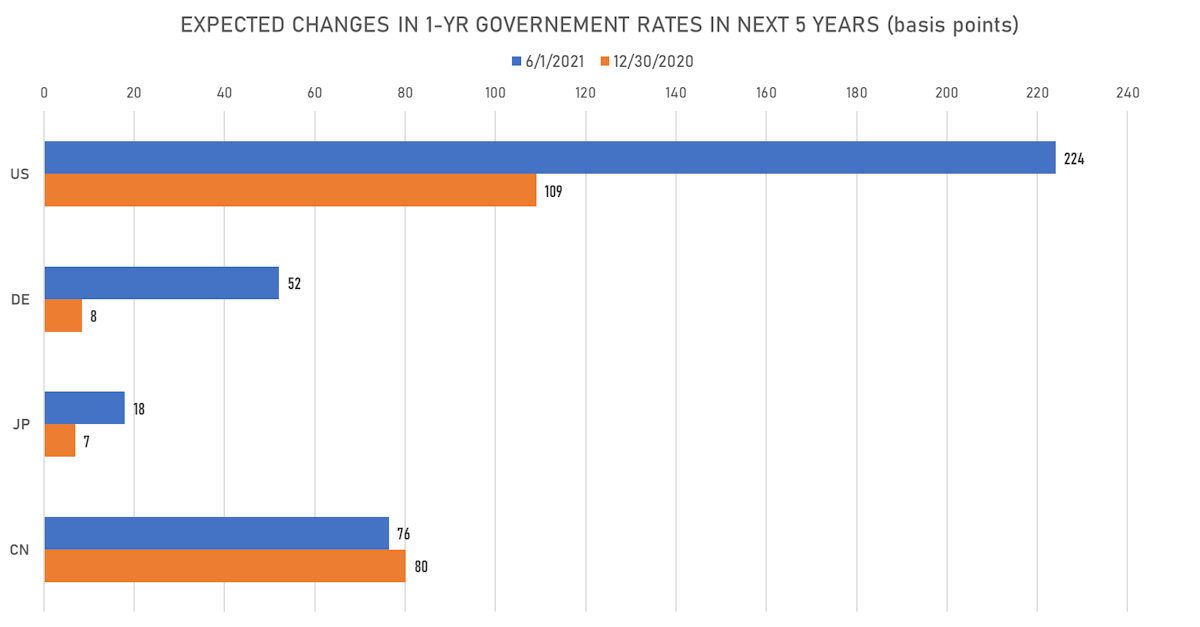

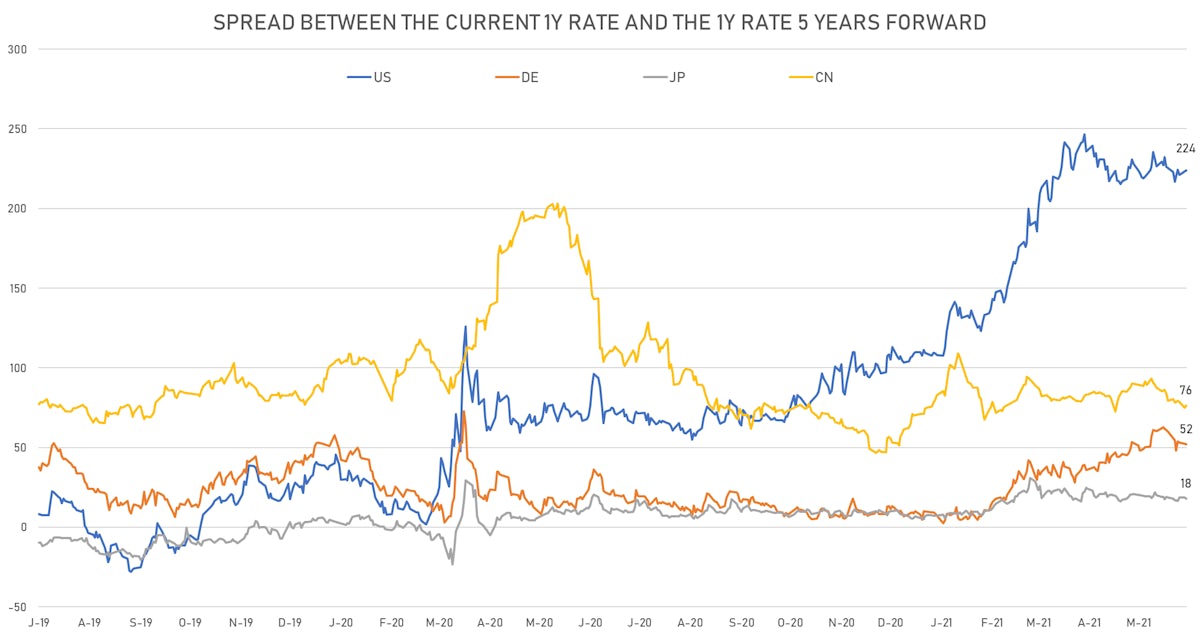

US FORWARD RATES

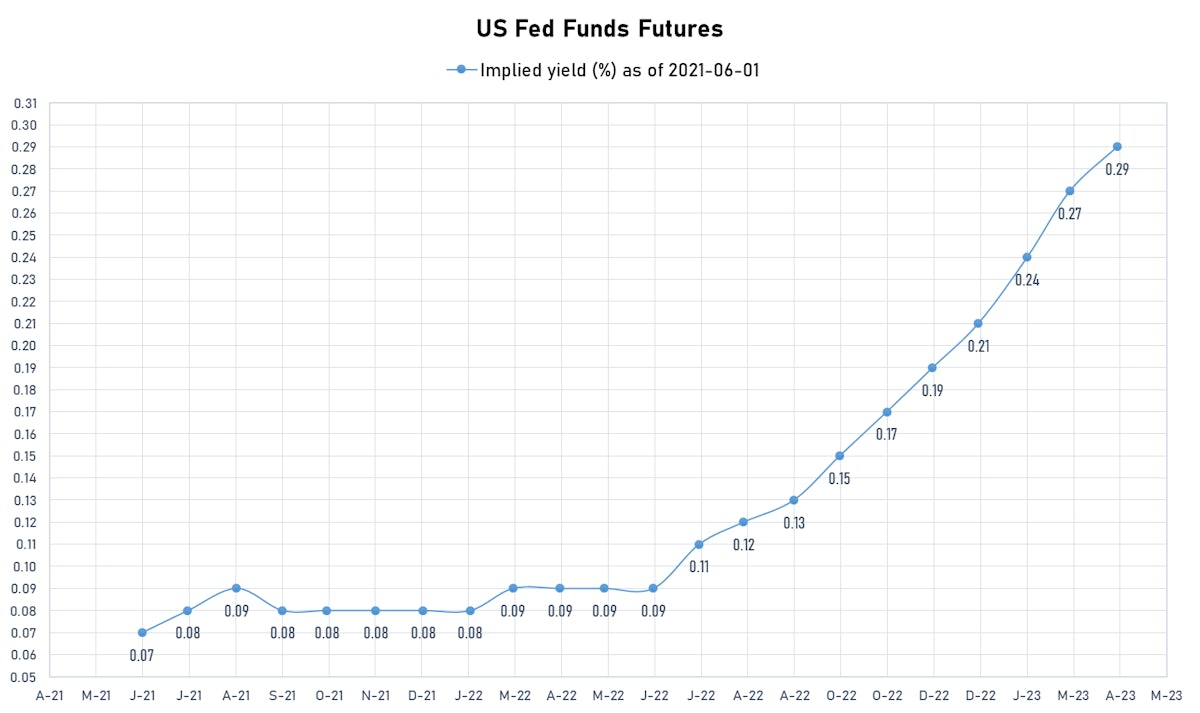

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 3.4 bp, now at 2.3094%

- Short-term rates are now expected to increase by 224.1 bp over the next 5 years

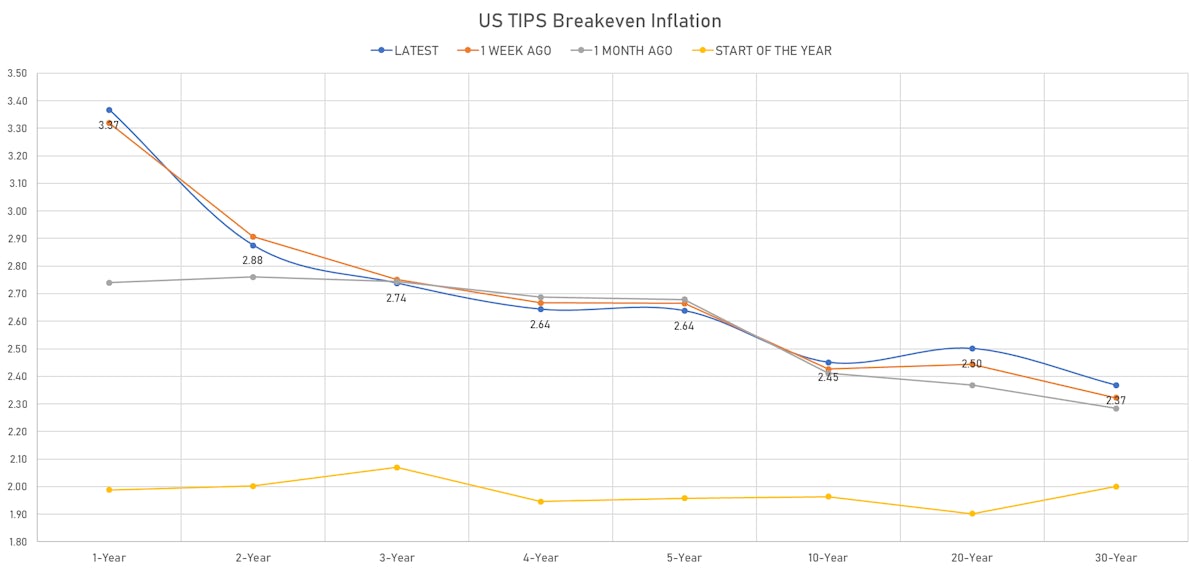

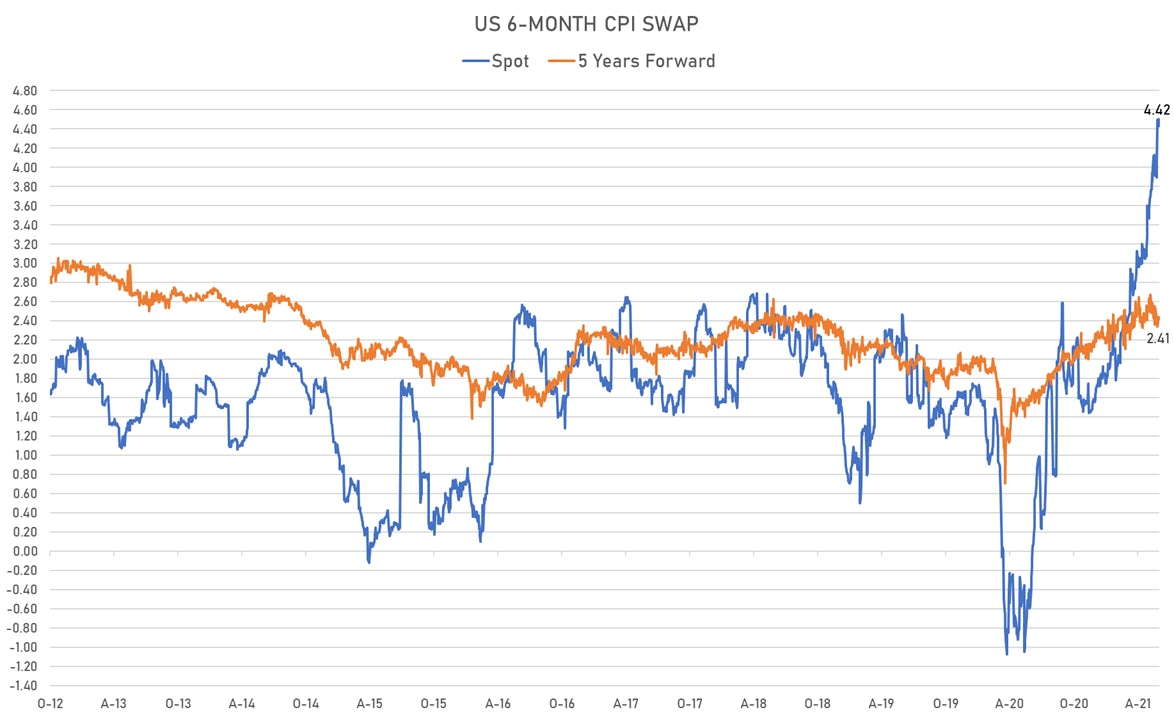

US INFLATION

- TIPS 1Y breakeven inflation at 3.37% (up 4.5bp); 2Y at 2.88% (up 4.0bp); 5Y at 2.64% (up 3.2bp); 10Y at 2.45% (up 3.8bp); 30Y at 2.37% (up 3.8bp)

- 6-month spot US CPI swap down -7.4 bp to 4.4250%, with a flattening of the forward curve

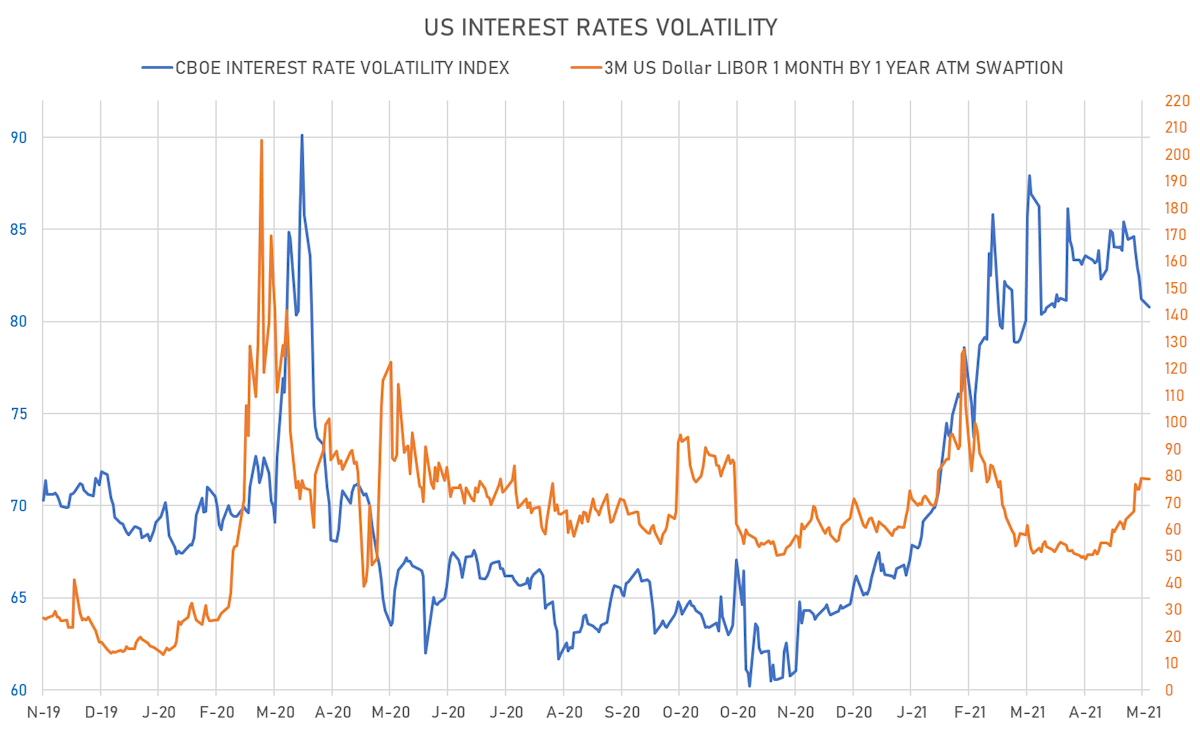

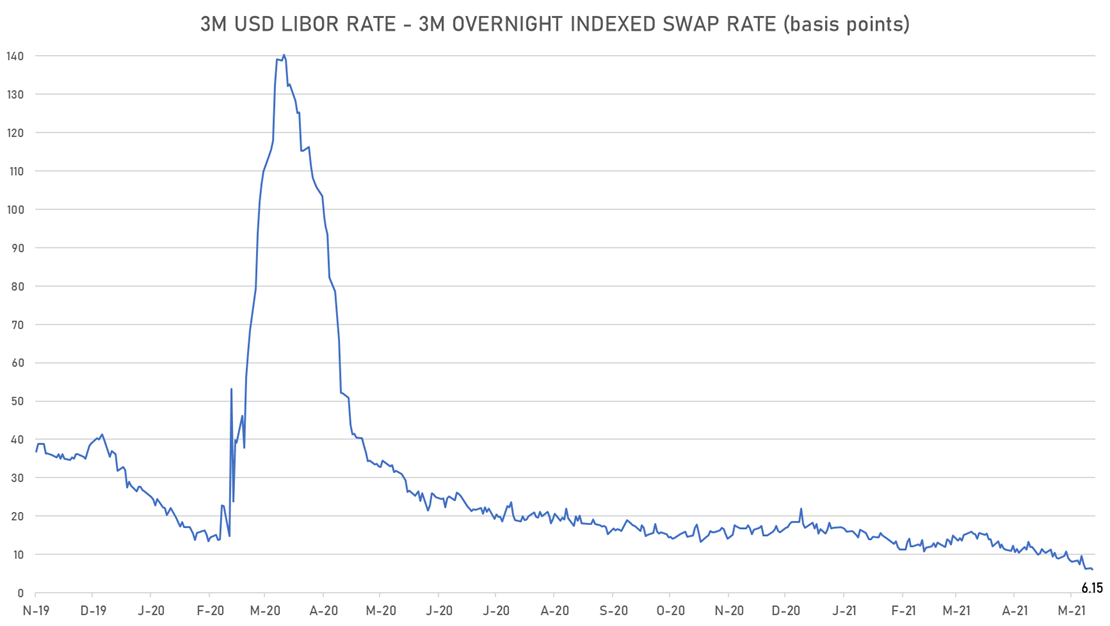

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 4.3% at 78.7%

- 3-Month LIBOR-OIS spread down -0.3 bp at 6.2 bp (12-months range: 6.2-30.2 bp)

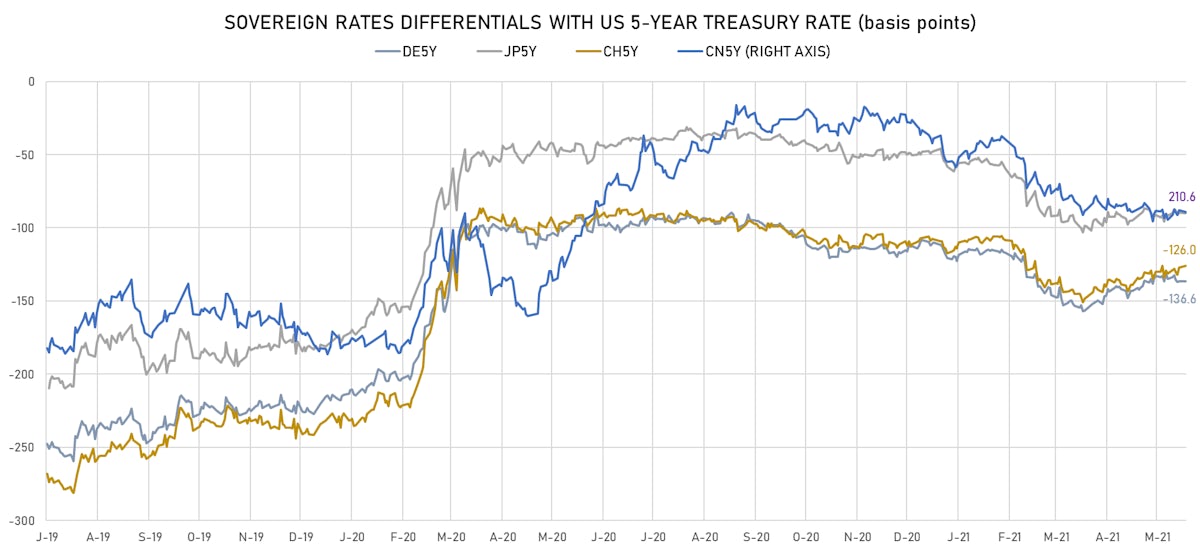

KEY GLOBAL RATES

- Germany 5Y: -0.567% (up 0.2 bp); the German 1Y-10Y curve is 0.8 bp steeper at 45.6bp (YTD change: +31.2 bp)

- Japan 5Y: -0.087% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.0 bp steeper at 19.4bp (YTD change: +5.2 bp)

- China 5Y: 2.909% (down -0.5 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 52.8bp (YTD change: +6.4 bp)

- Switzerland 5Y: -0.457% (up 4.8 bp); the Swiss 1Y-10Y curve is 7.9 bp steeper at 61.3bp (YTD change: +34.9 bp)