Rates

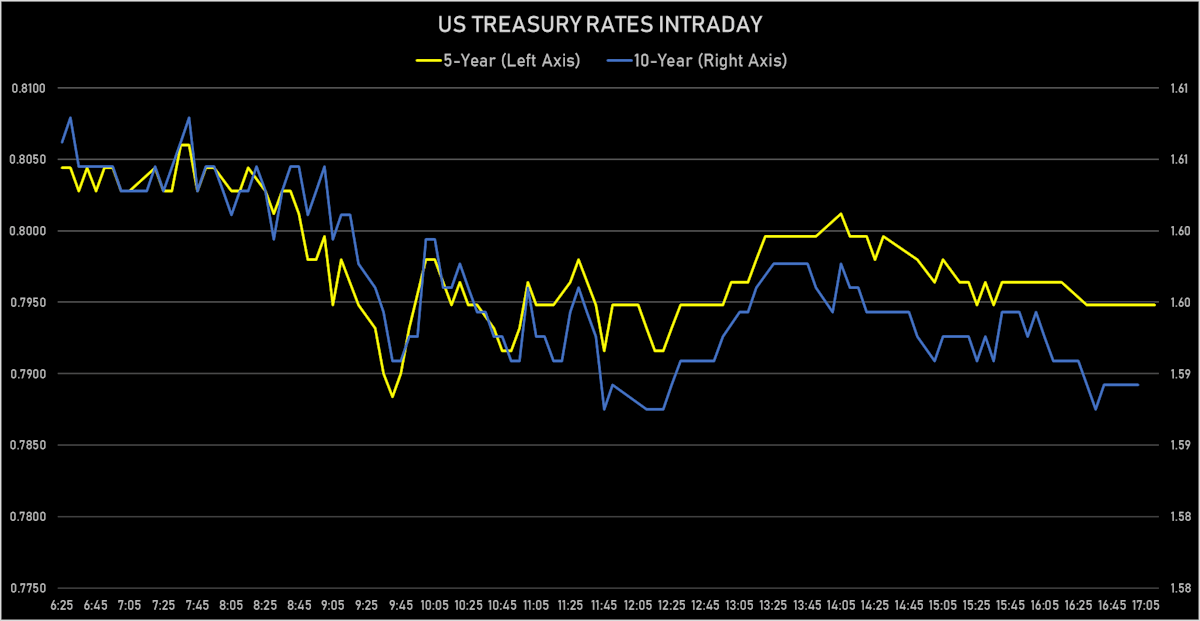

US Rates Curve Shifts Down In The Absence Of Any Catalyst To Rise Further

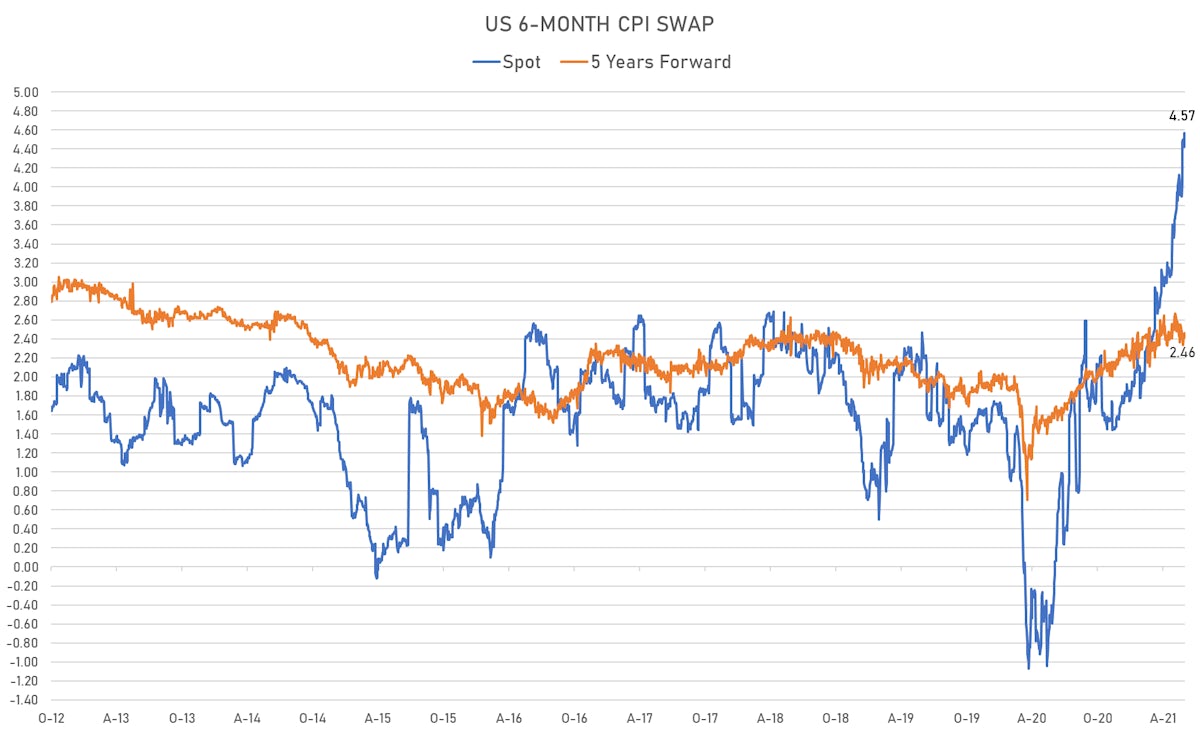

Short-term inflation markets were up today, with the beige book pointing to increased price pressures, with input prices rising faster than selling prices

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

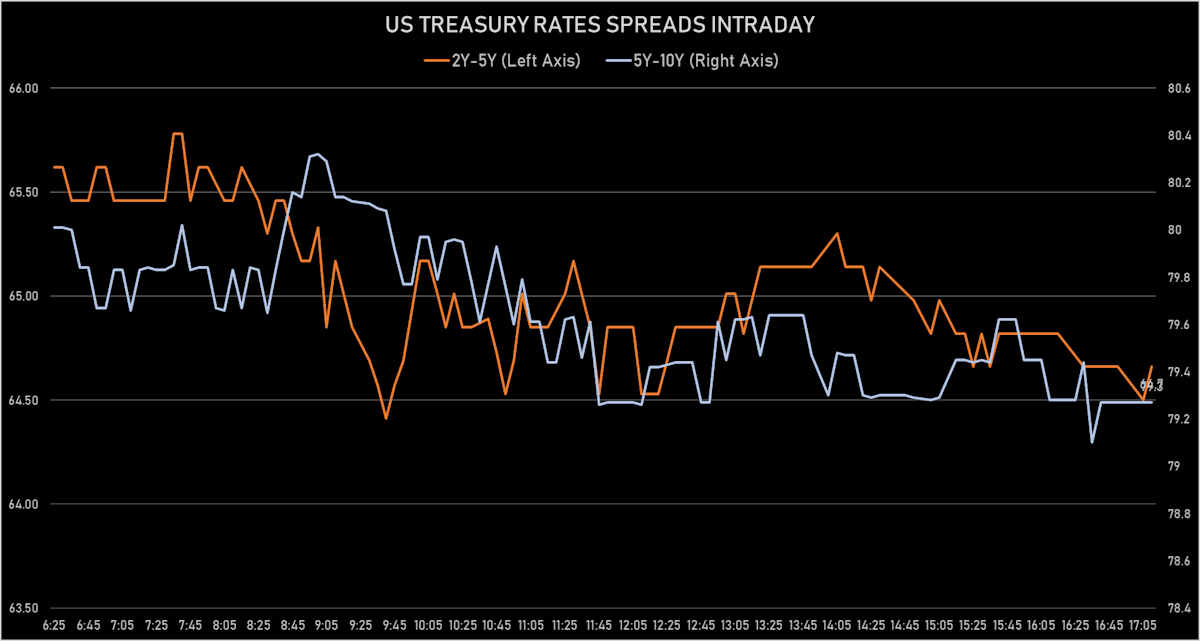

- Yield curve flattening, with the 1Y-10Y spread tightening -1.4 bp on the day, now at 156.3 bp (YTD change: +75.9)

- 1Y: 0.0430% (down 0.3 bp)

- 2Y: 0.1486% (down 0.2 bp)

- 5Y: 0.8028% (down 0.8 bp)

- 7Y: 1.2687% (down 1.2 bp)

- 10Y: 1.6062% (down 1.7 bp)

- 30Y: 2.2867% (down 1.4 bp)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 29 May (Redbook Research) at 13.00

- Dallas Fed, General Business Activity for May 2021 (Fed Reserve, Dallas) at 40.00

- Dallas Fed, Revenue (Sales for TROS) for May 2021 (Fed Reserve, Dallas) at 23.90

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 28 May (MBA, USA) at -4.00

- Mortgage applications, market composite index for W 28 May (MBA, USA) at 665.90

- Mortgage applications, market composite index, purchase for W 28 May (MBA, USA) at 261.40

- Mortgage applications, market composite index, refinancing for W 28 May (MBA, USA) at 3,022.00

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 28 May (MBA, USA) at 3.17

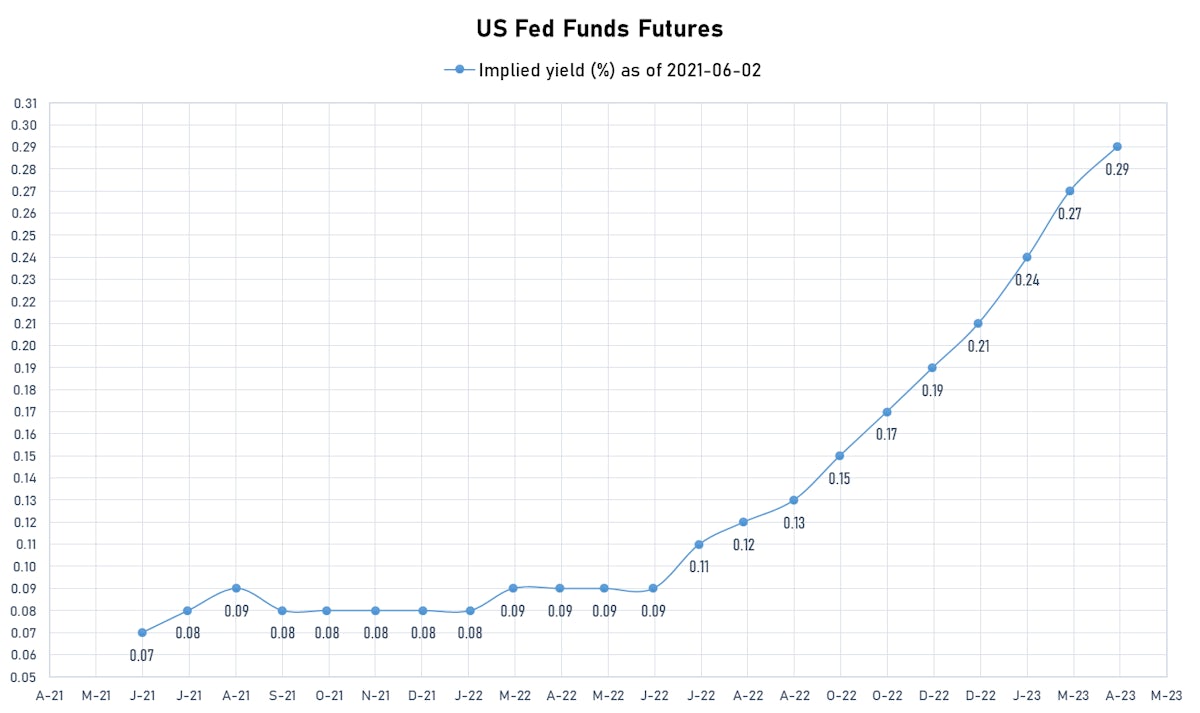

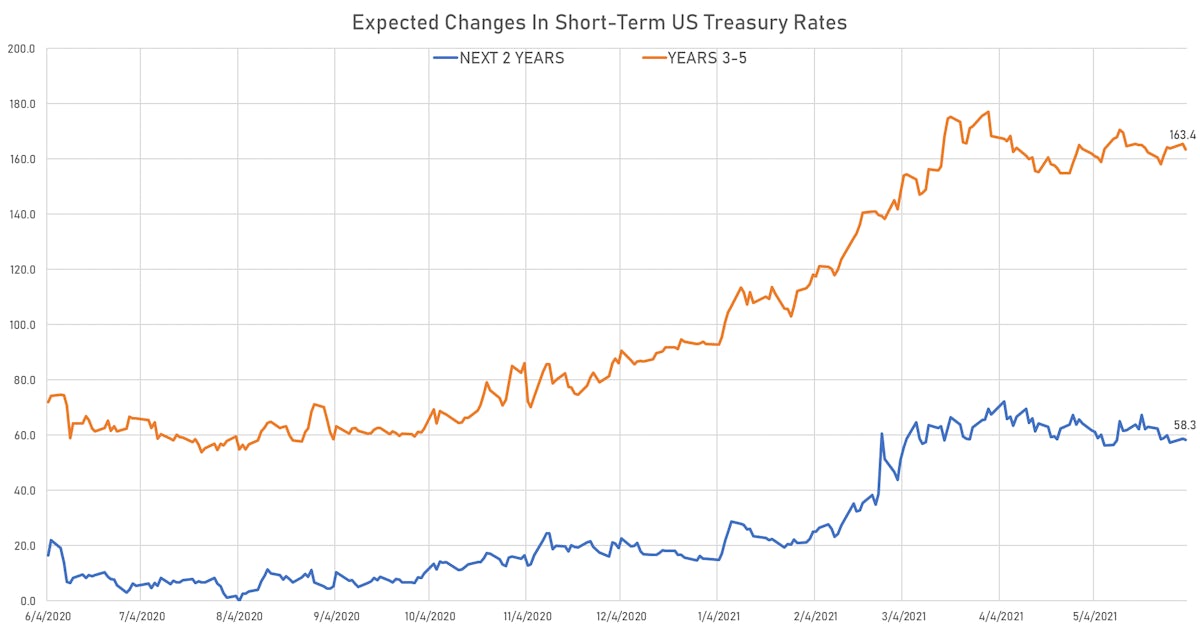

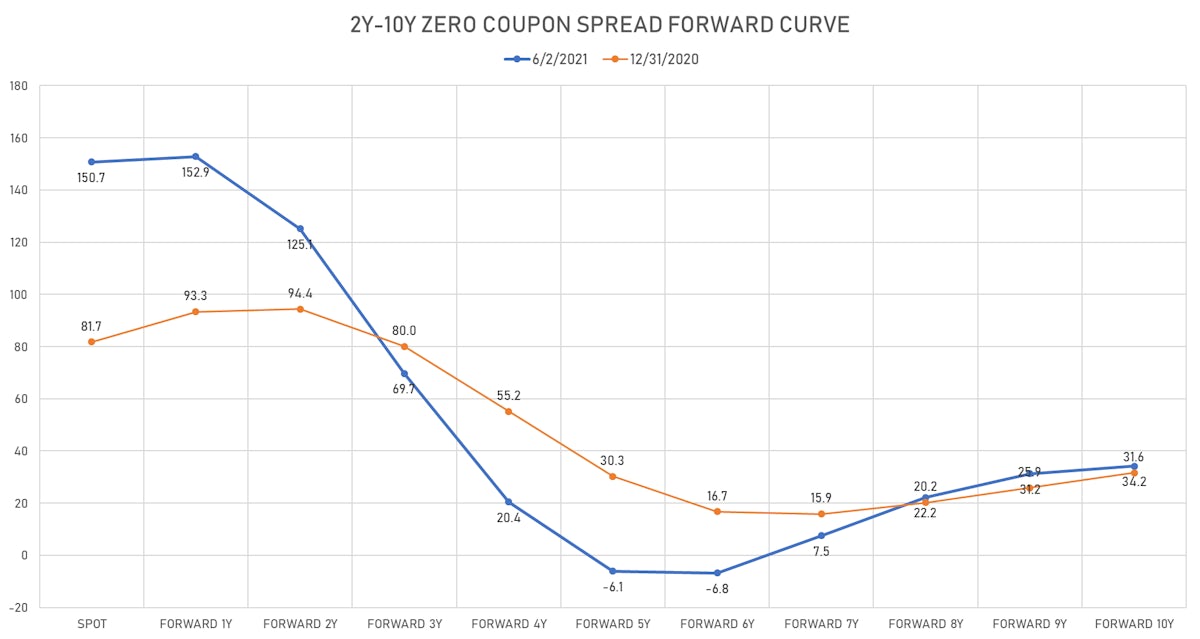

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 2.4 bp, now at 2.2858%

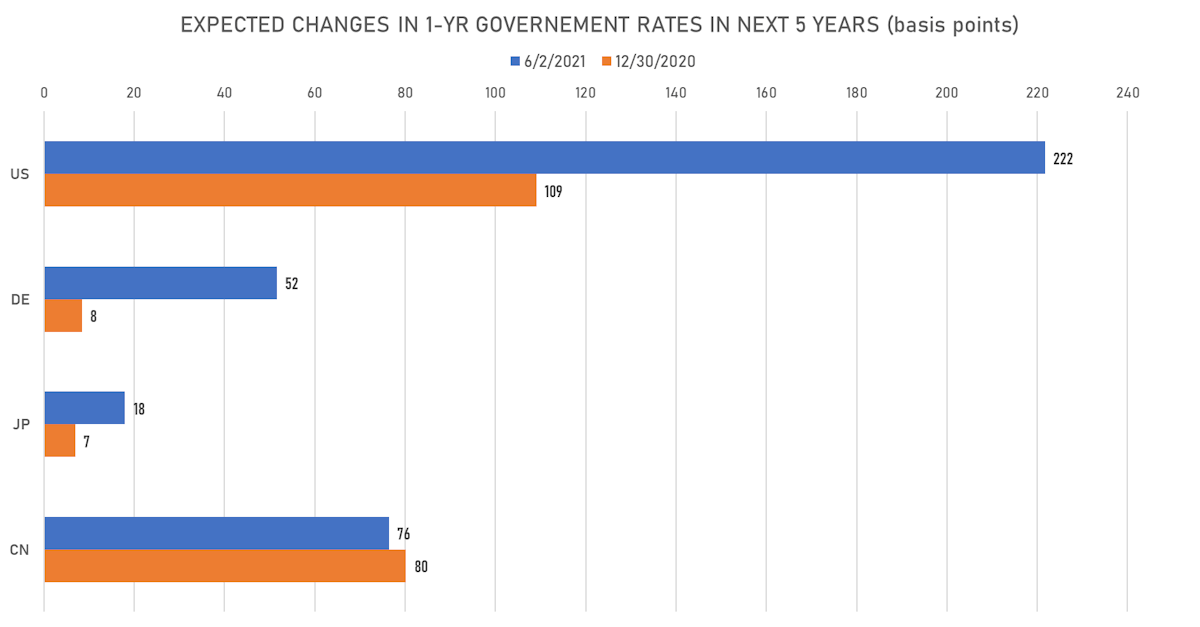

- Short-term rates are expected to increase by 221.7 bp over the next 5 years

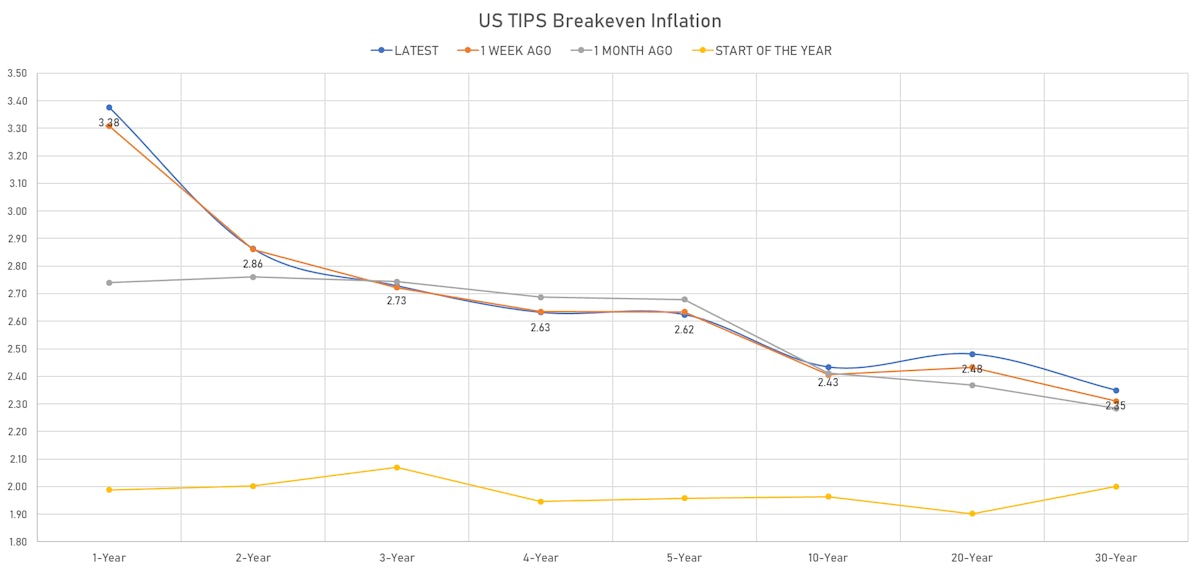

US INFLATION

- TIPS 1Y breakeven inflation at 3.38% (up 0.9bp); 2Y at 2.86% (down -1.3bp); 5Y at 2.62% (down -1.4bp); 10Y at 2.43% (down -1.7bp); 30Y at 2.35% (down -1.9bp)

- 6-month spot US CPI swap up 14.1 bp to 4.566%, with a steepening of the forward curve

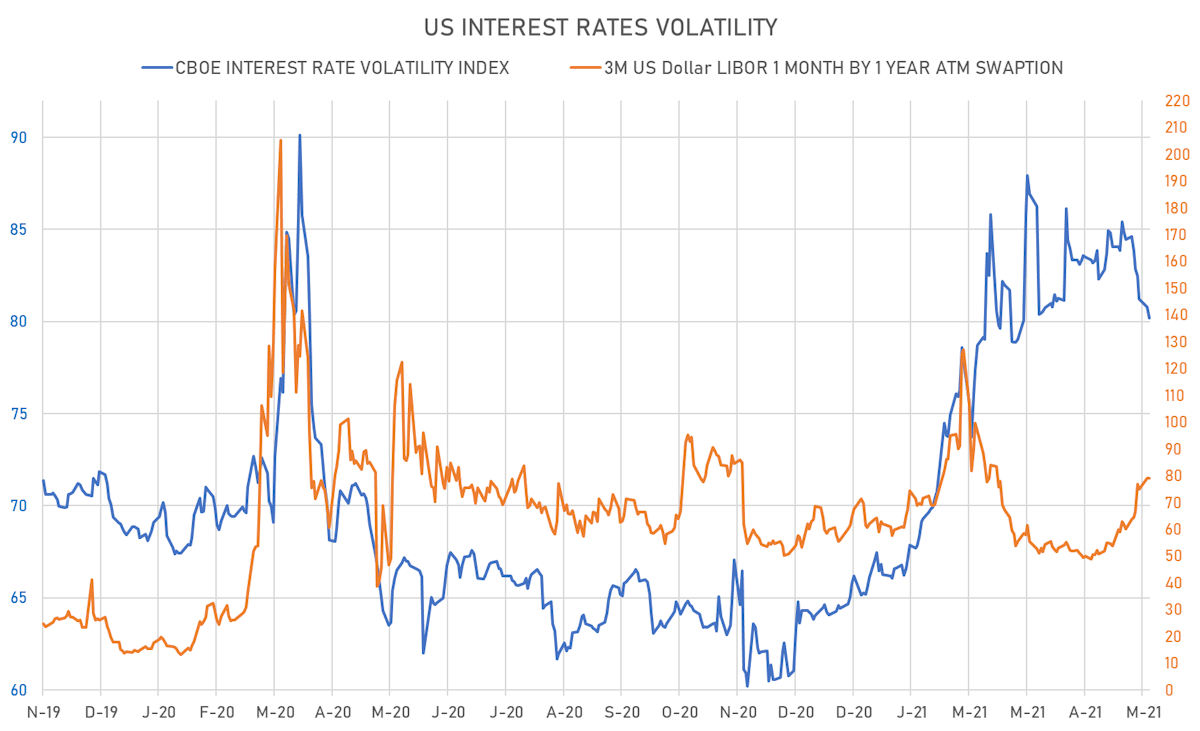

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 78.9%

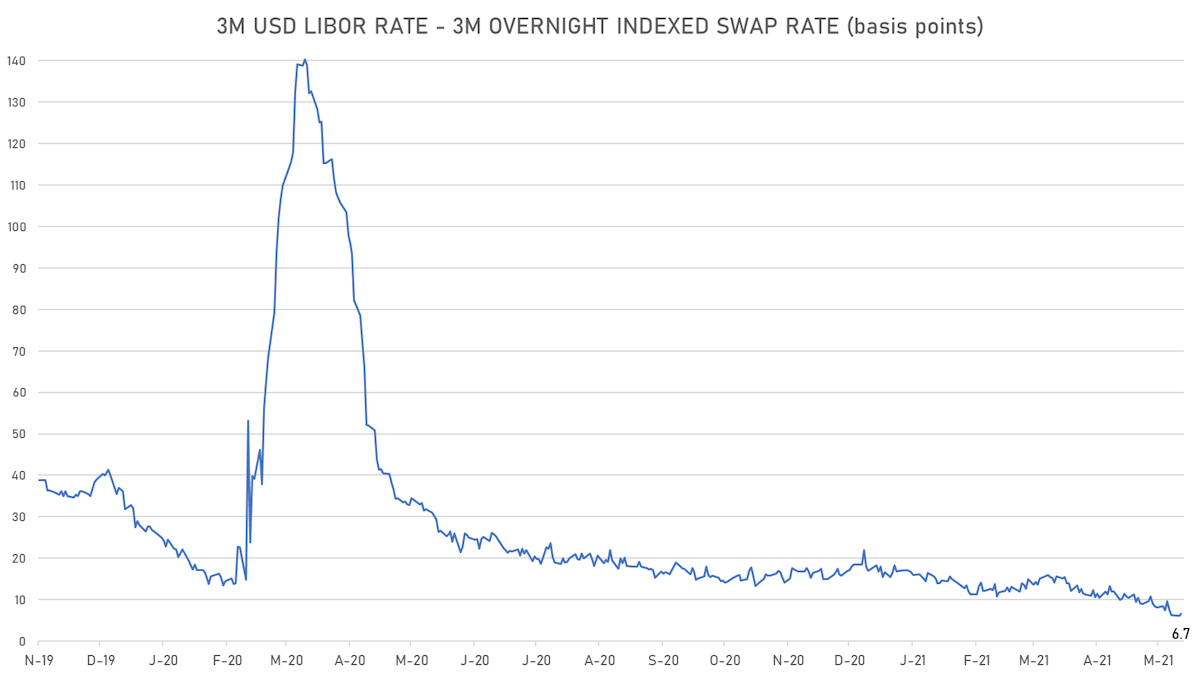

- 3-Month LIBOR-OIS spread up 0.6 bp at 6.7 bp (12-months range: 6.2-29.4 bp)

KEY INTERNATIONAL RATES

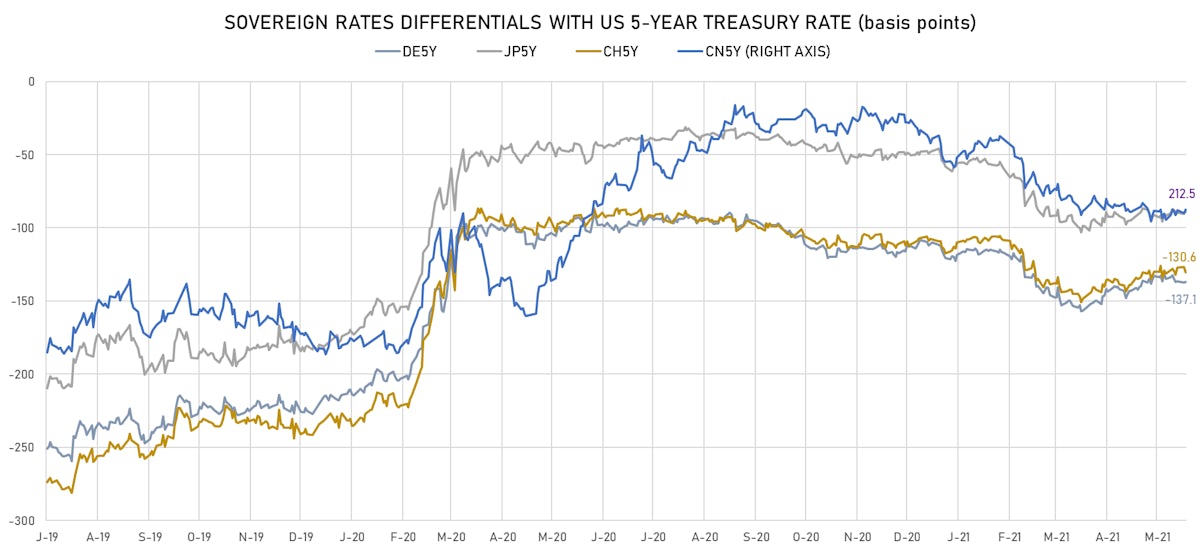

- Germany 5Y: -0.578% (down -1.3 bp); the German 1Y-10Y curve is 2.1 bp flatter at 44.5bp (YTD change: +29.1 bp)

- Japan 5Y: -0.087% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 19.4bp (YTD change: +5.3 bp)

- China 5Y: 2.920% (up 1.1 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 54.8bp (YTD change: +8.4 bp)

- Switzerland 5Y: -0.511% (down -5.4 bp); the Swiss 1Y-10Y curve is 0.4 bp flatter at 60.9bp (YTD change: +34.5 bp)