Rates

Good PMIs And Unexpectedly High ADP Jobs Report Drive Rates Higher

Attention now focused on the payrolls report tomorrow, with private payrolls expected around 600k: Jefferies see 395k, BofAML 500k, Credit Suisse 550k, Morgan Stanley 600k and Goldman Sachs 700k

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1Y-10Y spread widening 3.6 bp on the day, now at 157.9 bp (YTD change: +77.5)

- 1Y: 0.0460% (unchanged)

- 2Y: 0.1584% (up 1.2 bp)

- 5Y: 0.8397% (up 4.5 bp)

- 7Y: 1.2946% (up 3.8 bp)

- 10Y: 1.6250% (up 3.6 bp)

- 30Y: 2.2967% (up 2.4 bp)

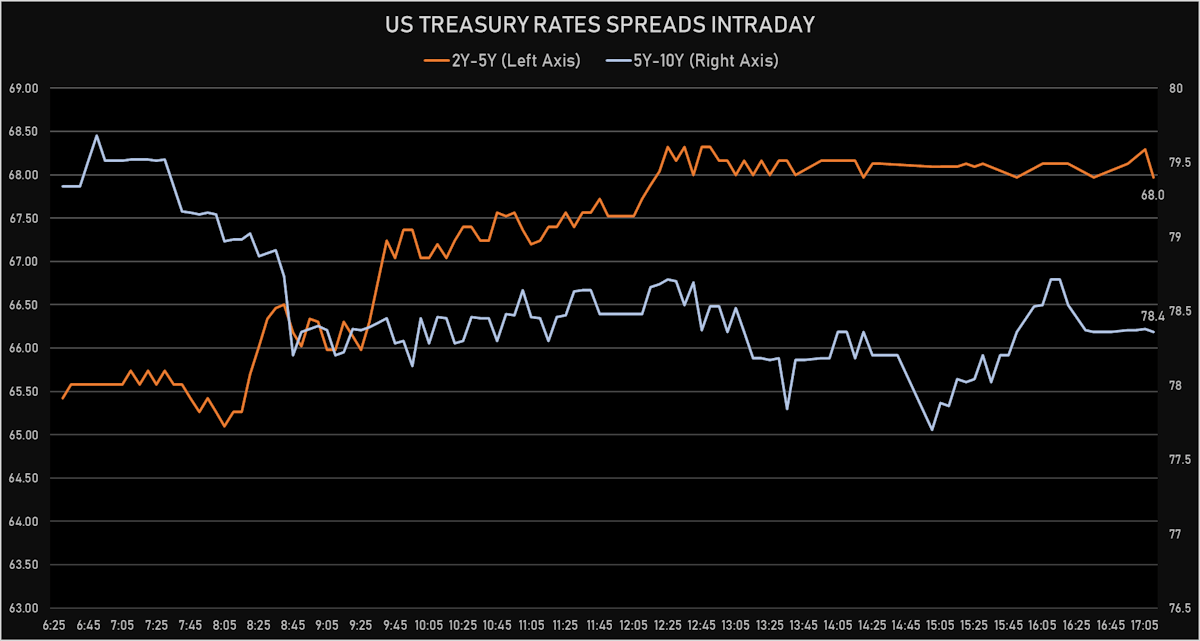

- US treasury curve spreads: 2-5 at 68.3bp (up 3.3bp today), 5-10 at 78.7bp (down -0.9bp today), 10-30 at 67.1bp (down -1.2bp today)

- Treasuries butterfly spreads: 2x5x10 at 9.9bp (down -4.3bp today), 5x10X30 at -11.6bp (down -0.3bp today), indicating an expectation of more rate hikes in the next 5 years

US MACRO RELEASES

- ISM Non-manufacturing, Business activity for May 2021 (ISM, United States) at 66.20, below consensus estimate of 67.20

- ISM Non-manufacturing, Employment for May 2021 (ISM, United States) at 55.30

- ISM Non-manufacturing, New orders for May 2021 (ISM, United States) at 63.90

- ISM Non-manufacturing, NMI/PMI for May 2021 (ISM, United States) at 64.00, above consensus estimate of 63.00

- ISM Non-manufacturing, Prices for May 2021 (ISM, United States) at 80.60

- Jobless Claims, National, Continued for W 22 May (U.S. Dept. of Labor) at 3.77, above consensus estimate of 3.62

- Jobless Claims, National, Initial for W 29 May (U.S. Dept. of Labor) at 385.00, below consensus estimate of 390.00

- Jobless Claims, National, Initial, four week moving average for W 29 May (U.S. Dept. of Labor) at 428.00

- Labor Cost, Unit, business, nonfarm, Change P/P for Q1 2021 (BLS, U.S Dep. Of Lab) at 1.70, above consensus estimate of -0.40

- ADP total nonfarm private employment (estimate), Absolute change for May 2021 (ADP - Automatic Data) at 978.00, above consensus estimate of 650.00

- Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for May 2021 (Challenger) at 24.59

- Labor Productivity, Output per hour of all persons, nonfarm business for Q1 2021 (BLS, U.S Dep. Of Lab) at 5.40, below consensus estimate of 5.50

- PMI, Composite, Output, Final for May 2021 (Markit Economics) at 68.70

- PMI, Services Sector, Business Activity, Final for May 2021 (Markit Economics) at 70.40

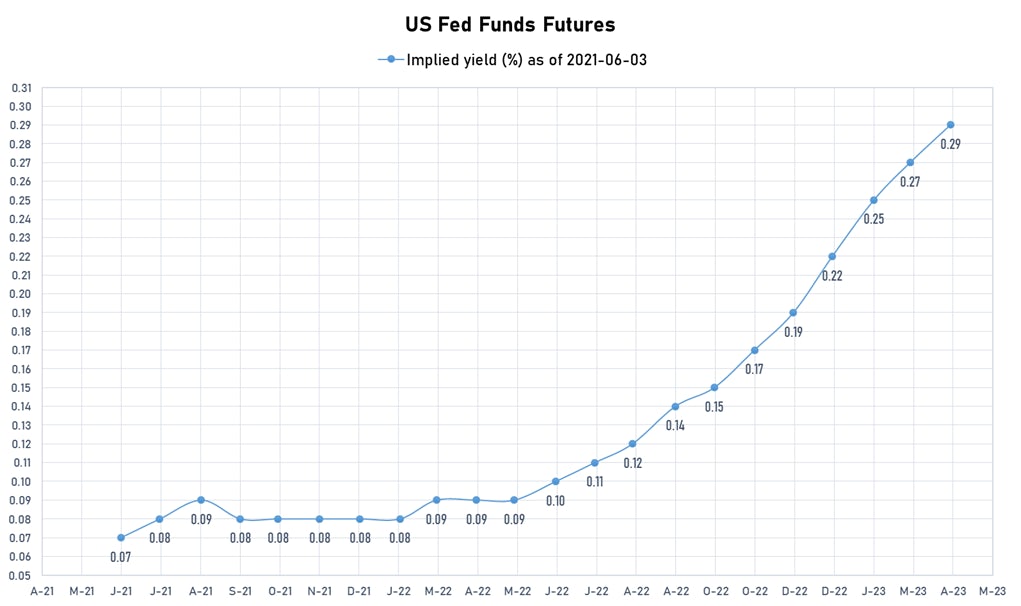

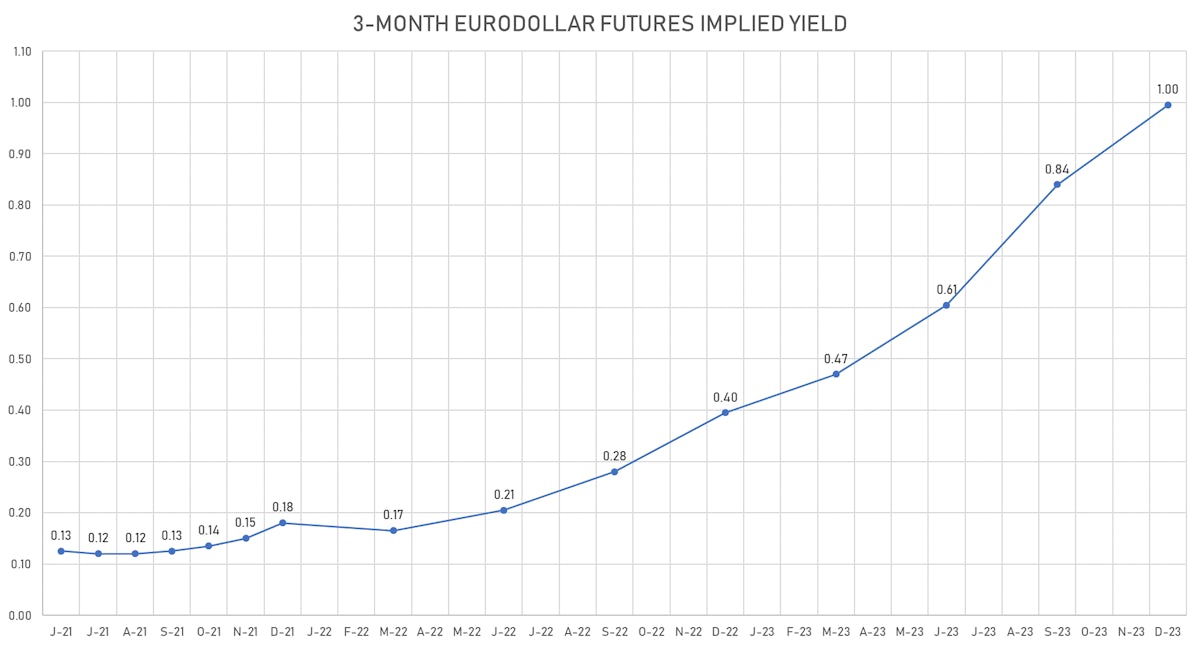

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 5.0 bp, now at 2.3357%

- Short-term rates are expected to increase by 226.2 bp over the next 5 years

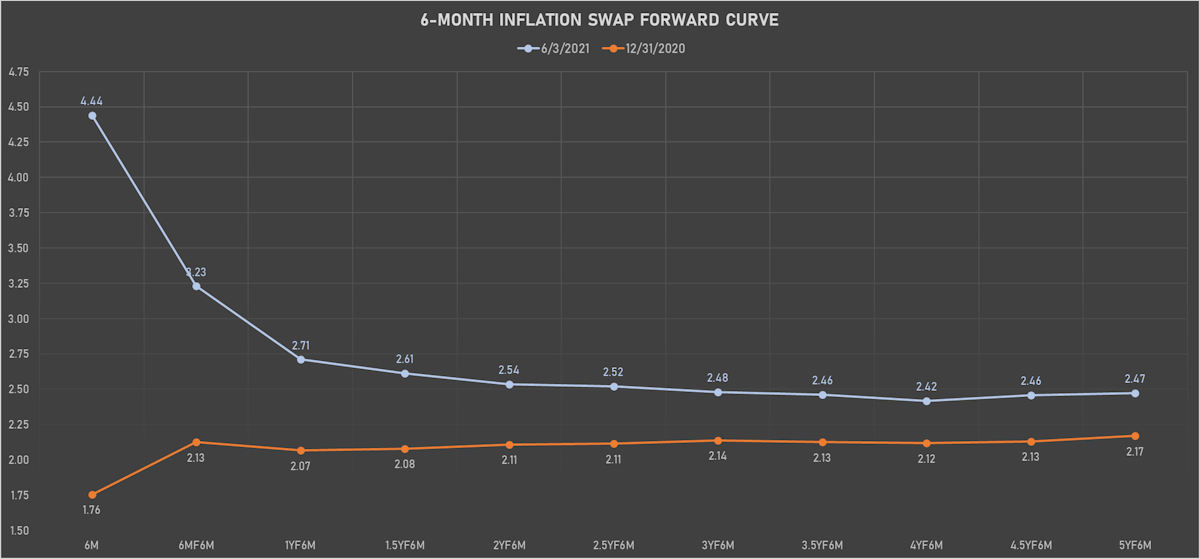

US INFLATION

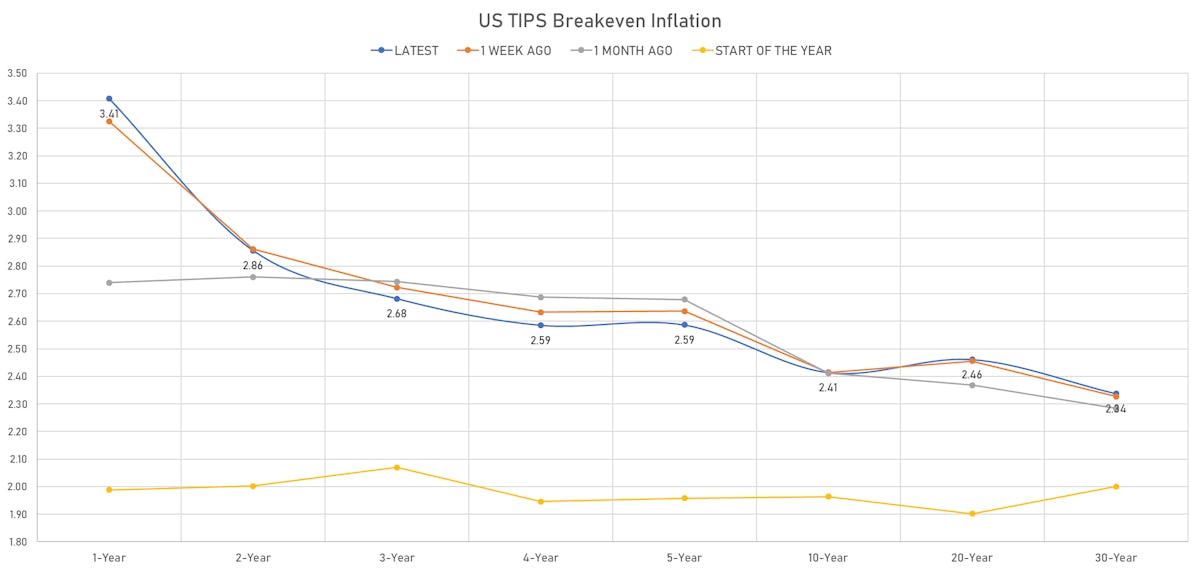

- TIPS 1Y breakeven inflation at 3.41% (up 3.2bp); 2Y at 2.86% (down -0.6bp); 5Y at 2.59% (down -3.7bp); 10Y at 2.41% (down -1.9bp); 30Y at 2.34% (down -1.2bp)

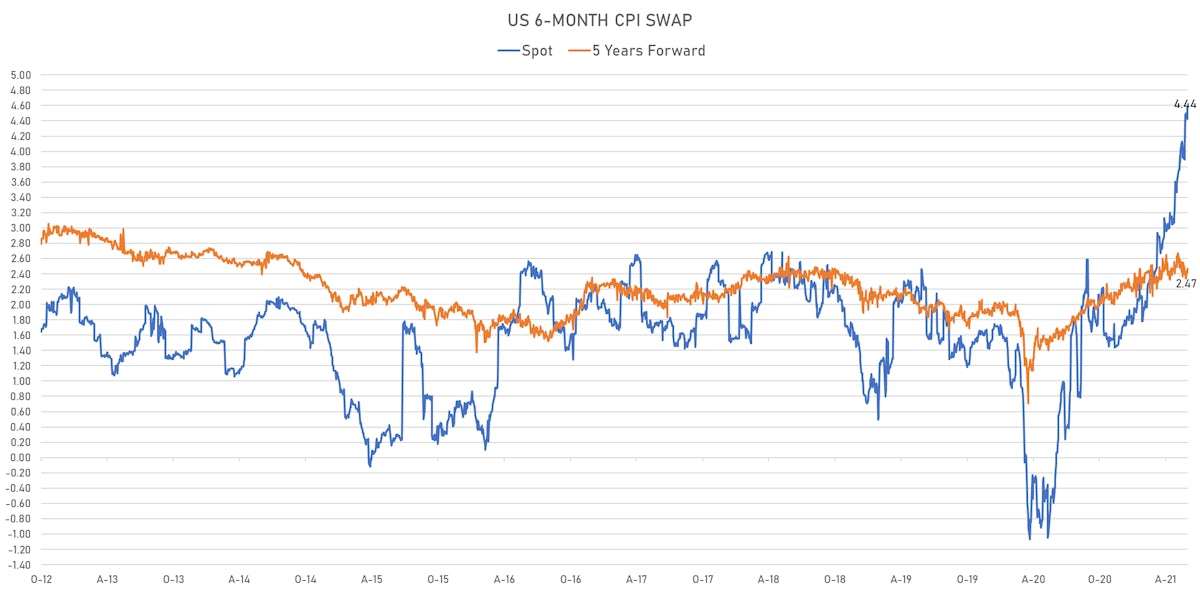

- 6-month spot US CPI swap down -12.7 bp to 4.439%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

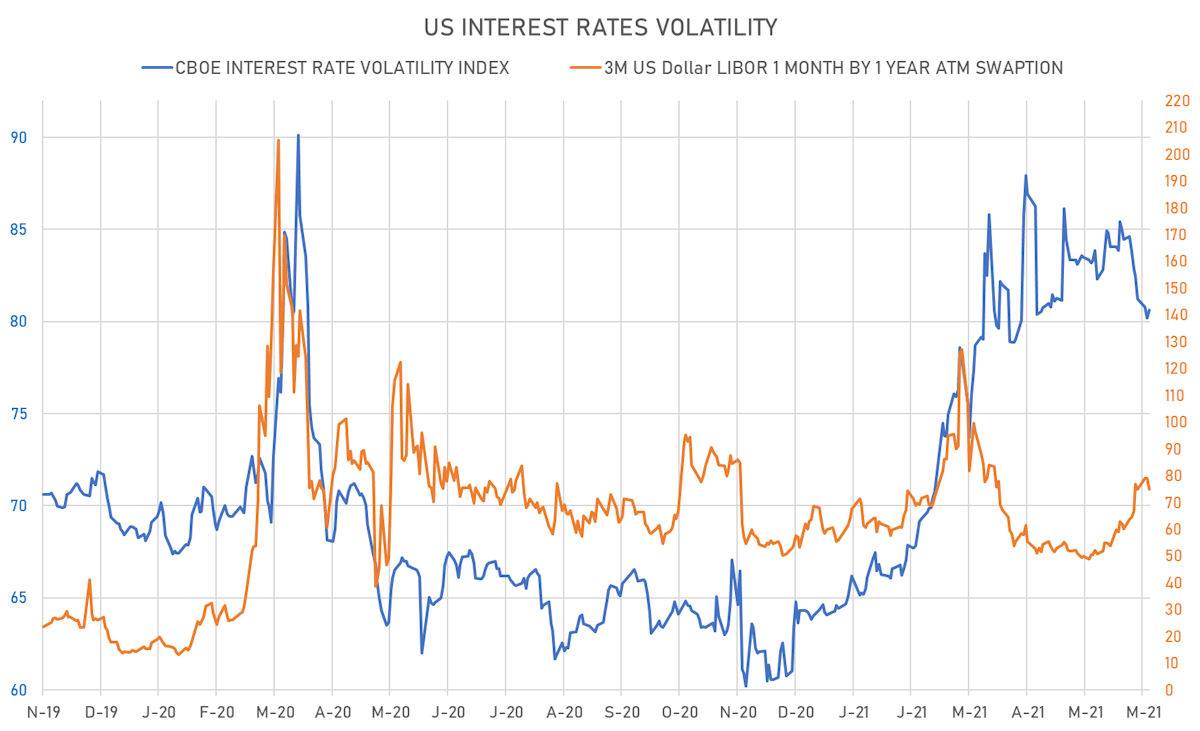

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.1% at 74.8%

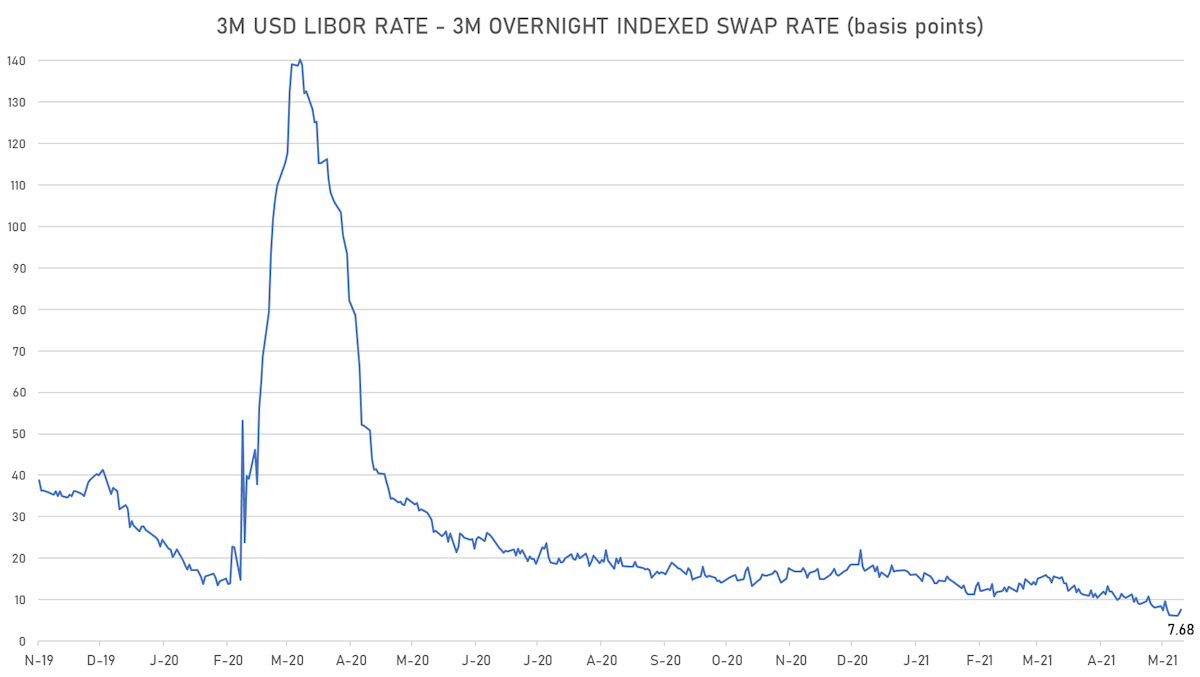

- 3-Month LIBOR-OIS spread up 1.0 bp at 7.7 bp (12-months range: 6.2-26.7 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.577% (down -0.3 bp); the German 1Y-10Y curve is 1.3 bp steeper at 46.0bp (YTD change: +30.4 bp)

- Japan 5Y: -0.087% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 19.8bp (YTD change: +5.5 bp)

- China 5Y: 2.928% (up 1.8 bp); the Chinese 1Y-10Y curve is 0.4 bp steeper at 54.8bp (YTD change: +8.8 bp)

- Switzerland 5Y: -0.440% (up 7.1 bp); the Swiss 1Y-10Y curve is 2.6 bp steeper at 63.5bp (YTD change: +37.1 bp)