Rates

Disappointing Nonfarm Payrolls And Manufacturing Orders Take Rates Down To End The Week

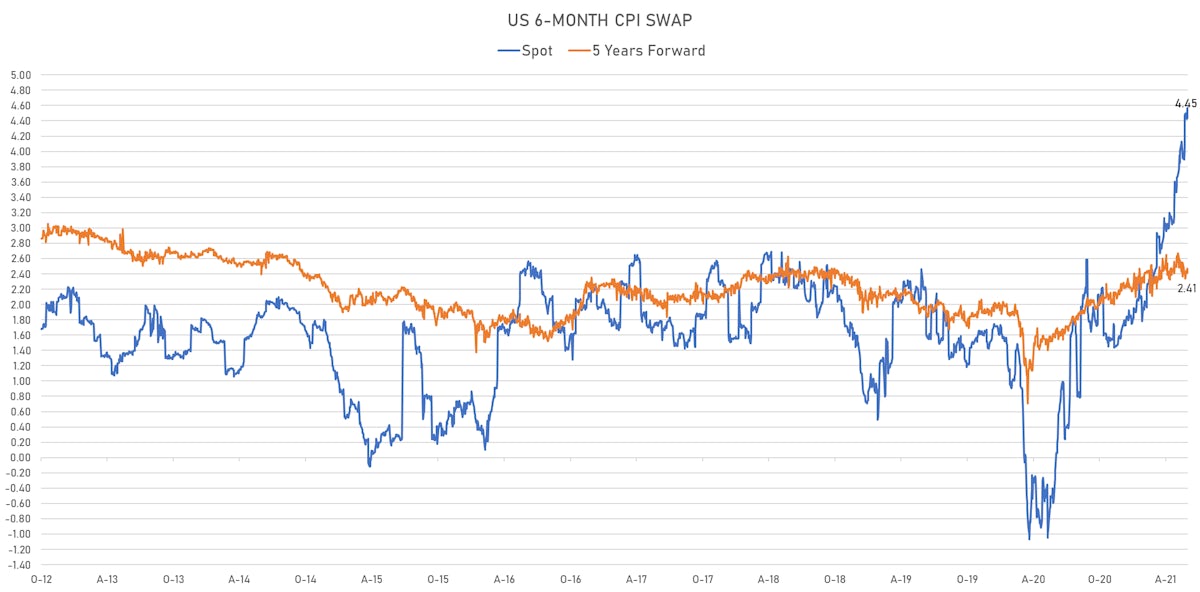

Higher than expected wage growth in the BLS data push short-term inflation expectations slightly up, with the 6-month CPI swap currently at 4.45%

Published ET

Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

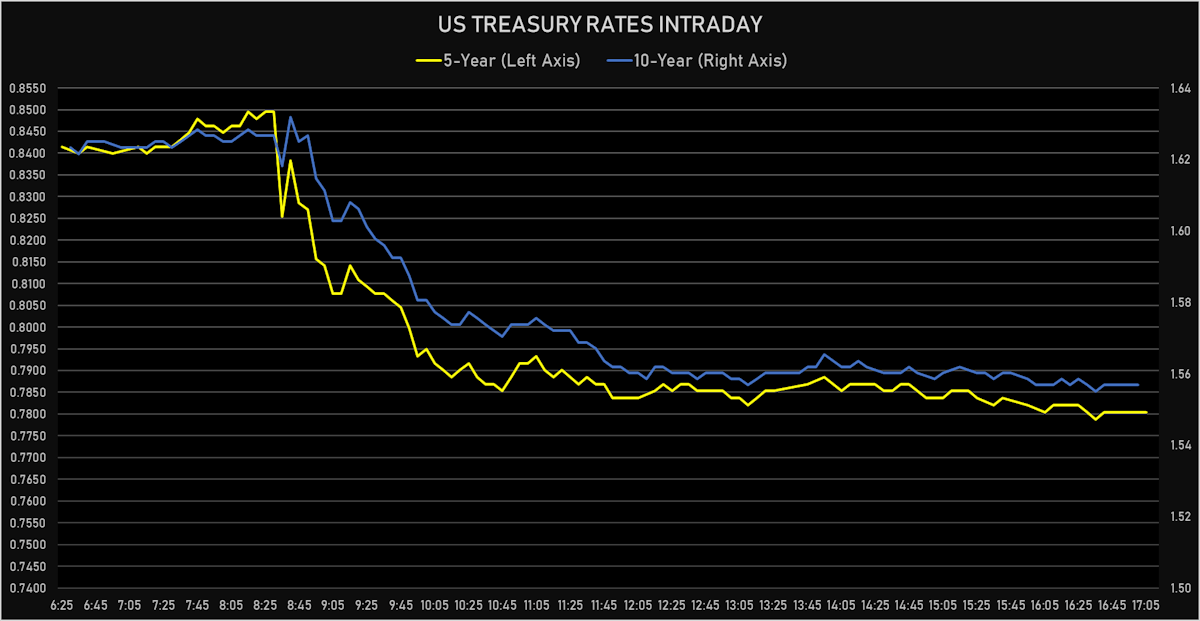

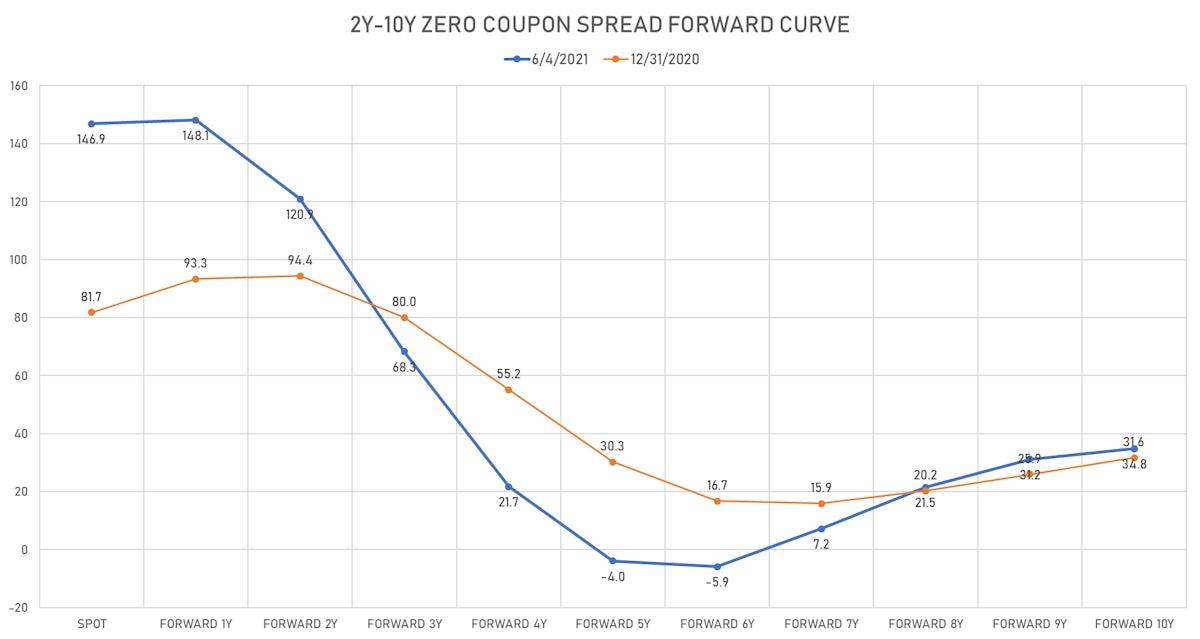

- Yield curve flattening, with the 1Y-10Y spread tightening -7.1 bp on the day, now at 151.1 bp (YTD change: +70.6)

- 1Y: 0.0460% (up 0.3 bp)

- 2Y: 0.1487% (down 1.0 bp)

- 5Y: 0.7804% (down 5.9 bp)

- 7Y: 1.2277% (down 6.7 bp)

- 10Y: 1.5568% (down 6.8 bp)

- 30Y: 2.2320% (down 6.5 bp)

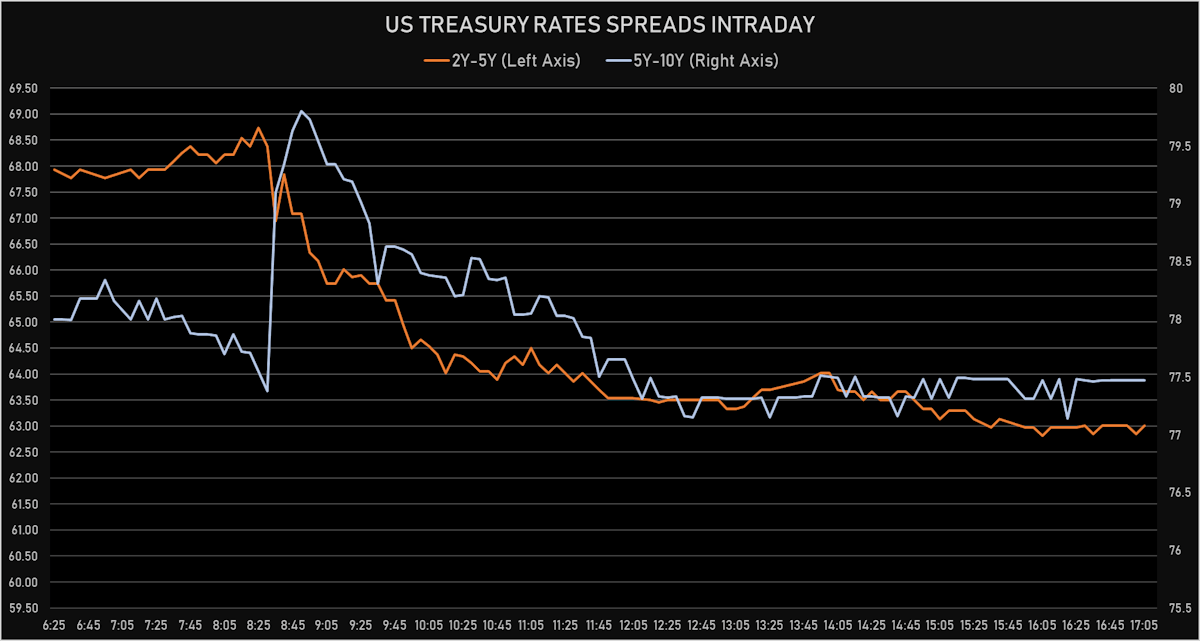

- US treasury curve spreads: 2-5 at 63.2bp (down -5.0bp today), 5-10 at 77.6bp (down -0.9bp today), 10-30 at 67.6bp (up 0.4bp today)

- Treasuries butterfly spreads: 2x5x10 at 14.2bp (up 4.3bp today), 5x10X30 at -10.4bp (up 1.2bp today)

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for May 2021 (BLS, U.S Dep. Of Lab) at 2.00, above consensus estimate of 1.60

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.50, above consensus estimate of 0.20

- Employment, Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for May 2021 (BLS, U.S Dep. Of Lab) at 23.00, below consensus estimate of 24.00

- Employment, Nonfarm payroll, service-producing, government, Absolute change for May 2021 (BLS, U.S Dep. Of Lab) at 67.00

- Employment, Nonfarm payroll, total private, Absolute change for May 2021 (BLS, U.S Dep. Of Lab) at 492k, below consensus estimate of 600k

- Employment, Nonfarm payroll, total, Absolute change for May 2021 (BLS, U.S Dep. Of Lab) at 559k, below consensus estimate of 650k

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for May 2021 (BLS, U.S Dep. Of Lab) at 34.90, below consensus estimate of 35.00

- Labor Force Partic for May 2021 (BLS, U.S Dep. Of Lab) at 61.60

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Apr 2021 (U.S. Census Bureau) at 1.00

- Manufacturers New Orders, Durable goods total, Change P/P for Apr 2021 (U.S. Census Bureau) at -1.30

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Apr 2021 (U.S. Census Bureau) at 2.20

- Manufacturers New Orders, Total manufacturing excluding transportation, Change P/P for Apr 2021 (U.S. Census Bureau) at 0.50

- Manufacturers New Orders, Total manufacturing, Change P/P for Apr 2021 (U.S. Census Bureau) at -0.60, below consensus estimate of -0.20

- Unemployment, Rate for May 2021 (BLS, U.S Dep. Of Lab) at 5.80, below consensus estimate of 5.90

- Unemployment, Rate, Special (U-6) for May 2021 (BLS, U.S Dep. Of Lab) at 10.20

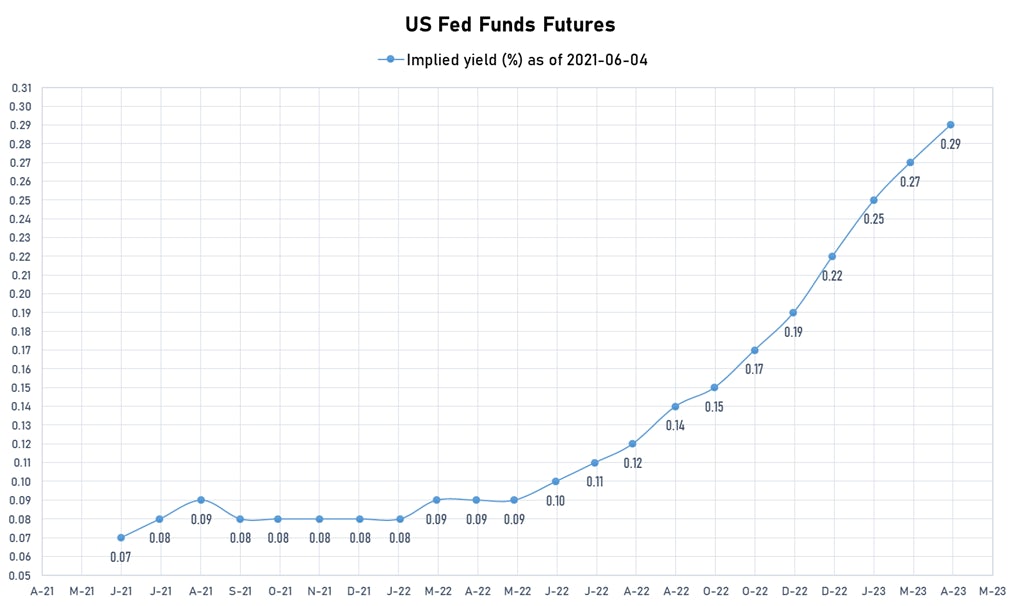

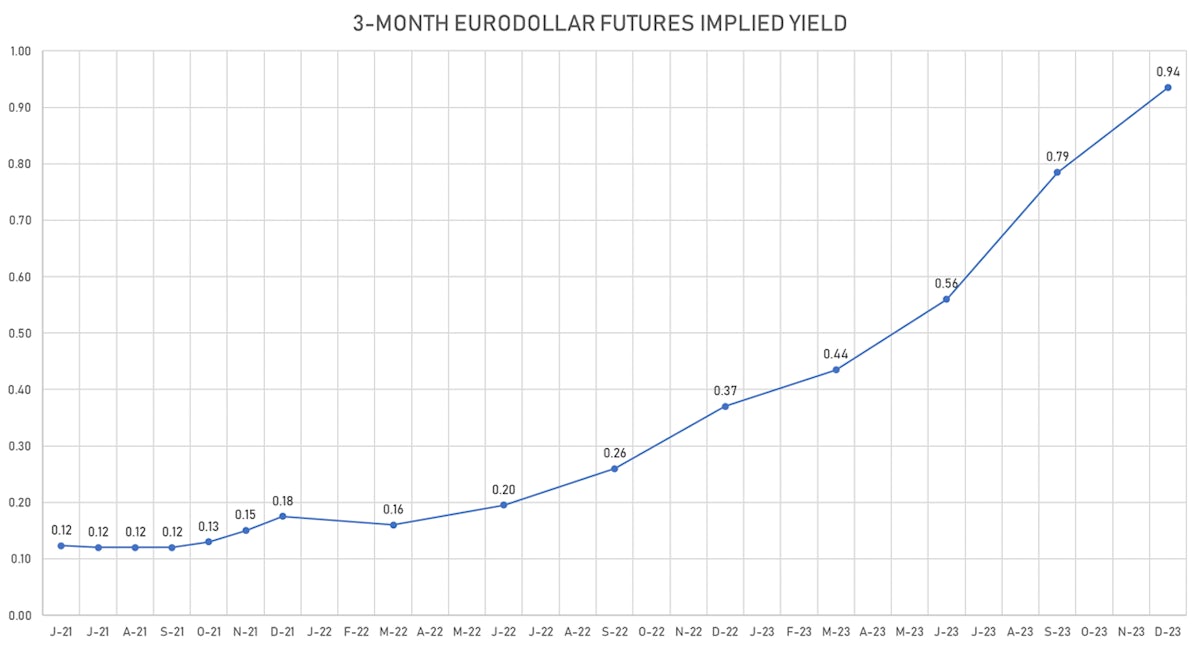

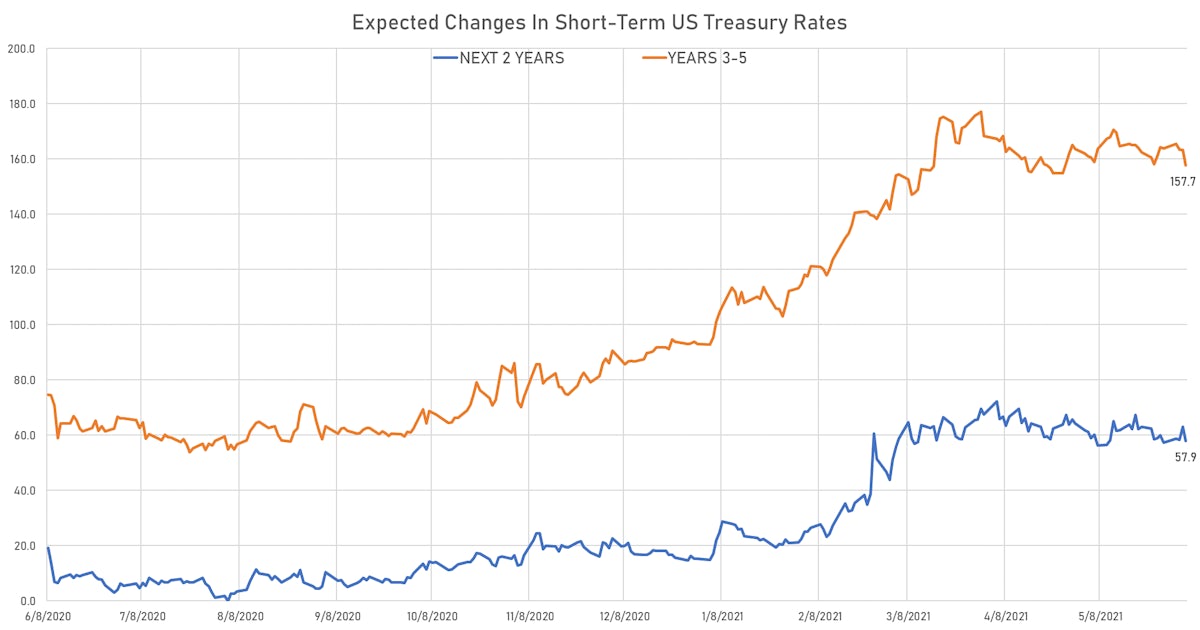

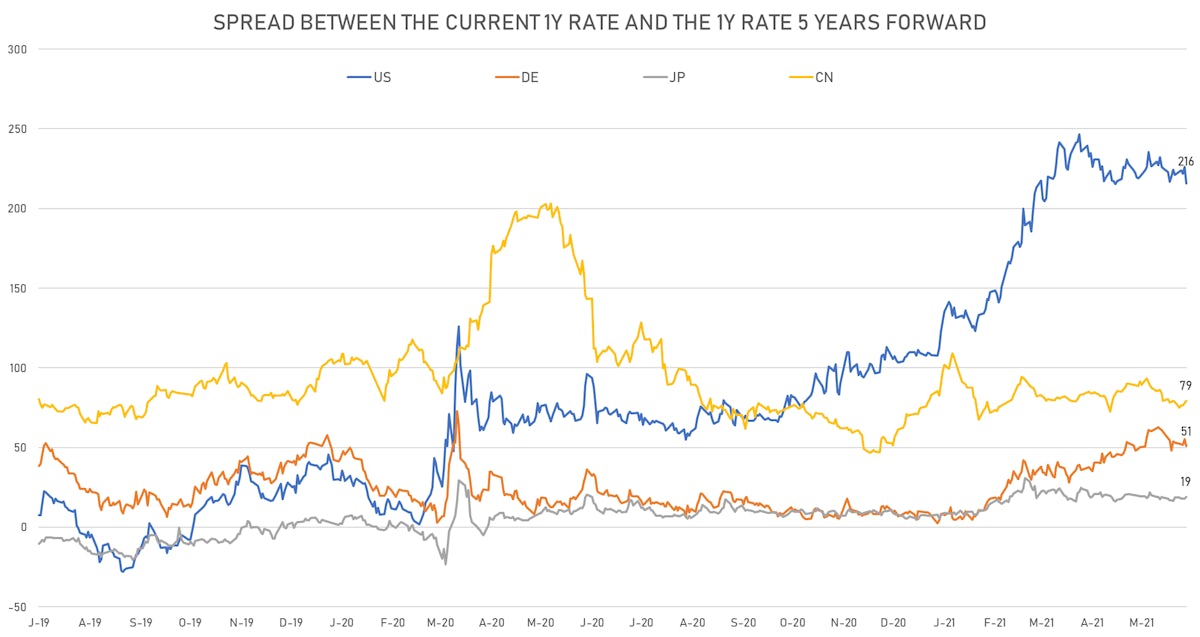

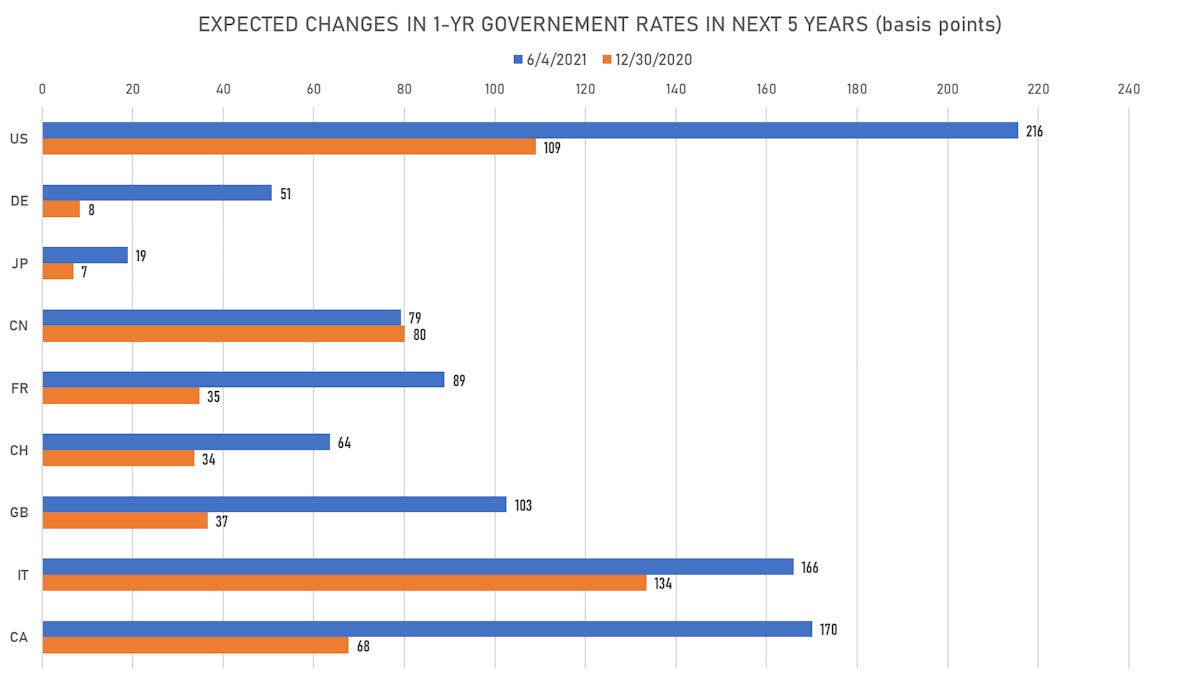

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 11.0 bp, now at 2.2255%

- The short-term rates are now expected to increase by 215.5 bp over the next 5 years, with this expectation coming down a lot this week

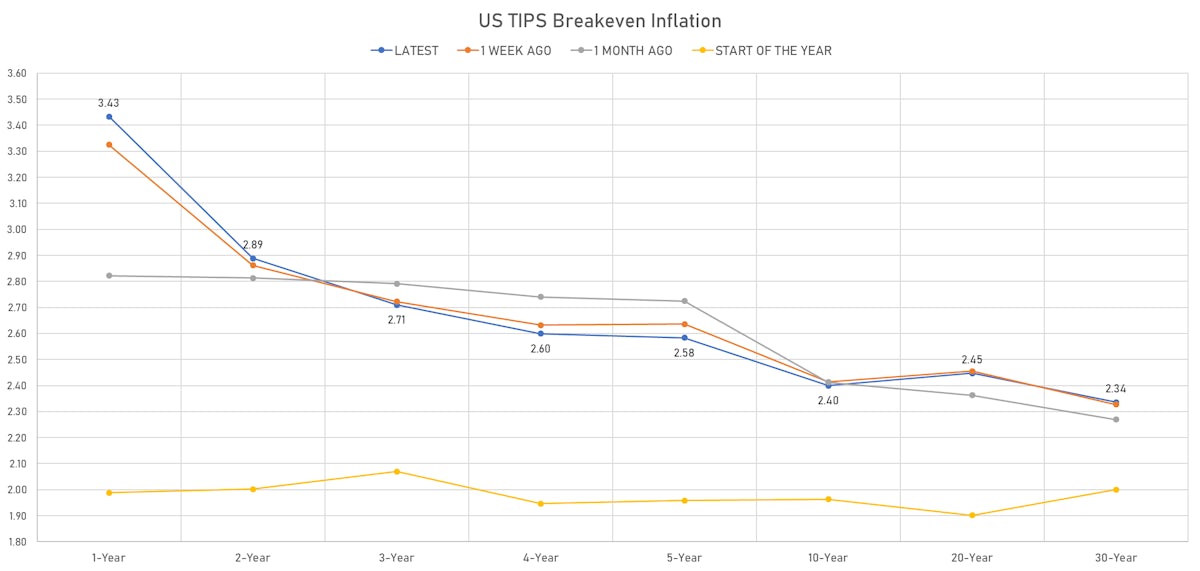

US INFLATION

- TIPS 1Y breakeven inflation at 3.43% (up 2.6bp); 2Y at 2.89% (up 3.2bp); 5Y at 2.58% (down -0.3bp); 10Y at 2.40% (down -1.4bp); 30Y at 2.34% (down -0.2bp)

- 6-month spot US CPI swap up 0.6 bp to 4.445%, with a steepening of the forward curve

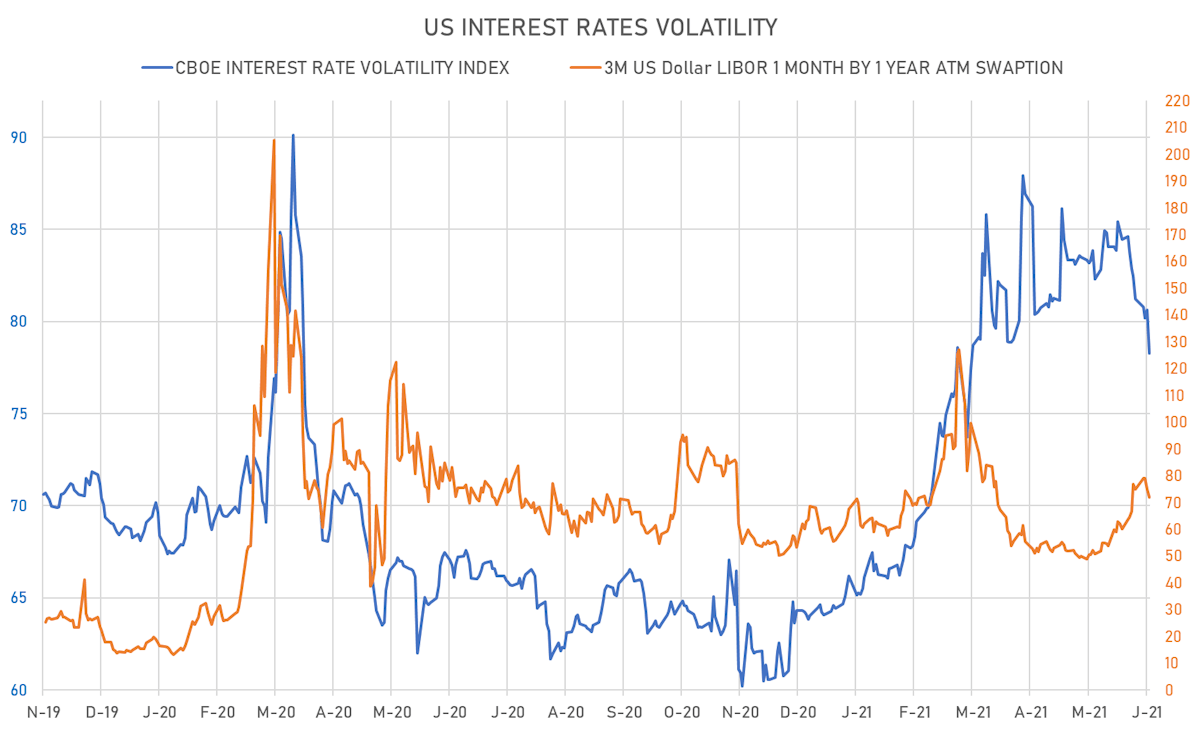

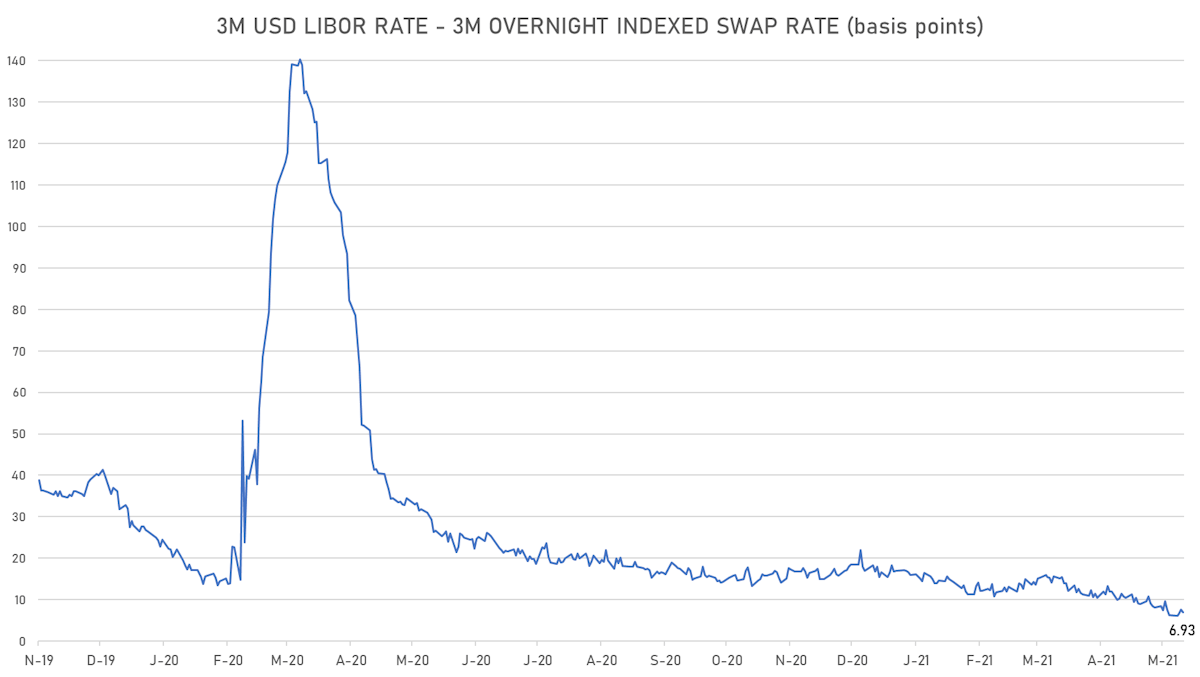

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.9% at 72.0%

- 3-Month LIBOR-OIS spread down -0.8 bp at 6.9 bp (12-months range: 6.2-26.7 bp)

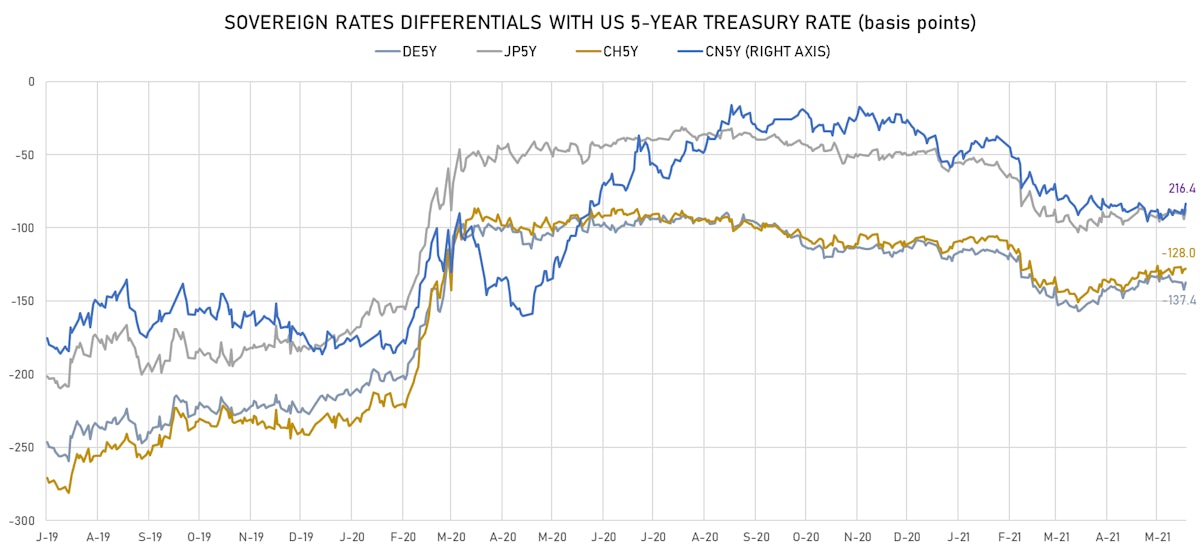

KEY INTERNATIONAL RATES

- Germany 5Y: -0.596% (down -1.5 bp); the German 1Y-10Y curve is 2.6 bp flatter at 42.5bp (YTD change: +27.8 bp)

- Japan 5Y: -0.087% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 19.8bp (YTD change: +5.9 bp)

- China 5Y: 2.944% (up 0.6 bp); the Chinese 1Y-10Y curve is 1.9 bp steeper at 57.1bp (YTD change: +10.7 bp)

- Switzerland 5Y: -0.500% (down -6.0 bp); the Swiss 1Y-10Y curve is 3.3 bp flatter at 60.2bp (YTD change: +33.8 bp)