Rates

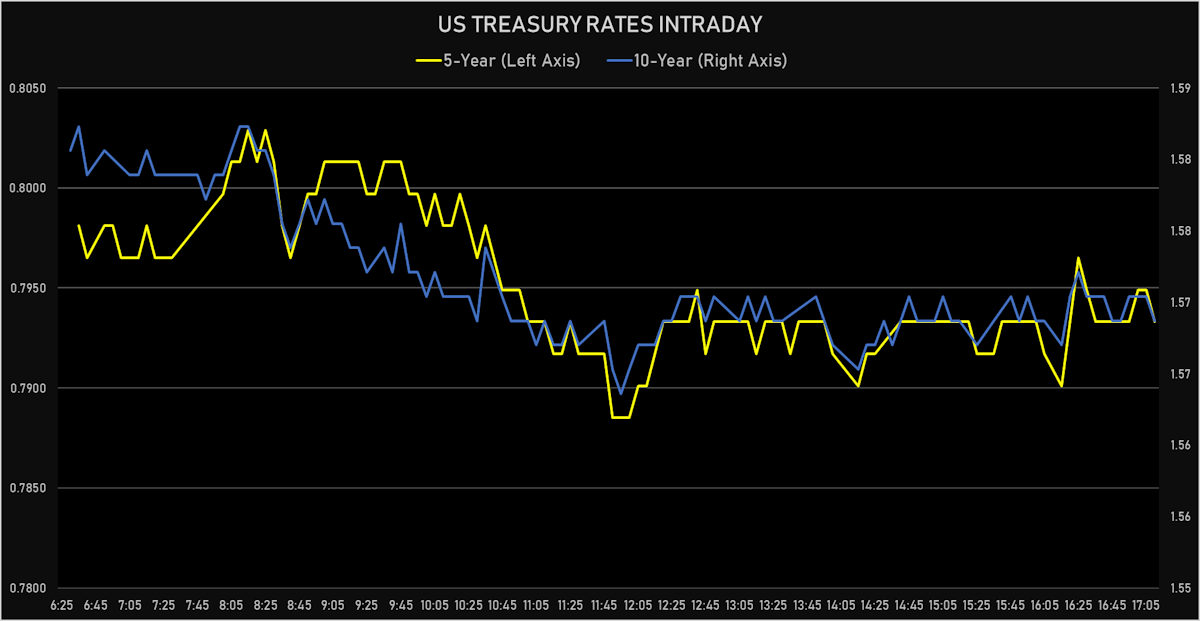

US Rates Open Higher On Yellen Inflation Comments, But Gave Back Most Of The Gains Intraday

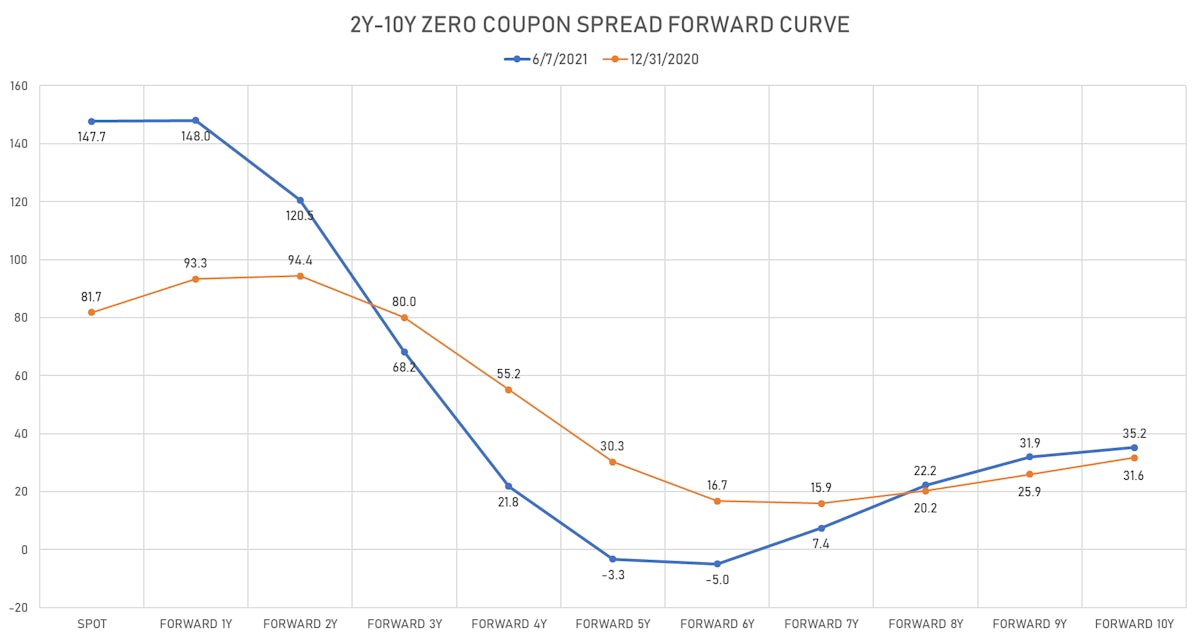

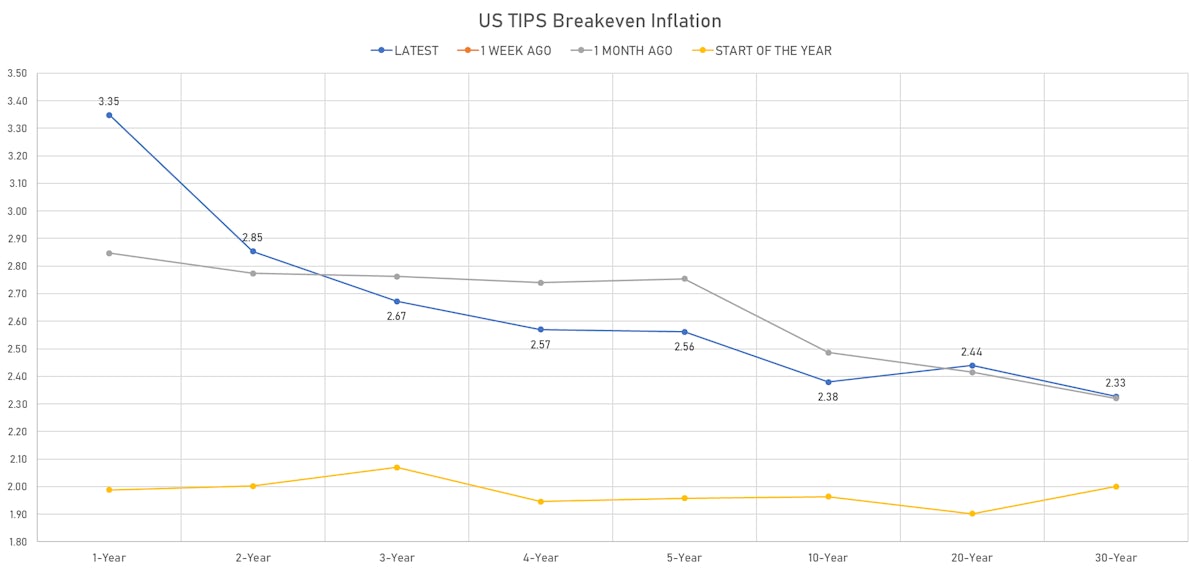

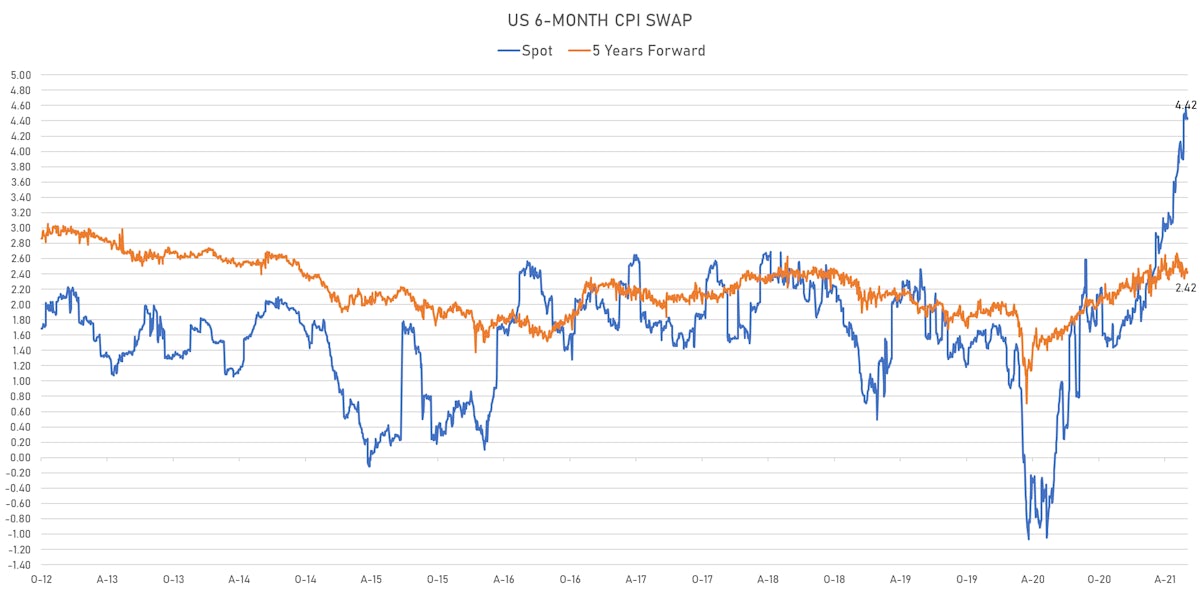

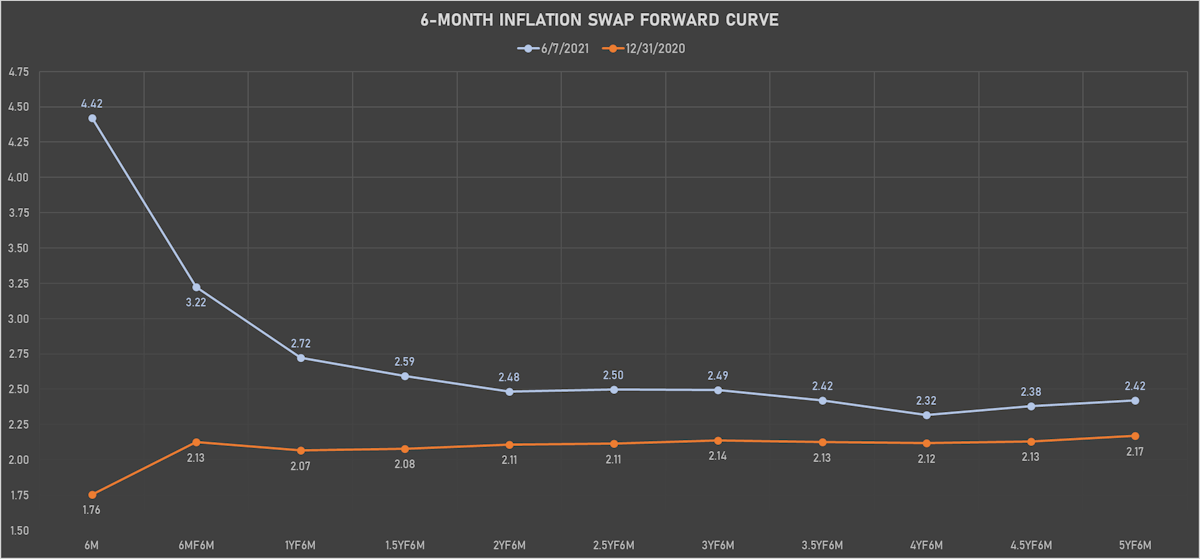

Biden also urged other countries to boost their economies with more fiscal spending, but inflation markets were unfazed: TIPS breakevens and short-term CPI swaps fell today, with the inflation forward curve flattening

Published ET

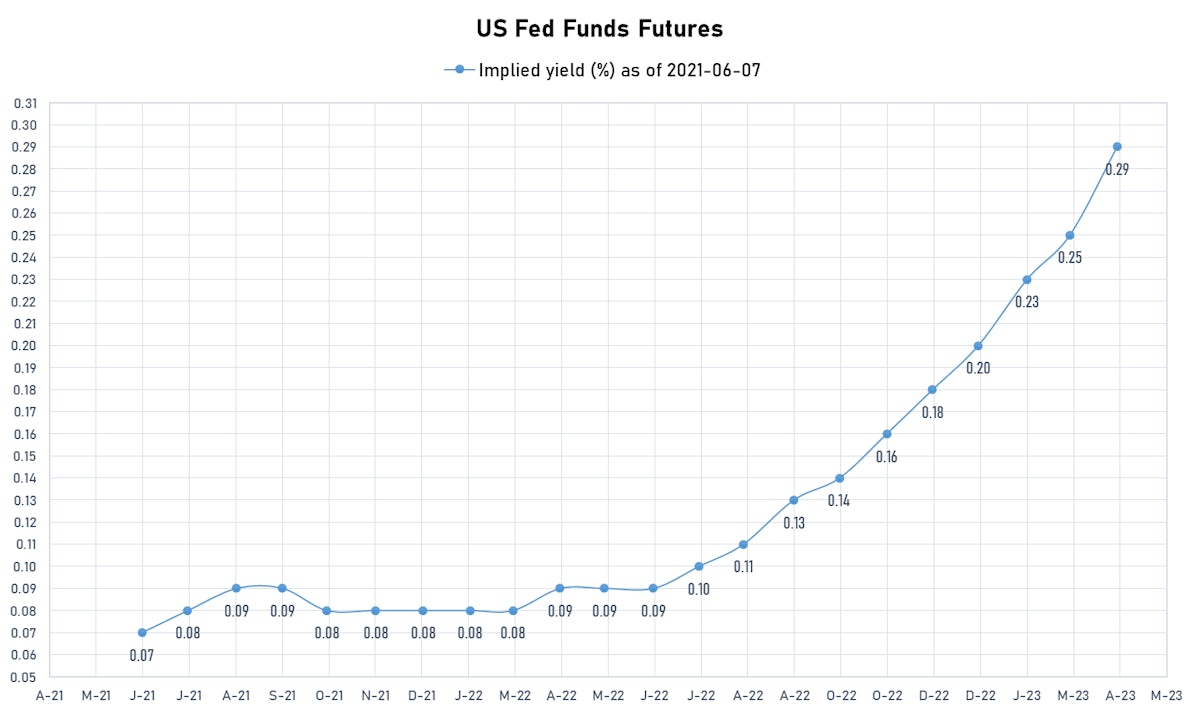

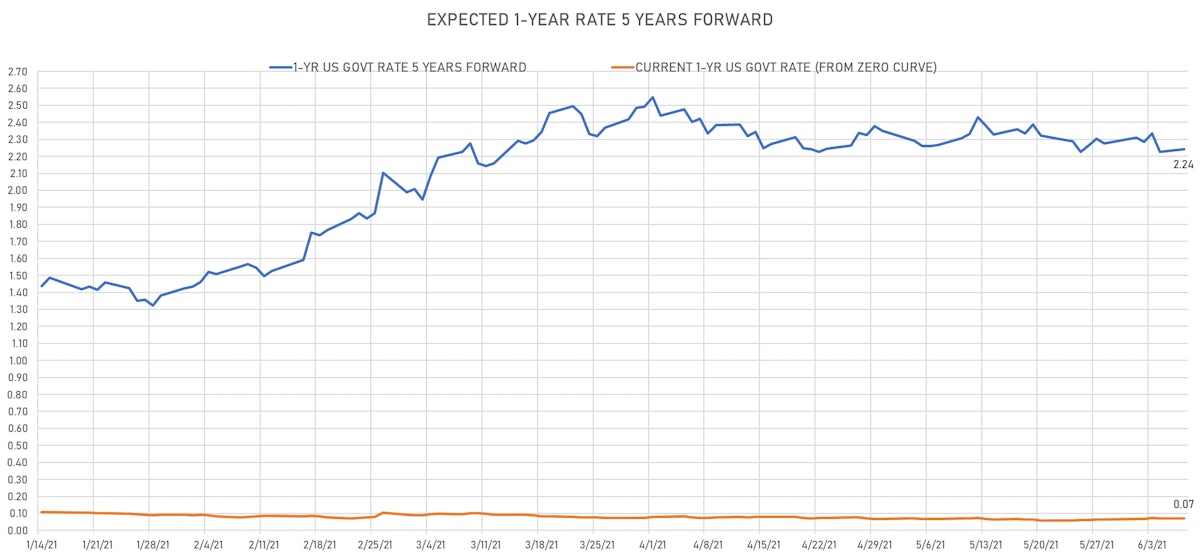

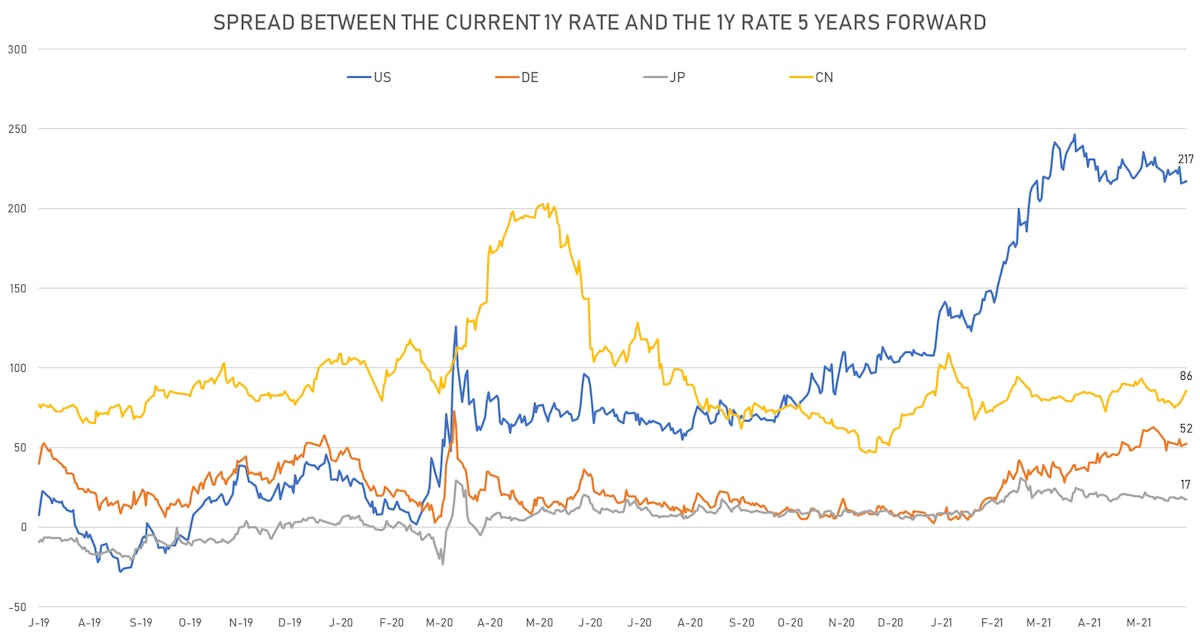

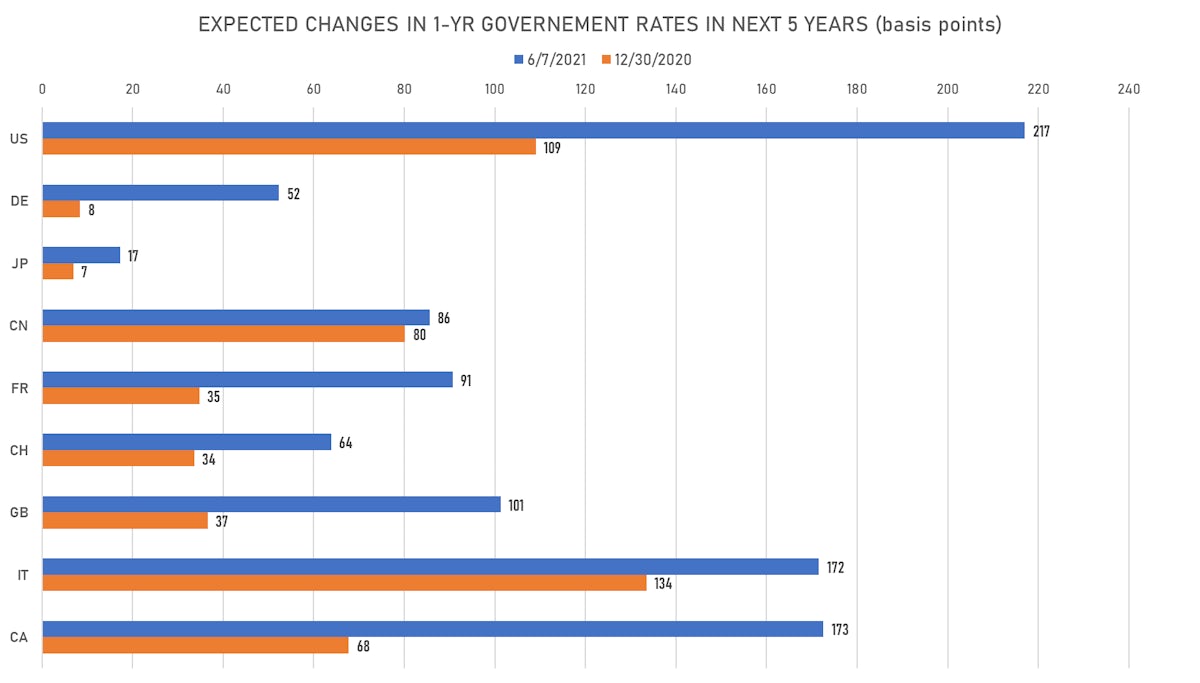

Expected US rate hikes in the next 5 years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1Y-10Y spread widening 0.9 bp on the day, now at 151.8 bp (YTD change: +71.3)

- 1Y: 0.0510% (up 0.3 bp)

- 2Y: 0.1567% (up 0.8 bp)

- 5Y: 0.7933% (up 1.3 bp)

- 7Y: 1.2383% (up 1.1 bp)

- 10Y: 1.5687% (up 1.2 bp)

- 30Y: 2.2468% (up 1.5 bp)

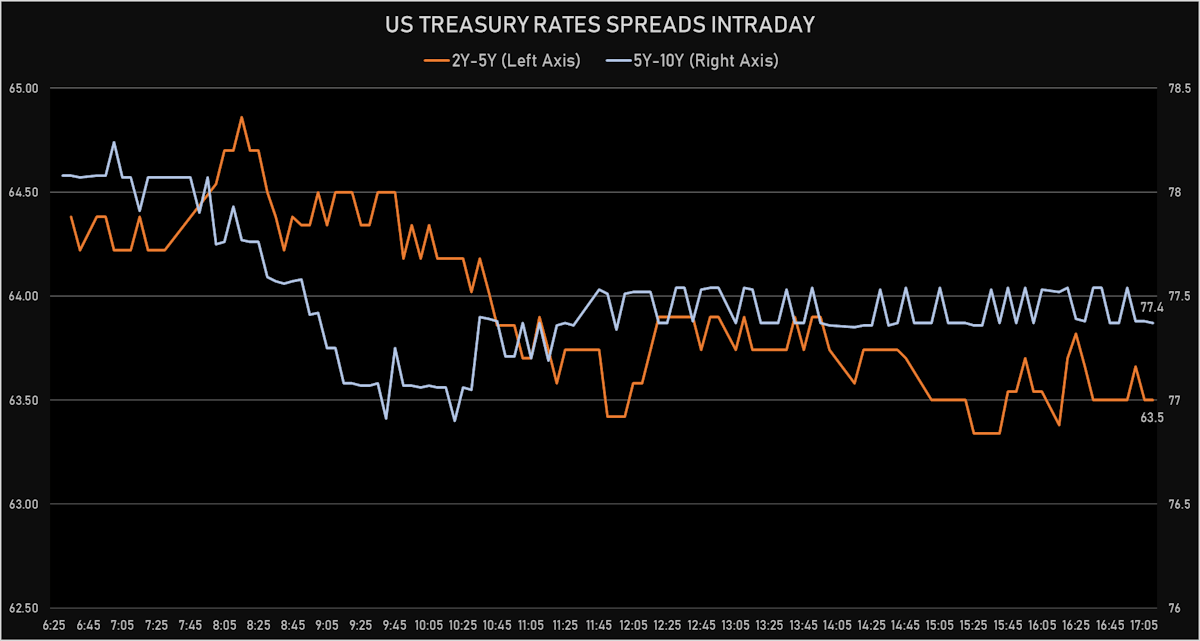

- US treasury curve spreads: 2-5 at 63.7bp (up 0.5bp today), 5-10 at 77.5bp (down -0.1bp today), 10-30 at 67.8bp (up 0.2bp today)

- Treasuries butterfly spreads: 2x5x10 at 13.4bp (down -0.8bp today), 5x10X30 at -9.9bp (up 0.5bp today)

US MACRO RELEASES

- Consumer credit, total, Absolute change for Apr 2021 (FED, U.S.) at $18.6B, below consensus estimate of 21.00

- The Conference Board Employment Trends Index (ETI) for May 2021 (The Conference Board) at 107.40

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 1.7 bp, now at 2.2423%

- Short-term rates are now expected to increase by 217.1 bp over the next 5 years

US INFLATION

- TIPS 1Y breakeven inflation at 3.35% (down -8.6bp); 2Y at 2.85% (down -3.5bp); 5Y at 2.56% (down -2.2bp); 10Y at 2.38% (down -2.1bp); 30Y at 2.33% (down -0.8bp)

- 6-month spot US CPI swap down -2.3 bp to 4.423%, with a flattening of the forward curve

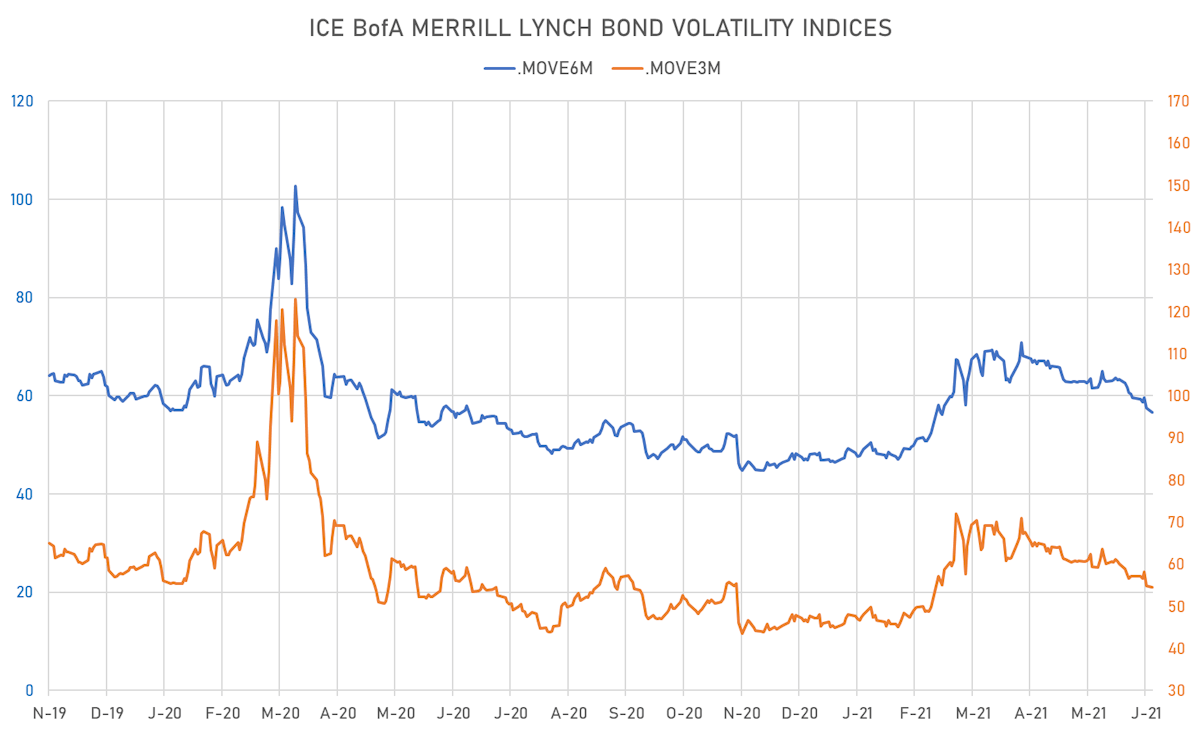

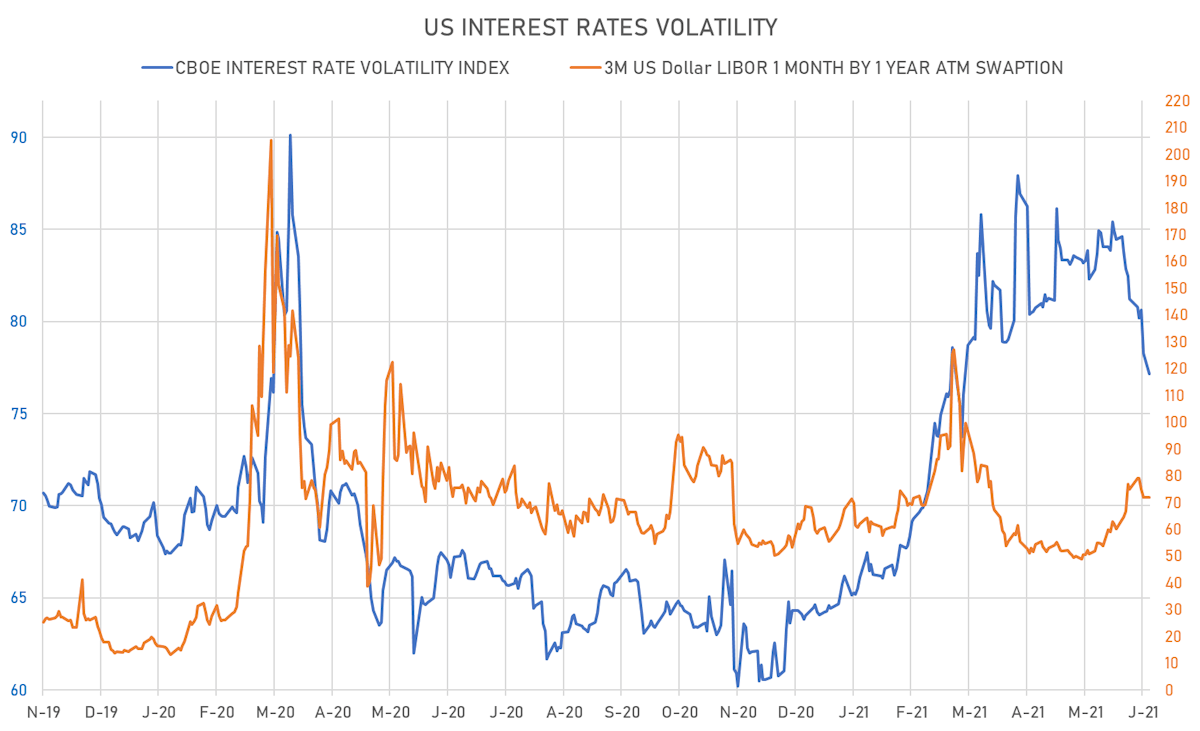

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 71.9%

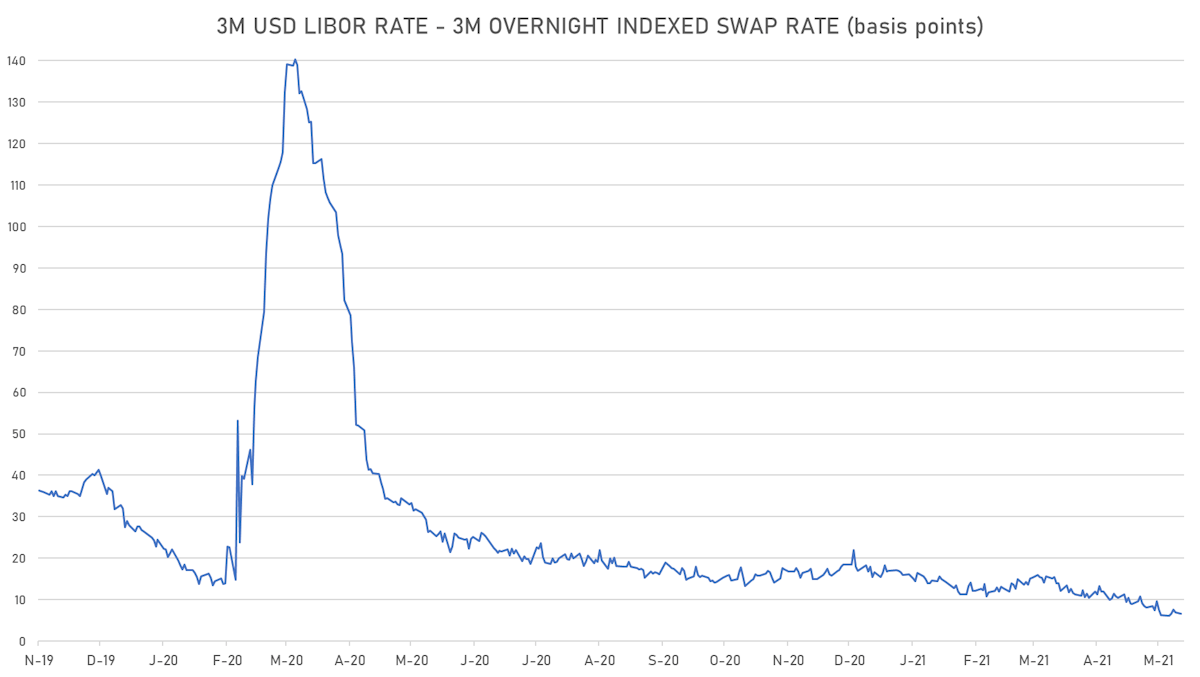

- 3-Month LIBOR-OIS spread down -0.3 bp at 6.6 bp (12-months range: 6.2-26.5 bp)

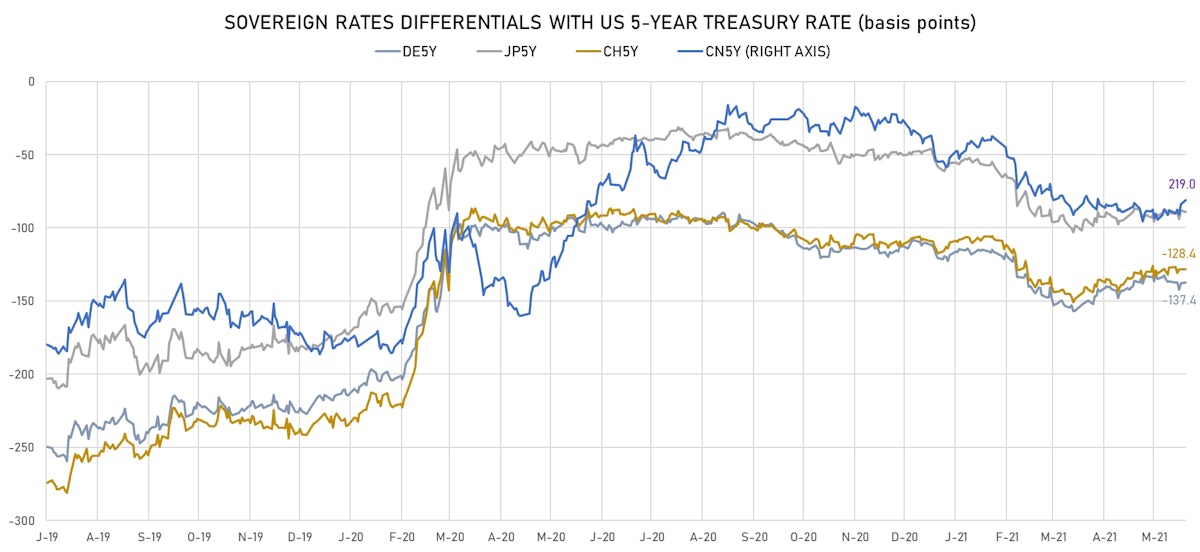

KEY INTERNATIONAL RATES

- Germany 5Y: -0.582% (up 1.3 bp); the German 1Y-10Y curve is 1.2 bp steeper at 44.4bp (YTD change: +29.0 bp)

- Japan 5Y: -0.087% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 19.4bp (YTD change: +5.4 bp)

- China 5Y: 2.983% (up 3.9 bp); the Chinese 1Y-10Y curve is 16.1 bp steeper at 73.2bp (YTD change: +26.8 bp)

- Switzerland 5Y: -0.491% (up 0.9 bp); the Swiss 1Y-10Y curve is 3.1 bp steeper at 64.3bp (YTD change: +36.9 bp)