Rates

US Rates Drift Lower In The Absence Of Major Macro Catalysts

Short-term inflation expectations drop as well; CPI data is coming later this week (on Thursday) but is not expected to disrupt the current bid for duration

Published ET

US 5-year treasury rate, falling since the beginning of April | Source: Refinitiv

QUICK US SUMMARY

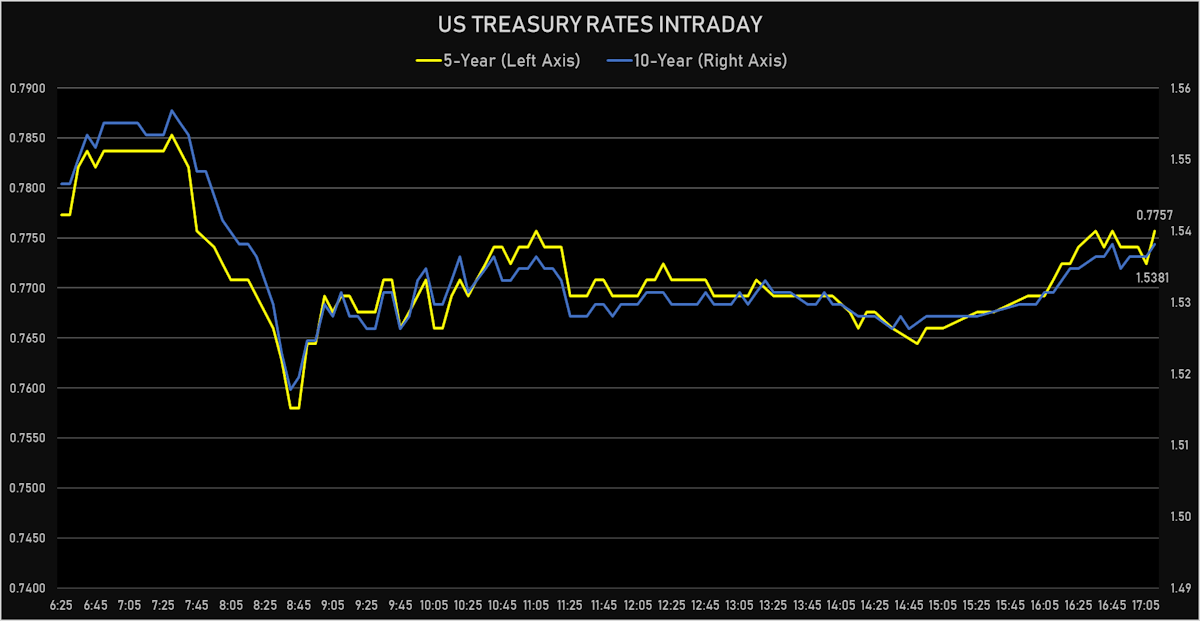

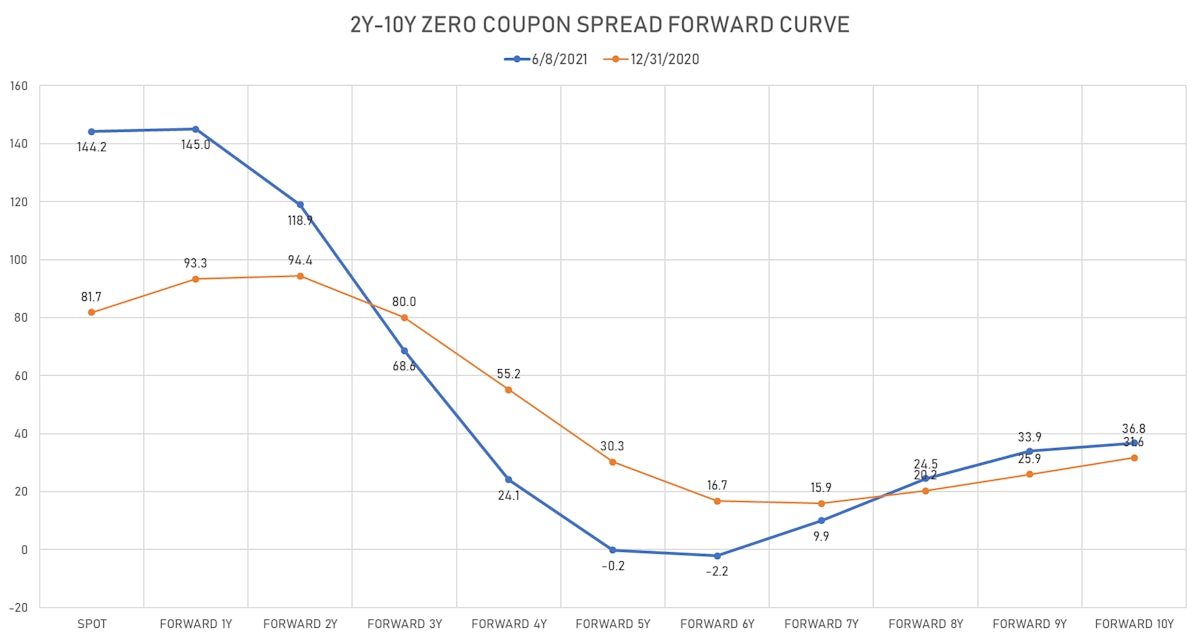

- Yield curve flattening, with the 1Y-10Y spread tightening -3.1 bp on the day, now at 148.7 bp (YTD change: +68.3)

- 1Y: 0.0510% (unchanged)

- 2Y: 0.1547% (down 0.2 bp)

- 5Y: 0.7757% (down 1.8 bp)

- 7Y: 1.2102% (down 2.8 bp)

- 10Y: 1.5381% (down 3.1 bp)

- 30Y: 2.2200% (down 2.7 bp)

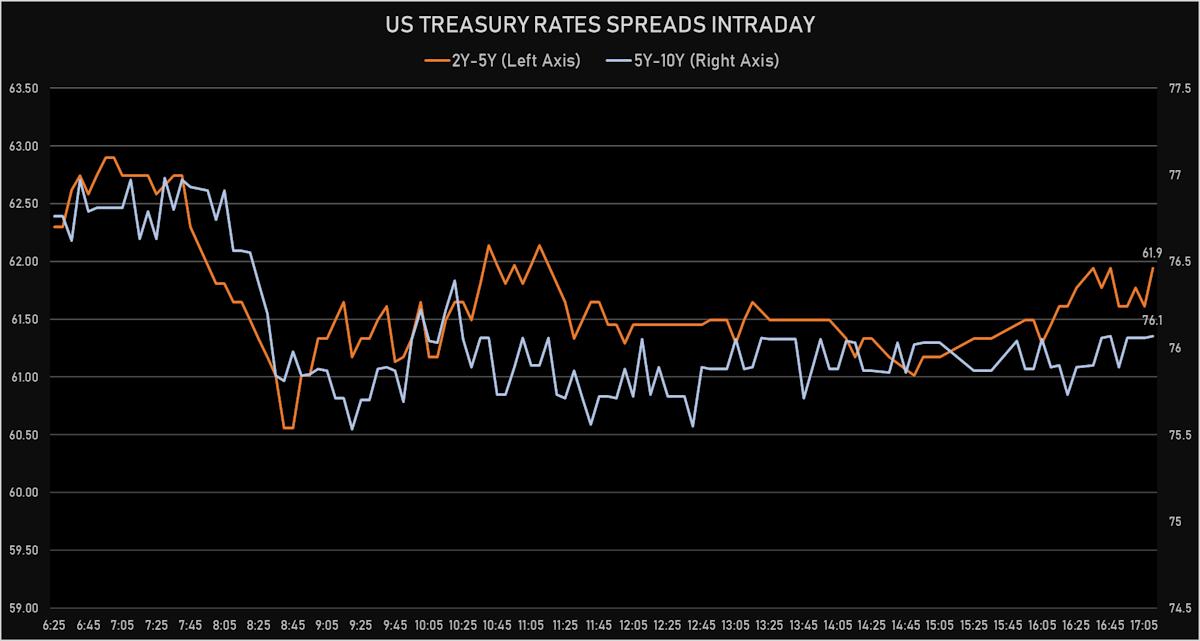

- US treasury curve spreads: 2-5 at 62.1bp (down -1.6bp today), 5-10 at 76.2bp (down -1.3bp today), 10-30 at 68.2bp (up 0.4bp today)

- Treasuries butterfly spreads: 2x5x10 at 14.0bp (up 0.6bp today), 5x10X30 at -8.3bp (up 1.6bp today)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 05 Jun (Redbook Research) at 14.50%

- JOLTS Job Openings for Apr 2021 (BLS, U.S Dep. Of Lab) at 9.29, above consensus estimate of 8.30

- NFIB, Index of Small Business Optimism for May 2021 (NFIB, United States) at 99.60

- Trade Balance, Total, Goods and services for Apr 2021 (U.S. Census Bureau) at -68.90, above consensus estimate of -69.00

- US 3-year note auction: high yield of 0.325% (vs 0.329% prior), direct bids at 18.3% (vs 18.1% prior), indirects at 54.2% (vs 49.6% prior), bid-to-cover of 2.47 (vs 2.42 prior)

US FORWARD RATES

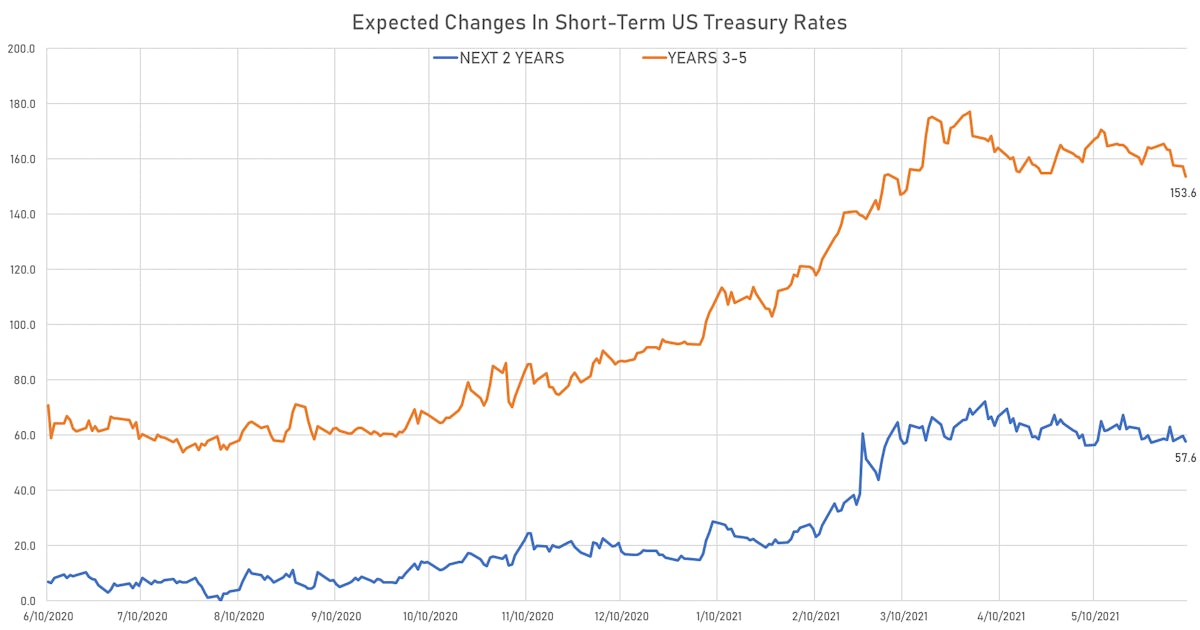

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 5.8 bp, now at 2.1845%

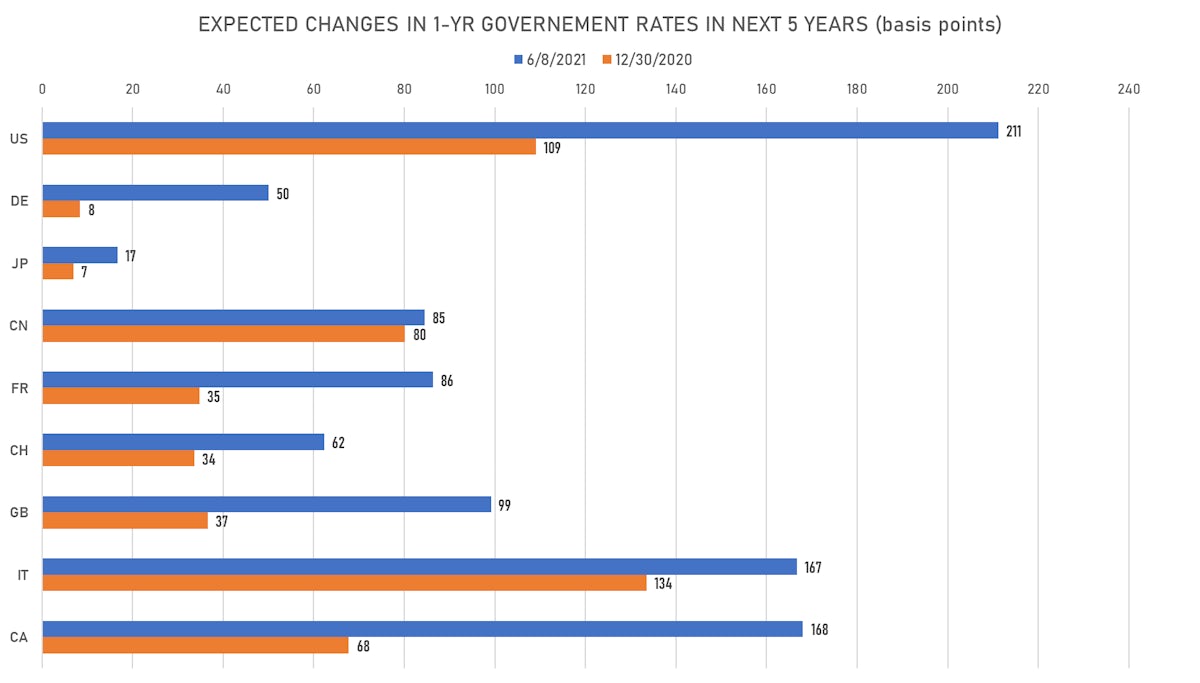

- Short-term rates are expected to increase by 211.3 bp over the next 5 years, down from 247bp at the end of March

US INFLATION

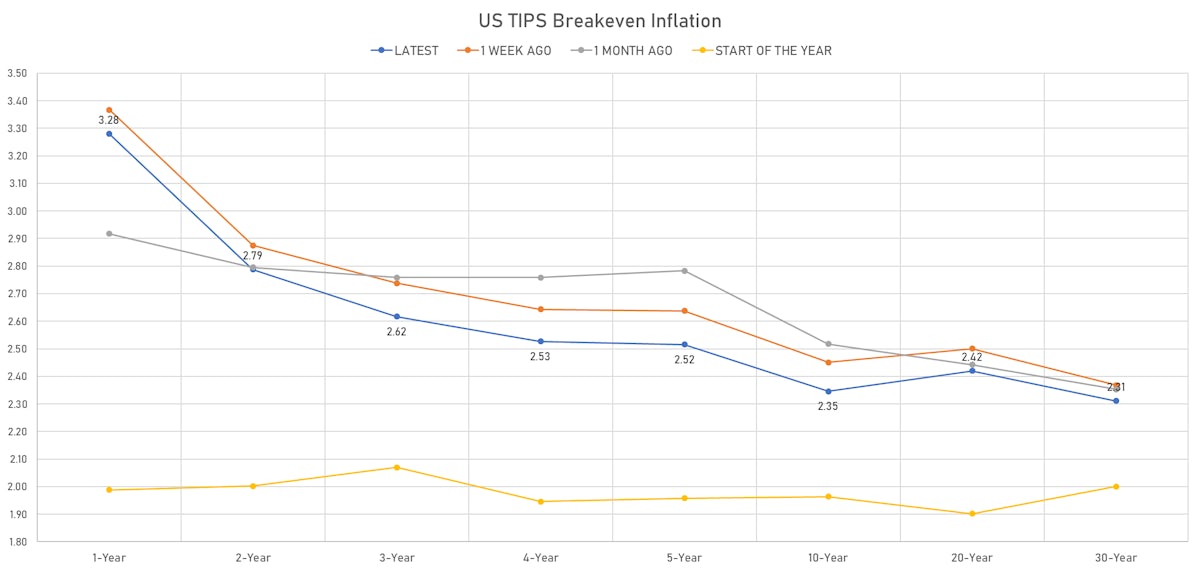

- TIPS 1Y breakeven inflation at 3.28% (down -6.8bp); 2Y at 2.79% (down -6.6bp); 5Y at 2.52% (down -4.6bp); 10Y at 2.35% (down -3.3bp); 30Y at 2.31% (down -1.6bp)

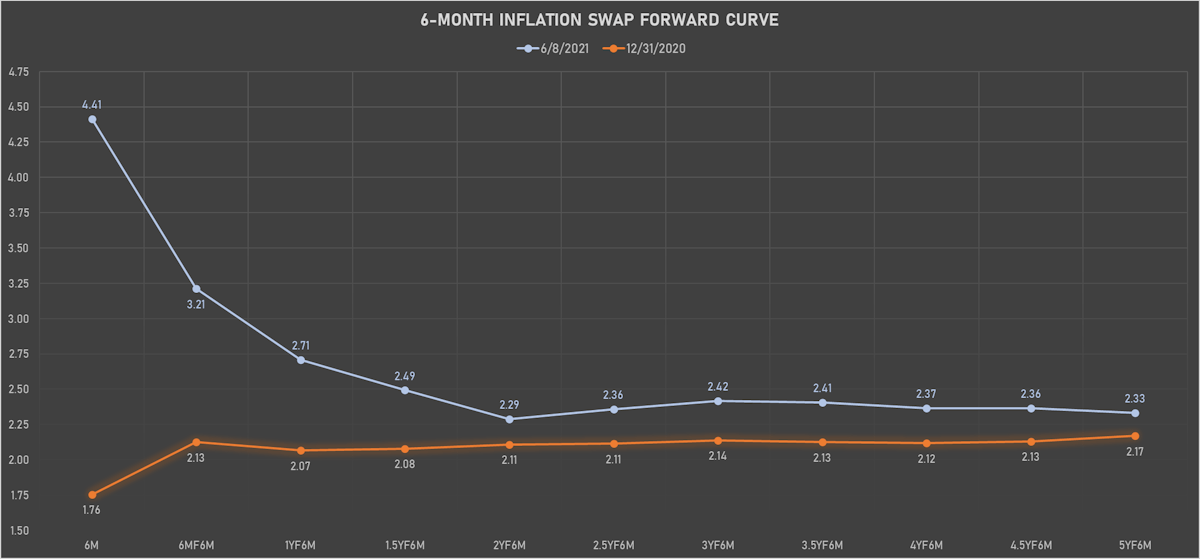

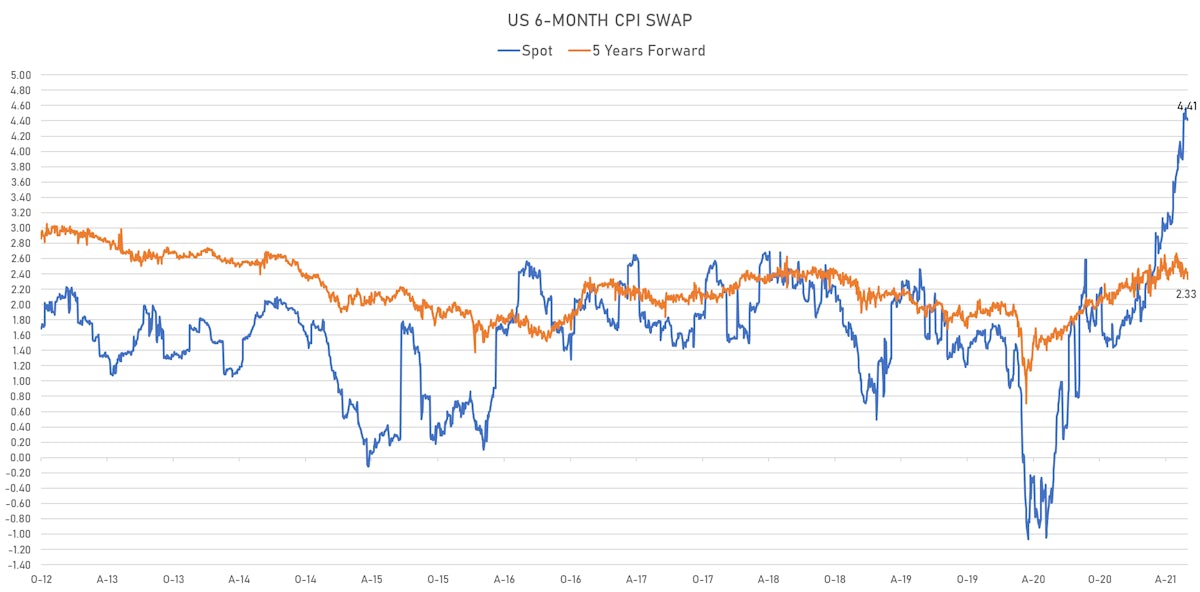

- 6-month spot US CPI swap down -0.9 bp to 4.414%, with a steepening of the forward curve

RATES VOLATILITY & LIQUIDITY

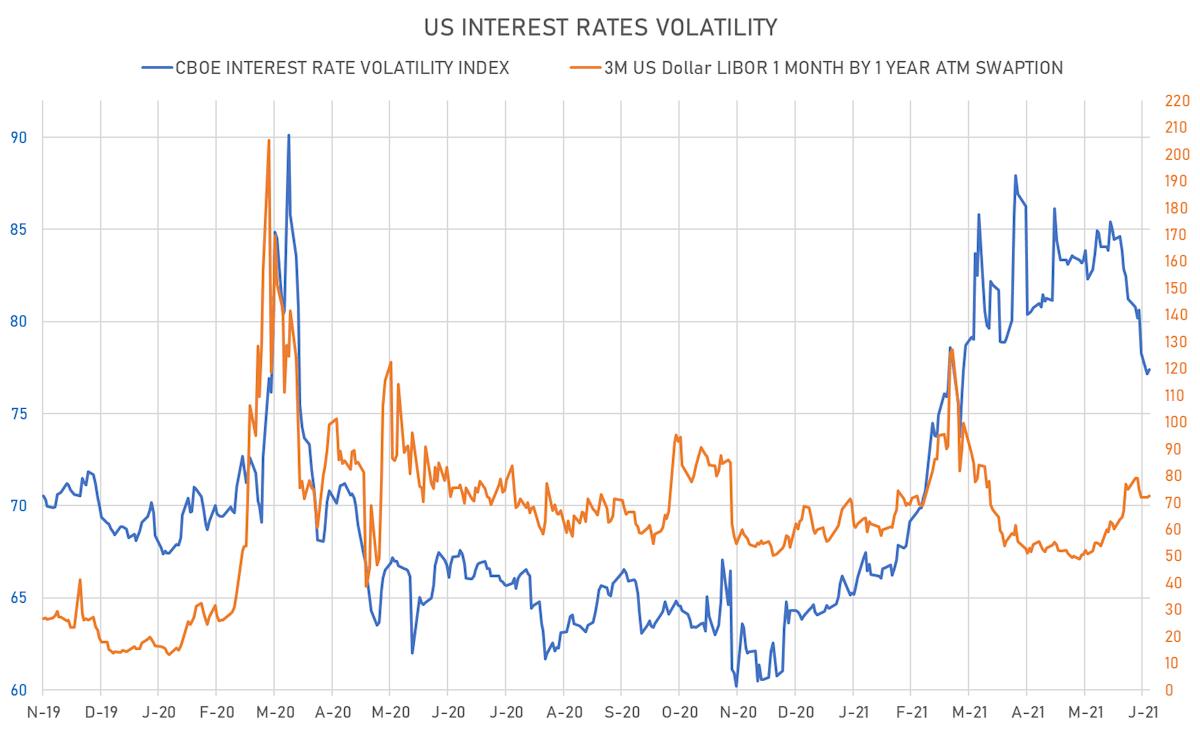

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.6% at 72.1%

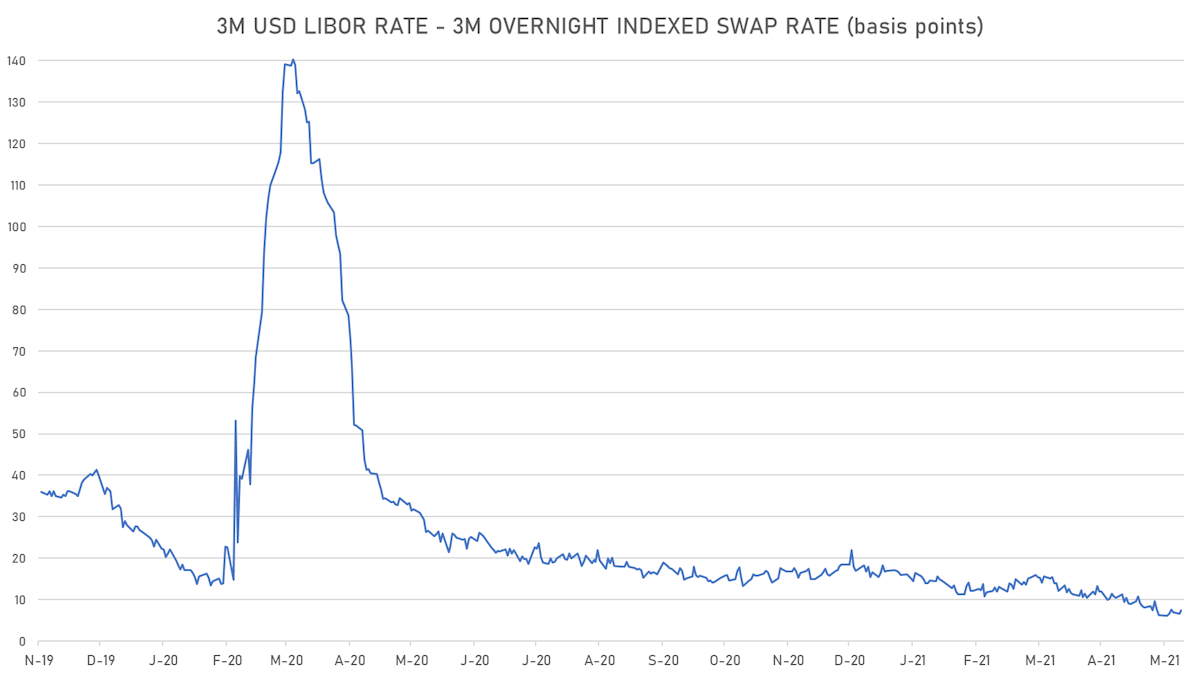

- 3-Month LIBOR-OIS spread up 0.9 bp at 7.5 bp (12-months range: 6.2-26.5 bp)

KEY INTERNATIONAL RATES

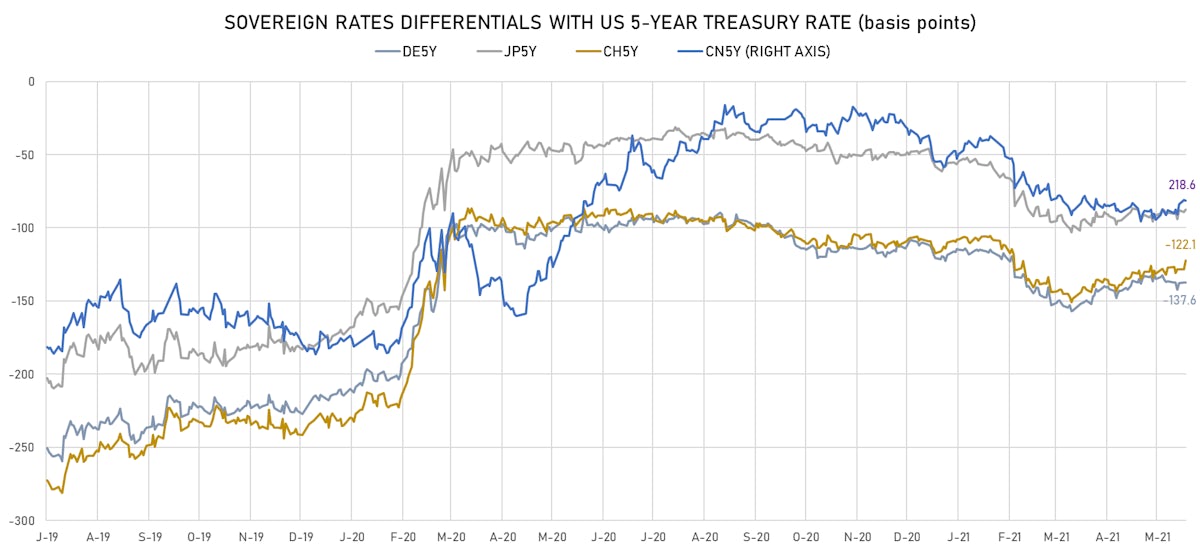

- Germany 5Y: -0.598% (down -1.9 bp); the German 1Y-10Y curve is 2.6 bp flatter at 41.7bp (YTD change: +26.4 bp)

- Japan 5Y: -0.100% (down 0.0 bp); the Japanese 1Y-10Y curve is 0.7 bp flatter at 19.2bp (YTD change: +4.7 bp)

- China 5Y: 2.962% (down -2.1 bp); the Chinese 1Y-10Y curve is 2.7 bp flatter at 70.5bp (YTD change: +24.1 bp)

- Switzerland 5Y: -0.445% (up 4.6 bp); the Swiss 1Y-10Y curve is 7.8 bp flatter at 55.5bp (YTD change: +29.1 bp)