Rates

Treasuries Close Higher After Early CPI Driven Drop Is Bought Into

The CPI number was high, but mostly driven by transitory things like exceptionally high used car prices; in addition, the month-on-month core CPI growth rate fell, indicating that May was probably the high-water mark

Published ET

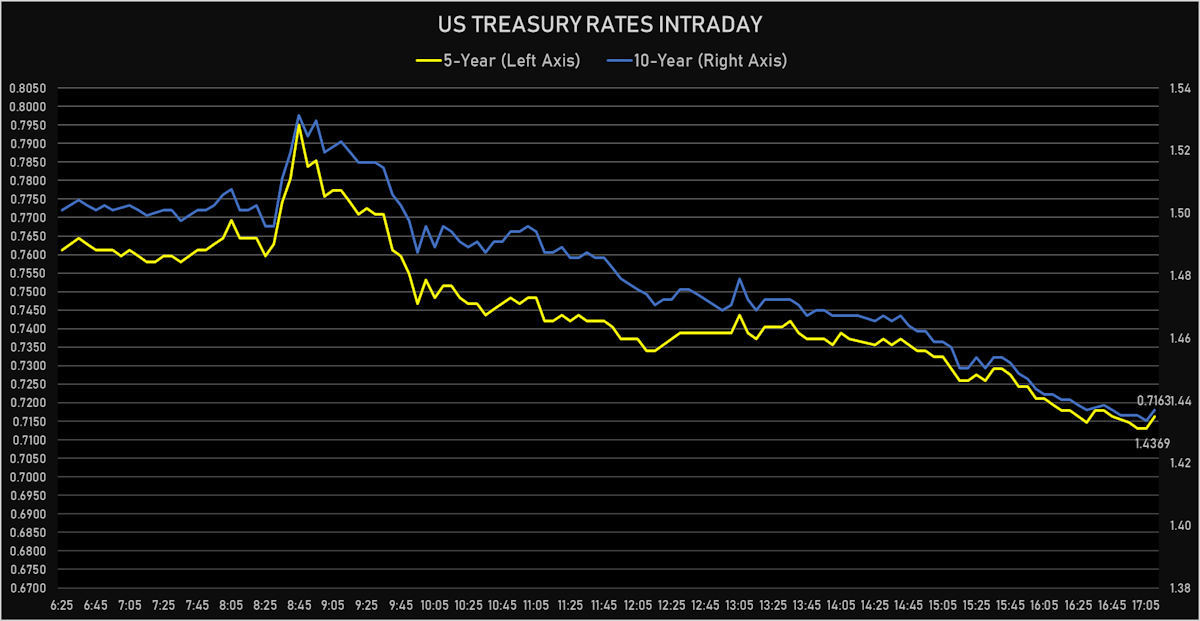

US 5-year treasury yield | Source: Refinitiv

QUICK US SUMMARY

- Yield curve flattening, with the 1Y-10Y spread tightening -5.5 bp on the day, now at 138.6 bp (YTD change: +58.1)

- 1Y: 0.0510% (unchanged)

- 2Y: 0.1469% (down 1.0 bp)

- 5Y: 0.7163% (down 3.4 bp)

- 7Y: 1.1238% (down 4.4 bp)

- 10Y: 1.4369% (down 5.5 bp)

- 30Y: 2.1304% (down 4.0 bp)

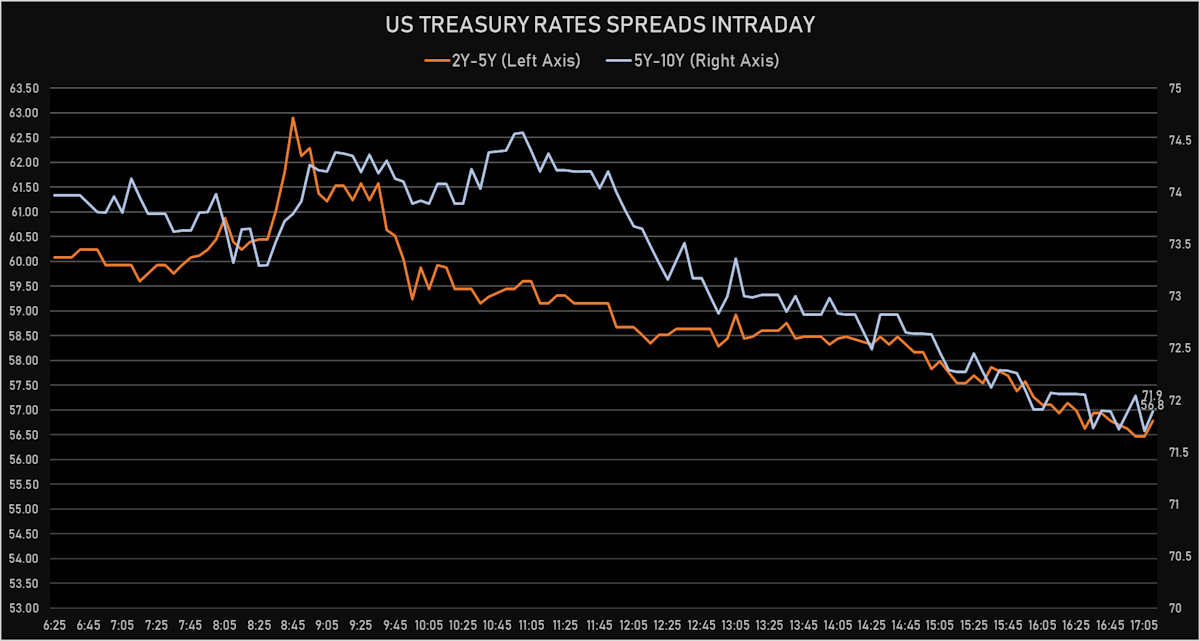

- US treasury curve spreads: 2-5 at 57.0bp (down -2.4bp today), 5-10 at 72.1bp (down -2.2bp today), 10-30 at 69.4bp (up 1.5bp today)

- Treasuries butterfly spreads: 2x5x10 at 15.3bp (up 1.1bp today), 5x10X30 at -3.0bp (up 3.4bp today)

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for May 2021 (BLS, U.S Dep. Of Lab) at 5.00, above consensus estimate of 4.70

- CPI, All items less food and energy for May 2021 (BLS, U.S Dep. Of Lab) at 275.72

- CPI, All items less food and energy, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.70, above consensus estimate of 0.40

- CPI, All items less food and energy, Change Y/Y, Price Index for May 2021 (BLS, U.S Dep. Of Lab) at 3.80, above consensus estimate of 3.40

- CPI, All items, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.60, above consensus estimate of 0.40

- CPI, All items, Price Index for May 2021 (BLS, U.S Dep. Of Lab) at 269.20, above consensus estimate of 268.47

- CPI, FRB Cleveland Median, 1 month, Change M/M for May 2021 (Fed Reserve Cleveland) at 0.30%

- Earnings, Average Weekly, Total Private, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at -0.10

- Federal Budget, Current Prices for May 2021 (Fiscal Service, USA) at -132.00

- Jobless Claims, National, Continued for W 29 May (U.S. Dept. of Labor) at 3.50, below consensus estimate of 3.60

- Jobless Claims, National, Initial for W 05 Jun (U.S. Dept. of Labor) at 376.00, above consensus estimate of 370.00

- Jobless Claims, National, Initial, four week moving average for W 05 Jun (U.S. Dept. of Labor) at 402.50

- US 30-year Treasury auction results: high yield of 2.172%; primary dealers take 17.98% of competitive bids, indirects take 64.04%; bid to cover ratio of 2.29

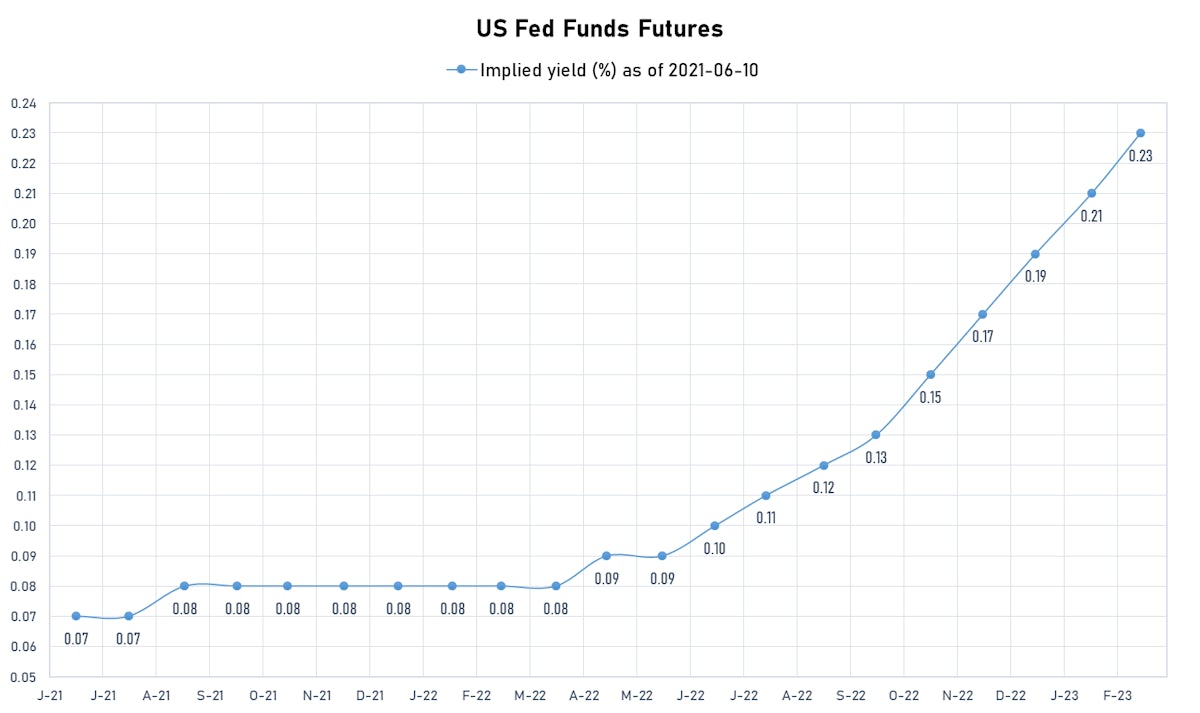

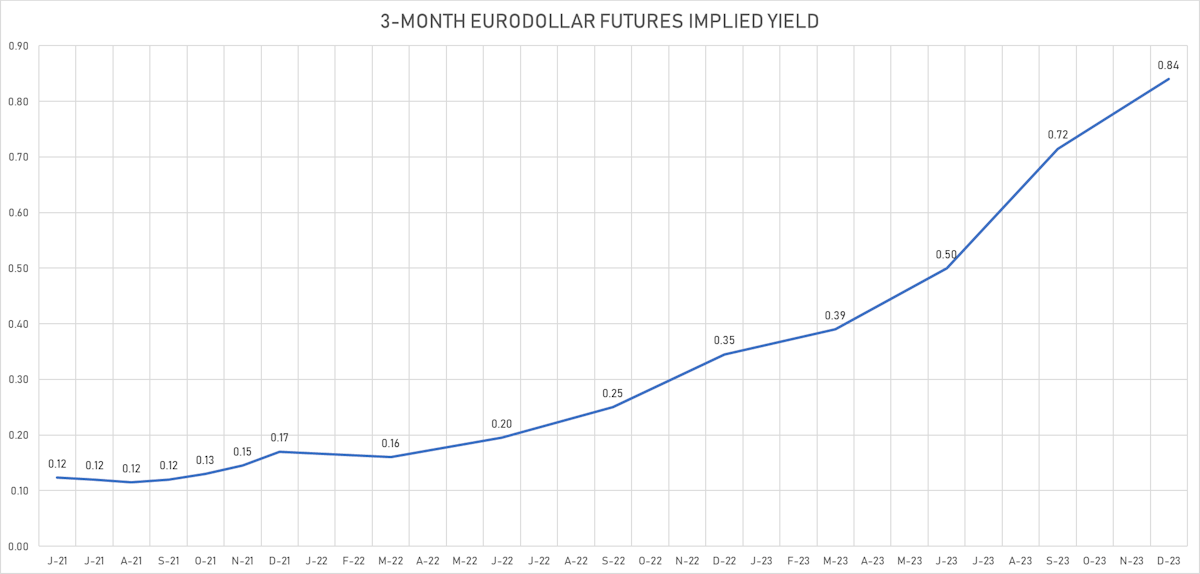

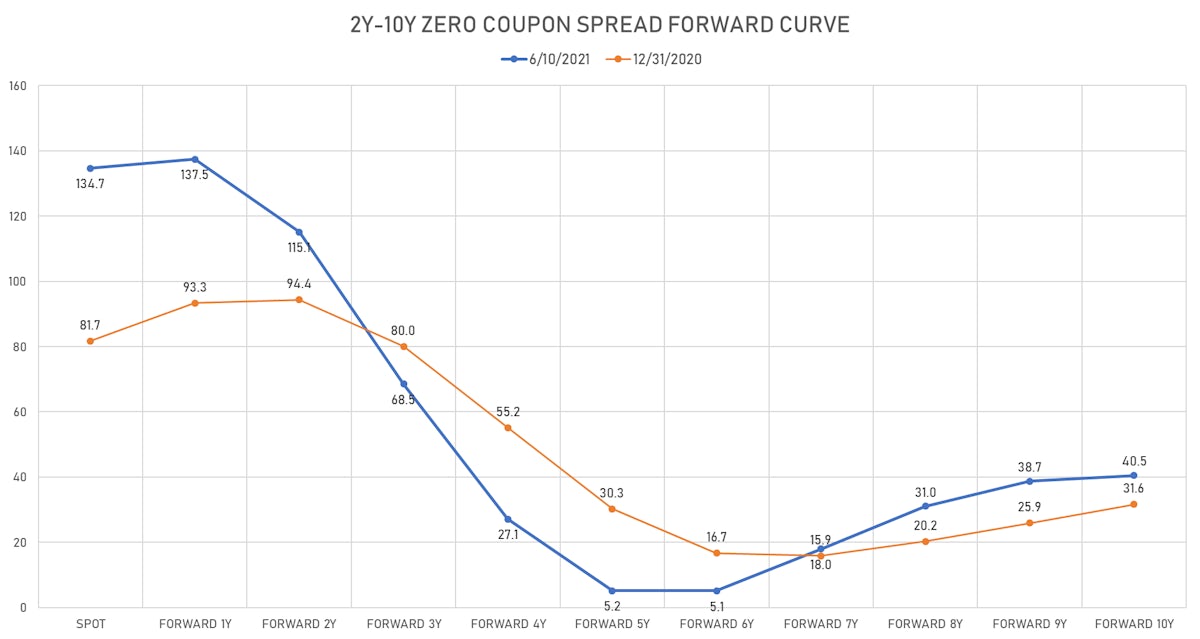

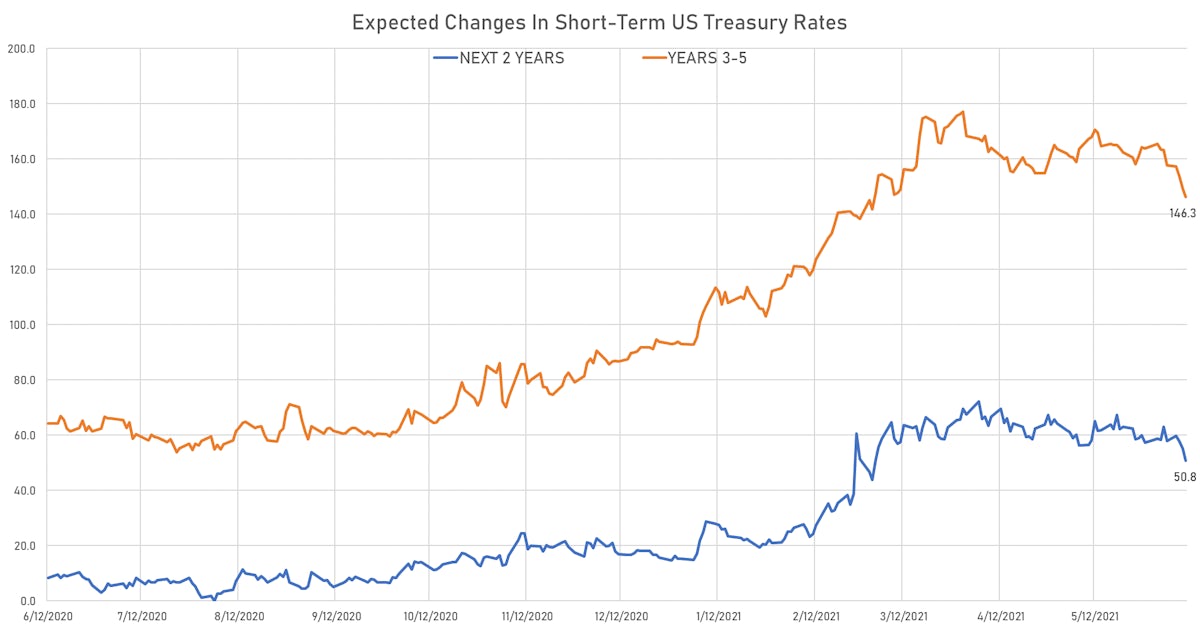

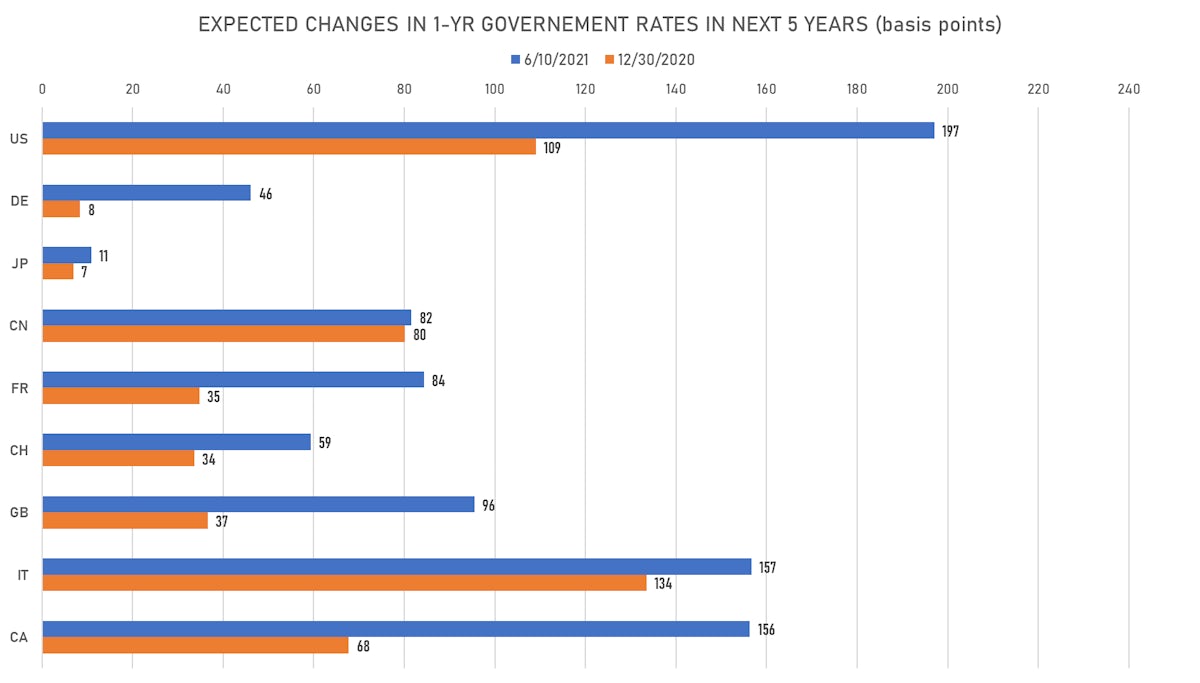

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 7.0 bp, now at 2.0424%

- Short-term rates are now expected to increase by 197.1 bp over the next 5 years, a 50bp drop from the 247bp expected a few weeks ago (Fed "lower for longer" theme)

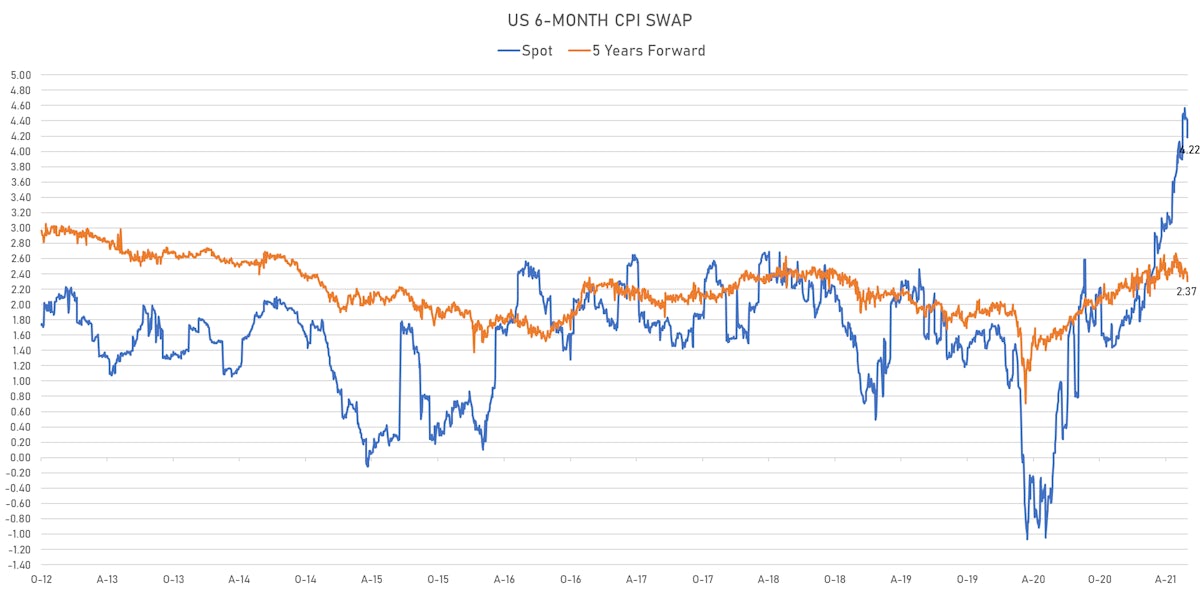

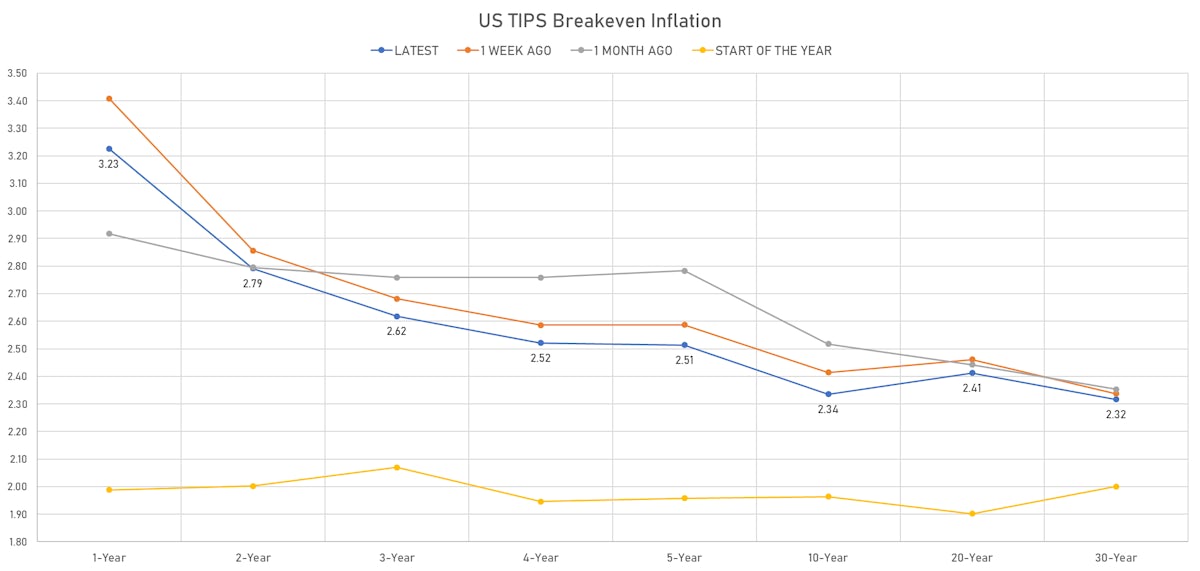

US INFLATION

- TIPS 1Y breakeven inflation at 3.23% (up 15.1bp); 2Y at 2.79% (up 9.8bp); 5Y at 2.51% (up 5.1bp); 10Y at 2.34% (up 3.1bp); 30Y at 2.32% (up 2.1bp)

- 6-month spot US CPI swap up 3.7 bp to 4.220%, with a flattening of the forward curve

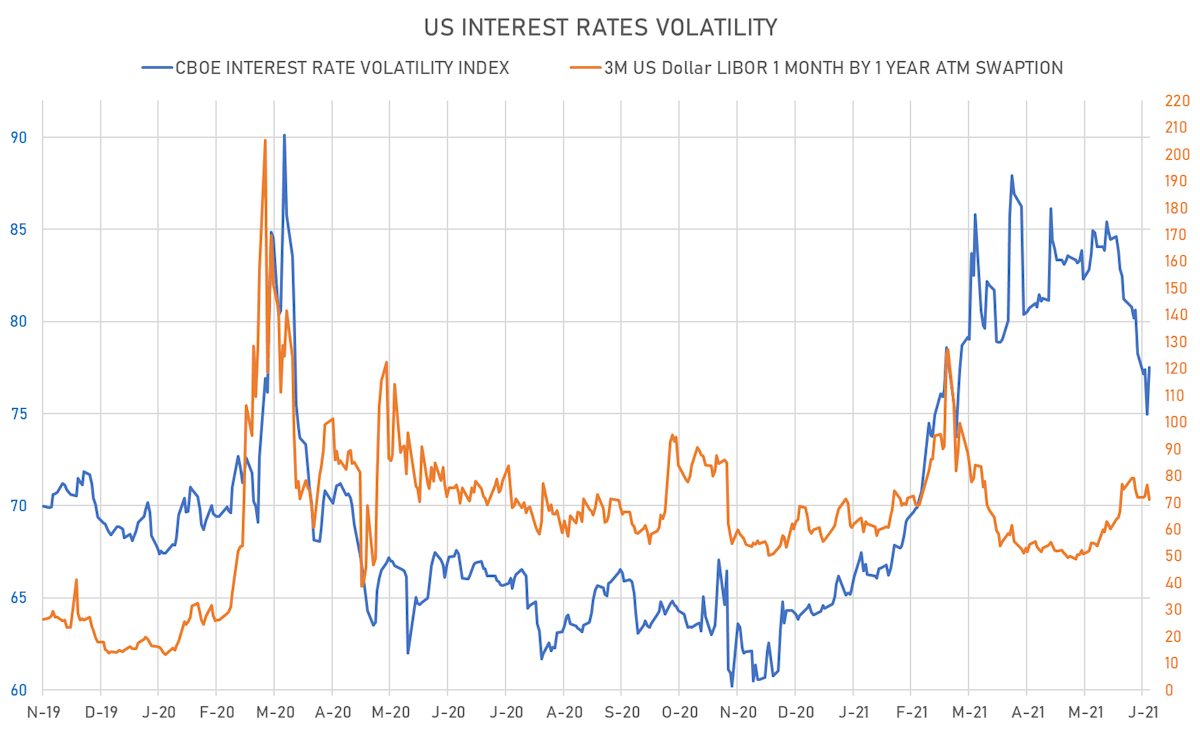

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -5.5% at 71.4%

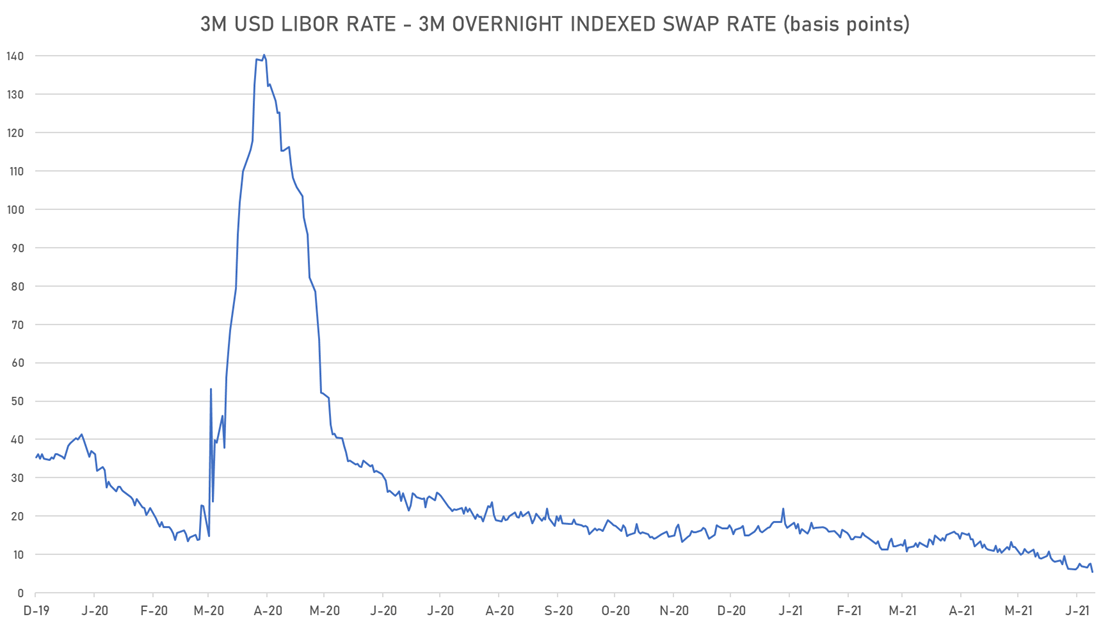

- 3-Month LIBOR-OIS spread down -2.2 bp at 5.5 bp (12-months range: 5.5-26.2 bp), lowest ever

KEY INTERNATIONAL RATES

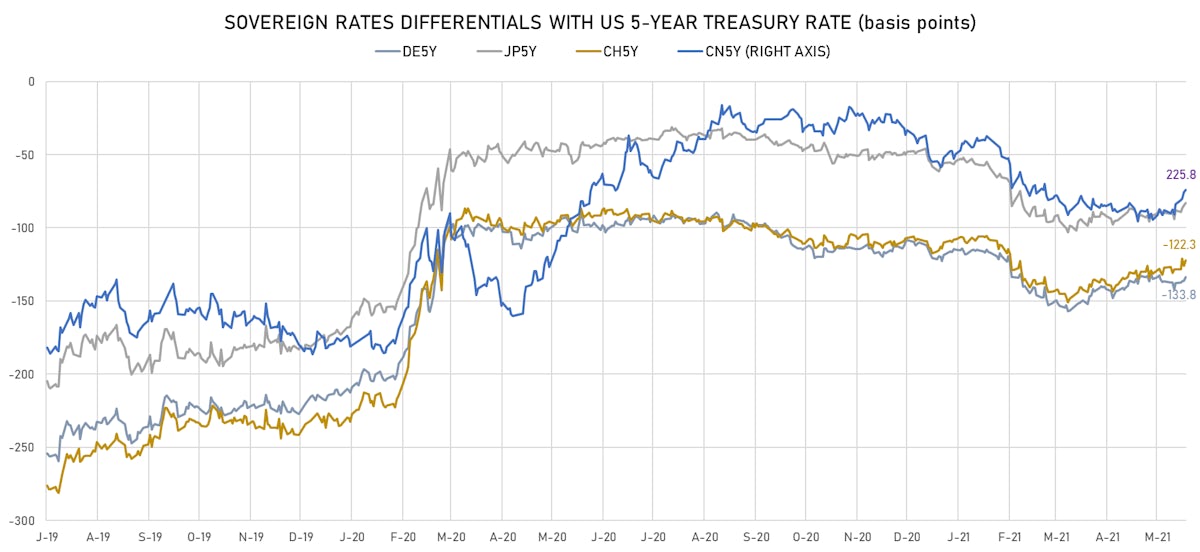

- Germany 5Y: -0.636% (down -0.5 bp); the German 1Y-10Y curve is 1.2 bp steeper at 39.4bp (YTD change: +25.2 bp)

- Japan 5Y: -0.102% (down -1.1 bp); the Japanese 1Y-10Y curve is 1.4 bp flatter at 16.3bp (YTD change: +2.3 bp)

- China 5Y: 2.974% (down -1.4 bp); the Chinese 1Y-10Y curve is 1.8 bp flatter at 69.4bp (YTD change: +23.0 bp)

- Switzerland 5Y: -0.507% (up 0.9 bp); the Swiss 1Y-10Y curve is 2.5 bp steeper at 60.7bp (YTD change: +34.3 bp)