Rates

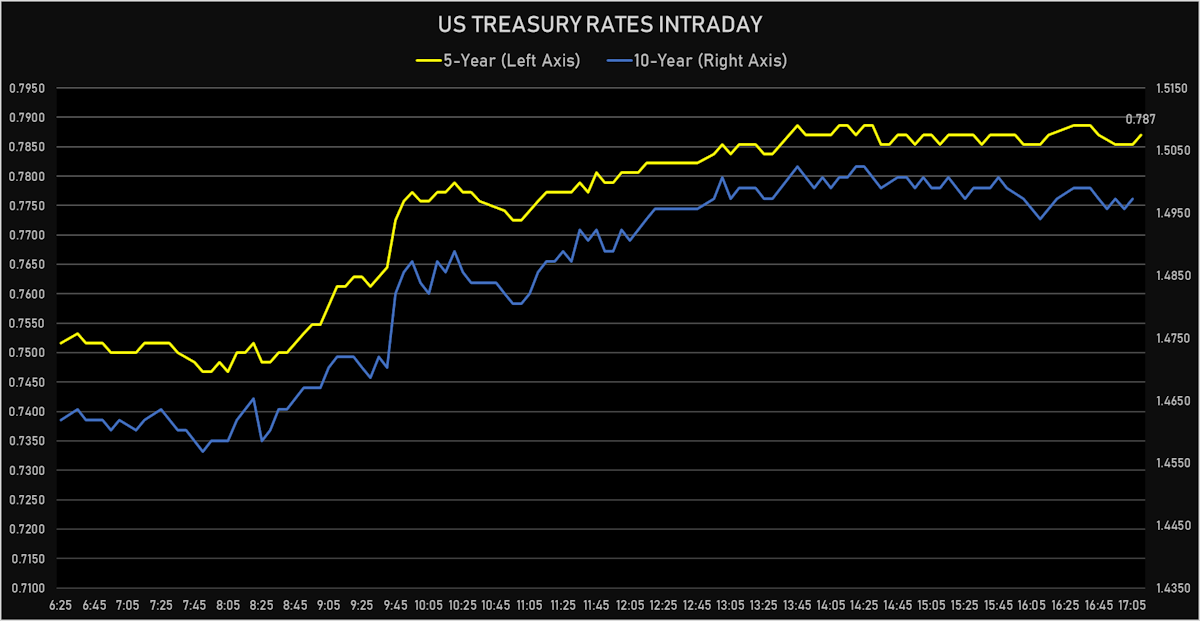

US Treasury Yields Bounce Off The Bottom Of The Recent Range

Several sell-side strategists were encouraging investors today to hedge potential FOMC upside rate volatility, pointing out the vulnerability of expensive treasury prices to a possibly more hawkish Fed

Published ET

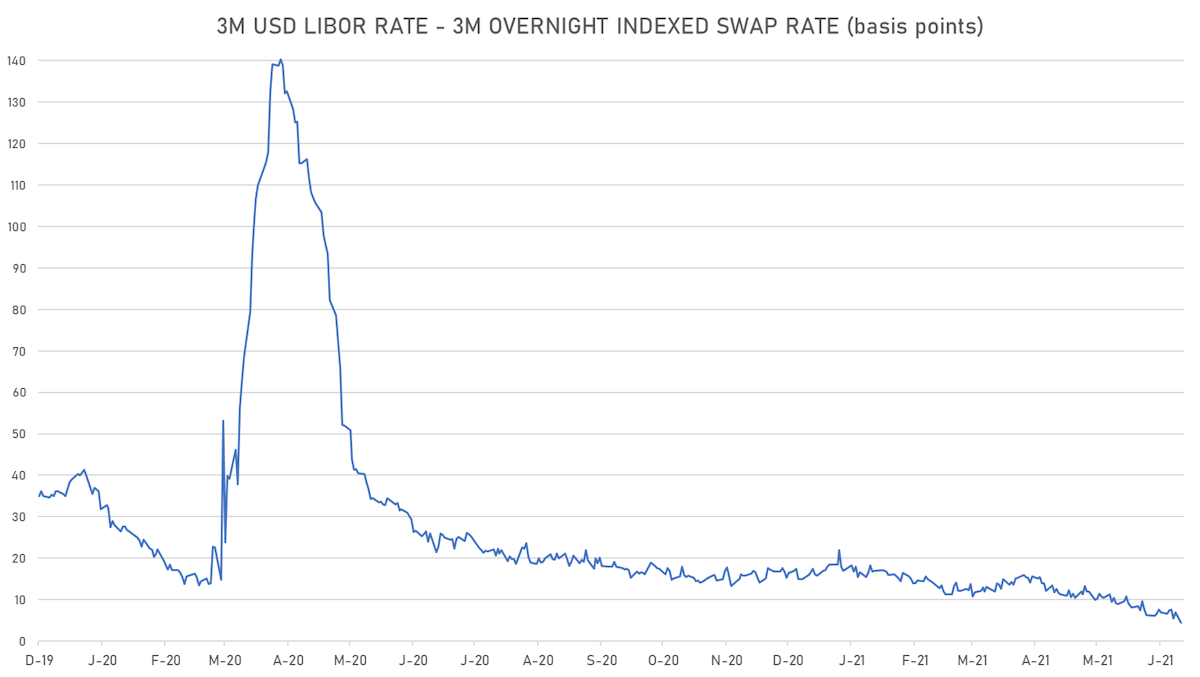

Liquidity galore: 3-month USD Libor At New All-Time Low | Source: Refinitiv

QUICK US SUMMARY

- Yield curve steepening, with the 1Y-10Y spread widening 4.1 bp on the day, now at 144.6 bp (YTD change: +64.2)

- 1Y: 0.0510% (up 0.3 bp)

- 2Y: 0.1610% (up 1.2 bp)

- 5Y: 0.7870% (up 4.3 bp)

- 7Y: 1.1960% (up 4.9 bp)

- 10Y: 1.4973% (up 4.4 bp)

- 30Y: 2.1843% (up 4.2 bp)

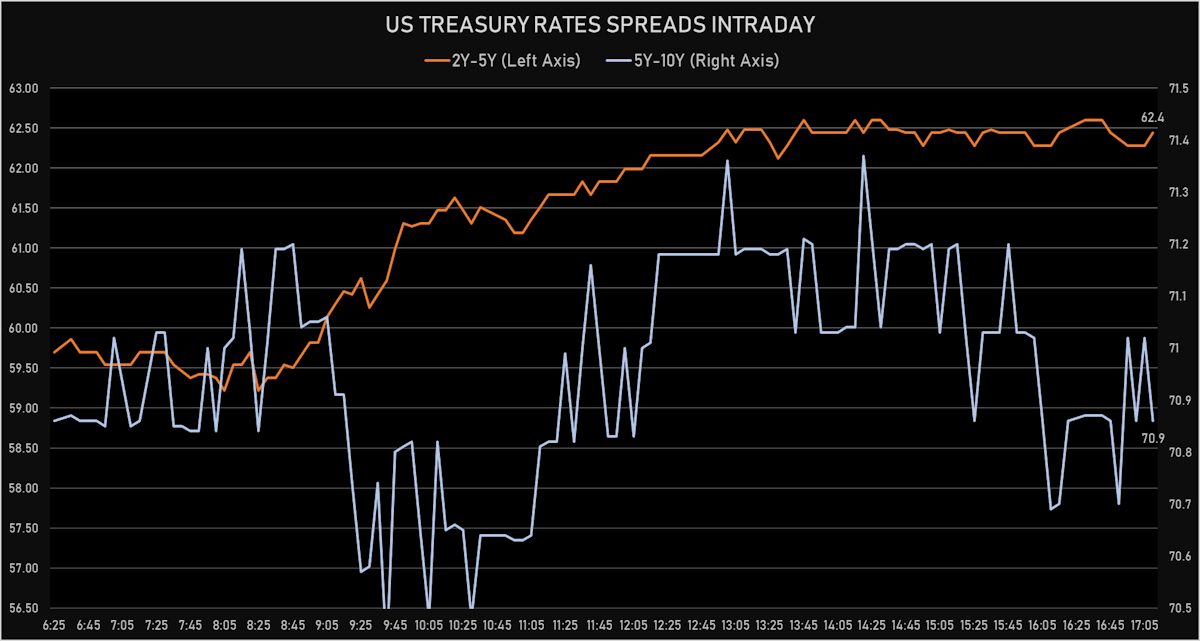

- US treasury curve spreads: 2-5 at 62.6bp (up 3.2bp today), 5-10 at 71.0bp (unchanged today), 10-30 at 68.8bp (down -0.1bp today)

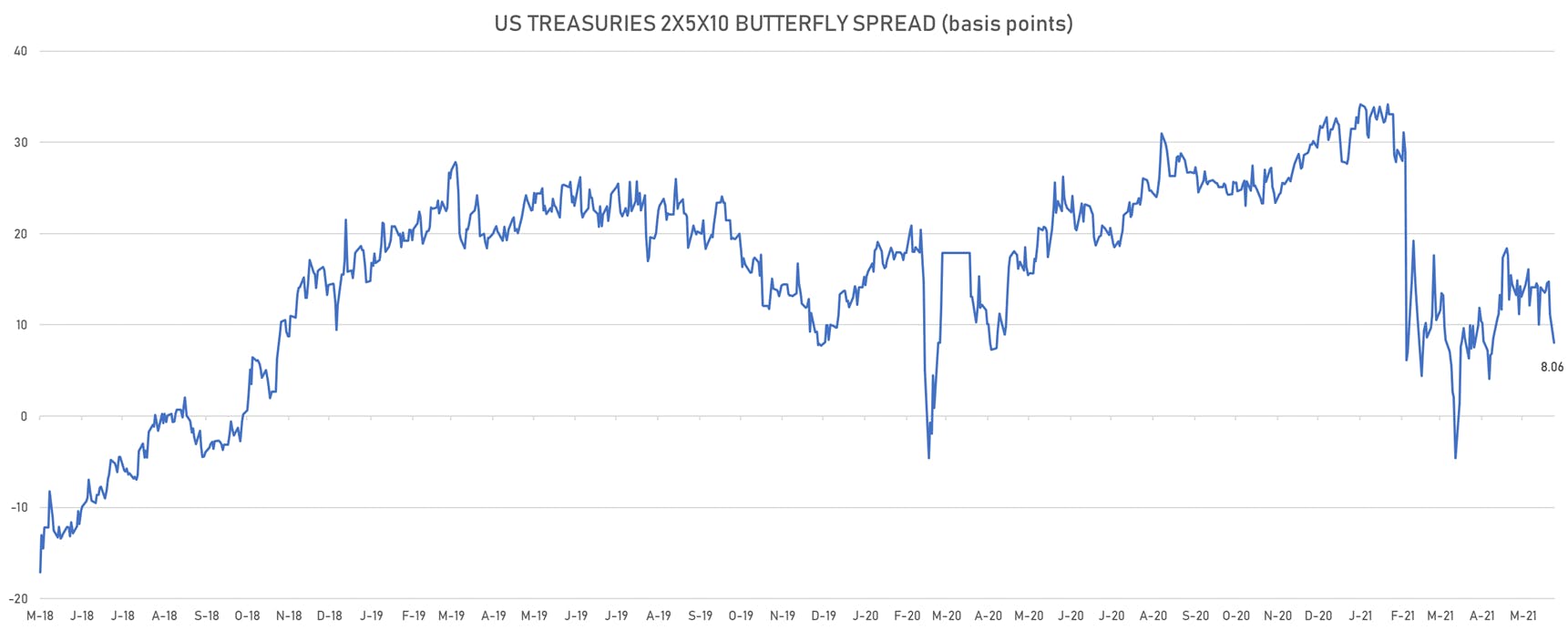

- Treasuries butterfly spreads: 2x5x10 at 8.1bp (down -3.1bp today), 5x10X30 at -2.5bp (up 0.4bp today)

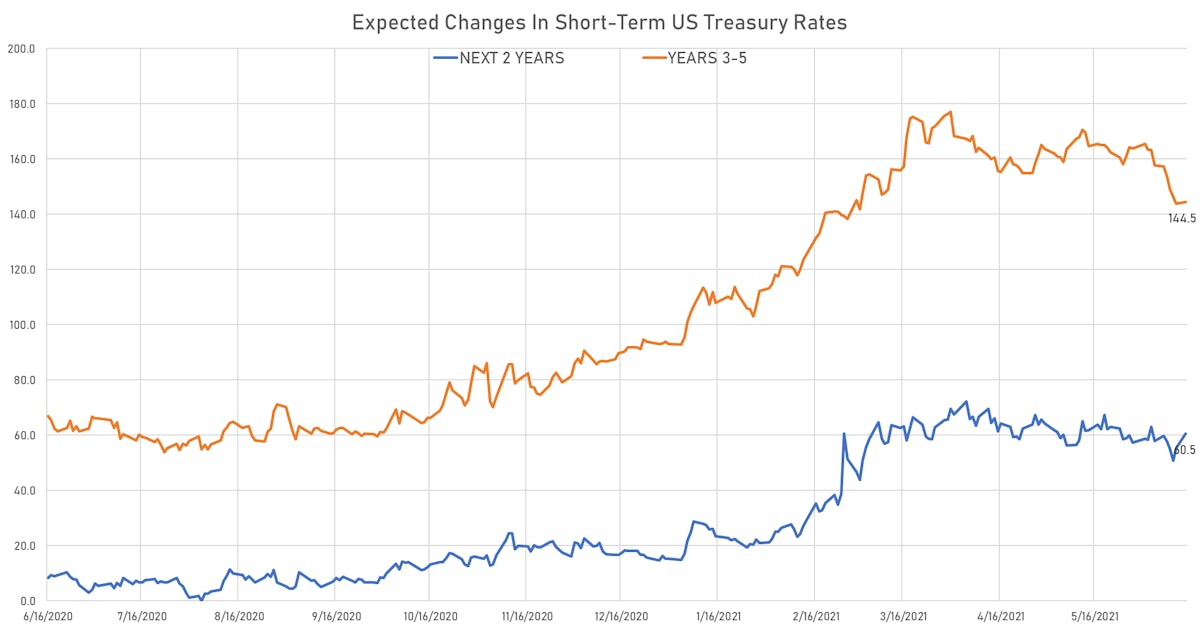

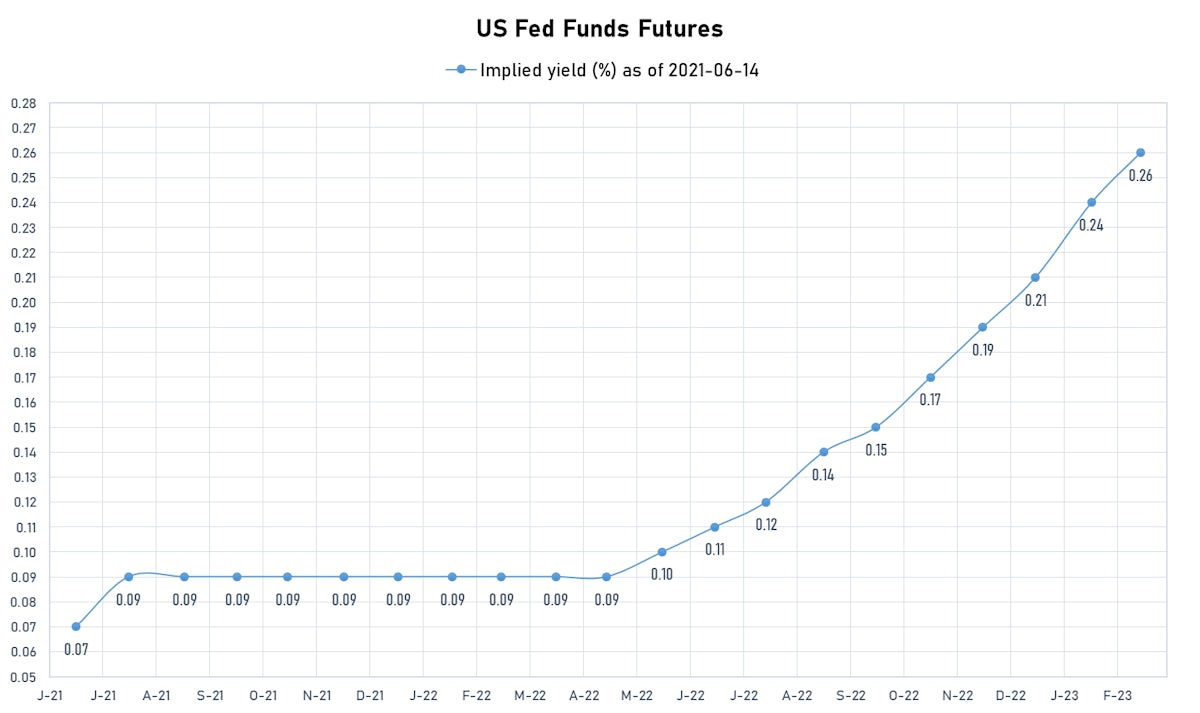

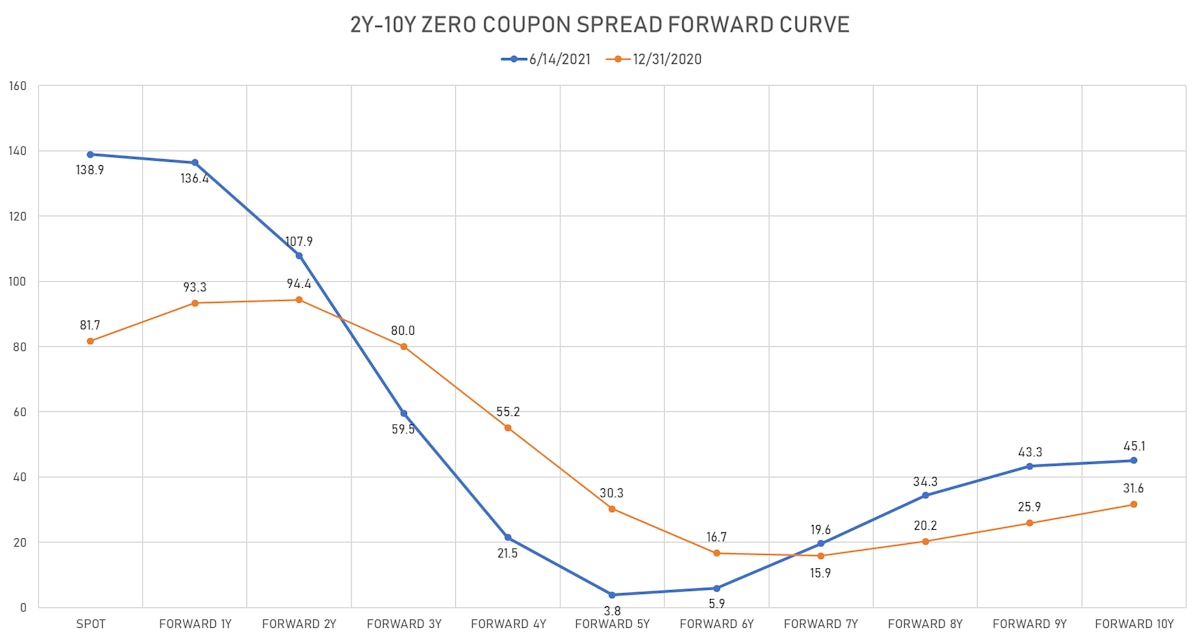

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

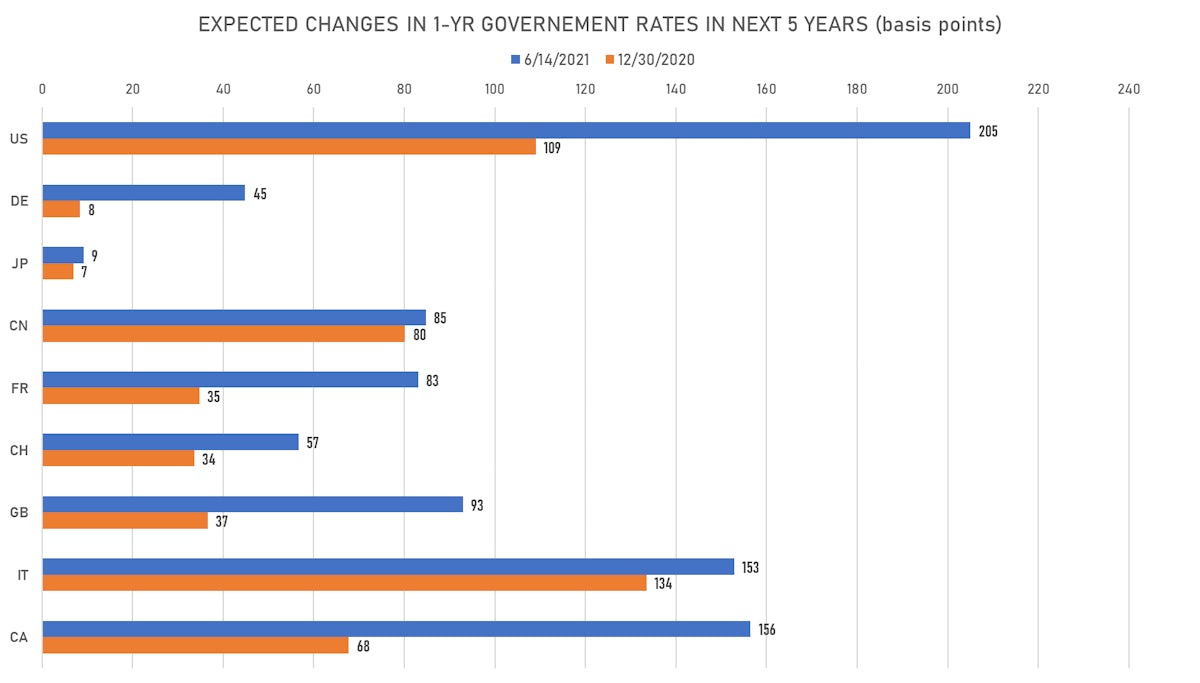

- US Treasury 1-year zero-coupon rate 5 years forward up 6.3 bp, now at 2.1259% (meaning that short-term rates are now expected to increase by 205.0 bp over the next 5 years)

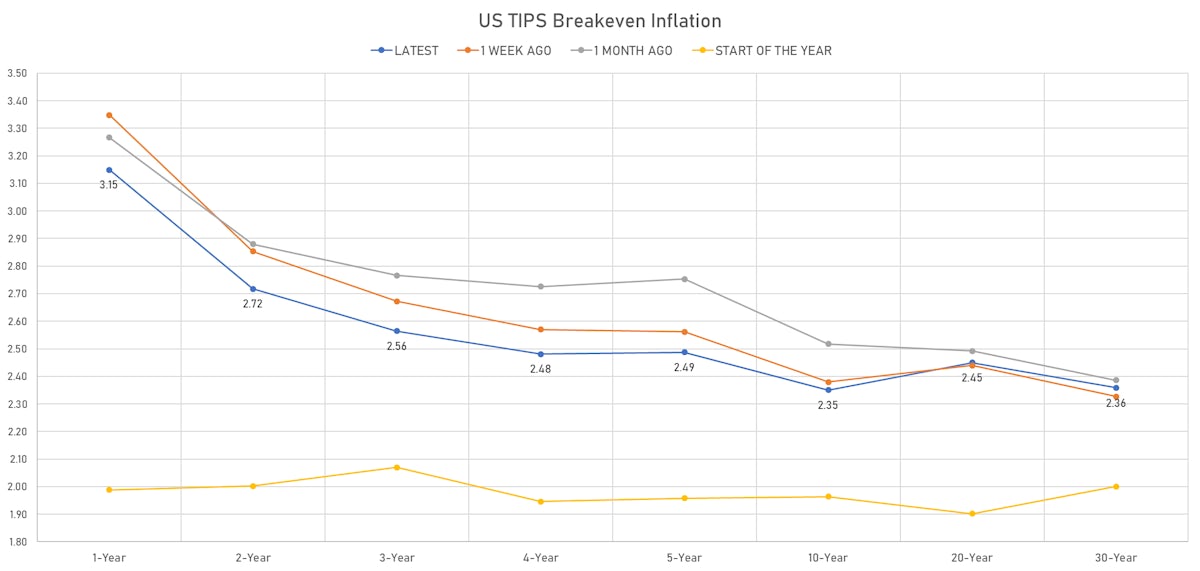

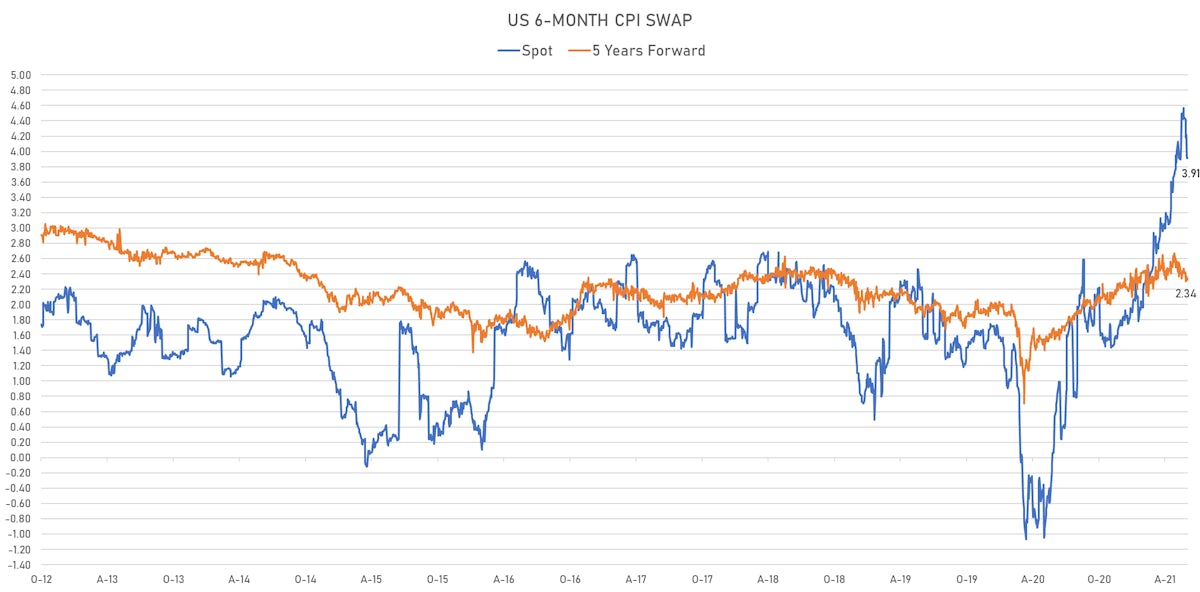

US INFLATION

- TIPS 1Y breakeven inflation at 3.15% (down -2.1bp); 2Y at 2.72% (up 0.3bp); 5Y at 2.49% (down -3.2bp); 10Y at 2.35% (up 2.6bp); 30Y at 2.36% (up 3.9bp)

- 6-month spot US CPI swap up 0.2 bp to 3.915%, with a flattening of the forward curve

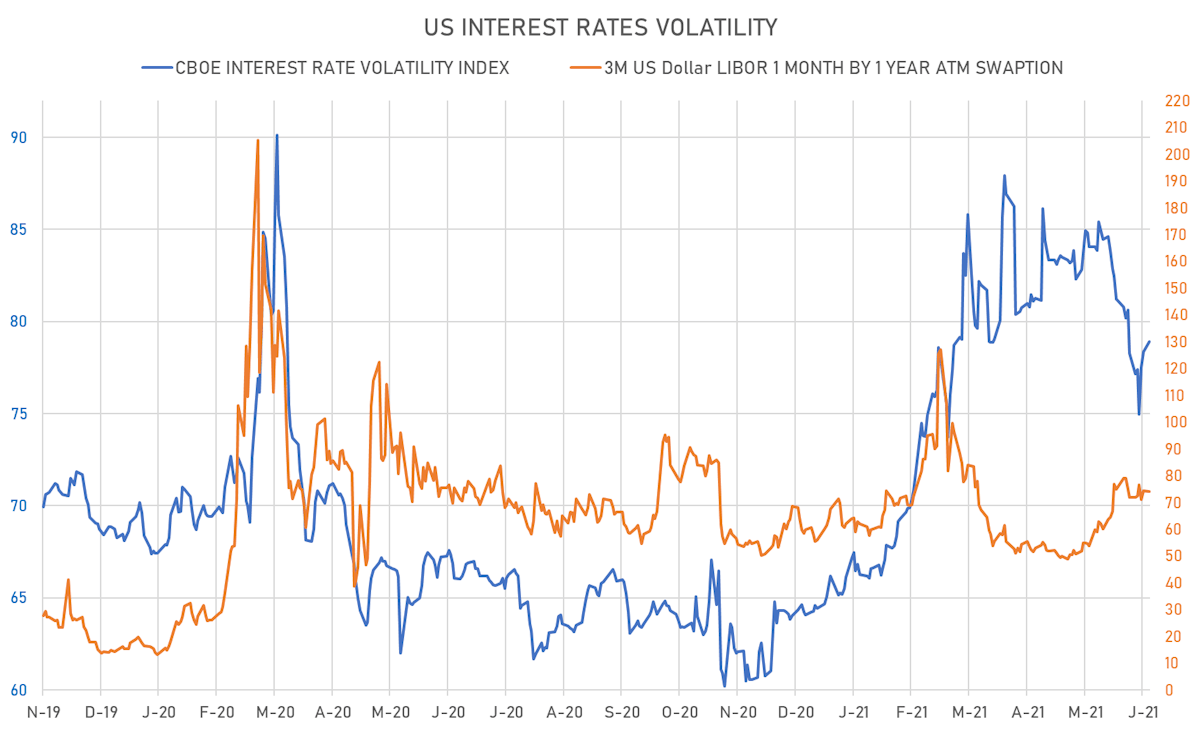

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 74.2%

- 3-Month LIBOR-OIS spread down -2.5 bp at 4.5 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

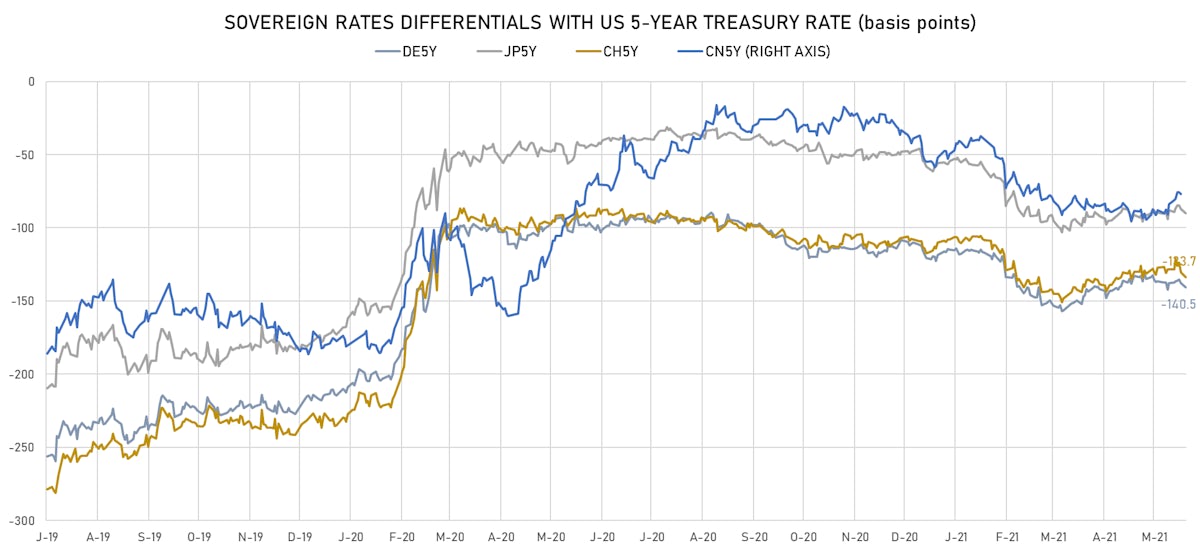

- Germany 5Y: -0.610% (up 1.1 bp); the German 1Y-10Y curve is 0.0 bp steeper at 39.6bp (YTD change: +23.8 bp)

- Japan 5Y: -0.107% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 15.4bp (YTD change: +1.2 bp)

- China 5Y: 2.982% (up 0.8 bp); the Chinese 1Y-10Y curve is 2.1 bp steeper at 71.5bp (YTD change: +25.1 bp)

- Switzerland 5Y: -0.541% (up 0.5 bp); the Swiss 1Y-10Y curve is 0.4 bp flatter at 49.9bp (YTD change: +27.0 bp)