Rates

US Curve Flattens, As Retails Sales Fell More Than Expected Last Month While Producer Prices Rose More Than Expected

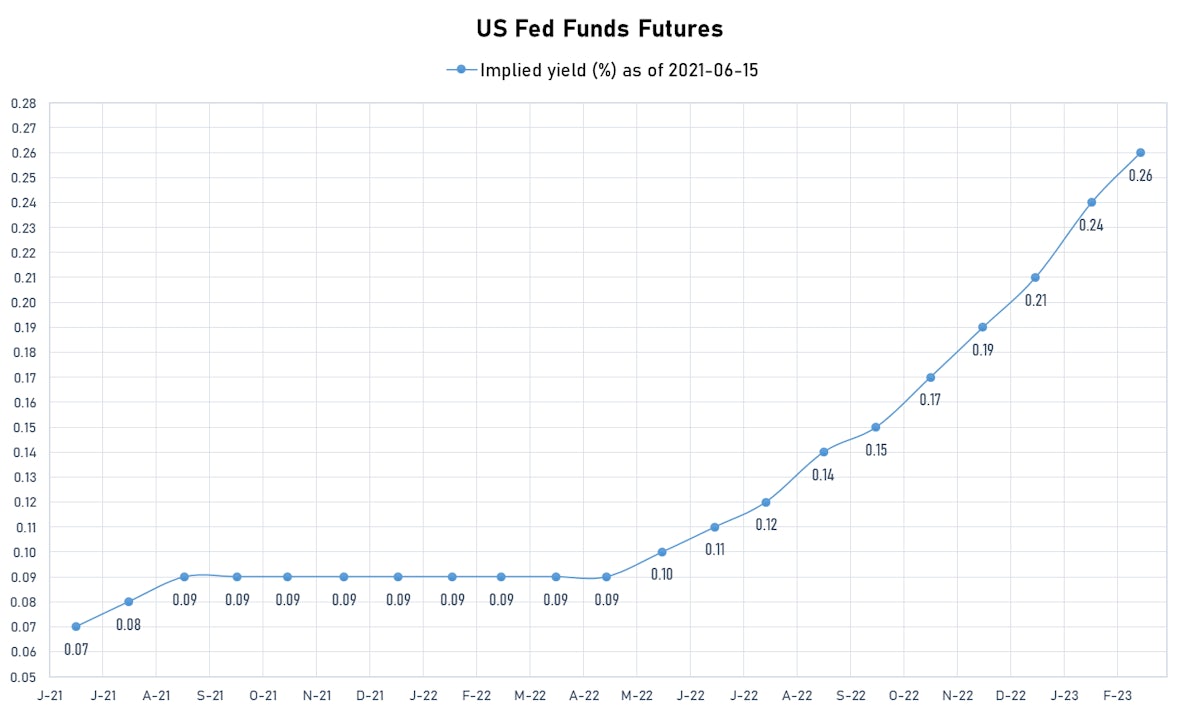

With all eyes on the FOMC, Goldman Sachs rates strategists see tapering being publicly discussed by the Fed no earlier than August to October, with the announcement of the pace in November, a full presentation of the plan in December, and a start in January 2022

Published ET

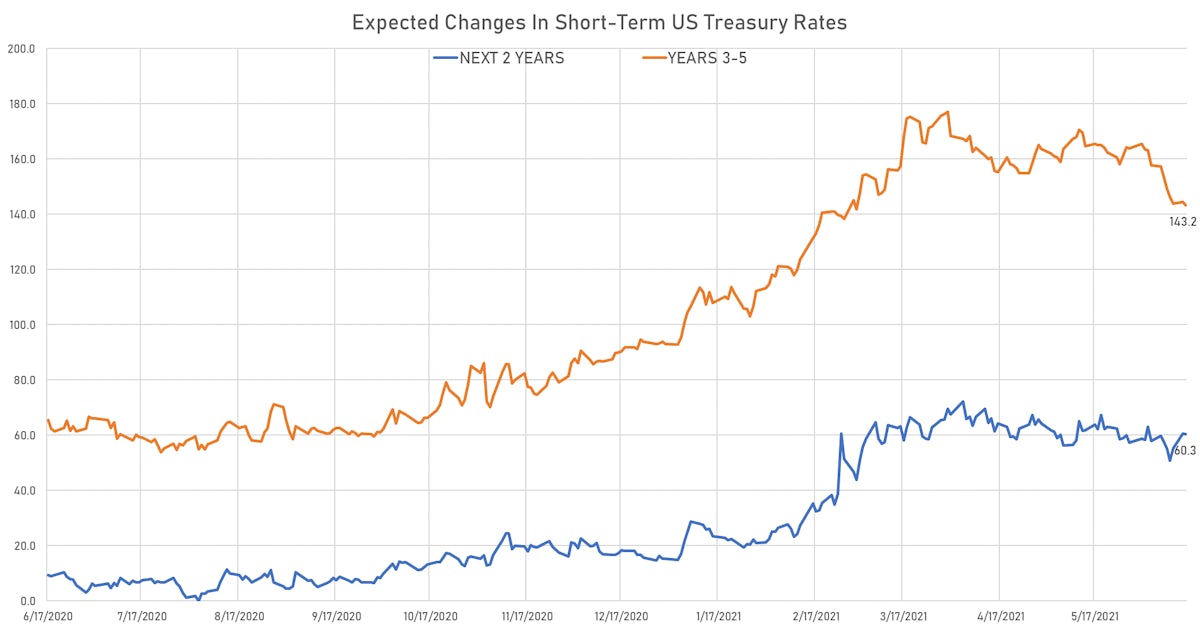

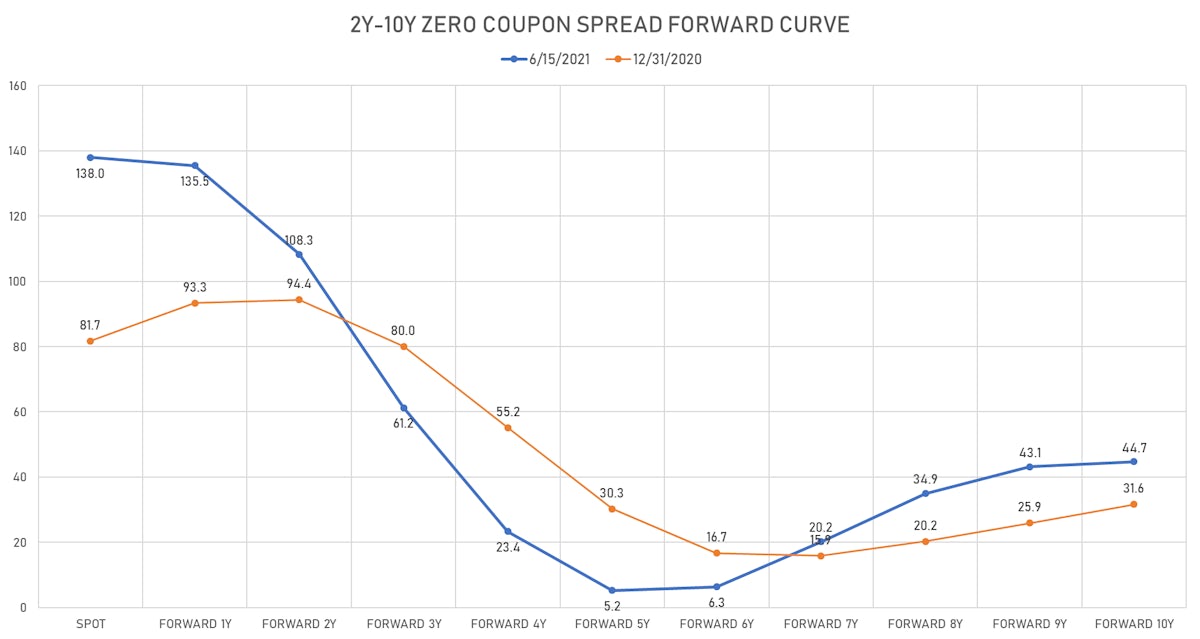

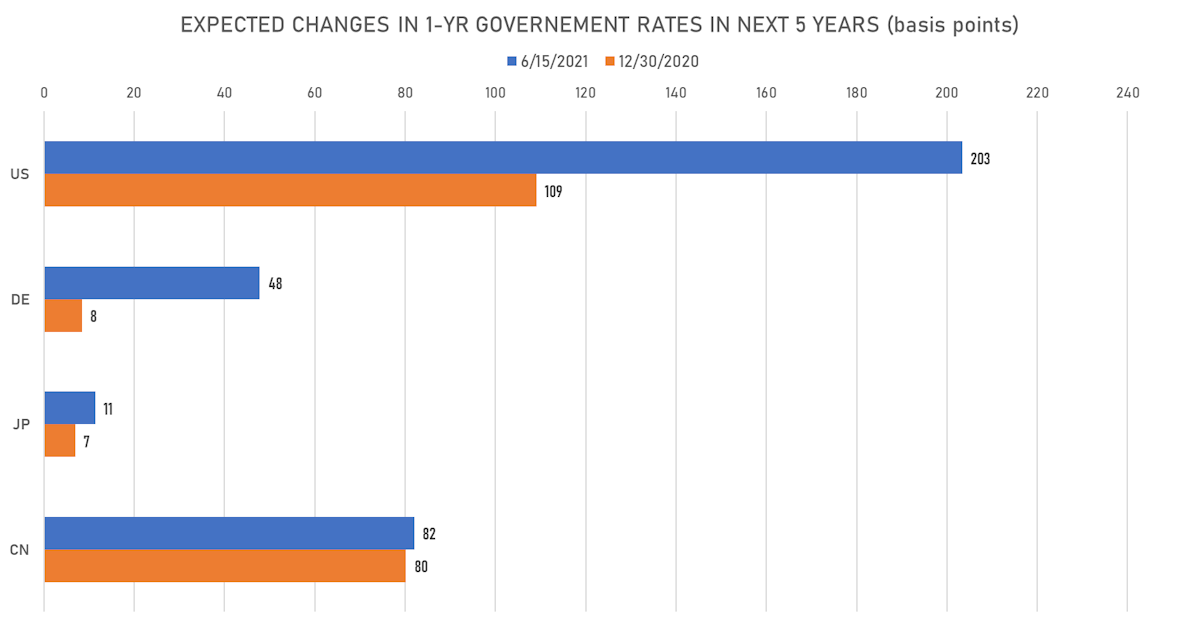

Implied rate hikes over the next 5 years, derived from the spread between the 1-year zero coupon and the 1-year zero coupon 5 years forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve flattening, with the 1Y-10Y spread tightening -1.6 bp on the day, now at 143.8 bp (YTD change: +63.3)

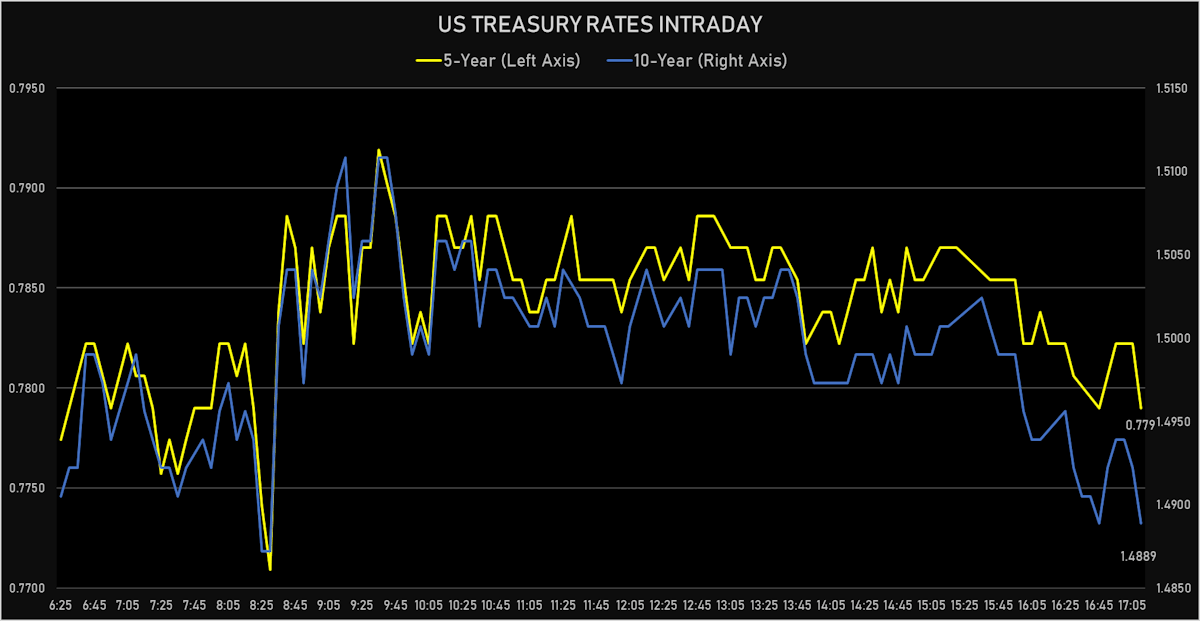

- 1Y: 0.0510% (up 0.8 bp)

- 2Y: 0.1650% (up 0.4 bp)

- 5Y: 0.7790% (down 0.8 bp)

- 7Y: 1.1866% (down 0.9 bp)

- 10Y: 1.4889% (down 0.8 bp)

- 30Y: 2.1850% (up 0.1 bp)

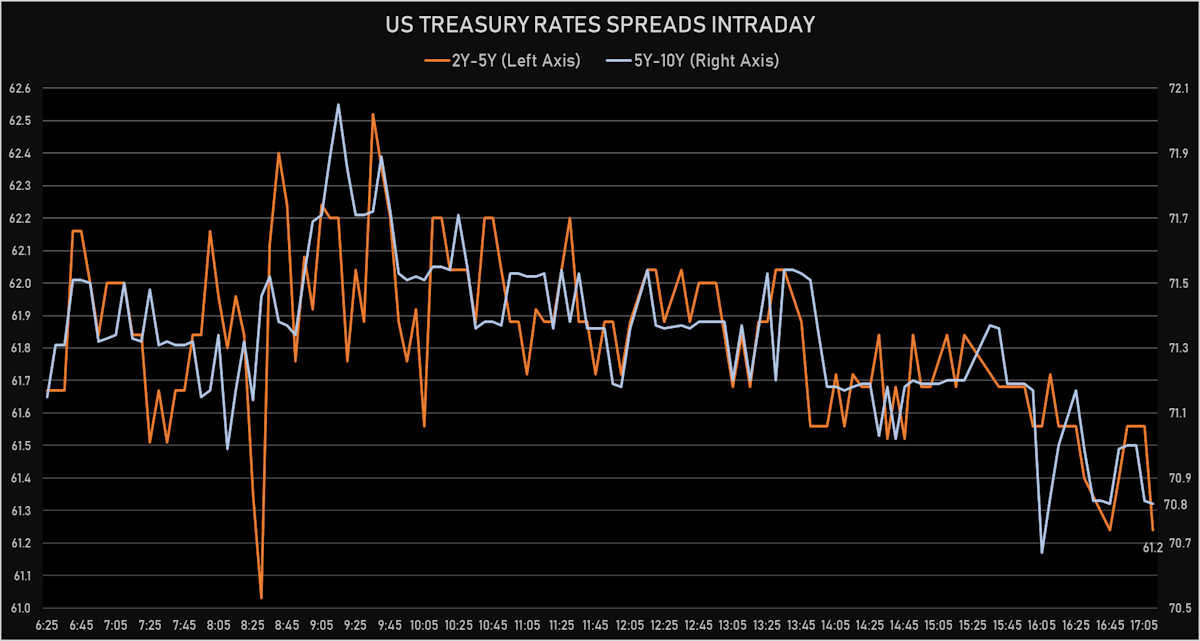

- US treasury curve spreads: 2-5 at 61.4bp (down -1.2bp today), 5-10 at 71.0bp (unchanged), 10-30 at 69.6bp (up 0.8bp today)

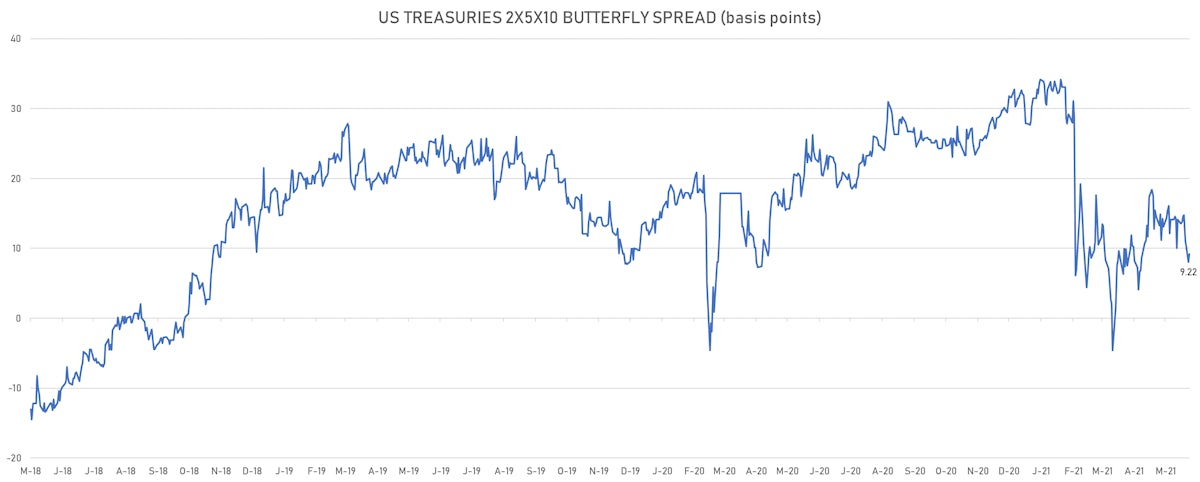

- Treasuries butterfly spreads: 2x5x10 at 9.2bp (up 1.2bp today), 5x10X30 at -2.0bp (up 0.5bp today)

US MACRO DATA RELEASES

- Capacity Utilization, Total index, Change M/M for May 2021 (FED, U.S.) at 75.20, above consensus estimate of 75.10

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 12 Jun (Redbook Research) at 16.40

- NAHB/Wells Fargo Housing Market Index for Jun 2021 (NAHB, United States) at 81.00, below consensus estimate of 83.00

- Net flows total, Current Prices for Apr 2021 (U.S. Dept. Treas.) at 101.20

- Net foreign acquisition of long-term securities, Current Prices for Apr 2021 (U.S. Dept. Treas.) at 59.30

- Net purchases (net long-term capital inflows), total, Current Prices for Apr 2021 (U.S. Dept. Treas.) at 100.70

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Apr 2021 (U.S. Dept. Treas.) at 49.60

- New York Fed, General Business Condition for Jun 2021 (FED, NY) at 17.40, below consensus estimate of 23.00

- Overall, Total business inventories, Change P/P for Apr 2021 (U.S. Census Bureau) at -0.20, below consensus estimate of -0.10

- PPI ex Food/Energy/Trade MM, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.70

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for May 2021 (BLS, U.S Dep. Of Lab) at 5.30

- Producer Prices, Final demand less foods and energy, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.70, above consensus estimate of 0.50

- Producer Prices, Final demand less foods and energy, Change Y/Y for May 2021 (BLS, U.S Dep. Of Lab) at 4.80, below consensus estimate of 4.80

- Producer Prices, Final demand, Change P/P for May 2021 (BLS, U.S Dep. Of Lab) at 0.80, above consensus estimate of 0.60

- Producer Prices, Final demand, Change Y/Y for May 2021 (BLS, U.S Dep. Of Lab) at 6.60, above consensus estimate of 6.30

- Production, Change P/P for May 2021 (FED, U.S.) at 0.80, above consensus estimate of 0.60

- Production, Manufacturing, Total (SIC), Change P/P for May 2021 (FED, U.S.) at 0.90, above consensus estimate of 0.60

- Retail Sales, Total excluding building material & motor vehicle & parts & gasoline station & food svc, Change P/P for May 2021 (U.S. Census Bureau) at -0.70, below consensus estimate of -0.60

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for May 2021 (U.S. Census Bureau) at -0.80

- Retail Sales, Total including food services, Change P/P for May 2021 (U.S. Census Bureau) at -1.30, below consensus estimate of -0.80

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for May 2021 (U.S. Census Bureau) at -0.70, below consensus estimate of 0.20

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 1.5 bp, now at 2.1112% (meaning that short-term rates are now expected to increase by 203.4 bp over the next 5 years)

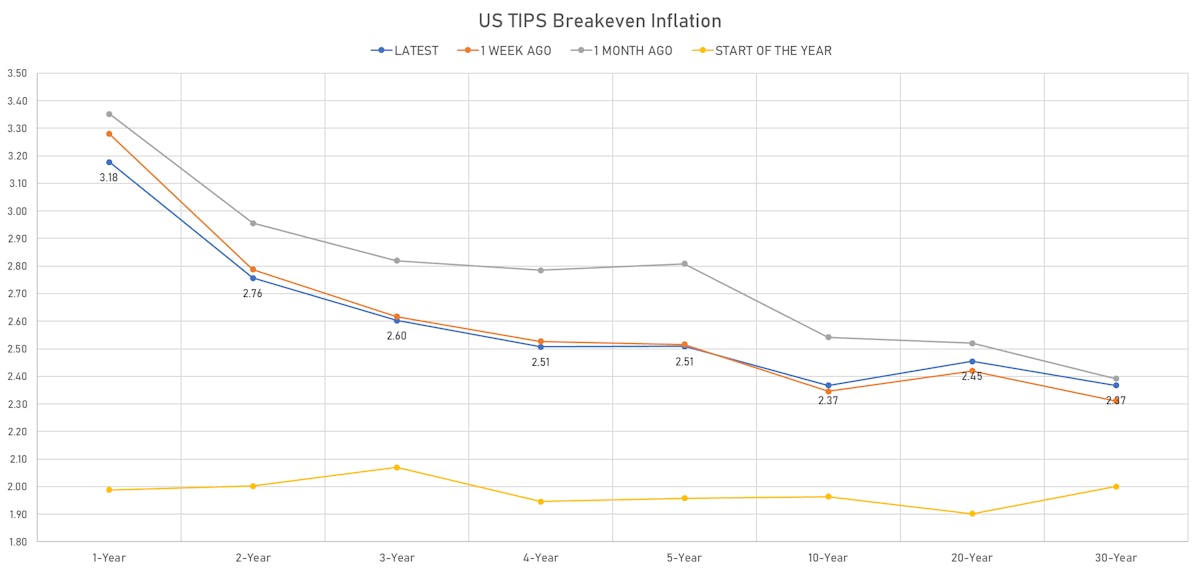

US INFLATION

- TIPS 1Y breakeven inflation at 3.18% (up 2.8bp); 2Y at 2.76% (up 3.9bp); 5Y at 2.51% (up 2.1bp); 10Y at 2.37% (up 1.6bp); 30Y at 2.37% (up 0.9bp)

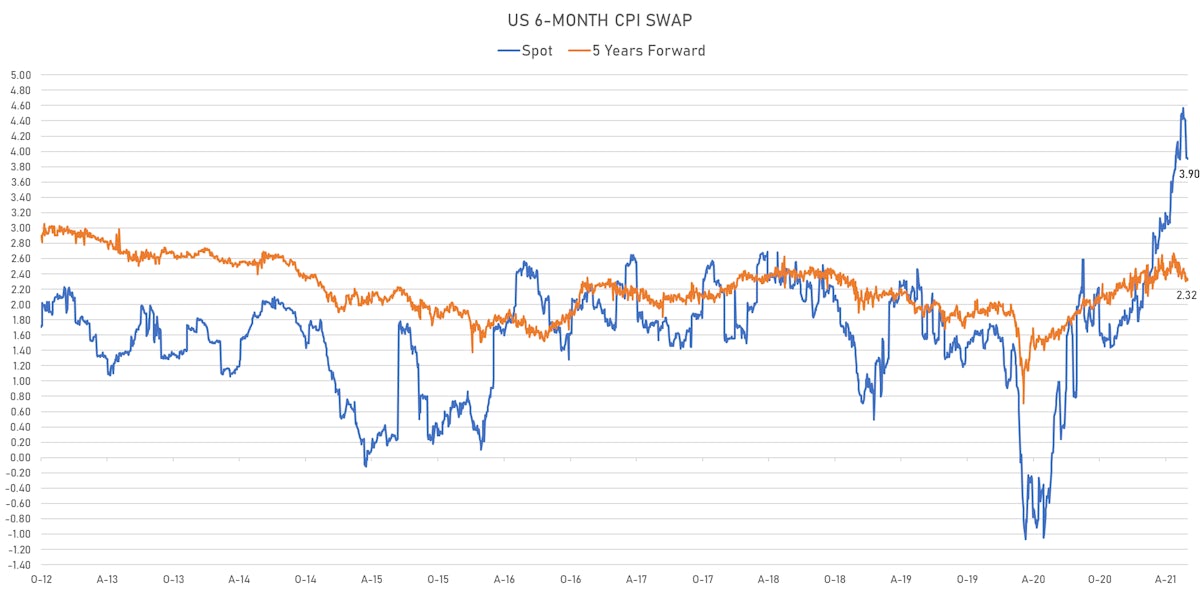

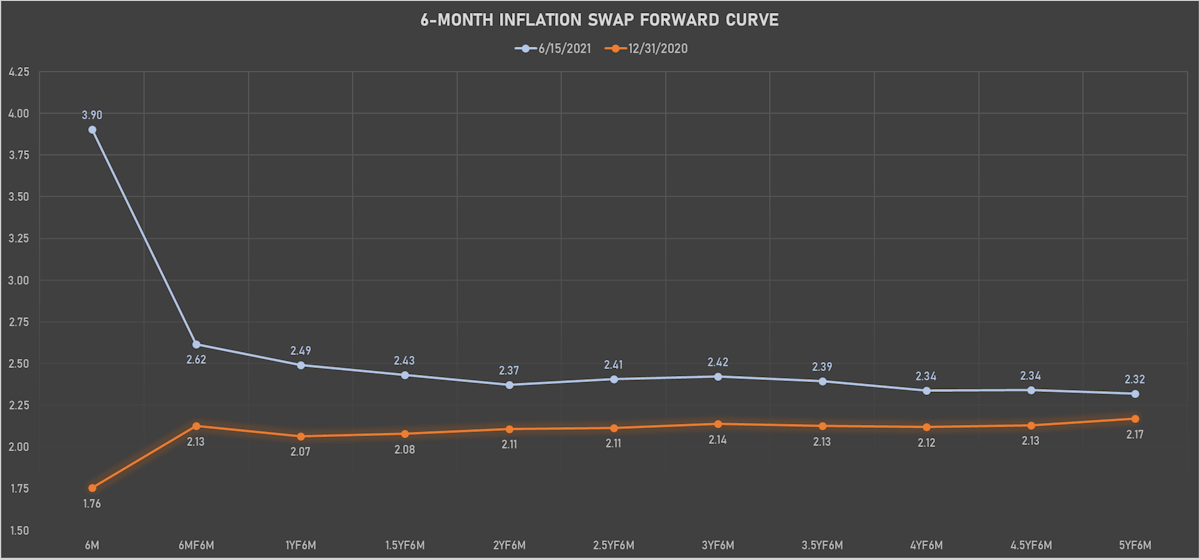

- 6-month spot US CPI swap down -1.2 bp to 3.903%, with a steepening of the forward curve (longer-term inflation dropping more)

RATES VOLATILITY & LIQUIDITY

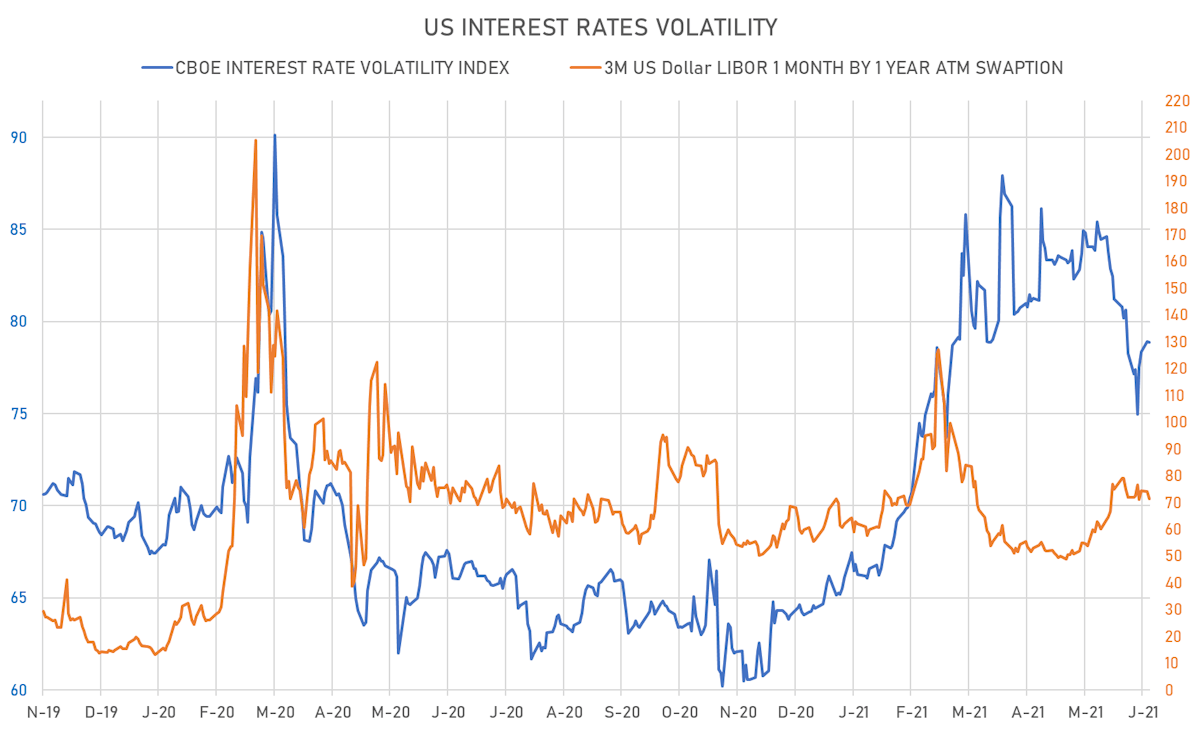

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.7% at 71.6%

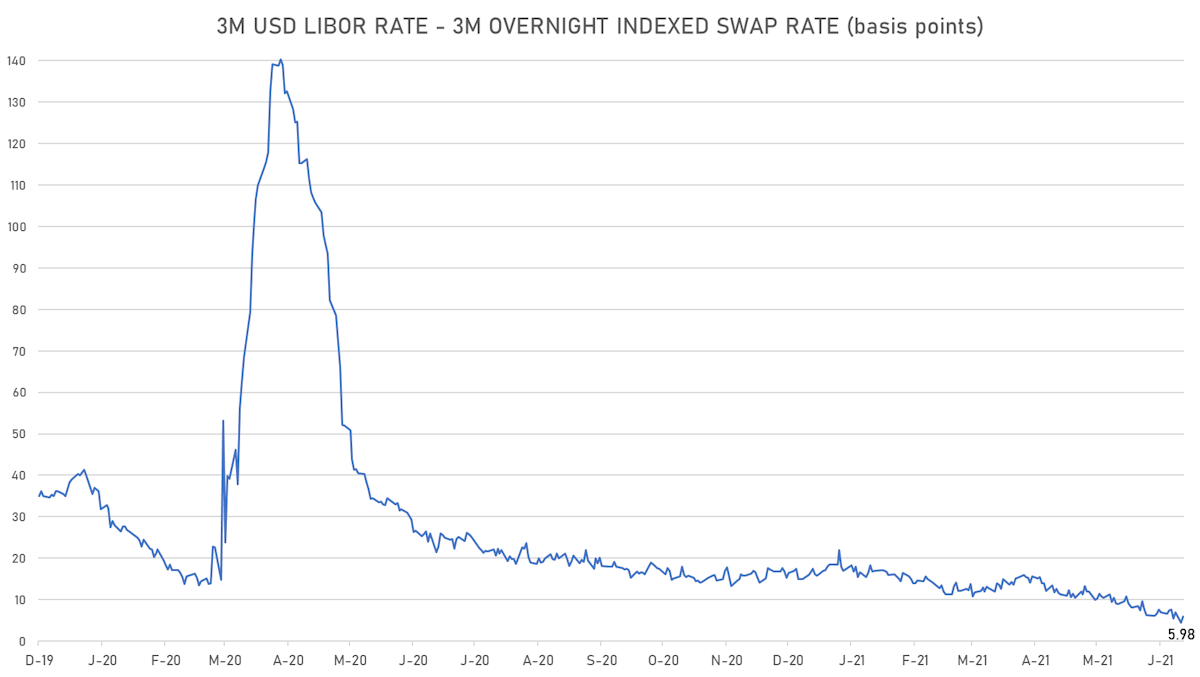

- 3-Month LIBOR-OIS spread up 1.5 bp at 6.0 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

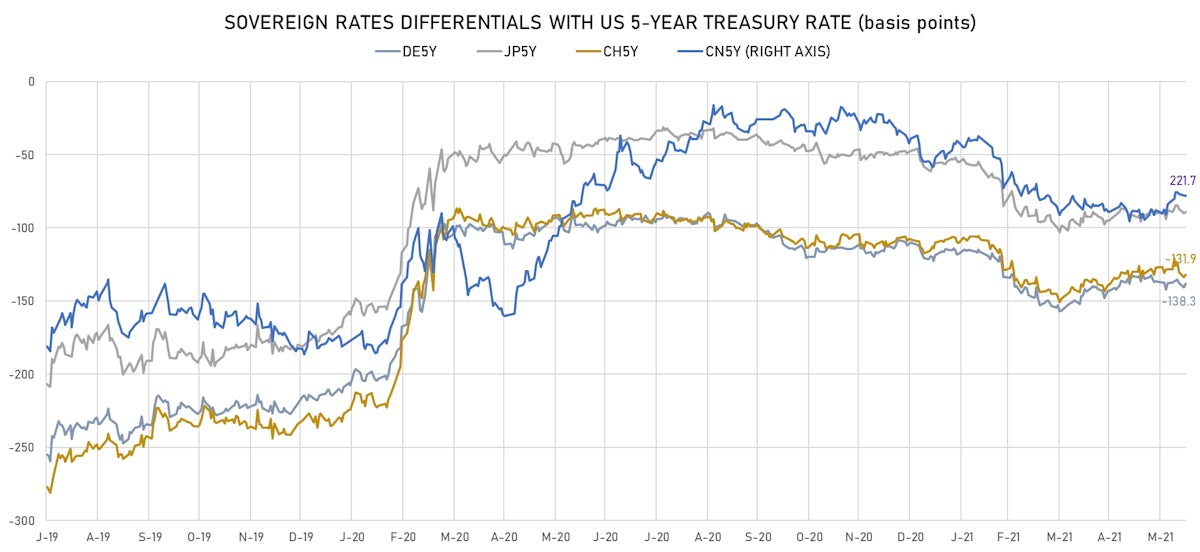

- Germany 5Y: -0.605% (up 1.4 bp); the German 1Y-10Y curve is 3.5 bp steeper at 42.5bp (YTD change: +27.3 bp)

- Japan 5Y: -0.102% (up 0.1 bp); the Japanese 1Y-10Y curve is 0.6 bp steeper at 16.5bp (YTD change: +1.8 bp)

- China 5Y: 2.996% (up 1.4 bp); the Chinese 1Y-10Y curve is 1.9 bp flatter at 69.6bp (YTD change: +23.2 bp)

- Switzerland 5Y: -0.540% (up 1.0 bp); the Swiss 1Y-10Y curve is 3.2 bp flatter at 51.2bp (YTD change: +23.8 bp)