Rates

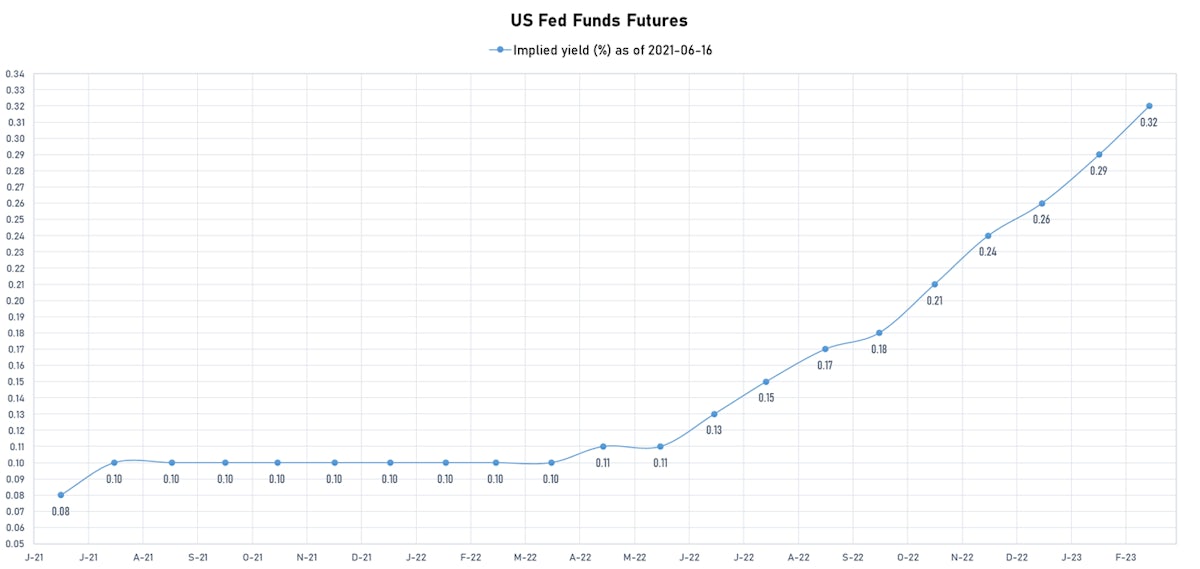

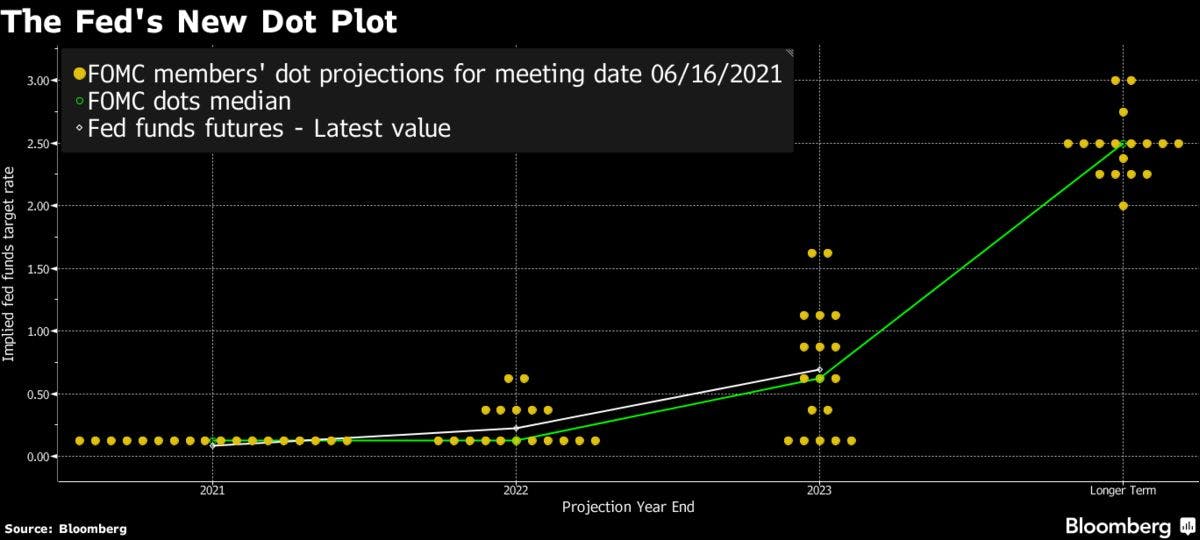

Fed Sees sees Two Rate Hikes Through 2023, Will Keep Purchasing Assets At Same pace For Now

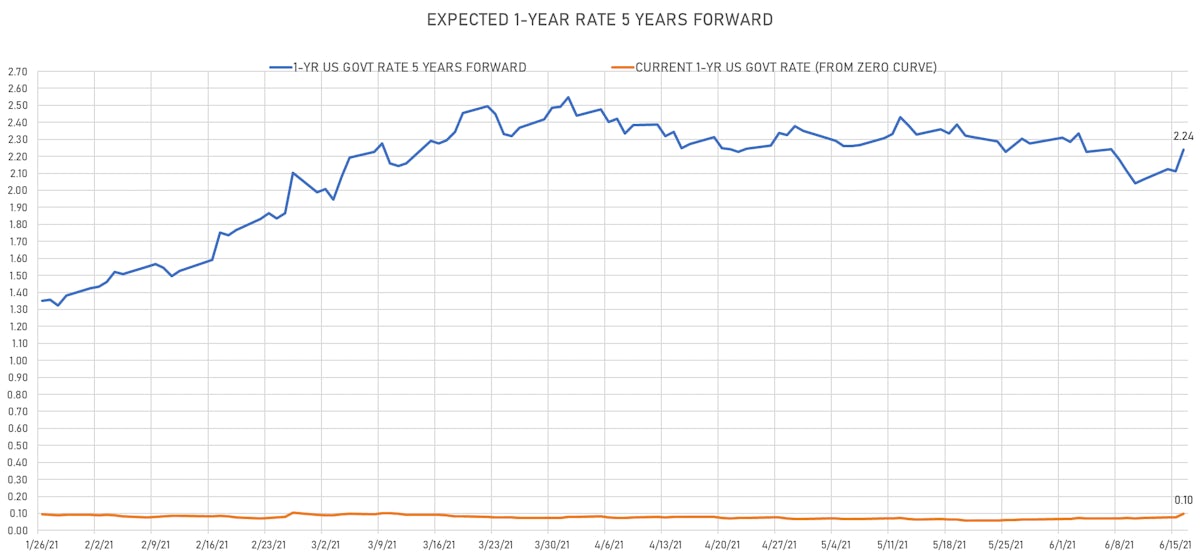

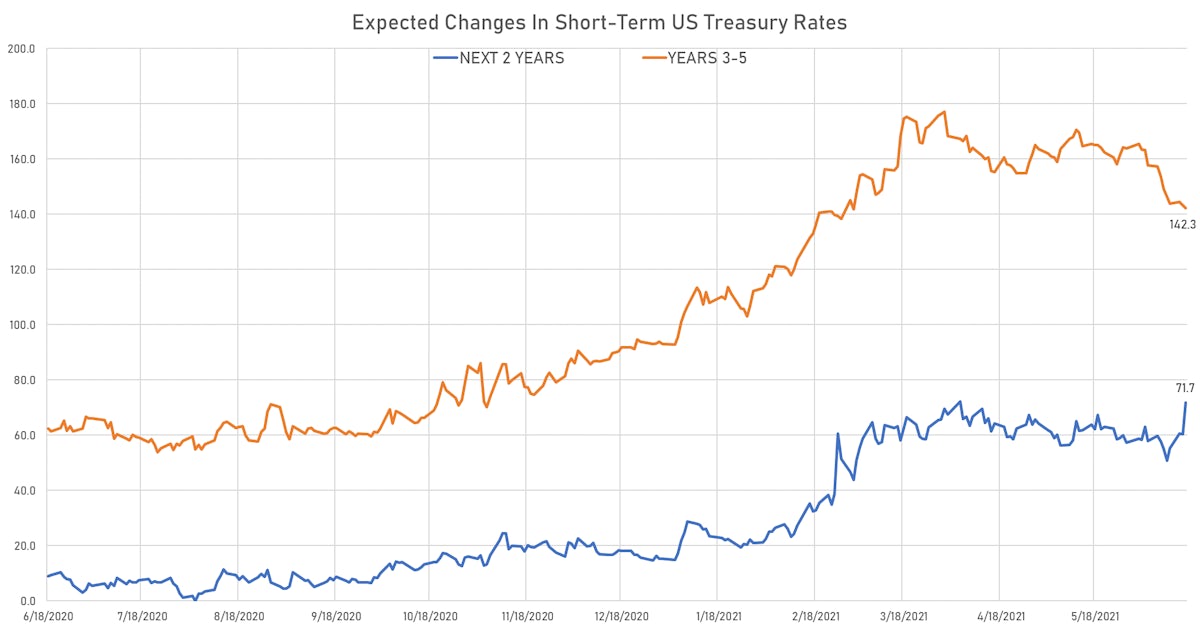

The 1-year US rate is now expected to rise by over 70bp in the next 2 years, with the first rate hike seen by the end of 2022: implied yields on Fed Funds futures for January 2023 are at 29bp

Published ET

Expected 1Y rate change over the next years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

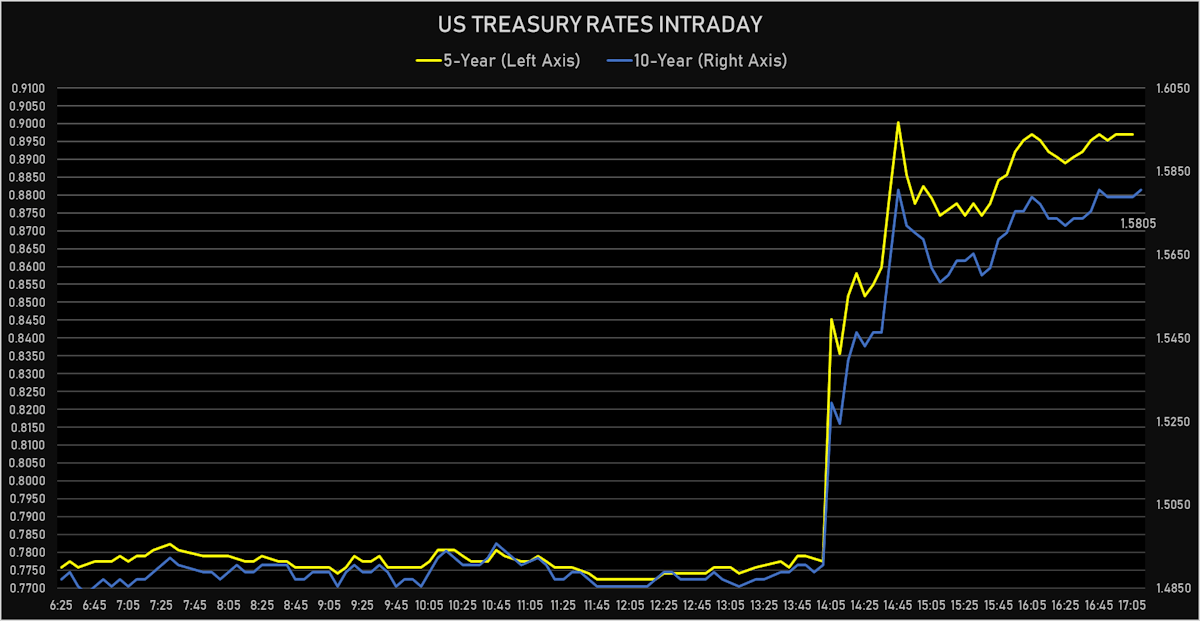

- Yield curve steepening, with the 1Y-10Y spread widening 7.6 bp on the day, now at 152.0 bp (YTD change: +71.5)

- 1Y: 0.0610% (up 1.5 bp)

- 2Y: 0.2072% (up 4.2 bp)

- 5Y: 0.8970% (up 11.8 bp)

- 7Y: 1.2995% (up 11.3 bp)

- 10Y: 1.5805% (up 9.2 bp)

- 30Y: 2.2108% (up 2.6 bp)

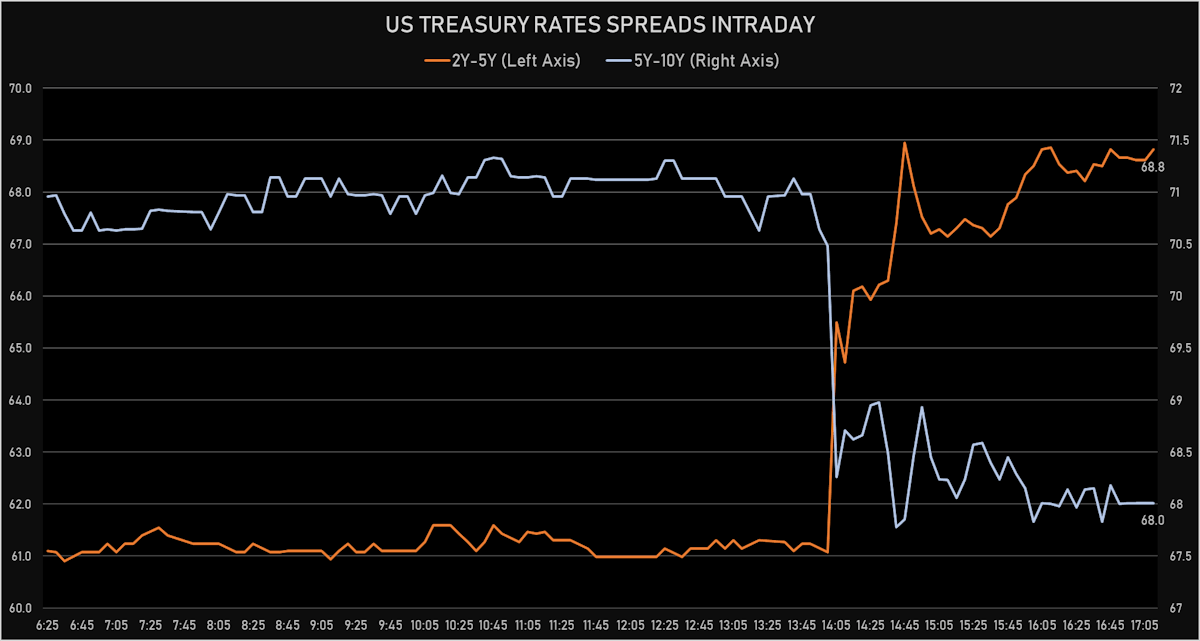

- US treasury curve spreads: 2-5 at 69.0bp (up 7.6bp today), 5-10 at 68.3bp (down -2.8bp today), 10-30 at 63.1bp (down -6.7bp today)

- Treasuries butterfly spreads: 2x5x10 at -1.2bp (down -10.4bp today), 5x10X30 at -5.4bp (down -3.4bp today)

US MACRO RELEASES

- Building Permits for May 2021 (U.S. Census Bureau) at 1.68 Mln, below consensus estimate of 1.73 Mln

- Building Permits, Change P/P for May 2021 (U.S. Census Bureau) at -3.00 %

- Export Prices, All commodities, Change P/P, Price Index for May 2021 (BLS, U.S Dep. Of Lab) at 2.20 %, above consensus estimate of 0.80 %

- Fed Interest On Excess Reserves for 17 Jun (FED, U.S.) increased to 0.15 %

- Housing Starts for May 2021 (U.S. Census Bureau) at 1.57 Mln, below consensus estimate of 1.63 Mln

- Housing Starts, Change P/P for May 2021 (U.S. Census Bureau) at 3.60 %

- Import Prices, All commodities, Change P/P, Price Index for May 2021 (BLS, U.S Dep. Of Lab) at 1.10 %, above consensus estimate of 0.80 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 11 Jun (MBA, USA) at 4.20 %

- Mortgage applications, market composite index for W 11 Jun (MBA, USA) at 672.40

- Mortgage applications, market composite index, purchase for W 11 Jun (MBA, USA) at 266.30

- Mortgage applications, market composite index, refinancing for W 11 Jun (MBA, USA) at 3026.60

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 11 Jun (MBA, USA) at 3.11 %

- Policy Rates, Fed Funds Target Rate for 17 Jun (FOMC, U.S.) at 0.125 %, no change

BLOOMBERG SUMMARY OF THE REVISED DOT PLOT

US FORWARD RATES

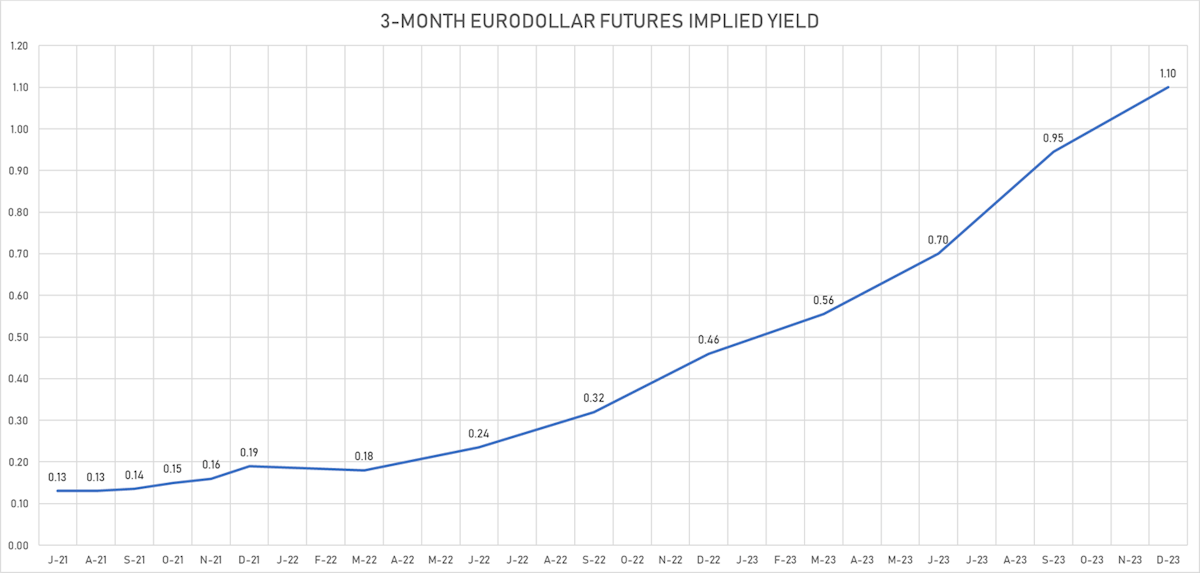

- 3-month USD Libor 5 years forward down 3.0 bp

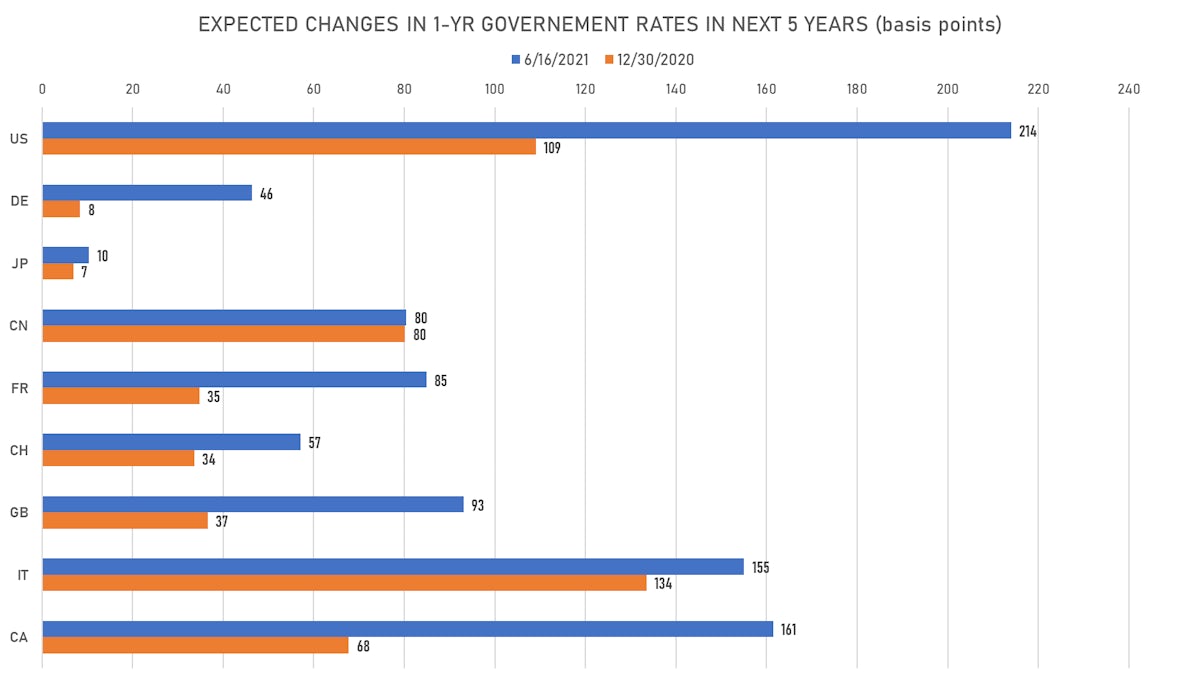

- US Treasury 1-year zero-coupon rate 5 years forward up 12.8 bp, now at 2.2391% (meaning that short-term rates are now expected to increase by 214.0 bp over the next 5 years)

US INFLATION

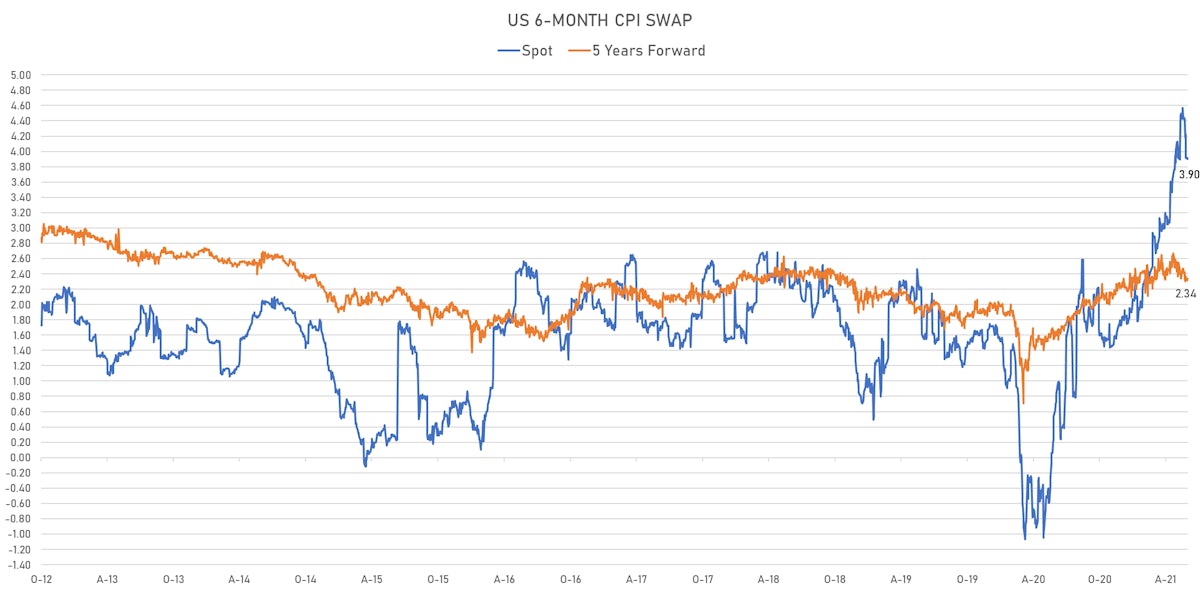

- TIPS 1Y breakeven inflation at 3.13% (down -4.8bp); 2Y at 2.65% (down -11.1bp); 5Y at 2.43% (down -8.0bp); 10Y at 2.30% (down -6.4bp); 30Y at 2.32% (down -5.0bp)

- 6-month spot US CPI swap down -0.2 bp to 3.901%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

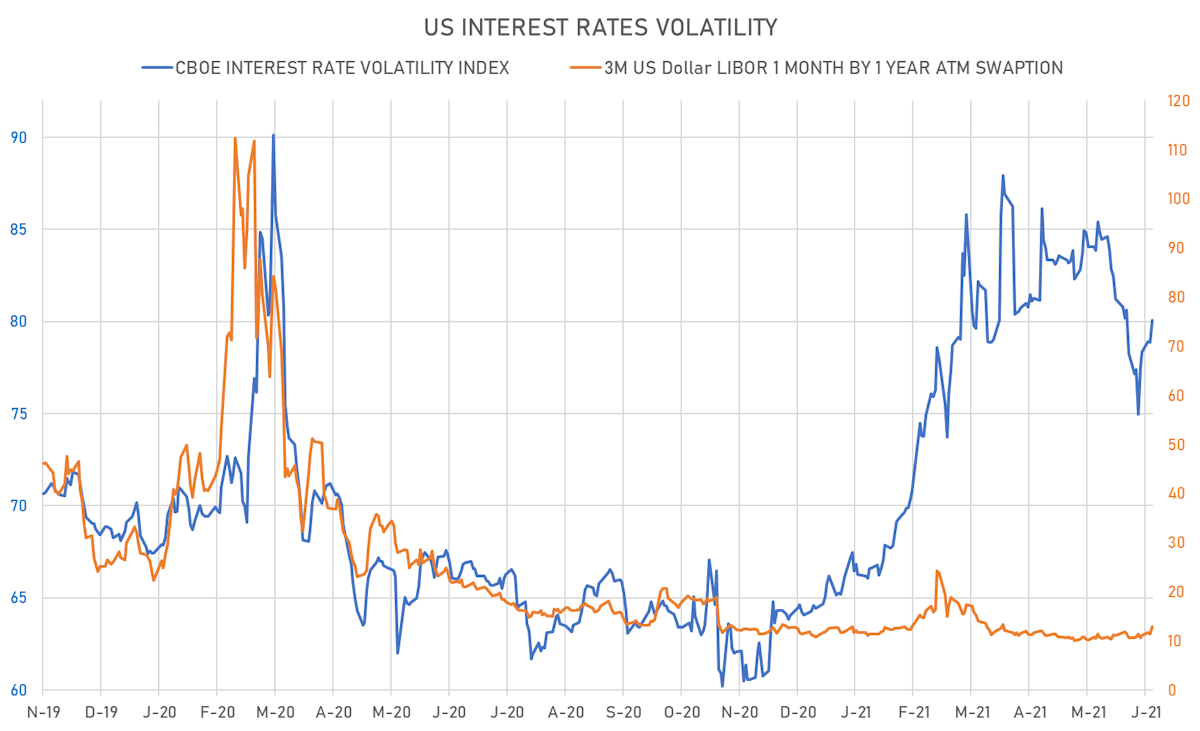

- USD swap rate implied normal volatility (USD 1 Month by 1 Year ATM Swaption) up 1.4% at 12.8%

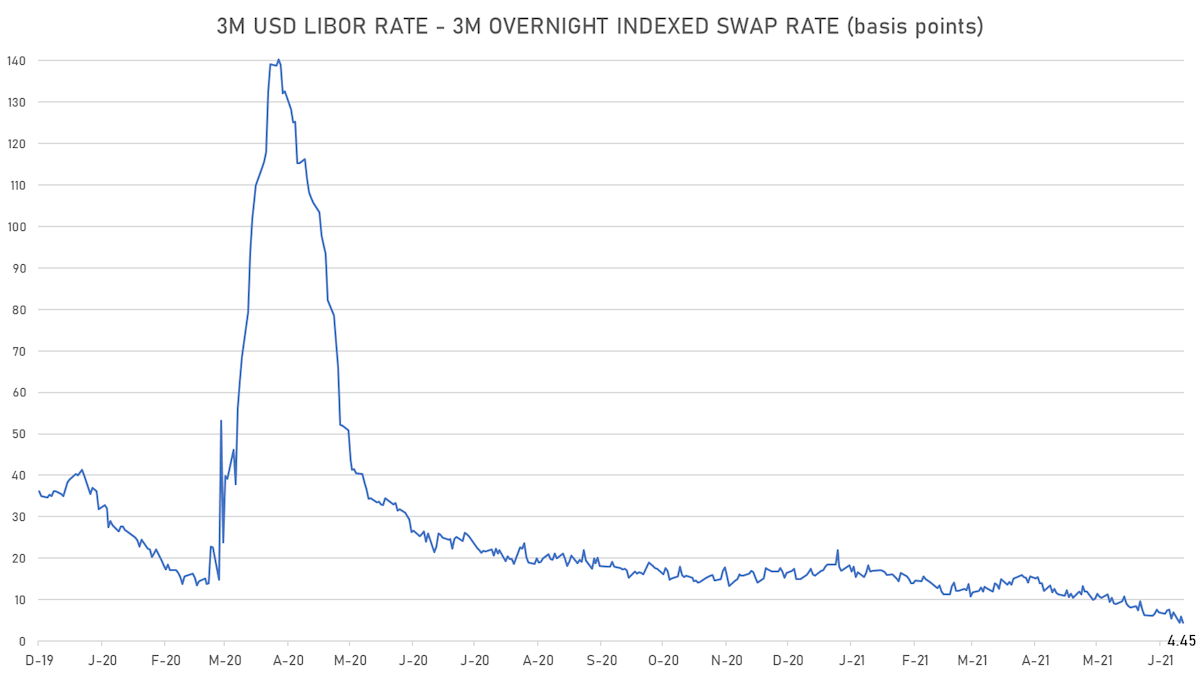

- 3-Month LIBOR-OIS spread down -1.5 bp at 4.5 bp (12-months range: 4.5-26.2 bp)

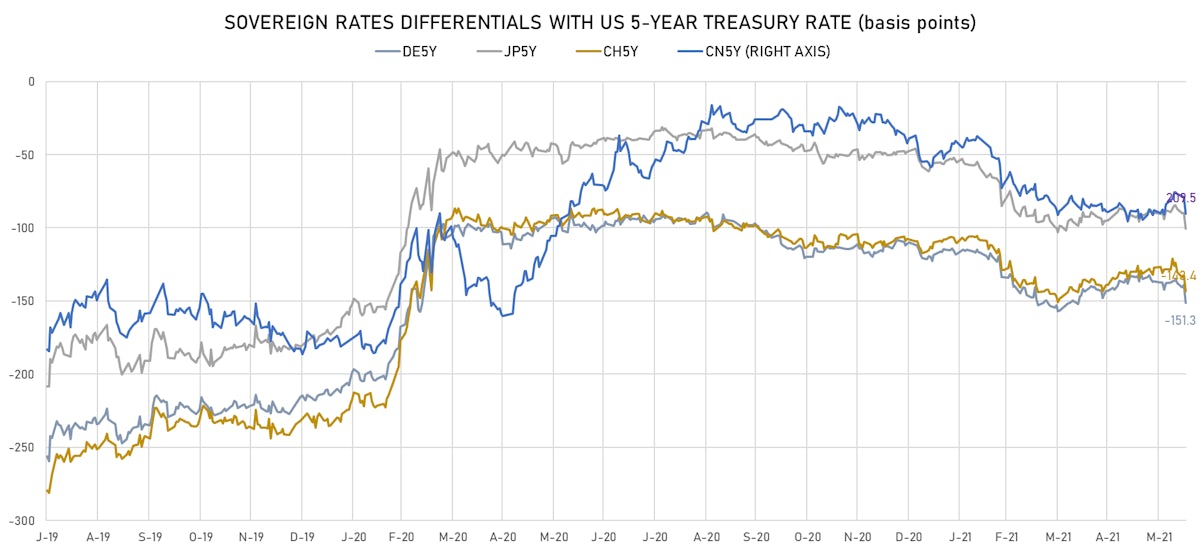

KEY INTERNATIONAL RATES

- Germany 5Y: -0.603% (down -1.2 bp); the German 1Y-10Y curve is 1.0 bp flatter at 41.7bp (YTD change: +26.3 bp)

- Japan 5Y: -0.109% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 16.6bp (YTD change: +2.3 bp)

- China 5Y: 2.992% (down -0.4 bp); the Chinese 1Y-10Y curve is 2.5 bp flatter at 67.1bp (YTD change: +20.7 bp)

- Switzerland 5Y: -0.537% (up 0.3 bp); the Swiss 1Y-10Y curve is 7.4 bp steeper at 58.6bp (YTD change: +31.2 bp)