Rates

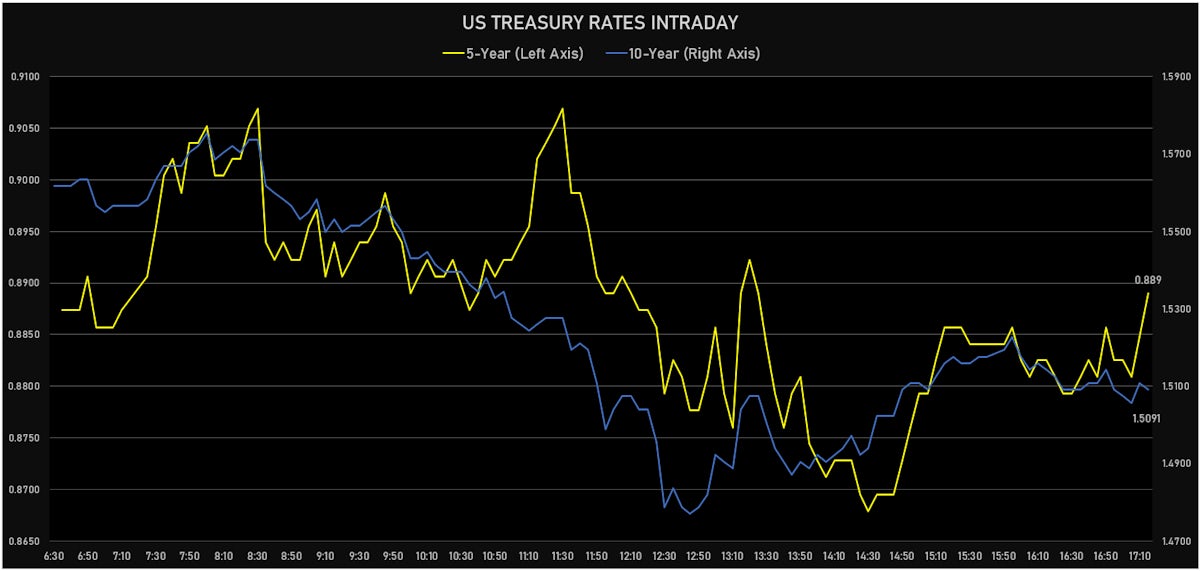

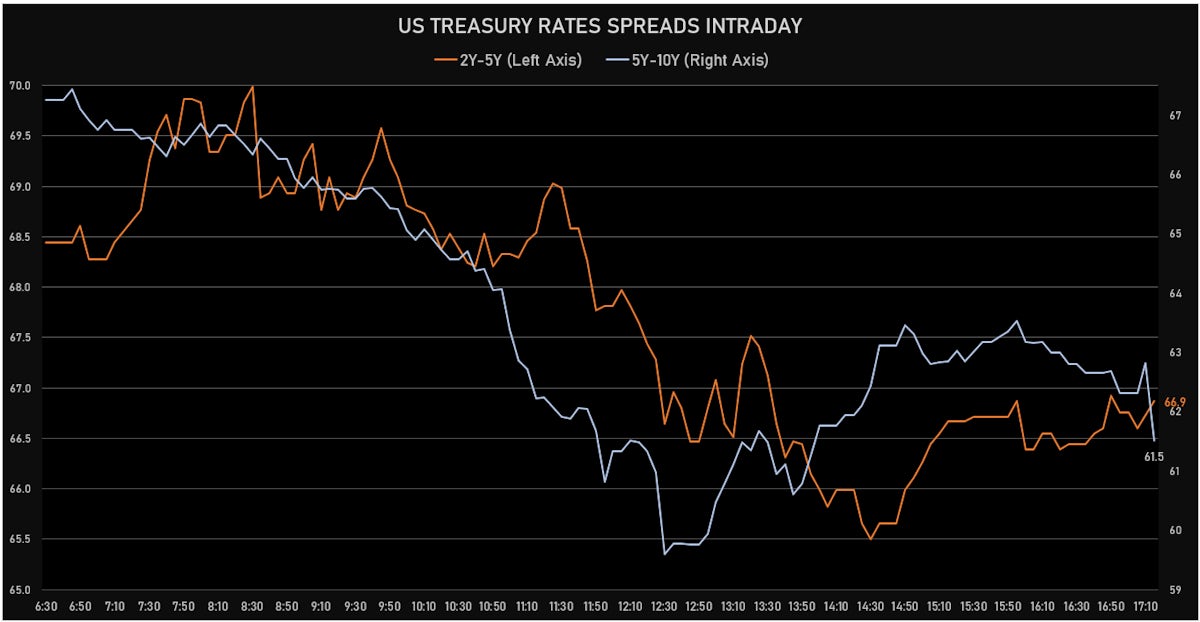

US Curve Shifts Down At The Longer End, With The 5-10 Spread Down 5bp

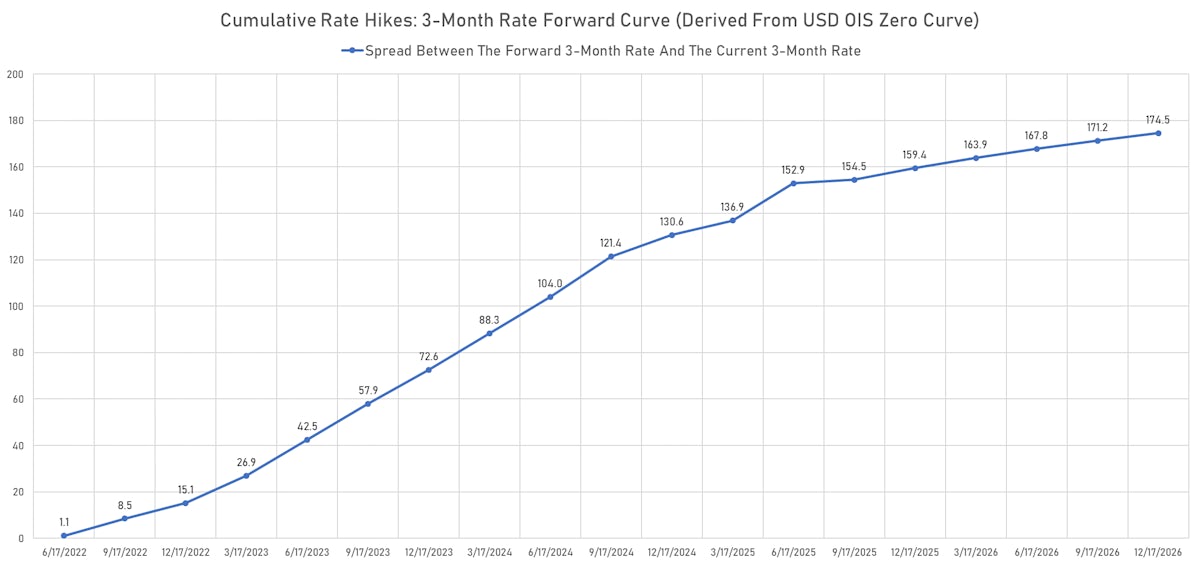

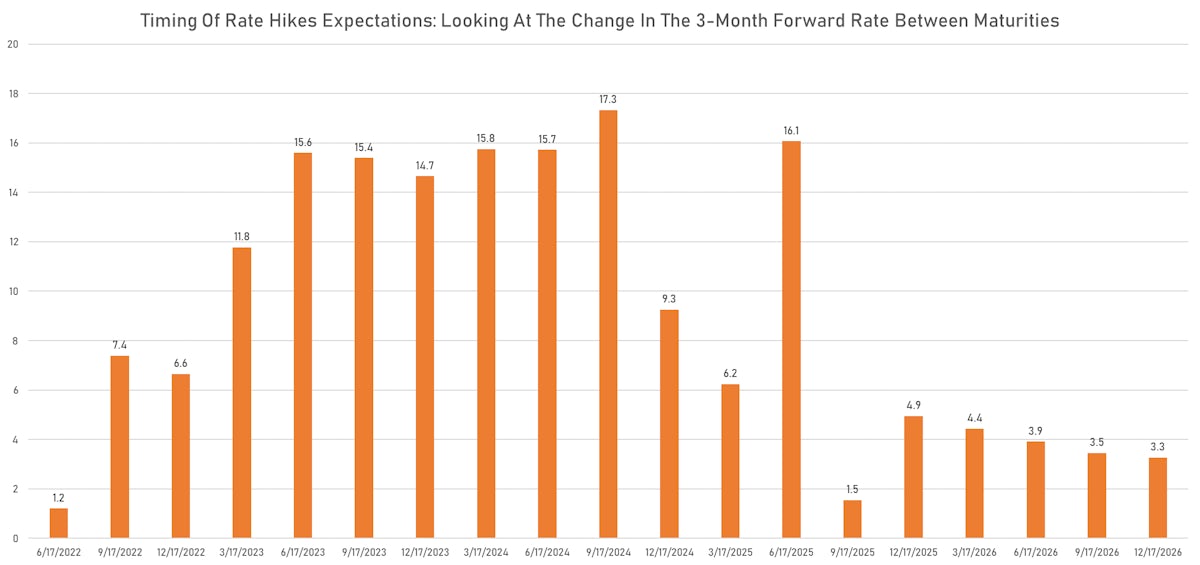

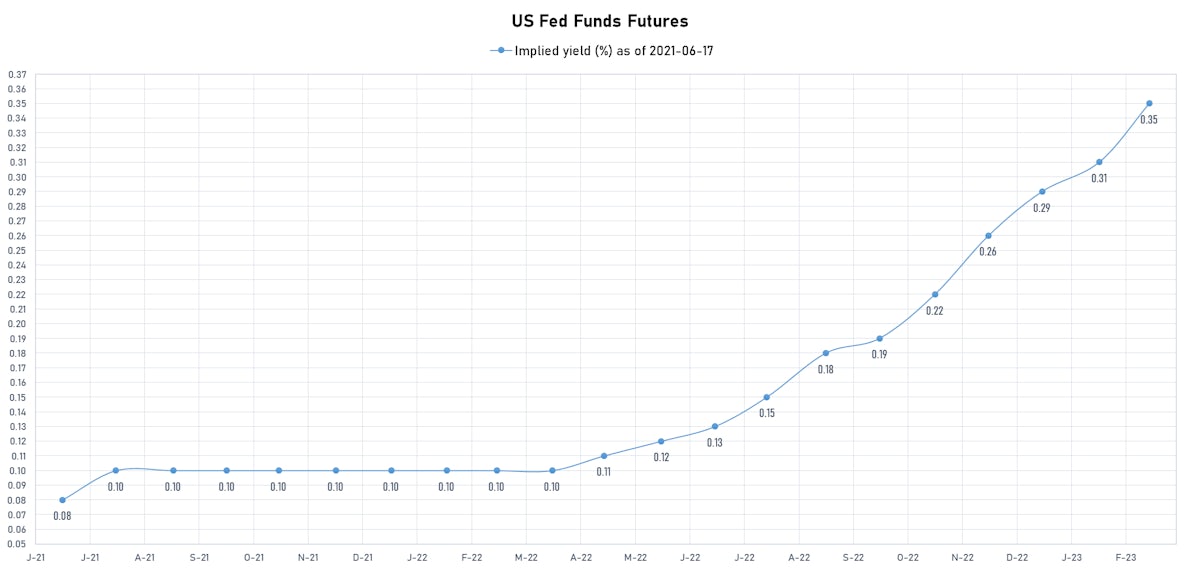

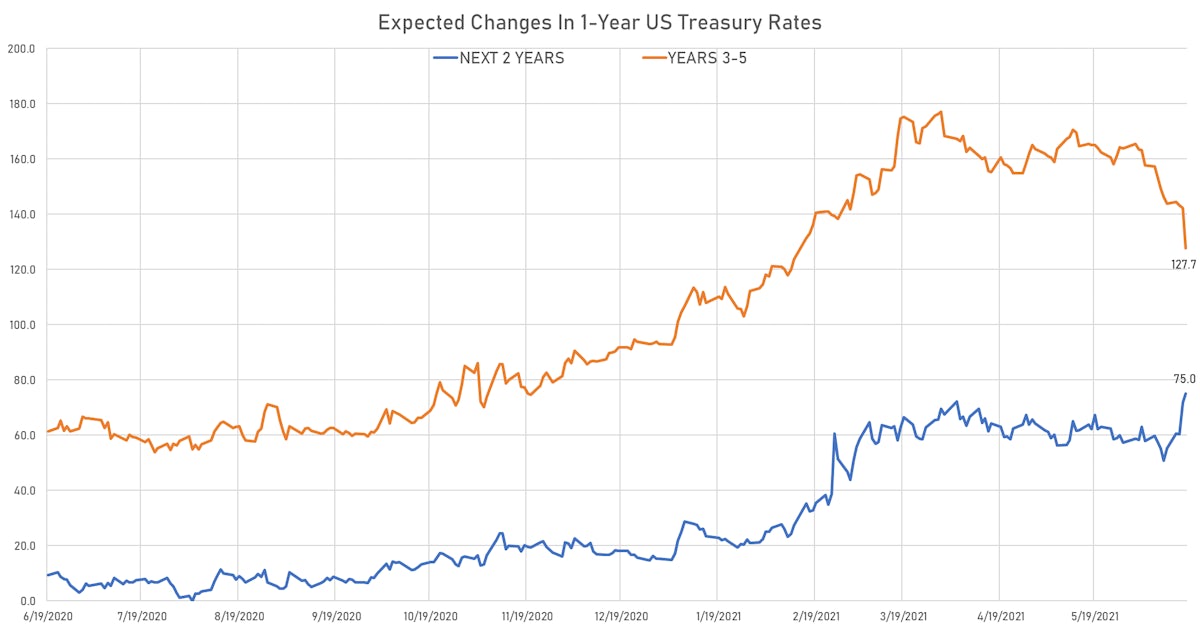

The market is currently pricing in half a rate hike in 2022, evenly split between Q3 and Q4 2022, and 75bp through 2023

Published ET

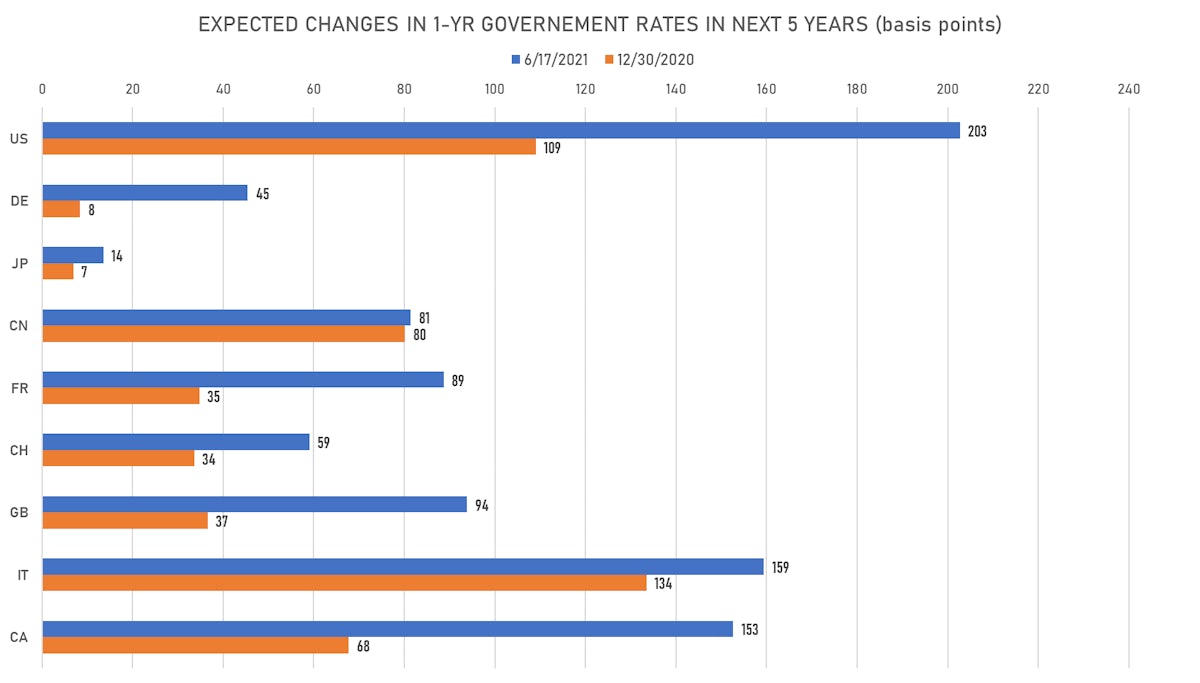

Expected Changes in US 1-Year Rate Over The Next 5 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve flattening, with the 1Y-10Y spread tightening -6.7 bp on the day, now at 142.7 bp (YTD change: +62.2)

- 1Y: 0.0840% (down 0.3 bp)

- 2Y: 0.2133% (up 0.6 bp)

- 5Y: 0.8809% (down 1.6 bp)

- 7Y: 1.2547% (down 4.5 bp)

- 10Y: 1.5108% (down 7.0 bp)

- 30Y: 2.0982% (down 11.3 bp)

- US treasury curve spreads: 2-5 at 66.8bp (down -2.2bp today), 5-10 at 63.0bp (down -5.2bp today), 10-30 at 58.8bp (down -4.2bp today)

- Treasuries butterfly spreads: 2s5s10s at -4.1bp (down -3.0bp today), 5s10s30s at -4.0bp (up 1.4bp today)

- Solid $16 5Y TIPS auction, which drew $45.4 B in bids for a 2.67 cove. Indirects takedown at historic high of 87.3%, while primary dealers took in a record low of 4.7% (down from 13.1% in April)

US MACRO RELEASES

- Jobless Claims, National, Continued for W 05 Jun (U.S. Dept. of Labor) at 3.52 Mln, above consensus estimate of 3.43 Mln

- Jobless Claims, National, Initial for W 12 Jun (U.S. Dept. of Labor) at 412.00 k, above consensus estimate of 359.00 k

- Jobless Claims, National, Initial, four week moving average for W 12 Jun (U.S. Dept. of Labor) at 395.00 k

- Leading Index, Change P/P for May 2021 (The Conference Board) at 1.30 %, in line with consensus estimate

- Philadelphia Fed, Future capital expenditures for Jun 2021 (FED, Philadelphia) at 40.40

- Philadelphia Fed, Future general business activity for Jun 2021 (FED, Philadelphia) at 69.20

- Philadelphia Fed, General business activity for Jun 2021 (FED, Philadelphia) at 30.70 , below consensus estimate of 31.00

- Philadelphia Fed, New orders for Jun 2021 (FED, Philadelphia) at 22.20

- Philadelphia Fed, Number of employees for Jun 2021 (FED, Philadelphia) at 30.70

- Philadelphia Fed, Prices paid for Jun 2021 (FED, Philadelphia) at 80.70

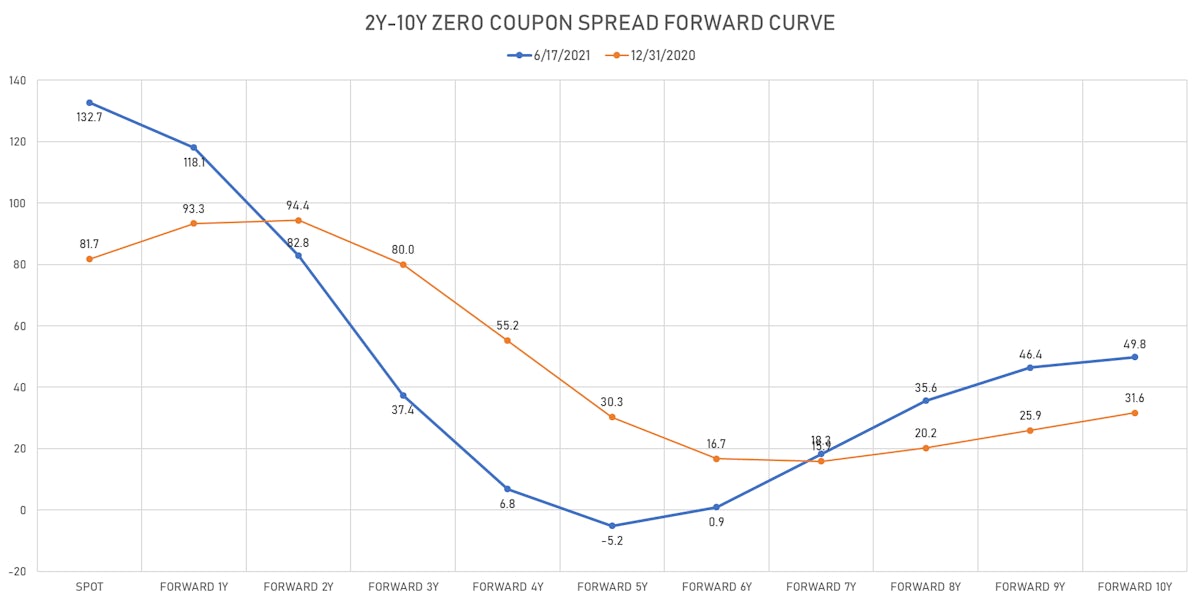

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 11.8 bp, now at 2.1213%

- 1-Year Treasury rates are now expected to increase by 202.7 bp over the next 5 years

- Looking at the USD OIS 3-month forward curve indicates that rate hikes could start as early as Q3 2022, with 75bp (3 hikes) expected through 2023

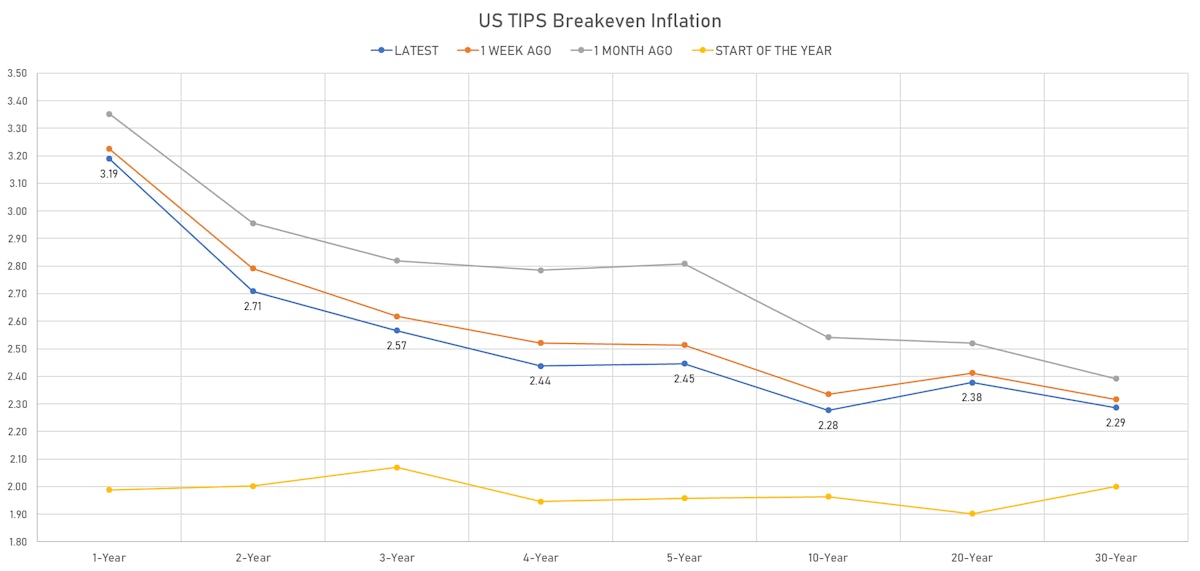

US INFLATION

- TIPS 1Y breakeven inflation at 3.19% (up 6.0bp); 2Y at 2.71% (up 6.4bp); 5Y at 2.45% (up 1.7bp); 10Y at 2.28% (down -2.5bp); 30Y at 2.29% (down -3.1bp)

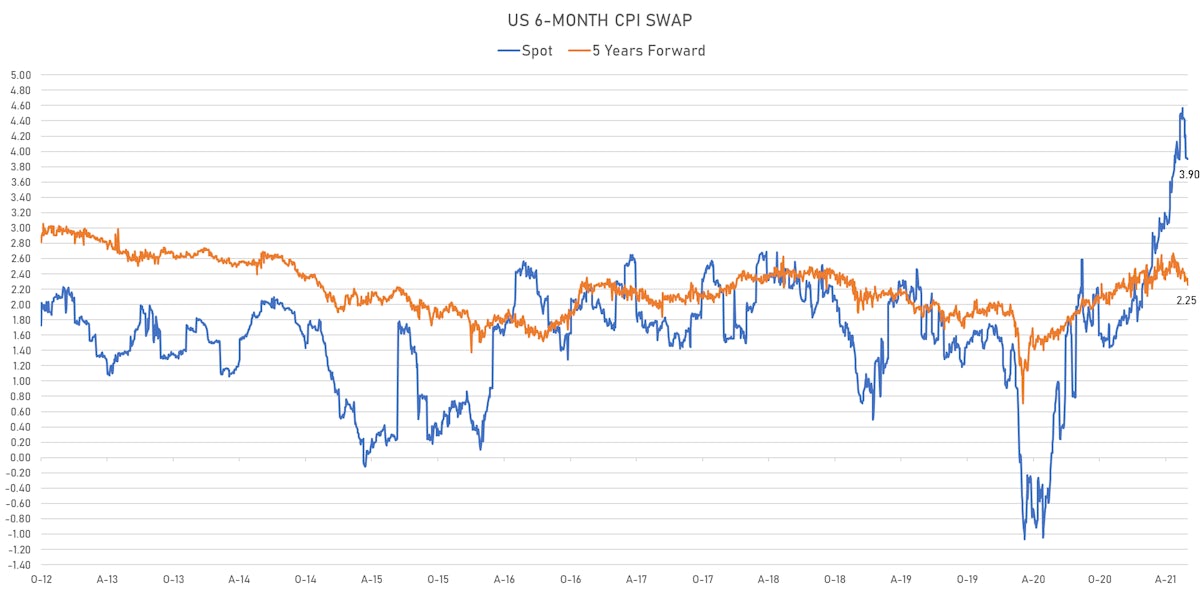

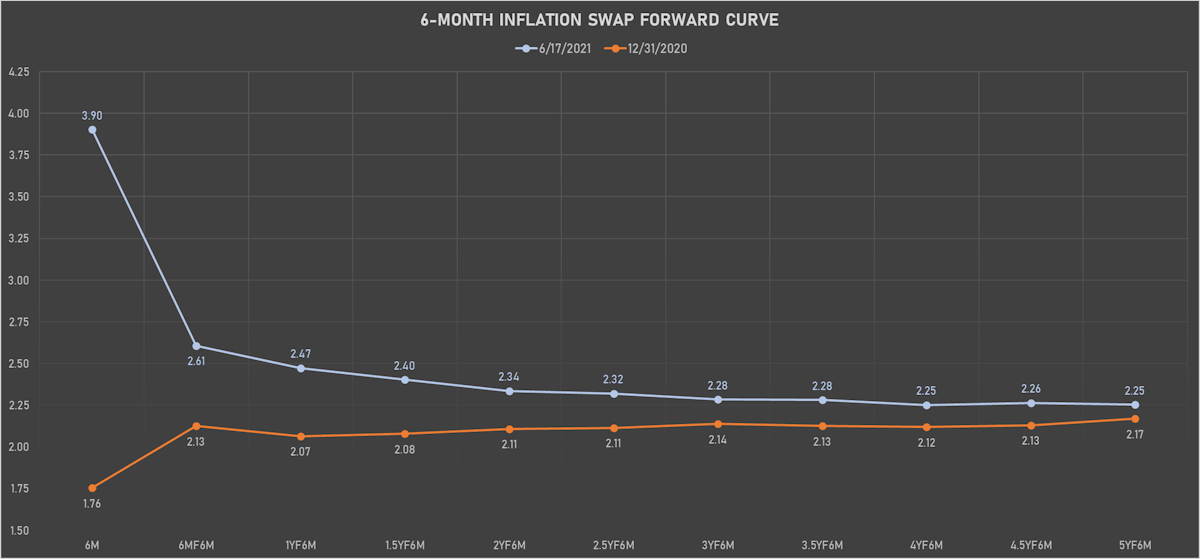

- 6-month spot US CPI swap up 0.1 bp to 3.902%, with a steepening of the forward curve

RATES VOLATILITY & LIQUIDITY

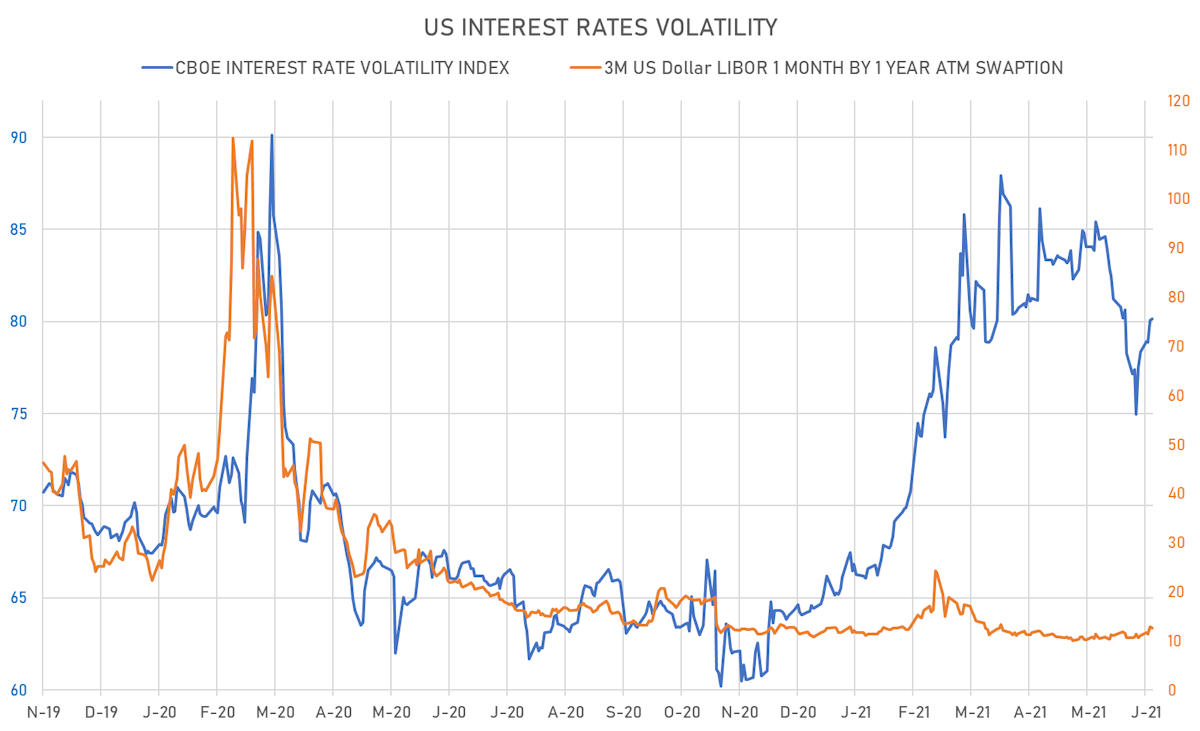

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 12.6%

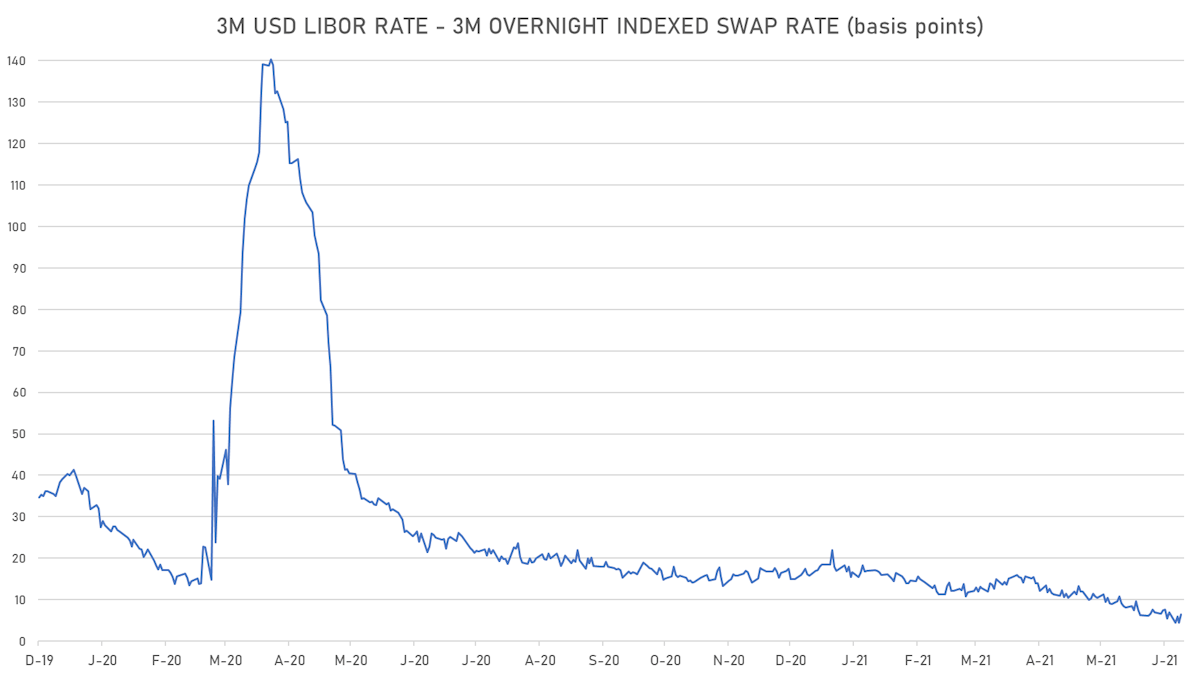

- 3-Month LIBOR-OIS spread up 2.0 bp at 6.5 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.595% (up 2.2 bp); the German 1Y-10Y curve is 5.2 bp steeper at 45.9bp (YTD change: +31.5 bp)

- Japan 5Y: -0.096% (up 1.4 bp); the Japanese 1Y-10Y curve is 1.1 bp steeper at 18.8bp (YTD change: +3.4 bp)

- China 5Y: 3.001% (up 0.9 bp); the Chinese 1Y-10Y curve is 0.7 bp steeper at 67.8bp (YTD change: +21.4 bp)

- Switzerland 5Y: -0.535% (up 0.2 bp); the Swiss 1Y-10Y curve is 1.2 bp steeper at 58.8bp (YTD change: +32.4 bp)