Rates

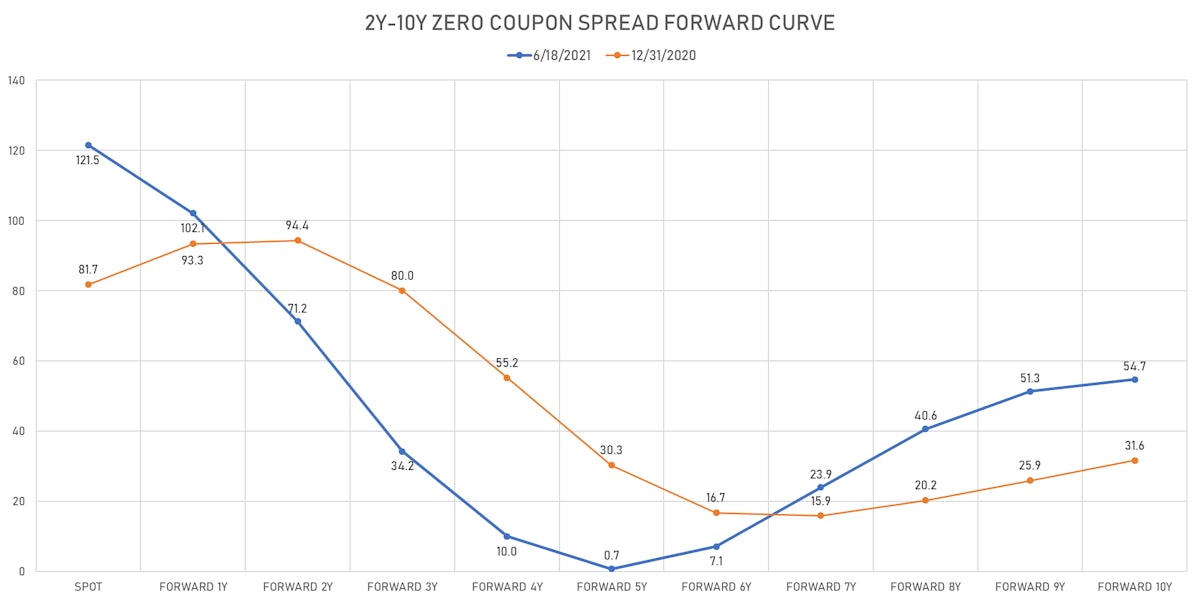

US Rates Curve Flattens Aggressively, Paints A Weak Economic Picture Past 2025

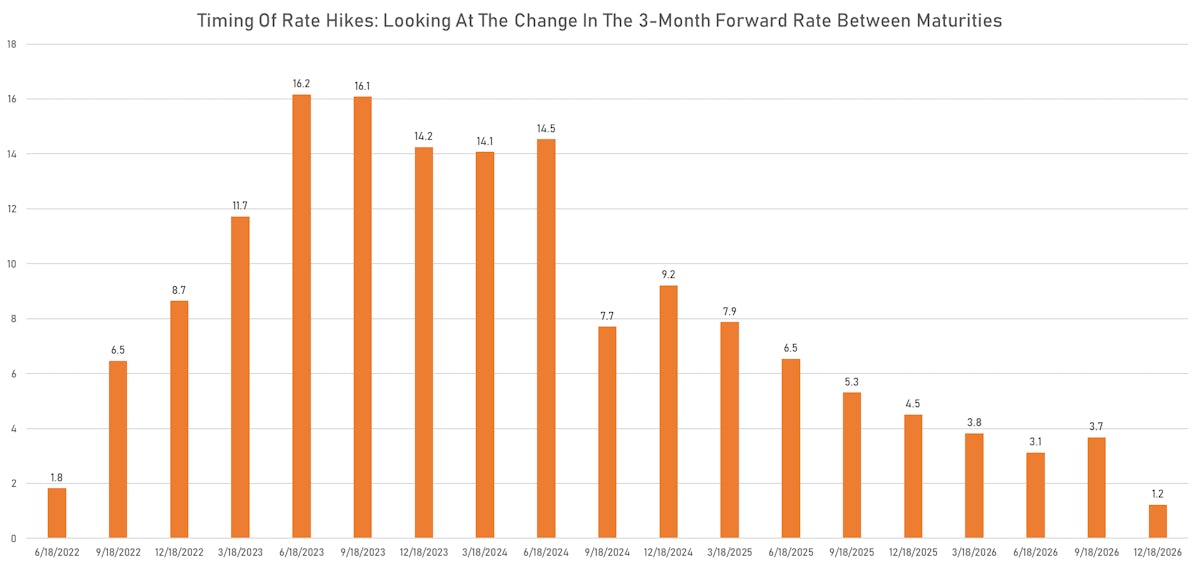

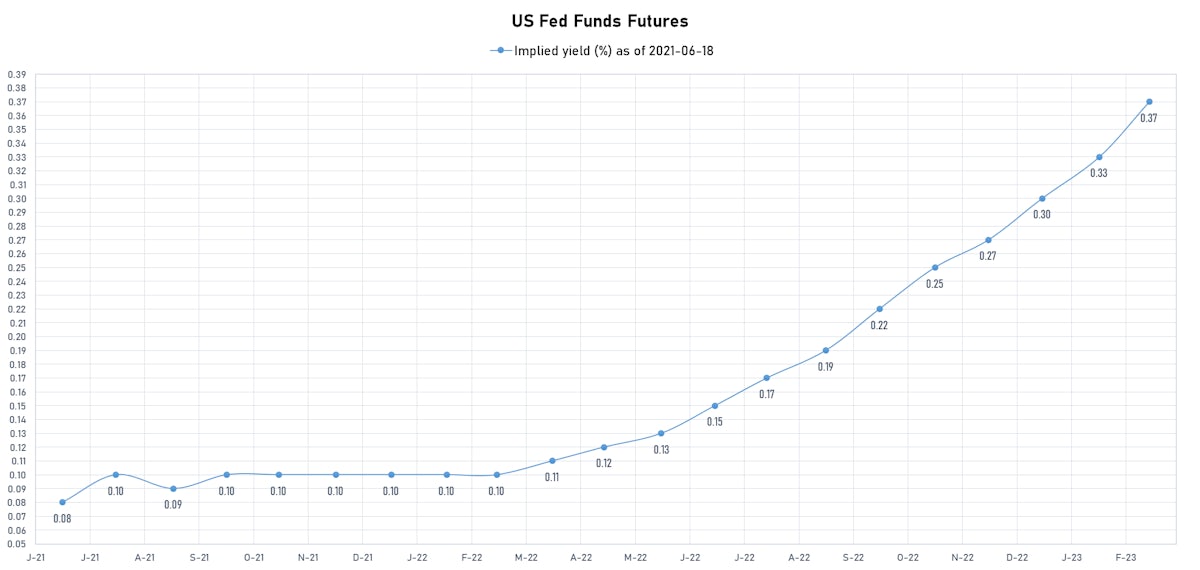

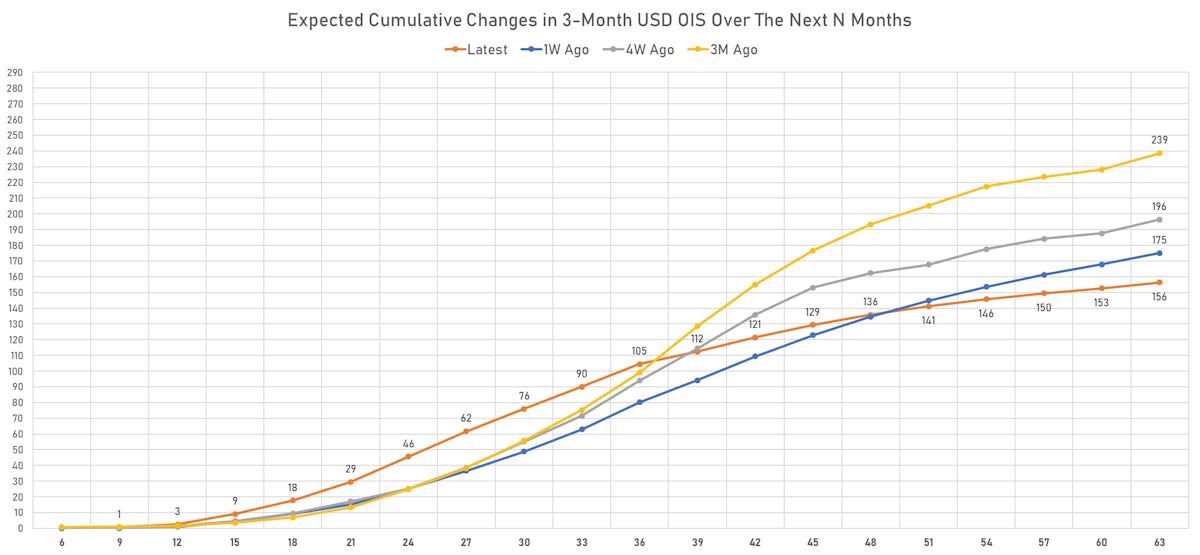

The total amount of rate hikes expectations over the next 3 years hasn't changed much in the last 3 months (at about 100bp), but the timing has been brought forward with more hikes now priced in the 12-month to 30-month window

Published ET

A look at expected rate hikes through the 3-month rate forward curve (derived from the USD OIS Zero Coupon Curve ) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Perhaps the most important under-reported point about what happened this week is this: rate hike expectations over the next 5 years have FALLEN by almost a full rate hike since last Friday. In fact, the curve is now priced as if rate hikes were going to be nearly 90% done after 4 years. Markets now expect 156 bp (6 hikes) over the next 5 years, versus 239bp (almost 10 hikes) 3 months ago.

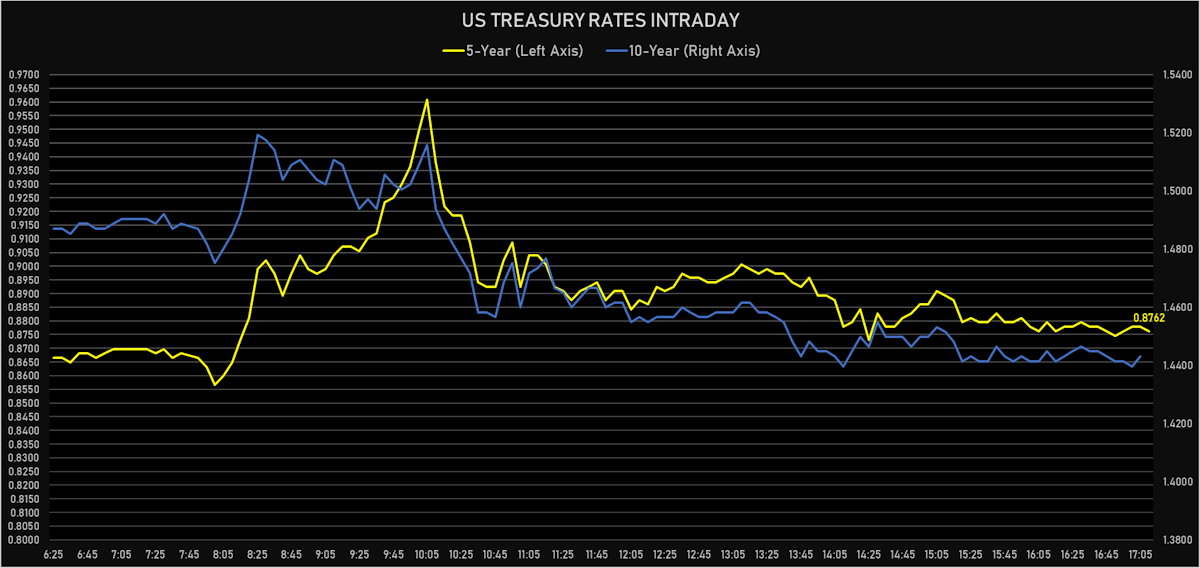

- Yield curve flattening, with the 1Y-10Y spread tightening -8.3 bp on the day, now at 137.2 bp (YTD change: +56.8)

- 1Y: 0.0710% (up 1.5 bp)

- 2Y: 0.2521% (up 3.9 bp)

- 5Y: 0.8762% (down 0.5 bp)

- 7Y: 1.2123% (down 4.2 bp)

- 10Y: 1.4431% (down 6.8 bp)

- 30Y: 2.0167% (down 8.1 bp)

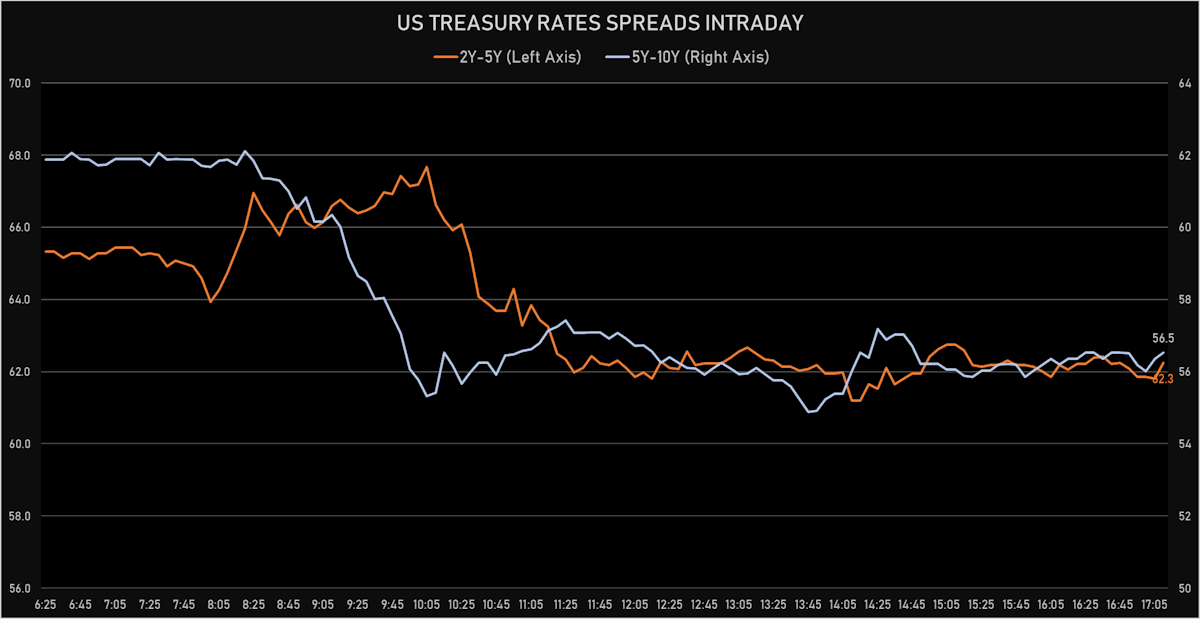

- US treasury curve spreads: 2-5 at 62.4bp (down -4.3bp today), 5-10 at 56.7bp (down -6.3bp today), 10-30 at 57.4bp (down -1.4bp today)

- Treasuries butterfly spreads: 2x5x10 at -6.1bp (down -2.0bp today), 5x10X30 at 0.9bp (up 4.9bp today)

GLOBAL MACRO RELEASES

- Germany, Producer Prices, Total industry, Change P/P, Price Index for May 2021 (Destatis) at 1.50 %, above consensus estimate of 0.70 %

- Germany, Producer Prices, Total industry, Change Y/Y, Price Index for May 2021 (Destatis) at 7.20 %, above consensus estimate of 6.40 %

- Japan, Policy Rates, Bank Of Japan Policy Rate Balance for 18 Jun (Bank of Japan) at -0.10%, in line with consensus estimate

- Poland, Employment, Average paid in enterprise sector, Change Y/Y for May 2021 (CSO, Poland) at 2.70 %

- Poland, Wages and Salaries, Average Monthly, Gross, Nominal, Enterprise sector, total, Change Y/Y, Current Prices for May 2021 (CSO, Poland) at 10.10 %, below consensus estimate of 10.30 %

- Slovakia, Unemployment, Rate, Total, registered for May 2021 (UPSVAR, Slovakia) at 7.90 %, below consensus estimate of 7.93 %

- United Kingdom, Retail Sales, Change, Total including automotive fuel, Change Y/Y for May 2021 (ONS, United Kingdom) at 24.60 %, below consensus estimate of 29.00 %

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change P/P for May 2021 (ONS, United Kingdom) at -2.10%, below consensus estimate of 1.50%

- United Kingdom, Retail Sales, Total RSI excluding automotive fuel, Change Y/Y for May 2021 (ONS, United Kingdom) at 21.70 %, below consensus estimate of 27.30 %

- United Kingdom, Retail Sales, Total including automotive fuel, Change P/P for May 2021 (ONS, United Kingdom) at -1.40 %, below consensus estimate of 1.60 %

US FORWARD RATES

- 3-month USD Libor 5 years forward down 3.0 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 13.3 bp, now at 1.9882%

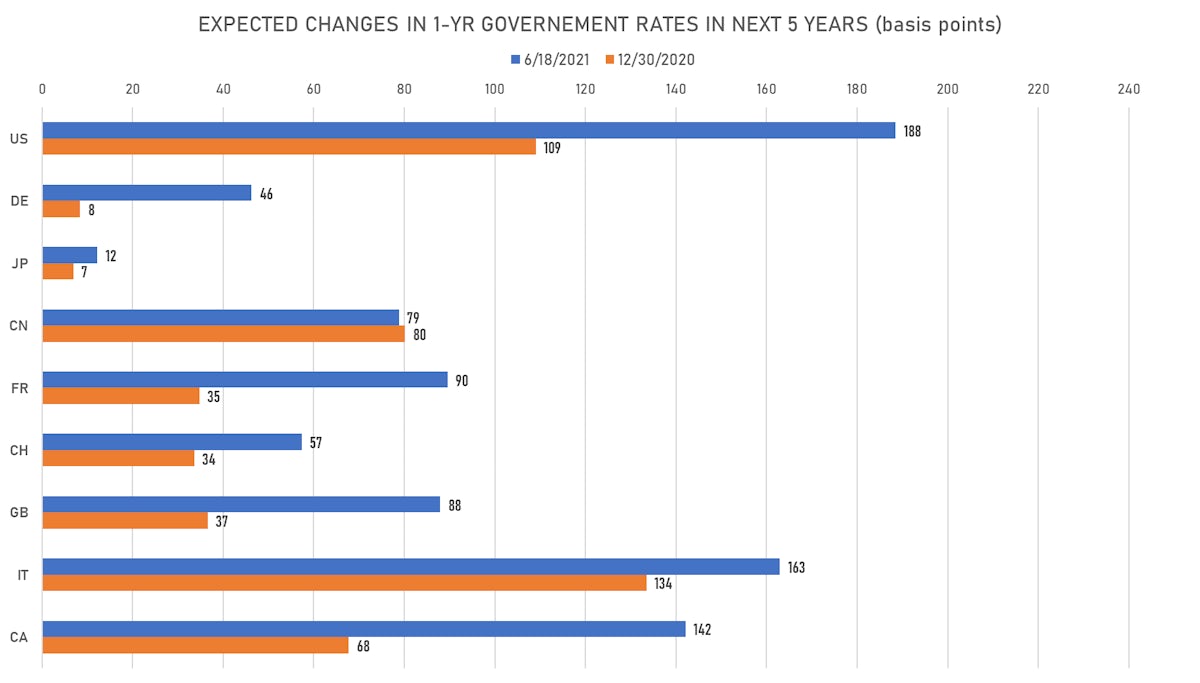

- 1-Year Treasury rates are now expected to increase by 188.5 bp over the next 5 years, a big drop since March

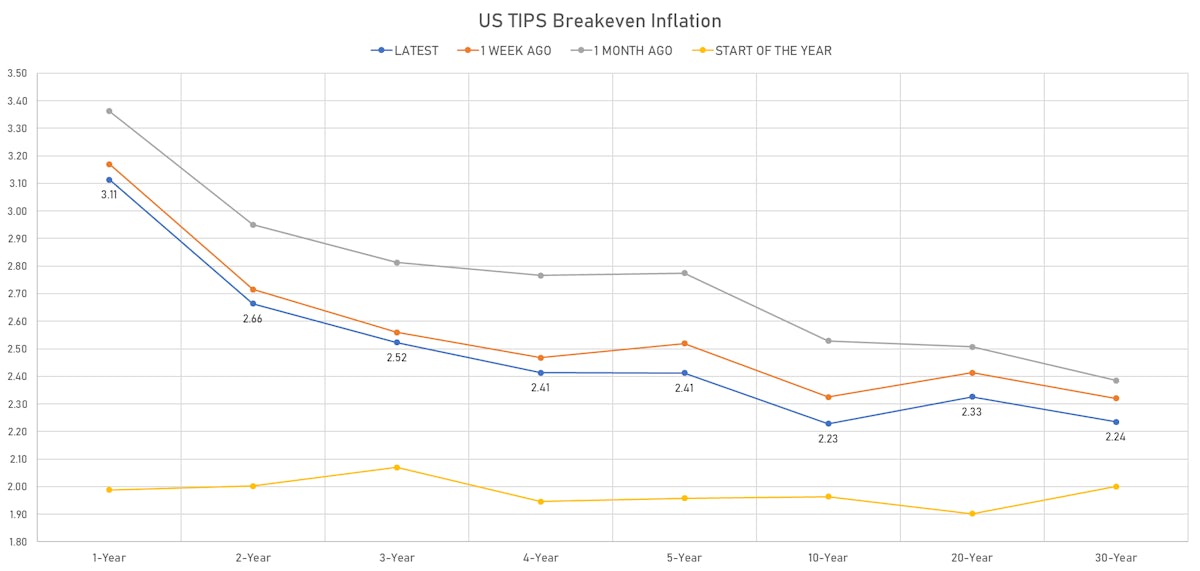

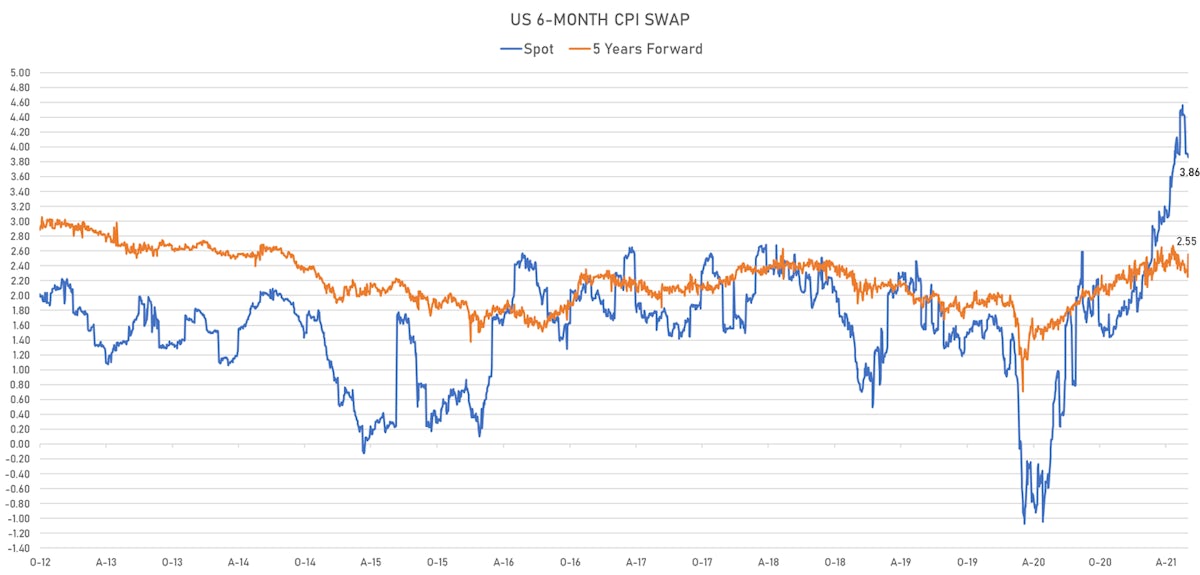

US INFLATION

- TIPS 1Y breakeven inflation at 3.11% (down -7.6bp); 2Y at 2.66% (down -4.5bp); 5Y at 2.41% (down -3.4bp); 10Y at 2.23% (down -4.9bp); 30Y at 2.24% (down -5.1bp)

- 6-month spot US CPI swap down -4.0 bp to 3.862%, with a flattening of the forward curve

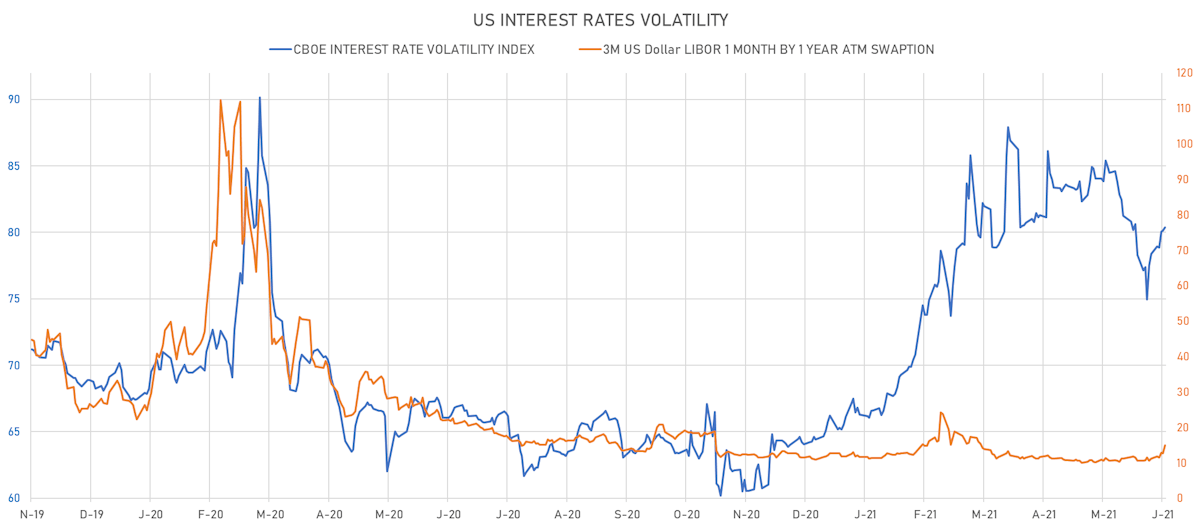

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.3% at 14.9%

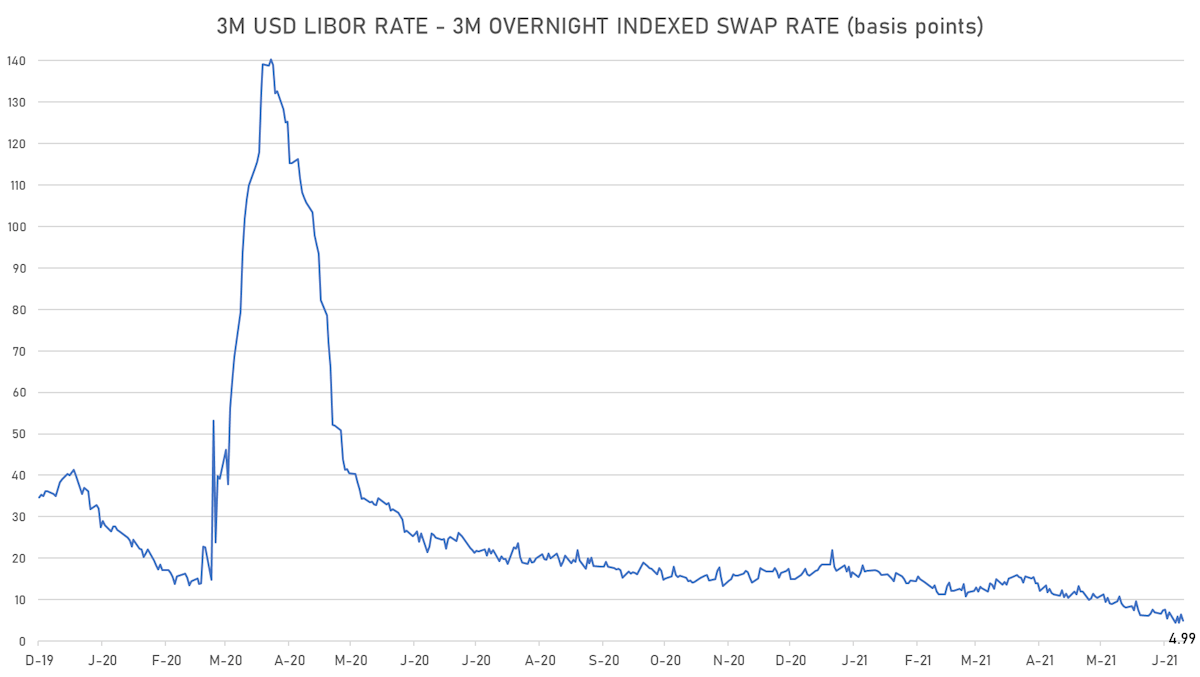

- 3-Month LIBOR-OIS spread down -1.5 bp at 5.0 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

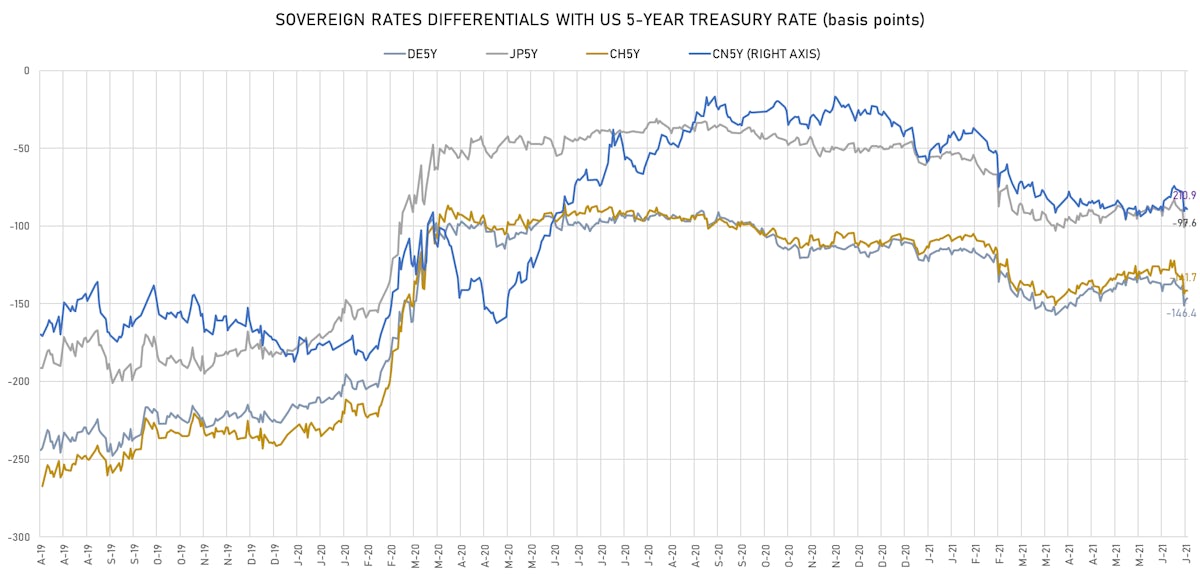

- Germany 5Y: -0.583% (up 0.6 bp); the German 1Y-10Y curve is 2.3 bp flatter at 44.6bp (YTD change: +29.2 bp)

- Japan 5Y: -0.092% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.8 bp flatter at 17.4bp (YTD change: +2.6 bp)

- China 5Y: 2.987% (down -1.6 bp); the Chinese 1Y-10Y curve is 1.8 bp flatter at 66.5bp (YTD change: +19.6 bp)

- Switzerland 5Y: -0.541% (down -0.6 bp); the Swiss 1Y-10Y curve is 0.3 bp flatter at 58.5bp (YTD change: +32.1 bp)