Rates

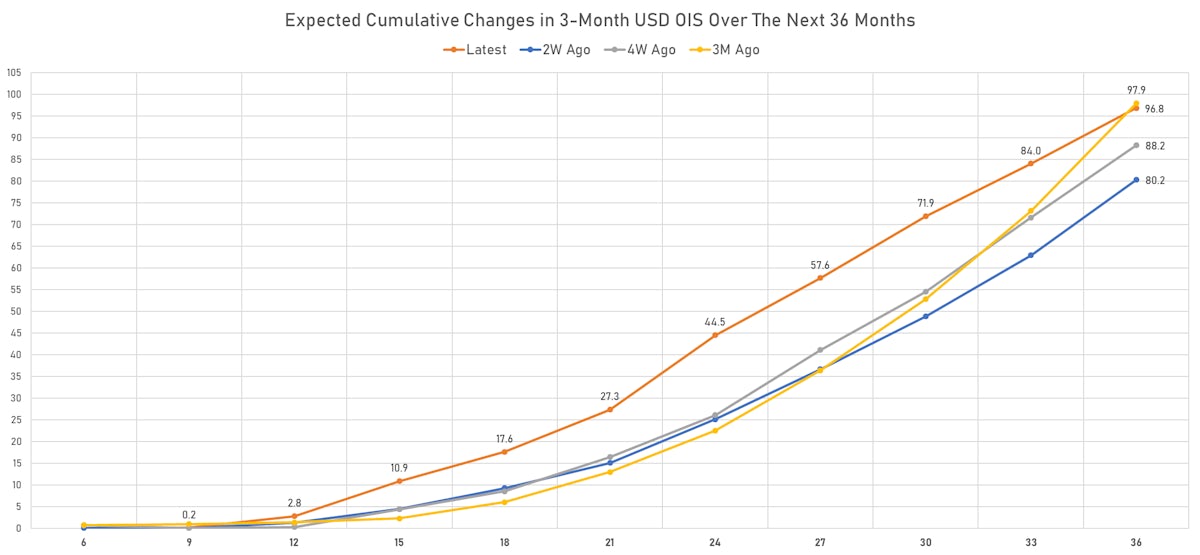

Nominal And Real US Rates Drop, Curve Flattens Slightly

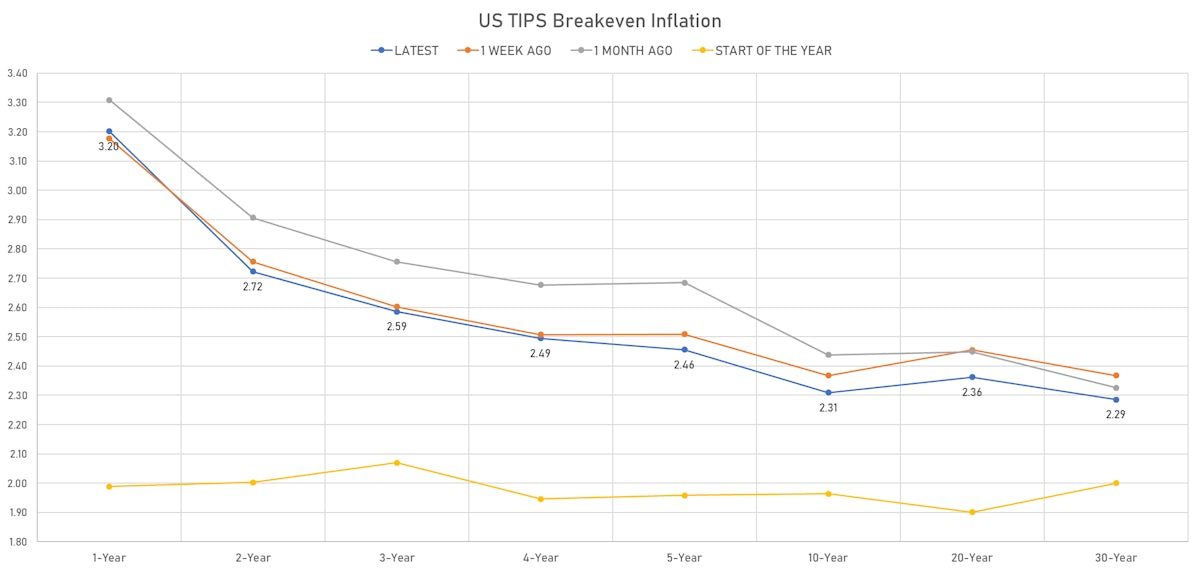

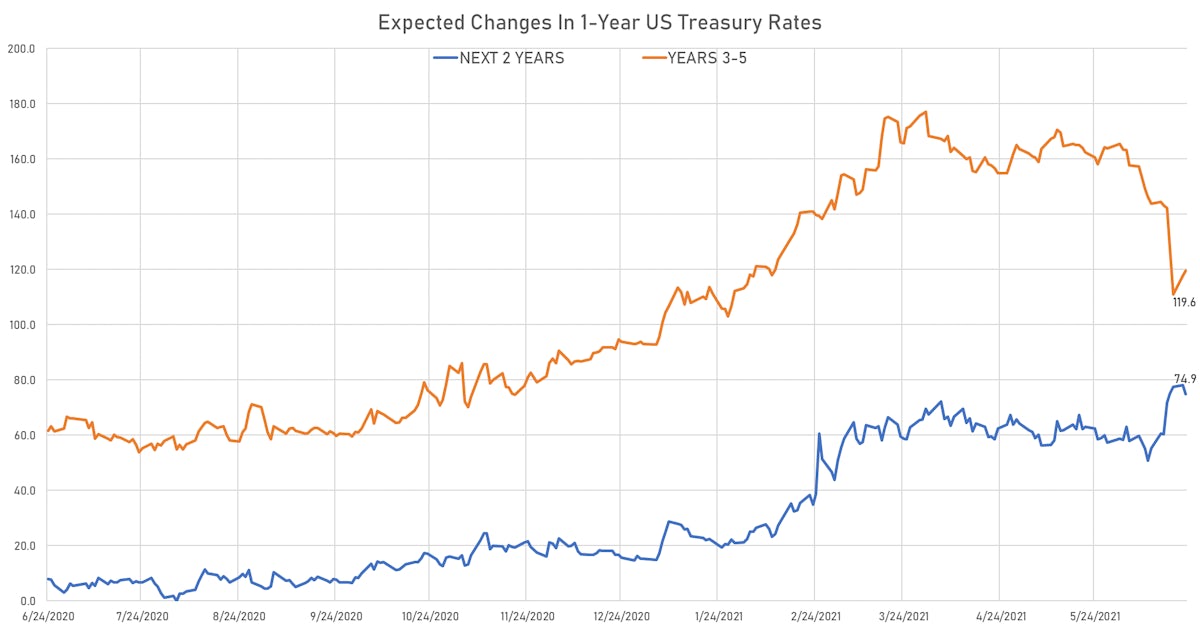

Despite a little steepening this week, the recent monster flattening in the US curve, coupled with pretty stable inflation expectations, are not indicative of markets believing in a lasting economic boom

Published ET

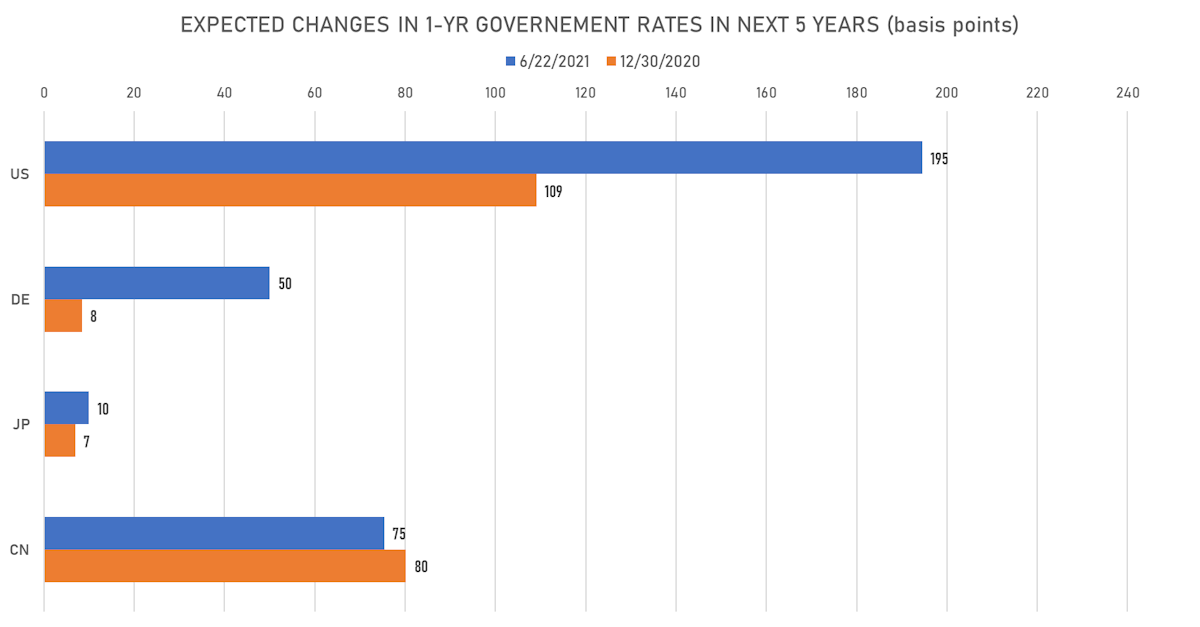

Changes in the 1-Year Zero Rate over the next 5 years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

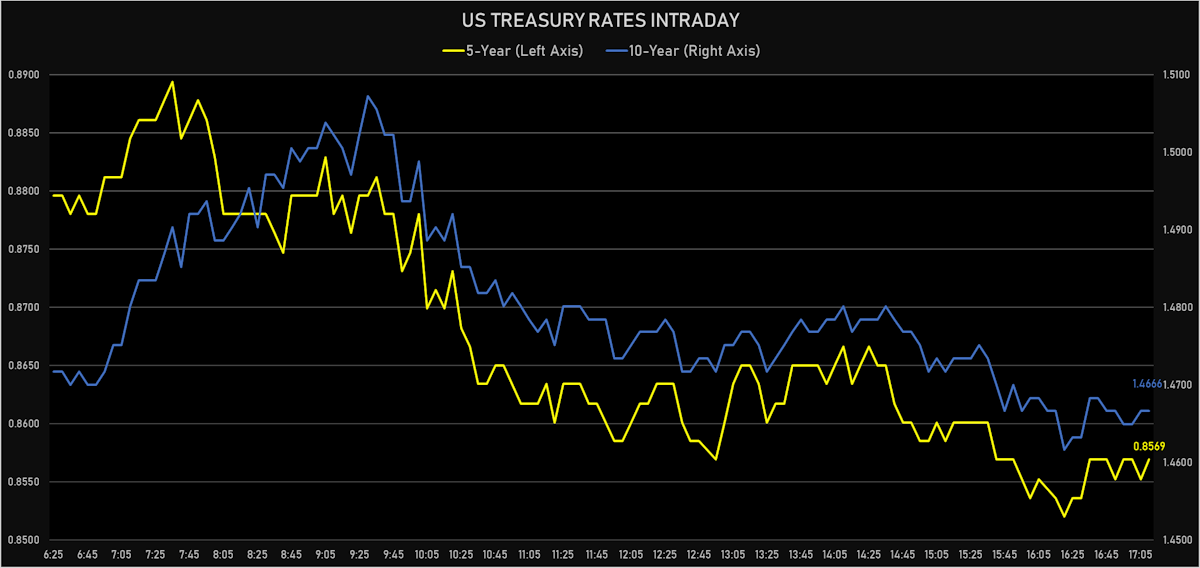

- Yield curve flattening, with the 1s10s Treasury spread tightening -2.5 bp on the day, now at 137.8 bp (YTD change: +57.3)

- 1Y: 0.0890% (down 0.5 bp)

- 2Y: 0.2301% (down 2.6 bp)

- 5Y: 0.8569% (down 3.1 bp)

- 7Y: 1.2170% (down 2.6 bp)

- 10Y: 1.4666% (down 3.1 bp)

- 30Y: 2.0906% (down 2.9 bp)

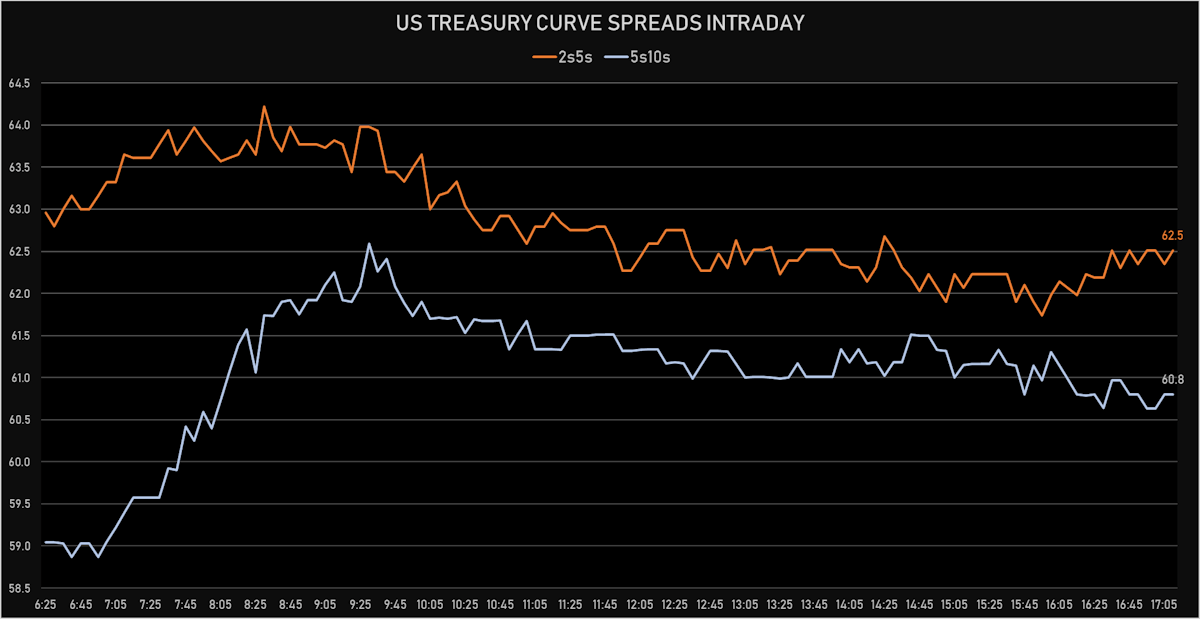

- US treasury curve spreads: 2s5s at 62.7bp (down -0.5bp today), 5s10s at 61.0bp (up 0.2bp today), 10s30s at 62.4bp (up 0.1bp today)

- Treasuries butterfly spreads: 2s5s10s at -2.1bp (up 0.7bp today), 5s10s30s at 1.4bp (unchanged)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 19 Jun (Redbook Research) at 17.60 %

- Existing-Home Sales, Single-Family and Condos, total for May 2021 (NAR, United States) at 5.80 Mln, above consensus estimate of 5.72 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for May 2021 (NAR, United States) at -0.90 %

- Richmond Fed Manufacturing, Manufacturing Index for Jun 2021 (FED, Richmond) at 22.00, above consensus estimate of 17.0

- Richmond Fed Manufacturing, Shipments, current conditions for Jun 2021 (FED, Richmond) at 8.00

- Richmond Fed Services, Revenues for Jun 2021 (FED, Richmond) at 25.00

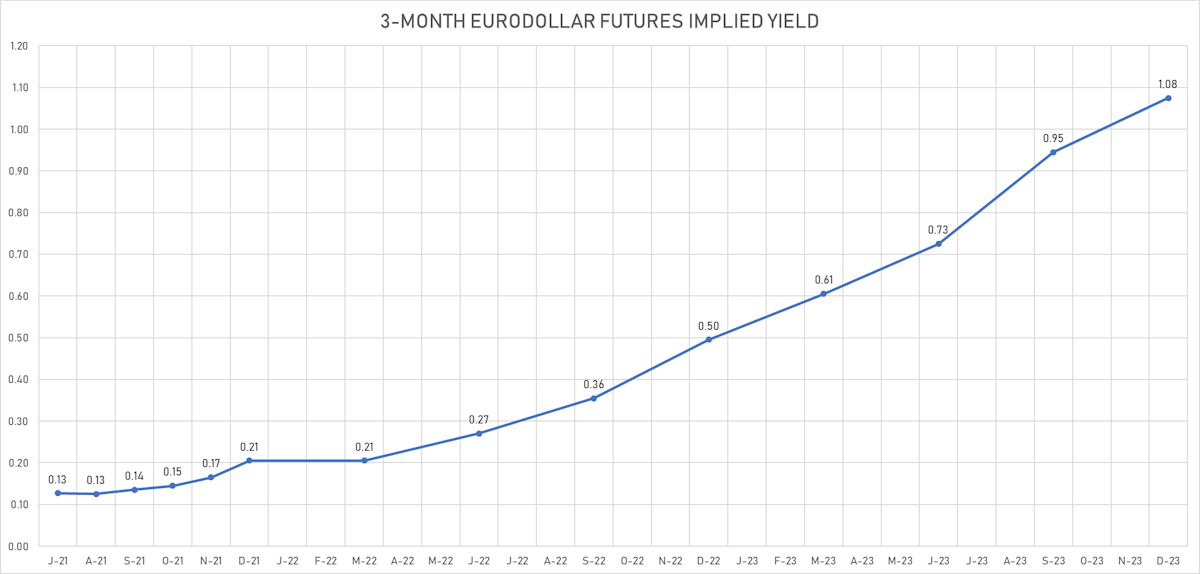

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 2.1 bp, now at 2.0398%

- 1-Year Treasury rates are now expected to increase by 194.6 bp over the next 5 years

US INFLATION

- TIPS 1Y breakeven inflation at 3.20% (up 3.6bp); 2Y at 2.72% (up 3.0bp); 5Y at 2.46% (up 4.3bp); 10Y at 2.31% (up 4.2bp); 30Y at 2.29% (up 2.2bp)

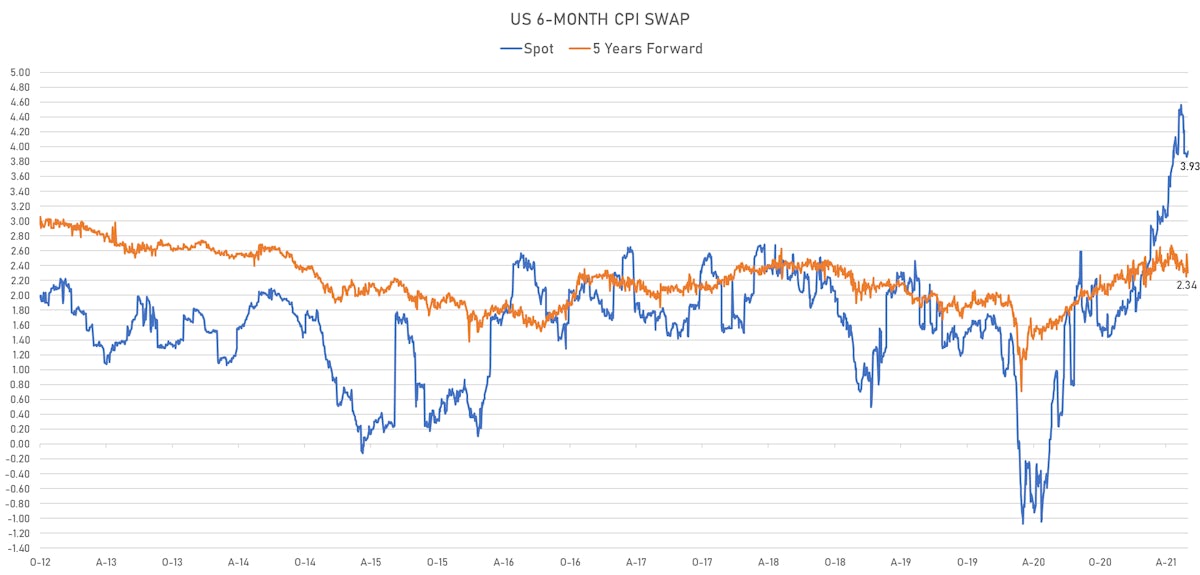

- 6-month spot US CPI swap up 1.6 bp to 3.934%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

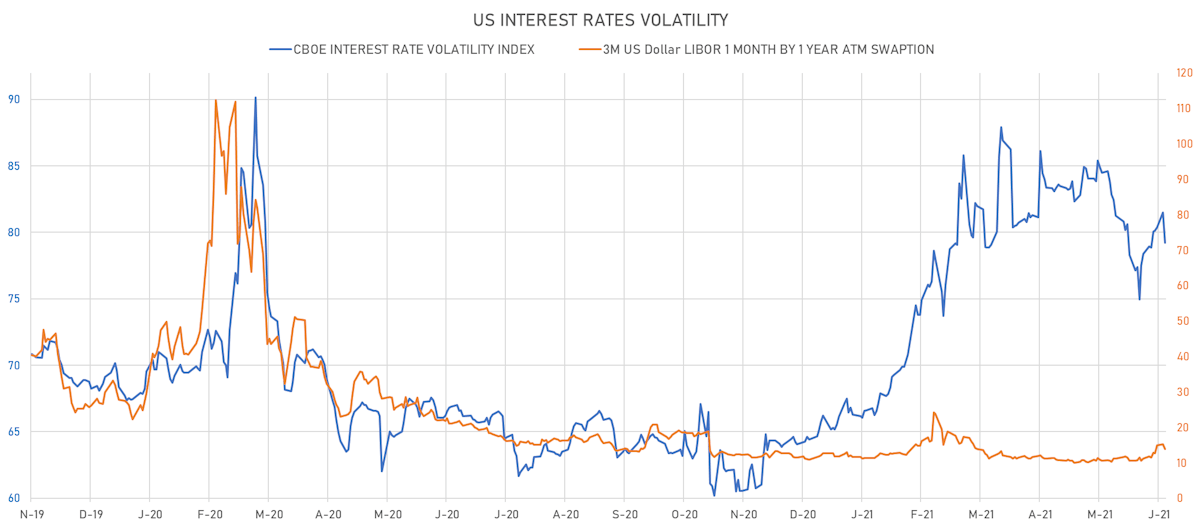

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.4% at 13.8%

- 3-Month LIBOR-OIS spread up 1.0 bp at 6.1 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

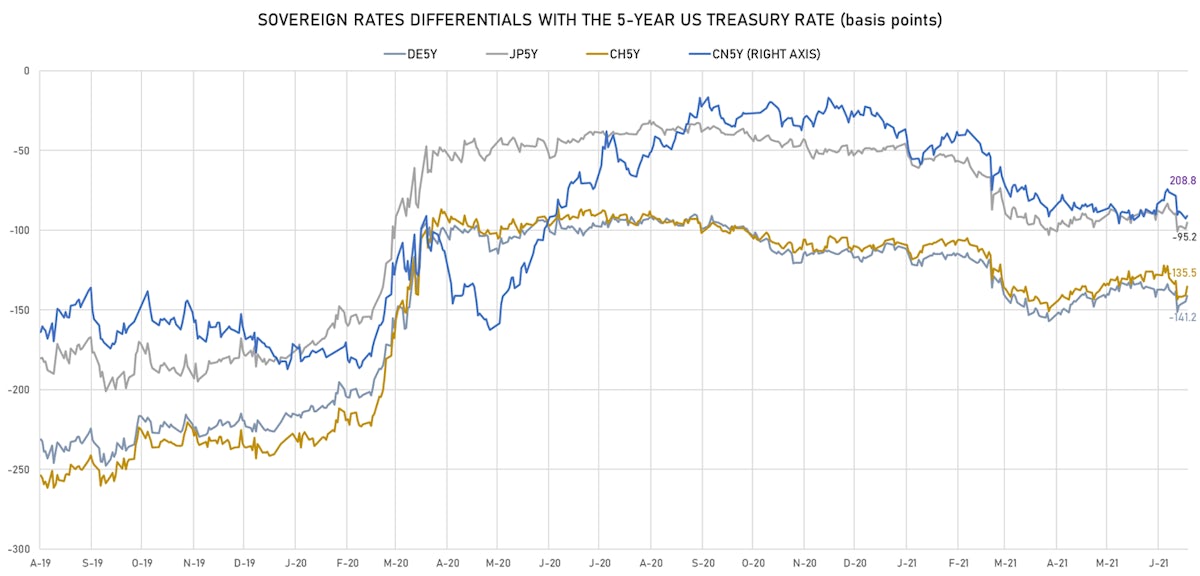

- Germany 5Y: -0.554% (up 0.6 bp); the German 1Y-10Y curve is 1.6 bp steeper at 47.4bp (YTD change: +32.3 bp)

- Japan 5Y: -0.098% (up 1.0 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 16.4bp (YTD change: +2.6 bp)

- China 5Y: 2.945% (down -1.5 bp); the Chinese 1Y-10Y curve is 0.2 bp flatter at 63.8bp (YTD change: +17.4 bp)

- Switzerland 5Y: -0.498% (up 2.3 bp); the Swiss 1Y-10Y curve is 4.3 bp steeper at 63.7bp (YTD change: +29.3 bp)