Rates

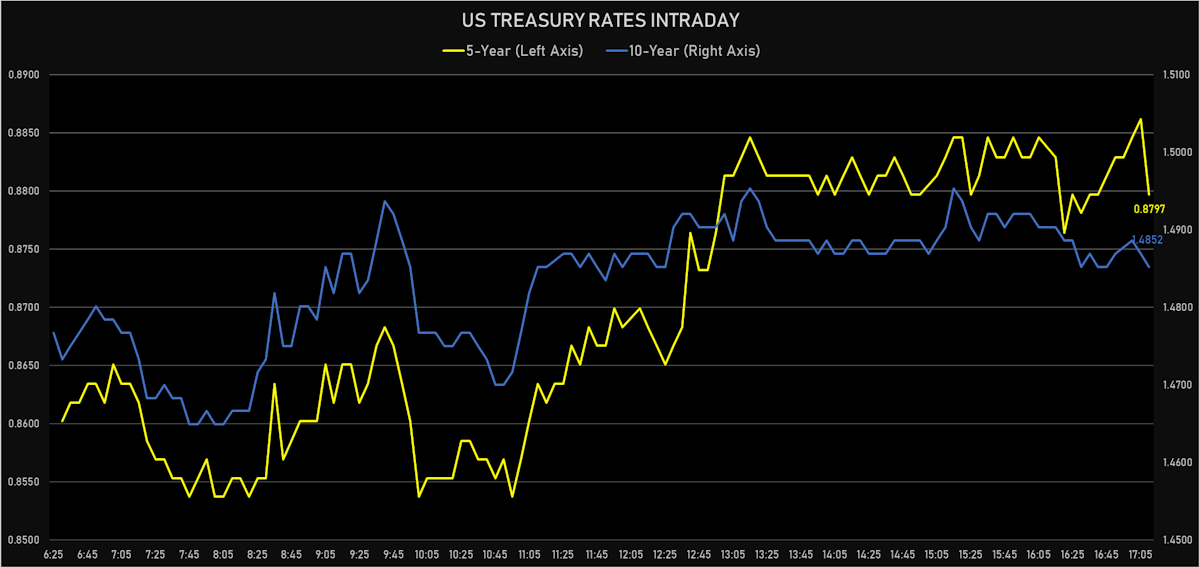

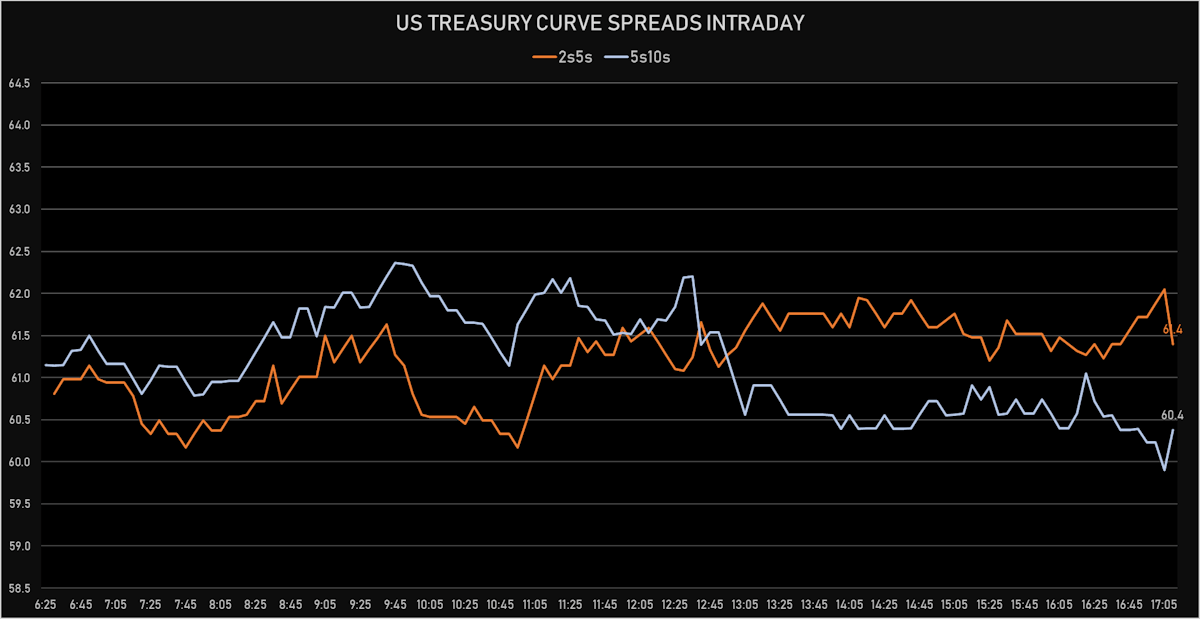

Rates Rise Most At The Short End Of The Curve, 2s10s And 5s10s Flatter Today

Short-term inflation expectations rose, with more Fed speakers talking today; Rosengren in particular said: "if anything, what's surprising at this point is that we're not seeing average hourly earnings, overall, even a little bit higher"

Published ET

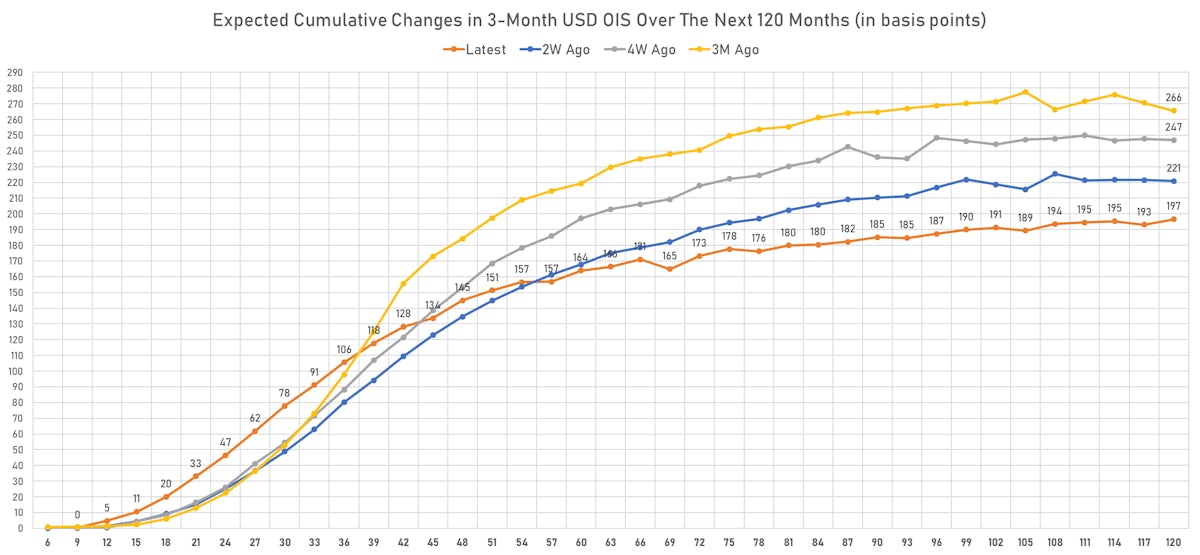

Market rate hikes expectations for the next 3 years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1s10s Treasury spread widening 1.9 bp today, now at 140.4 bp (YTD change: +60.0)

- 1Y: 0.0810% (unchanged)

- 2Y: 0.2641% (up 3.4 bp)

- 5Y: 0.8797% (up 2.3 bp)

- 7Y: 1.2405% (up 2.3 bp)

- 10Y: 1.4852% (up 1.9 bp)

- 30Y: 2.1049% (up 1.4 bp)

- US treasury curve spreads: 2s5s at 61.6bp (down -1.1bp today), 5s10s at 60.5bp (down -0.4bp today), 10s30s at 62.0bp (down -0.4bp today)

- Treasuries butterfly spreads: 2s5s10s at -1.4bp (up 0.7bp today), 5s10s30s at 1.4bp (unchanged)

US MACRO RELEASES

- Building Permits for May 2021 (U.S. Census Bureau) at 1.68 Mln

- Building Permits, Change P/P for May 2021 (U.S. Census Bureau) at -2.90 %

- Current Account, Balance for Q1 2021 (BEA, US Dept. Of Com) at -195.70 Bln USD, above consensus estimate of -206.80 Bln USD

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 18 Jun (MBA, USA) at 2.10 %

- Mortgage applications, market composite index for W 18 Jun (MBA, USA) at 686.40

- Mortgage applications, market composite index, purchase for W 18 Jun (MBA, USA) at 268.00

- Mortgage applications, market composite index, refinancing for W 18 Jun (MBA, USA) at 3110.30

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 18 Jun (MBA, USA) at 3.18 %

- New Home Sales for May 2021 (U.S. Census Bureau) at 0.77 Mln, below consensus estimate of 0.87 Mln

- New Home Sales, Change P/P for May 2021 (U.S. Census Bureau) at -5.90 %

- PMI, Composite, Output, Flash for Jun 2021 (Markit Economics) at 63.90, below consensus estimate of 67.6

- PMI, Manufacturing Sector, Total, Flash for Jun 2021 (Markit Economics) at 62.60 , above consensus estimate of 61.50

- PMI, Services Sector, Business Activity, Flash for Jun 2021 (Markit Economics) at 64.80 , below consensus estimate of 70.00

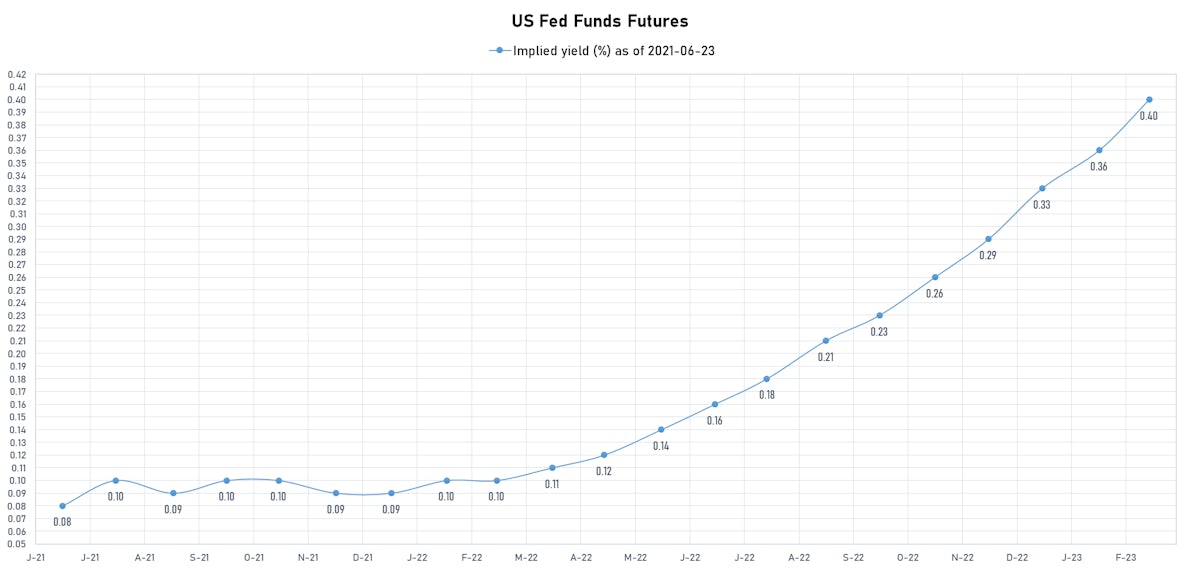

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.2 bp

- The market currently expects the 3-month USD OIS rate to rise by 20.1 bp over the next 18 months (equivalent to 0.8 rate hike) and 105.6 bp over the next 3 years (equivalent to 4.2 rate hikes)

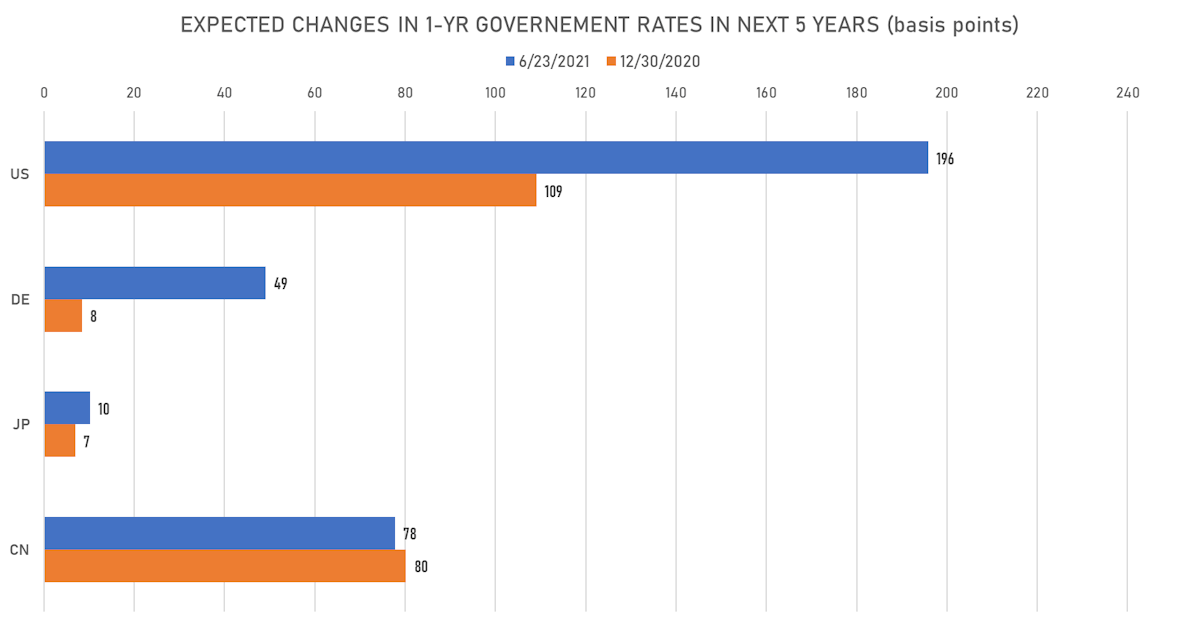

- US Treasury 1-year zero-coupon rate 5 years forward up 1.9 bp, now at 2.0592%, meaning that it is now expected to rise by 196 bp over the next 5 years

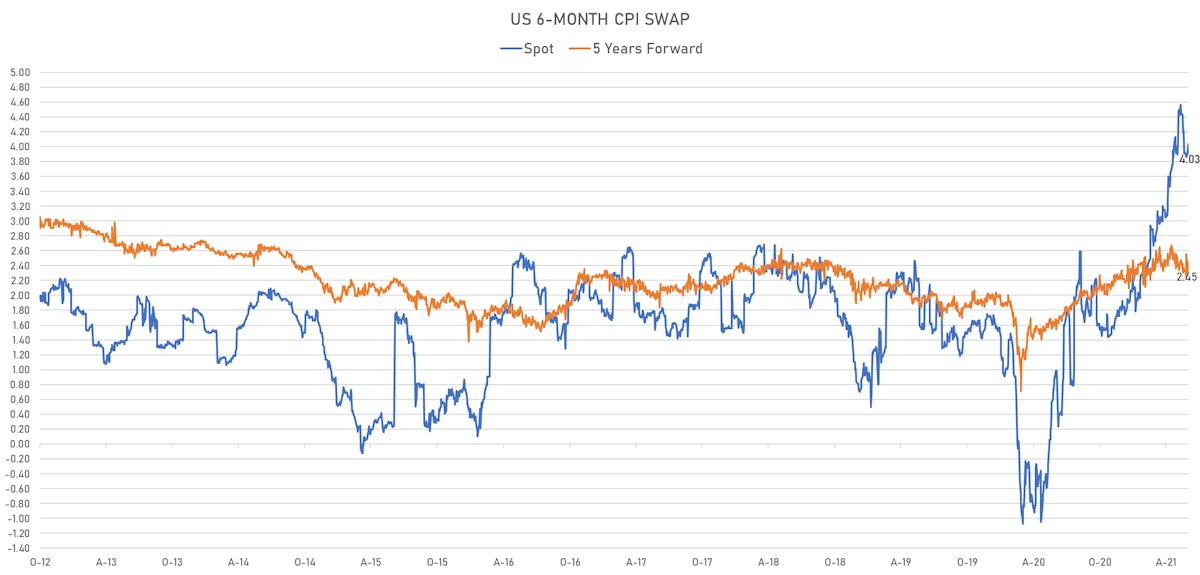

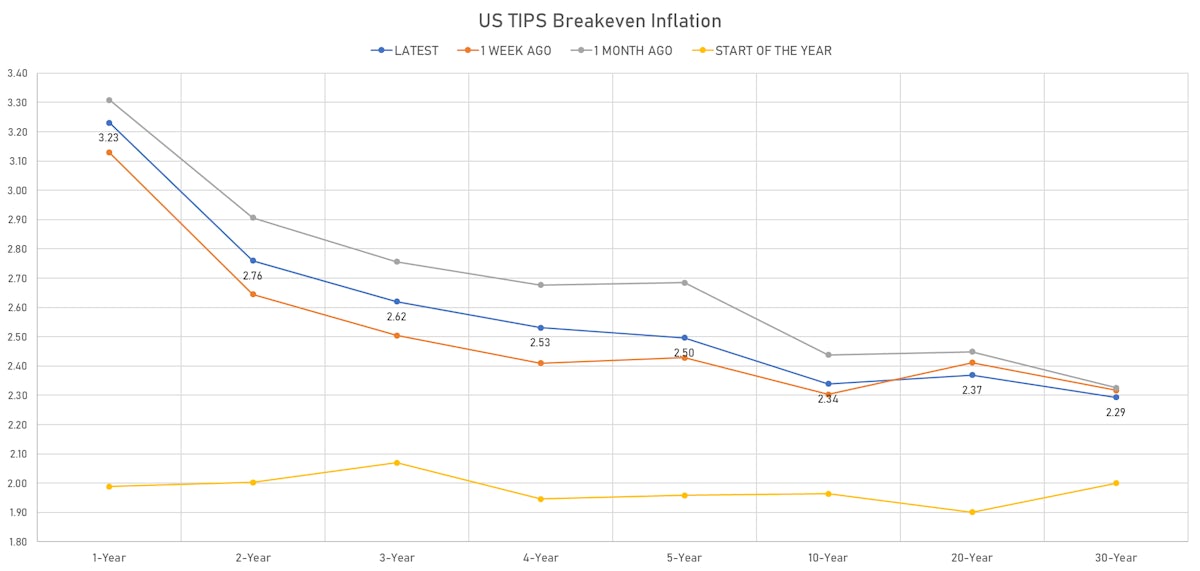

US INFLATION

- TIPS 1Y breakeven inflation at 3.23% (up 2.9bp); 2Y at 2.76% (up 3.8bp); 5Y at 2.50% (up 4.1bp); 10Y at 2.34% (up 3.0bp); 30Y at 2.29% (up 0.8bp)

- 6-month spot US CPI swap up 10.1 bp to 4.035%, with a flattening of the forward curve

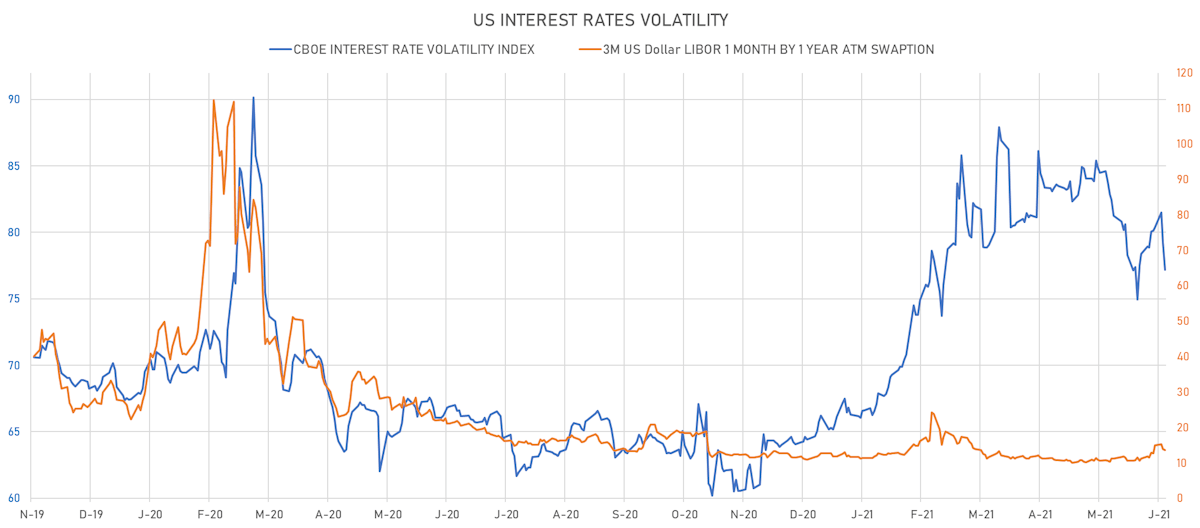

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 13.6%

- 3-Month LIBOR-OIS spread up 1.9 bp at 7.9 bp (12-months range: 4.5-26.2 bp)

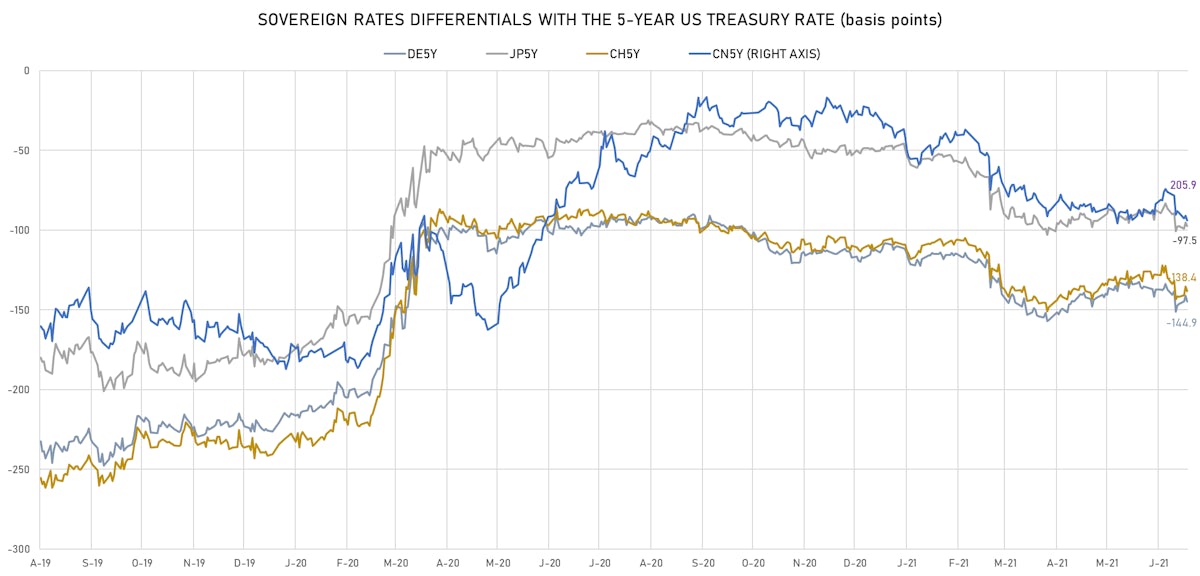

KEY INTERNATIONAL RATES

- Germany 5Y: -0.569% (down -1.4 bp); the German 1Y-10Y curve is 1.7 bp flatter at 46.2bp (YTD change: +30.6 bp)

- Japan 5Y: -0.095% (down 0.0 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 17.3bp (YTD change: +3.1 bp)

- China 5Y: 2.939% (down -0.6 bp); the Chinese 1Y-10Y curve is 0.8 bp steeper at 64.6bp (YTD change: +18.2 bp)

- Switzerland 5Y: -0.504% (down -0.6 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 62.4bp (YTD change: +31.0 bp)