Rates

US Curve Steepens As Long-Term Treasuries Tail To Close The Week

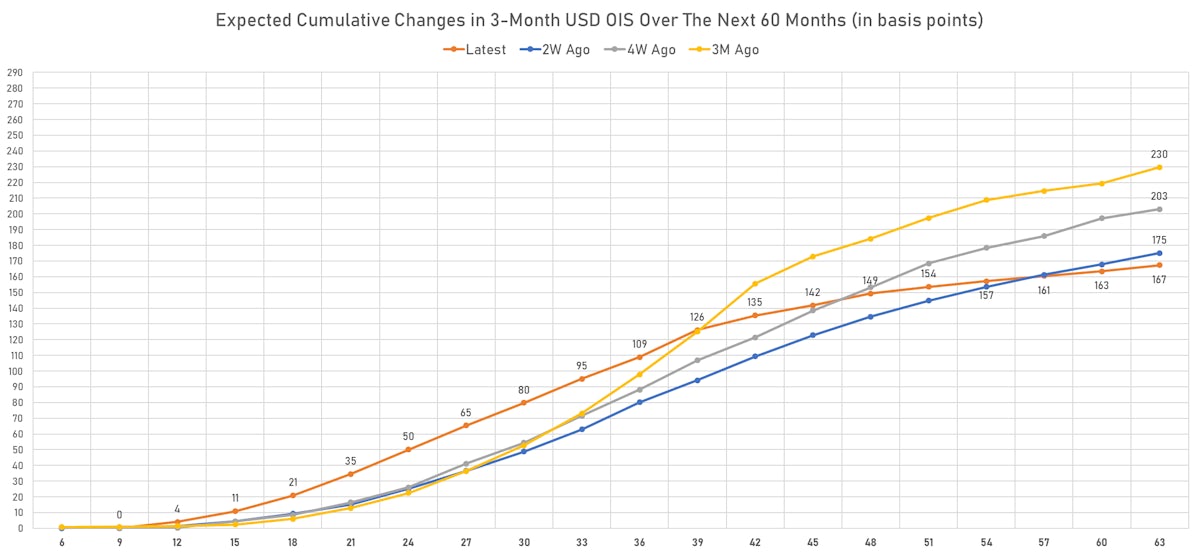

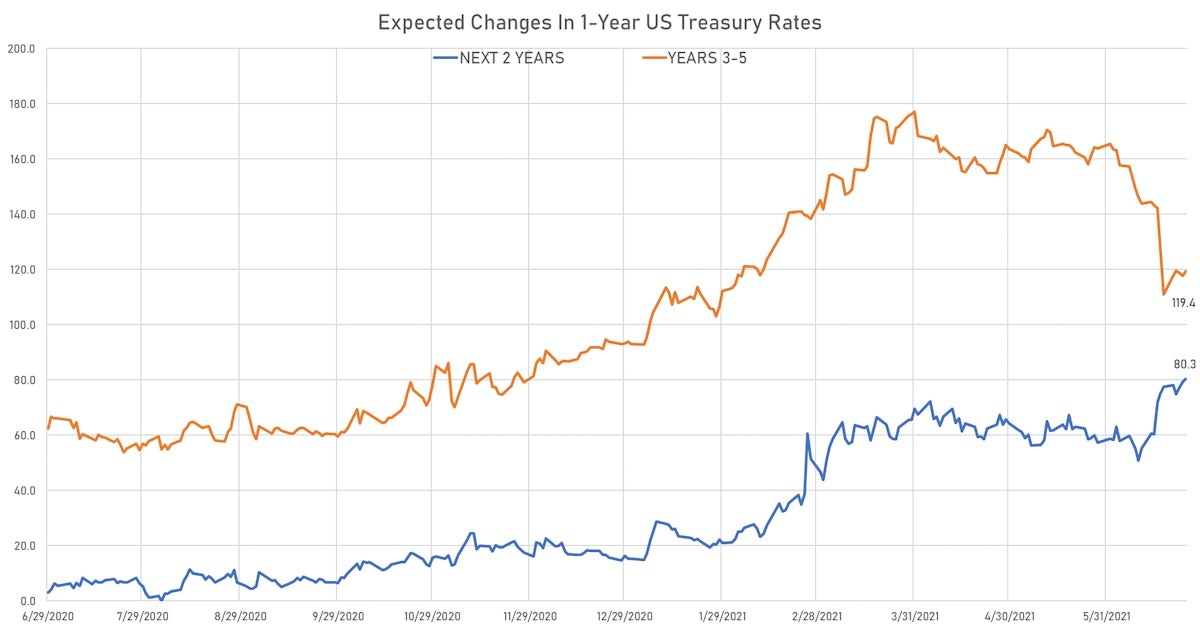

The market currently expects the 3-month USD OIS rate to rise by 20.9 bp over the next 18 months (equivalent to 0.8 rate hike)and 108.9 bp over the next 3 years (equivalent to 4.4 rate hikes)

Published ET

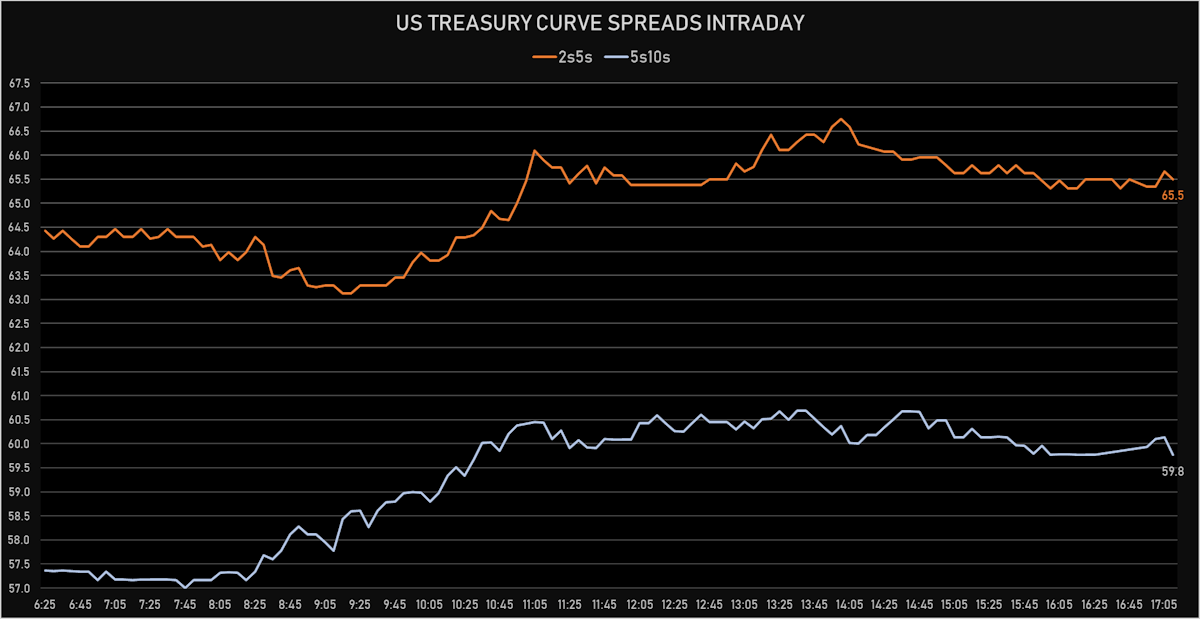

US Treasury Curve Spreads | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1s10s Treasury spread widening 2.5 bp on the day, now at 144.3 bp (YTD change: +63.9)

- 1Y: 0.0810% (unchanged)

- 2Y: 0.2681% (down 0.2 bp)

- 5Y: 0.9247% (up 1.0 bp)

- 7Y: 1.2828% (up 2.9 bp)

- 10Y: 1.5241% (up 2.5 bp)

- 30Y: 2.1508% (up 4.5 bp)

- US treasury curve spreads: 2s5s at 65.7bp (up 1.2bp today), 5s10s at 59.9bp (up 1.6bp today), 10s30s at 62.7bp (up 1.8bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.1bp (up 0.4bp today), 5s10s30s at 1.8bp (down -0.5bp today)

US MACRO RELEASES

- 1 Year Inflation Expectations (median) for Jun 2021 (UMICH, Survey) at 4.20 %

- Change P/P for May 2021 (BEA, US Dept. Of Com) at -2.00 %, above consensus estimate of -2.50 %

- Personal Consumption Expenditure, Change P/P for May 2021 (BEA, US Dept. Of Com) at 0.00 %, below consensus estimate of 0.40 %

- Personal Consumption Expenditure, Change P/P for May 2021 (BEA, US Dept. Of Com) at 0.40 %

- Personal Consumption Expenditure, Change P/P for May 2021 (BEA, US Dept. Of Com) at -0.40 %

- Personal Consumption Expenditure, Change Y/Y for May 2021 (BEA, US Dept. Of Com) at 3.90 %

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for May 2021 (BEA, US Dept. Of Com) at 0.50 %, below consensus estimate of 0.60 %

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for May 2021 (BEA, US Dept. Of Com) at 3.40 %, in line with consensus estimate

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for May 2021 (Fed Resrv, Dallas) at 2.80 %

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Jun 2021 (UMICH, Survey) at 2.80 %

- University of Michigan, Consumer Expectations Index, Volume Index for Jun 2021 (UMICH, Survey) at 83.50 , below consensus estimate of 84.00

- University of Michigan, Consumer Sentiment Index, Volume Index for Jun 2021 (UMICH, Survey) at 85.50 , below consensus estimate of 86.50

- University of Michigan, Current Conditions Index, Volume Index for Jun 2021 (UMICH, Survey) at 88.60 , below consensus estimate of 90.70

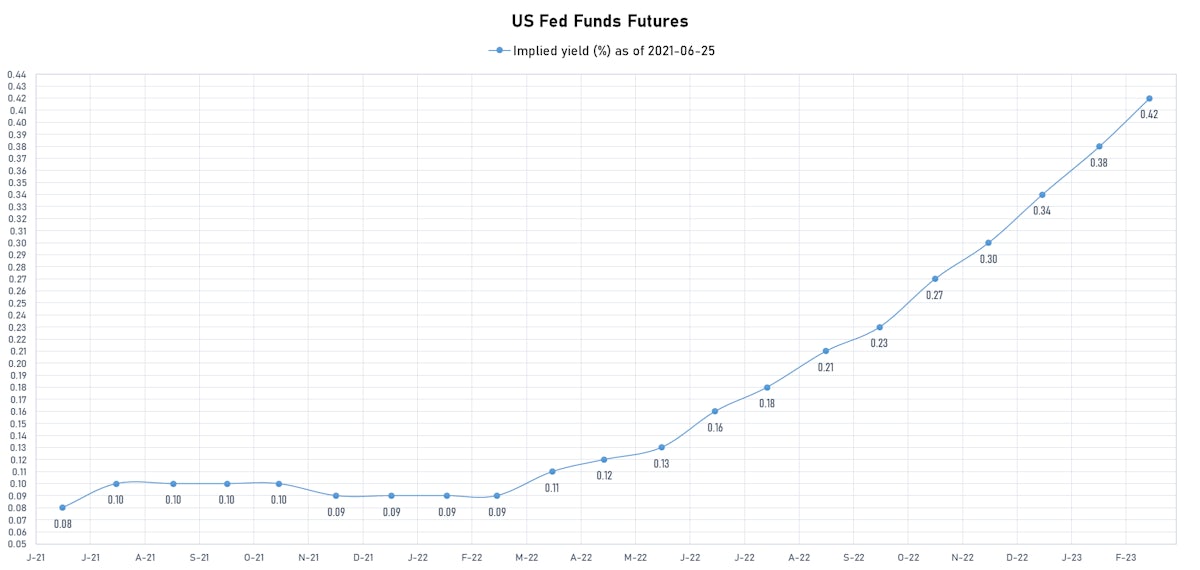

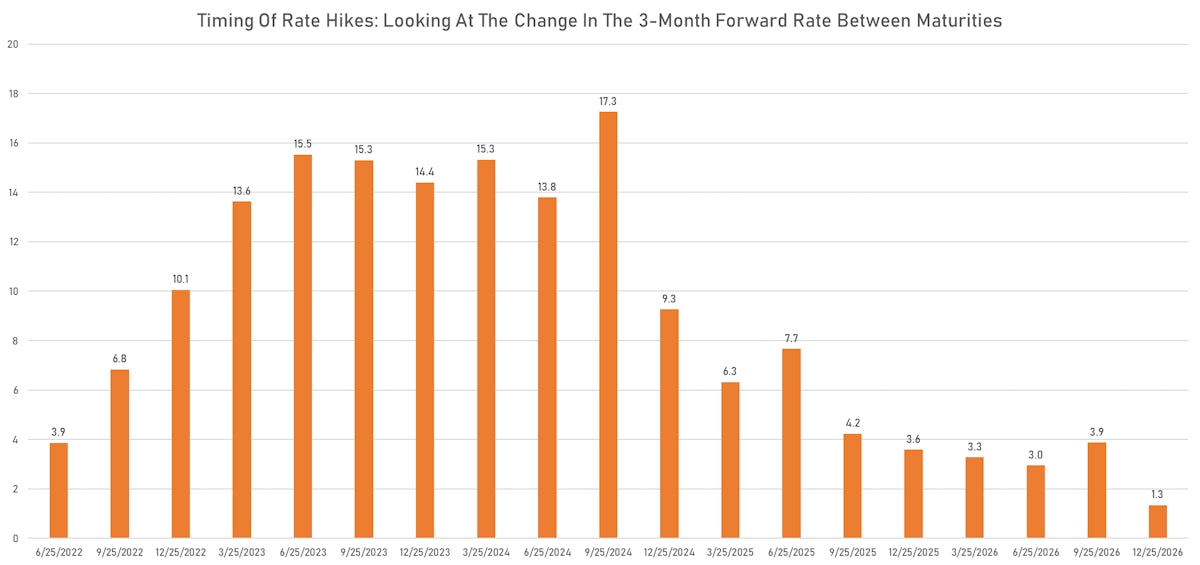

US FORWARD RATES

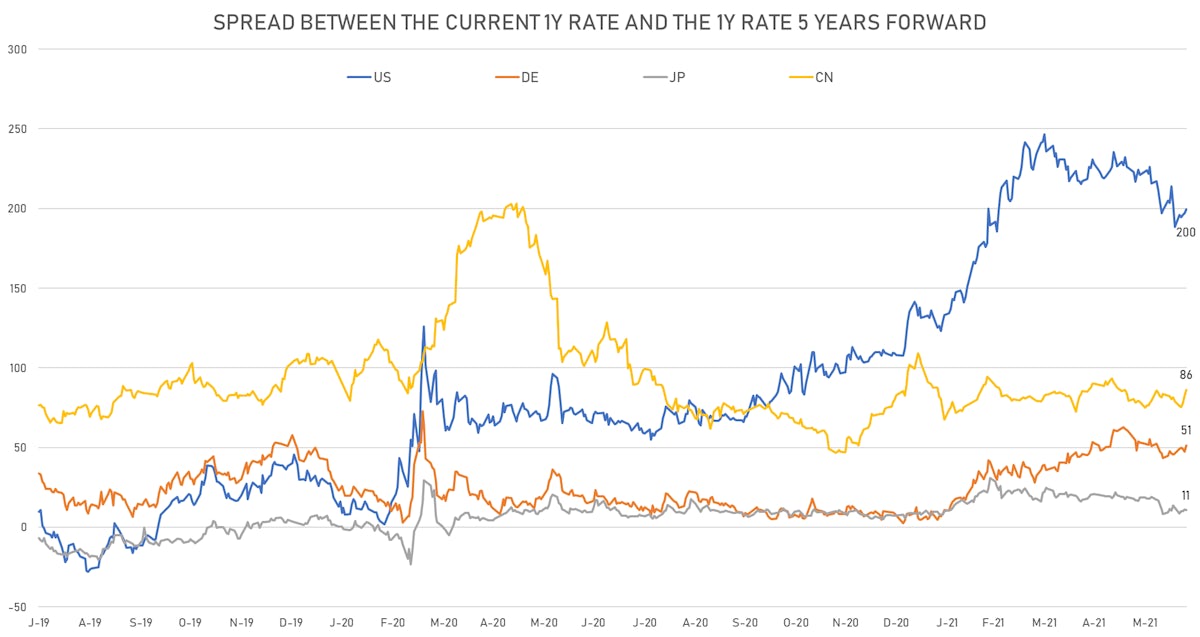

- 3-month USD Libor 5 years forward up 1.2 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 2.8 bp, now at 2.0990%

- 1-Year Treasury rates are now expected to increase by 199.7 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 20.9 bp over the next 18 months (equivalent to 0.8 rate hike)and 108.9 bp over the next 3 years (equivalent to 4.4 rate hikes)

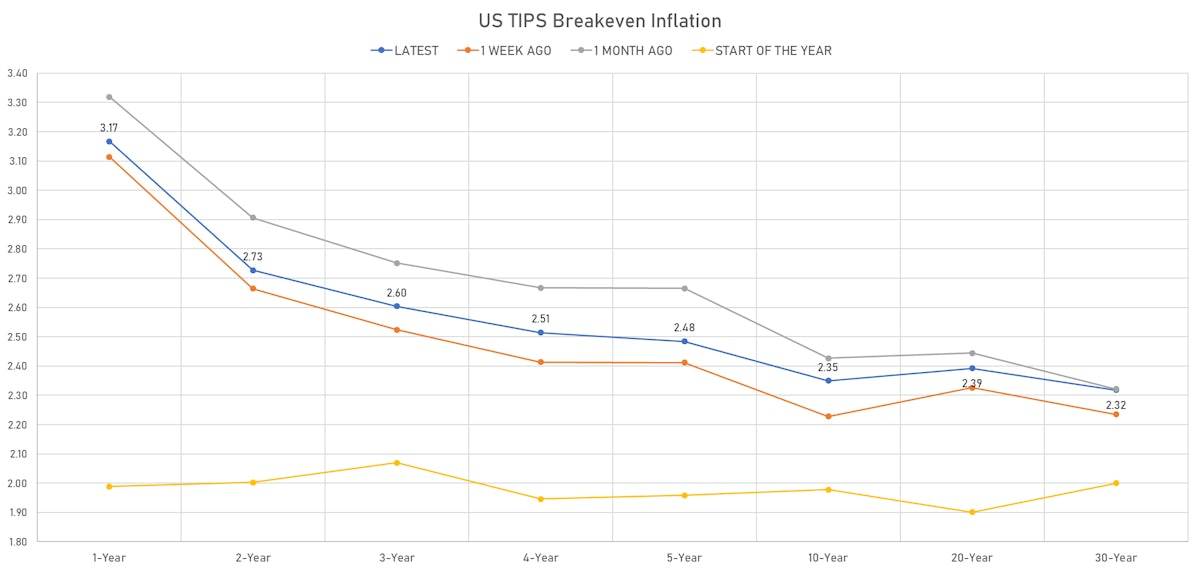

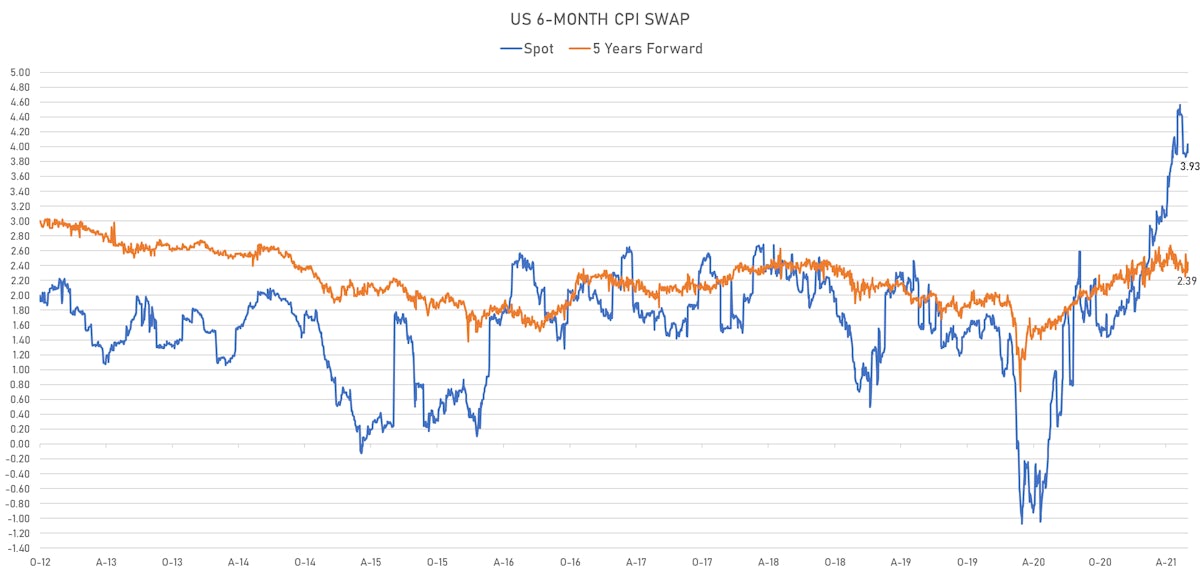

US INFLATION

- TIPS 1Y breakeven inflation at 3.17% (down -1.2bp); 2Y at 2.73% (up 0.8bp); 5Y at 2.48% (up 2.7bp); 10Y at 2.35% (up 4.3bp); 30Y at 2.32% (up 4.7bp)

- 6-month spot US CPI swap up 0.7 bp to 3.933%, with a flattening of the forward curve

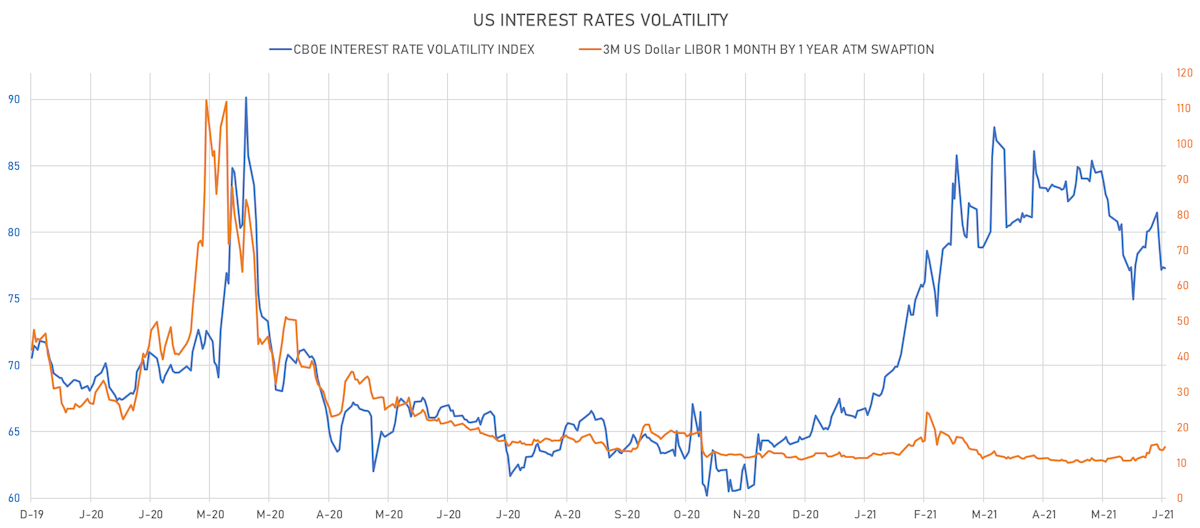

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8% at 14.4%

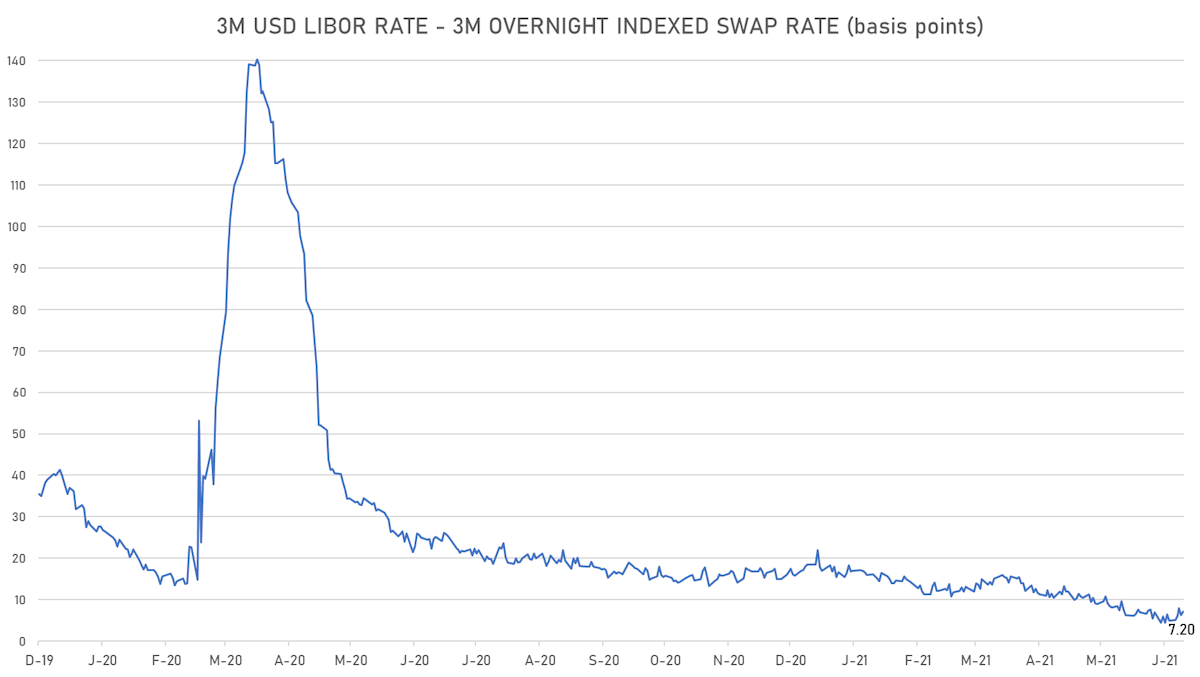

- 3-Month LIBOR-OIS spread up 0.9 bp at 7.2 bp (12-months range: 4.5-26.2 bp)

KEY INTERNATIONAL RATES

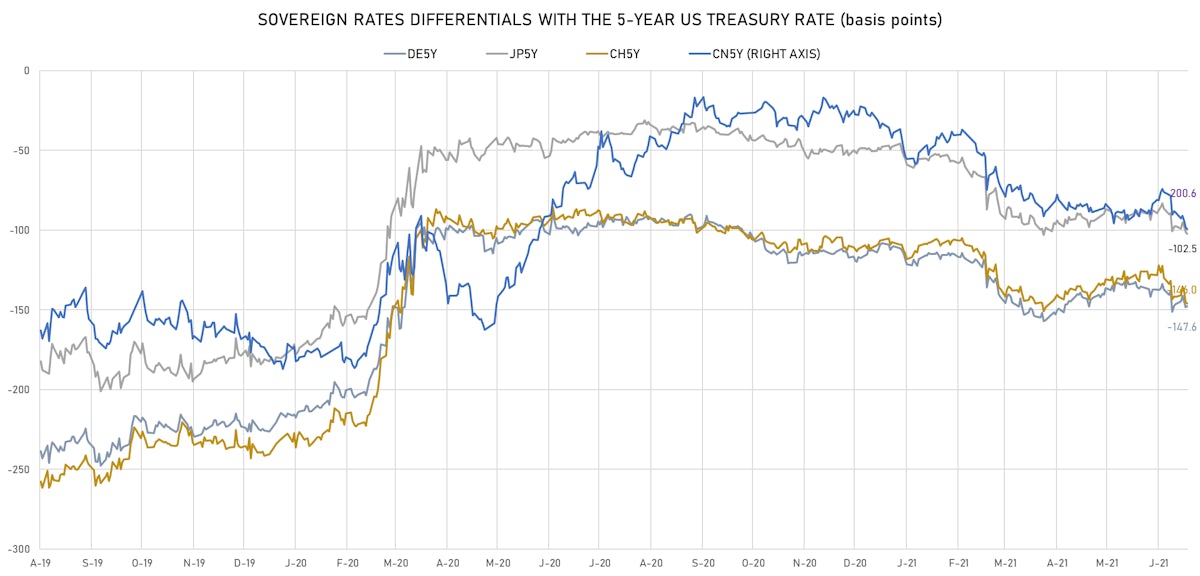

- Germany 5Y: -0.548% (up 1.6 bp); the German 1Y-10Y curve is 2.8 bp steeper at 48.7bp (YTD change: +32.7 bp)

- Japan 5Y: -0.092% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp flatter at 16.4bp (YTD change: +2.4 bp)

- China 5Y: 2.931% (down -0.2 bp); the Chinese 1Y-10Y curve is 3.0 bp steeper at 72.8bp (YTD change: +26.4 bp)

- Switzerland 5Y: -0.535% (up 0.2 bp); the Swiss 1Y-10Y curve is 6.5 bp steeper at 63.3bp (YTD change: +37.9 bp)