Rates

US Rates Down, Duration Bought To Start The Week

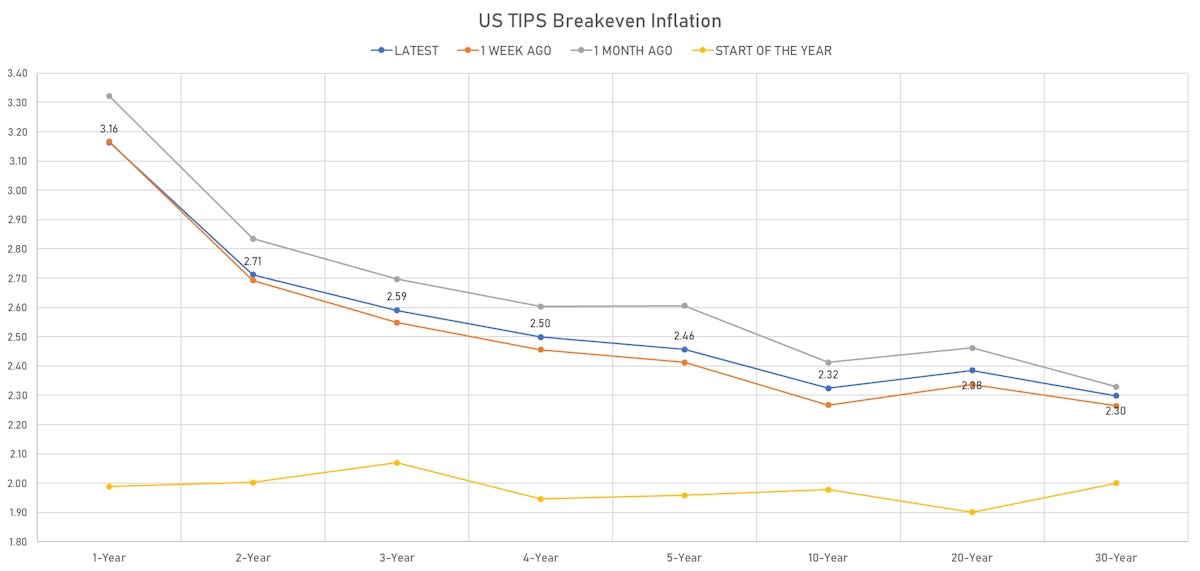

Inflation forward curve flattens as short-term expectations fall, while the long end stays well anchored

Published ET

Forward rates changes currently priced in by the market | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

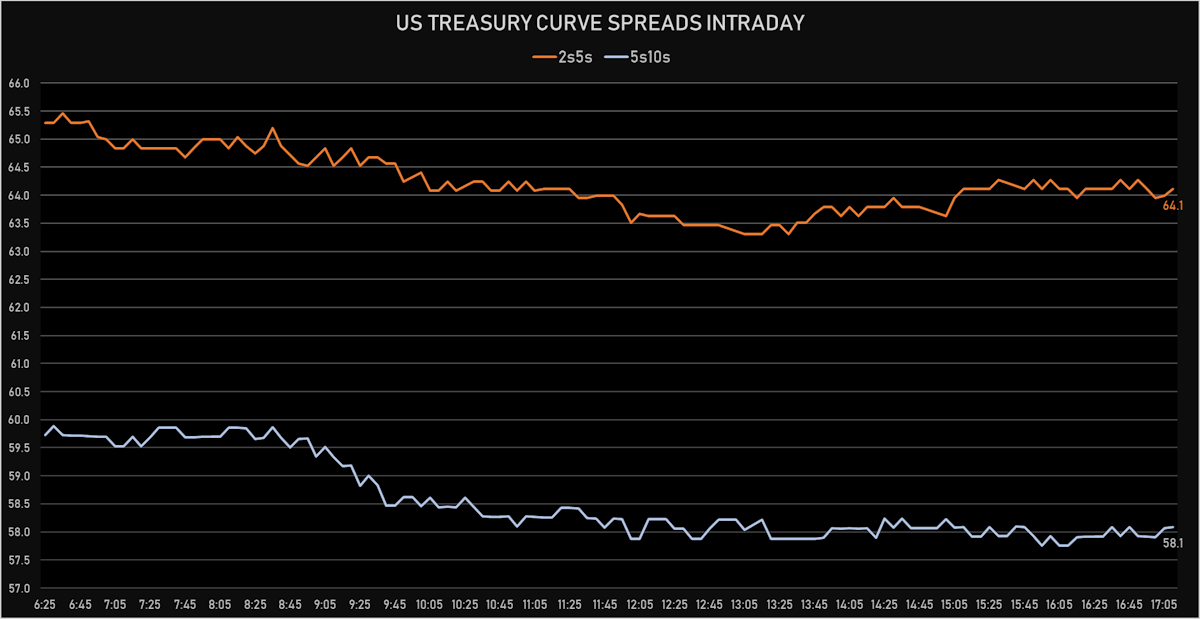

- Yield curve flattening, with the 1s10s Treasury spread tightening -3.7 bp on the day, now at 140.1 bp (YTD change: +59.6)

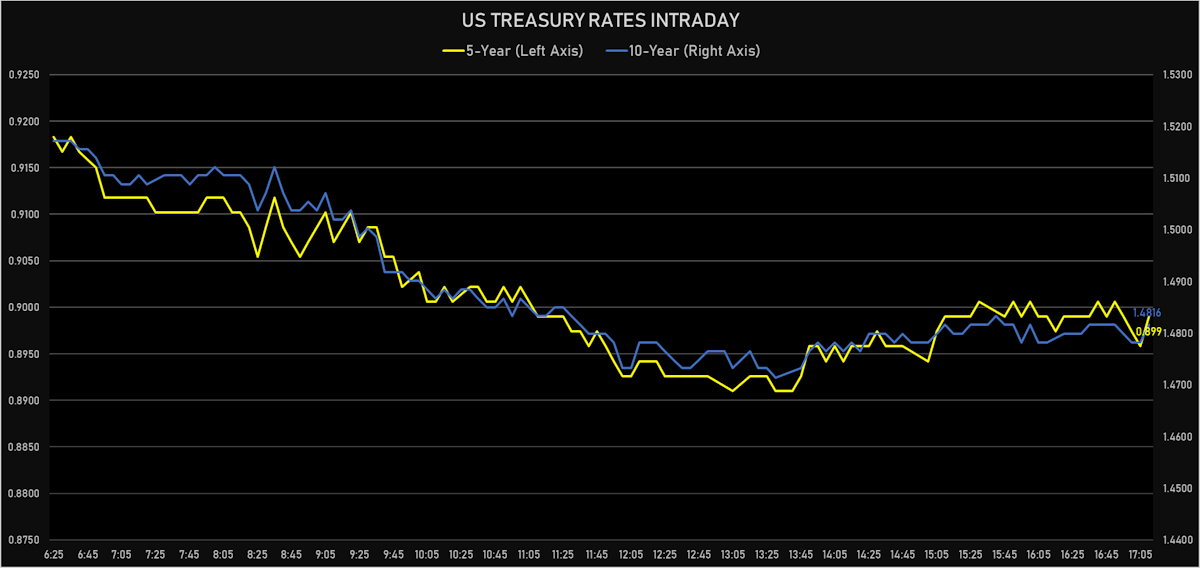

- 1Y: 0.0810% (down 0.5 bp)

- 2Y: 0.2563% (down 1.2 bp)

- 5Y: 0.8990% (down 2.6 bp)

- 7Y: 1.2500% (down 3.3 bp)

- 10Y: 1.4816% (down 4.3 bp)

- 30Y: 2.1007% (down 5.0 bp)

- US treasury curve spreads: 2s5s at 64.3bp (down -1.4bp today), 5s10s at 58.3bp (down -1.7bp today), 10s30s at 61.9bp (down -0.8bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.4bp (down -0.3bp today), 5s10s30s at 3.1bp (up 1.3bp today)

US MACRO

- Dallas Fed, General Business Activity for Jun 2021 (Federal Reserve, Dallas) at 31.10, below consensus of 32.5

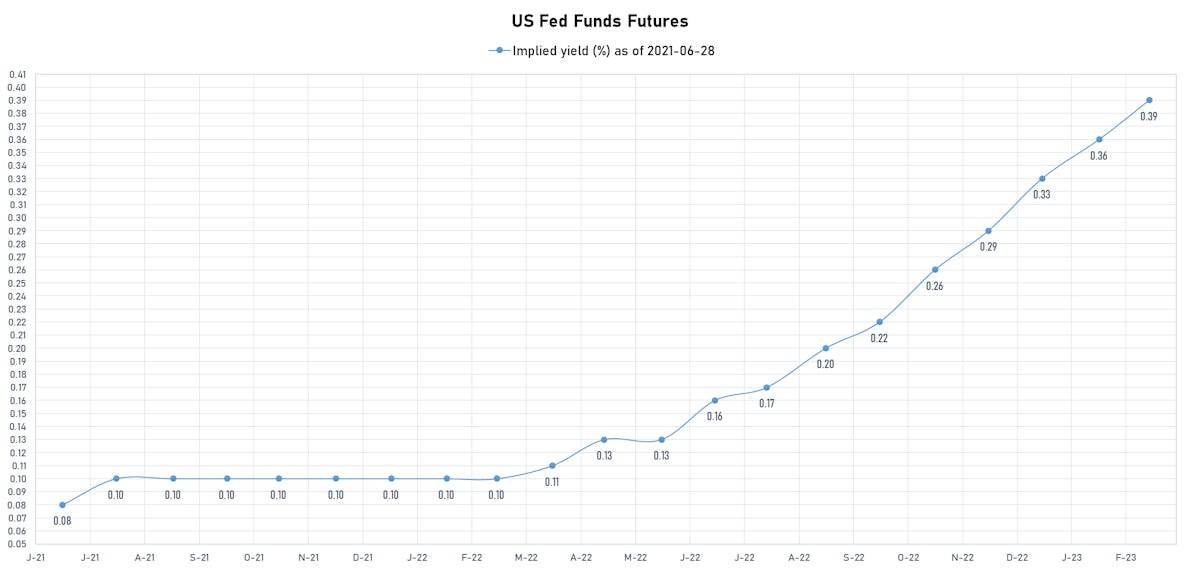

- Fed's Barkin (on the hawkish side, but not a voter in 2022) said a rate hike is possible as soon as 2022 "if the numbers hit"

- Solid auctions of 13- and 26-week treasury bills (total issuance of US$ 126.455bn): 13W $64,937M accepted (vs prior: $59,059M) and 26W $61,518M (prior: $55,951M)

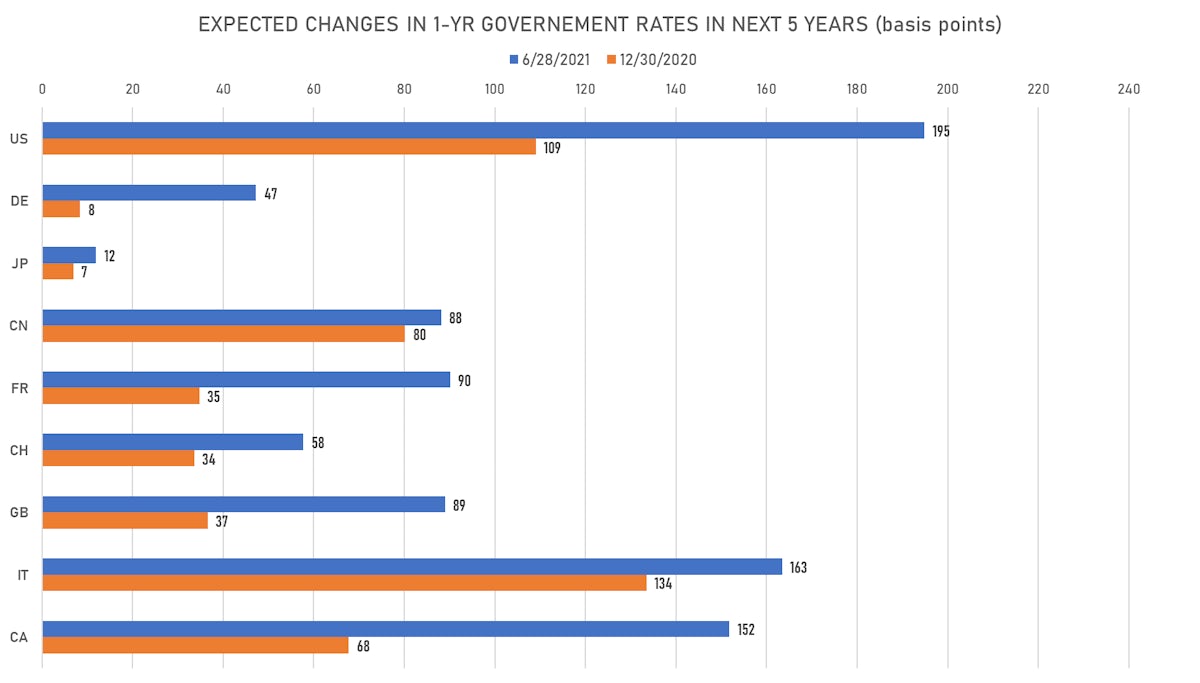

US FORWARD RATES

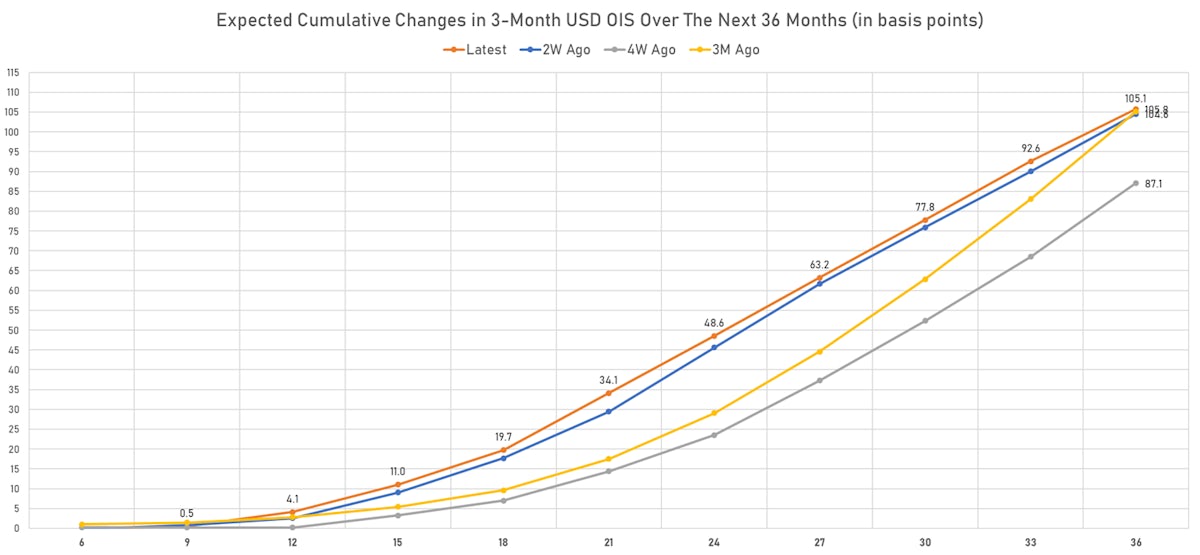

- 3-month USD Libor 5 years forward down 1.4 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 5.2 bp, now at 2.0469%

- 1-Year Treasury rates are now expected to increase by 194.8 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 19.7 bp over the next 18 months (equivalent to 0.8 rate hike) and 105.8 bp over the next 3 years (equivalent to 4.2 rate hikes)

US INFLATION

- TIPS 1Y breakeven inflation at 3.16% (down -0.3bp); 2Y at 2.71% (down -1.5bp); 5Y at 2.46% (down -2.7bp); 10Y at 2.32% (down -2.5bp); 30Y at 2.30% (down -1.9bp)

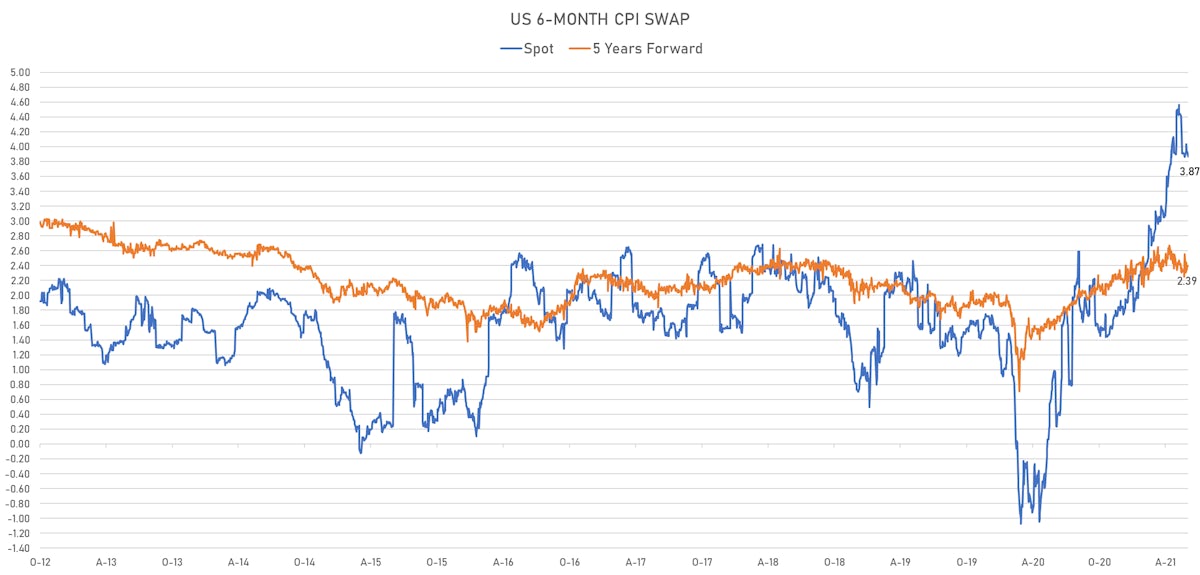

- 6-month spot US CPI swap down -6.8 bp to 3.865%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

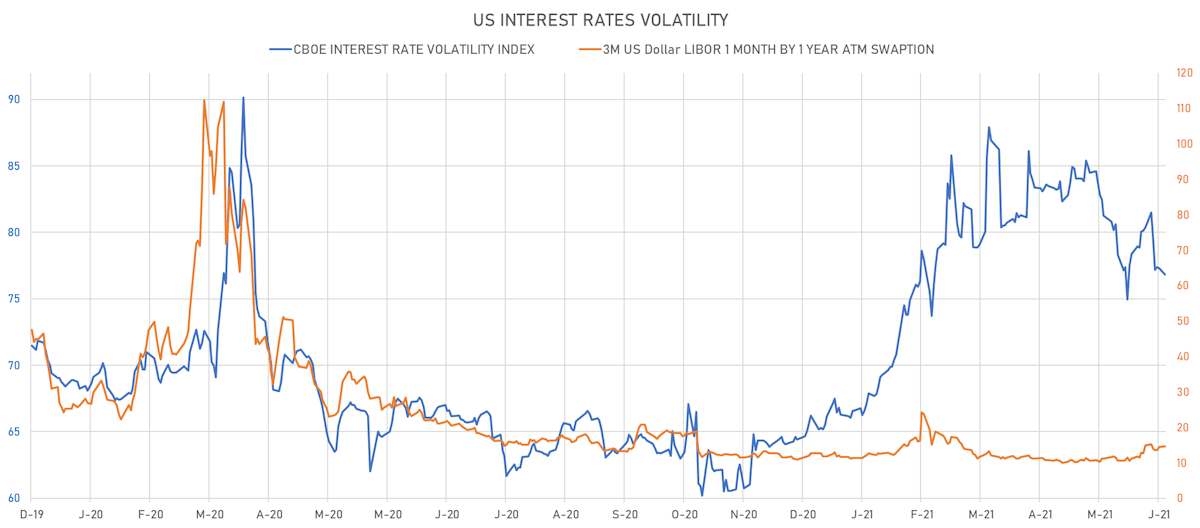

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.2% at 14.6%

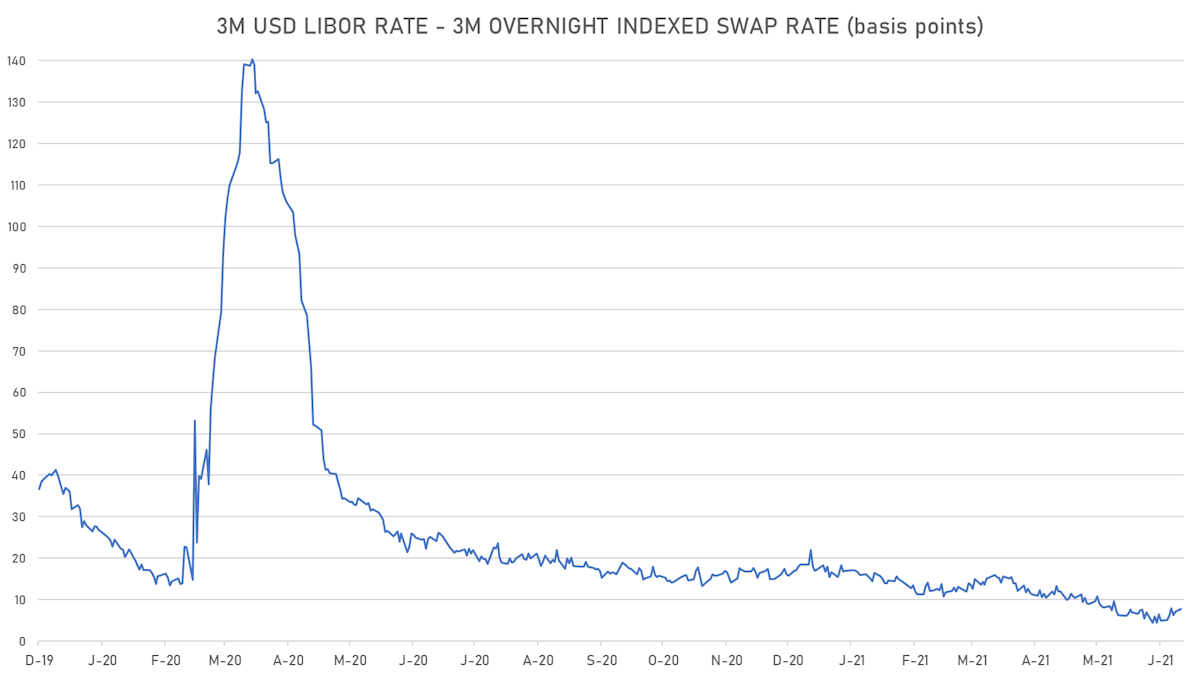

- 3-Month LIBOR-OIS spread up 0.6 bp at 7.8 bp (12-months range: 4.5-26.2 bp)

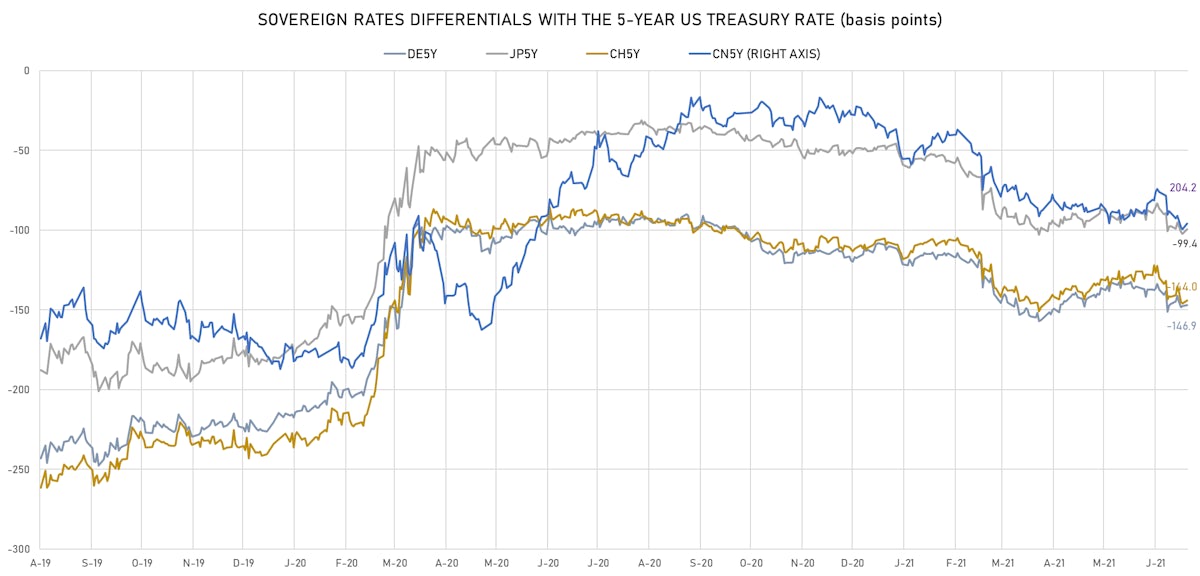

KEY INTERNATIONAL RATES

- Germany 5Y: -0.569% (down -1.9 bp); the German 1Y-10Y curve is 3.2 bp flatter at 44.7bp (YTD change: +29.5 bp)

- Japan 5Y: -0.087% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 17.4bp (YTD change: +3.1 bp)

- China 5Y: 2.941% (up 1.0 bp); the Chinese 1Y-10Y curve is 0.5 bp flatter at 72.3bp (YTD change: +25.9 bp)

- Switzerland 5Y: -0.541% (down -0.6 bp); the Swiss 1Y-10Y curve is 7.7 bp flatter at 56.6bp (YTD change: +30.2 bp)