Rates

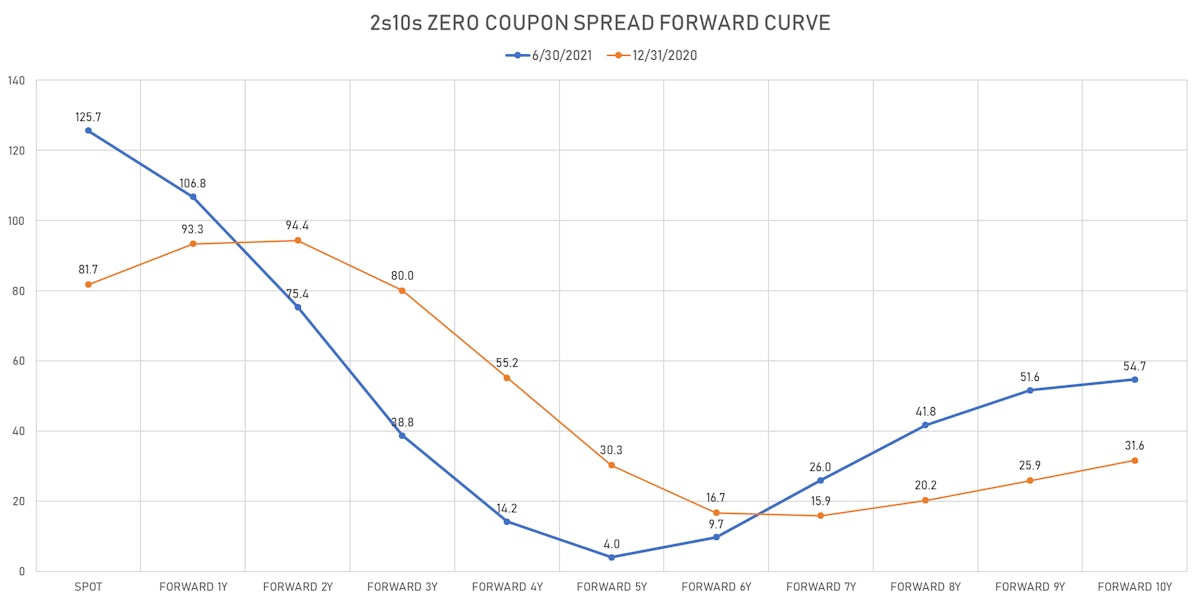

Very Modest Flattening Of The US Treasury Rates Curve To End The Quarter

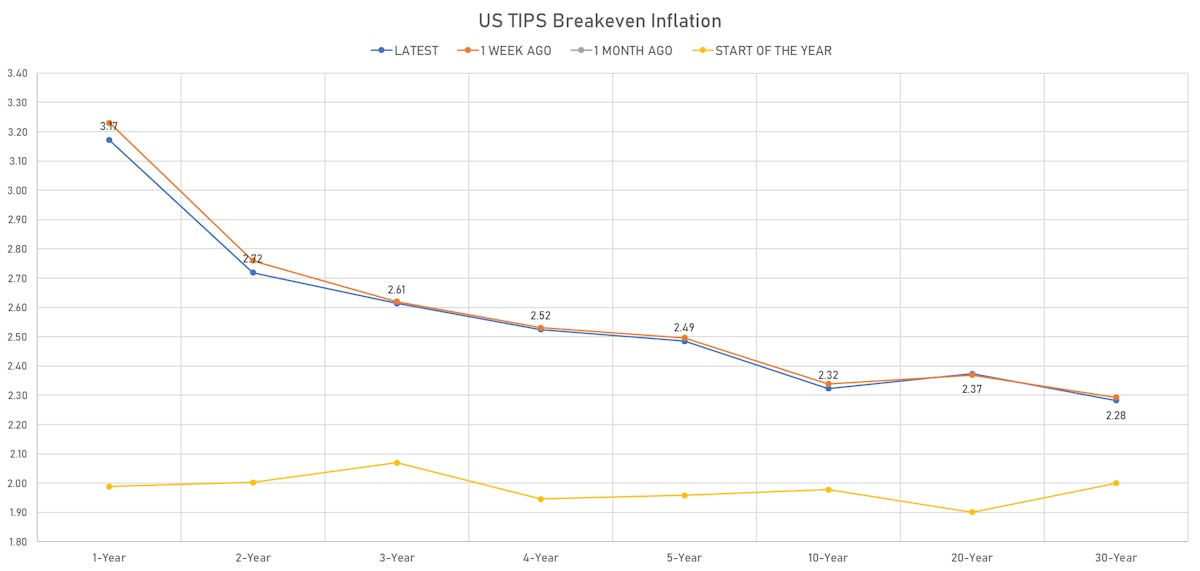

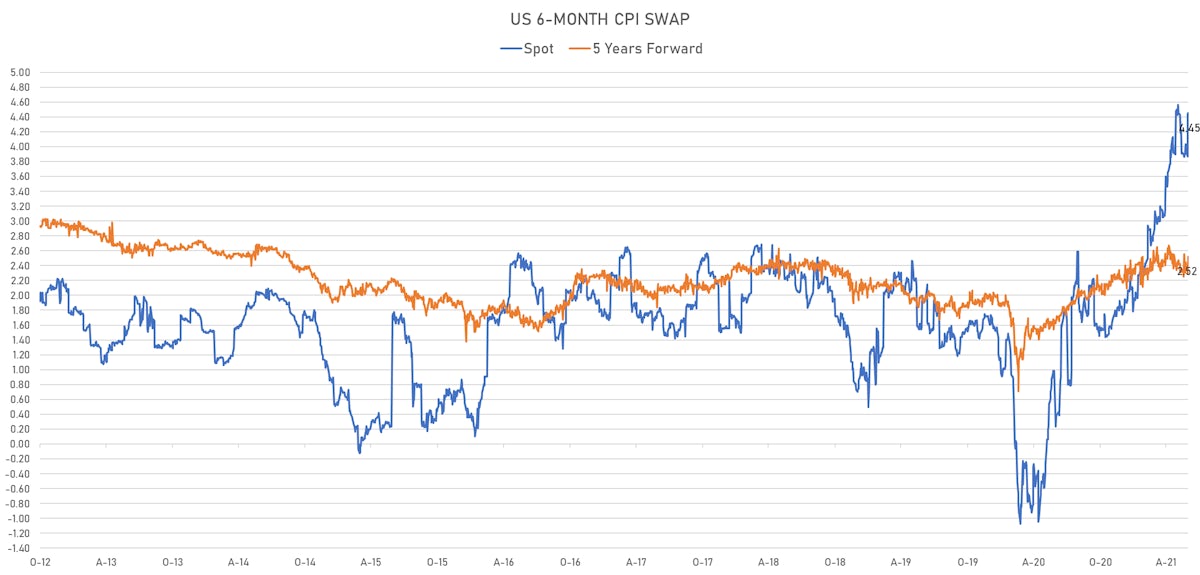

Short-term inflation swaps are at elevated levels compared to last week and the inflation curve flattened somewhat today, though it is still extremely steep: 6-Month CPI swap at 4.45% vs 2.52% 5 Years Forward

Published ET

US TIPS Real Yields | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

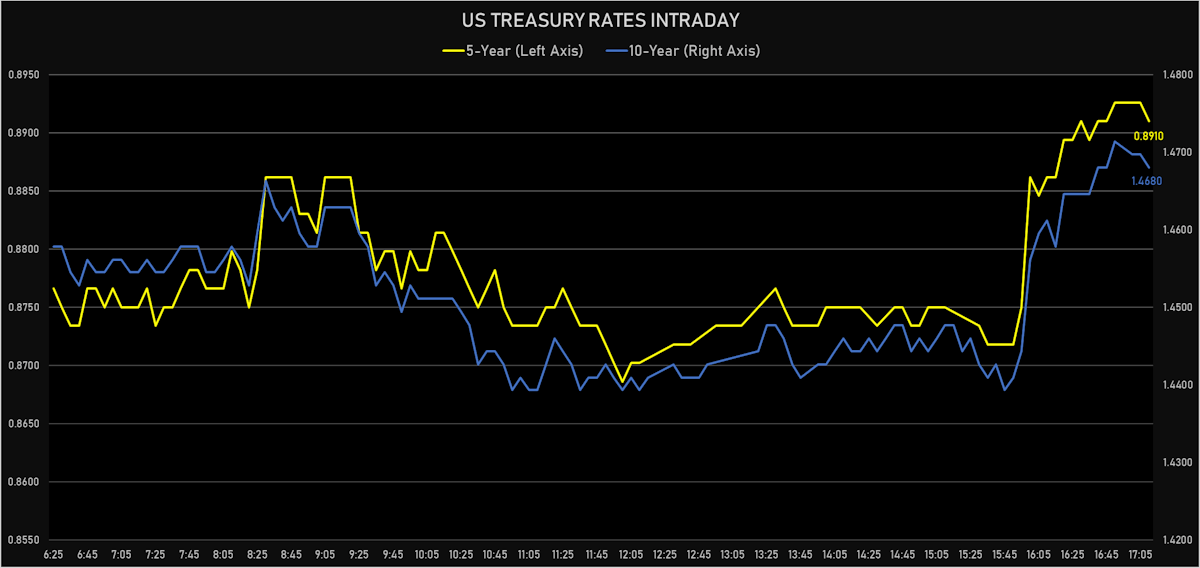

- Yield curve flattening, with the 1s10s Treasury spread tightening -0.4 bp on the day, now at 139.4 bp (YTD change: +59.0)

- 1Y: 0.0740% (down 0.3 bp)

- 2Y: 0.2525% (unchanged)

- 5Y: 0.8910% (unchanged)

- 7Y: 1.2383% (down 0.5 bp)

- 10Y: 1.4680% (down 0.7 bp)

- 30Y: 2.0884% (up 0.1 bp)

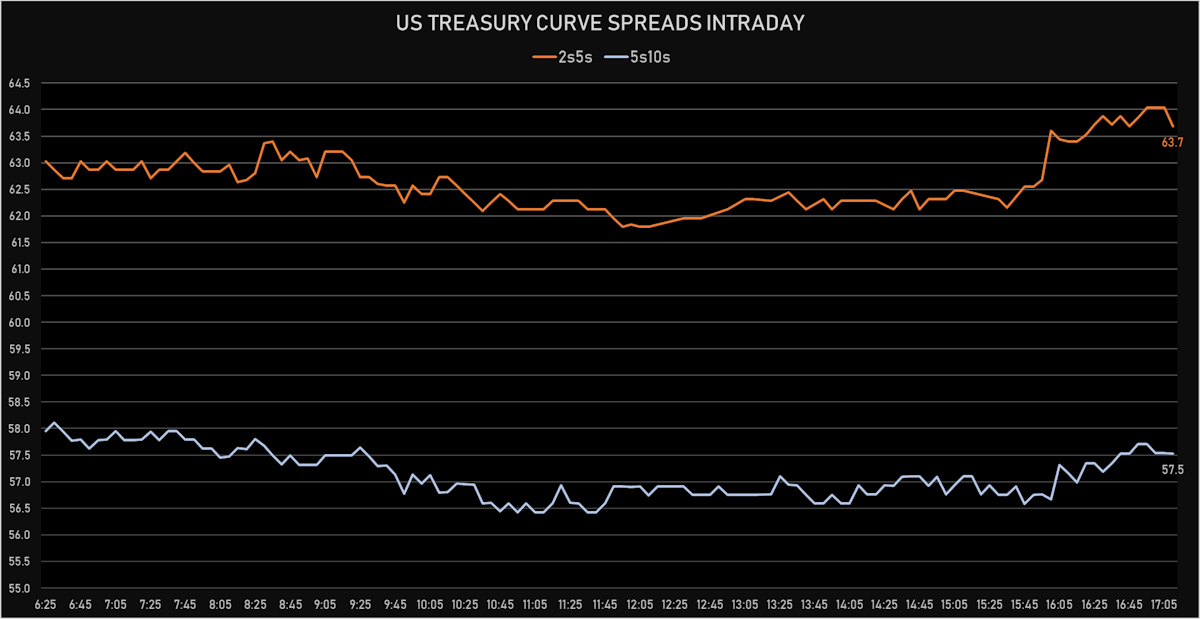

- US treasury curve spreads: 2s5s at 63.9bp (unchanged), 5s10s at 57.7bp (down -0.7bp today), 10s30s at 62.1bp (up 0.8bp today)

- Treasuries butterfly spreads: 2s5s10s at -6.5bp (down -0.7bp today), 5s10s30s at 3.8bp (up 1.0bp today)

US MACRO RELEASES

- Chicago PMI, Total Business Barometer for Jun 2021 (MNI Indicators) at 66.10 , below consensus estimate of 70.00

- ADP total nonfarm private employment (estimate), Absolute change for Jun 2021 (ADP - Automatic Data) at 692.00 k, above consensus estimate of 600.00 k; May revised down to 886k from 978k. Companies with 500+ workers added 240k jobs, medium [50-499] added 236k, and small [0-49] added 215k.

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 25 Jun (MBA, USA) at -6.90 %

- Mortgage applications, market composite index for W 25 Jun (MBA, USA) at 638.80

- Mortgage applications, market composite index, purchase for W 25 Jun (MBA, USA) at 255.20

- Mortgage applications, market composite index, refinancing for W 25 Jun (MBA, USA) at 2856.60

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 25 Jun (MBA, USA) at 3.20 %

- Pending Home Sales, United States for May 2021 (NAR, United States) at 114.70

- Pending Home Sales, United States, Change P/P for May 2021 (NAR, United States) at 8.00 %, above consensus estimate of -0.80 %

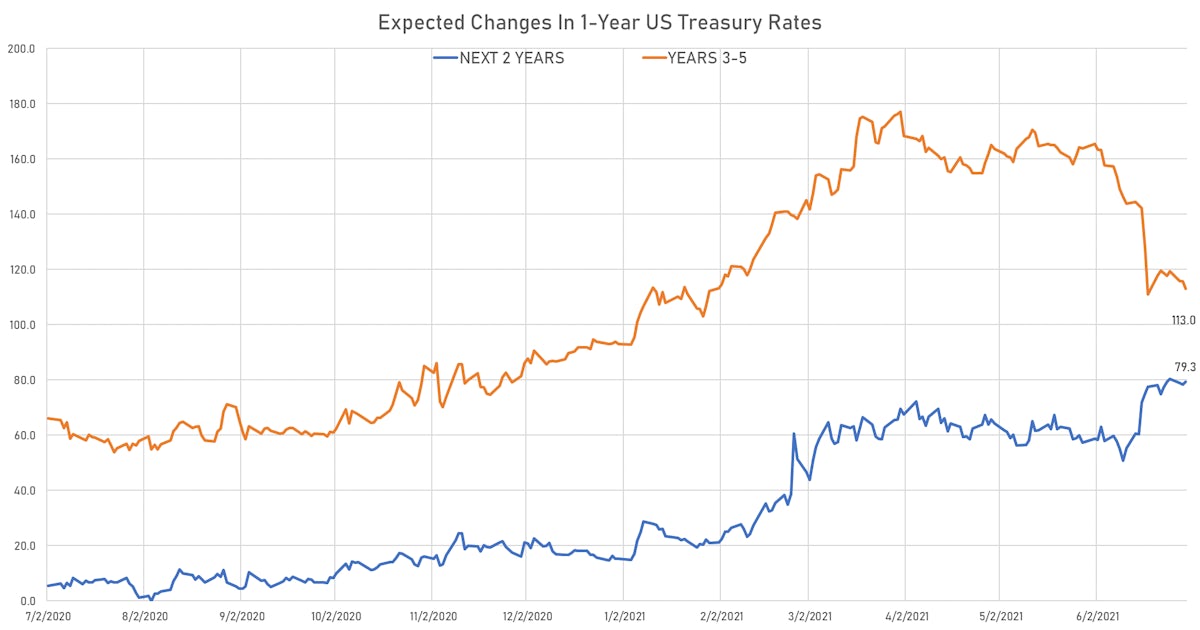

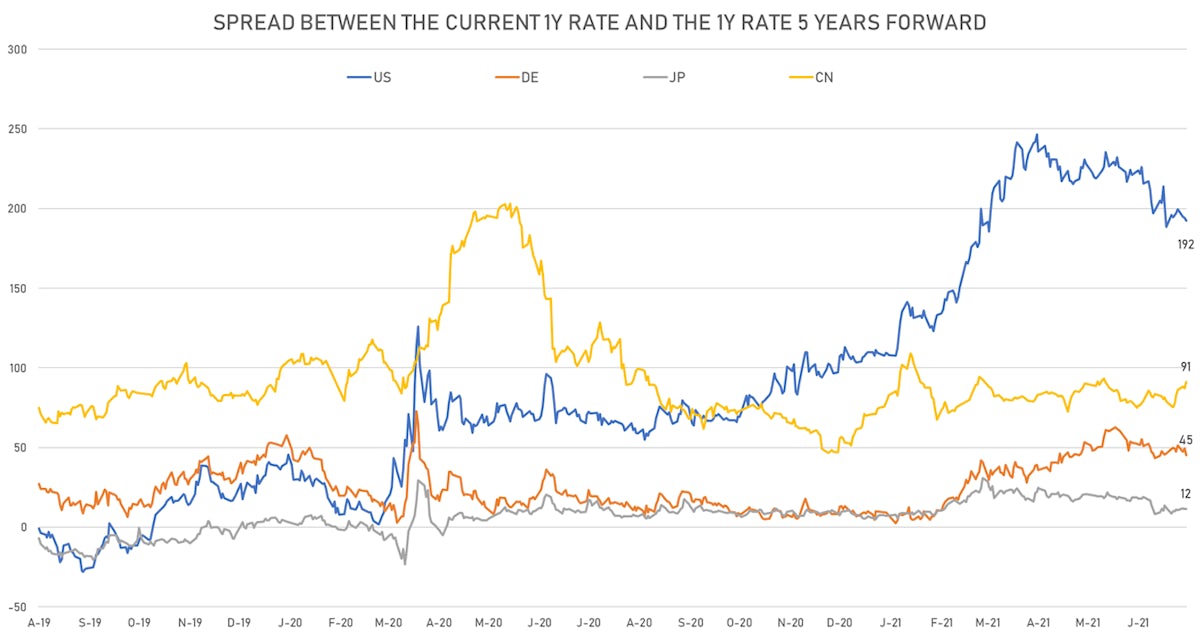

US FORWARD RATES

- 3-month USD Libor 5 years forward down 0.1 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 1.6 bp, now at 2.0216%

- 1-Year Treasury rates are now expected to increase by 192.3 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 20.5 bp over the next 18 months (equivalent to 0.8 rate hike)and 107.4 bp over the next 3 years (equivalent to 4.3 rate hikes)

US INFLATION

- TIPS 1Y breakeven inflation at 3.17% (down -0.5bp); 2Y at 2.72% (down -0.5bp); 5Y at 2.49% (up 1.4bp); 10Y at 2.32% (up 0.4bp); 30Y at 2.28% (down -0.4bp)

- 6-month spot US CPI swap up 1.3 bp to 4.452%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

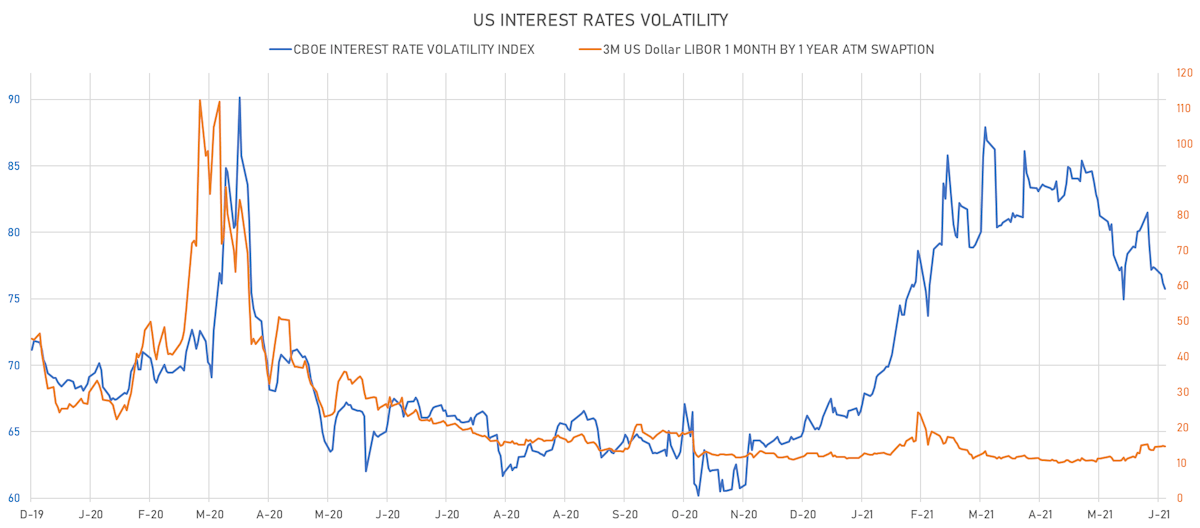

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 14.6%

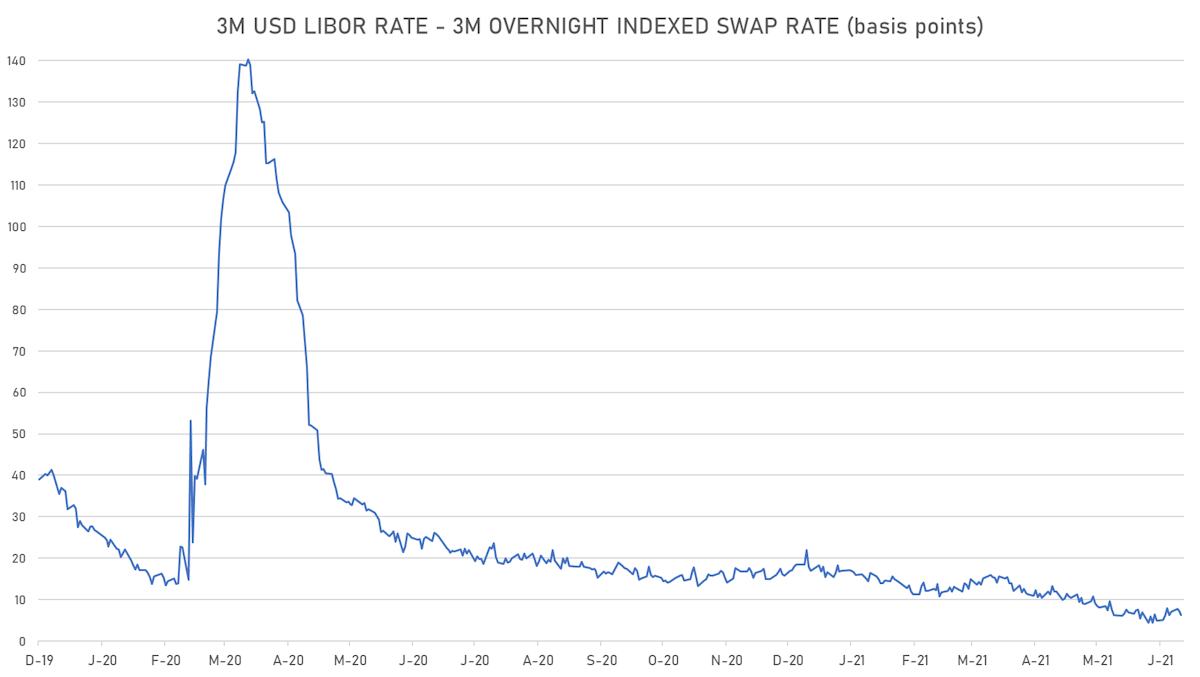

- 3-Month LIBOR-OIS spread down -0.9 bp at 6.3 bp (12-months range: 4.5-25.8 bp)

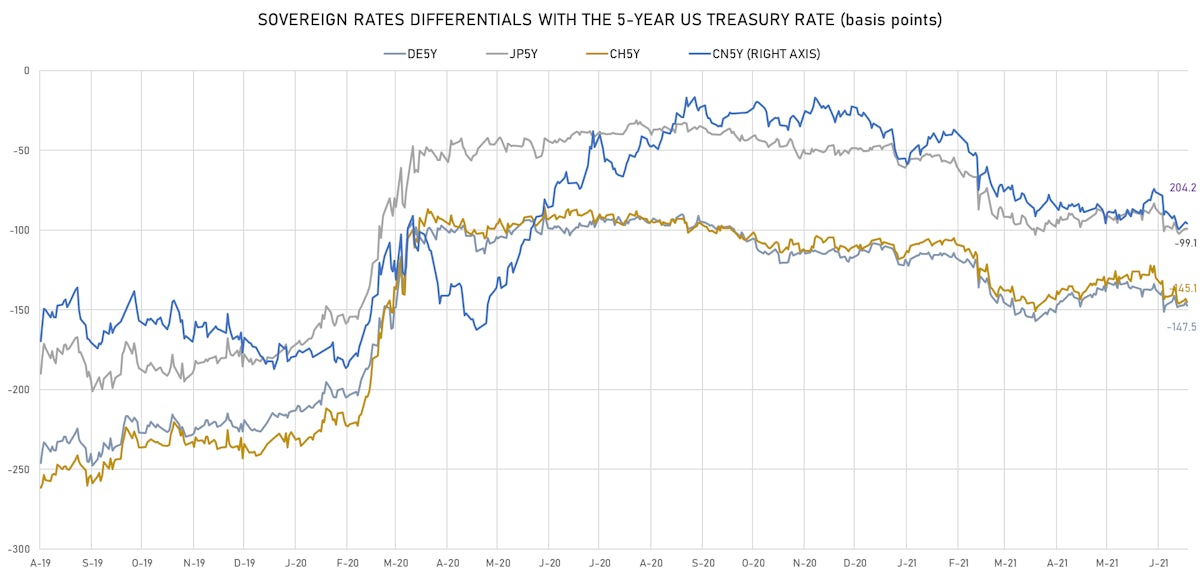

KEY INTERNATIONAL RATES

- Germany 5Y: -0.585% (down -2.1 bp); the German 1Y-10Y curve is 5.6 bp flatter at 40.2bp (YTD change: +24.9 bp)

- Japan 5Y: -0.104% (unchanged); the Japanese 1Y-10Y curve is 0.8 bp flatter at 18.1bp (YTD change: +2.3 bp)

- China 5Y: 2.933% (down -1.0 bp); the Chinese 1Y-10Y curve is 4.3 bp steeper at 76.1bp (YTD change: +29.7 bp)

- Switzerland 5Y: -0.560% (down -2.0 bp); the Swiss 1Y-10Y curve is 9.0 bp flatter at 52.4bp (YTD change: +25.7 bp)