Rates

US Curve Flattens Further, As Short Rates Rise And Long Rates Fall

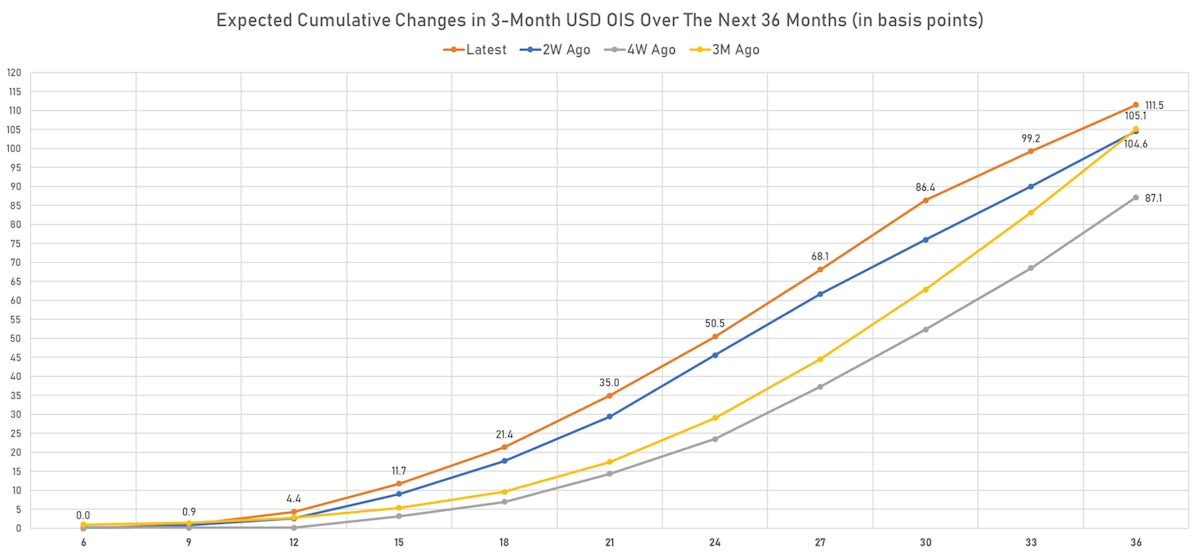

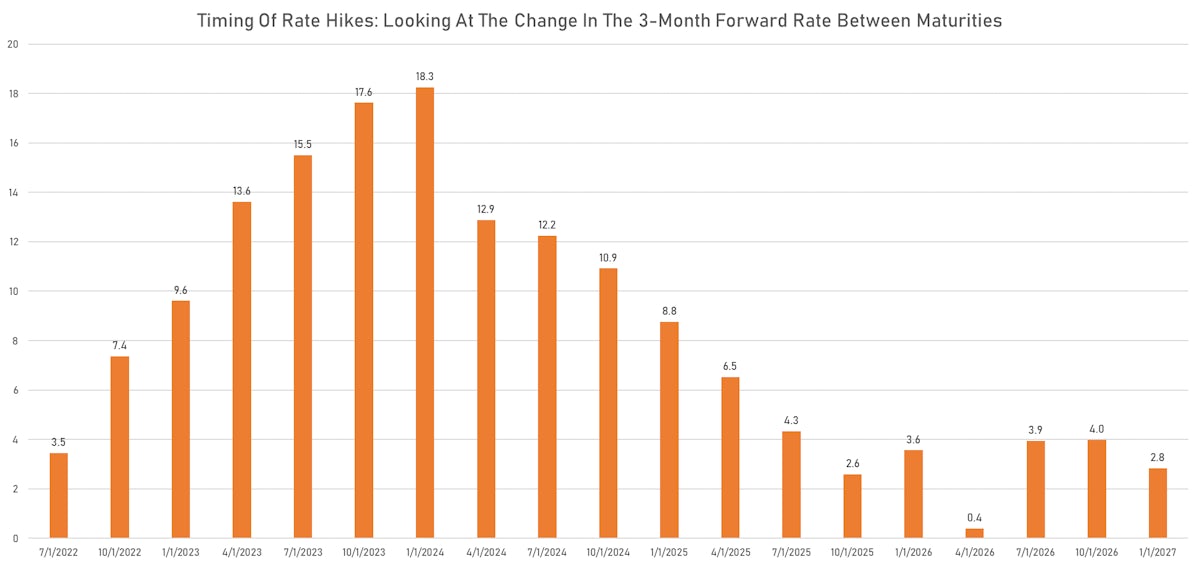

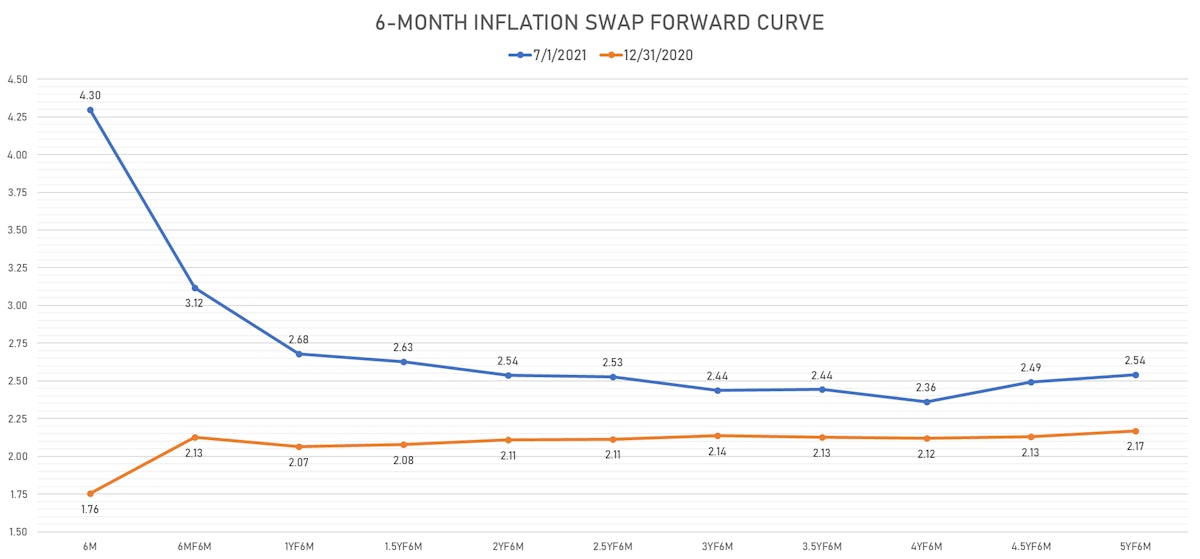

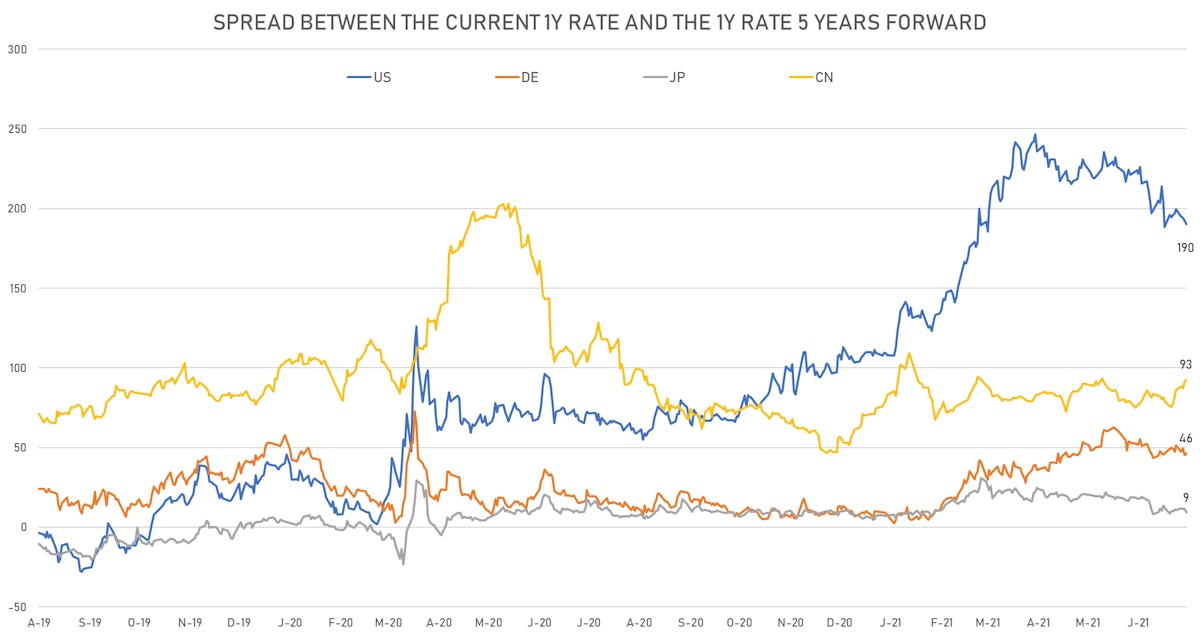

A look at the forward rates curve points to a very shallow hiking cycle for the Fed, an indication that a true normalization of rates will be difficult in an economy used to cheap financing

Published ET

Expectations of rate hikes have increased for the next 2 years and sharply decreased thereafter | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

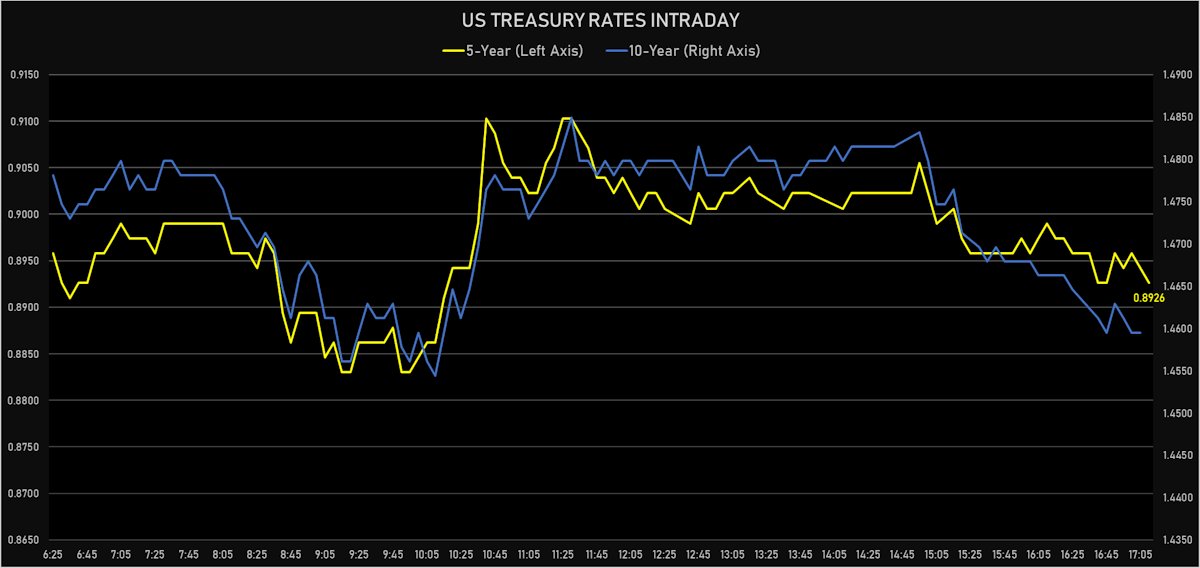

- Yield curve flattening, with the 1s10s Treasury spread tightening -0.8 bp on the day, now at 138.9 bp (YTD change: +58.4)

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2547% (up 0.2 bp)

- 5Y: 0.8926% (up 0.2 bp)

- 7Y: 1.2313% (down 0.7 bp)

- 10Y: 1.4595% (down 0.8 bp)

- 30Y: 2.0647% (down 2.4 bp)

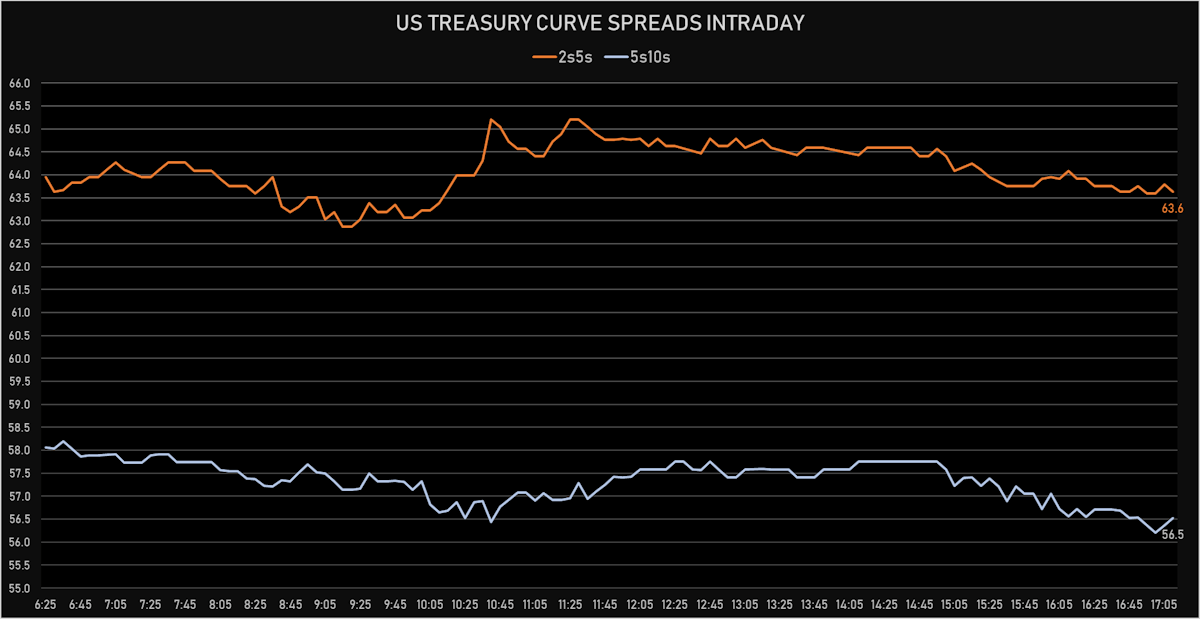

- US treasury curve spreads: 2s5s at 63.8bp (down -0.1bp today), 5s10s at 56.7bp (down -1.0bp today), 10s30s at 60.5bp (down -1.6bp today)

- Treasuries butterfly spreads: 2s5s10s at -7.5bp (down -1.0bp today), 5s10s30s at 3.6bp (down -0.2bp today)

US MACRO RELEASES

- Construction Spending, Change P/P for May 2021 (U.S. Census Bureau) at -0.30 %, below consensus estimate of 0.40 %

- ISM Manufacturing, Employment for Jun 2021 (ISM, United States) at 49.90

- ISM Manufacturing, New orders for Jun 2021 (ISM, United States) at 66.00

- ISM Manufacturing, PMI total for Jun 2021 (ISM, United States) at 60.60 , below consensus estimate of 61.00

- ISM Manufacturing, Prices for Jun 2021 (ISM, United States) at 92.10, above consensus estimate of 86.50

- Jobless Claims, National, Continued for W 19 Jun (U.S. Dept. of Labor) at 3.47 Mln, above consensus estimate of 3.38 Mln

- Jobless Claims, National, Initial for W 26 Jun (U.S. Dept. of Labor) at 364.00 k, below consensus estimate of 390.00 k

- Jobless Claims, National, Initial, four week moving average for W 26 Jun (U.S. Dept. of Labor) at 392.75 k

- Announced job layoffs - Tally (Challenger, Gray & Christmas), Volume for Jun 2021 (Challenger) at 20.48 k

- PMI, Manufacturing Sector, Total, Final for Jun 2021 (Markit Economics) at 62.10, below consensus estimate of 62.6

US FORWARD RATES

- 3-month USD Libor 5 years forward down 1.3 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 2.1 bp, now at 2.00%

- 1-Year Treasury rates are now expected to increase by 190.2 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 21.4 bp over the next 18 months (equivalent to 0.9 rate hike) and 111.5 bp over the next 3 years (equivalent to 4.5 rate hikes)

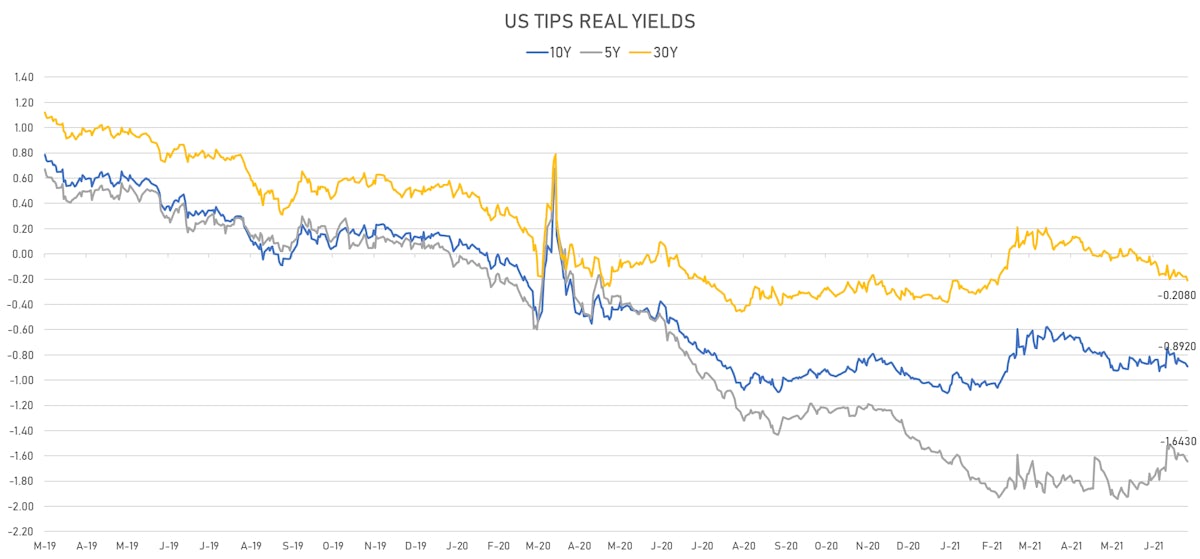

US INFLATION

- TIPS 1Y breakeven inflation at 3.18% (up 1.0bp); 2Y at 2.73% (up 1.5bp); 5Y at 2.50% (up 1.9bp); 10Y at 2.33% (up 1.0bp); 30Y at 2.29% (up 0.7bp)

- 6-month spot US CPI swap down -15.6 bp to 4.297%, with a flattening of the forward curve

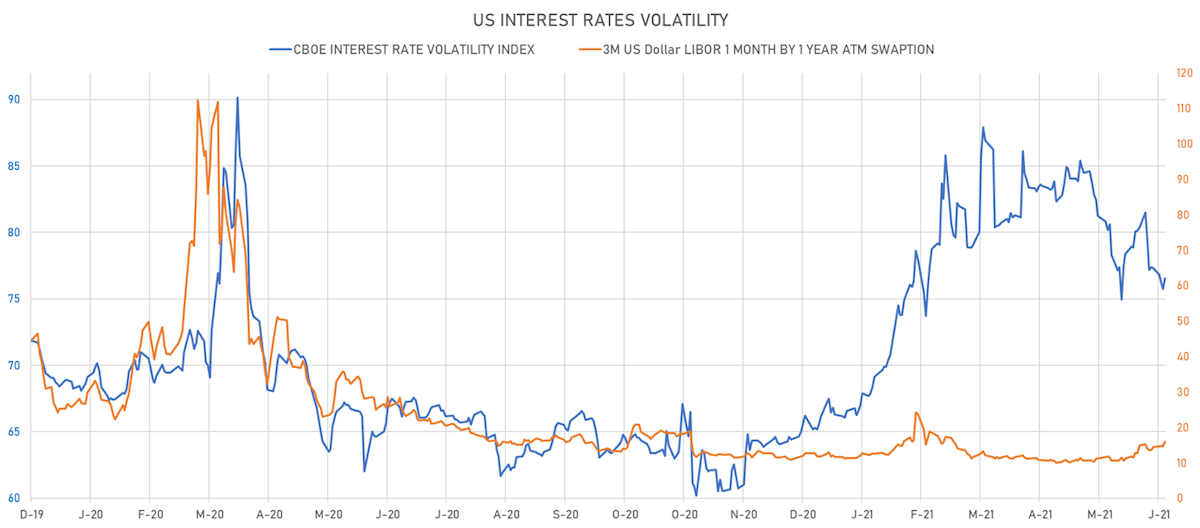

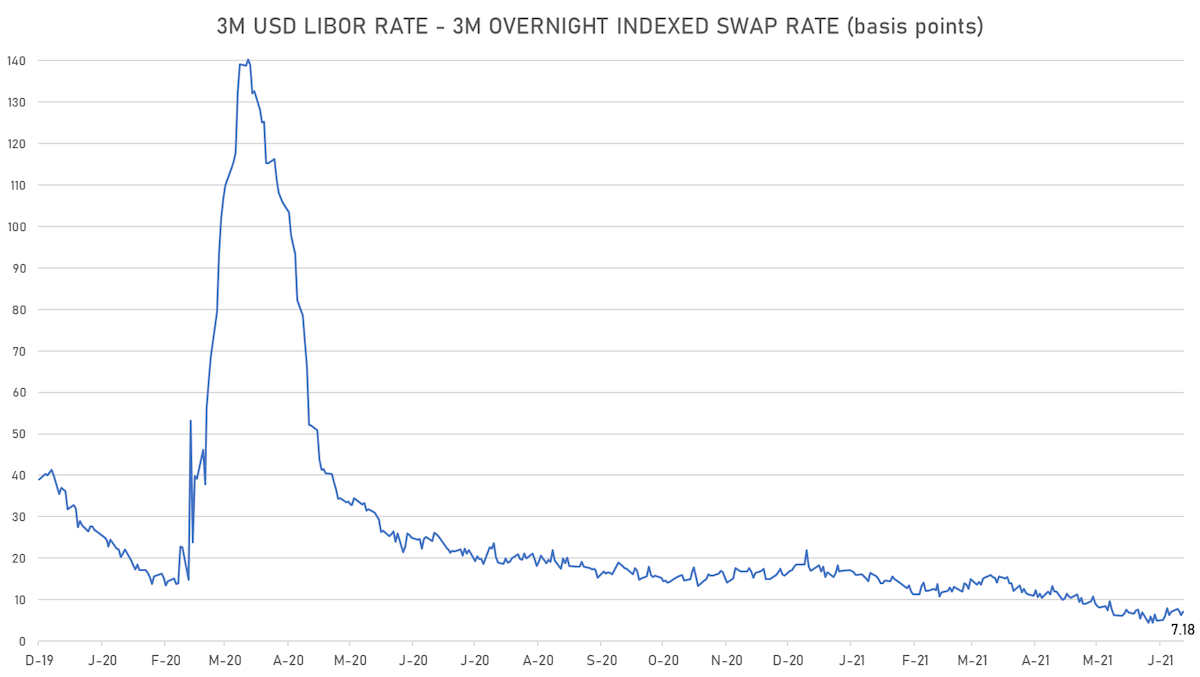

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.4% at 16.0%

- 3-Month LIBOR-OIS spread up 0.9 bp at 7.2 bp (12-months range: 4.5-25.4 bp)

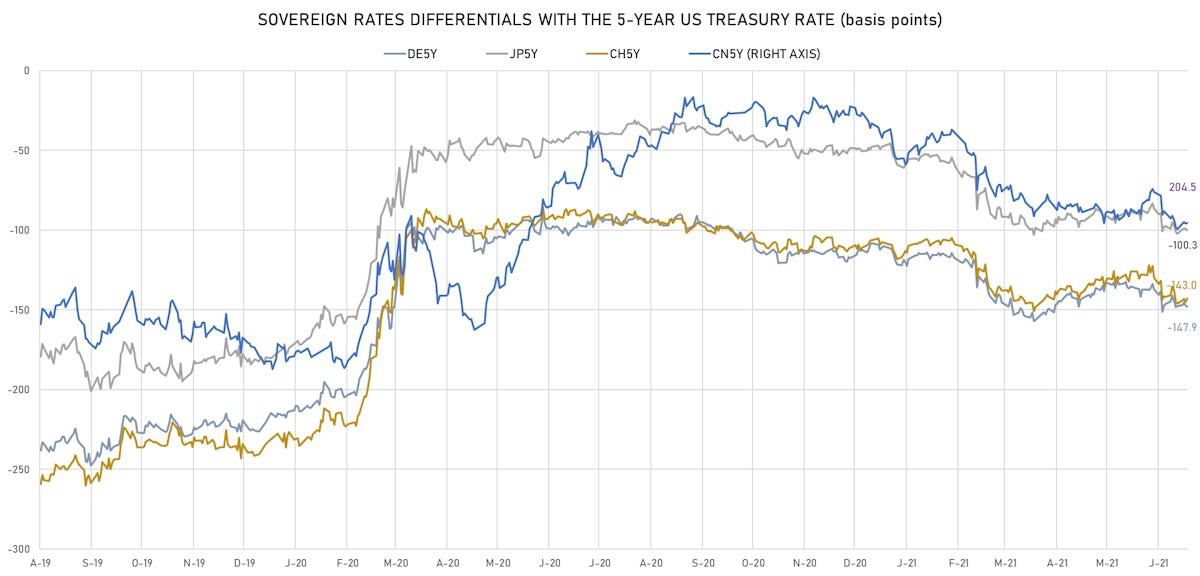

KEY INTERNATIONAL RATES

- Germany 5Y: -0.588% (down -0.2 bp); the German 1Y-10Y curve is 2.4 bp steeper at 42.6bp (YTD change: +27.3 bp)

- Japan 5Y: -0.102% (down -1.0 bp); the Japanese 1Y-10Y curve is 1.2 bp flatter at 14.9bp (YTD change: +1.1 bp)

- China 5Y: 2.938% (up 0.5 bp); the Chinese 1Y-10Y curve is 2.8 bp steeper at 78.9bp (YTD change: +32.5 bp)

- Switzerland 5Y: -0.537% (up 2.3 bp); the Swiss 1Y-10Y curve is 5.0 bp steeper at 57.1bp (YTD change: +30.7 bp)