Rates

Weak ISM Causes Significant Repricing Of The US Rates Curve

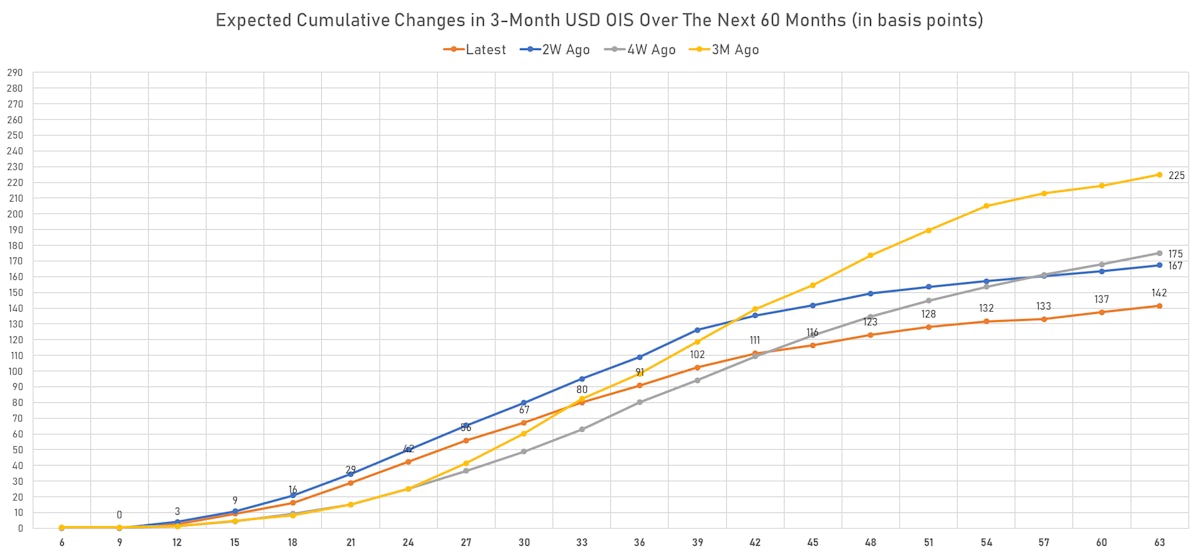

The probability of a 25bp rate hike before the end of the 2022 has dropped to 60%, from over 80% last week, and the number of rate hikes expected over the next 3 years dropped from 4.3 to 3.6

Published ET

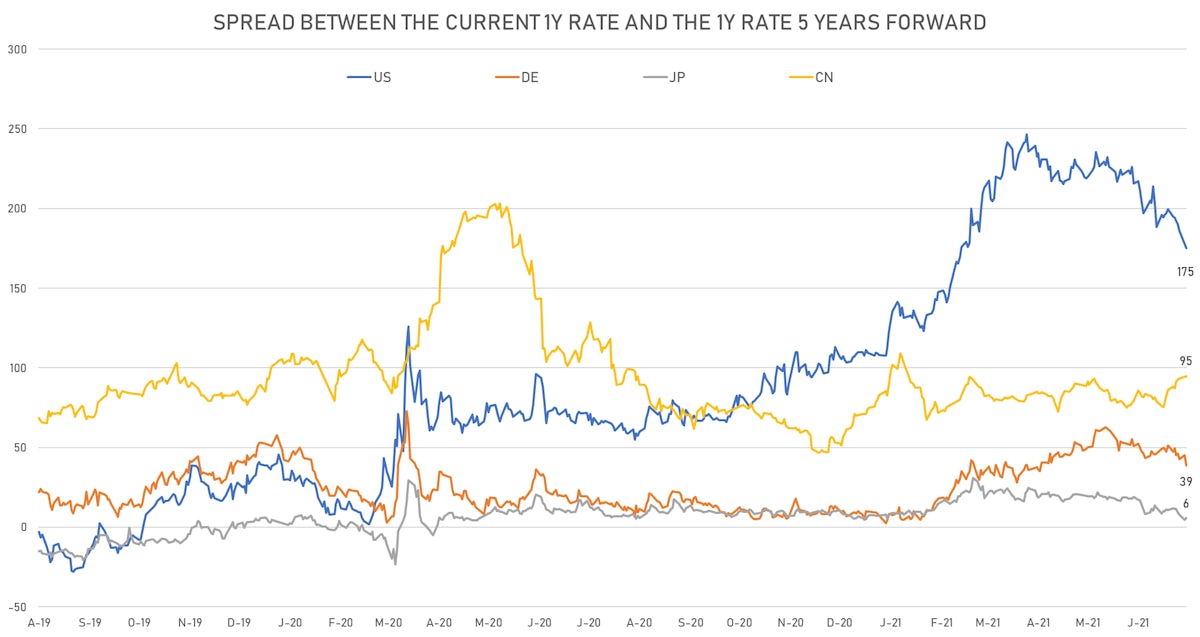

Expected Changes In 1Y Treasury Rates Over The Next 5 Years | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

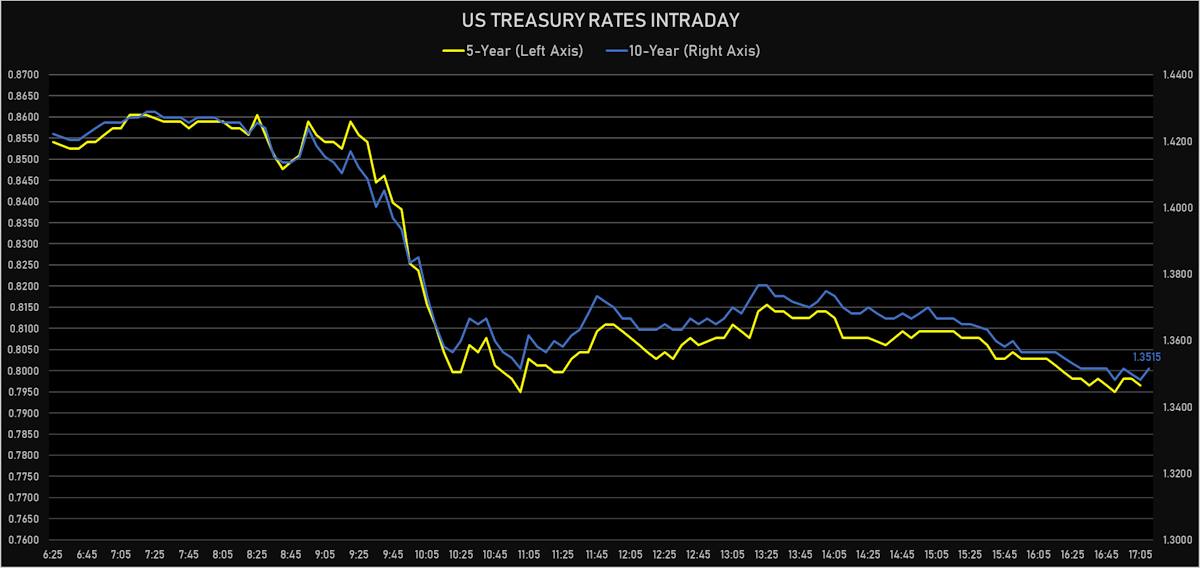

- Yield curve flattening, with the 1s10s Treasury spread tightening -7.9 bp on the day, now at 128.1 bp (YTD change: +47.6)

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2199% (down 1.8 bp)

- 5Y: 0.7965% (down 6.3 bp)

- 7Y: 1.1170% (down 7.7 bp)

- 10Y: 1.3515% (down 7.9 bp)

- 30Y: 1.9818% (down 6.3 bp)

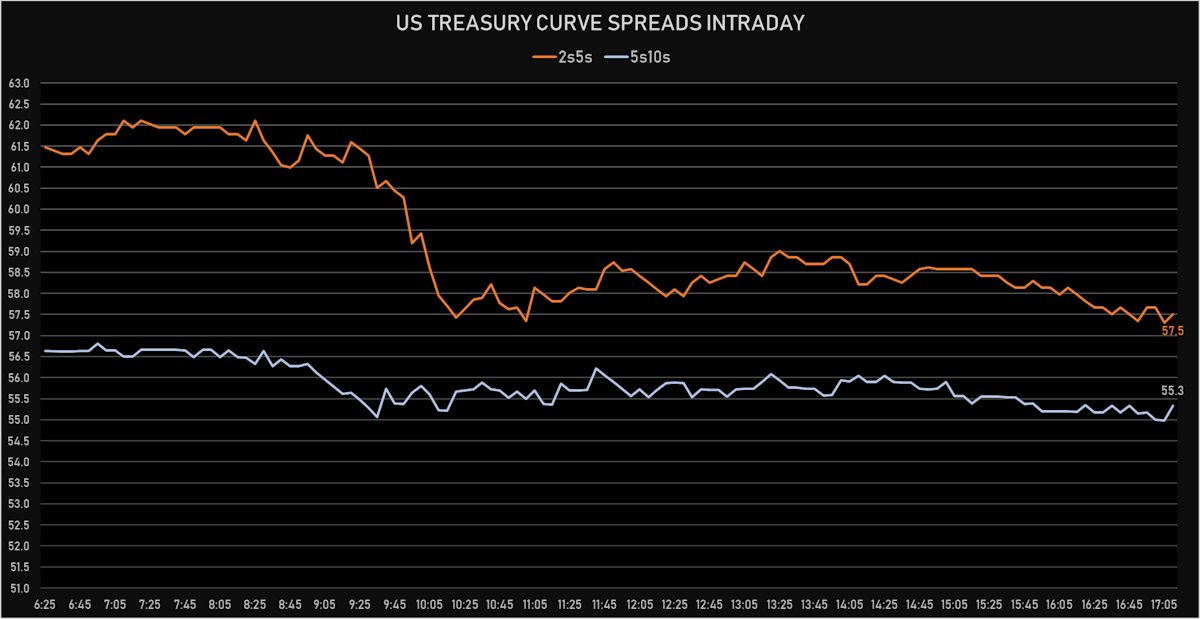

- US treasury curve spreads: 2s5s at 57.7bp (down -4.5bp today), 5s10s at 55.5bp (down -1.5bp today), 10s30s at 63.0bp (up 1.5bp today)

US MACRO RELEASES

- ISM Non-manufacturing, Business activity for Jun 2021 (ISM, United States) at 60.40 , below consensus estimate of 66.40

- ISM Non-manufacturing, Employment for Jun 2021 (ISM, United States) at 49.30

- ISM Non-manufacturing, New orders for Jun 2021 (ISM, United States) at 62.10

- ISM Non-manufacturing, NMI/PMI for Jun 2021 (ISM, United States) at 60.10 , below consensus estimate of 63.50

- ISM Non-manufacturing, Prices for Jun 2021 (ISM, United States) at 79.50

- The Conference Board Employment Trends Index (ETI) for Jun 2021 (The Conference Board) at 109.84

- PMI, Composite, Output, Final for Jun 2021 (Markit Economics) at 63.70, below consensus estimate of 63.90

- PMI, Services Sector, Business Activity, Final for Jun 2021 (Markit Economics) at 64.60, below consensus of 64.80

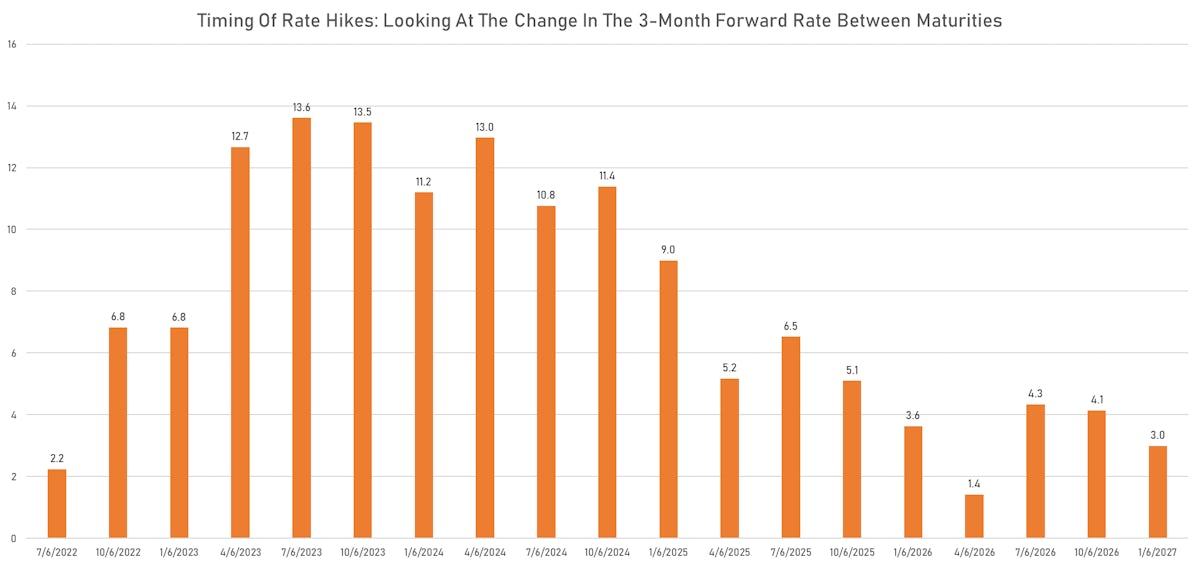

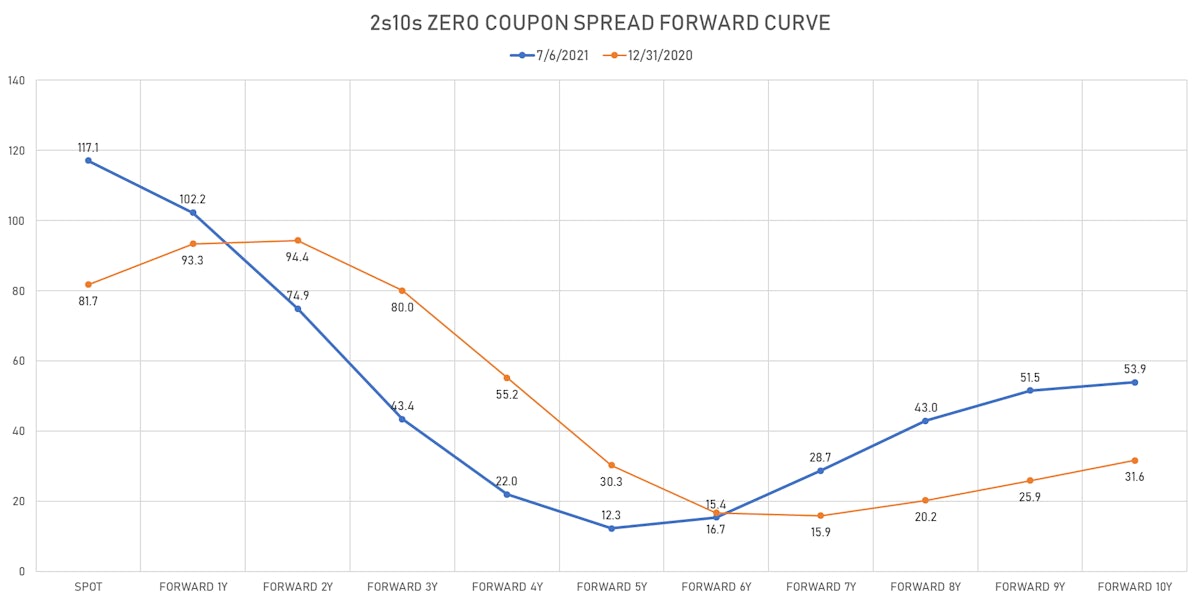

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.6 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 11.3 bp, now at 1.8384%

- 1-Year Treasury rates are now expected to increase by 175.0 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 16.2 bp over the next 18 months (equivalent to 0.6 rate hike) and 90.8 bp over the next 3 years (equivalent to 3.6 rate hikes)

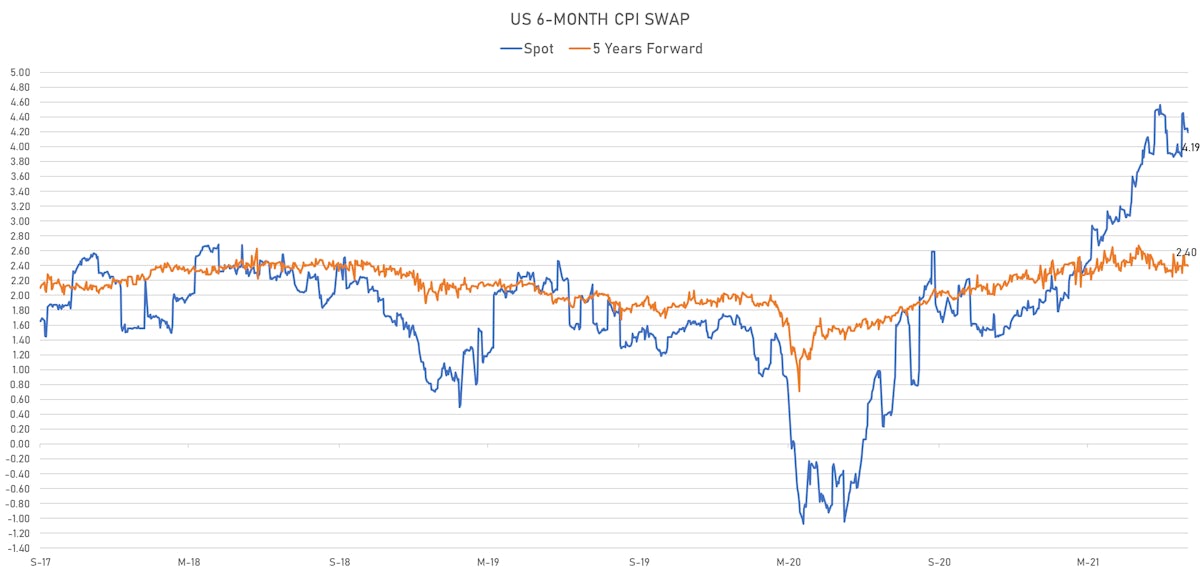

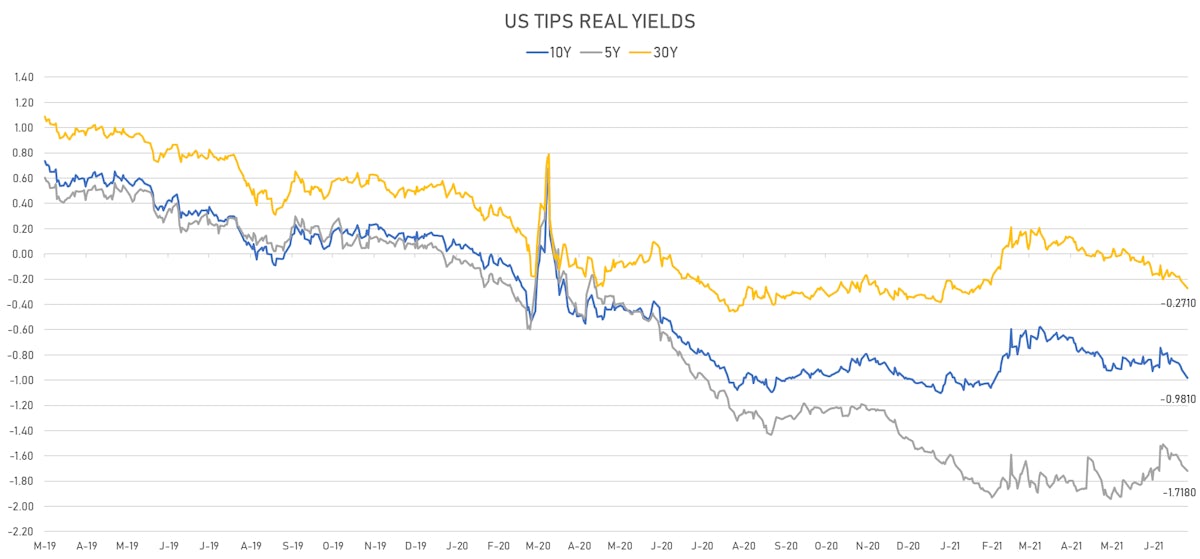

US INFLATION

- TIPS 1Y breakeven inflation at 3.02% (down -8.8bp); 2Y at 2.66% (down -2.9bp); 5Y at 2.49% (down -1.6bp); 10Y at 2.31% (down -1.2bp); 30Y at 2.27% (down -0.8bp)

- 6-month spot US CPI swap down -5.7 bp to 4.193%, with a flattening of the forward curve

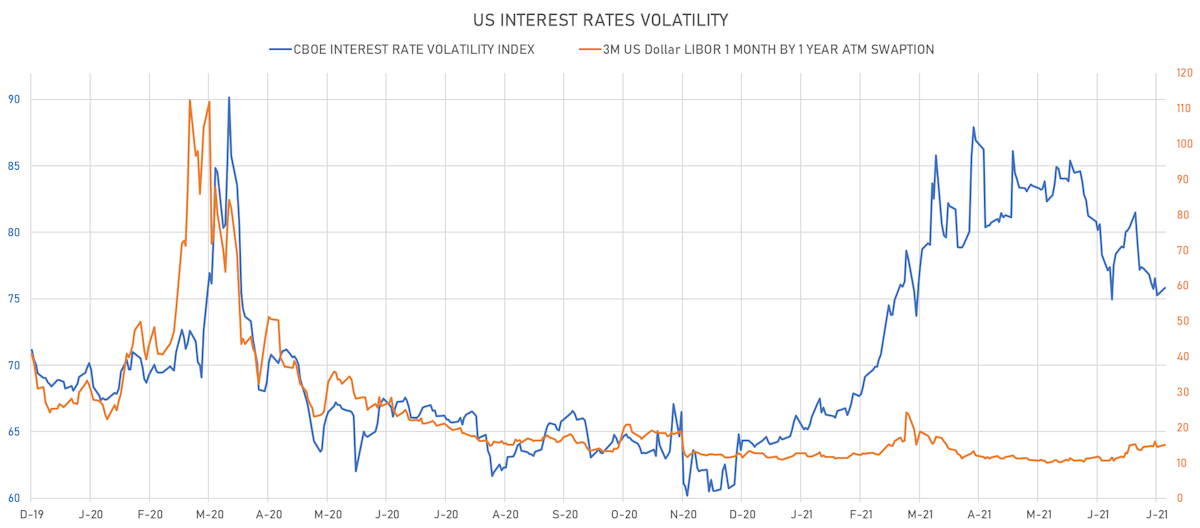

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.6% at 15.0%

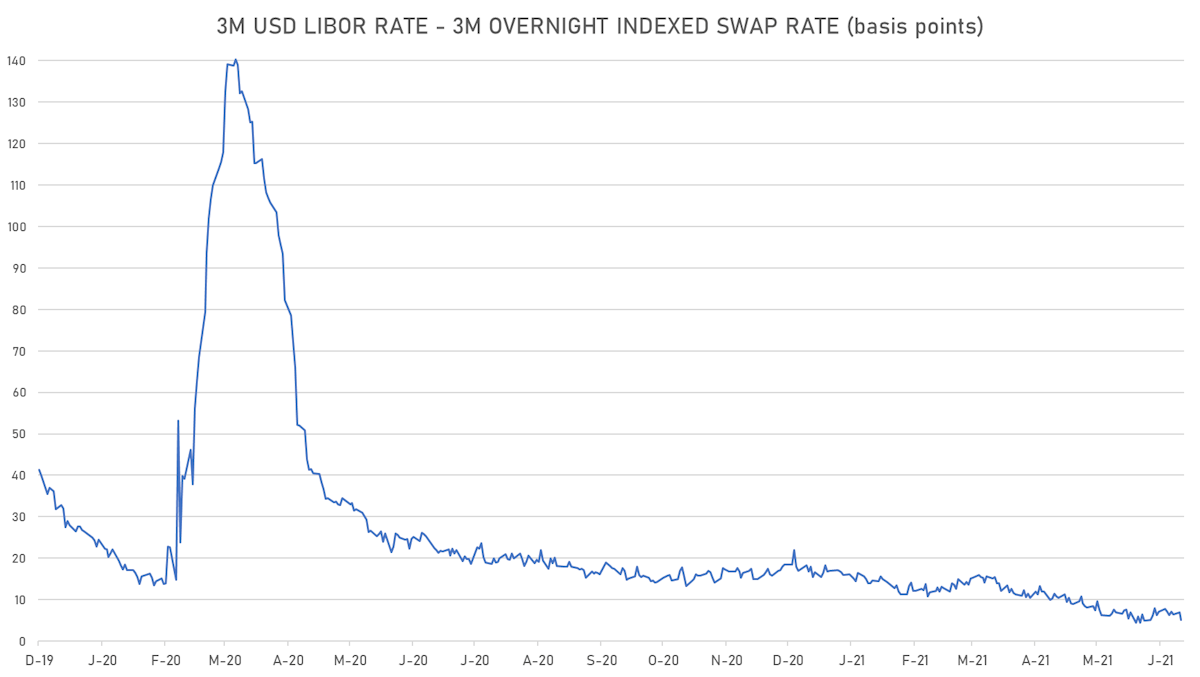

- 3-Month LIBOR-OIS spread down -1.8 bp at 5.2 bp (12-months range: 4.5-23.6 bp)

KEY INTERNATIONAL RATES

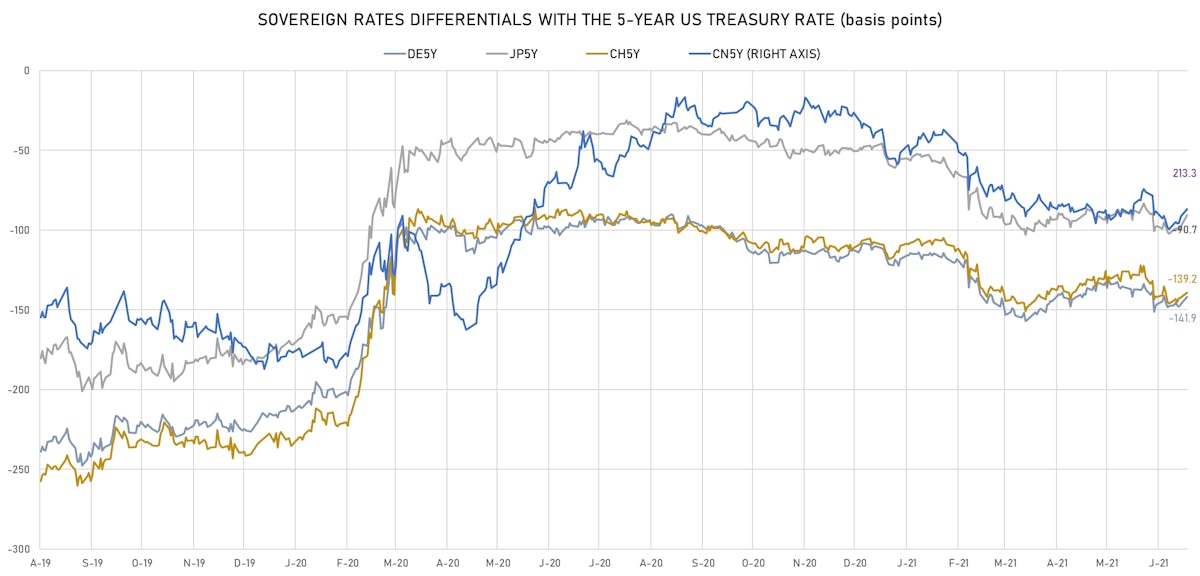

- Germany 5Y: -0.619% (down -3.9 bp); the German 1Y-10Y curve is 3.1 bp flatter at 39.1bp (YTD change: +23.4 bp)

- Japan 5Y: -0.108% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 15.1bp (YTD change: +0.8 bp)

- China 5Y: 2.929% (up 0.1 bp); the Chinese 1Y-10Y curve is 1.8 bp steeper at 82.3bp (YTD change: +35.9 bp)

- Switzerland 5Y: -0.595% (down -3.9 bp); the Swiss 1Y-10Y curve is 4.6 bp flatter at 51.9bp (YTD change: +24.5 bp)