Rates

Another Day Of Bull Flattening For The US Curve, As FOMC Minutes Stress Patience

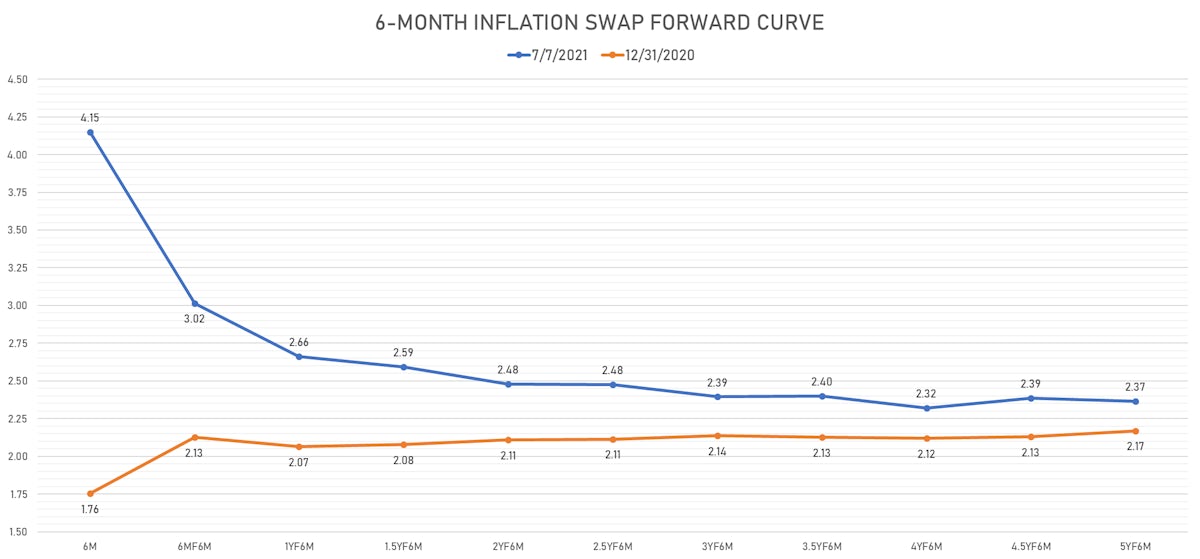

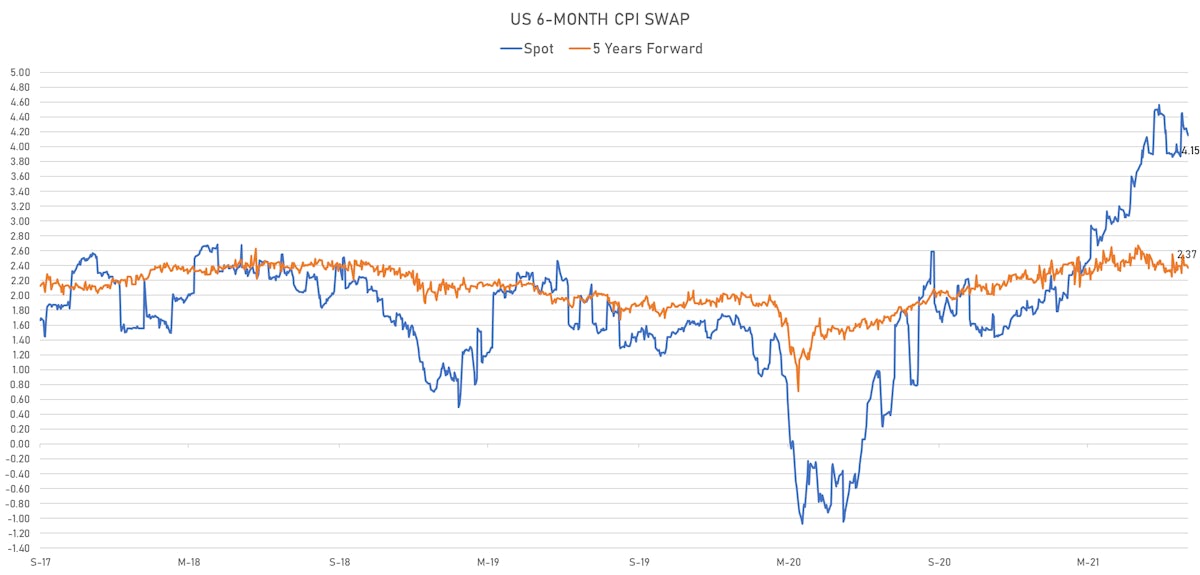

Short-term inflation expectations dropped again today and mid-term inflation expectations were stable, thereby slightly flattening the inflation swap curve (still at elevated level)

Published ET

The US 3-month 2-year treasury spread has given back more than half of the June FOMC gains | Source: Refinitiv

QUICK US SUMMARY

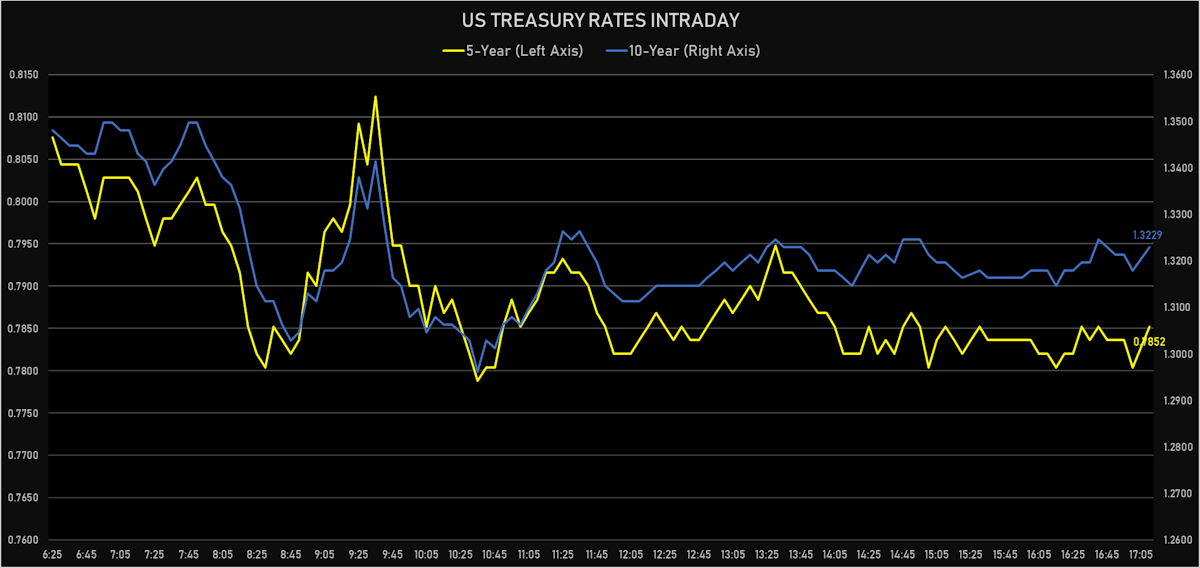

- Yield curve flattening, with the 1s10s Treasury spread tightening -2.9 bp on the day, now at 125.7 bp (YTD change: +45.2)

- 1Y: 0.0660% (unchanged)

- 2Y: 0.2181% (down 0.2 bp)

- 5Y: 0.7852% (down 1.1 bp)

- 7Y: 1.0961% (down 2.1 bp)

- 10Y: 1.3229% (down 2.9 bp)

- 30Y: 1.9423% (down 4.0 bp)

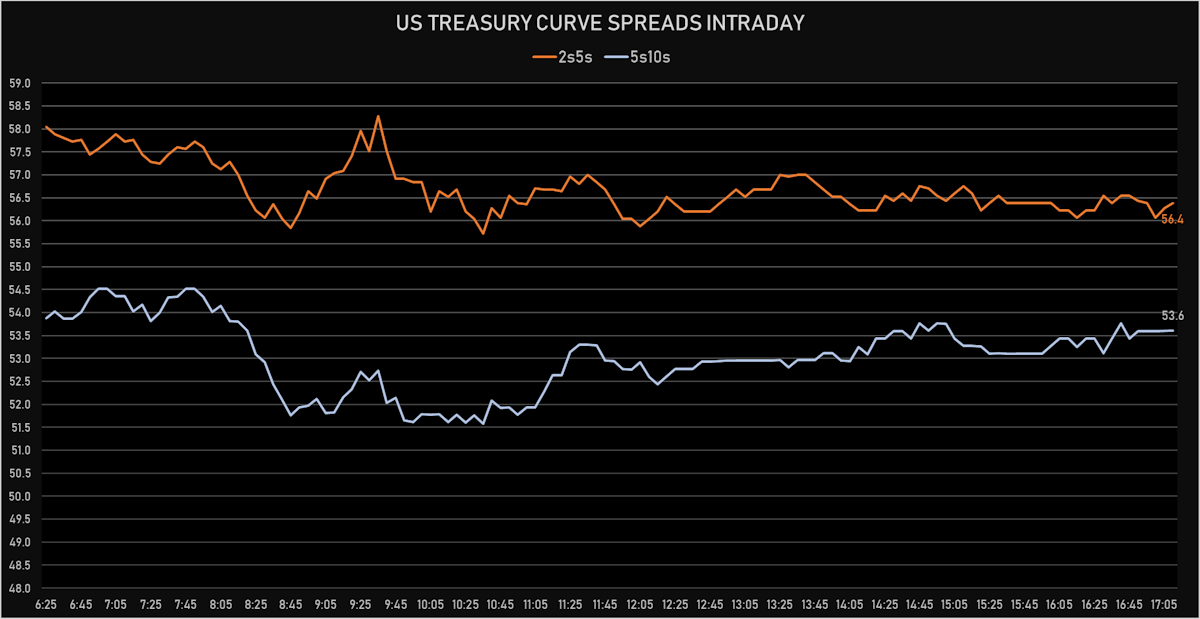

- US treasury curve spreads: 2s5s at 56.7bp (down -1.1bp today), 5s10s at 53.9bp (down -1.7bp today), 10s30s at 62.0bp (down -1.0bp today)

- Treasuries butterfly spreads: 2s5s10s at -3.3bp (down -0.8bp today), 5s10s30s at 8.2bp (up 1.1bp today)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 03 Jul (Redbook Research) at 19.40 %

- JOLTS Job Openings for May 2021 (BLS, U.S Dep. Of Lab) at 9.21 Mln, below consensus estimate of 9.39 Mln

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 02 Jul (MBA, USA) at -1.80 %

- Mortgage applications, market composite index for W 02 Jul (MBA, USA) at 627.00

- Mortgage applications, market composite index, purchase for W 02 Jul (MBA, USA) at 252.40

- Mortgage applications, market composite index, refinancing for W 02 Jul (MBA, USA) at 2,791.30

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 02 Jul (MBA, USA) at 3.15 %

US FORWARD RATES

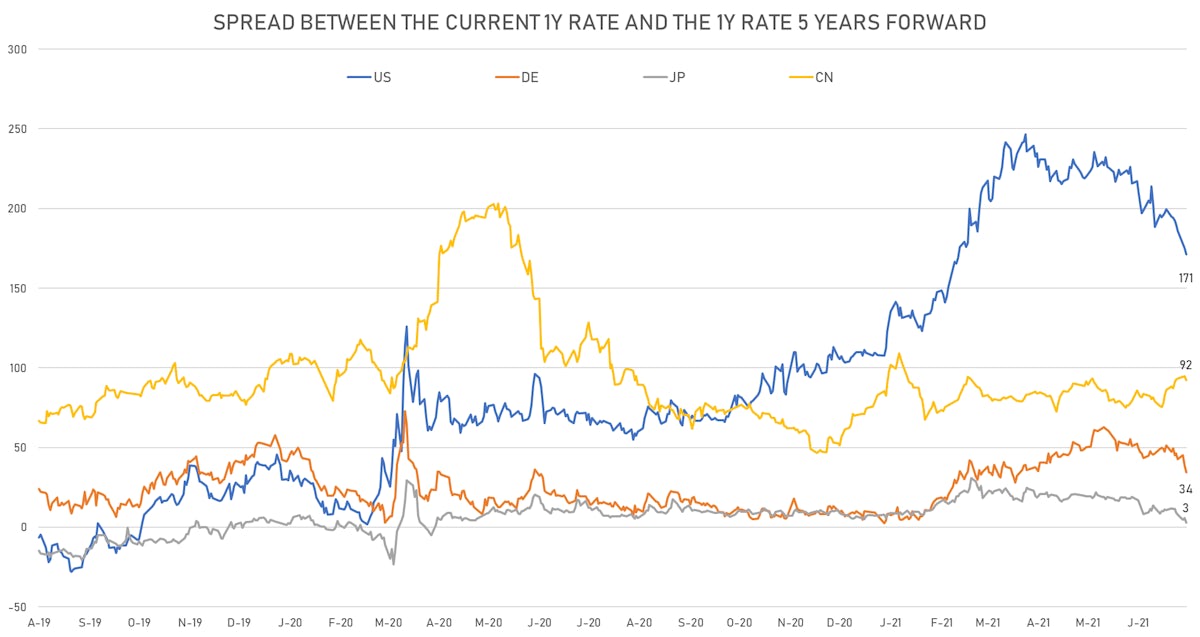

- 3-month USD Libor 5 years forward up 1.8 bp

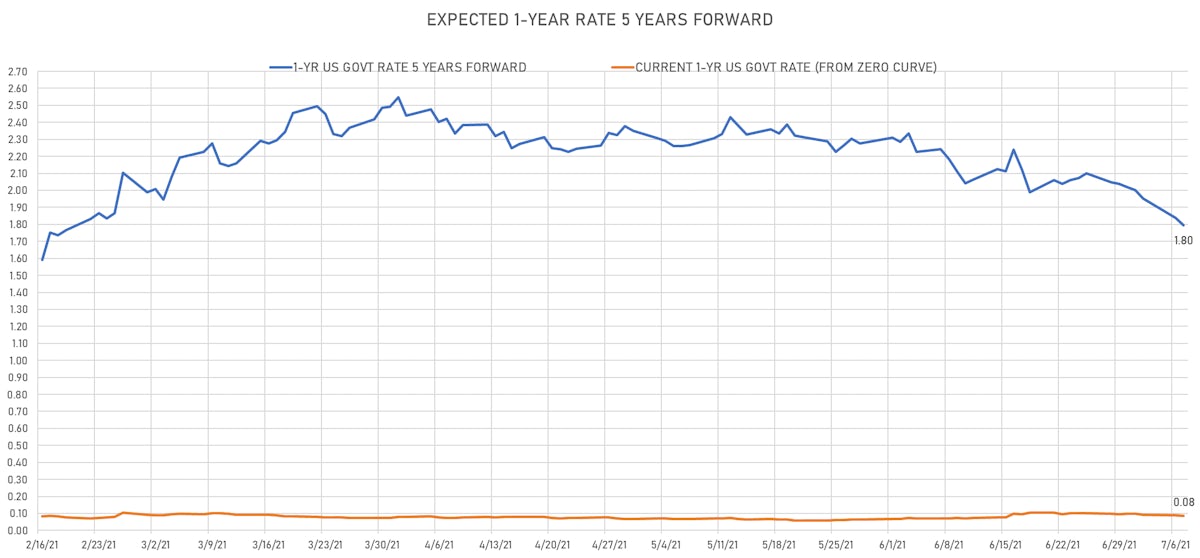

- US Treasury 1-year zero-coupon rate 5 years forward down 4.2 bp, now at 1.7962%

- 1-Year Treasury rates are now expected to increase by 171.1 bp over the next 5 years

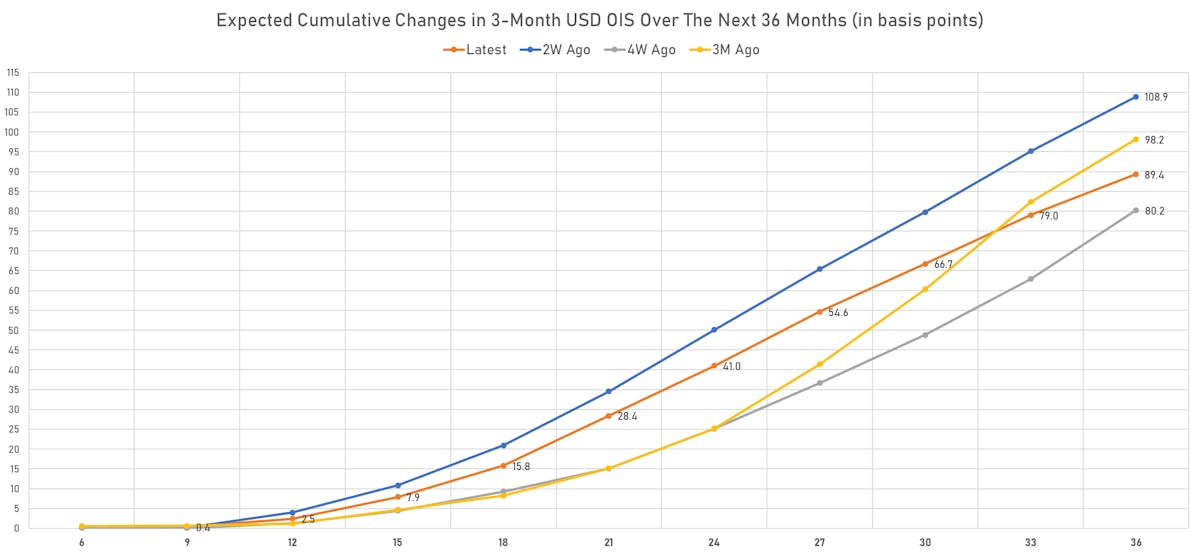

- The market currently expects the 3-month USD OIS rate to rise by 15.8 bp over the next 18 months (equivalent to 0.6 rate hike) and 89.4 bp over the next 3 years (equivalent to 3.6 rate hikes)

US INFLATION

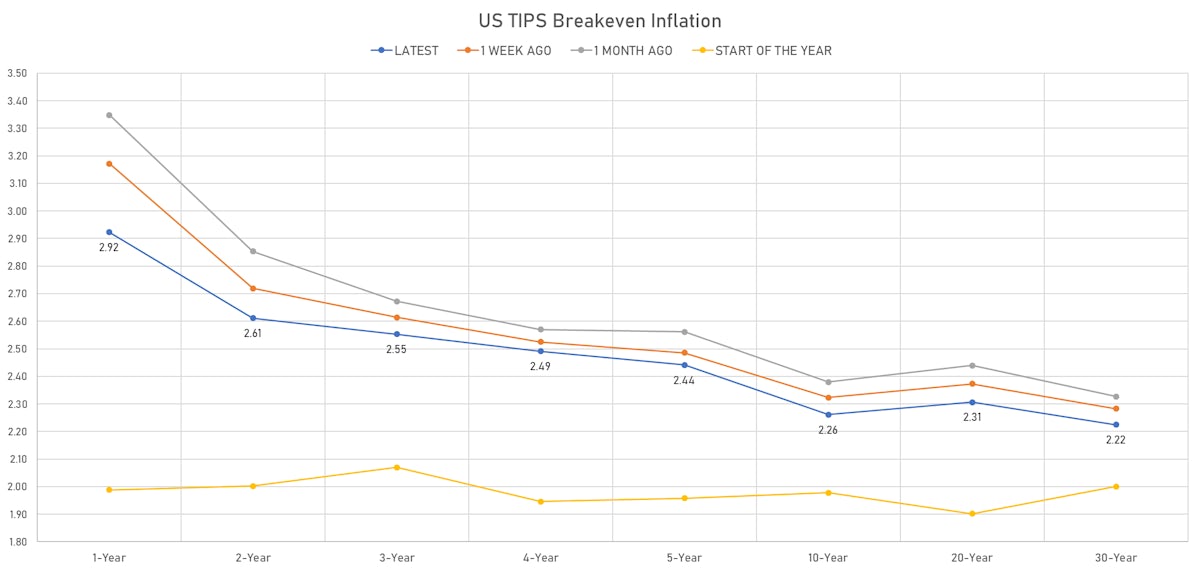

- TIPS 1Y breakeven inflation at 2.92% (down -9.7bp); 2Y at 2.61% (down -5.2bp); 5Y at 2.44% (down -4.5bp); 10Y at 2.26% (down -5.2bp); 30Y at 2.22% (down -4.5bp)

- 6-month spot US CPI swap down -4.4 bp to 4.15%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

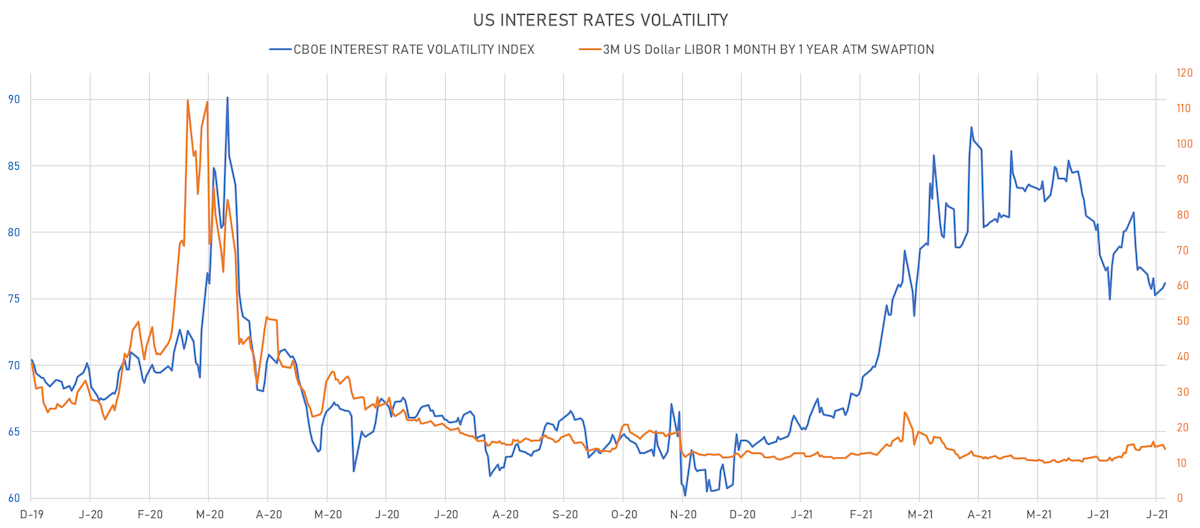

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.1% at 13.9%

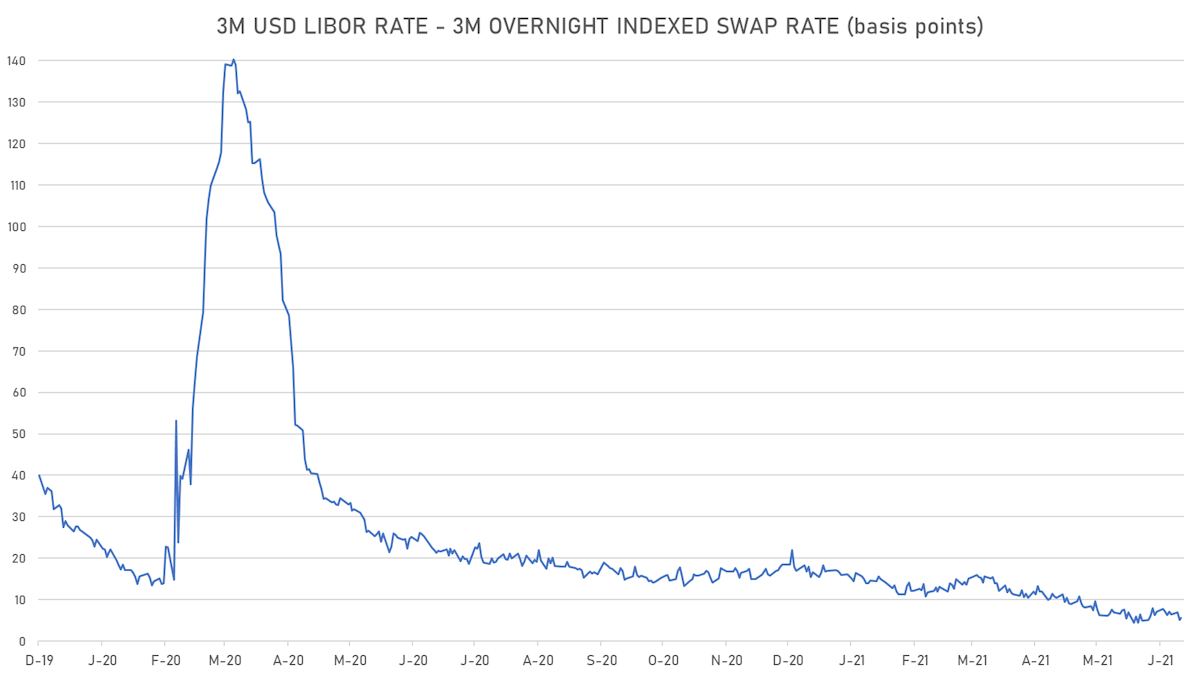

- 3-Month LIBOR-OIS spread up 0.5 bp at 5.7 bp (12-months range: 4.5-23.6 bp)

KEY INTERNATIONAL RATES

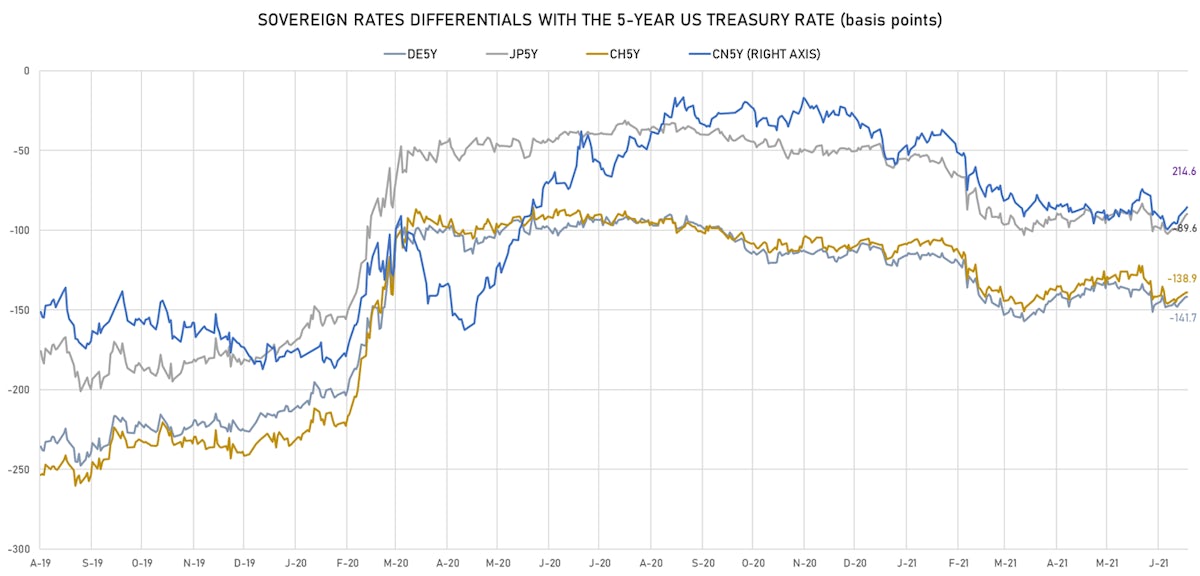

- Germany 5Y: -0.638% (down -1.0 bp); the German 1Y-10Y curve is 1.6 bp flatter at 36.2bp (YTD change: +21.8 bp)

- Japan 5Y: -0.102% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 13.8bp (YTD change: -0.1 bp)

- China 5Y: 2.931% (up 0.2 bp); the Chinese 1Y-10Y curve is 0.8 bp flatter at 81.5bp (YTD change: +35.1 bp)

- Switzerland 5Y: -0.604% (down -0.9 bp); the Swiss 1Y-10Y curve is 4.9 bp flatter at 50.0bp (YTD change: +19.6 bp)