Rates

US Rates Rebound Strongly From The Belly Out

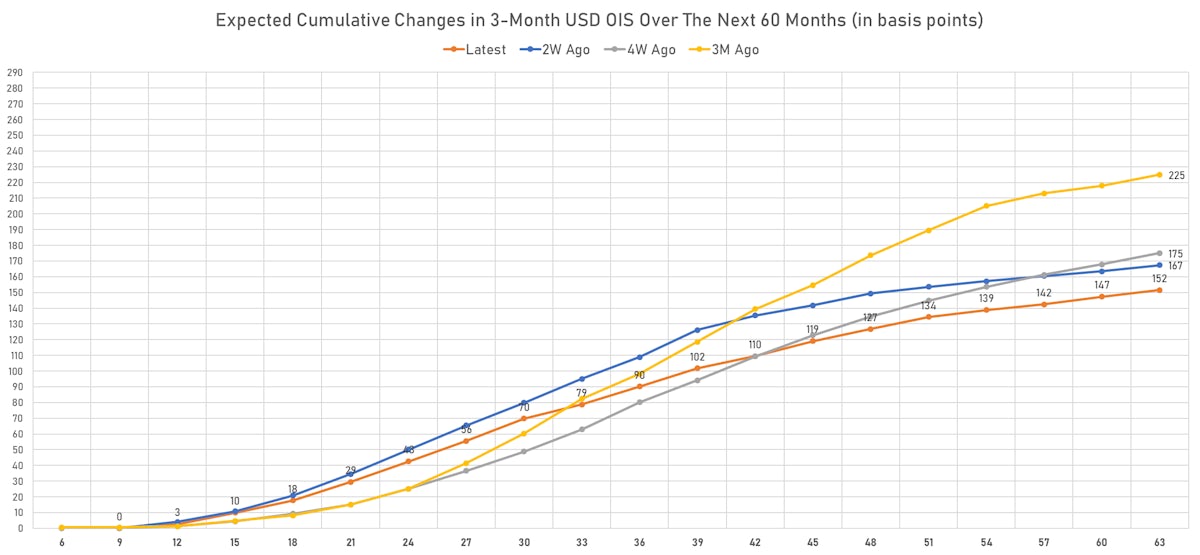

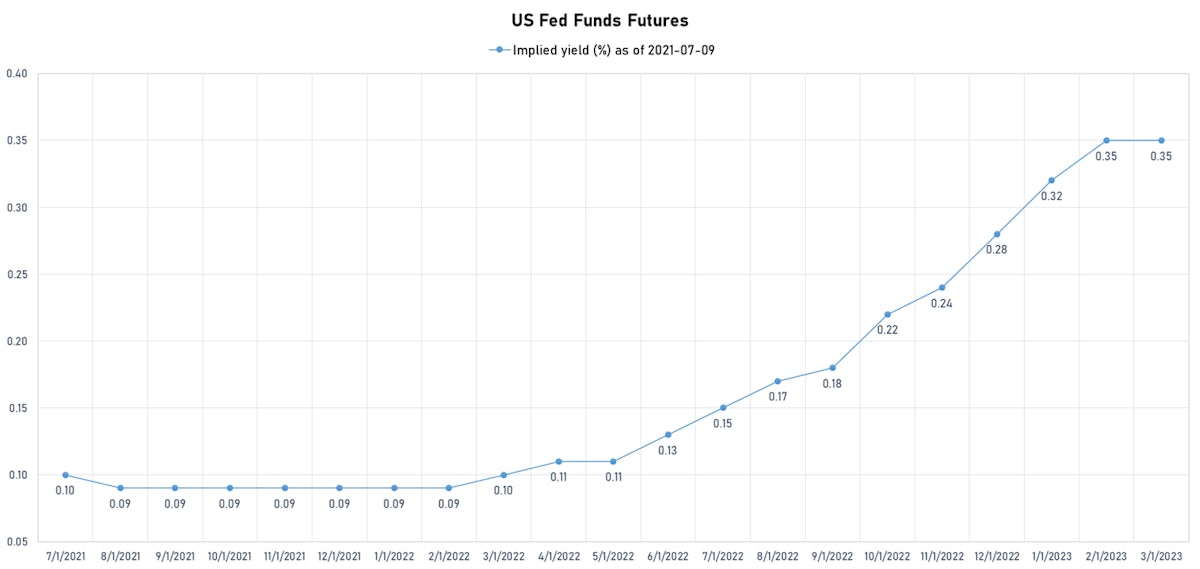

The most notable move in the past month (post FOMC) has been the sharp drop in the expected terminal rate, which fell even lower this week in a confirmation that we are unlikely to see a return of the roaring '20s (market now more worried about growth than inflation)

Published ET

Rate hikes priced into the 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1s10s Treasury spread widening 6.4 bp on the day, now at 129.8 bp (YTD change: +49.4)

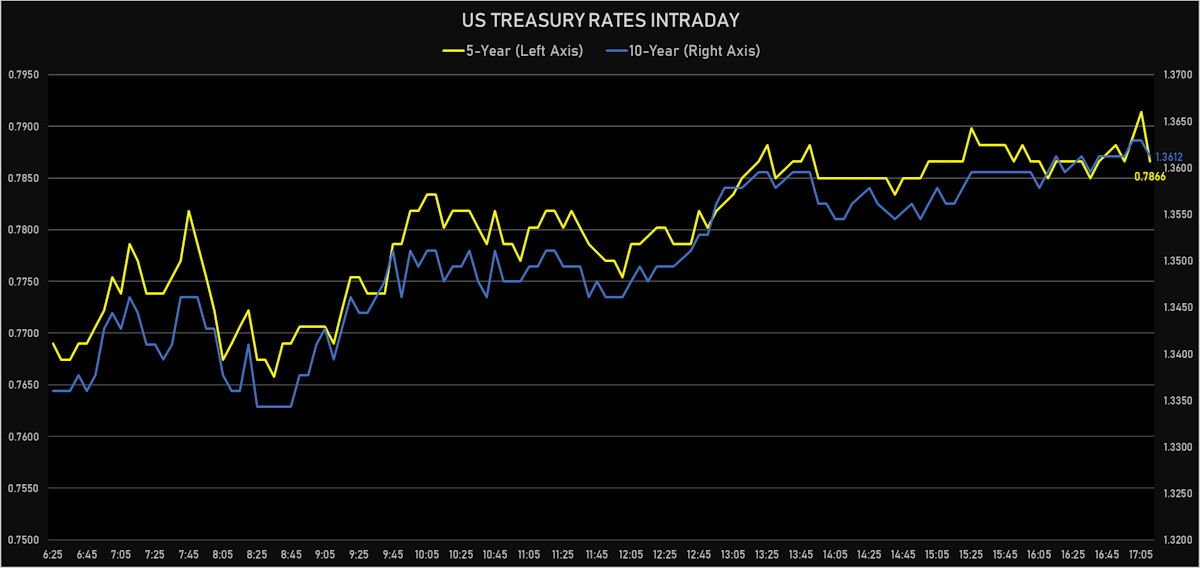

- 1Y: 0.0630% (up 0.3 bp)

- 2Y: 0.2146% (up 1.8 bp)

- 5Y: 0.7866% (up 4.5 bp)

- 7Y: 1.1144% (up 5.3 bp)

- 10Y: 1.3612% (up 6.7 bp)

- 30Y: 1.9896% (up 6.4 bp)

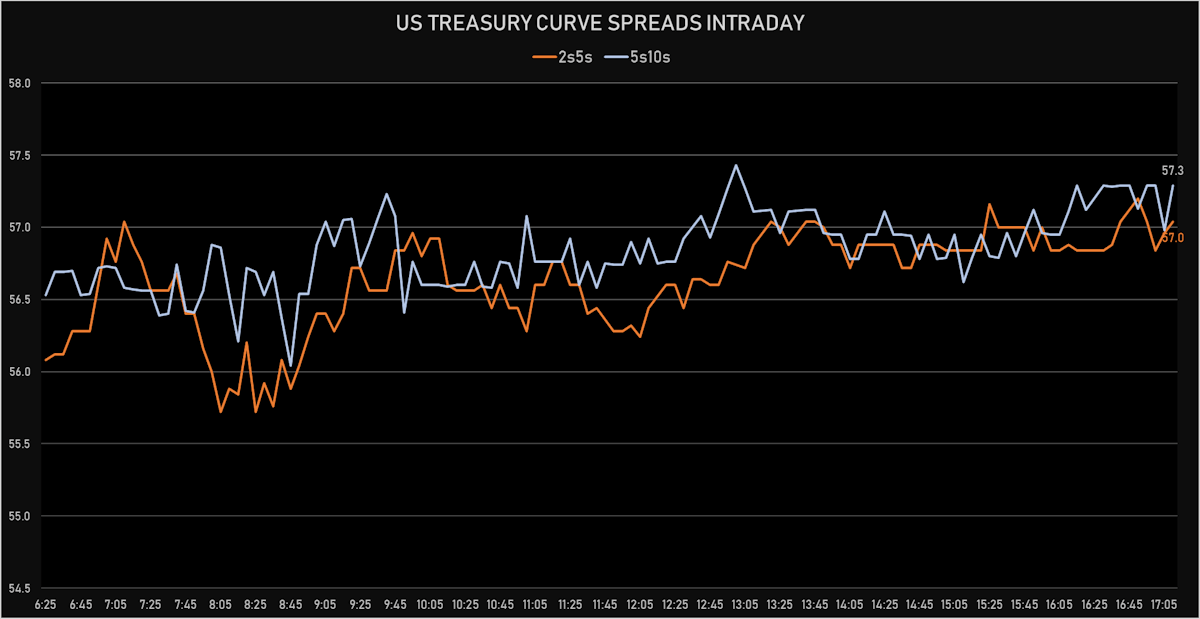

- US treasury curve spreads: 2s5s at 57.2bp (up 2.6bp today), 5s10s at 57.5bp (up 2.2bp today), 10s30s at 62.9bp (down -0.2bp today)

- Treasuries butterfly spreads: 2s5s10s at -0.1bp (down -0.4bp today), 5s10s30s at 4.8bp (down -3.4bp today)

US MACRO RELEASES

- Wholesale Inventories, Change P/P for May 2021 (U.S. Census Bureau) at 1.30 %, above consensus estimate of 1.10 %

- Wholesale Trade, Change P/P for May 2021 (U.S. Census Bureau) at 0.80 %

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.7 bp

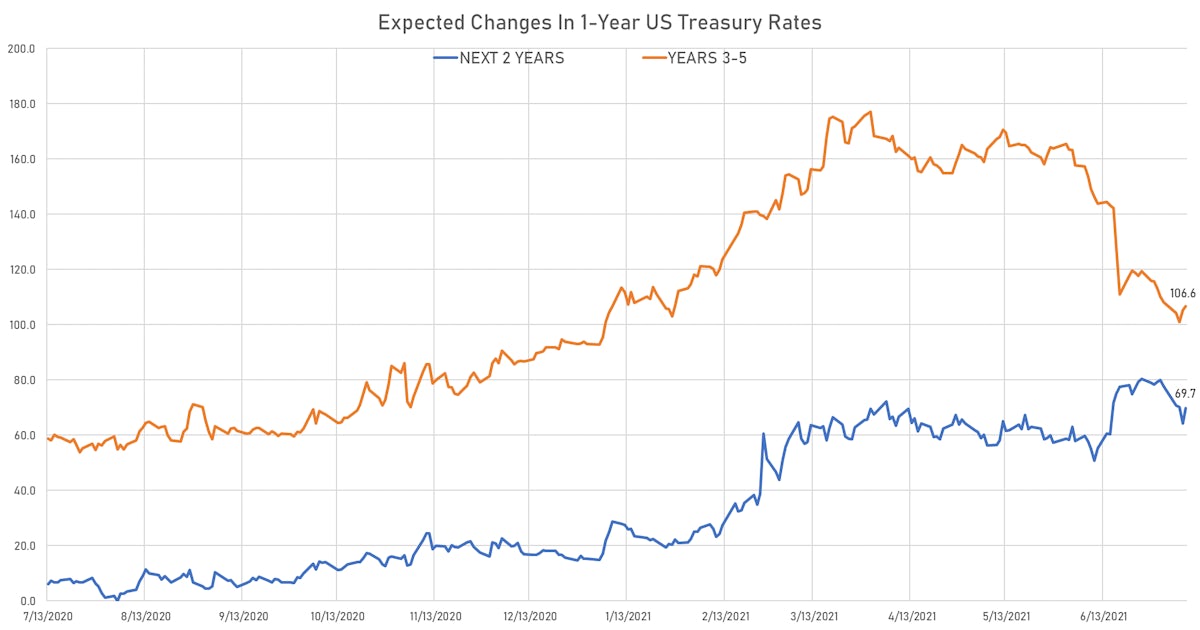

- US Treasury 1-year zero-coupon rate 5 years forward up 7.2 bp, now at 1.8498%

- 1-Year Treasury rates are now expected to increase by 176.4 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 17.7 bp over the next 18 months (equivalent to 0.71 rate hike) and 90.2 bp over the next 3 years (equivalent to 3.61 rate hikes)

- That means the market is currently placing a 71% probability that rate hikes start before the end of 2022

US INFLATION

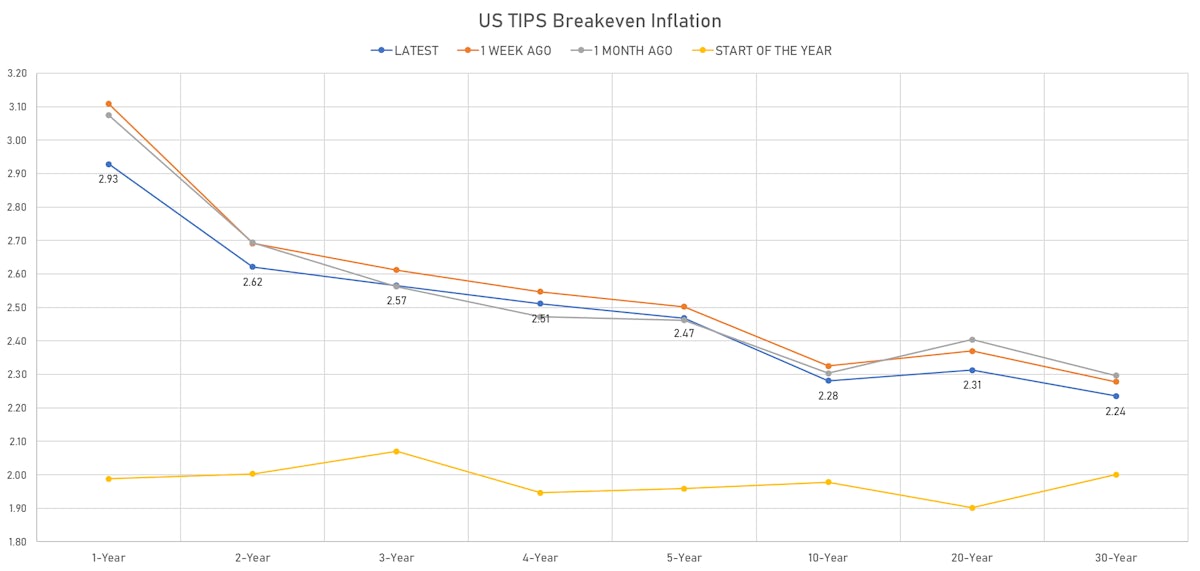

- TIPS 1Y breakeven inflation at 2.93% (up 0.5bp); 2Y at 2.62% (up 3.4bp); 5Y at 2.47% (up 6.5bp); 10Y at 2.28% (up 5.8bp); 30Y at 2.24% (up 5.2bp)

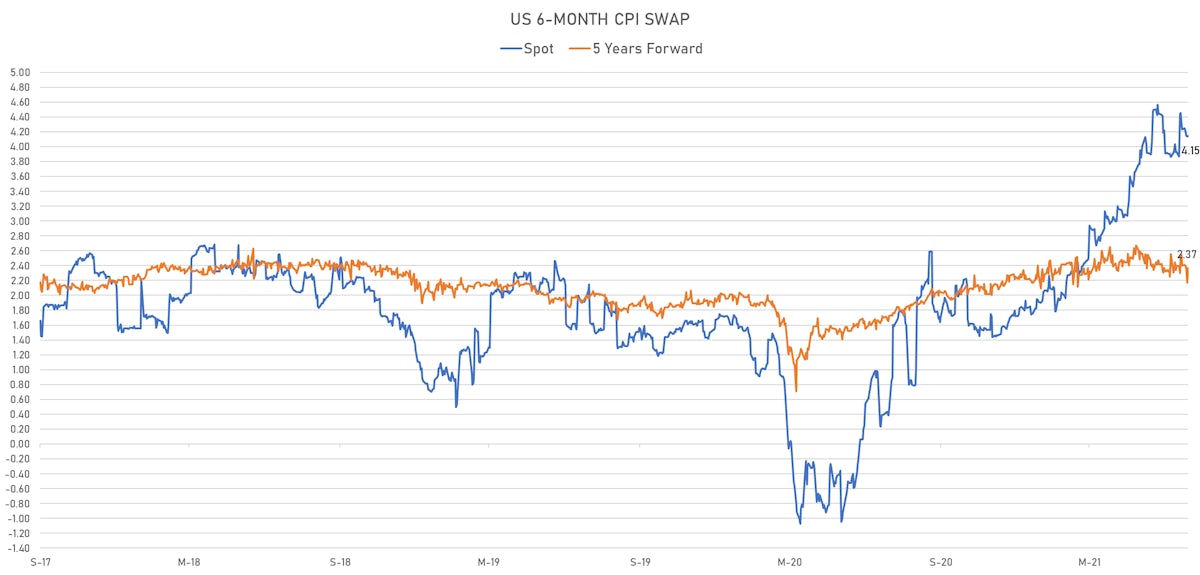

- 6-month spot US CPI swap up 1.3 bp to 4.146%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

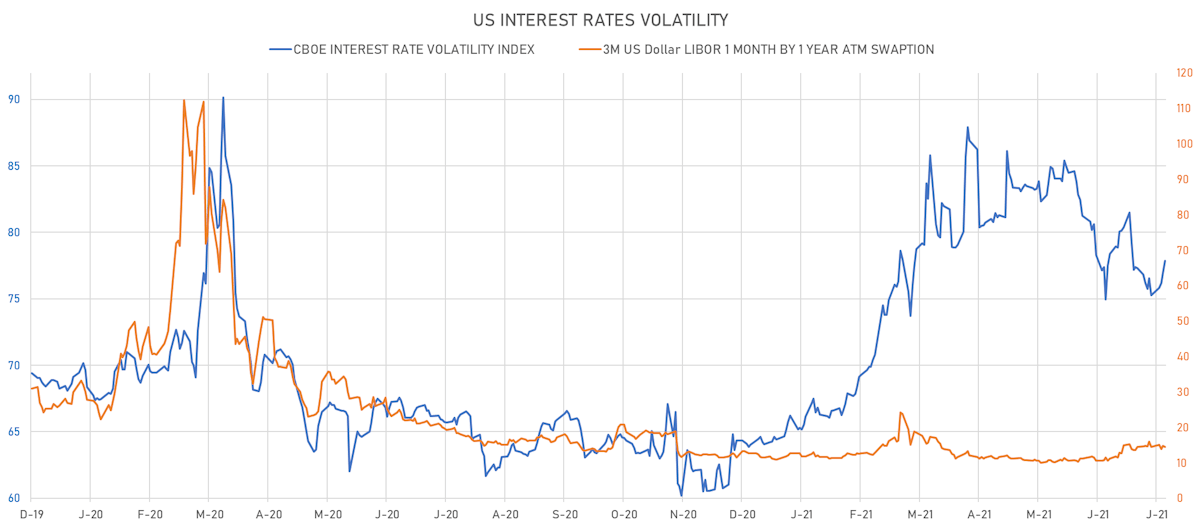

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.2% at 14.5%

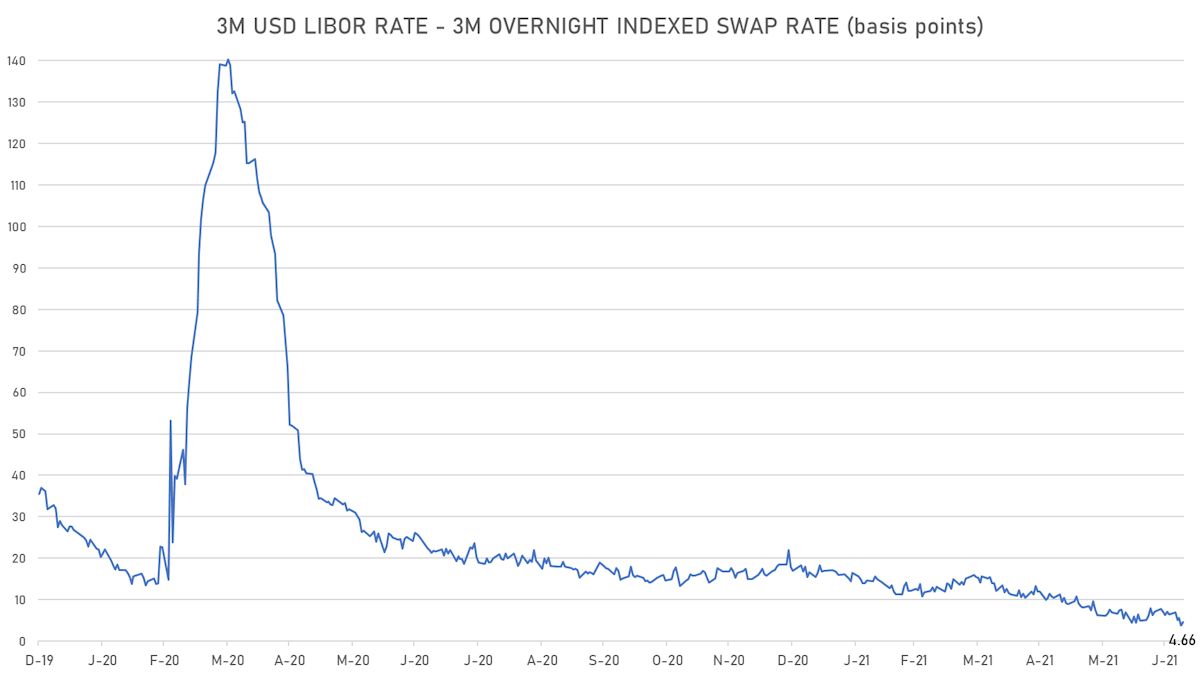

- 3-Month LIBOR-OIS spread up 1.0 bp at 4.7 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

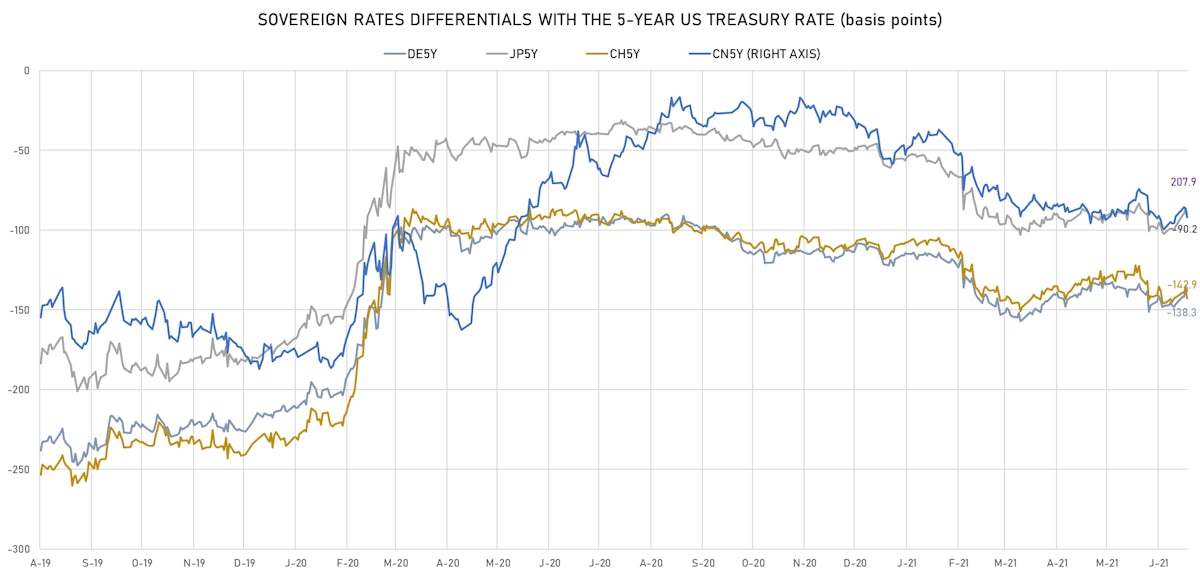

- Germany 5Y: -0.597% (up 1.3 bp); the German 1Y-10Y curve is 1.0 bp steeper at 37.3bp (YTD change: +22.0 bp)

- Japan 5Y: -0.107% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.6 bp steeper at 14.0bp (YTD change: +0.3 bp)

- China 5Y: 2.866% (down -1.2 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 89.3bp (YTD change: +42.9 bp)

- Switzerland 5Y: -0.642% (down -1.8 bp); the Swiss 1Y-10Y curve is 3.3 bp steeper at 51.1bp (YTD change: +23.7 bp)