Rates

US Rates Curve Steepens, As The Probability Of Fed Funds Hike In The Next 18 Months Rises To 97%

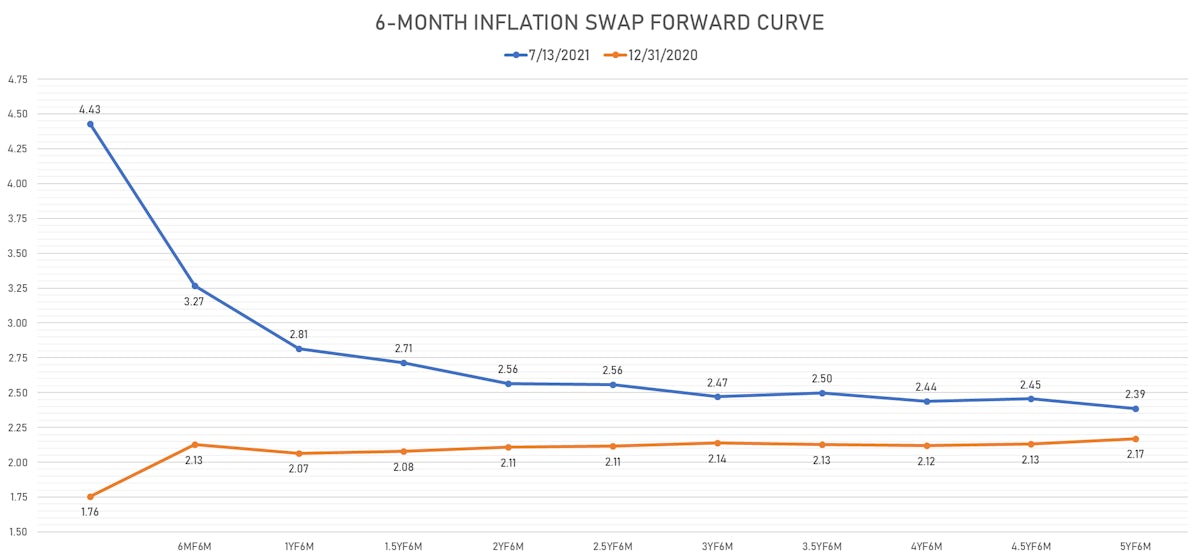

Short-term inflation markets jumped today as the latest CPI print exceeded consensus estimates: the 1-year TIPS breakeven was up 38bp and 6-month US CPI swap up 25bp, while longer-term inflation expectations stayed well anchored

Published ET

Spot 6-month CPI swap vs 5Y forward | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

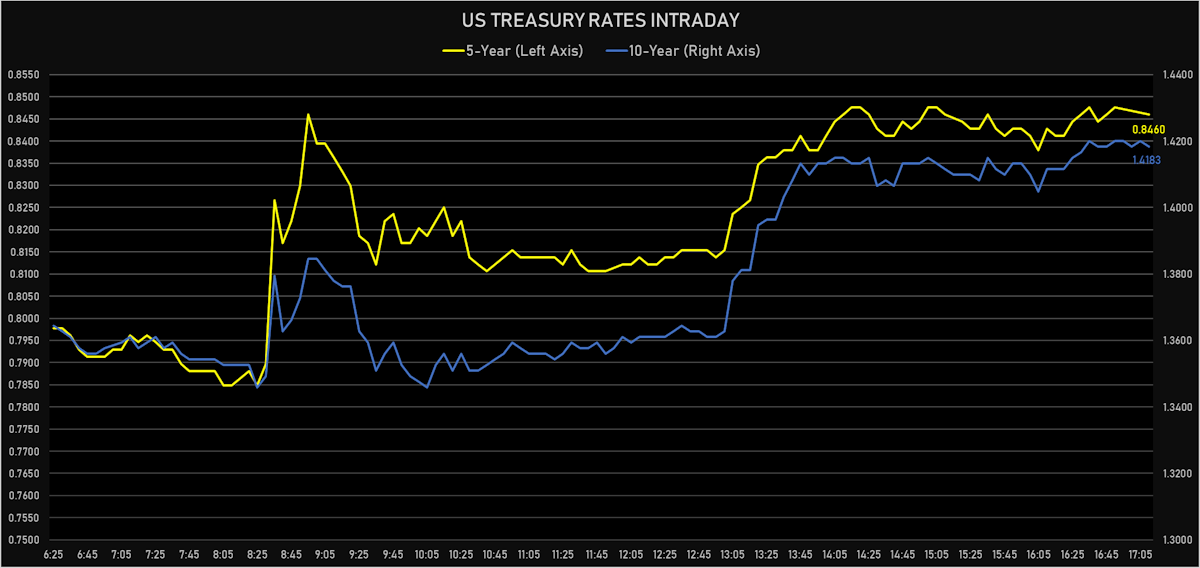

- Yield curve steepening, with the 1s10s Treasury spread widening 4.8 bp on the day, now at 135.0 bp (YTD change: +54.6)

- 1Y: 0.0680% (up 0.2 bp)

- 2Y: 0.2548% (up 2.8 bp)

- 5Y: 0.8460% (up 5.1 bp)

- 7Y: 1.1656% (up 5.0 bp)

- 10Y: 1.4183% (up 5.1 bp)

- 30Y: 2.0490% (up 4.9 bp)

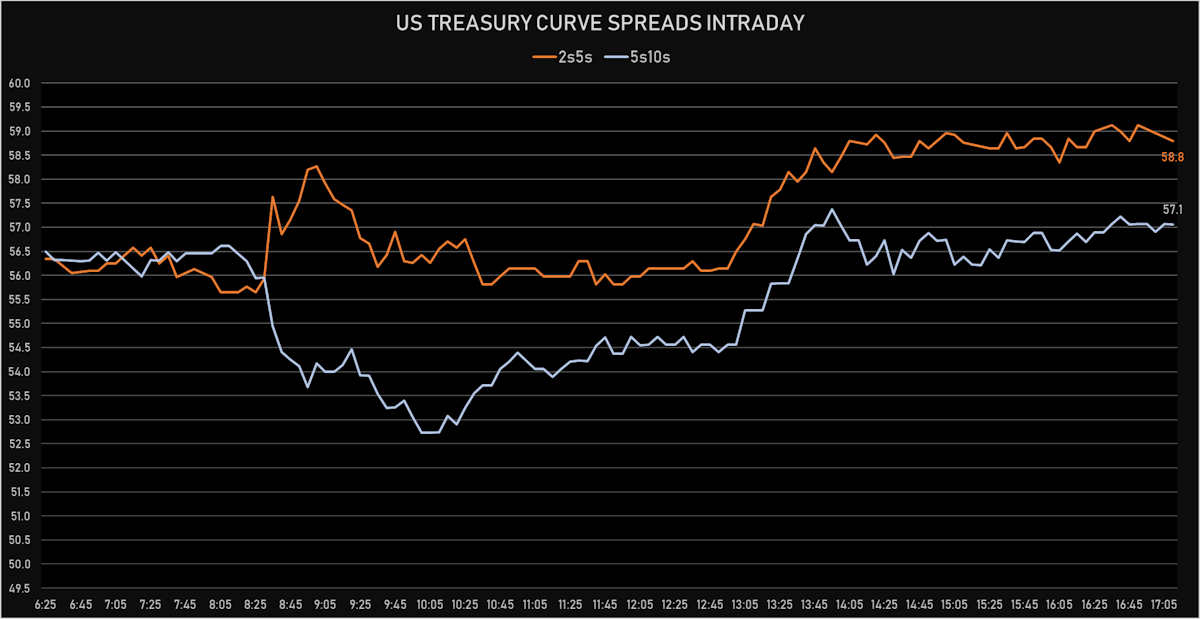

- US treasury curve spreads: 2s5s at 59.1bp (up 2.2bp today), 5s10s at 57.3bp (down -0.1bp today), 10s30s at 63.1bp (up 0.0bp today)

- Treasuries butterfly spreads: 2s5s10s at -2.3bp (down -2.4bp today), 5s10s30s at 5.4bp (down -0.4bp today)

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 10 Jul (Redbook Research) at 14.00 %

- CPI - All Urban Samples: All Items, Change Y/Y for Jun 2021 (BLS, U.S Dep. Of Lab) at 5.40%, above consensus estimate of 4.90 %

- CPI, All items less food and energy for Jun 2021 (BLS, U.S Dep. Of Lab) at 278.14

- CPI, All items less food and energy, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 0.90 %, above consensus estimate of 0.40 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 4.50 %, above consensus estimate of 4.00 %

- CPI, All items, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 0.90 %, above consensus estimate of 0.50 %

- CPI, All items, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 271.70 , above consensus estimate of 270.64

- CPI, FRB Cleveland Median, 1 month, Change M/M for Jun 2021 (Fed Reserve, Cleveland) at 0.20 %

- Earnings, Average Weekly, Total Private, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at -0.90 %

- Federal Budget, Current Prices for Jun 2021 (Fiscal Service, USA) at -174.00 Bln USD, above consensus estimate of -194.00 Bln USD

- NFIB, Index of Small Business Optimism for Jun 2021 (NFIB, United States) at 102.50

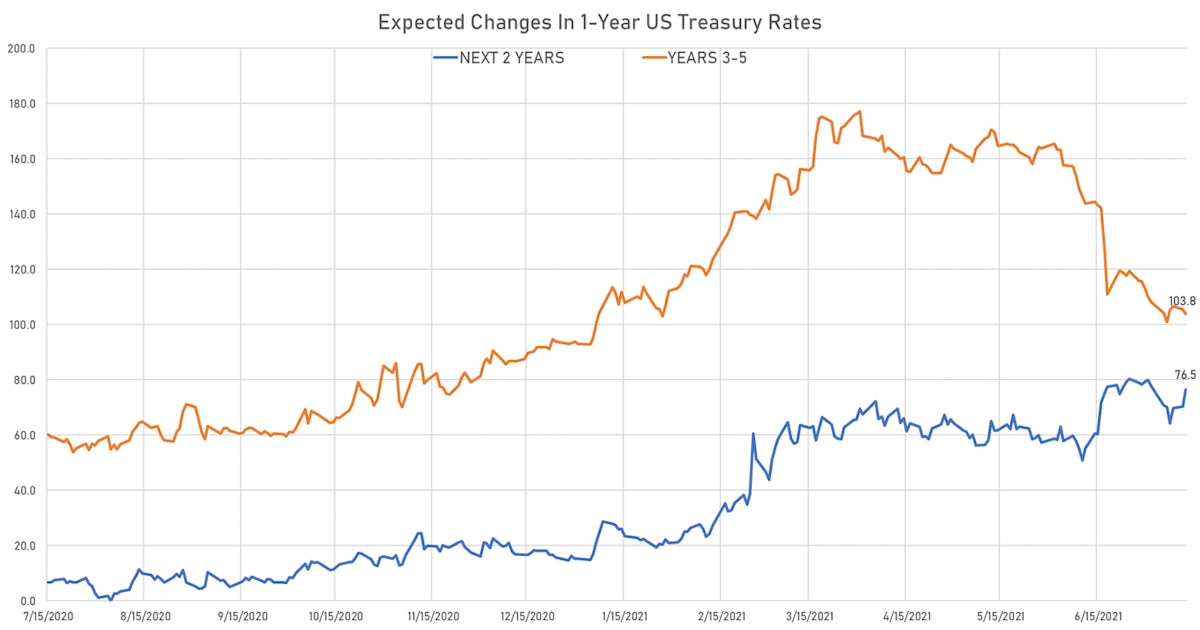

US FORWARD RATES

- 3-month USD Libor 5 years forward up 0.7 bp

- US Treasury 1-year zero-coupon rate 5 years forward up 5.2 bp, now at 1.8985%

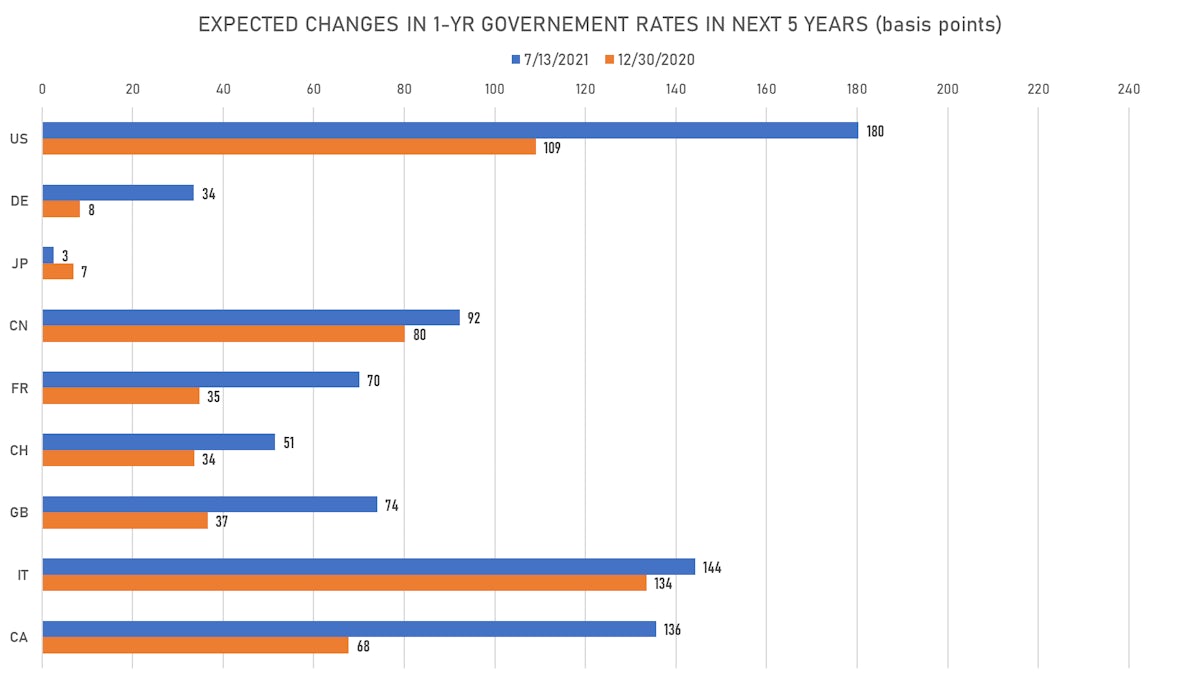

- 1-Year Treasury rates are now expected to increase by 180.3 bp over the next 5 years

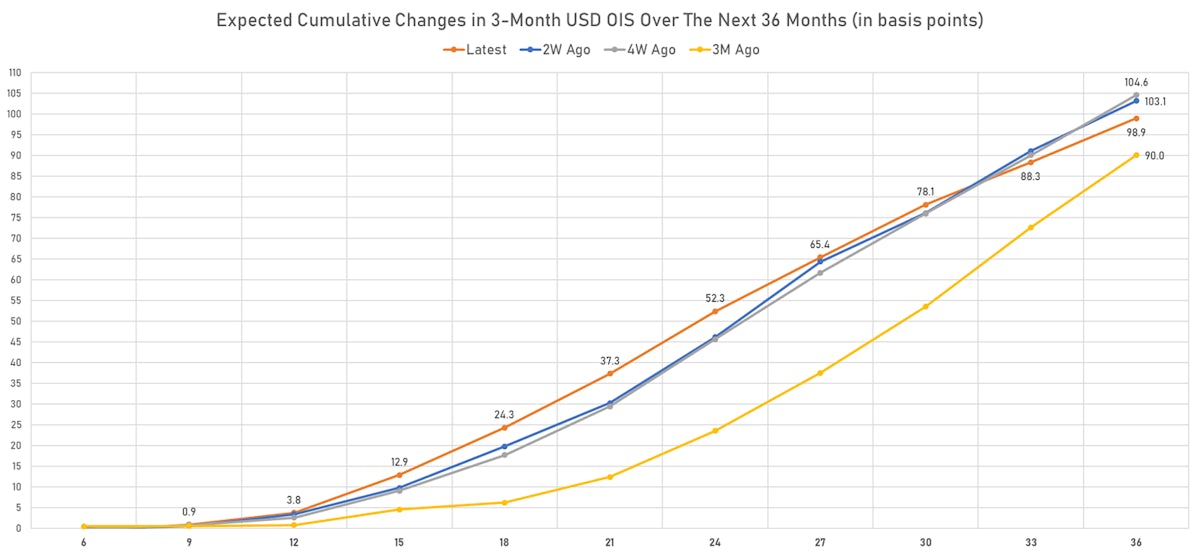

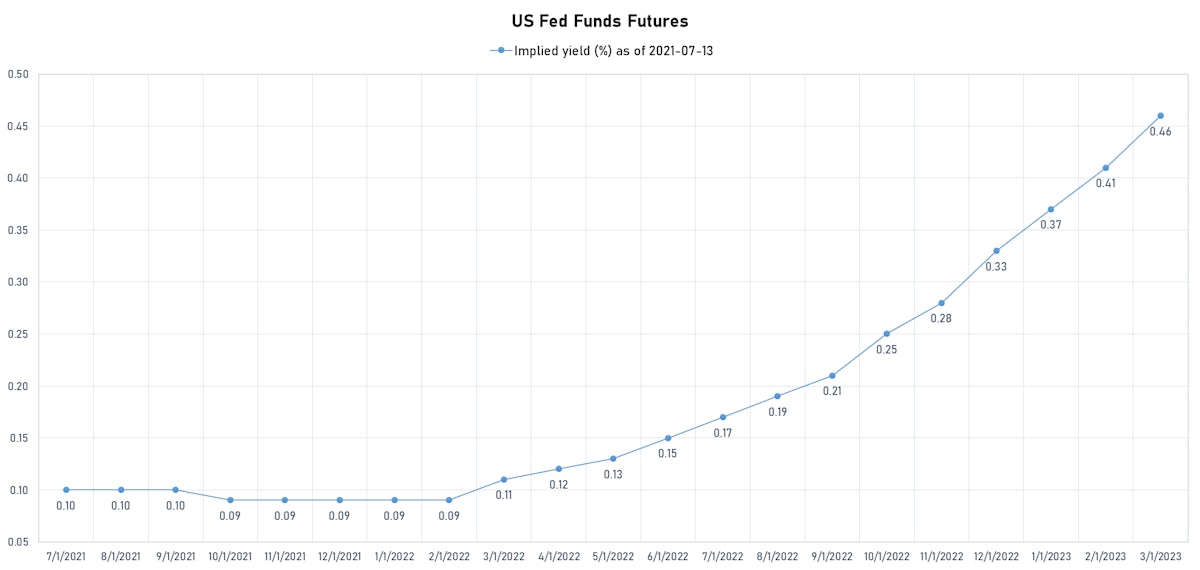

- The market currently expects the 3-month USD OIS rate to rise by 24.3 bp over the next 18 months (equivalent to 0.97 rate hike) and 98.9 bp over the next 3 years (equivalent to 3.96 rate hikes)

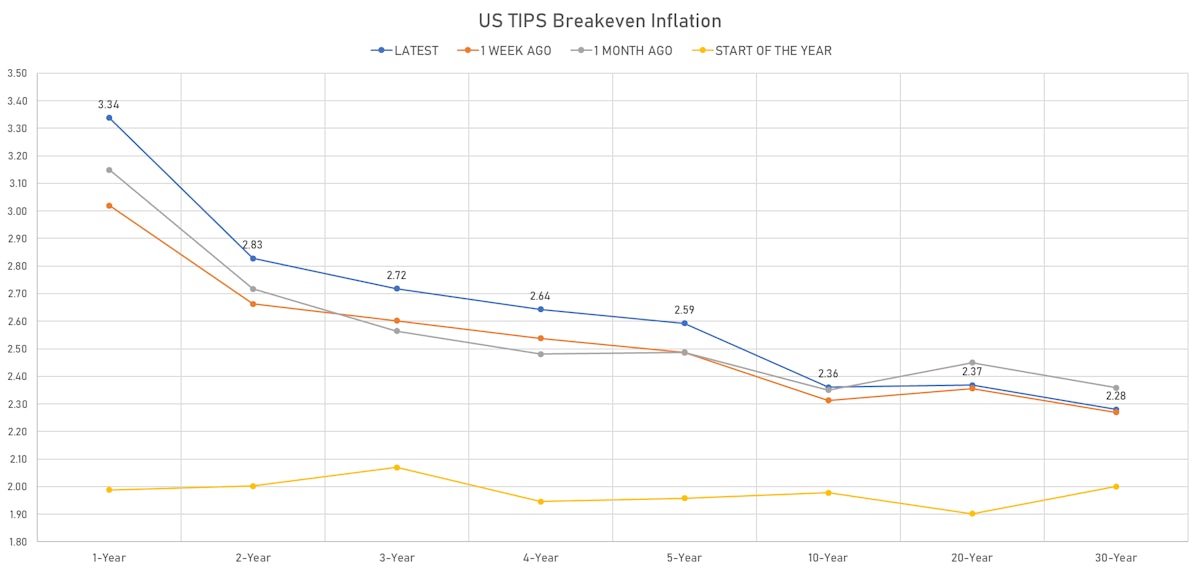

US INFLATION

- TIPS 1Y breakeven inflation at 3.34% (up 38.4bp); 2Y at 2.83% (up 16.0bp); 5Y at 2.59% (up 8.7bp); 10Y at 2.36% (up 4.0bp); 30Y at 2.28% (up 1.1bp)

- 6-month spot US CPI swap up 24.8 bp to 4.429%, with a steepening of the forward curve

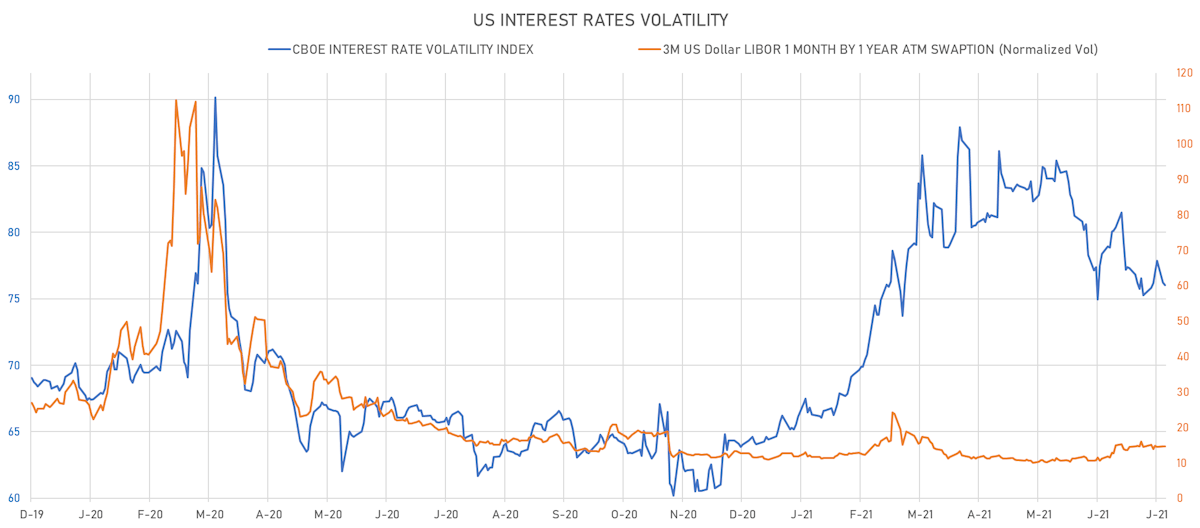

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down 0.0% at 14.6%

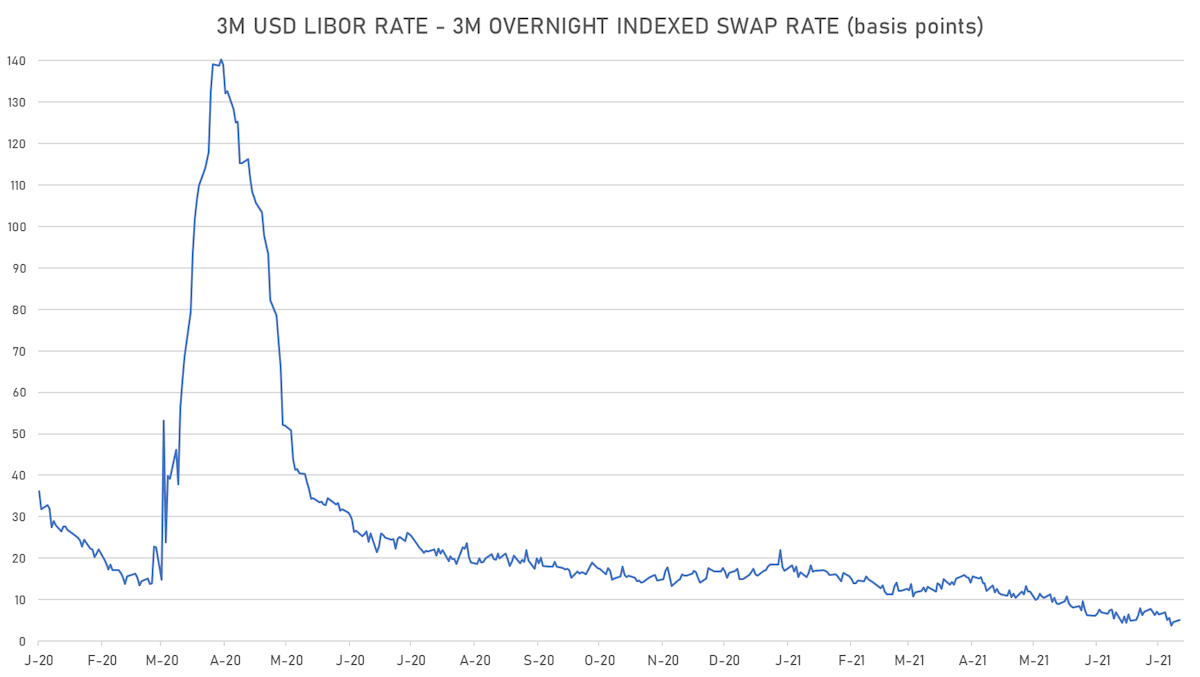

- 3-Month LIBOR-OIS spread up 0.4 bp at 5.5 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

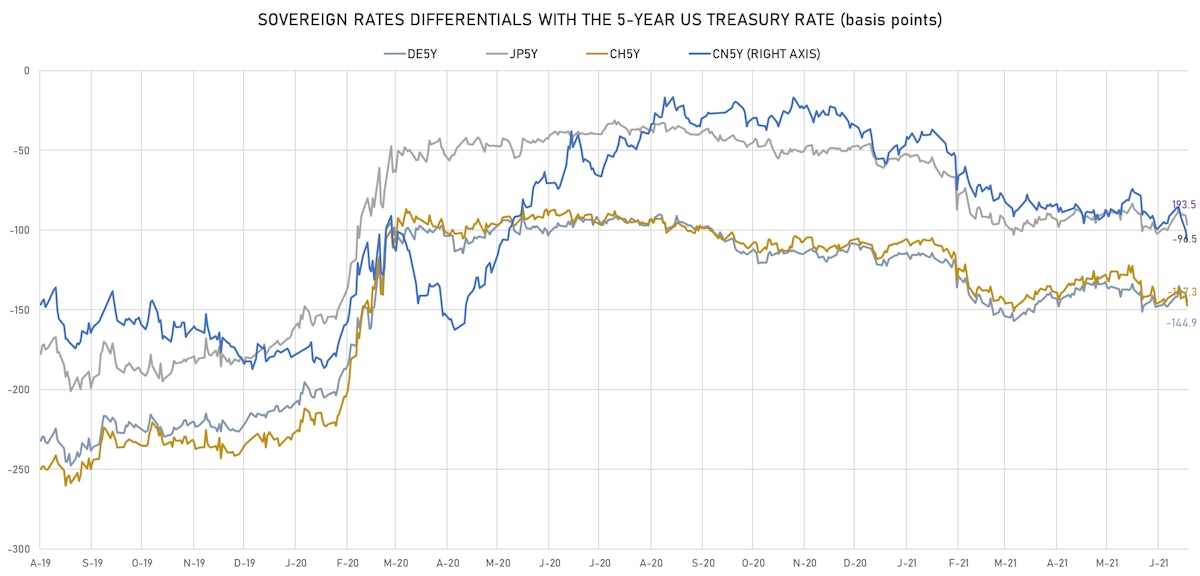

- Germany 5Y: -0.591% (down -0.3 bp); the German 1Y-10Y curve is 0.2 bp steeper at 36.5bp (YTD change: +20.3 bp)

- Japan 5Y: -0.107% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 13.9bp (YTD change: -0.1 bp)

- China 5Y: 2.781% (down -1.1 bp); the Chinese 1Y-10Y curve is 1.1 bp steeper at 86.4bp (YTD change: +40.0 bp)

- Switzerland 5Y: -0.627% (down -1.1 bp); the Swiss 1Y-10Y curve is 4.9 bp steeper at 56.3bp (YTD change: +27.6 bp)