Rates

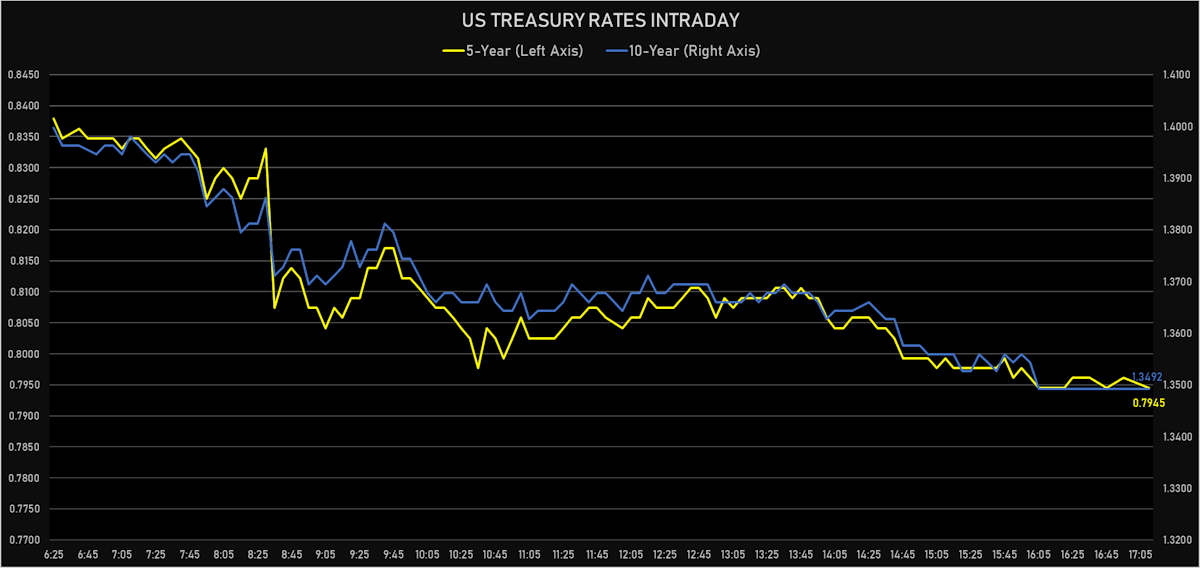

US Rates Fall Across The Curve, As Duration Bid Comes Back

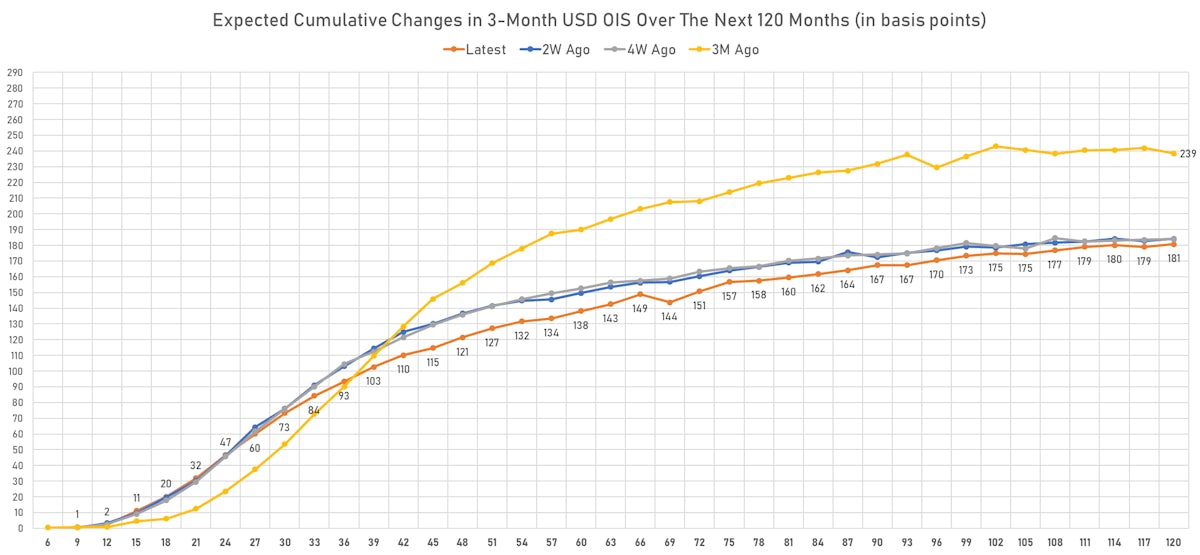

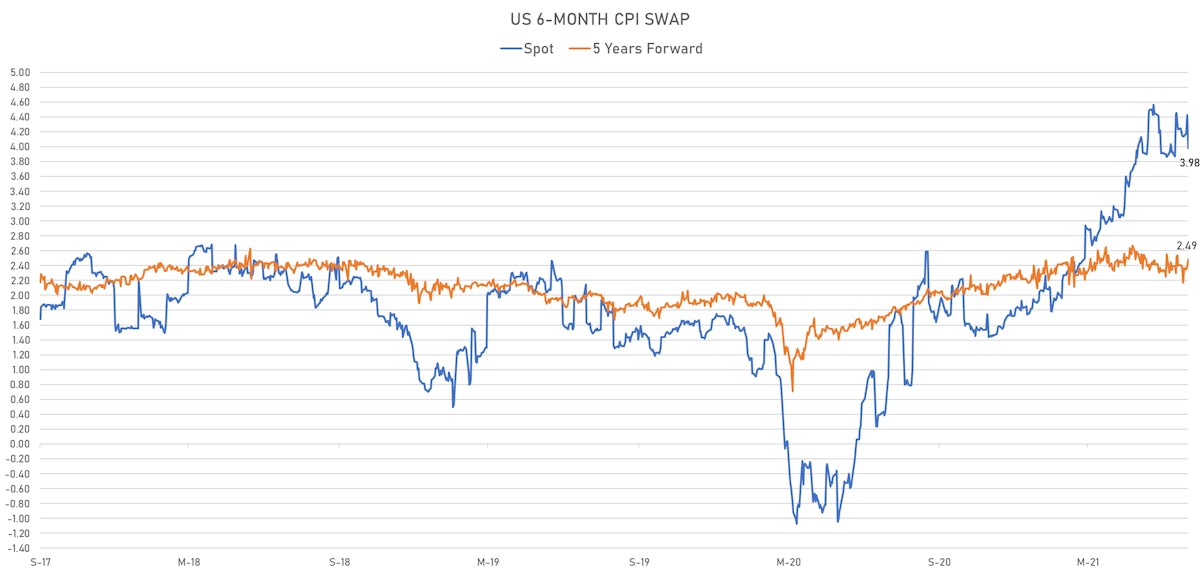

With J Powell speaking to Congress today, the inflation swap curve is slightly flatter: the front end dropped and the medium term edged up; market expectations still point to mostly temporary inflation pressures

Published ET

US TIPS Real Yields | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve flattening, with the 1s10s Treasury spread tightening -7.4 bp on the day, now at 127.5 bp (YTD change: +47.1)

- 1Y: 0.0740% (up 0.5 bp)

- 2Y: 0.2250% (down 3.0 bp)

- 5Y: 0.7945% (down 5.2 bp)

- 7Y: 1.1026% (down 6.3 bp)

- 10Y: 1.3492% (down 6.9 bp)

- 30Y: 1.9737% (down 7.5 bp)

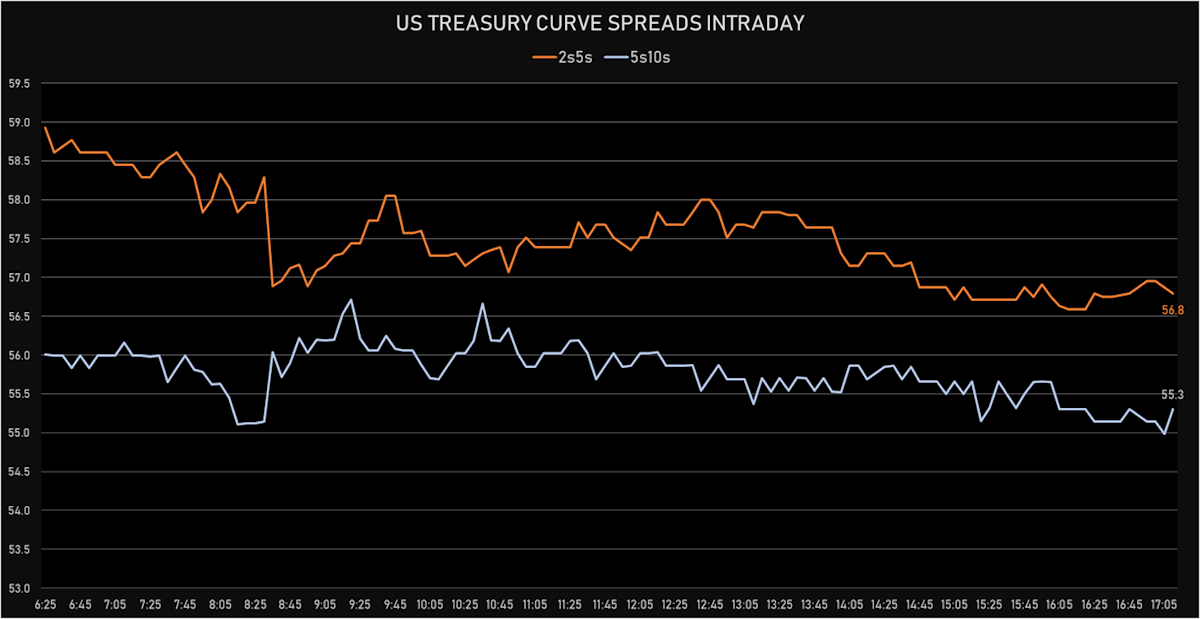

- US treasury curve spreads: 2s5s at 57.0bp (down -2.0bp today), 5s10s at 55.5bp (down -1.8bp today), 10s30s at 62.5bp (down -0.6bp today)

- Treasuries butterfly spreads: 2s5s10s at -1.9bp (up 0.4bp today), 5s10s30s at 6.8bp (up 1.4bp today)

US MACRO RELEASES

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 09 Jul (MBA, USA) at 16.00 %

- Mortgage applications, market composite index for W 09 Jul (MBA, USA) at 727.50

- Mortgage applications, market composite index, purchase for W 09 Jul (MBA, USA) at 273.30

- Mortgage applications, market composite index, refinancing for W 09 Jul (MBA, USA) at 3361.50

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 09 Jul (MBA, USA) at 3.09 %

- PPI ex Food/Energy/Trade MM, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 0.50 %

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 5.50 %

- Producer Prices, Final demand less foods and energy, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 1.00 %, above consensus estimate of 0.50 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Jun 2021 (BLS, U.S Dep. Of Lab) at 5.60 %, above consensus estimate of 5.10 %

- Producer Prices, Final demand, Change P/P for Jun 2021 (BLS, U.S Dep. Of Lab) at 1.00 %, above consensus estimate of 0.60 %

- Producer Prices, Final demand, Change Y/Y for Jun 2021 (BLS, U.S Dep. Of Lab) at 7.30 %, above consensus estimate of 6.80 %

- Refinitiv / Ipsos Primary Consumer Sentiment Index (CSI) for Jul 2021 (Refinitiv/Ipsos) at 61.42 (vs prior of 62.5)

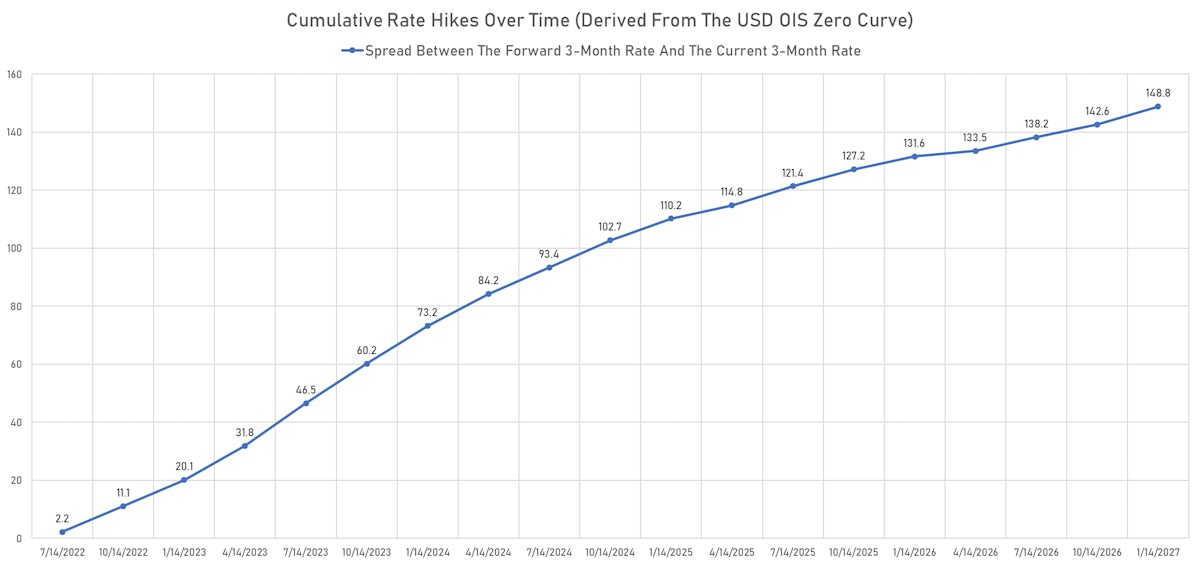

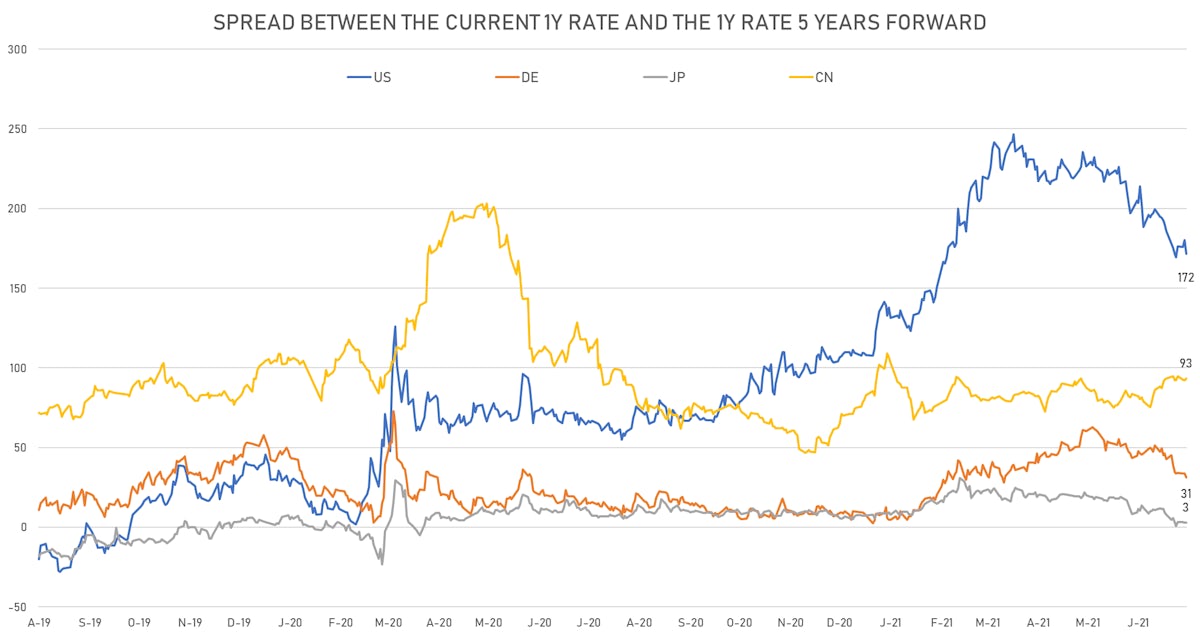

US FORWARD RATES

- 3-month USD Libor 5 years forward down 0.9 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 9.6 bp, now at 1.8027%

- 1-Year Treasury rates are now expected to increase by 171.6 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 20.1 bp over the next 18 months (equivalent to 0.80 rate hike) and 93.4 bp over the next 3 years (equivalent to 3.74 rate hikes)

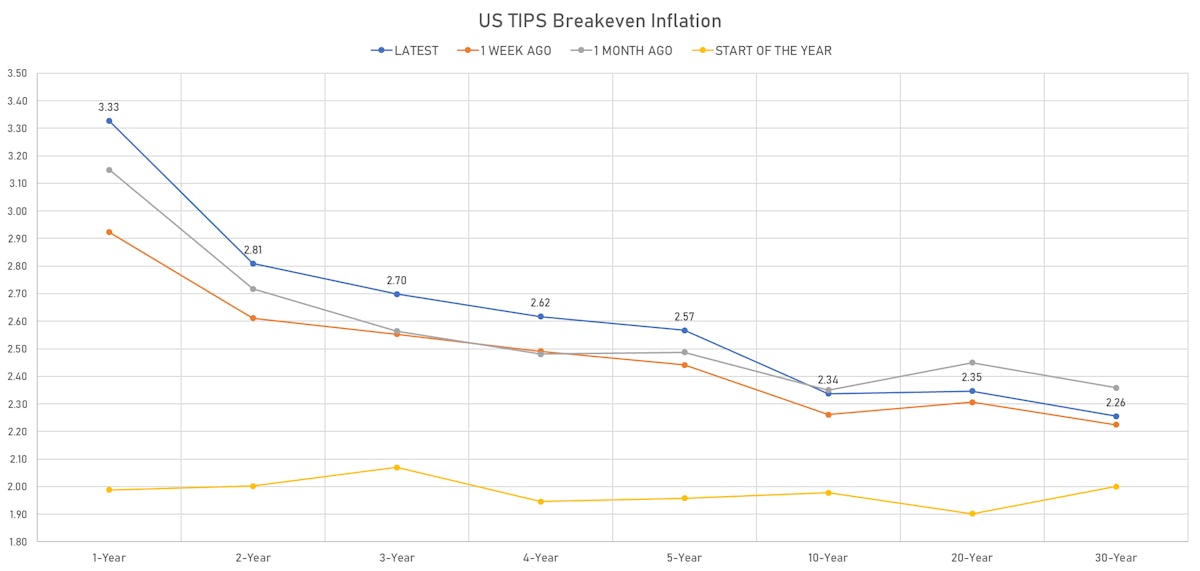

US INFLATION

- TIPS 1Y breakeven inflation at 3.33% (down -1.1bp); 2Y at 2.81% (down -1.9bp); 5Y at 2.57% (down -2.5bp); 10Y at 2.34% (down -2.4bp); 30Y at 2.26% (down -2.5bp)

- 6-month spot US CPI swap down -44.8 bp to 3.981%, with a flattening of the forward curve

RATES VOLATILITY & LIQUIDITY

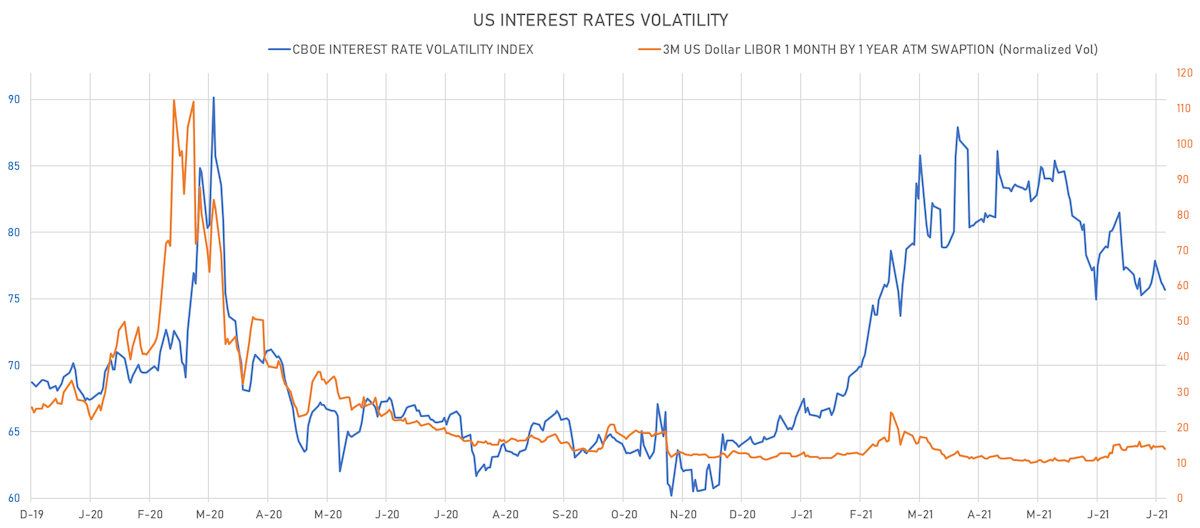

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.7% at 13.9%

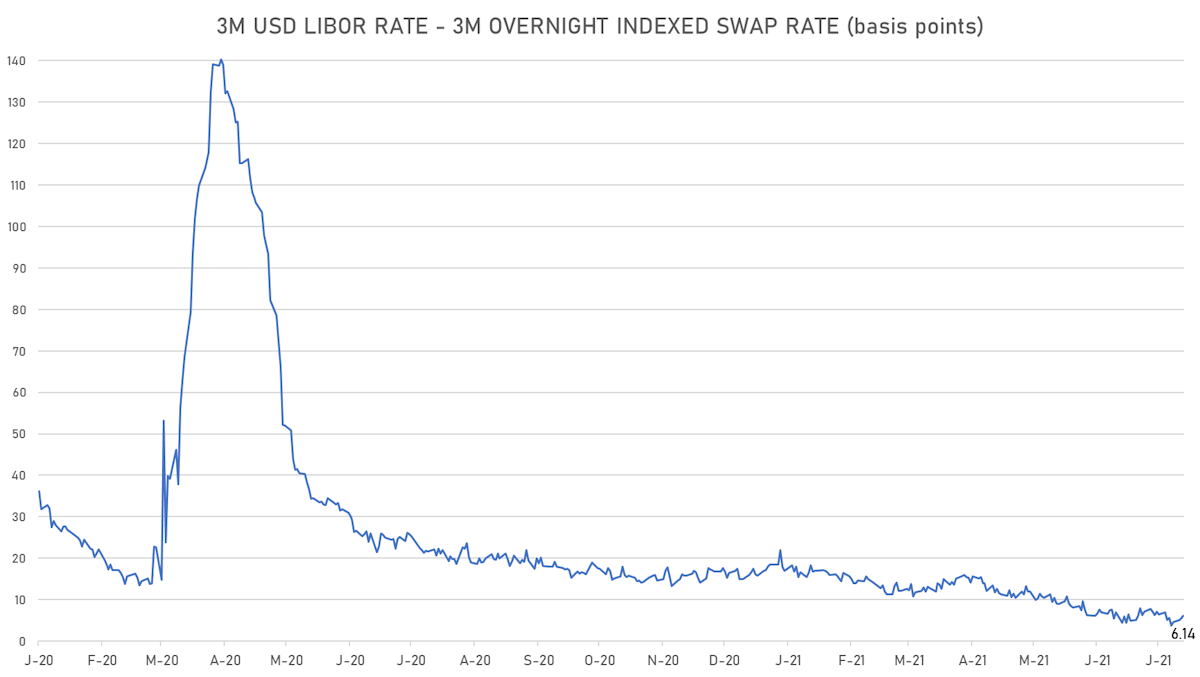

- 3-Month LIBOR-OIS spread up 0.6 bp at 6.1 bp (12-months range: 3.7-23.6 bp)

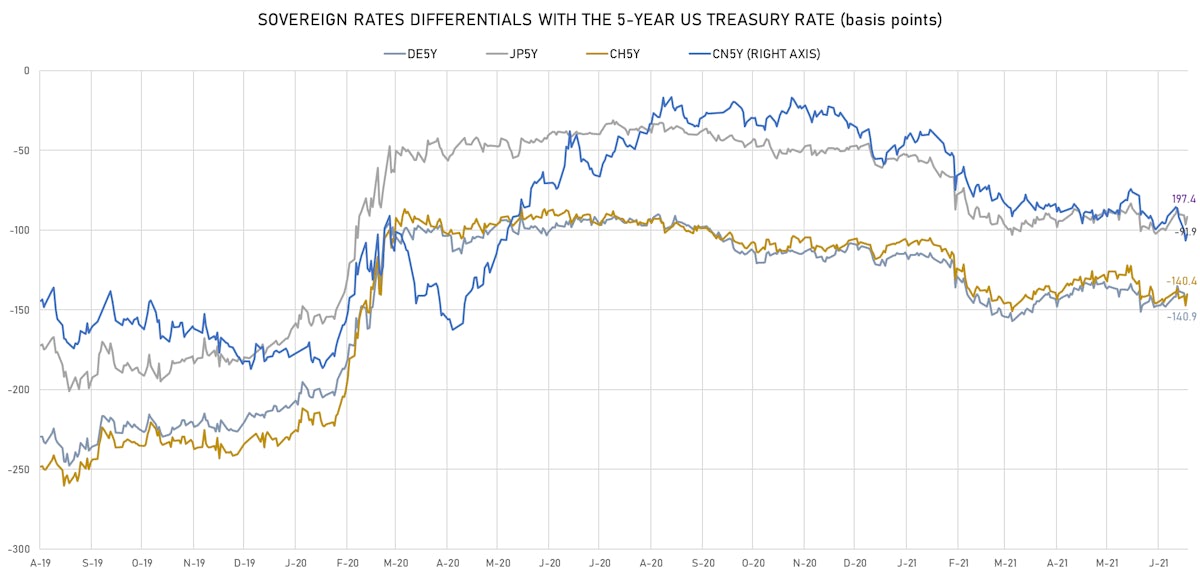

KEY INTERNATIONAL RATES

- Germany 5Y: -0.613% (down -1.1 bp); the German 1Y-10Y curve is 1.3 bp flatter at 33.6bp (YTD change: +19.0 bp)

- Japan 5Y: -0.124% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 13.2bp (YTD change: -0.3 bp)

- China 5Y: 2.768% (down -1.3 bp); the Chinese 1Y-10Y curve is 0.8 bp steeper at 87.2bp (YTD change: +40.8 bp)

- Switzerland 5Y: -0.609% (up 1.8 bp); the Swiss 1Y-10Y curve is 1.5 bp flatter at 52.5bp (YTD change: +26.1 bp)