Rates

Duration Bought As Industrial Production Growth Slowed in June, US Rates Curve Flattens

The 1-year forward 1-year breakeven inflation seems to have peaked in the US and Germany, though it still rising in the UK, which should be the first of those countries to hike rates next year

Published ET

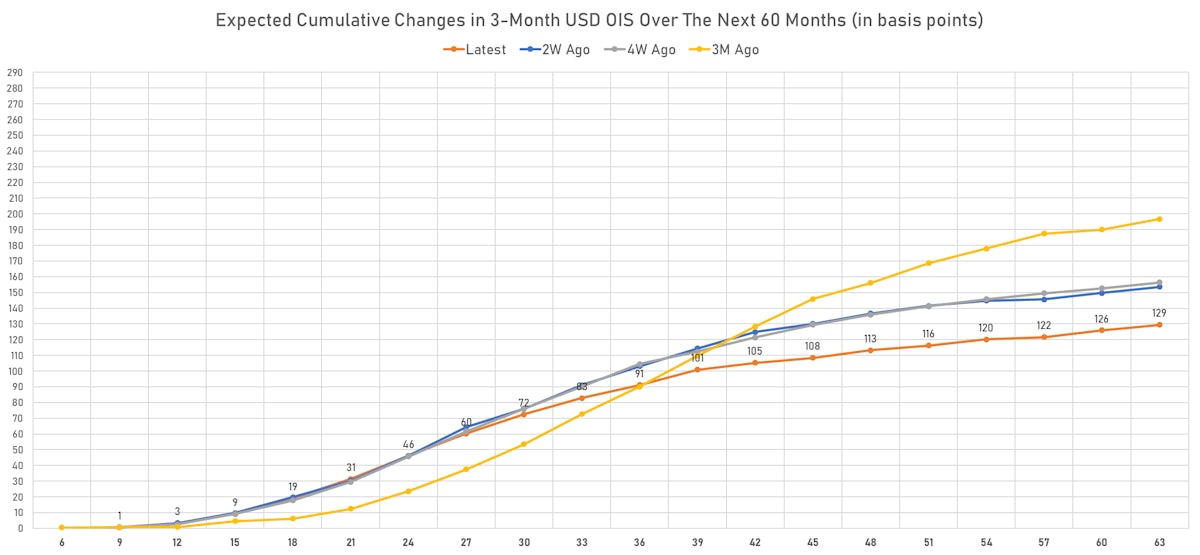

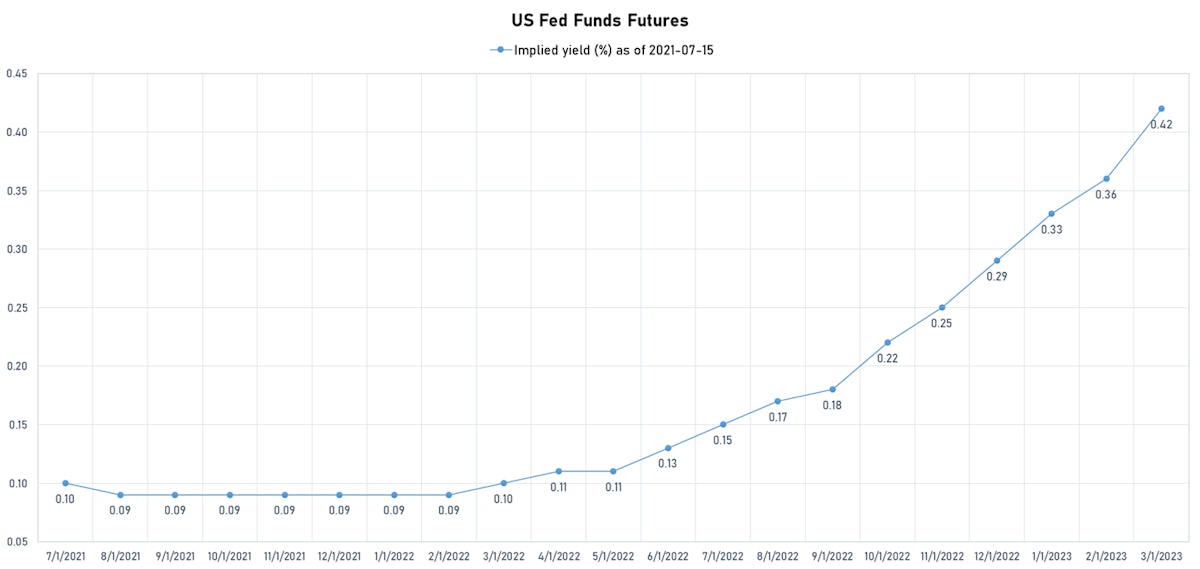

Rates markets have drastically changed their Fed hikes expectations since March | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

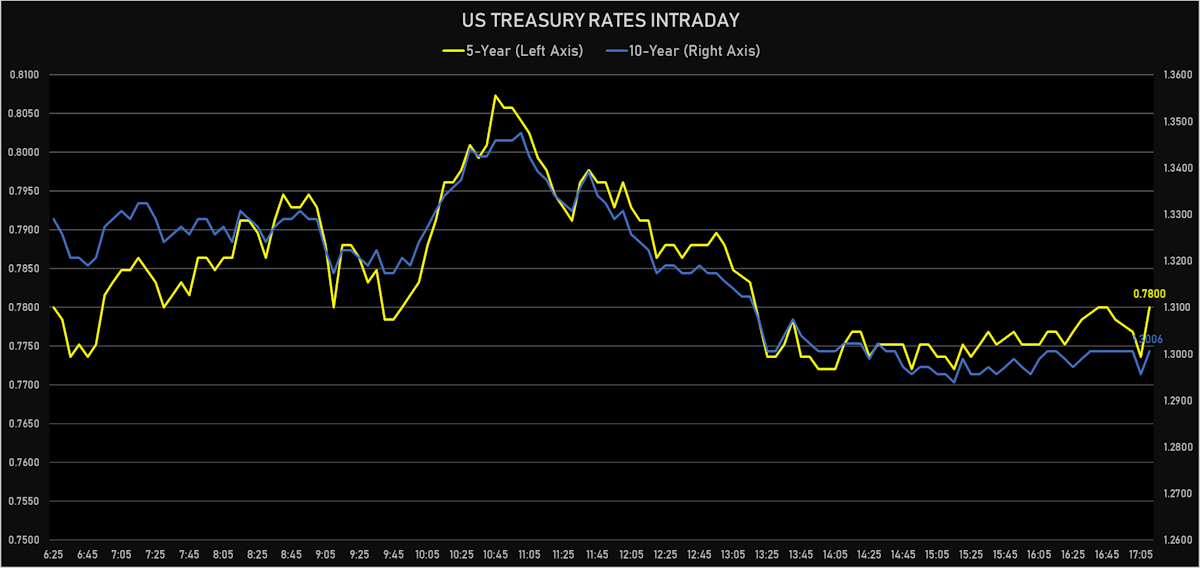

- Yield curve flattening, with the 1s10s Treasury spread tightening -4.6 bp on the day, now at 122.7 bp (YTD change: +42.2)

- 1Y: 0.0740% (down 0.3 bp)

- 2Y: 0.2271% (up 0.2 bp)

- 5Y: 0.7800% (down 1.5 bp)

- 7Y: 1.0724% (down 3.0 bp)

- 10Y: 1.3006% (down 4.9 bp)

- 30Y: 1.9258% (down 4.8 bp)

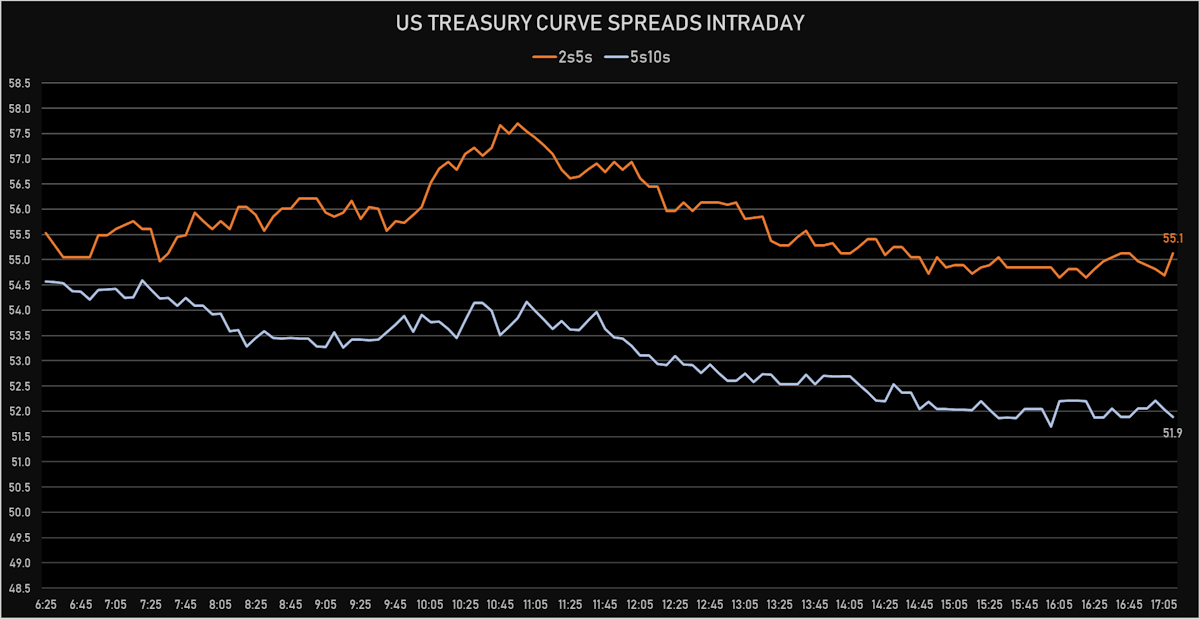

- US treasury curve spreads: 2s5s at 55.3bp (down -1.7bp), 5s10s at 52.1bp (down -3.4bp), 10s30s at 62.5bp (unchanged)

- Treasuries butterfly spreads: 2s5s10s at -3.6bp (down -1.8bp), 5s10s30s at 9.4bp (up 2.6bp)

US MACRO RELEASES

- Capacity Utilization, Total index, Change M/M for Jun 2021 (FED, U.S.) at 75.40 %, below consensus estimate of 75.60 %

- Export Prices, All commodities, Change P/P, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 1.20 %, in line with consensus estimate

- Import Prices, All commodities, Change P/P, Price Index for Jun 2021 (BLS, U.S Dep. Of Lab) at 1.00 %, below consensus estimate of 1.20 %

- Jobless Claims, National, Continued for W 03 Jul (U.S. Dept. of Labor) at 3.24 Mln, below consensus estimate of 3.31 Mln

- Jobless Claims, National, Initial for W 10 Jul (U.S. Dept. of Labor) at 360.00 k, in line with consensus estimate

- Jobless Claims, National, Initial, four week moving average for W 10 Jul (U.S. Dept. of Labor) at 382.50 k

- New York Fed, General Business Condition for Jul 2021 (FED, NY) at 43.00 , above consensus estimate of 18.00

- Philadelphia Fed, Future capital expenditures for Jul 2021 (FED, Philadelphia) at 41.20

- Philadelphia Fed, Future general business activity for Jul 2021 (FED, Philadelphia) at 48.60

- Philadelphia Fed, General business activity for Jul 2021 (FED, Philadelphia) at 21.90 , below consensus estimate of 28.00

- Philadelphia Fed, New orders for Jul 2021 (FED, Philadelphia) at 17.00

- Philadelphia Fed, Number of employees for Jul 2021 (FED, Philadelphia) at 29.20

- Philadelphia Fed, Prices paid for Jul 2021 (FED, Philadelphia) at 69.70

- Production, Change P/P for Jun 2021 (FED, U.S.) at 0.40 %, below consensus estimate of 0.60 %

- Production, Manufacturing, Total (SIC), Change P/P for Jun 2021 (FED, U.S.) at -0.10 %, below consensus estimate of 0.20 %

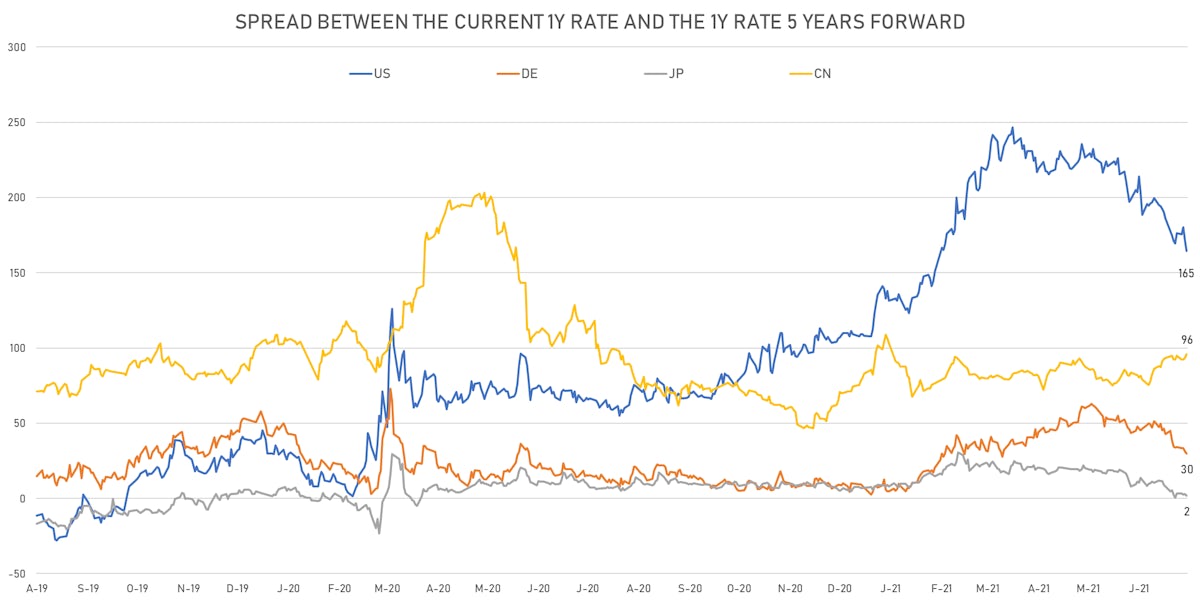

US FORWARD RATES

- 3-month USD Libor 5 years forward up 1.5 bp

- US Treasury 1-year zero-coupon rate 5 years forward down 7.2 bp, now at 1.7305%

- 1-Year Treasury rates are now expected to increase by 164.5 bp over the next 5 years

- The market currently expects the 3-month USD OIS rate to rise by 19.2 bp over the next 18 months (equivalent to 0.77 rate hike) and 91.1 bp over the next 3 years (equivalent to 3.65 rate hikes)

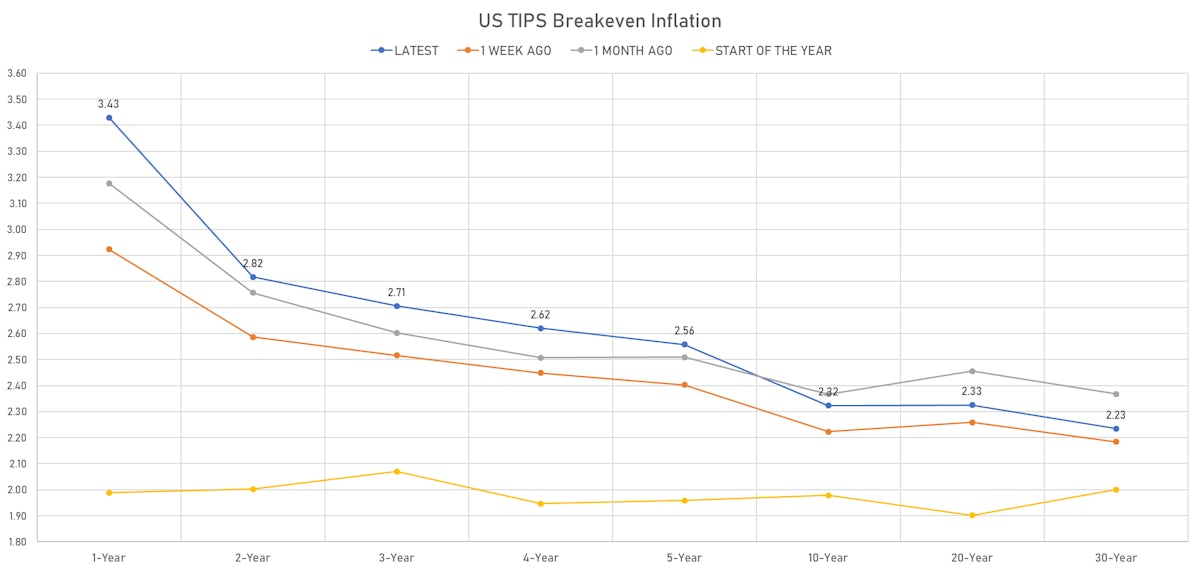

US INFLATION

- TIPS 1Y breakeven inflation at 3.43% (up 10.2bp); 2Y at 2.82% (up 0.8bp); 5Y at 2.56% (down -1.0bp); 10Y at 2.32% (down -1.4bp); 30Y at 2.23% (down -2.1bp)

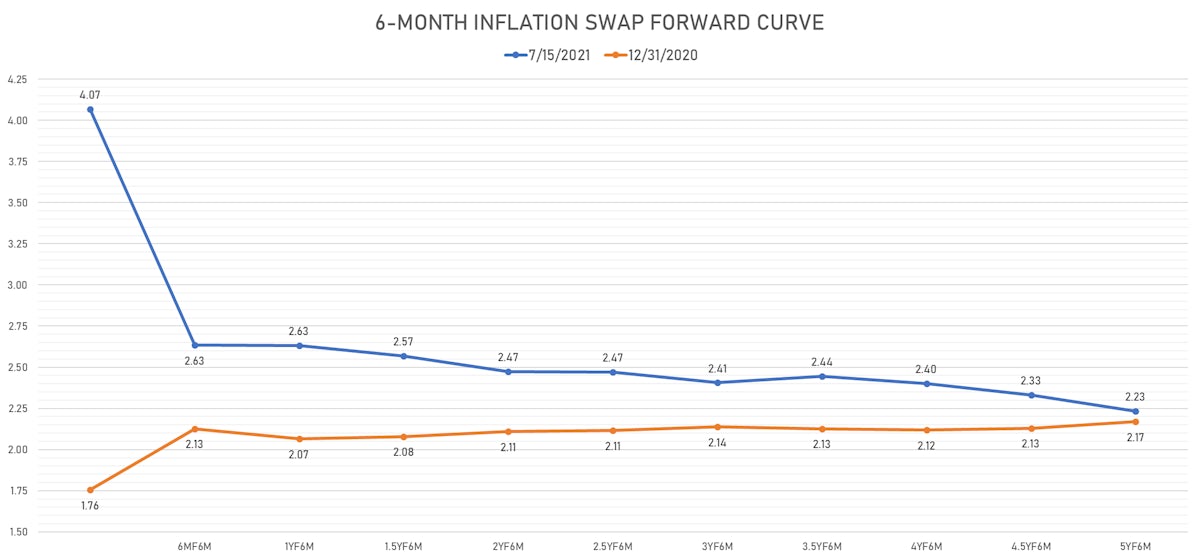

- 6-month spot US CPI swap up 8.7 bp to 4.068%, with a steepening of the forward curve

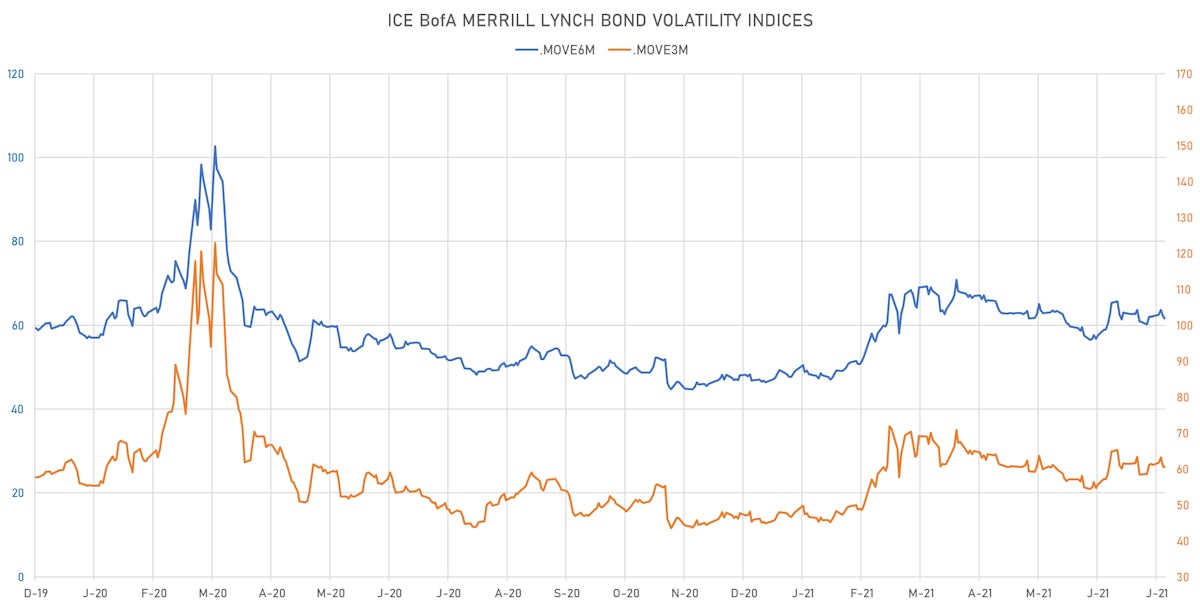

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.1% at 14.0%

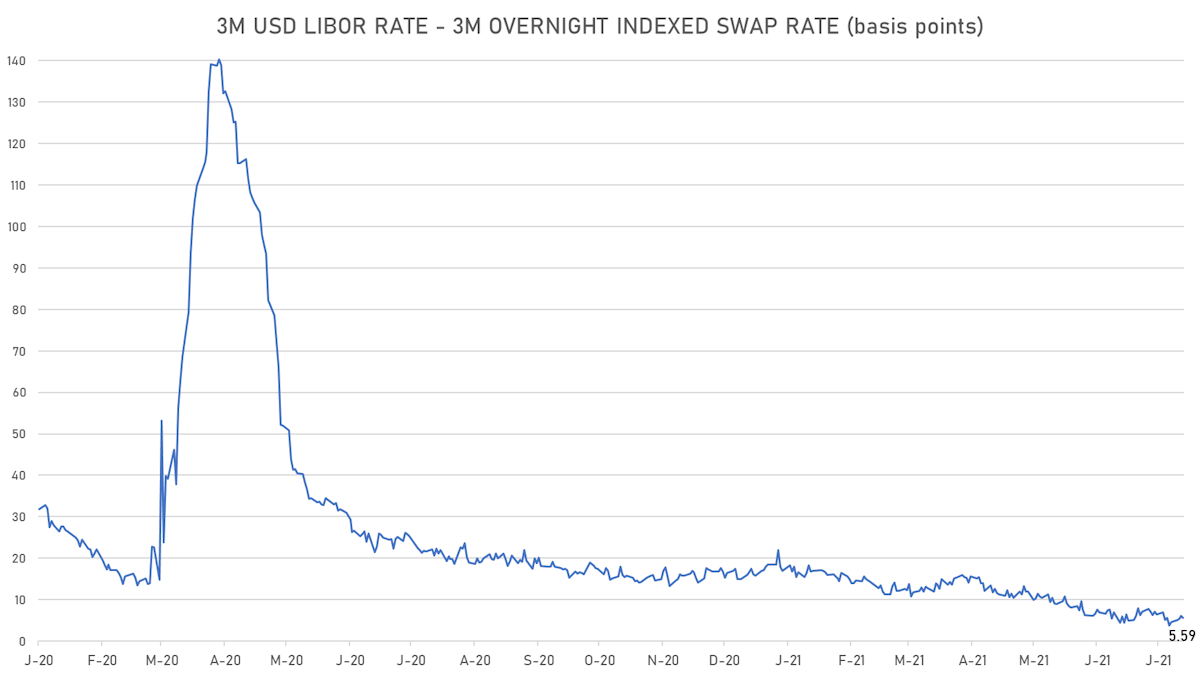

- 3-Month LIBOR-OIS spread down -0.6 bp at 5.6 bp (12-months range: 3.7-23.6 bp)

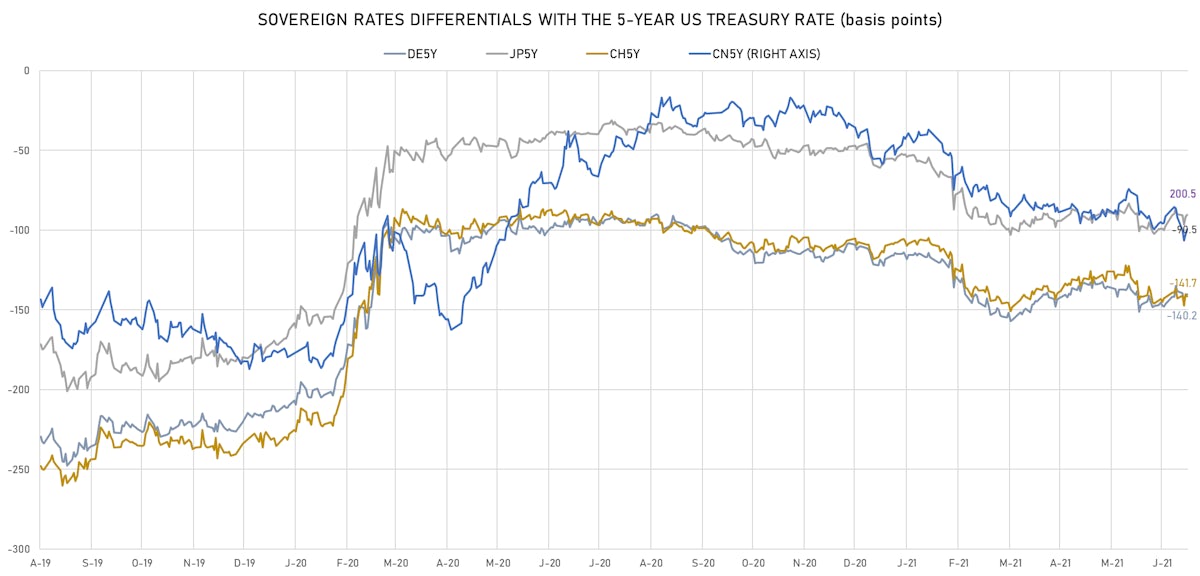

KEY INTERNATIONAL RATES

- Germany 5Y: -0.629% (down -0.8 bp); the German 1Y-10Y curve is 1.3 bp flatter at 32.8bp (YTD change: +17.7 bp)

- Japan 5Y: -0.117% (down -0.1 bp); the Japanese 1Y-10Y curve is unchanged at 13.4bp (YTD change: -0.3 bp)

- China 5Y: 2.785% (up 1.7 bp); the Chinese 1Y-10Y curve is 4.2 bp steeper at 91.4bp (YTD change: +45.0 bp)

- Switzerland 5Y: -0.637% (down -2.8 bp); the Swiss 1Y-10Y curve is 7.7 bp flatter at 44.8bp (YTD change: +18.4 bp)