Rates

Very Little Change In Rates To Close Out The Week

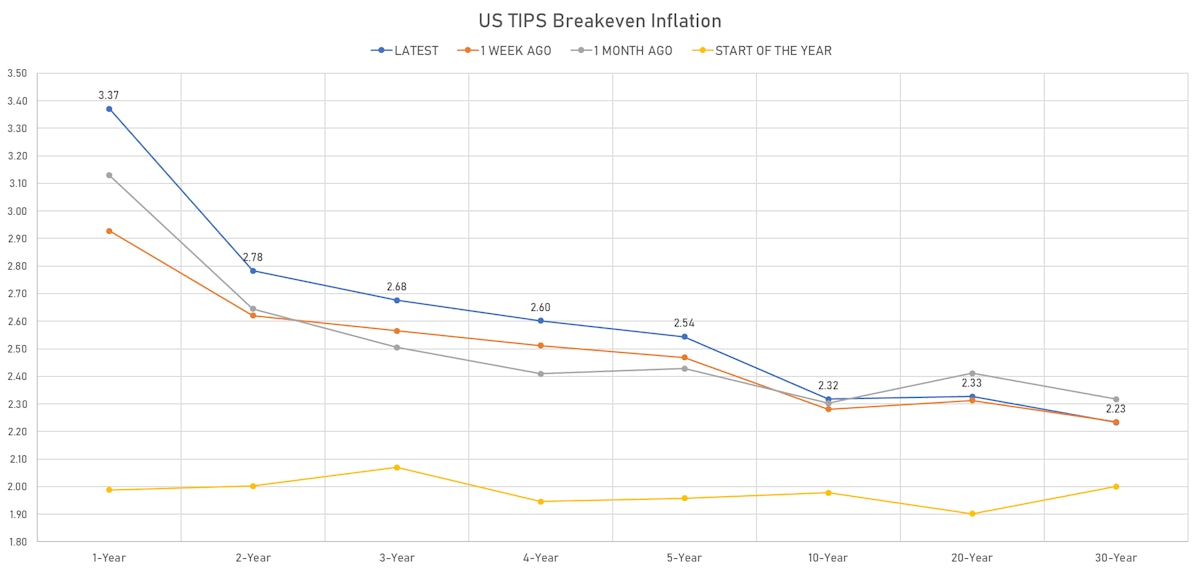

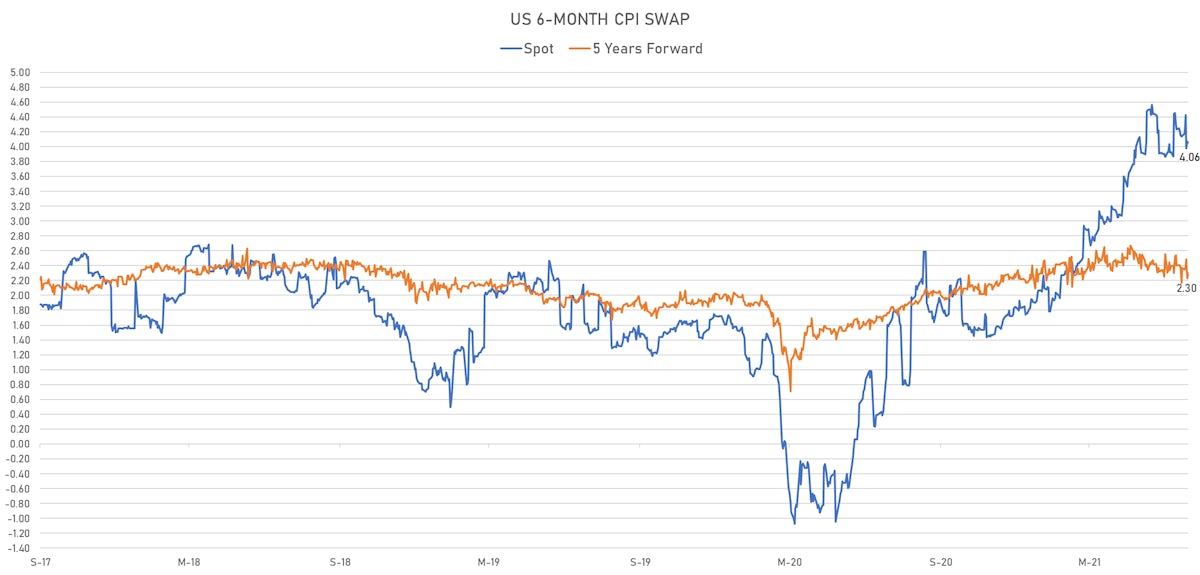

On the inflation front, there is a disconnect between the high readings of the University of Michigan survey and market pricing of forward inflation (through TIPS or swaps)

Published ET

Short-term inflation expectations seem to be past their peak in the US and Germany (derived from treasury securities) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

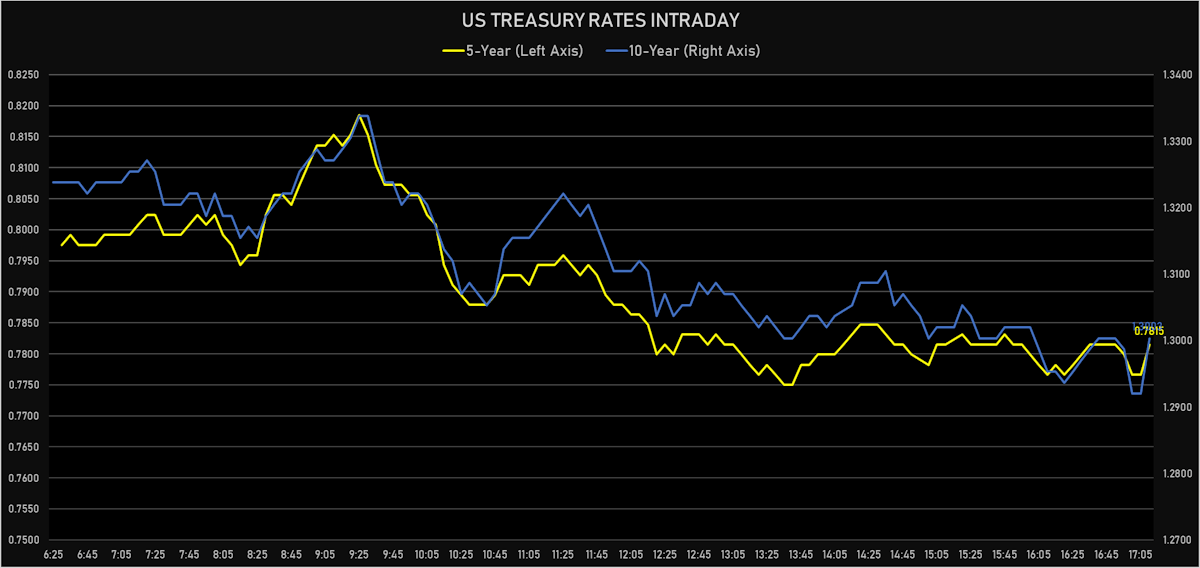

- Yield curve broadly unchanged with the 1s10s spread down -0.3 bp today, now at 122.6 bp (YTD change: +42.2)

- 1Y: 0.0740% (up 0.3 bp)

- 2Y: 0.2275% (unchanged)

- 5Y: 0.7815% (up 0.1 bp)

- 7Y: 1.0722% (unchanged)

- 10Y: 1.3003% (unchanged)

- 30Y: 1.9277% (up 0.2 bp)

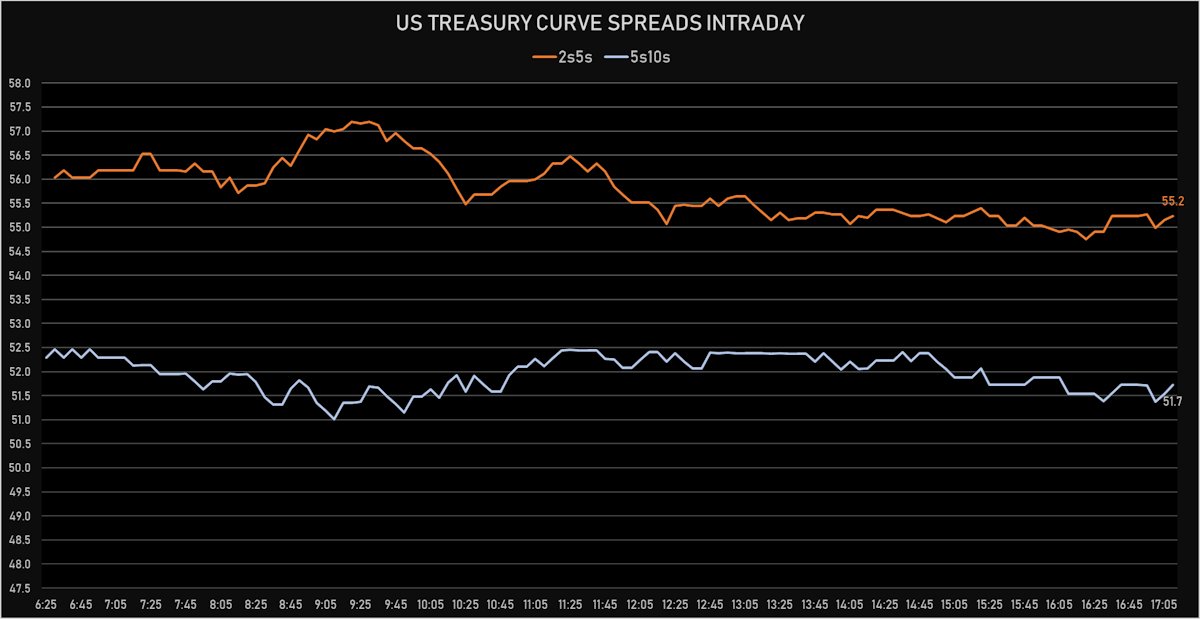

- US treasury curve spreads: 2s5s at 55.4bp (up 0.1bp today), 5s10s at 51.9bp (down -0.2bp), 10s30s at 62.8bp (up 0.2bp today)

- Treasuries butterfly spreads: 2s5s10s at -3.9bp (down -0.3bp), 5s10s30s at 10.8bp (up 1.4bp)

US MACRO RELEASES

- 1 Year Inflation Expectations (median), preliminary for Jul 2021 (UMICH, Survey) at 4.80 %

- Net flows total, Current Prices for May 2021 (U.S. Dept. Treas.) at 105.30 Bln USD

- Net foreign acquisition of long-term securities, Current Prices for May 2021 (U.S. Dept. Treas.) at -63.60 Bln USD

- Net purchases (net long-term capital inflows), total, Current Prices for May 2021 (U.S. Dept. Treas.) at -30.20 Bln USD

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for May 2021 (U.S. Dept. Treas.) at -93.40 Bln USD

- Overall, Total business inventories, Change P/P for May 2021 (U.S. Census Bureau) at 0.50 %, in line with consensus estimate

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.10 %, above consensus estimate of 0.40 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.10 %

- Retail Sales, Total including food services, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.60 %, above consensus estimate of -0.40 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.30 %, above consensus estimate of 0.40 %

- University of Michigan, Current Conditions Index-prelim, Volume Index for Jul 2021 (UMICH, Survey) at 84.50 , below consensus estimate of 90.20

- University of Michigan, Total-prelim, Change Y/Y for Jul 2021 (UMICH, Survey) at 2.90 %

- University of Michigan, Total-prelim, Volume Index for Jul 2021 (UMICH, Survey) at 78.40 , below consensus estimate of 85.00

- University of Michigan, Total-prelim, Volume Index for Jul 2021 (UMICH, Survey) at 80.80 , below consensus estimate of 86.50

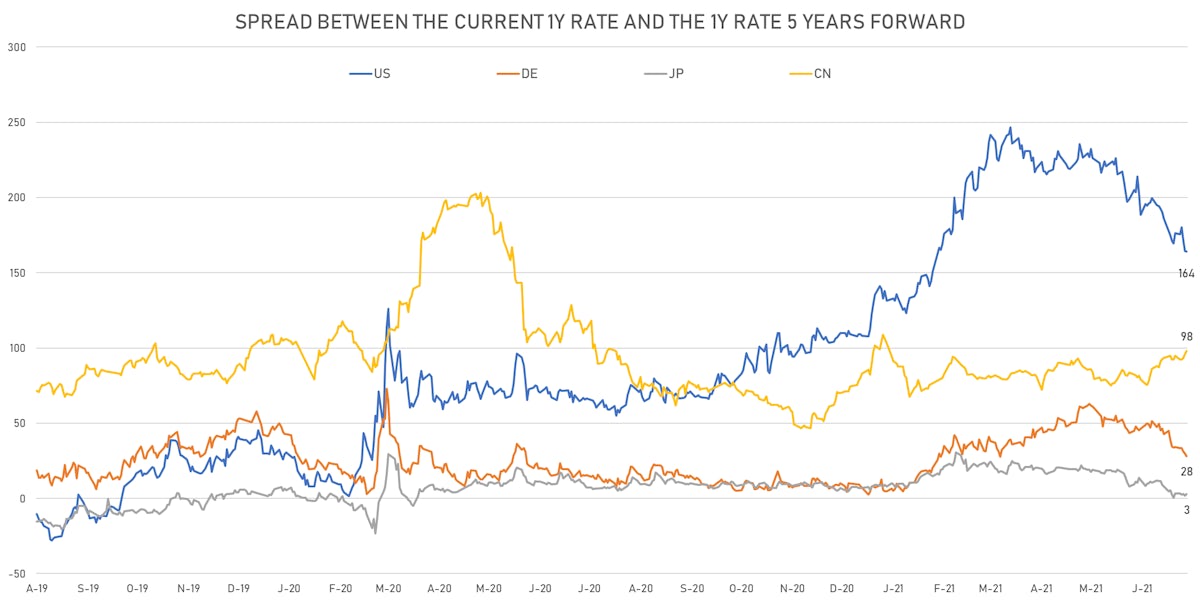

US FORWARD RATES

- 3-month USD Libor 5 years forward down 0.9 bp

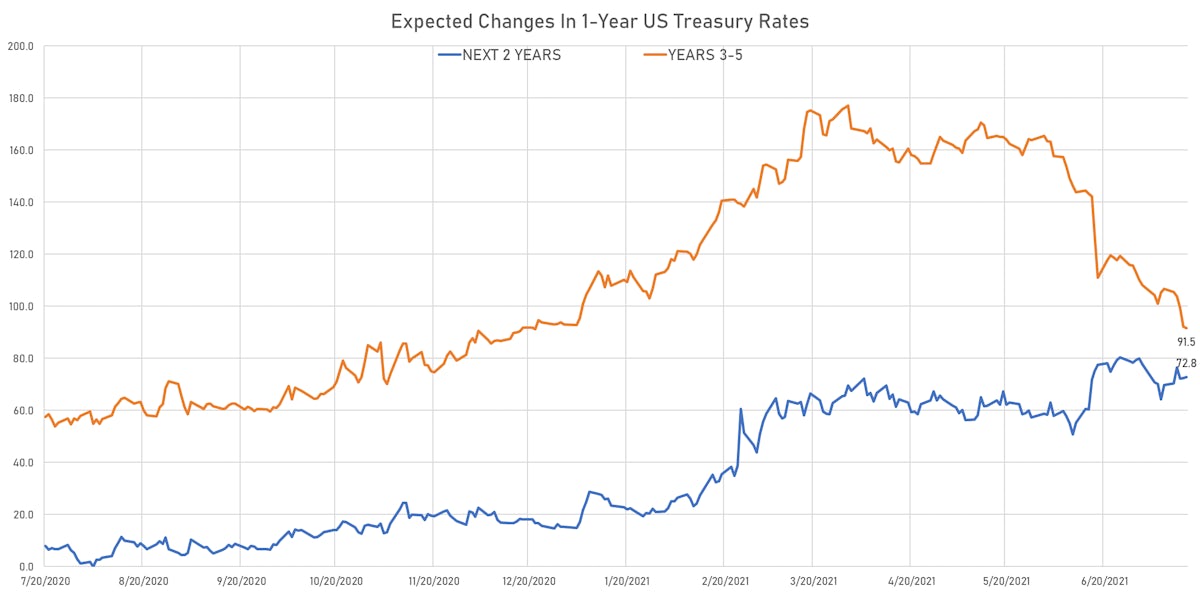

- US Treasury 1-year zero-coupon rate 5 years forward down 0.4 bp, now at 1.7261%

- 1-Year Treasury rates are now expected to increase by 164.3 bp over the next 5 years

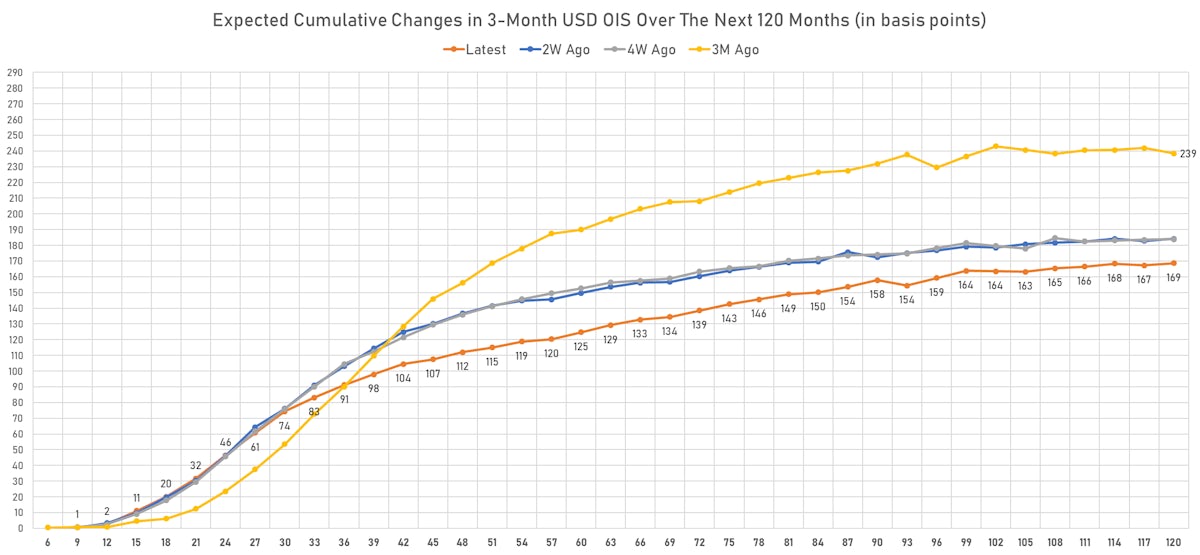

- The market currently expects the 3-month USD OIS rate to rise by 20.0 bp over the next 18 months (equivalent to 0.80 rate hike) and 91.2 bp over the next 3 years (equivalent to 3.65 rate hikes)

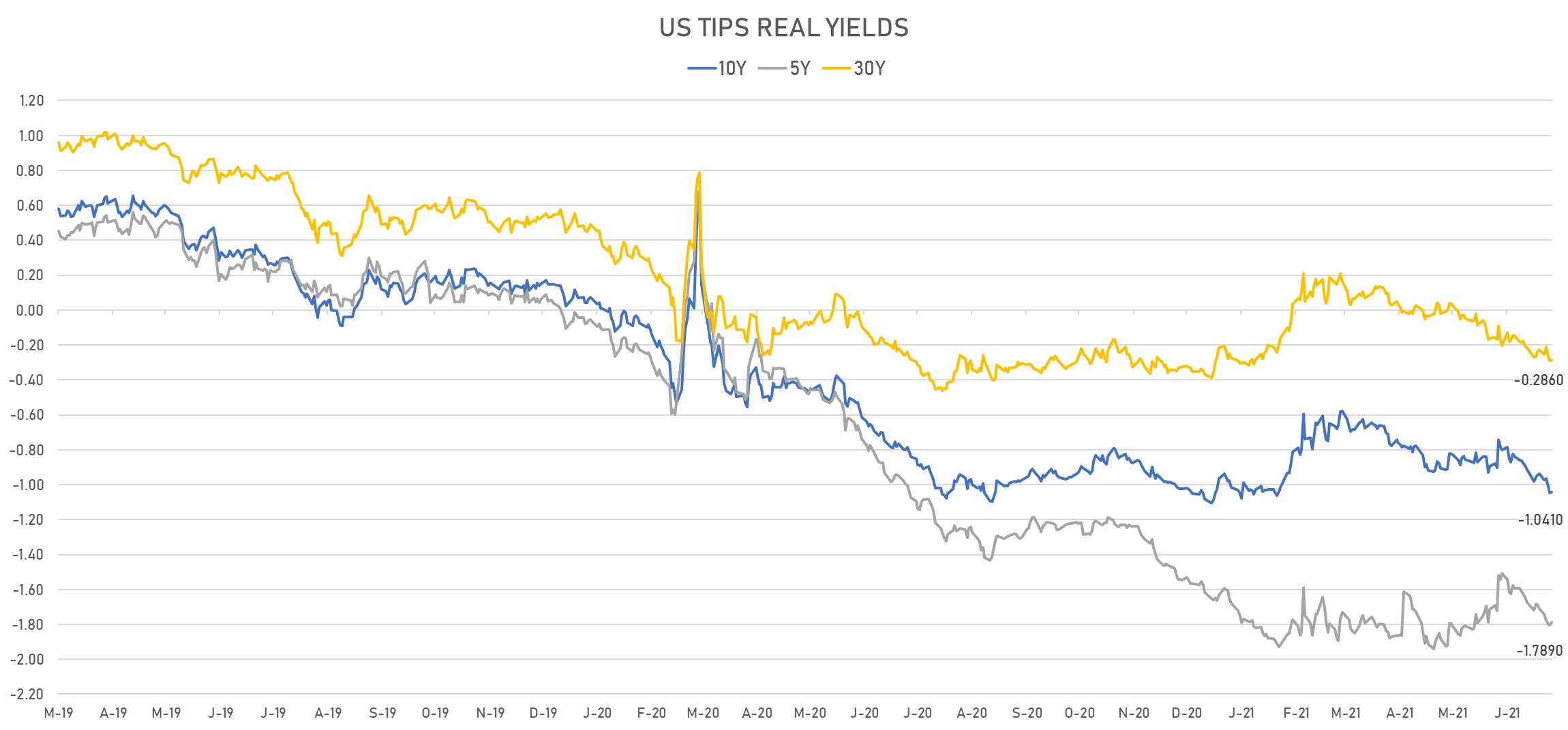

US INFLATION

- TIPS 1Y breakeven inflation at 3.37% (down -5.8bp); 2Y at 2.78% (down -3.4bp); 5Y at 2.54% (down -1.4bp); 10Y at 2.32% (down -0.6bp); 30Y at 2.23% (down -0.2bp)

- 6-month spot US CPI swap down -1.2 bp to 4.056%, with a flattening of the forward curve

US TIPS REAL YIELDS

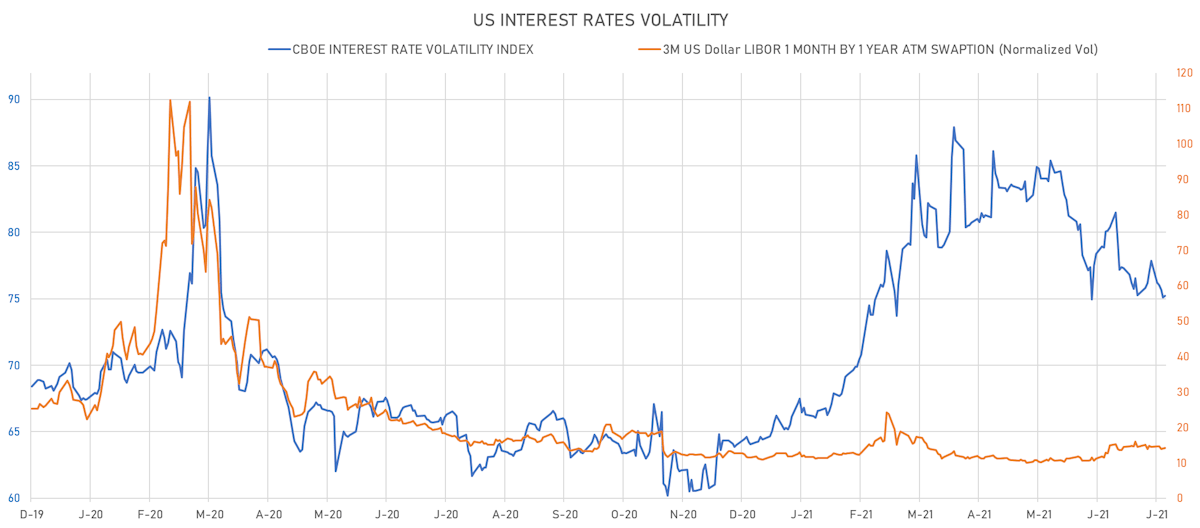

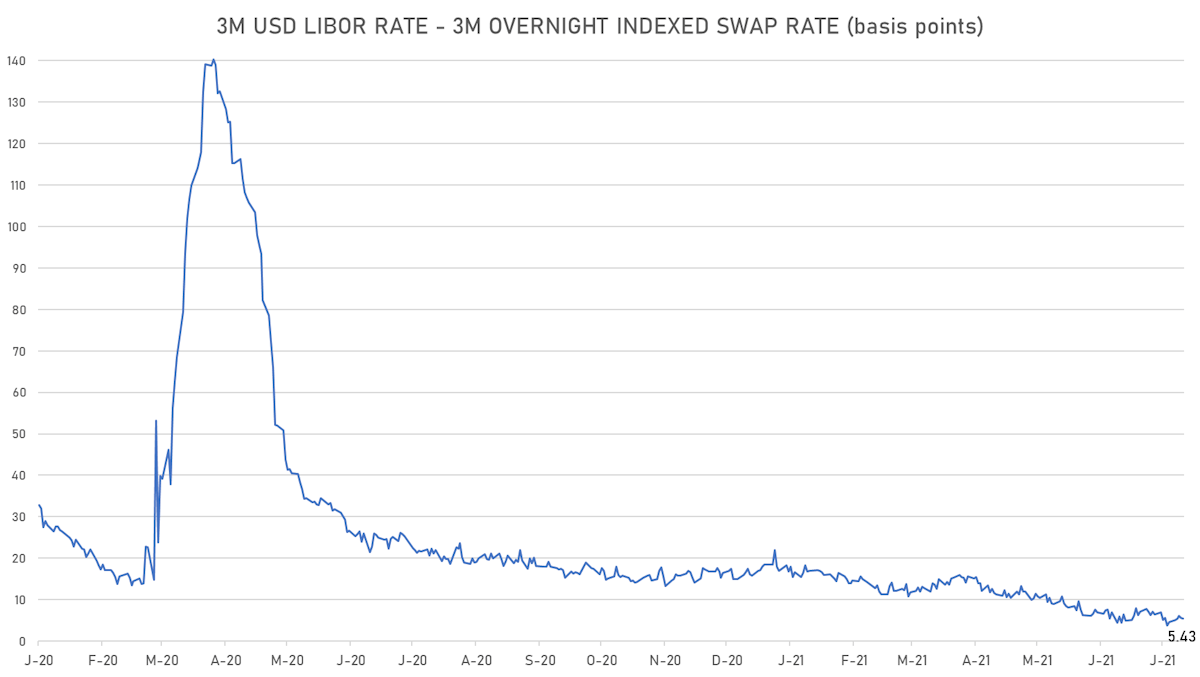

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.1% at 14.1%

- 3-Month LIBOR-OIS spread down -0.2 bp at 5.4 bp (12-months range: 3.7-23.6 bp)

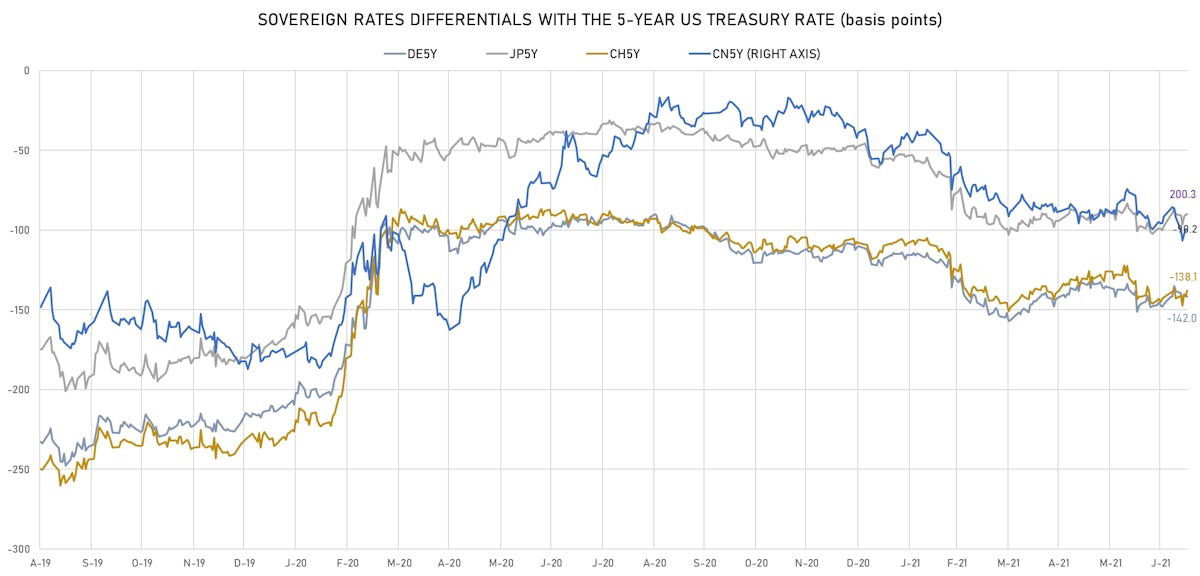

KEY INTERNATIONAL RATES

- Germany 5Y: -0.638% (down -1.6 bp); the German 1Y-10Y curve is 2.6 bp flatter at 30.2bp (YTD change: +15.1 bp)

- Japan 5Y: -0.118% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 15.1bp (YTD change: +0.2 bp)

- China 5Y: 2.784% (down -0.1 bp); the Chinese 1Y-10Y curve is 2.5 bp steeper at 93.9bp (YTD change: +47.5 bp)

- Switzerland 5Y: -0.599% (up 3.8 bp); the Swiss 1Y-10Y curve is 4.1 bp flatter at 41.7bp (YTD change: +14.3 bp)