Rates

Brutal Repricing Of The US Rates Curve From The Belly Out

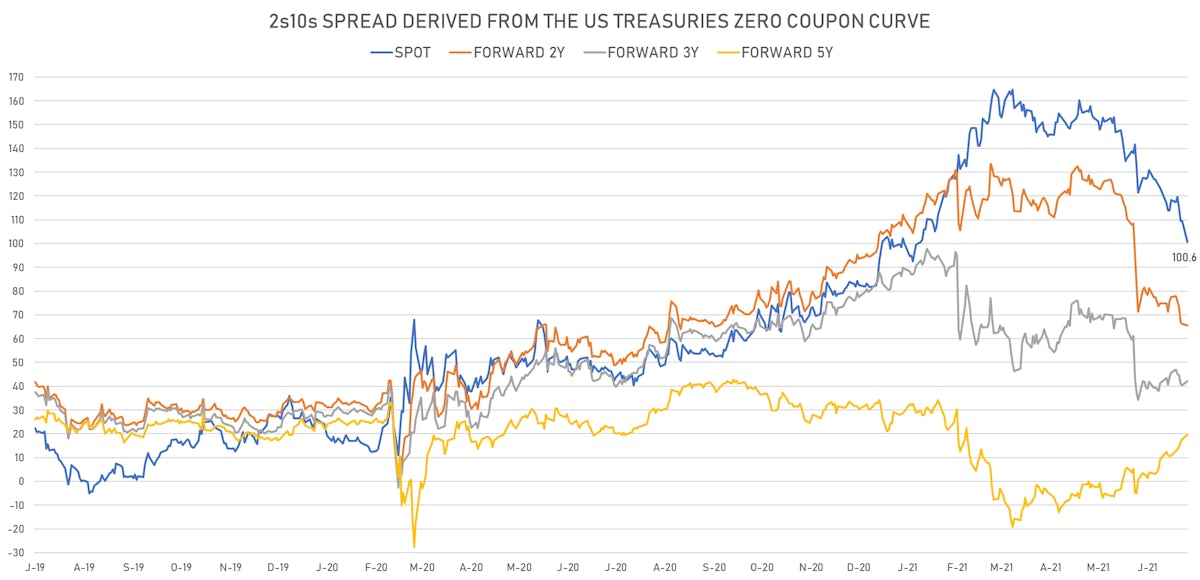

The first quarter saw positioning turn excessively bearish duration, with the forward 2s10s briefly inverting in March; those large short positions are in the process of being flushed out, which has been pushing yields to levels that are probably too low based on fundamentals

Published ET

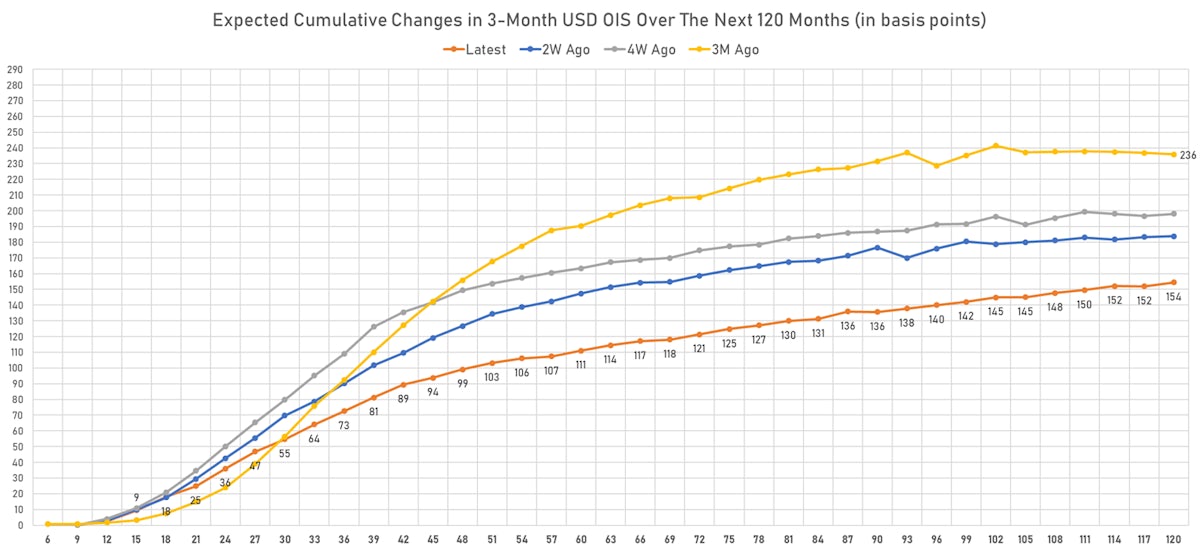

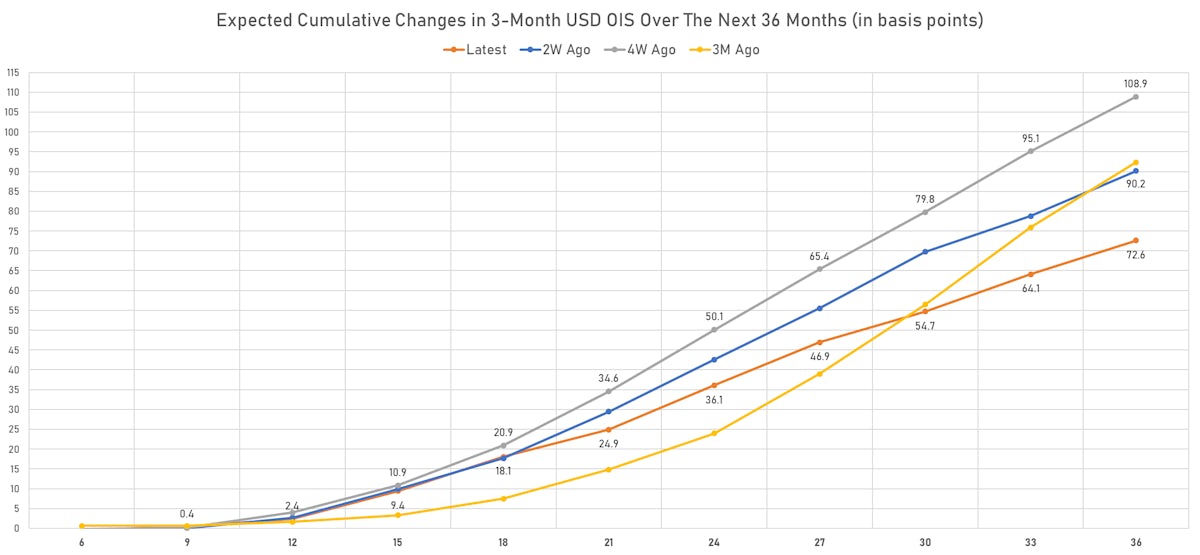

Implied Rate Hikes From The 3-Month USD OIS Forward Curve | Sources: ϕpost, Refinitiv data

NOTABLE CHANGES SINCE THE POST-FOMC RISE IN RATES LAST MONTH

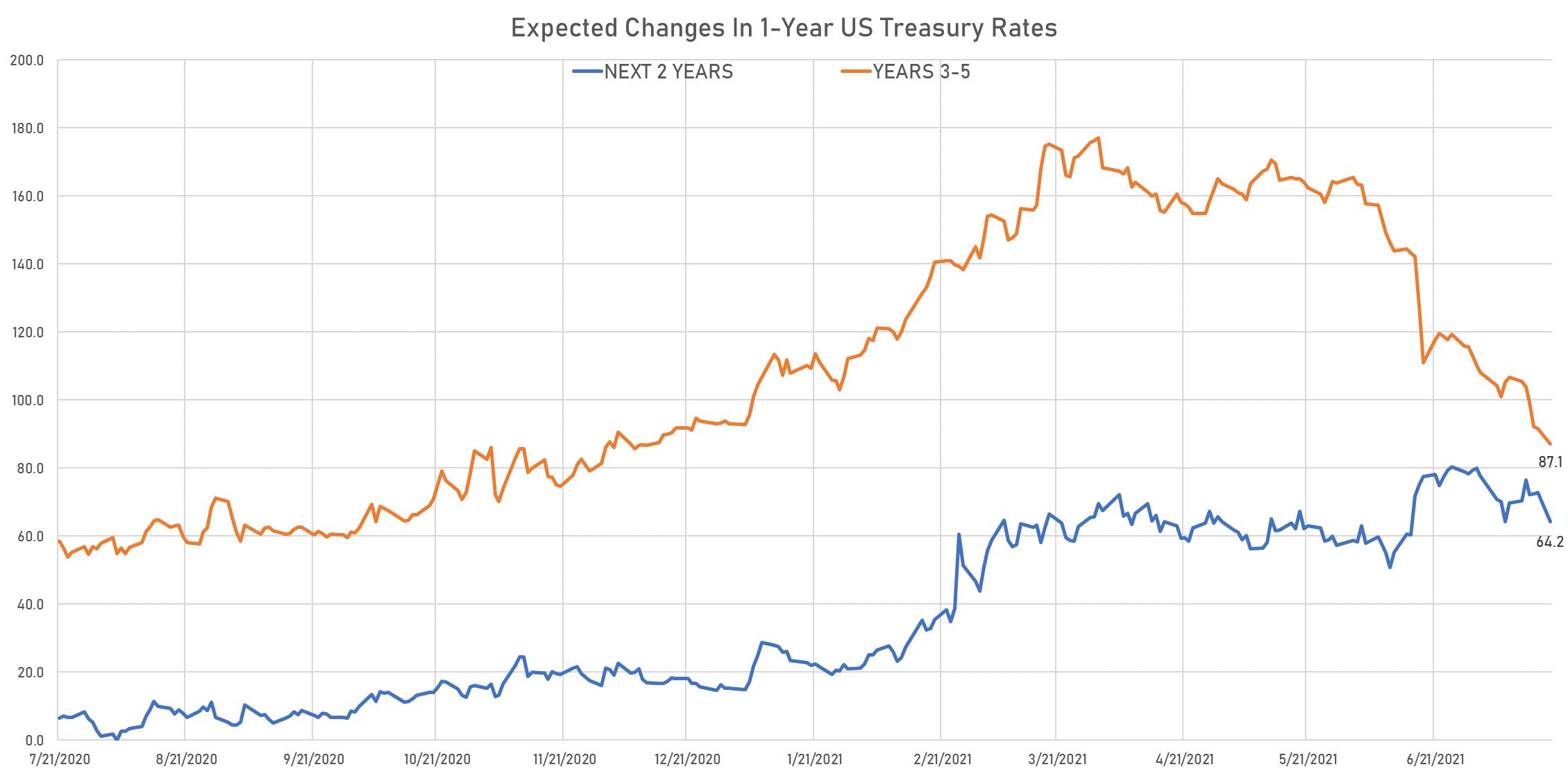

- Overall, the market now prices in a shorter economic rebound, followed by unimpressive forward growth that would not be able to withstand sharply higher rates

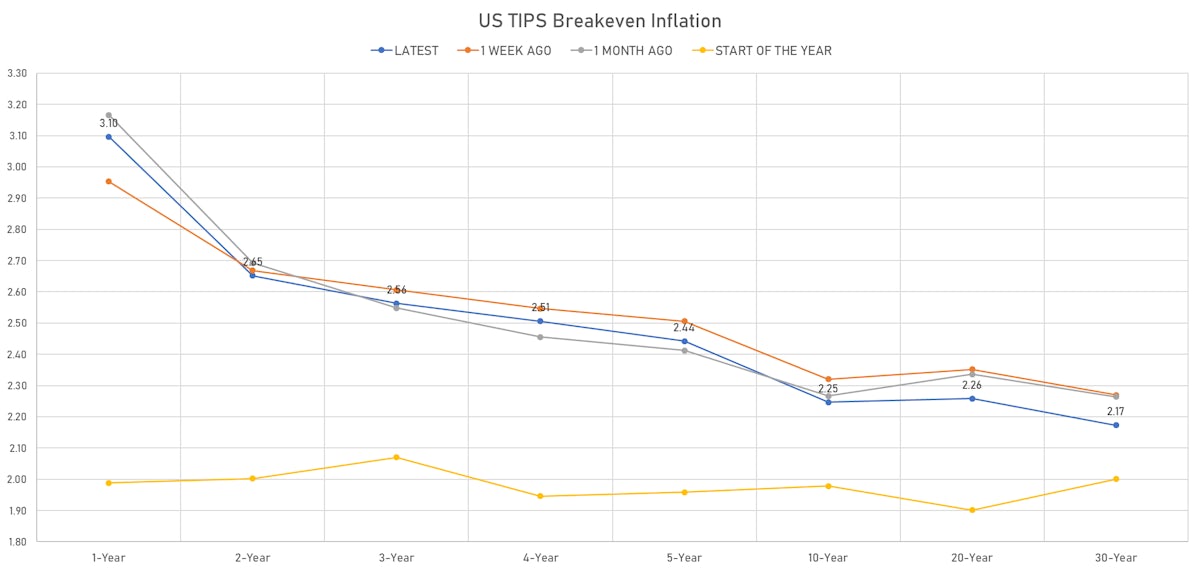

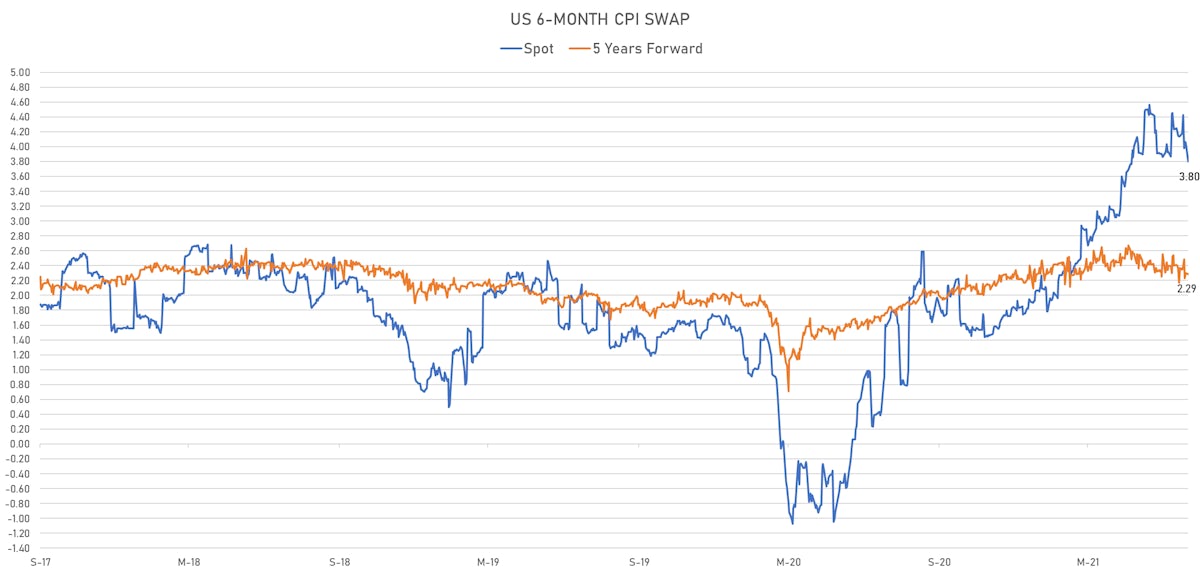

- Short-term inflation expectations have come down drastically, with longer-term inflation mostly unchanged

- Broadly-held short duration positions have had to cover, which is now pushing yields down further

- The timing and expectation of a first hike by the end of 2022 has not changed (still on)

- But the subsequent rate hikes have been pared down, leading to short-term forward rates now being 30bp lower in 3 years and 60bp lower in 5 years

- The "terminal rate" (short-term rate in 10 years) is down to 1.63% vs 2.08% last month (and 2.77% back in March at the peak of the "reflation" theme)

QUICK US DAILY SUMMARY

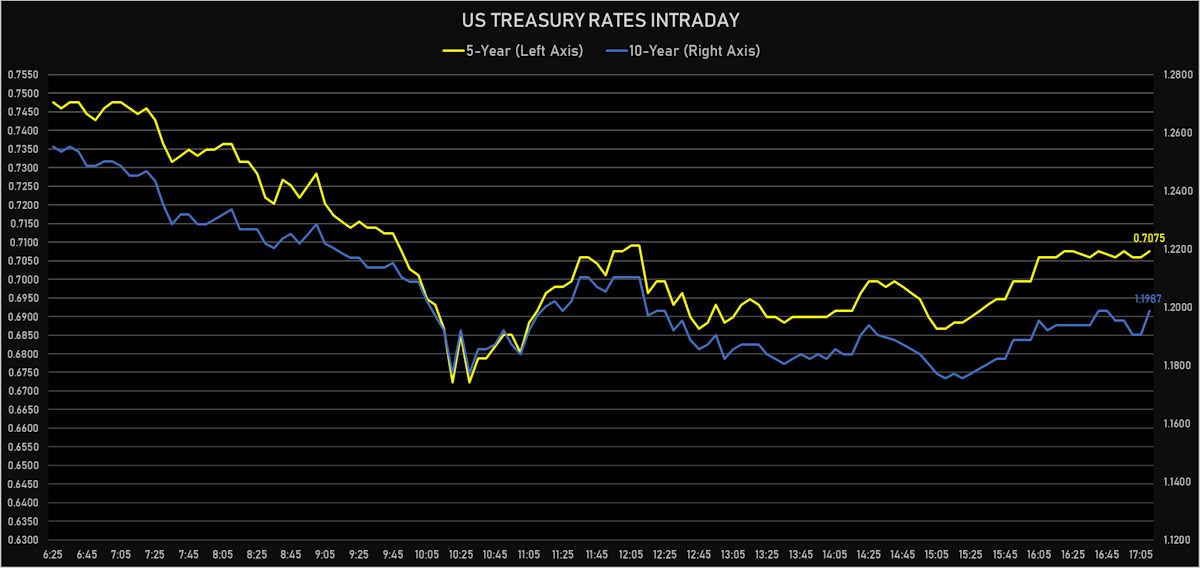

- Yield curve flatter today, with the 1s10s Treasury spread tightening -9.9 bp, now at 112.3 bp (YTD change: +31.8)

- 1Y: 0.0760% (down 0.3 bp)

- 2Y: 0.2176% (down 1.0 bp)

- 5Y: 0.7075% (down 7.4 bp)

- 7Y: 0.9817% (down 9.1 bp)

- 10Y: 1.1987% (down 10.2 bp)

- 30Y: 1.8292% (down 9.9 bp)

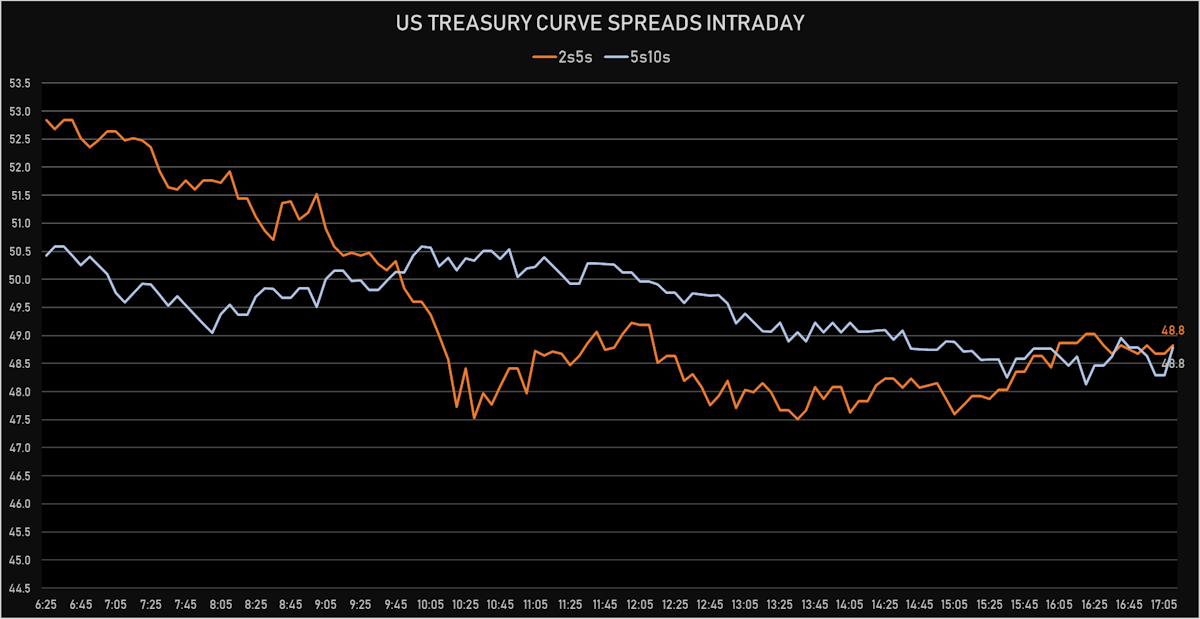

- US treasury curve spreads: 2s5s at 49.0bp (down -6.4bp), 5s10s at 49.0bp (down -2.9bp), 10s30s at 63.2bp (up 0.3bp today)

- Treasuries butterfly spreads: 2s5s10s at -0.4bp (up 3.5bp today), 5s10s30s at 14.4bp (up 3.6bp)

US MACRO RELEASES

- NAHB/Wells Fargo Housing Market Index for Jul 2021 (NAHB, United States) at 80.00, below consensus estimate of 82.00

US FORWARD RATES

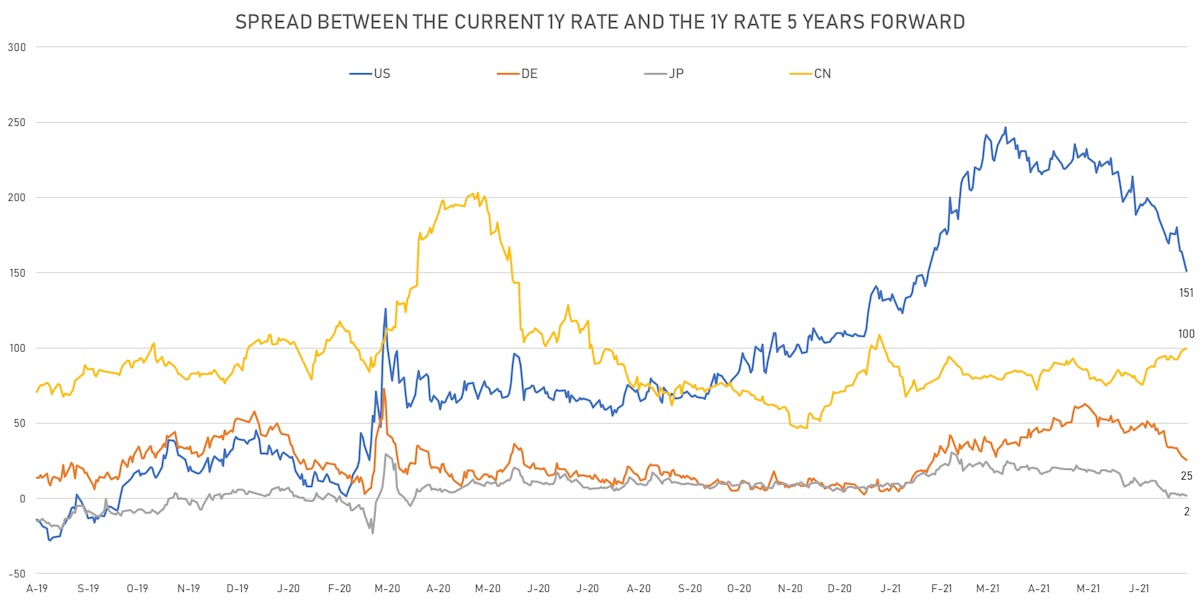

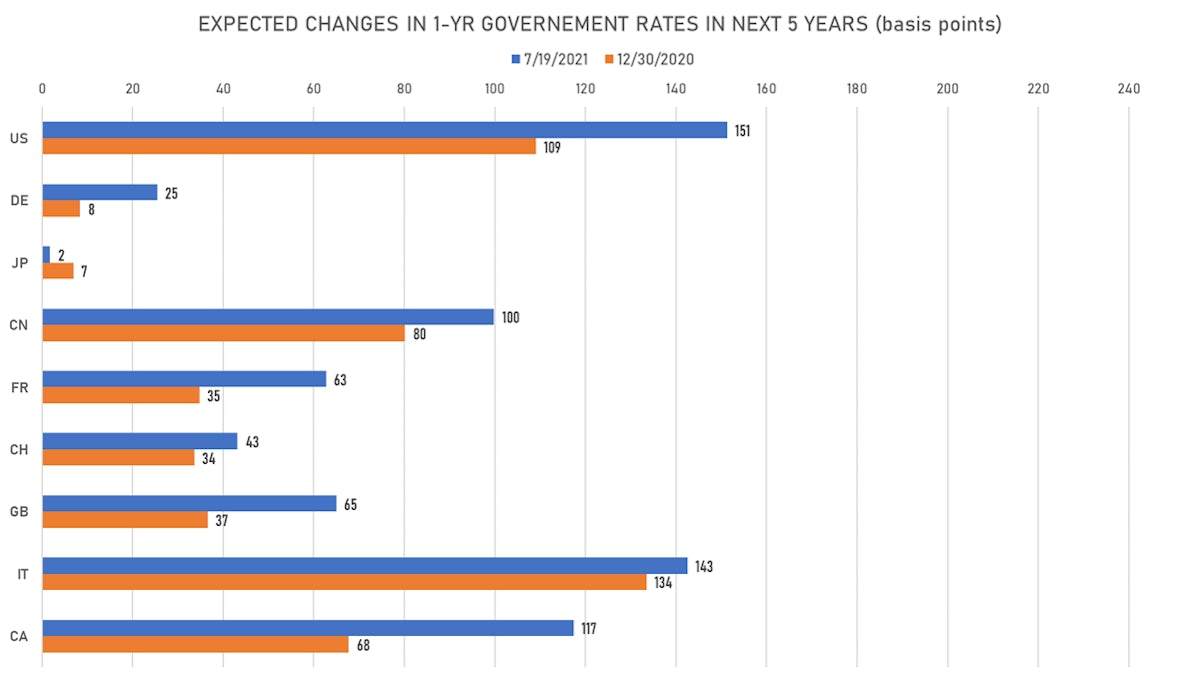

- US Treasury 1-year zero-coupon rate 5 years forward down 13.2 bp, now at 1.5937%

- 1-Year Treasury rates are now expected to increase by 151.3 bp over the next 5 years (down from 250bp a few months ago)

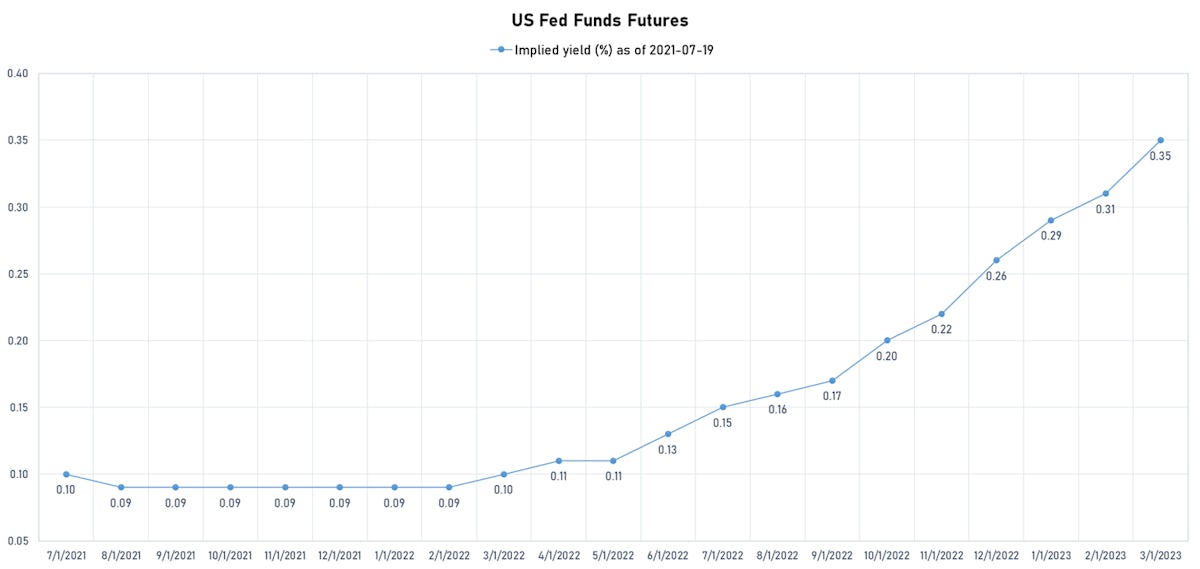

- 3-month Eurodollar futures market prices in 68.3% probability of a 25bp hike by end of 2022

- 3-month USD OIS rate to rise by 18.1 bp over the next 18 months (equivalent to 0.72 rate hike) and 72.6 bp over the next 3 years (equivalent to 2.90 rate hikes)

US INFLATION

- TIPS 1Y breakeven inflation at 3.10% (down -27.5bp); 2Y at 2.65% (down -13.1bp); 5Y at 2.44% (down -10.1bp); 10Y at 2.25% (down -7.1bp); 30Y at 2.17% (down -6.0bp)

- 6-month spot US CPI swap down -25.5 bp to 3.801%, with a flattening of the forward curve

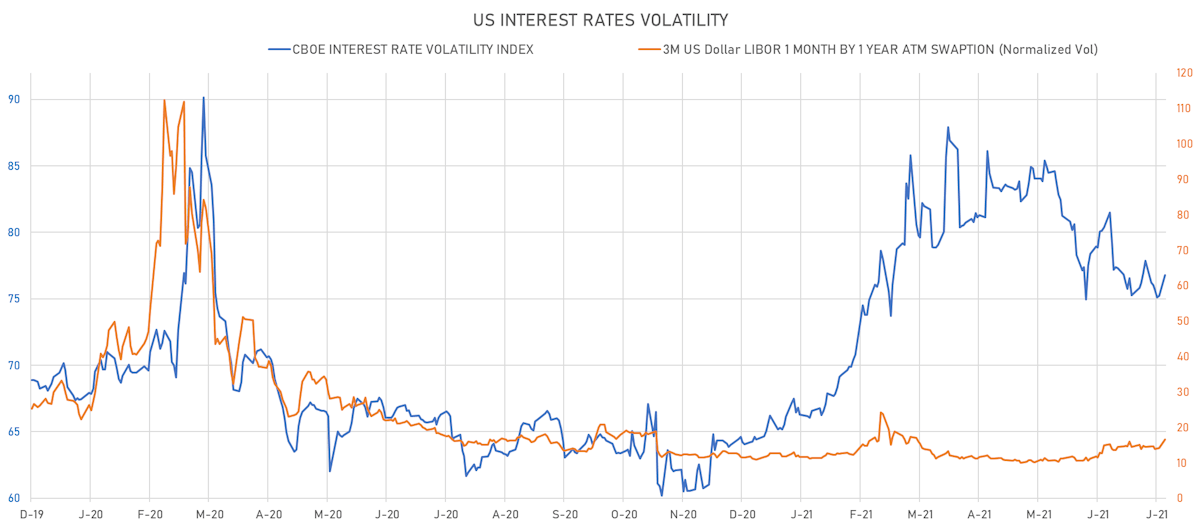

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.5% at 16.6%

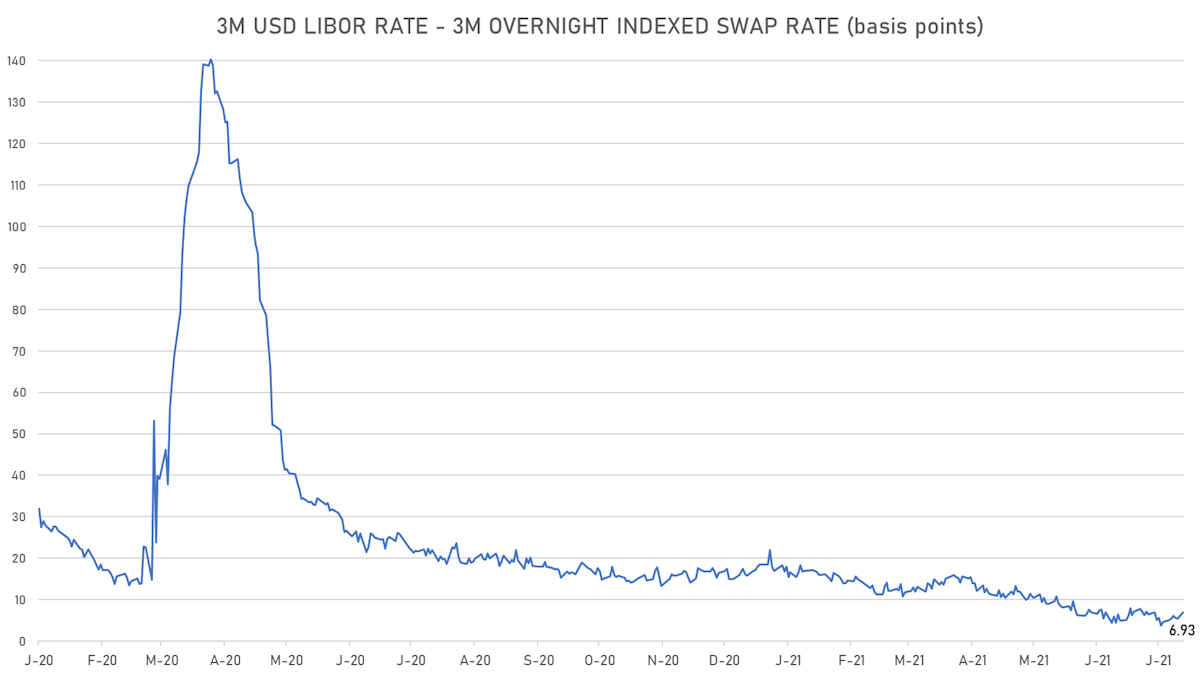

- 3-Month LIBOR-OIS spread up 1.5 bp at 6.9 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.661% (down -1.9 bp); the German 1Y-10Y curve is 8.1 bp flatter at 21.7bp (YTD change: +7.0 bp)

- Japan 5Y: -0.117% (down -0.4 bp); the Japanese 1Y-10Y curve is unchanged at 14.4bp (YTD change: +0.2 bp)

- China 5Y: 2.786% (up 0.2 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 95.9bp (YTD change: +49.5 bp)

- Switzerland 5Y: -0.643% (down -7.0 bp); the Swiss 1Y-10Y curve is 1.7 bp steeper at 43.4bp (YTD change: +16.0 bp)