Rates

US Rates Rebound, Markets Still Recalibrating Growth Expectations

US 10-Year treasury rates touched 1.1290% before equity markets opened, rebounded to hit 1.2218% at the close; analysts do not expect the short-term low to be in yet, with 1.0750% in view

Published ET

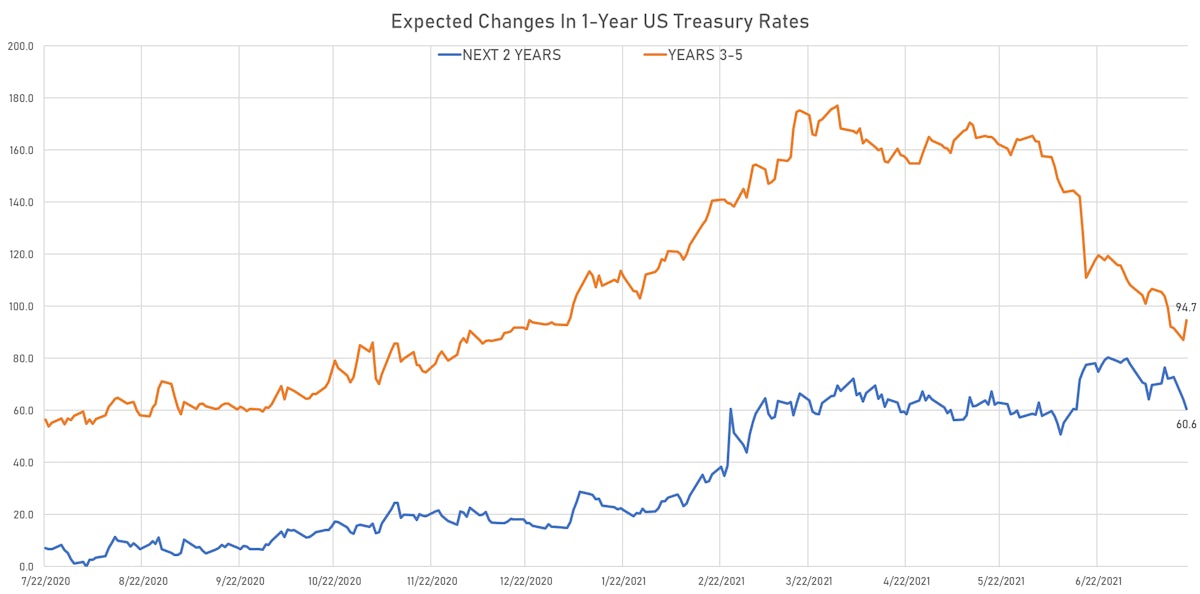

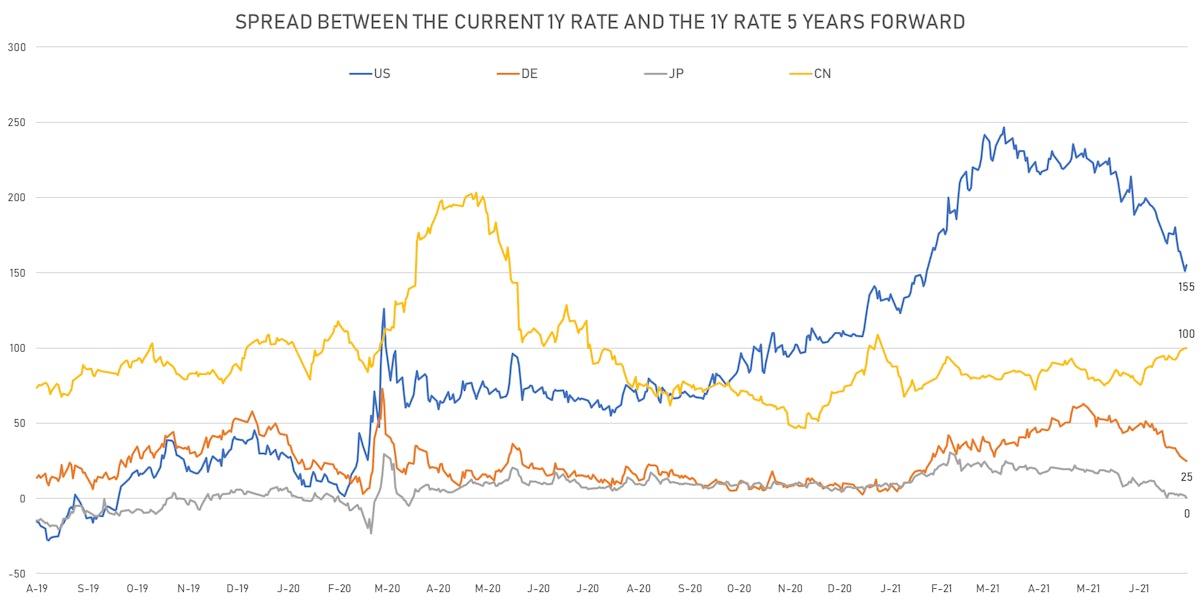

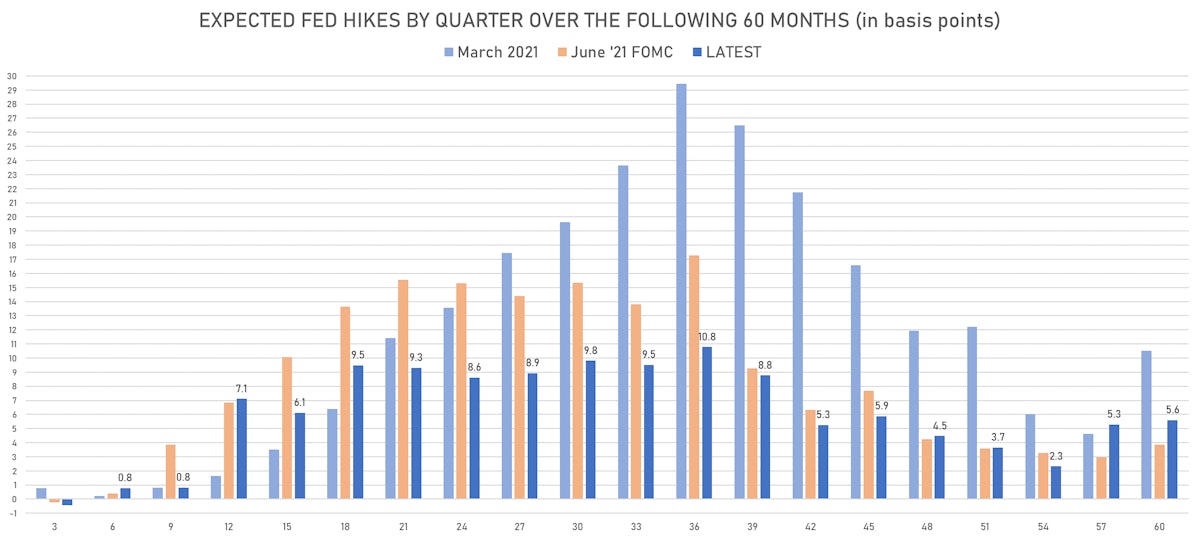

The timing and magnitude of expected Fed hikes have changed dramatically over the past months | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- Yield curve steepening, with the 1s10s Treasury spread widening 2.3 bp, now at 114.8 bp (YTD change: +34.3)

- 1Y: 0.0740% (unchanged)

- 2Y: 0.2016% (down 1.6 bp)

- 5Y: 0.6850% (down 2.3 bp)

- 7Y: 0.9793% (down 0.2 bp)

- 10Y: 1.2218% (up 2.3 bp)

- 30Y: 1.8771% (up 4.8 bp)

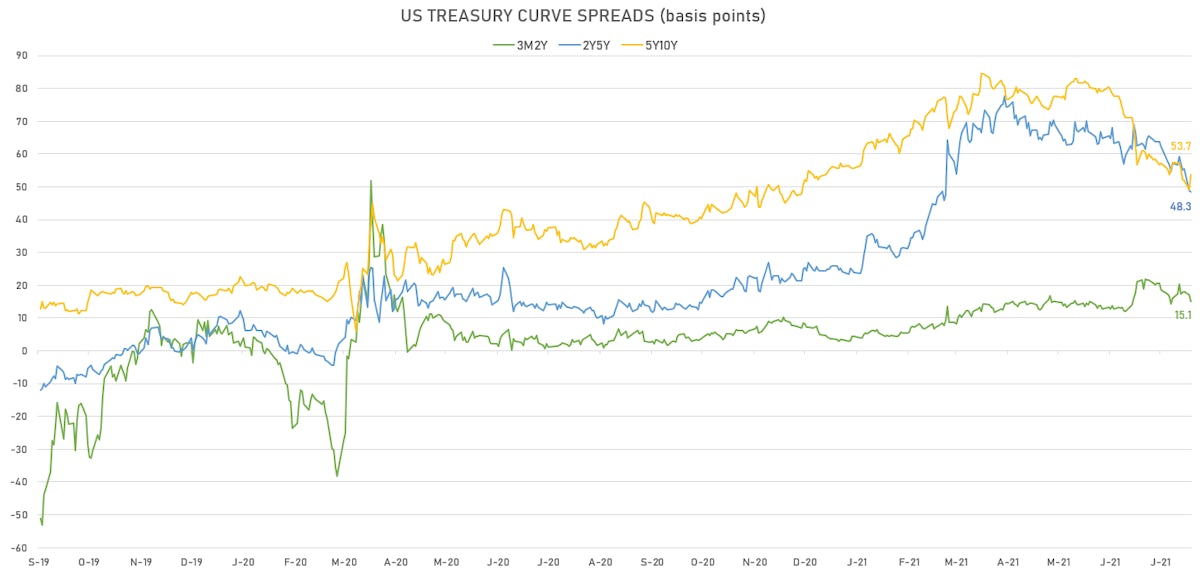

- US treasury curve spreads: 2s5s at 48.4bp (down -0.6bp), 5s10s at 53.7bp (up 4.7bp today), 10s30s at 65.5bp (up 2.5bp today)

- Treasuries butterfly spreads: 2s5s10s at 5.0bp (up 5.4bp today), 5s10s30s at 11.3bp (down -3.1bp)

- US 5-Year TIPS Real Yield: -1.6 bp at -1.7740%; 10-Year TIPS Real Yield: +1.8 bp at -1.0500%; 30-Year TIPS Real Yield: +3.6 bp at -0.2890%

US MACRO RELEASES

- Building Permits for Jun 2021 (U.S. Census Bureau) at 1.60 Mln, below consensus estimate of 1.70 Mln

- Building Permits, Change P/P for Jun 2021 (U.S. Census Bureau) at -5.10 %

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 17 Jul (Redbook Research) at 15.00 %

- Housing Starts for Jun 2021 (U.S. Census Bureau) at 1.64 Mln, above consensus estimate of 1.59 Mln

- Housing Starts, Change P/P for Jun 2021 (U.S. Census Bureau) at 6.30 %

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 3.8 bp, now at 1.6315%

- 1-Year Treasury rates are now expected to increase by 155.3 bp over the next 5 years (equivalent to 6 x 25bp hikes)

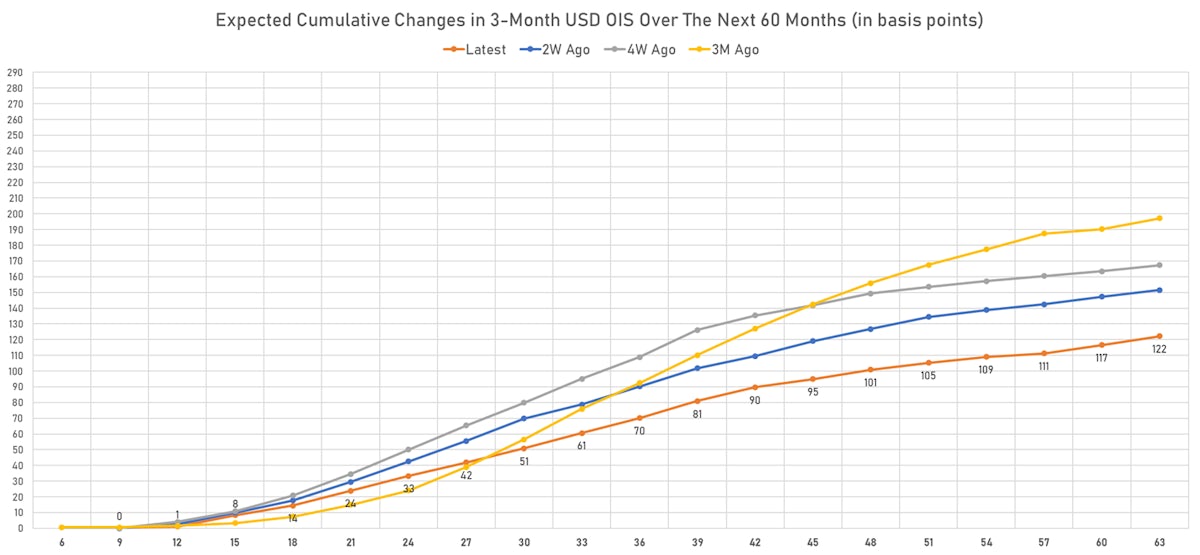

- The market currently expects the 3-month USD OIS rate to rise by 14.4 bp over the next 18 months (equivalent to 0.58 rate hike) and 70.1 bp over the next 3 years (equivalent to 2.8 rate hikes)

US INFLATION & REAL RATES

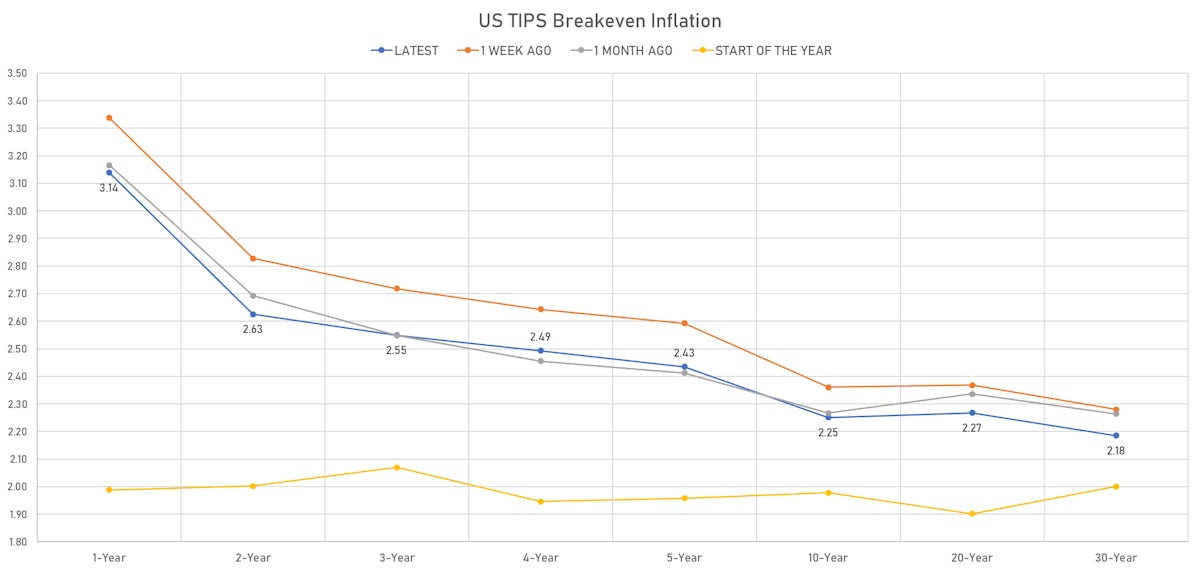

- TIPS 1Y breakeven inflation at 3.14% (up 4.2bp); 2Y at 2.63% (down -2.6bp); 5Y at 2.43% (down -0.8bp); 10Y at 2.25% (up 0.4bp); 30Y at 2.18% (up 1.2bp)

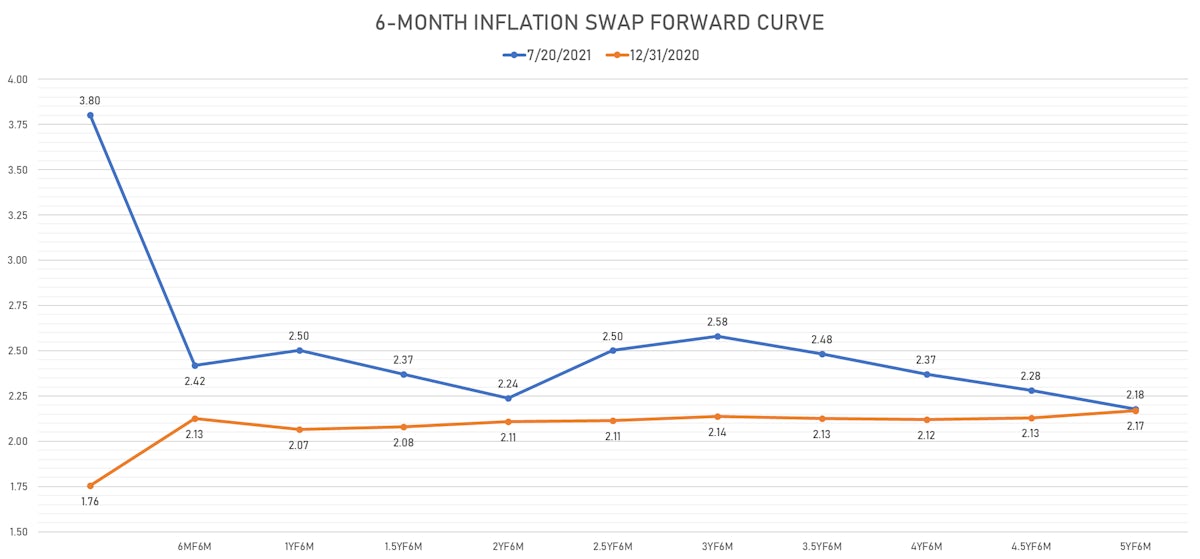

- 6-month spot US CPI swap unchanged at 3.80%, with a steepening of the forward curve

RATES VOLATILITY & LIQUIDITY

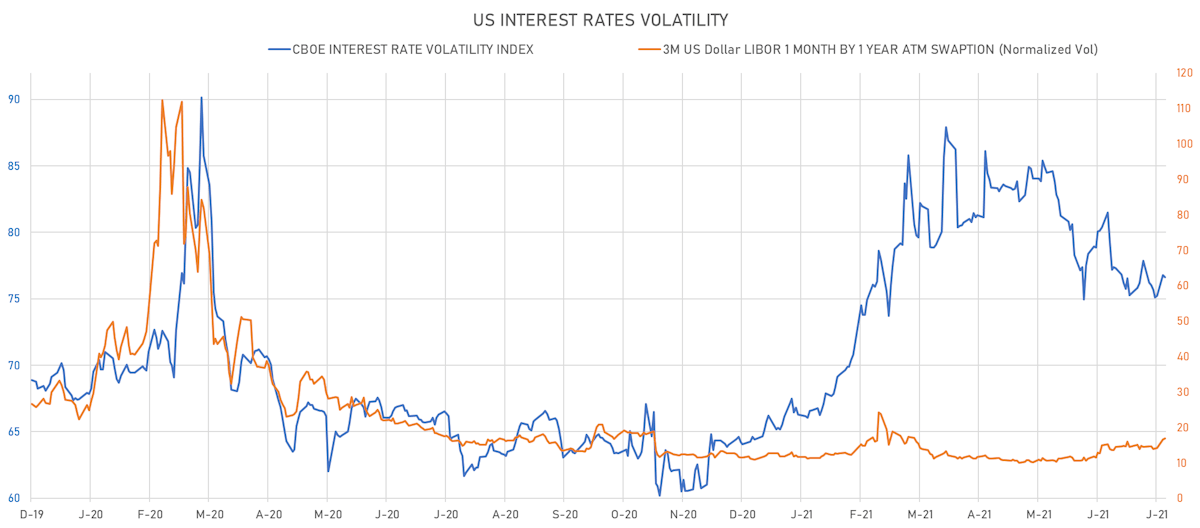

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.2% at 16.8%

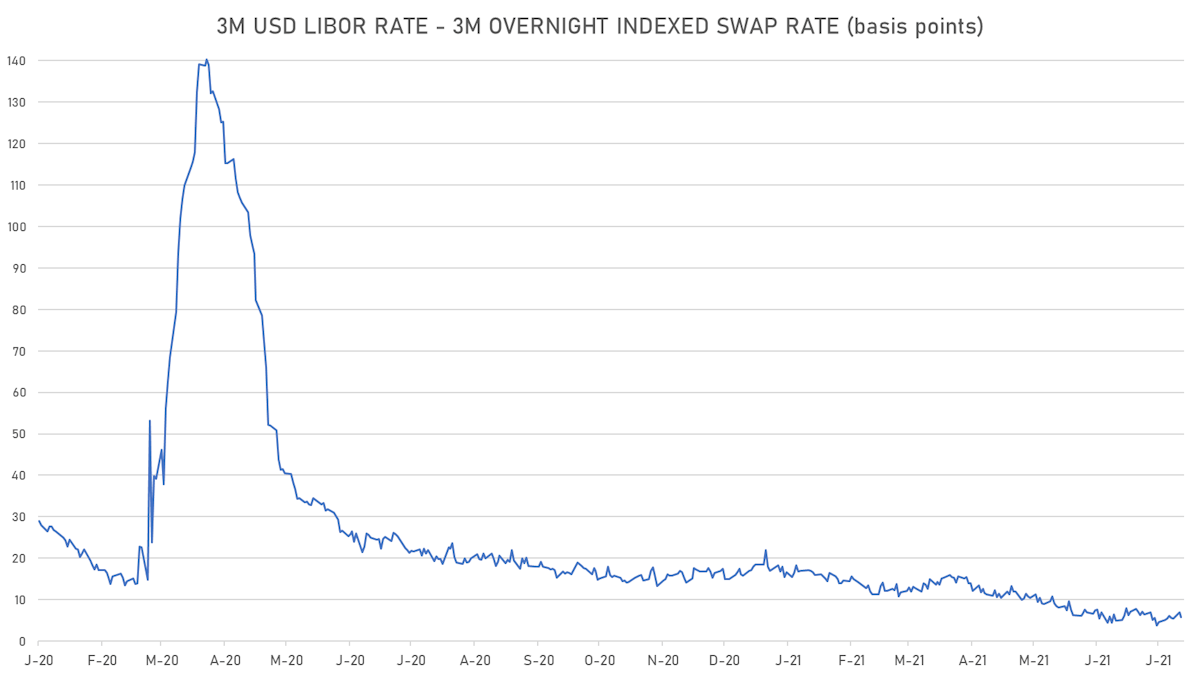

- 3-Month LIBOR-OIS spread down -1.1 bp at 5.8 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

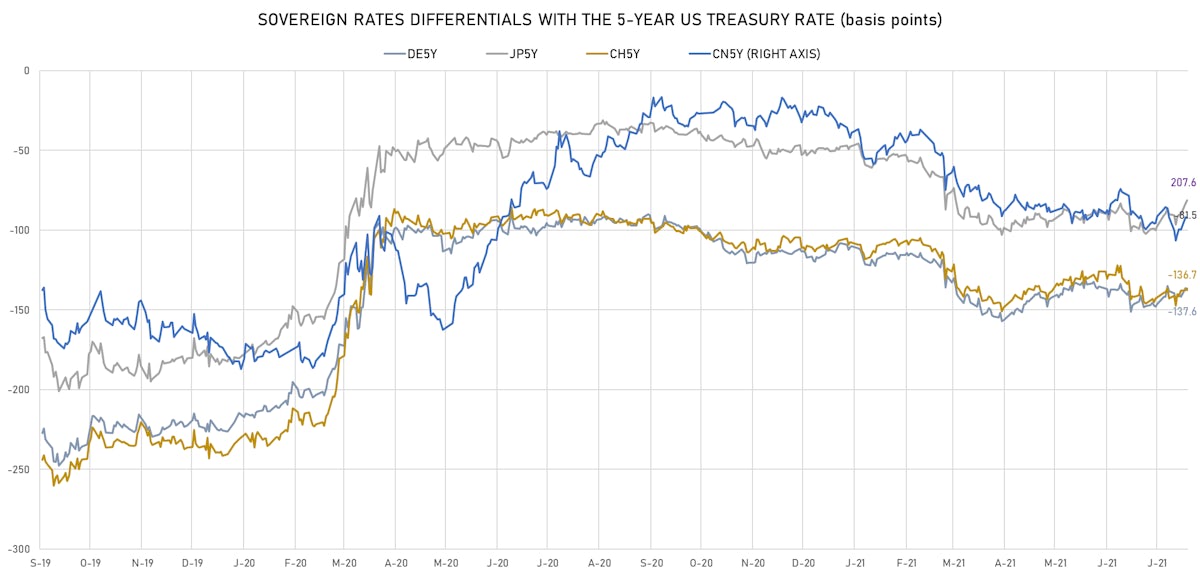

- Germany 5Y: -0.692% (down -3.4 bp); the German 1Y-10Y curve is 0.2 bp steeper at 22.0bp (YTD change: +7.2 bp)

- Japan 5Y: -0.131% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.0 bp flatter at 14.5bp (YTD change: +0.2 bp)

- China 5Y: 2.761% (down -2.5 bp); the Chinese 1Y-10Y curve is 2.5 bp steeper at 98.4bp (YTD change: +52.0 bp)

- Switzerland 5Y: -0.670% (down -1.3 bp); the Swiss 1Y-10Y curve is 3.1 bp flatter at 39.4bp (YTD change: +12.9 bp)