Rates

US Rates Dip After Monster Two-Day Rally

The moves in rates this week reflect the difficulty of gauging future economic growth in such an uncertain environment, with the delta variant but also a Fed divided about its possible next steps

Published ET

Changes in the US 1-Year Treasury Rate (Derived From The Zero-Coupon Forward Curve) | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

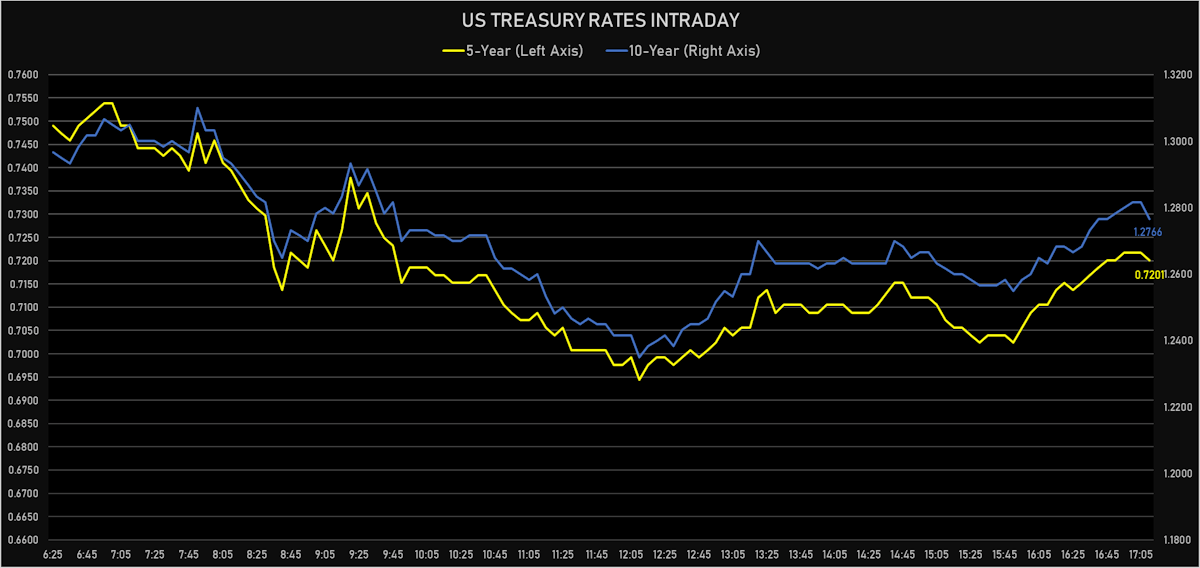

- Yield curve flattening, with the 1s10s Treasury spread tightening -1.3 bp on the day, now at 120.6 bp (YTD change: +40.1)

- 1Y: 0.0710% (down 0.3 bp)

- 2Y: 0.2018% (down 0.8 bp)

- 5Y: 0.7201% (down 1.8 bp)

- 7Y: 1.0301% (down 1.6 bp)

- 10Y: 1.2766% (down 1.5 bp)

- 30Y: 1.9126% (down 2.7 bp)

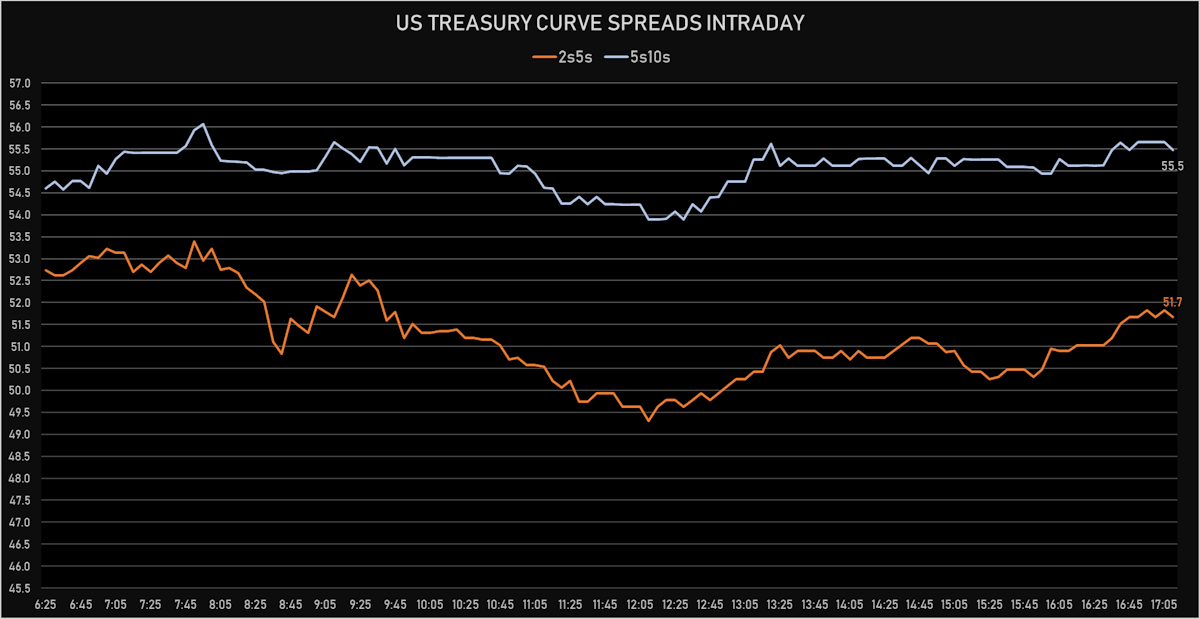

- US treasury curve spreads: 2s5s at 51.9bp (down -1.0bp), 5s10s at 55.7bp (up 0.3bp today), 10s30s at 63.6bp (down -1.2bp)

- Treasuries butterfly spreads: 2s5s10s at 3.5bp (up 1.2bp today), 5s10s30s at 7.2bp (down -2.4bp)

- US 5-Year TIPS Real Yield: -2.7 bp at -1.8000%; 10-Year TIPS Real Yield: -2.0 bp at -1.0310%; 30-Year TIPS Real Yield: -2.3 bp at -0.2760%

US MACRO RELEASES

- Chicago Fed CFMMI, National Activity Index for Jun 2021 (Fed Res, Chicago) at 0.09

- Existing-Home Sales, Single-Family and Condos, total for Jun 2021 (NAR, United States) at 5.86 Mln, below consensus estimate of 5.90 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Jun 2021 (NAR, United States) at 1.40 %

- Jobless Claims, National, Continued for W 10 Jul (U.S. Dept. of Labor) at 3.24 Mln, above consensus estimate of 3.10 Mln

- Jobless Claims, National, Initial for W 17 Jul (U.S. Dept. of Labor) at 419.00 k, above consensus estimate of 350.00 k

- Jobless Claims, National, Initial, four week moving average for W 17 Jul (U.S. Dept. of Labor) at 385.25 k

- Kansas Fed, Current composite index for Jul 2021 (FED, Kansas) at 30.00

- Kansas Fed, Current production index for Jul 2021 (FED, Kansas) at 41.00

- Leading Index, Change P/P for Jun 2021 (The Conference Board) at 0.70 %, below consensus estimate of 0.90 %

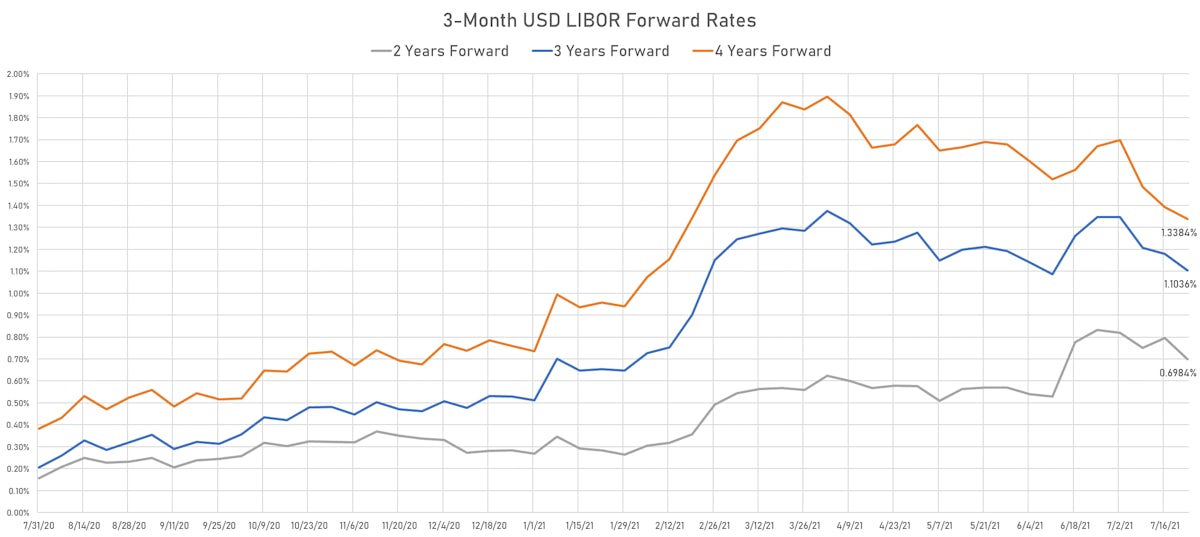

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 1.9 bp, now at 1.7123%

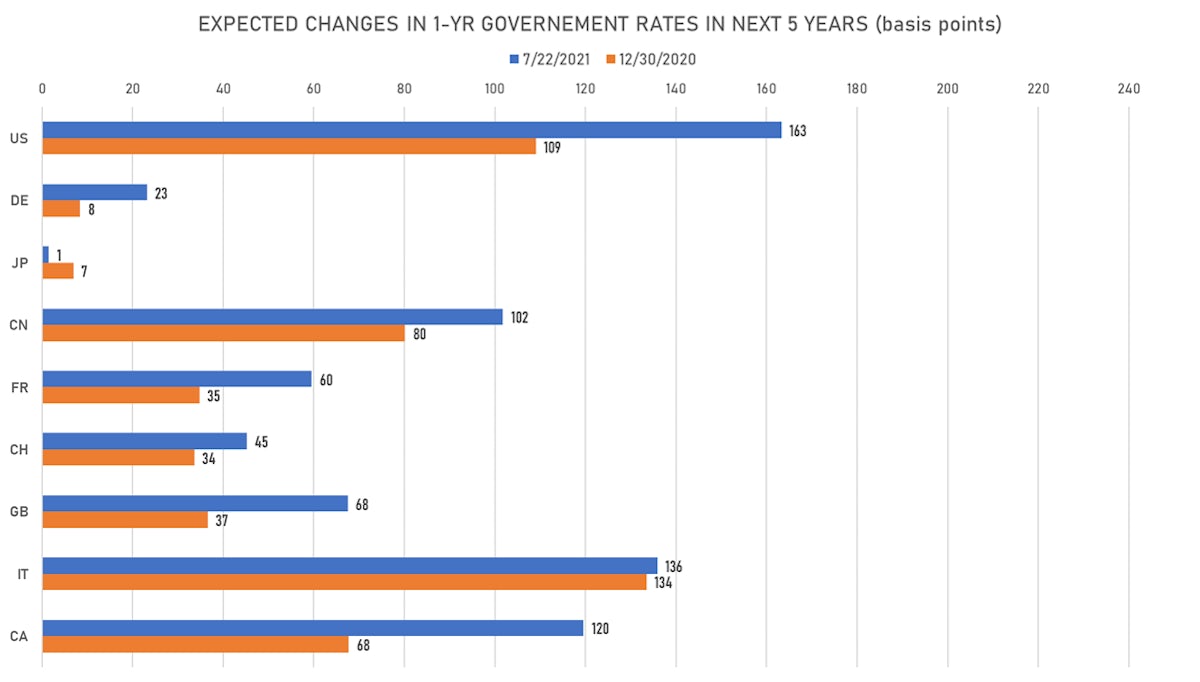

- 1-Year Treasury rates are now expected to increase by 163.3 bp over the next 5 years

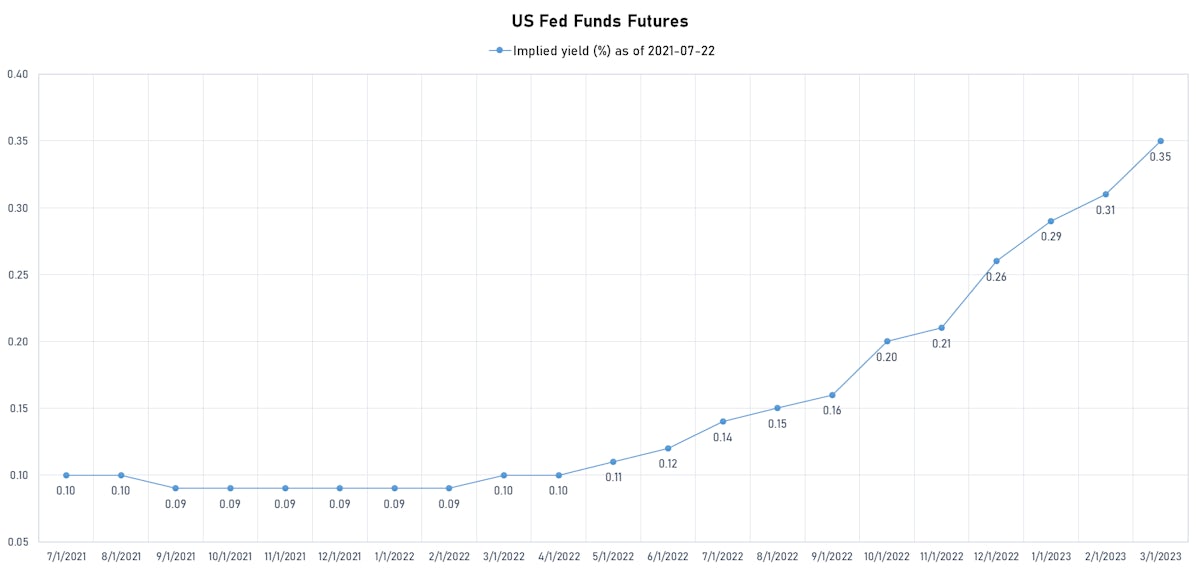

- 3-month Eurodollar futures expected hike of 17.5 bp by the end of 2022 (meaning the market prices 70.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 15.2 bp of rate hikes over the next 18 months (equivalent to 0.61 rate hike) and 69.9 bp over the next 3 years (equivalent to 2.80 rate hikes)

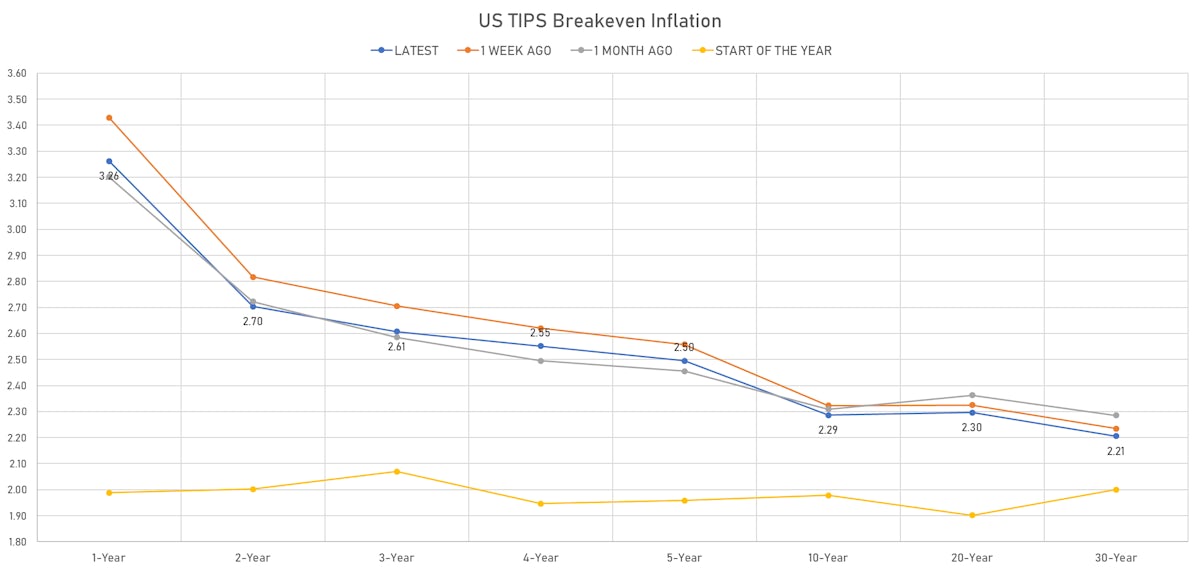

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.26% (up 2.0bp); 2Y at 2.70% (up 2.9bp); 5Y at 2.50% (up 1.3bp); 10Y at 2.29% (up 0.7bp); 30Y at 2.21% (down -0.5bp)

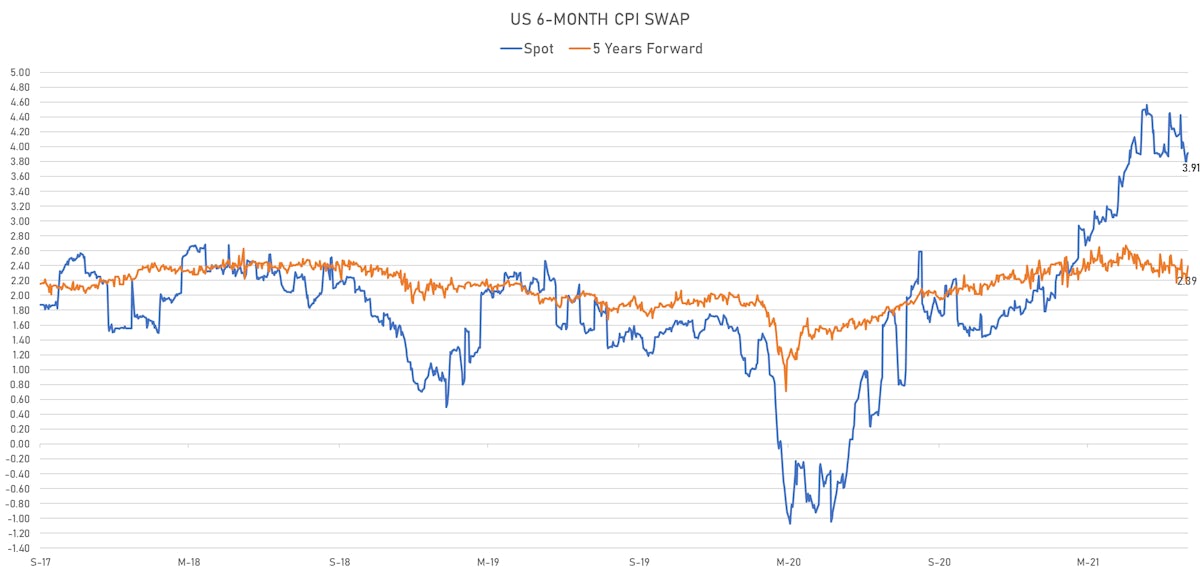

- 6-month spot US CPI swap up 0.9 bp to 3.913%, with a flattening of the forward curve

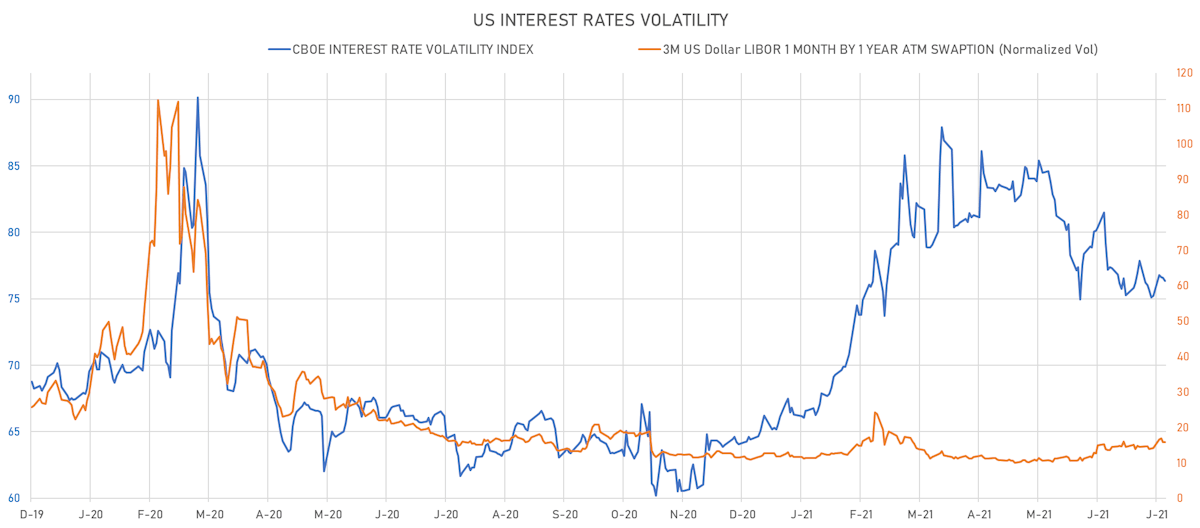

RATES VOLATILITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) unchanged at 15.8%

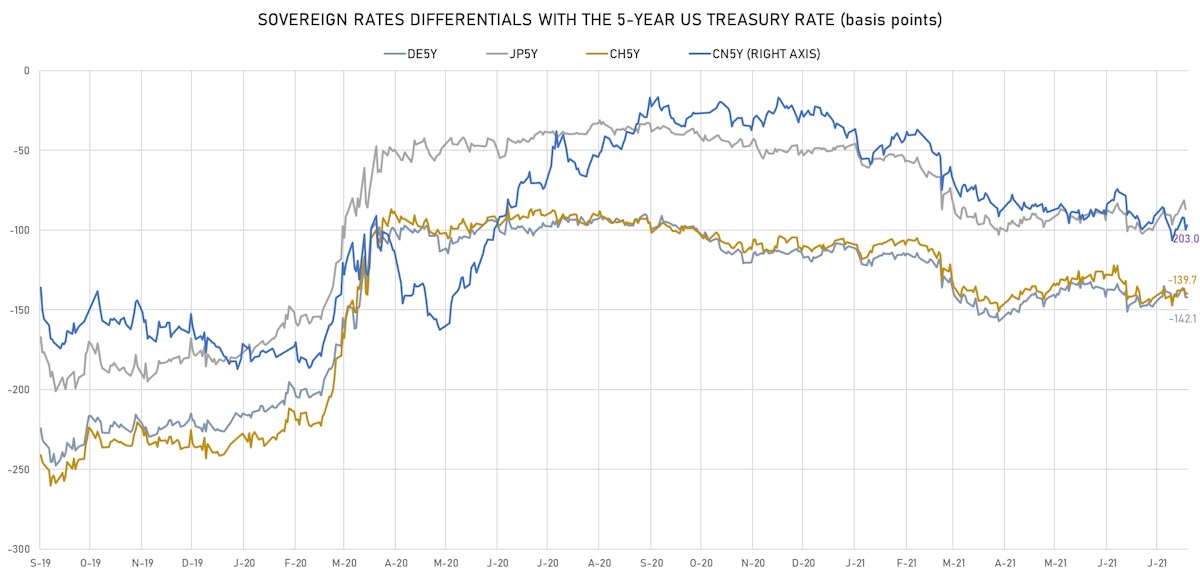

KEY INTERNATIONAL RATES

- Germany 5Y: -0.699% (down -1.8 bp); the German 1Y-10Y curve is 2.2 bp flatter at 21.4bp (YTD change: +6.4 bp)

- Japan 5Y: -0.122% (down 0.0 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 14.4bp (YTD change: -0.1 bp)

- China 5Y: 2.750% (up 1.0 bp); the Chinese 1Y-10Y curve is 1.2 bp flatter at 95.7bp (YTD change: +49.3 bp)

- Switzerland 5Y: -0.677% (down -1.1 bp); the Swiss 1Y-10Y curve is 7.7 bp flatter at 34.0bp (YTD change: +7.6 bp)