Rates

Slight Steepening Of The US Treasury Curve, But Real Yields Close To Record Lows

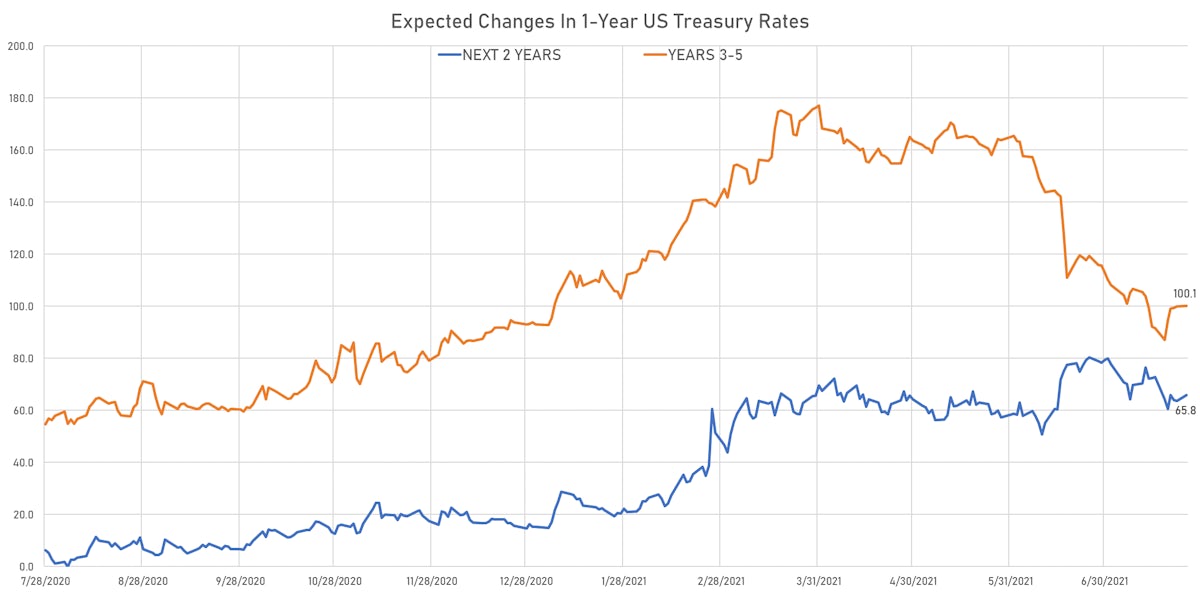

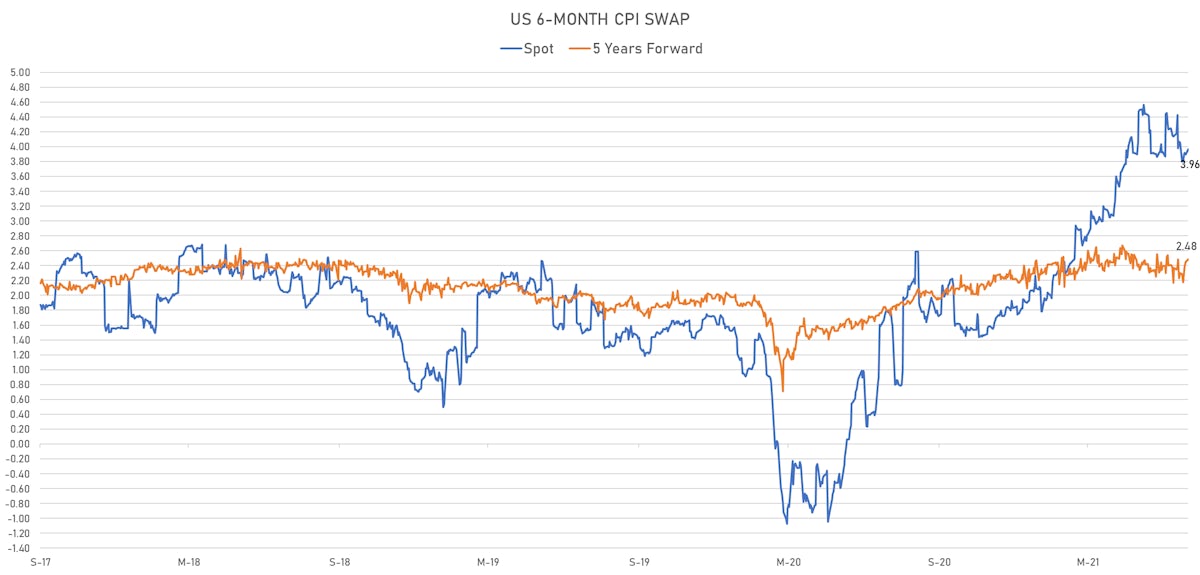

Higher inflation expectations are spreading down the forward swap curve, with the markets now pricing in a slower normalization of the short-term inflation surge

Published ET

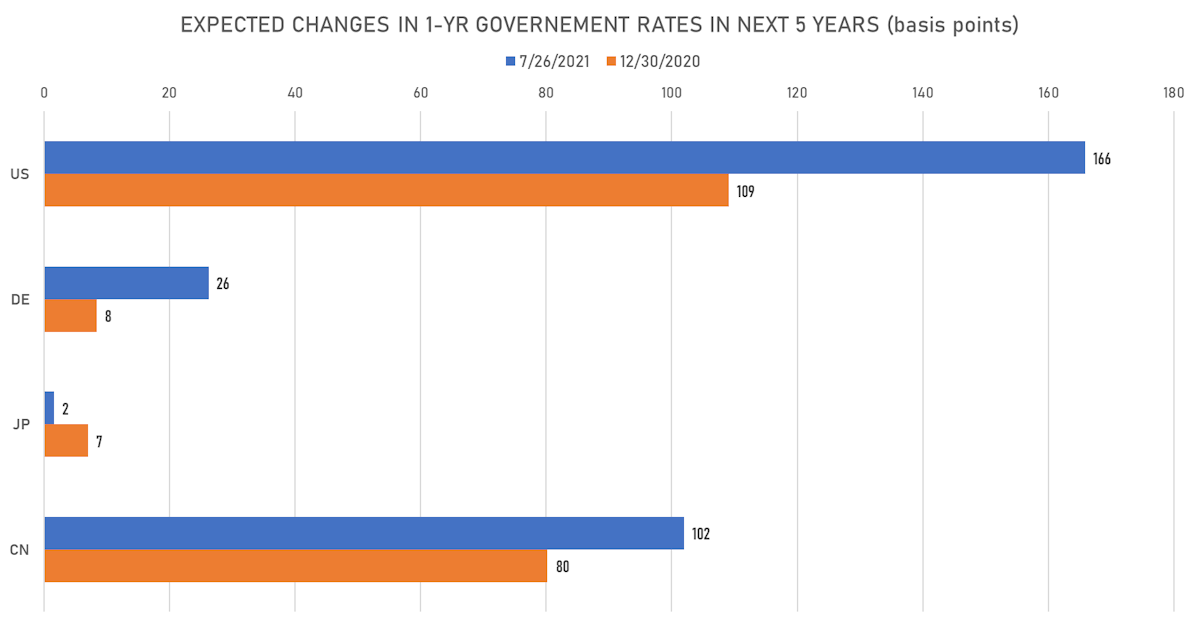

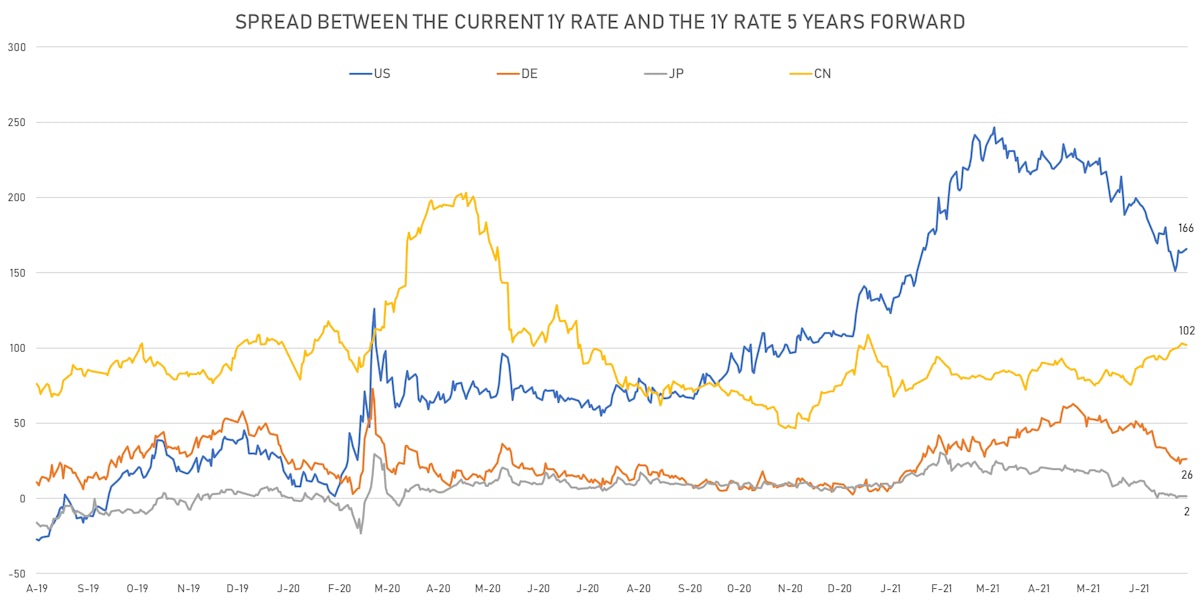

Current rate hikes expectations are slightly higher in the short term, much lower in the longer term | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +0.3bp today, now at 0.1316%

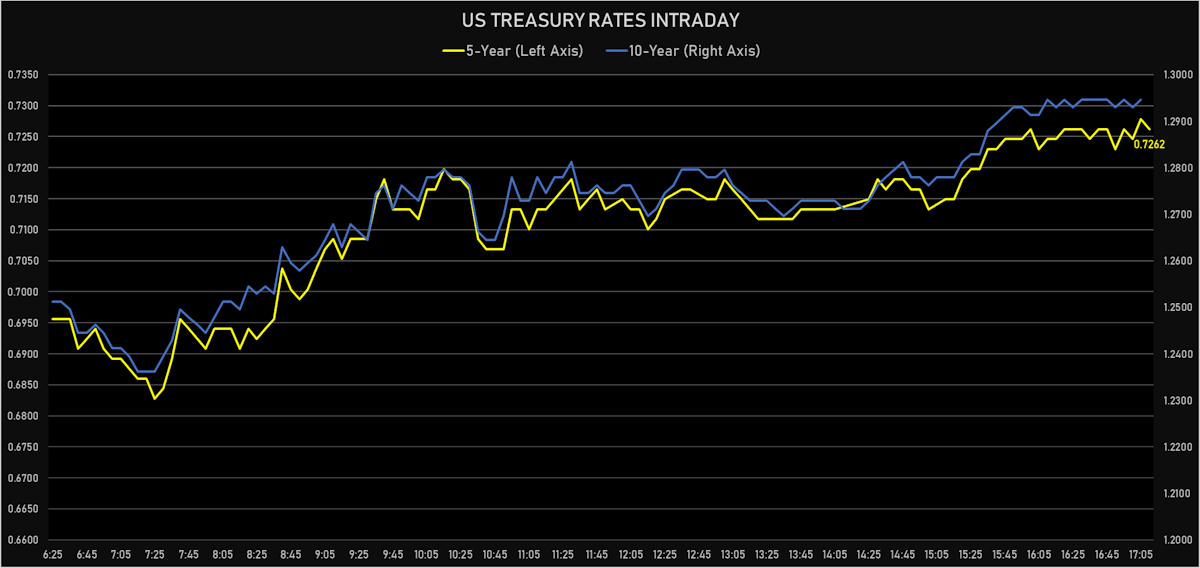

- The treasury yield curve steepened, with the 1s10s spread widening 1.6 bp, now at 122.4 bp (YTD change: +41.9bp)

- 1Y: 0.0710% (down 0.2 bp)

- 2Y: 0.1961% (down 0.4 bp)

- 5Y: 0.7262% (up 1.3 bp)

- 7Y: 1.0414% (up 1.4 bp)

- 10Y: 1.2946% (up 1.3 bp)

- 30Y: 1.9470% (up 2.4 bp)

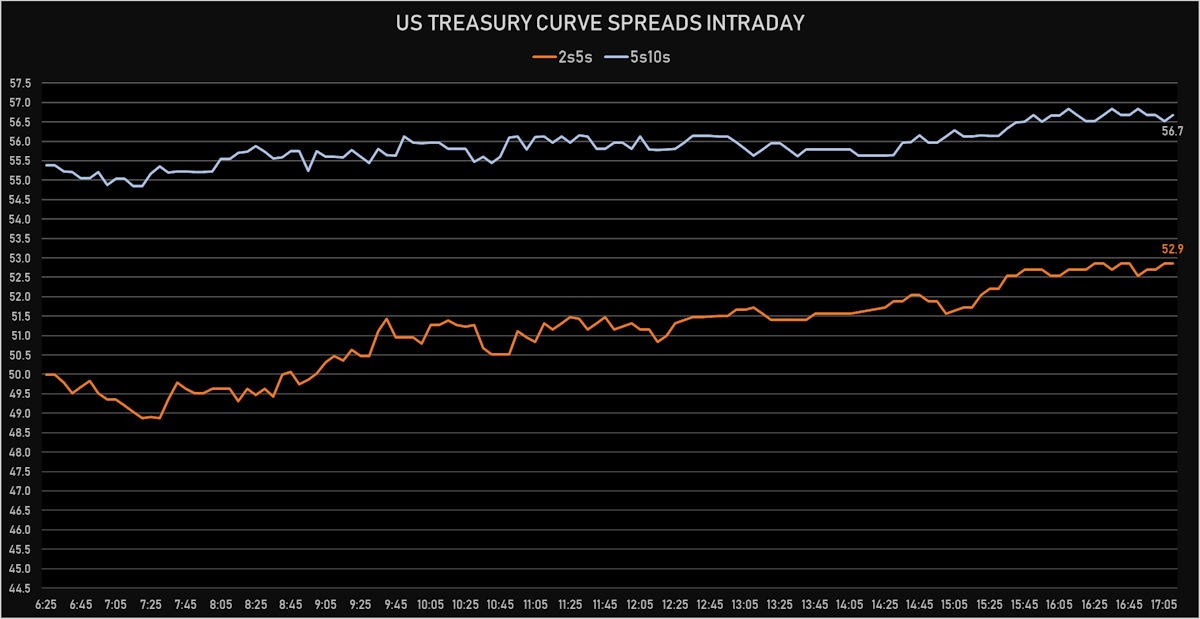

- US treasury curve spreads: 2s5s at 53.0bp (up 1.7bp today), 5s10s at 56.8bp (unchanged), 10s30s at 65.3bp (up 1.1bp today)

- Treasuries butterfly spreads: 2s5s10s at 3.5bp (down -1.6bp), 5s10s30s at 7.9bp (up 0.9bp)

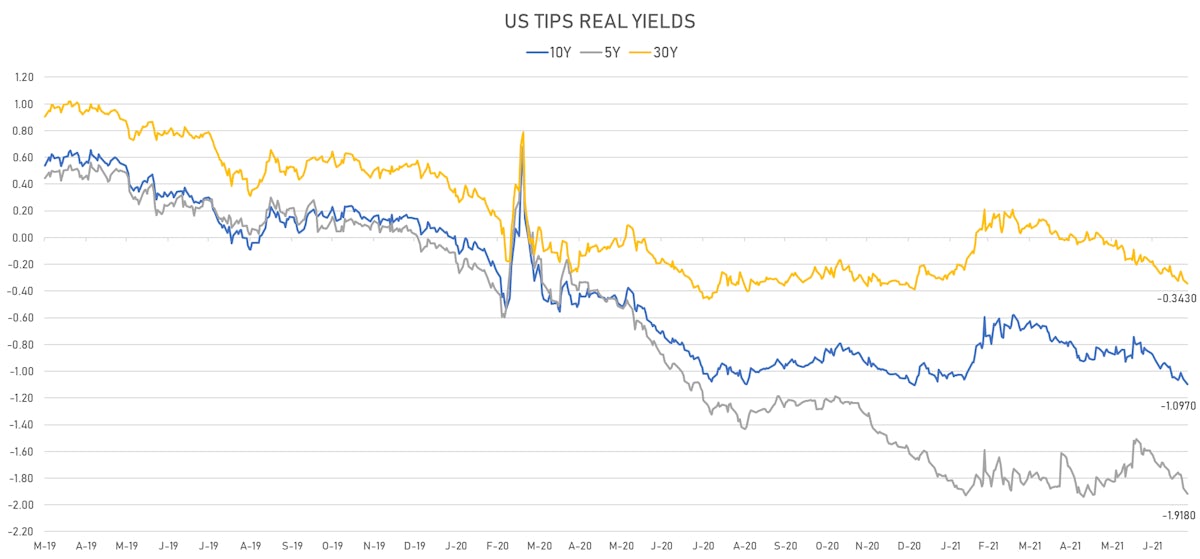

- US 5-Year TIPS Real Yield: -4.3 bp at -1.9180%; 10-Year TIPS Real Yield: -3.7 bp at -1.0970%; 30-Year TIPS Real Yield: -2.7 bp at -0.3430%

US MACRO RELEASES

- Building Permits for Jun 2021 (U.S. Census Bureau) at 1.59 Mln

- Building Permits, Change P/P for Jun 2021 (U.S. Census Bureau) at -5.30 %

- Dallas Fed, General Business Activity for Jul 2021 (Fed Reserve, Dallas) at 27.3, below consensus estimate of 32.5

- New Home Sales for Jun 2021 (U.S. Census Bureau) at 0.68 Mln, below consensus estimate of 0.80 Mln

- New Home Sales, Change P/P for Jun 2021 (U.S. Census Bureau) at -6.60 %, below consensus estimate of 3.00 %

US TREASURY AUCTIONS

- Total accepted bids: $60,739M for 13-Week Bills

- $57,365M in 26-Week Bills

- $65,746M in 2-Year Notes, priced well with decent bid/cover ratio, stopped at 0.213% (slight stop through from 0.215% "when issued" before the auction)

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward up 2.3 bp, now at 1.7366%

- 1-Year Treasury rates are now expected to increase by 165.9 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 17.0 bp by the end of 2022 (meaning the market prices 68.0% chance of a 25bp hike by end of 2022)

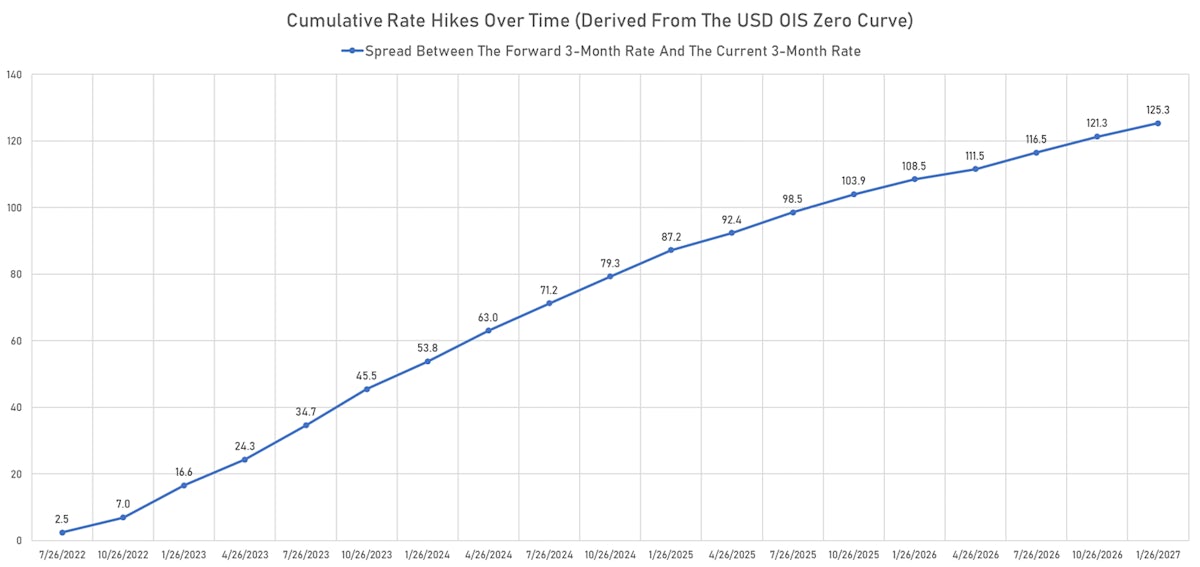

- The 3-month USD OIS forward curve prices in 16.6 bp of rate hikes over the next 18 months (equivalent to 0.67 rate hike) and 71.2 bp over the next 3 years (equivalent to 2.85 rate hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.45% (up 14.6bp); 2Y at 3.02% (up 25.4bp); 5Y at 2.74% (up 17.7bp); 10Y at 2.39% (up 5.0bp); 30Y at 2.31% (up 5.1bp)

- 6-month spot US CPI swap up 6.3 bp to 3.962%, with a steepening of the forward curve

- US TIPS Real Yields keep falling, with the 10Y now at -1.0970%

RATES VOLATILITY & LIQUIDITY

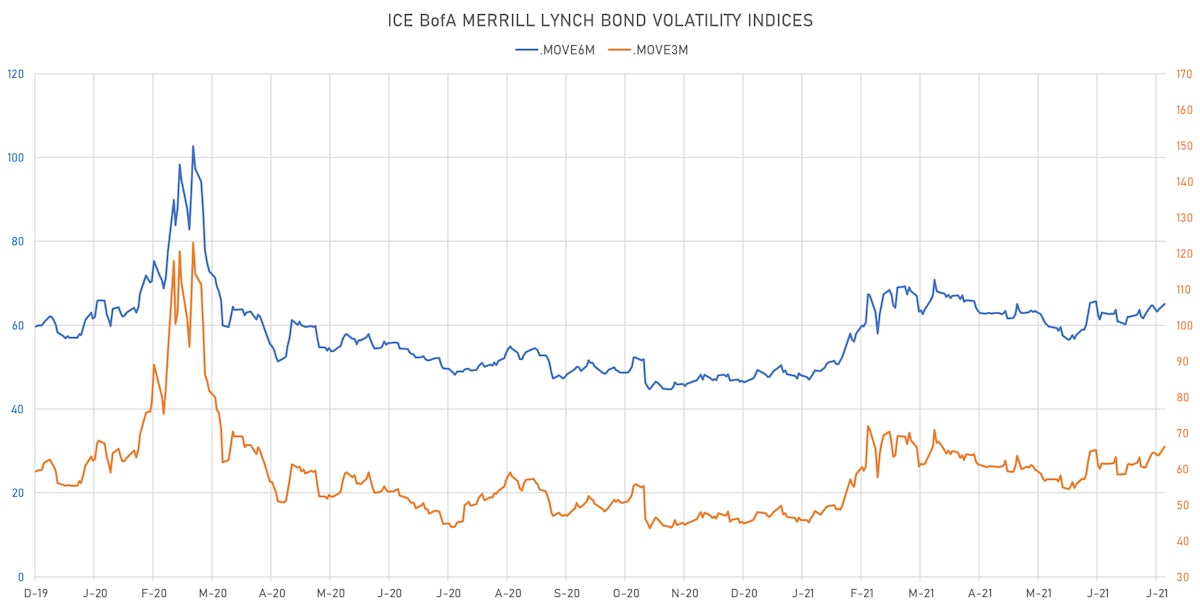

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.9% at 16.8%

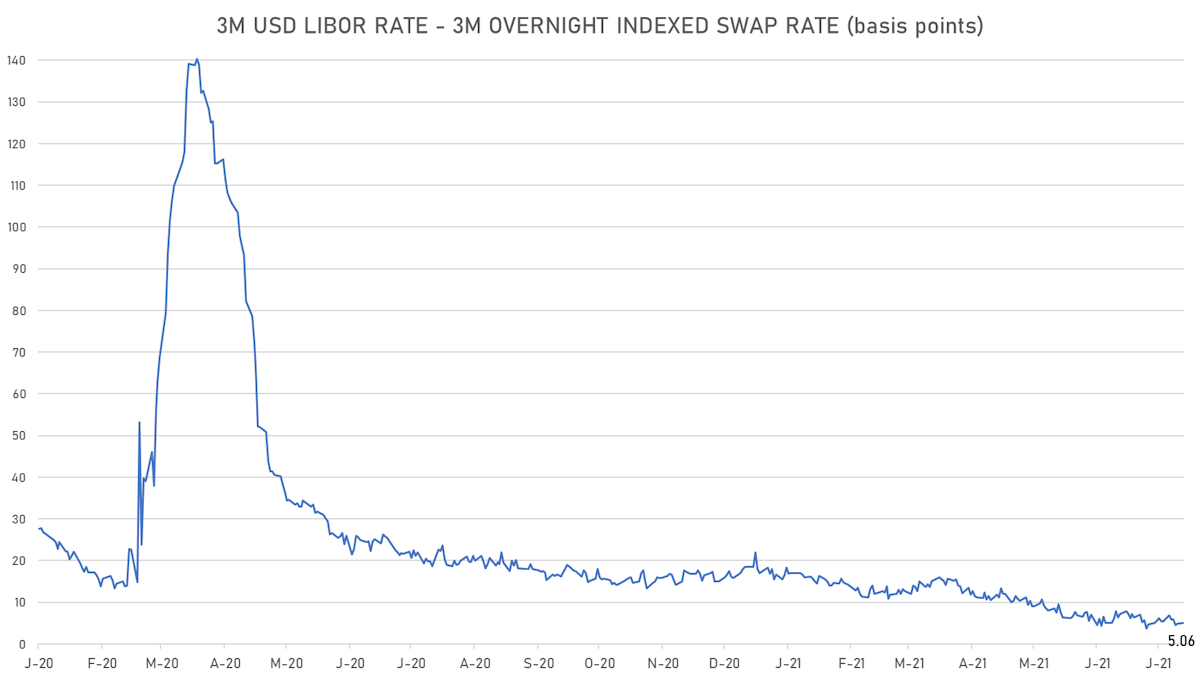

- 3-Month LIBOR-OIS spread up 0.2 bp at 5.1 bp (12-months range: 3.7-23.6 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.697% (down -0.1 bp); the German 1Y-10Y curve is 0.6 bp steeper at 23.3bp (YTD change: +7.8 bp)

- Japan 5Y: -0.131%; the Japanese 1Y-10Y curve at 14.3bp (YTD change: -0.2 bp)

- China 5Y: 2.684% (down -4.5 bp); the Chinese 1Y-10Y curve is 0.1 bp flatter at 96.1bp (YTD change: +49.7 bp)

- Switzerland 5Y: -0.669% (up 0.7 bp); the Swiss 1Y-10Y curve is 2.2 bp flatter at 35.5bp (YTD change: +10.1 bp)