Rates

Rates Lower, Short-Term Inflation Expectations Higher As Market Awaits FOMC Statement Tomorrow

The US Treasury gathered US$ 66.8bn in bids for a decent 5-year auction, though price concession was affected by rates pushing lower today

Published ET

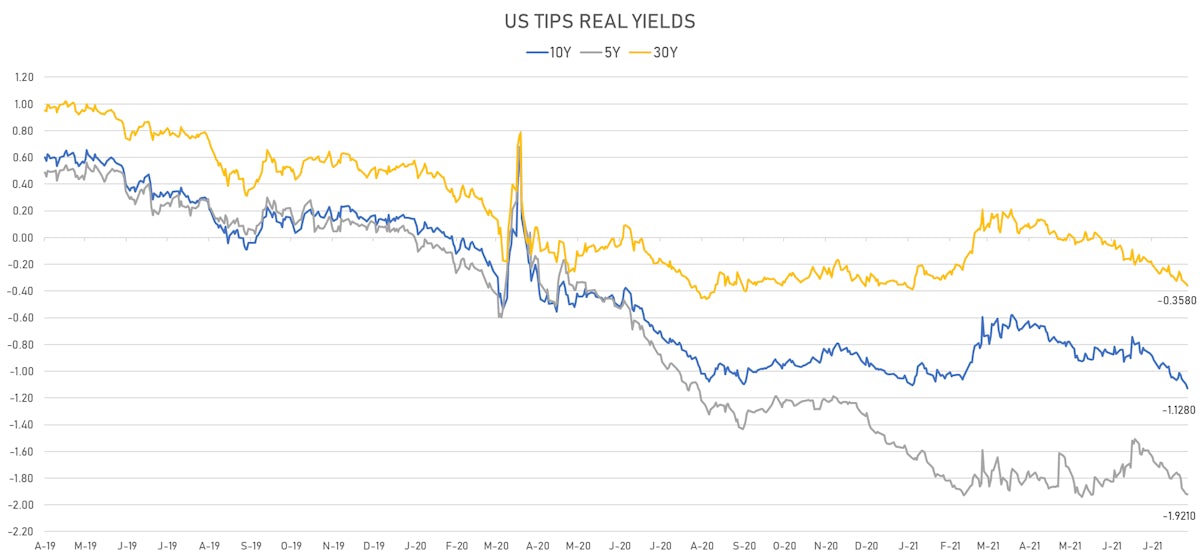

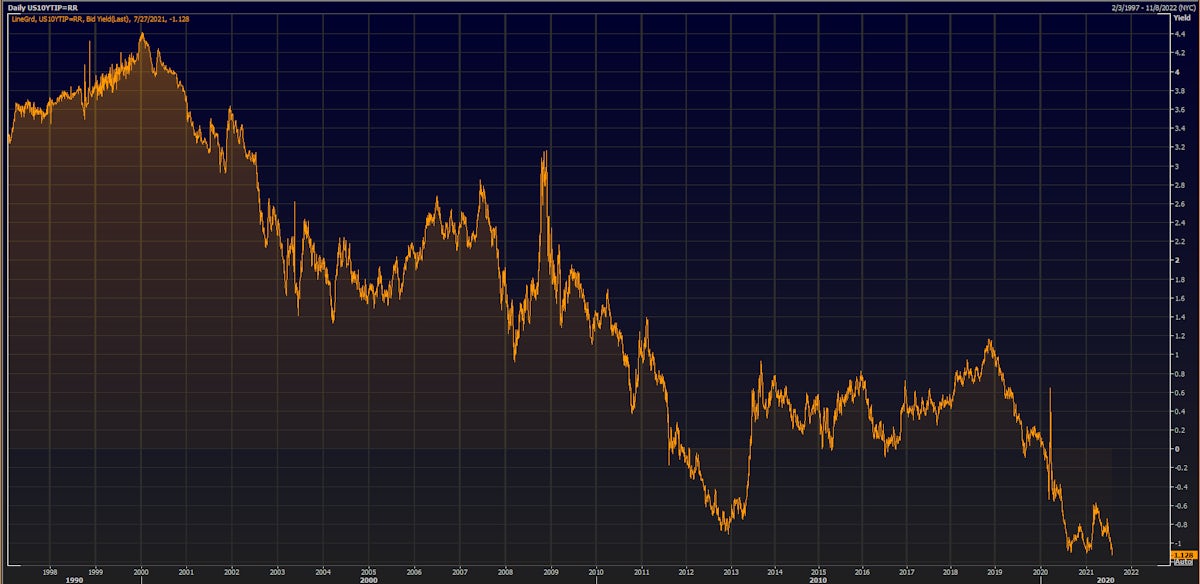

10-Year Real Yields Just Closed At New Record Low | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR -0.2bp today, now at 0.1296%

- The treasury yield curve flattened, with the 1s10s spread tightening -5.5 bp, now at 116.8 bp (YTD change: +36.4bp)

- 1Y: 0.0710% (unchanged)

- 2Y: 0.2075% (up 1.1 bp)

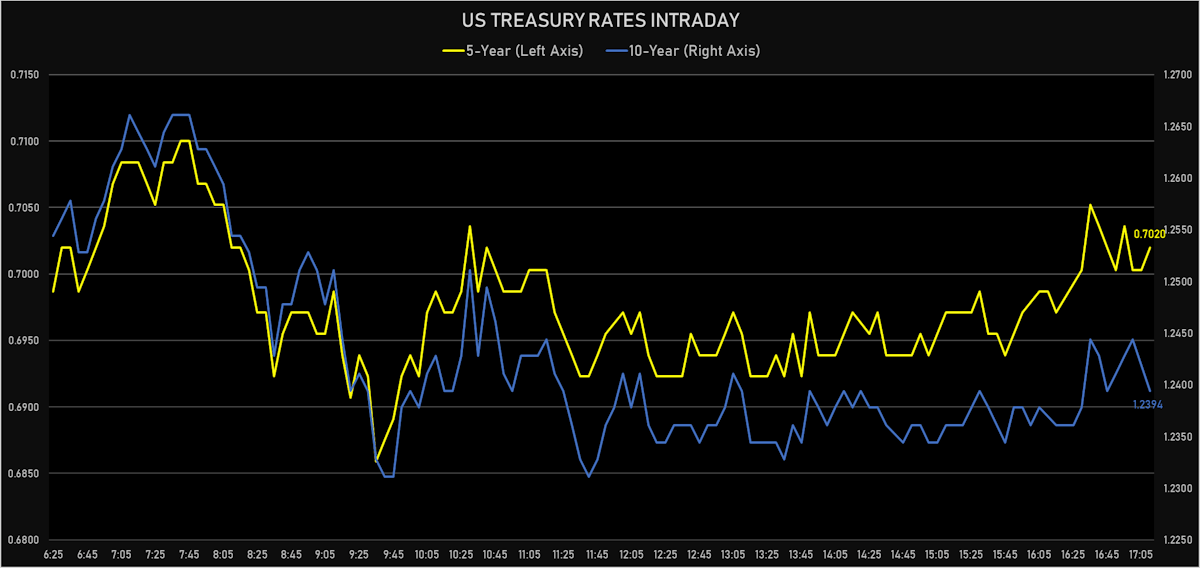

- 5Y: 0.7020% (down 2.4 bp)

- 7Y: 0.9994% (down 4.2 bp)

- 10Y: 1.2394% (down 5.5 bp)

- 30Y: 1.8930% (down 5.4 bp)

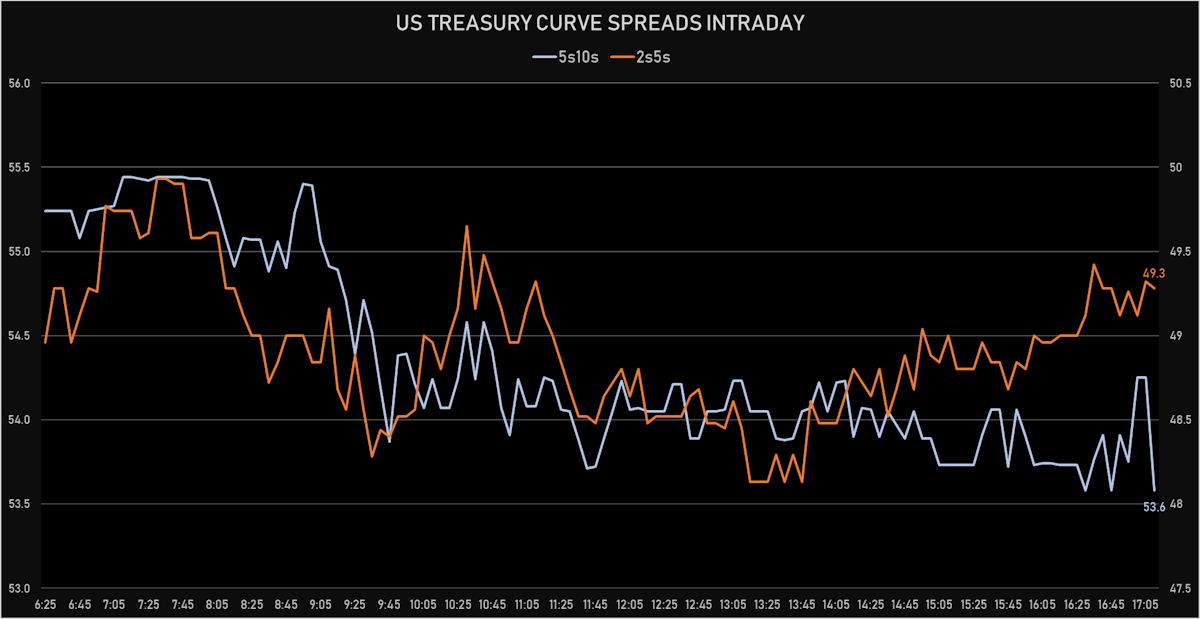

- US treasury curve spreads: 2s5s at 49.5bp (down -3.6bp), 5s10s at 53.7bp (down -3.1bp), 10s30s at 65.4bp (up 0.2bp today)

- Treasuries butterfly spreads: 2s5s10s at 3.9bp (up 0.5bp today), 5s10s30s at 10.5bp (up 2.6bp)

- US 5-Year TIPS Real Yield: -0.3 bp at -1.9210%; 10-Year TIPS Real Yield: -3.1 bp at -1.1280%; 30-Year TIPS Real Yield: -1.5 bp at -0.3580%

US MACRO RELEASES

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 24 Jul (Redbook Research) at 16.00 %

- Conference Board, Consumer confidence for Jul 2021 (The Conference Board) at 129.10 , above consensus estimate of 123.90

- Dallas Fed, General Business Activity for Jul 2021 (Fed Reserve, Dallas) at 33.30

- Dallas Fed, Revenue (Sales for TROS) for Jul 2021 (Fed Reserve, Dallas) at 21.70

- House Prices, FHFA, USA (Purchase-Only) for May 2021 (OFHEO, United States) at 337.40

- House Prices, FHFA, USA (Purchase-Only), Change P/P for May 2021 (OFHEO, United States) at 1.70 %

- House Prices, FHFA, USA (Purchase-Only), Change Y/Y for May 2021 (OFHEO, United States) at 18.00 %

- House Prices, S&P Case-Shiller, Composite-20, Change P/P for May 2021 (Standard & Poor's) at 1.80 %, above consensus estimate of 1.60 %

- House Prices, S&P Case-Shiller, Composite-20, Change P/P, Price Index for May 2021 (Standard & Poor's) at 2.10 %

- House Prices, S&P Case-Shiller, Composite-20, Change Y/Y, Price Index for May 2021 (Standard & Poor's) at 17.00 %, above consensus estimate of 16.40 %

- Manufacturers New Orders, Durable goods excluding defense, Change P/P for Jun 2021 (U.S. Census Bureau) at 1.00 %

- Manufacturers New Orders, Durable goods excluding transportation, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.30 %, below consensus estimate of 0.80 %

- Manufacturers New Orders, Durable goods total, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.80 %, below consensus estimate of 2.10 %

- Manufacturers New Orders, Nondefense capital goods excluding aircraft, Change P/P for Jun 2021 (U.S. Census Bureau) at 0.50 %, below consensus estimate of 0.70 %

- Richmond Fed Manufacturing, Manufacturing Index for Jul 2021 (FED, Richmond) at 27.00

- Richmond Fed Manufacturing, Shipments, current conditions for Jul 2021 (FED, Richmond) at 21.00

- Richmond Fed Services, Revenues for Jul 2021 (FED, Richmond) at 19.00

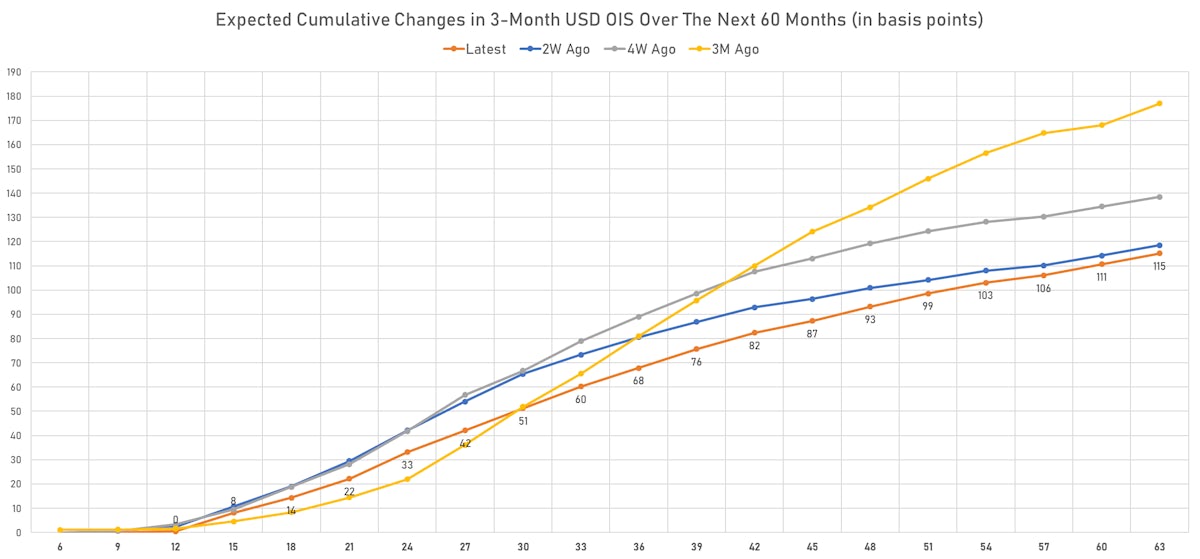

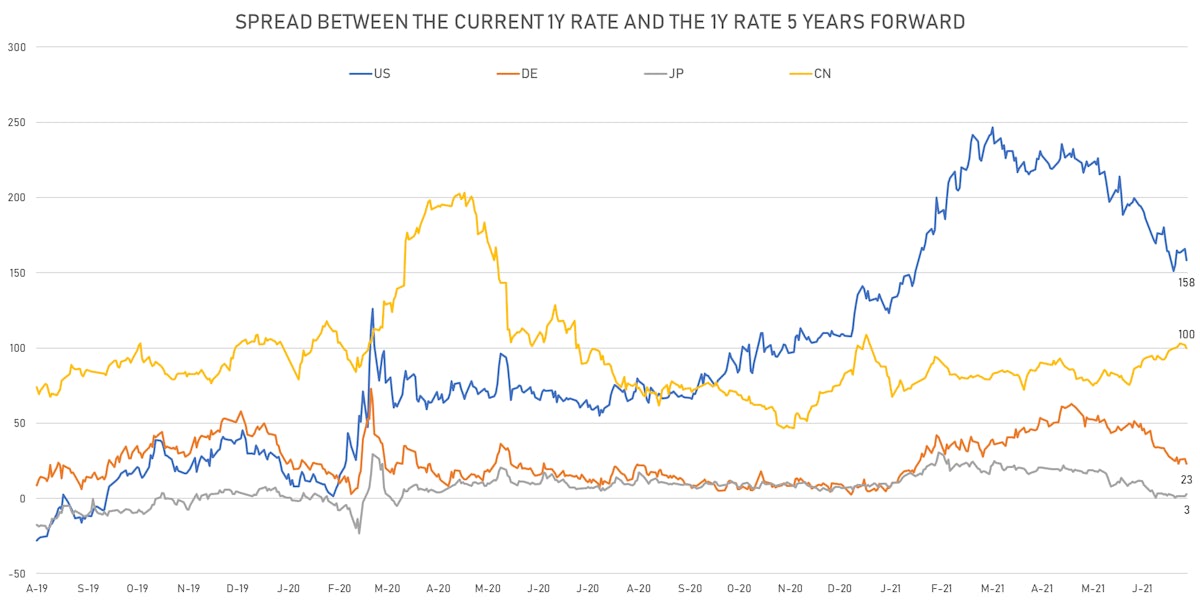

US FORWARD RATES

- US Treasury 1-year zero-coupon rate 5 years forward down 7.9 bp, now at 1.6577%

- 1-Year Treasury rates are now expected to increase by 158.2 bp over the next 5 years

- 3-month Eurodollar futures expected hike of 15.0 bp by the end of 2022 (meaning the market prices 60.0% chance of a 25bp hike by end of 2022)

- The 3-month USD OIS forward curve prices in 14.4 bp of rate hikes over the next 18 months (equivalent to 0.57 rate hike) and 67.8 bp over the next 3 years (equivalent to 2.71 rate hikes)

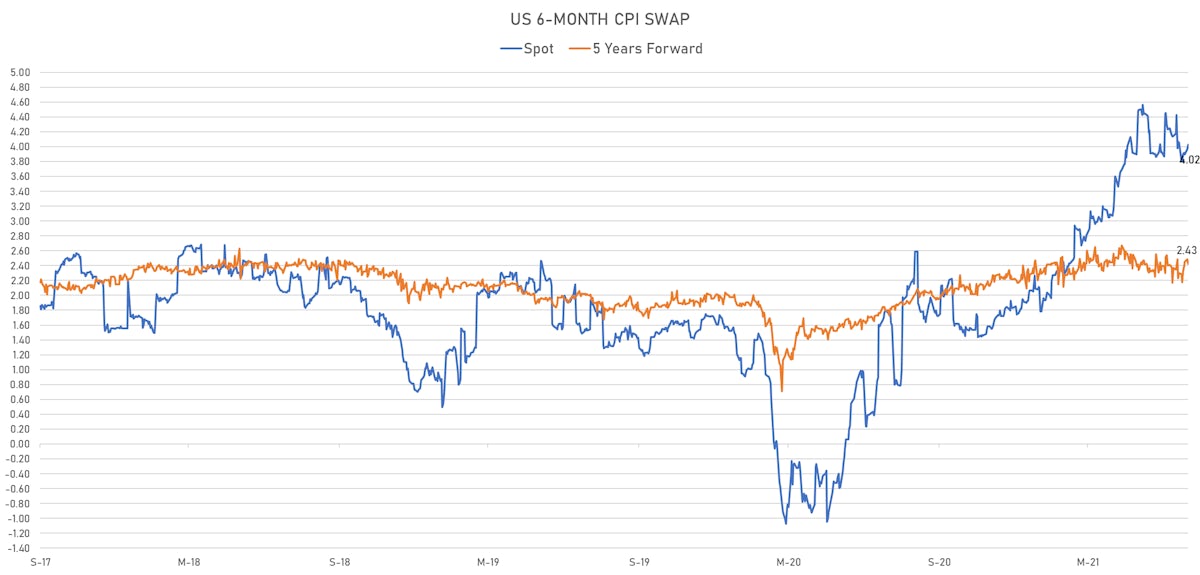

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.47% (up 1.9bp); 2Y at 3.02% (up 0.3bp); 5Y at 2.71% (down -2.4bp); 10Y at 2.37% (down -2.4bp); 30Y at 2.27% (down -3.8bp)

- 6-month spot US CPI swap up 6.2 bp to 4.024%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.9210%, -0.3 bp today; 10Y at -1.1280%, -3.1 bp today; 30Y at -0.3580%, -1.5 bp today

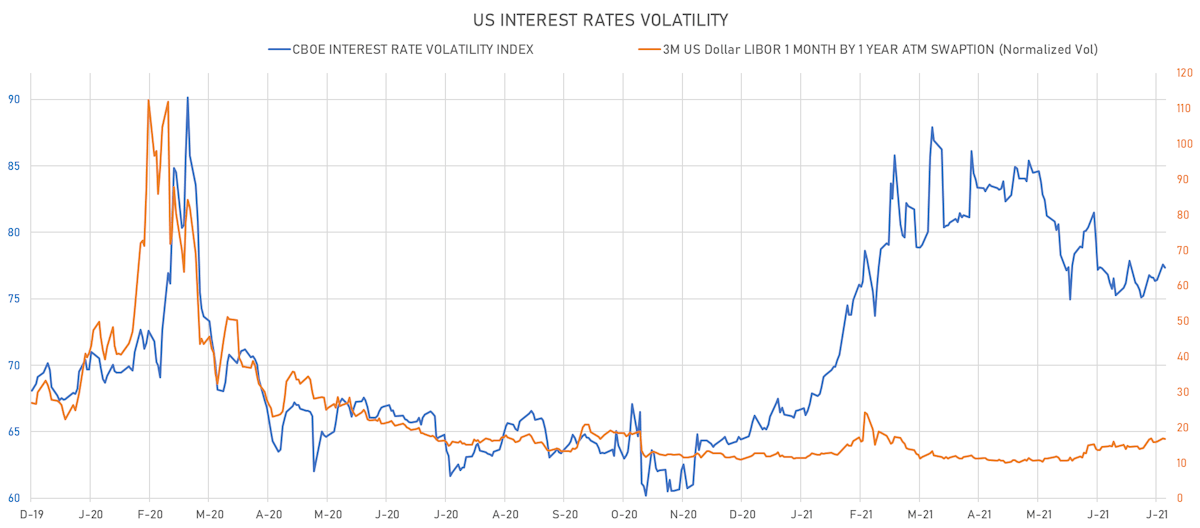

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.1% at 16.7%

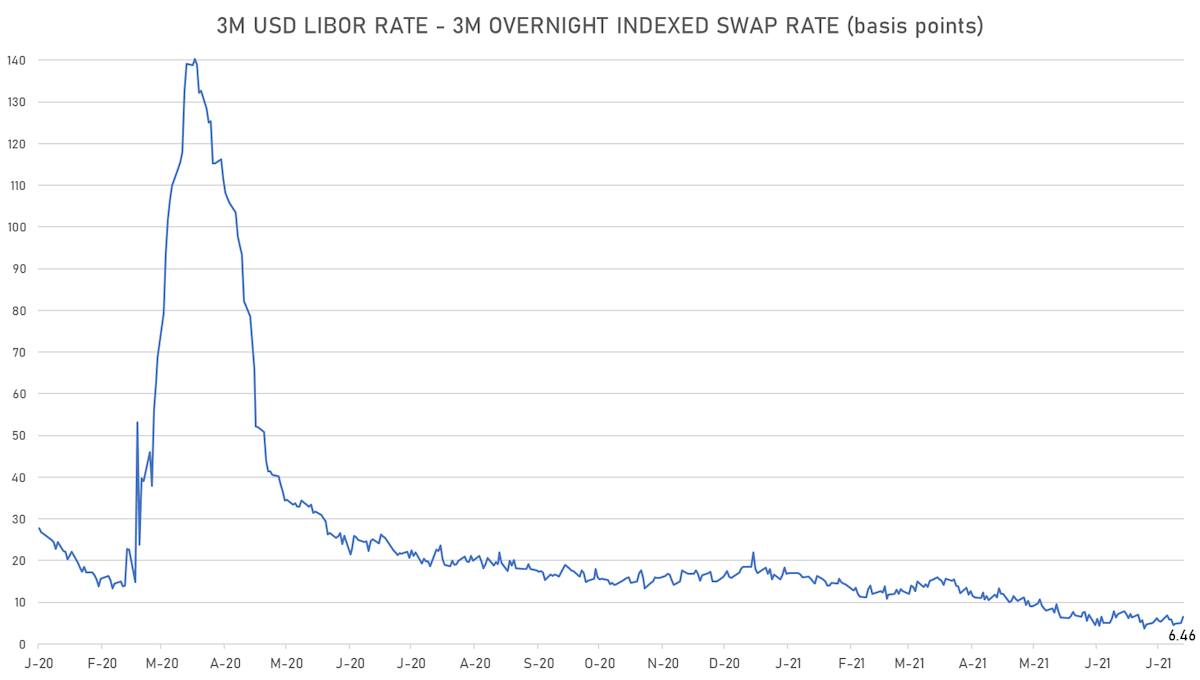

- 3-Month LIBOR-OIS spread up 1.4 bp at 6.5 bp (12-months range: 3.7-23.6 bp)

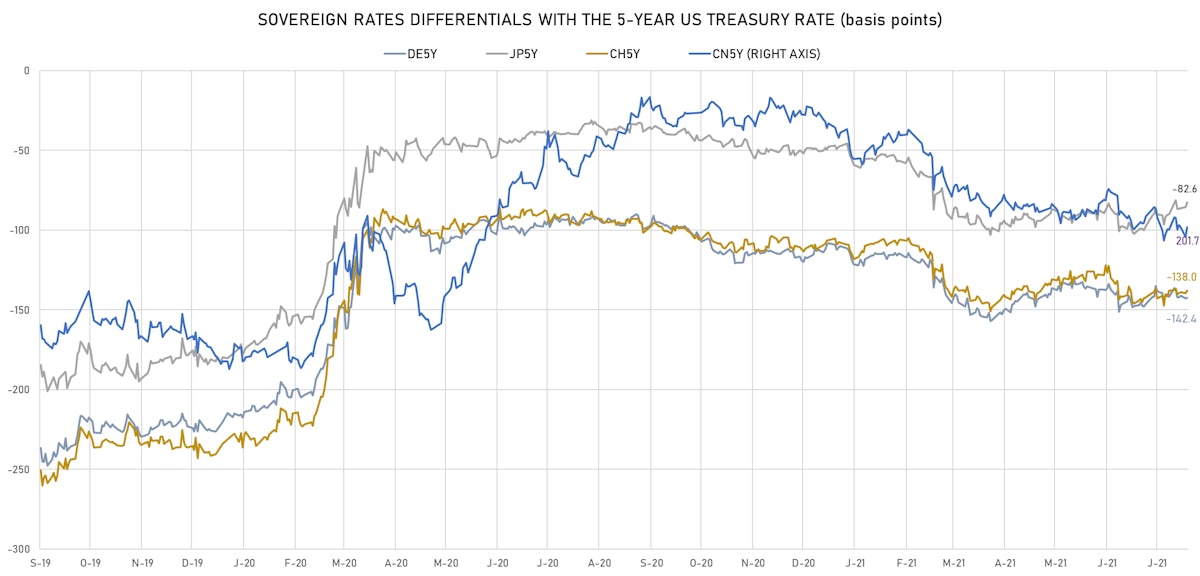

KEY INTERNATIONAL RATES

- Germany 5Y: -0.724% (down -2.1 bp); the German 1Y-10Y curve is 2.7 bp flatter at 20.1bp (YTD change: +5.1 bp)

- Japan 5Y: -0.117% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.9 bp steeper at 14.4bp (YTD change: +0.7 bp)

- China 5Y: 2.719% (up 3.5 bp); the Chinese 1Y-10Y curve is 0.4 bp flatter at 95.7bp (YTD change: +49.3 bp)

- Switzerland 5Y: -0.663% (down -0.9 bp); the Swiss 1Y-10Y curve is 2.1 bp flatter at 35.0bp (YTD change: +8.0 bp)